Follow Up to Trade Alert (SPY) May 9, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY

Buy the S&P 500 SPDR?s (SPY) May, 2016 $209-$214 in-the-money vertical bear put spread at $4.35 or best

Opening Trade

5-9-2016

expiration date: May 20, 2016

Portfolio weighting: 10%

Number of Contracts = 23 contracts

There is a method to my madness here.

With the volatility Index (VIX) popping above $16 this morning, a window has briefly opened that lets us earn some extra money buying a S&P 500 SPDR?s (SPY) May, 2016 $209-$214 in-the-money vertical bear put spread.

This is because we can earn excess premium on the short $209 leg of the trade.

To lose money on this position the (SPY) has to make a run at the new all time highs in the coming 9 trading days.

With the US dollar (UUP) now on a definite strengthening trend I think this is impossible. A strong dollar diminishes the foreign earnings of the big American multinationals, major components of the S&P 500.

I think it is much more likely that stocks grind down in coming weeks to first retest the unchanged on 2016 level at $2,043, and then the 200-day moving average at $2,012.

Share prices are anything but inspirational here.

Price earnings multiples are at all time highs at 19X. The calendar is hugely negative. Soggy and heavily financially engineered Q1 earnings reports came and went.

Huge hedge fund shorts have been covered with large losses, and no one is in a rush to jump back into the short side.

Oh, and the (SPY) is bumping up against granite like two year resistance at $2014 that will take months to break through in the best case.

Did I mention that US equity mutual funds have been net sellers of stock since 2014?

This position is also a hedge against what I call ?The Dreaded Flat Line of Death? scenario. This is where the market doesn?t move at all over a prolonged period of time and no one makes any money at all, except us.

If I am right on all of this May will come in as the most profitable month for the Mad Hedge Fund Trader Trade Alert Service in more than a year. For new subscribers, your timing is perfect!

By the way, I noticed a surge of new subscriptions right after Nyquist won the Kentucky Derby. No doubt the new readers were spending their winnings. It looks like your assessment of investment newsletters is as good as your selection of horseflesh.

And Nyquist carried the lucky number 13. Talk about an out of consensus trade!

You can pay all the way up to $4.60 for this spread and it still makes sense.

If you can?t do the options, buy the ProShares Short S&P 500 Short Fund ETF (SH) (click here for the prospectus at http://www.proshares.com/funds/sh.html), or the ProShares Ultra Short S&P 500 Short Fund 2X ETF (SDS) (click here for the prospectus at http://www.proshares.com/funds/sds.html).

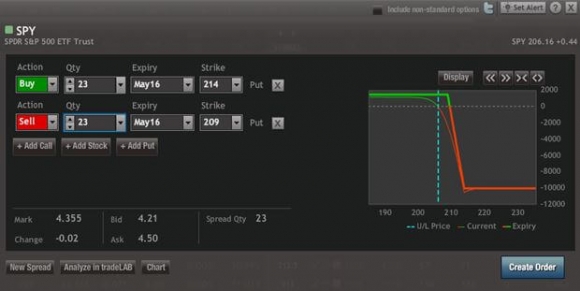

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 9 days to expiration.

Here are the specific trades you need to execute this position:

Buy 23 May, 2016 (SPY) $214 puts at????.?.??$7.90

Sell short 23 May, 2016 (SPY) $209 puts at.???.?..$3.55

Net Cost:???????????????????......$4.35

Potential Profit: $5.00 - $4.35 = $0.65

(23 X 100 X $0.65) = $1,495 or 14.94% profit in 9 trading days.

Time for Some Downside Protection

Time for Some Downside Protection

?