Follow Up to Trade Alert - (SPY) November 3, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- UPDATE

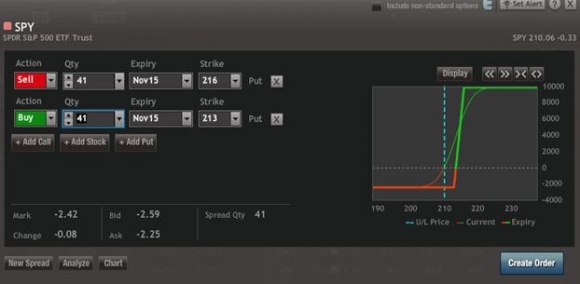

SELL the S&P 500 SPDR?s (SPY) November, 2015 $213-$216 in-the-money vertical bear put spread at $2.42 or best

Closing Trade

11-3-2015

expiration date: November 20, 2015

Portfolio weighting: 10%

Number of Contracts = 41 contracts

Don?t stand in the way of a melt up.

As 2015 reaches its tag ends, my tolerance for running losses approaches zero. This was a wealth preservation move, not a wealth creation one.

Up 38% on the year, I can afford this luxury.

I can?t tell you how many hedge fund friends of mine were shut out by the market?s recent parabolic moves, left on the sidelines trying to get in. Now that they have de-risked, they haven?t been able to re-risk.

?Clever? has failed, and ?boring? has carried the day.

As a result, the market momentum could carry through the end of the year, and then some.

Clearly, the stock market didn?t read the textbook on how long recoveries were supposed to take.

So with the October nonfarm payroll approaching on Friday, and oil (USO) and junk bonds (HYG) rallying, I?m going to bail here at close to cost, with only a 1.2% hickey on the position.

What makes this easier is that my last two short bond (TLT) trades have been instant winners, which I picked up to hedge my short (SPY) positions.

IT?S ALL ABOUT TOTAL RETURN, NOT ATTAINING BRAGGING RIGHTS.

There are no ?soft pitches? anywhere in the financial markets right now. Only ?close your eyes and buy? ones.

Given the choice of losing money for you, or sitting on my hands, I?ll take the latter all day long.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 41 November, 2015 (SPY) $216 puts at????.?.??$6.20

Buy to cover short 41 November, 2015 (SPY) $213 puts at.?$3.78

Net Proceeds:?????????????????.....$2.42

Loss: $2.45 - $2.42 = $0.03

(41 X 100 X $0.03) = $123 or 0.12% profit for the notional $100,000 portfolio