Follow Up to Trade Alert - (SPY) October 14, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY-UPDATE

?RISK OFF?

Buy the S&P 500 SPDR?s (SPY) November, 2015 $207-$210 in-the-money vertical bear put spread at $2.45 or best

Opening Trade

10-14-2015

expiration date: November 20, 2015

Portfolio weighting: 10%

Number of Contracts = 38 contracts

From feast to famine.

After knocking out a head spinning 40 Trade Alerts in September, we have fallen in to a Trade Alert famine in October.

After bringing in a blockbuster 12% profit last month, we are now posting negative numbers for the month.

Markets have suddenly gone strangely silent.

Is this the calm before the next storm?

That?s a definite maybe.

Got to love that (XIV), the Velocity Shares Daily Inverse VIX Short Term ETN. We have pulled off four round trips in the short volatility fund, all of them profitable.

Volatility had to go down, lest half of Wall Street drop dead from the stress.

Every Volatility Index (VIX) spike from here on is to be sold into with both hands. I think we are going to see the (VIX) trading between $12-$22 for almost all of the next year.

The $30 handles in the (VIX) are to be seen no more.

In addition, we simple ran out of crisis. The global political scene has calmed down. China quit crashing. Oil and commodities may have finally found a bottom.

So investors and traders have stopped being so negative. But they haven?t become positive either. Hence the pause to for Q3 earnings to come out as the excuse to do nothing.

When we get the all clear signal, I expect the S&P 500 to take a run at a new all time high by the end of 2015. After all, that?s only 7% north from here.

With November the largest corporate stock buy back of the year, underperforming managers desperately chasing returns, commodities getting a new lease on life, and interest rates remaining low as far as the eye can see, it couldn?t go any other way.

But just to been sure, I?ll ask former Federal Reserve Chairman Ben Bernanke when I have dinner with him tonight.

No kidding!

A new high will not happen by November 20, hence the logic behind the S&P 500 SPDR?s (SPY) November, 2015 $207-$210 in-the-money vertical bear put spread.

I think the (SPY) 200-day moving average is going to present prodigious upside resistance the first several times around. And if the market retests the August and September lows one more time, giving us our final fright of the year, so much the better.

Isn?t Halloween coming soon?

You can pay all the way up to $2.65 for this spread and it still makes sense. If you are unable to do options buy (SDS) for a short term trade.

It is a bet that the (SPY) does not trade above $207 in the next 26 trading days.

The market has just enjoyed a short covering rally for the ages, up 9 out of the last 11 days. It is waaaaay overbought.

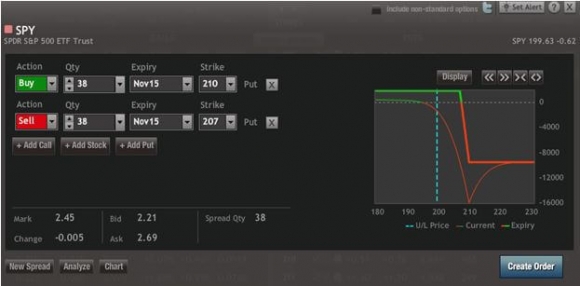

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 38 November, 2015 (SPY) $210 puts at????.?.??$10.65

Sell short 38 November, 2015 (SPY) $207 puts at????..?$8.20

Net Cost:?????????????????????.....$2.45

Potential Profit at expiration: $3.00 - $2.45 = $0.55

(38 X 100 X $0.55) = $2,090 or 2.09% profit for the notional $100,000 portfolio