Follow Up to Trade Alert - (TLT) November 6, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (TLT)- TAKE PROFITS-UPDATE

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) November, 2015 $125-$128 in-the-money vertical bear put spread at $2.97 or best

Closing Trade

11-6-2015

expiration date: November 20, 2015

Portfolio weighting: 10%

Number of Contracts = 37 contracts

Sorry for the delay in getting this Trade Alert UPDATE out to you as promised. But my phone has been ringing off the hook from big hedge funds wanting to know what to do next.

You could almost hear the roof blow off the top of the New York Stock Exchange when they announced the October nonfarm payroll. At a mind blowing 271,000, it came in at double the low-ball pessimistic estimates.

The headline unemployment rate dropped to 5.0%, a decade low. The 4% handle beckons next month.

Bonds (TLT), the Japanese yen (FXY), (YCS), the Euro (FXE), (EUO), oil (USO), and gold (GLD) crashed.

Banks stocks (KBE), the dollar (UUP) rocketed. Stocks were indifferent, as they already saw this move coming in October.

I have been observing these asset classes and their interrelationships for a half century, and every one is simultaneously pointing to the same conclusion. There is a gigantic ?RISK ON? move unfolding for the rest of 2015, and possibly for the next six months.

If you are one of the many new readers of the Diary of a Mad Hedge Fund Trader who only recently just started reading this letter, you can now rush out and buy back all of those stocks you sold at the bottom in August because other newsletters told you to do so, like everyone else.

If you are one of my long-term subscribers, you already knew this was coming and positioned for it accordingly.

GOTTA LOVE THOSE SHORT BOND AND JAPANESE YEN POSITIONS!

There was really no place for the bears to hide in the October numbers.

YOY gains in wages were biggest since July, 2009. Private sector job growth was an eye-popping +268,000. The August and September payroll reports were revised up 12,000.

Business and professional services saw a +78,000 gain. Health care tacked on +45,000 jobs, while retail picked up +44,000. Mining lost -5,000 jobs, as usual.

The truly significant development with this data set was that the broader U-6 unemployment rate finally broke 10% for the first time in eight years, dropping to 9.8%.

The October number RULES OUT ANY CHANCE THAT THE FED WILL NOT RAISE RATES at the December 16-17 meeting.

Now that the economy is clearly strengthening, the global stock markets have stabilized, and a floor has been put under China, the path is clear for two such rate rises.

A new debate will now ensue. Will the Fed accelerate its tightening policy, moving beyond just two modest increases?

PERISH THE THOUGHT!

Here are the implications for you IRA, 401k, and pension fund.

*Stocks - sideways first, then higher. They already anticipated this figure with the heroic rise in October.

*Bonds - Keep falling until the next recession, whenever that is.

*Commodities - down first, then up big.

*Foreign Currencies - fall for another few years.

*Precious Metals - drop to new four year lows.

*Volatility - stays low until the next ?Sell in May.?

*The Ags - put in a bottom and then rise with El Ni?o.

*Real Estate - keeps rising as buyers rush to beat bigger rate increases.

THERE IS A REALLY EXCITING POSSIBILITY NOW SETTING UP FOR THE YEAR END.

Originally I thought that a mid-December rate rise then would trigger a mini correction in the major stock indexes. Today?s nonfarm payroll eliminates that uncertainty, and the correction that went with it.

Instead, we are getting that mini correction now. It will only last several more days. After that, it is UP, UP, AND AWAY.

We could well ring out this year with the markets at the top tick of the year. Now that?s a thought!

Take the home run.

By betting that today?s October nonfarm payroll would come in better than expected, you have clocked a 10% profit in four trading days in the iShares Barclays 20+ Year Treasury Bond Fund (TLT) November, 2015 $125-$128 in-the-money vertical bear put spread.

Within nanoseconds of the announcement, the Treasury bond market (TLT) suffered one of the largest losses of the year, down some 2 FULL points.

Nice place to be short. WELL DONE!

At the current price you have reaped 90% of the maximum potential profit in this spread. The risk/reward does not favor carrying the position for two more weeks just to grab the last three cents.

As my late mentor, Morgan Stanley?s Barton Biggs used to tell me, ?Always leave the last 10% of a move for the next guy.?

So, TAKE THE MONEY AND RUN!

If you can?t get the $2.97 price immediately, stick to your guns. Just leave the limit order for the spread in until it gets done. There is zero chance the (TLT) can recover the $125 strike before the November 20 expiration.

For the many (TBT) followers out there, the coast is clear. It is safe to come out of your bunker now. You can make a lot of money trading a $41-$48 range. Take profits for the short term, but hold for the medium and long term.

As a result, the US Treasury bond market appears within a hair?s breadth of breaking down from its recent range.

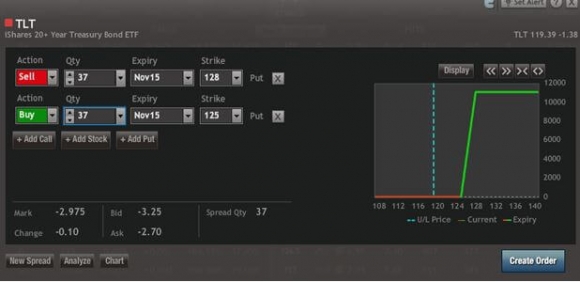

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 37 November, 2015 (TLT) $128 puts at????.?.??$8.80

Buy to cover short 37 November, 2015 (TLT) $125 puts a?.$5.83

Net Cost:???????????????????.?.....$2.97

Profit: $2.97 - $2.70 = $0.27

(37 X 100 X $0.27) = $999 or 0.99% profit for the notional $100,000 portfolio