Follow Up to Trade Alert - (SPY) May 20, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY-UPDATE

Buy the S&P 500 SPDR?s (SPY) June, 2016 $210-$215 in-the-money vertical bear put spread at $4.34 or best

Opening Trade

5-20-2016

Expiration date: June 17, 2016

Portfolio weighting: 10%

Number of Contracts = 23 contracts

You can pay all the way up to $4.60 for this spread and it still makes sense.

If you can?t do the options, buy the ProShares Short S&P 500 Short Fund ETF (SH) (click here for the prospectus at http://www.proshares.com/funds/sh.html), or the ProShares Ultra Short S&P 500 Short Fund 2X ETF (SDS) (click here for the prospectus at http://www.proshares.com/funds/sds.html).

In the wake of the Fed?s Wednesday flip-flop, I?m sitting here looking at my screens.

The dollar, Euro, Yen, US Treasury bonds, commodities, gold, silver, and oil all say interest rates are RISING on June 17.

Stocks are saying they?re FALLING.

The million-dollar question is: Who?s lying?

My bet is that it?s stocks that are telling the porky pies.

Here is the tell. The Federal Reserve April Open Market Committee minutes said that a rate rise was on the table if the economic data justify it.

The problem is that having shown their cards for an imminent rate rise, the global market assumption will be that a rate rise in four weeks is a sure thing.

This pretty much screams at you how all asset classes will trade for the next month.

The US dollar (UUP), lured on by the prospect of an expanding yield advantage over the rest of the world, will continue to appreciate. The Euro (FXE), Yen (FXY), US Treasury bonds (TLT), commodities, gold, silver, and oil (USO) will fall.

It?s that simple.

I have to tell you that having traded stocks for a half century, I learned long ago that stocks are congenital liars. So this is not a new thing.

Look no further than the latest batch of data releases. Even though the S&P 500 (SPY) is just short of an all time high, US equity mutual funds have shown net outflows of nearly $20 billion.

It is corporate buy backs and mergers and acquisitions that are levitating the indexes up here. Take those away, and there is nothing but air supporting prices up here.

Think of it as a Wiley Coyote moment.

That is why I sold short the market once again today, specifically through purchasing the S&P 500 SPDR?s (SPY) June, 2016 $210-$215 in-the-money vertical bear put spread at $4.34. This represents a tactical layering on top of my existing short positions.

To lose money, the S&P 500 has to trade at or above the $210 level at the June 17 expiration in 20 trading days.

Then what happens next?

The Fed will stay true to their words, and NOT raise rates in June because, guess what, the economic data don?t justify it. Investors will believe they have a free pass on rates for the rest of 2016 and a global rally ensures.

Having flip-flopped, the Fed will flip-flop again.

That gives my short play here a life of about three weeks, which is just shy? of the entire maturity of my current trading book.

Then it will be time to step out of the market and let IT tell you what it is going to do next.

Sounds to me like a good time to take a cruise.

Queen Mary 2 anyone?

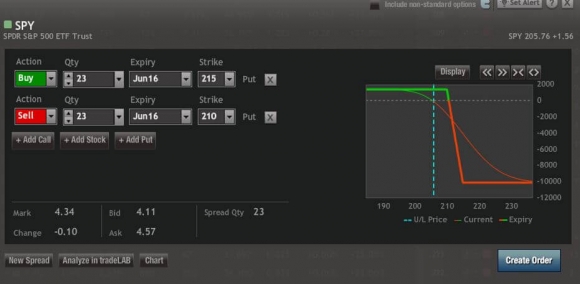

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 9 days to expiration.

Here are the specific trades you need to execute this position:

Buy 23 June, 2016 (SPY) $215 puts at????.?.??$10.70

Sell short 23 June, 2016 (SPY) $210 puts at.???.?..$6.36

Net Cost:???????????????????......$4.34

Potential Profit: $5.00 - $4.34 = $0.66

(23 X 100 X $0.66) = $1,518 or 15.20% profit in 20 trading days.

Not An Investment Strategy