Follow Up to Trade Alert - (TSLA) October 5, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (TSLA)- BUY-UPDATE

BUY the Tesla (TSLA) November, 2015 $200-$220 in-the-money vertical bull call spread at $15.80 or best

?RISK ON?

Opening Trade

10-5-2015

expiration date: November 20, 2015

Portfolio weighting: 10%

Number of Contracts = 6 contracts

I received a call from Tesla over the weekend. They wanted to know when I could come in a test drive my new Signature Series Model X SUV.

I am number 645 on the waiting list. I ordered the car 3 ? years ago and placed a $40,000 deposit on the first day they started accepting orders.

The reason my number was so high was that I waited until I got home before placing my order on my PC.

The other 644 bought the $130,000 car on their cell phones!

I casually asked how many on the waiting list they had for the $80,000 standard Model X, which lacks the ?ludicrous? mode with the 2.9 second 0-60 acceleration.

She answered 20,000.

Yikes!

I thus spent the weekend catching up on all things Tesla.

During the August Concourse d? Elegance vintage car show at Pebble Beach, California, I managed to catch up with Tesla?s senior management. All lights were flashing green, and it was full speed ahead.

The new Gigafactory being built outside Reno, Nevada will pave the way for the firm?s entry into the mass market. The big issue in selecting a site was not cost or subsidies, but the permitting process.

In Nevada, where almost everything is legal, you can get a building permit in 30 days, compared to months elsewhere, and years in California.

Expect to see the Model Tesla 3 out in 2 1/2 years, which will cost $35,000 and get a 300-mile range. Ranges on Lithium Ion battery driven vehicles are doubling every four years.

Buying a car at that price, with no maintenance and free fuel for life, is the same as paying $20,000 for a gasoline driven car.

That?s when Tesla ramps up production from this year?s 48,000 units to 500,000, turning the ?Big Three? auto makers into the ?Big Four.? This is why the big long term institutional investors are going gaga over the stock.

All that has been missing this year has been a decent entry point to buy the stock. It now appears we have one, the stock giving up 17% from its August $295 high.

All of which brings me to Tesla?s share price, which has just taken a swan dive from $265 to $190 as hot money fled the big momentum names.

Let me tell you that the revolutionary vehicle is still wildly misunderstood, and the company has done a lousy job making its case. I guess you can afford that luxury when consumers line up for years to buy your product.

The electric power source is, in fact, the least important aspect of the Tesla cars. Here are 15 reasons that are more important:

1) The vehicle has 75% fewer parts than any other, massively reducing production costs. The drive train has 11 parts, compared to over 1,500 for conventional gasoline powered transportation. Tour the factory and it is eerily silent. There are almost no people, just a handful who service the dozens of German robots that put these things together.

2) No maintenance is required, as any engineer will tell you about electric motors. You just rotate the tires every 6,000 miles.

3) This means that no dealer network is required. There is nothing to fix.

4) If you do need to repair something, usually it can be done over the phone. Rebooting the computer addresses most issues. If not, they will send a van to do a repair at your house for free.

5) The car runs at room temperature, not the 500 degrees in standard internal combustion cars. This means that the parts last forever.

6) The car is connected to the Internet 24/7. Once a month it upgrades its own software when you are sleeping. You jump in the car the next morning and a message appears on your screen saying, ?We just upgraded the following 20 Apps.? This is the first car I ever owned that improved itself with age, as I do myself.

7) This is how most of the recalls have been done as well, over the Internet while you are sleeping.

8) If you need to recharge at a public station, it is free. Tesla has its own national network of superchargers that will top you up in 45 minutes, and allow you to drive across the country (see map below). But hotels and businesses have figured out that electric car drivers are the kind of big spending customers they want to attract. So public stations have been multiplying like rabbits. When I first started driving my Nissan Leaf in 2010 there were only 25 charging stations in the Bay Area. There are now over 1,000. They even have them at Costco, Walgreens, and McDonald?s.

9) No engine means a lot more space for other things, like storage. You get two trunks in the Model-S, a generous one behind, and a ?frunk? in front.

10) Drive an electric car in California, and you are treated like visiting royalty. You can drive in the HOV commuter lanes as a single driver. This won?t last forever, but it?s a nice perk now.

11) There is a large and growing market for all American made products. Tesla has a far higher percentage of US parts (100%) than any of the big three.

12) Since almost every part is made on site at the Fremont factory, supply line disruptions are eliminated. Most American cars are over dependent on Asian supply lines for parts and frequently fall victim to disruptions, like floods and tidal waves.

13) There are almost no controls, providing for more cost savings. Except for the drive train, windows, and turn signals, all vehicle controls are on the touch screen, like a giant iPhone 6 plus.

14) A number of readers have argued that the Tesla really runs on coal, as this is still the source of 36% of the US power supply. However, if you program the car between midnight and 7:00 AM (one of my ideas that Tesla adopted in a recent upgrade), you are using electricity generated by the utilities to maintain grid integrity at night that otherwise goes unused and wasted. How much power is wasted like this in the US every night? Enough to recharge 150 million cars per night!

15) With a one year waiting list for new Model X orders, Tesla does not need to advertise. This is one of the biggest expenses of the Detroit Big Three.

16) Oh yes, the car is good for the environment, a big political issue for more than half the country.

No machine made by humans is perfect. So in the interest of full disclosure, here are a few things Tesla did not tell you before you bought the car.

1) There is no spare tire or jack, just an instant repair kit in a can.

2) The car weighs a staggering 3 tons, so conventional jacks don?t work. Lithium is heavy stuff, and the electric rotors and stators on the wheels that generate power weight 250 pounds each. This means you only get 12,000 miles per set of tires.

3) The car is only 8 inches off the ground, so only a scissor jack works.

4) The 21-inch tires on the high performance model are a special order. Get a blowout in the middle of nowhere and you could get stranded for days. So if you plan to drive to remote places, like Lake Tahoe, as I do, better carry a 19-inch spare in the ?frunk? to get you back home.

5) If you let some dummy out in the boonies jack the car up the wrong way, he might puncture the battery and set it on fire. It will be a decade before many mechanics learn how to work with this advanced technology. The solution here is to put a hockey puck between the car and the jack. And good luck explaining what this is to a Californian.

6) With my Leaf, I always carried a 100-foot extension cord in the trunk. If power got low, I just stopped for lunch at the nearest sushi shop and plugged in for a charge. Not so with Tesla. You are limited to using their 20-foot charging cable, or it won?t work. I haven?t found anyone from the company who can tell be why this is the case.

The investment play here is not with the current Model S1, which is really just a test bed for the company to learn how to execute real mass production with the Tesla 3. This is why the current price/earnings multiple is meaningless. Battery technologies are advancing so fast now, that range/weights are doubling every four years.

And guess what? Detroit is so far behind developing this technology that they will never catch up. My guess is that they eventually buy batteries and drive trains from Tesla on a licensed basis, as Toyota (for the RAV4) and Daimler Benz (for the A Class) already are. Detroit?s entire existing hybrid technologies are older versions similarly purchased from the Japanese (bet you didn?t know that!).

That leaves the global car market to Tesla for the taking. Sales in China are taking place at a price 50% higher than here in the US, and the early indications are that they will be an absolute blowout. Government support there is no surprise, given that the air pollution in Beijing is so thick you can cut it with a knife.

All of this will boost the shares from the present $250 to over $500. I would say $1,000 a share, but I don?t want to give it the Apple (AAPL) curse. So if you can use the current weakness to buy it under $250, you will be well rewarded.

You might also go out and buy a Model S1 for yourself as well. It?s like driving a street legal Formula 1 racecar and is a total blast. Just watch out for soccer moms driving Silverado?s speaking on cell phones.

You can pay all the way up to $17.00 for this spread and it still makes sense. If you can?t trade options, then buy the stock.

The high-end broker targets for this stock (Morgan Stanley) are up to $465.

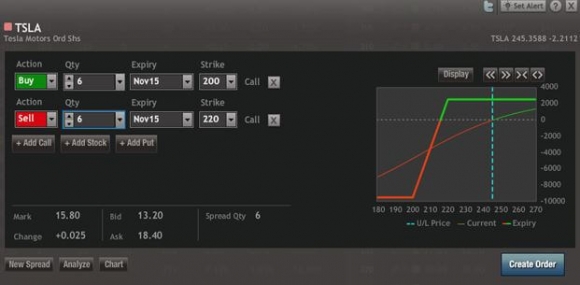

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here: http://www.madhedgefundtrader.com/ltt-executetradealerts/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 6 November, 2015 (TSLA) $200 calls at????.?.$48.80

Sell short 6 November, 2015 (TSLA) $220 calls at..????.$33.00

Net Cost:??????????????????.?.....$15.80

Potential Profit: $20.00 - $15.80 = $4.20

(6 X 100 X $4.20) = $2,520 or 2.52% profit for the notional $100,000 portfolio.

Ouch!

Ouch!