“We have few, if any spare tires left,” said Mohamed El-Erian, CIO of mega bond house PIMCO, about the nail studded road ahead for the US economy.

Global Market Comments

January 28, 2025

Fiat Lux

Featured Trade:

(THE NEW OFFSHORE CENTER: AMERICA),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)

Officials in South Dakota have figured out how to make up for the complete collapse of their oil fracking industry. They are morphing the Peace Garden State into a major offshore banking center.

South Dakota is not alone. Some 200,000 corporations, limited liability companies, and family trusts are registered in remote Stateline, Nevada on the sparkling shores of Lake Tahoe.

And there has been a sudden outbreak of expensive John Lobb shoes, Turnbull & Asser shirts, and Brioni suites in rustic Cheyenne, Wyoming, as foreign bankers and their high-paid tax attorneys descend on the city in droves.

Meet the United States of America, the new tax haven capital of the world.

Friends in the business told me that accounts in Switzerland, the Cayman Islands, and the British Virgin Islands are being closed down by the tens of thousands and moved to the US shores.

Almost all of this money is being transferred by wealthy European, Middle Eastern, and Chinese families who are more interested in “return of capital” than “return on capital.”

It’s best to pay a few dollars in American taxes than have your money expropriated by a corrupt and covetous foreign government, have your children kidnapped, or get stood up against a wall and shot.

The move was prompted by the Obama administration, which pushed through the Foreign Account Tax Compliance Act of 2010, known as FACTA.

Its goal was to flush out wealthy Americans hiding income and assets abroad. The law saddles offshore banks with hefty penalties and fines for helping US citizens avoid the IRS.

For example, Rothschild Bank was hit with a $11.5 million fine for helping 300 Americans hide $794 million in assets.

The law has had the unintended consequence of bringing rich foreigners into compliance as well. It is almost impossible now for an American to open a bank or brokerage account in a country that is not FACTA-compliant.

You are really limited to the dubious domiciles of Nauru, Bahrain, and Vanuatu, all favorites of organized crime, drug dealers, and terrorist groups.

As a former Swiss banker myself, I can tell you that Swiss secrecy was always a myth.

The ice broke during the 1980s when Switzerland froze the accounts of the Ferdinand Marcos family (who I once interviewed for The Economist magazine), who had spent decades looting the government of the Philippines.

Investigators finally found the money invested in several office buildings in Manhattan. The money was eventually returned to the people of the Philippines.

The Swiss reputation for secrecy took a further blow in 2007 when Bradley Birkenfeld, a US citizen working for Union Bank of Switzerland, made the unfortunate decision to fly from Europe to the Caribbean, changing planes in New York City.

There, he was promptly arrested for helping his fellow countrymen avoid taxes. Among the many pearls of wisdom we learned from this case was that the bank advised clients to sneak cash out of the US by sticking large carat polished diamonds into toothpaste tubes.

As a result, 80 Swiss banks paid more than $5 billion in fines. Birkenfeld served a three-year jail sentence after turning over a list of 20,000 US clients. The IRS graciously allowed an amnesty period for his customers.

Birkenfeld was eventually paid a $104 million reward by the IRS Whistleblower Office for turning in his clients, some 30% of the taxes recovered, the largest in US history. Now, Birkenfeld has a wealth management problem of a different kind.

The Swiss haven’t been driven into the poor house yet. They are still holding $1.9 trillion in assets for foreign depositors.

The great irony in all of this is that a number of candidates have been campaigning for president, claiming that America is in a long-term decline and that money is leaving the country.

The foreign 1% beg to differ.

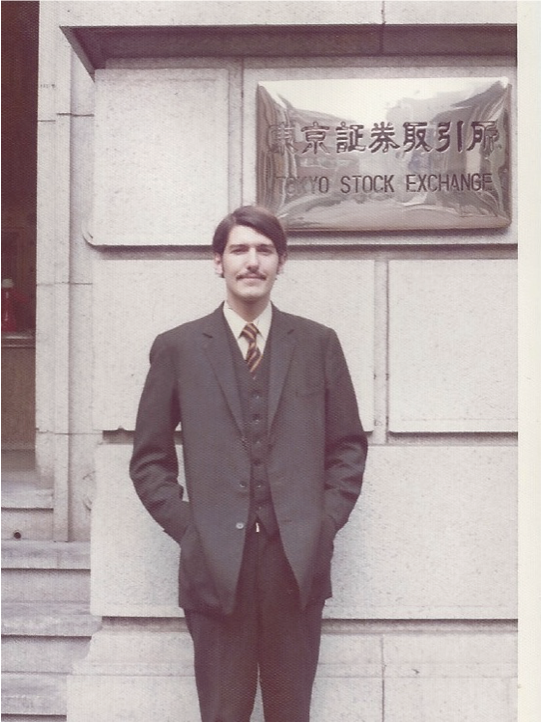

The North Dakota Peace Garden

A Former Swiss Banker

Yahoo is occasionally down in various parts of the country. AWeber, the service provider we use to send out the Trade Alerts by email, sometimes goes completely down for hours and initially denies that the problem was at their end.

They blamed a surge in Internet traffic (probably another battle in the ongoing cyber war that we will never hear about), server delays, and for good measure, complained that their dog ate their homework.

However, paid subscribers to my Text Alert Service received messages on their cell phones within seconds worldwide, and thus were able to act immediately on my perfectly timed Trade Alerts.

Every time I see this happen, I am amazed that I lived this long to see this technology develop. It’s all really great…. when it works.

To activate this service, please log in to your account and text your cell phone number to support@madhedgefundtrader.com

Time is of the essence in the volatile markets. Individual traders need to grab every advantage they can. This is an important one.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Hook Me Up to John Thomas

Global Market Comments

January 27, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TRADE WAR BEGINS),

(SPY), (TLT), (TSLA), (NFLX)

The punitive 25% tariff against Columbia for refusing to take back their own immigrants clearly signals how international relations will be conducted going forward. Never mind that it was rolled back 25 hours later. The intentions are clear. Notice that it is America’s biggest exporters, the Magnificent Seven, that are getting absolutely slaughtered this morning.

Who’s next? There are no allies anymore.

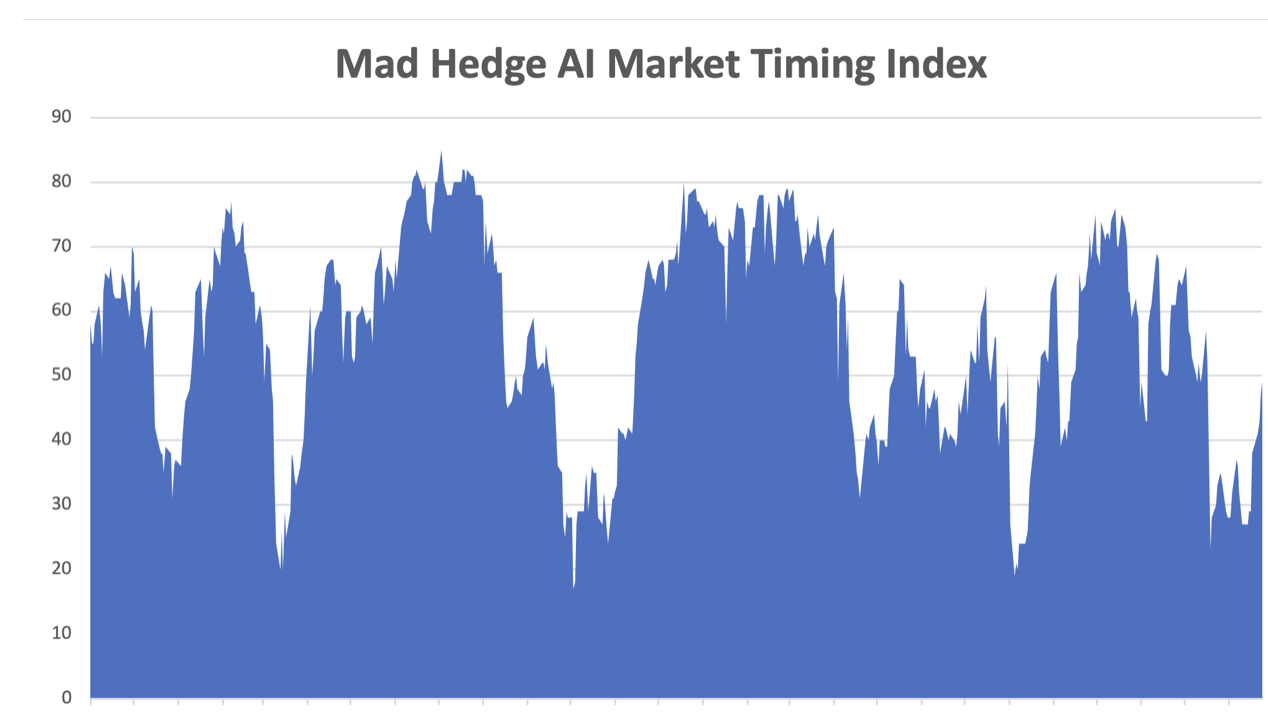

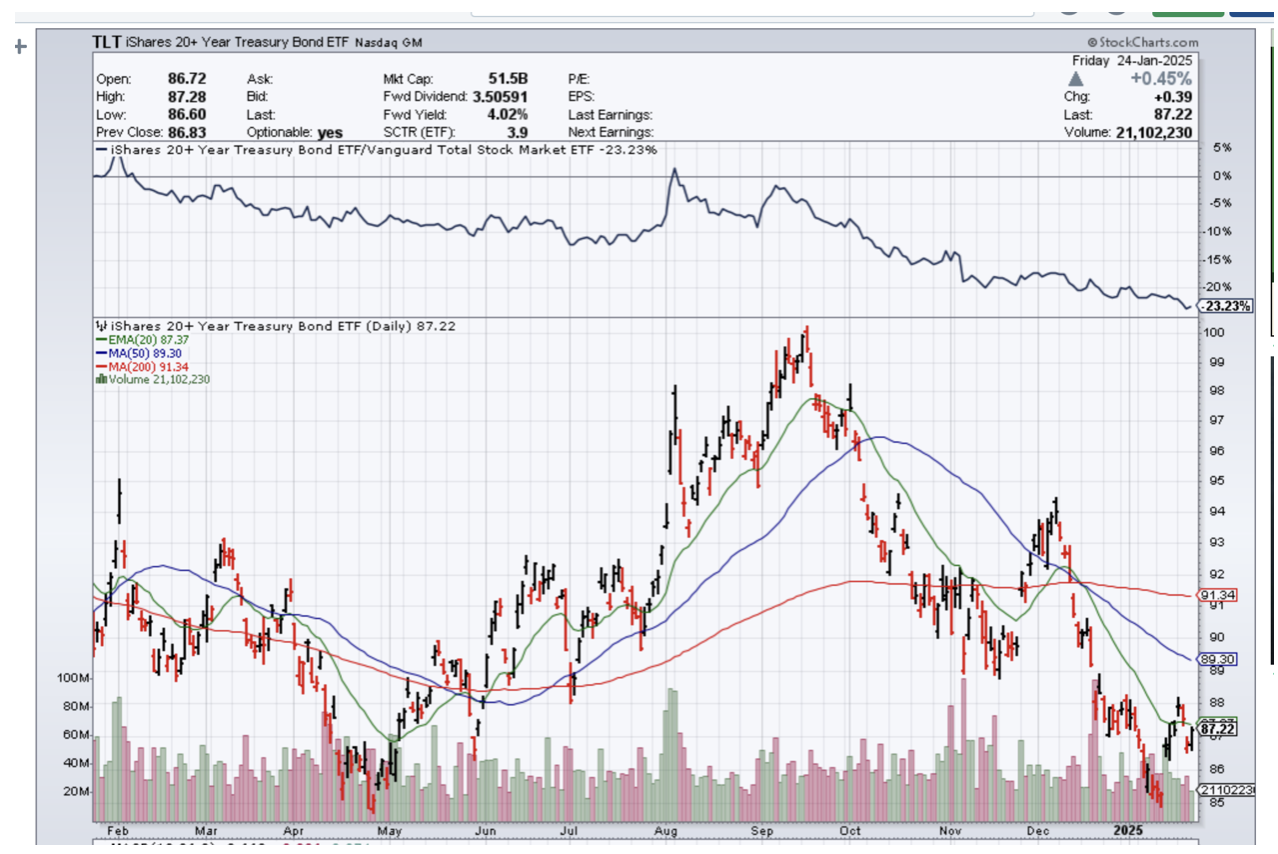

I am normally not a shy, retiring, or timid person, as those who know me will testify heartily. However, given that I have only executed three trades this month, one might be forgiven for thinking so. Those would be successful longs and shorts in Tesla (TSLA) and a stop loss in bonds (TLT). Still, up 2.29% so far in such an indecisive month is better than a poke in the eye with a sharp stick.

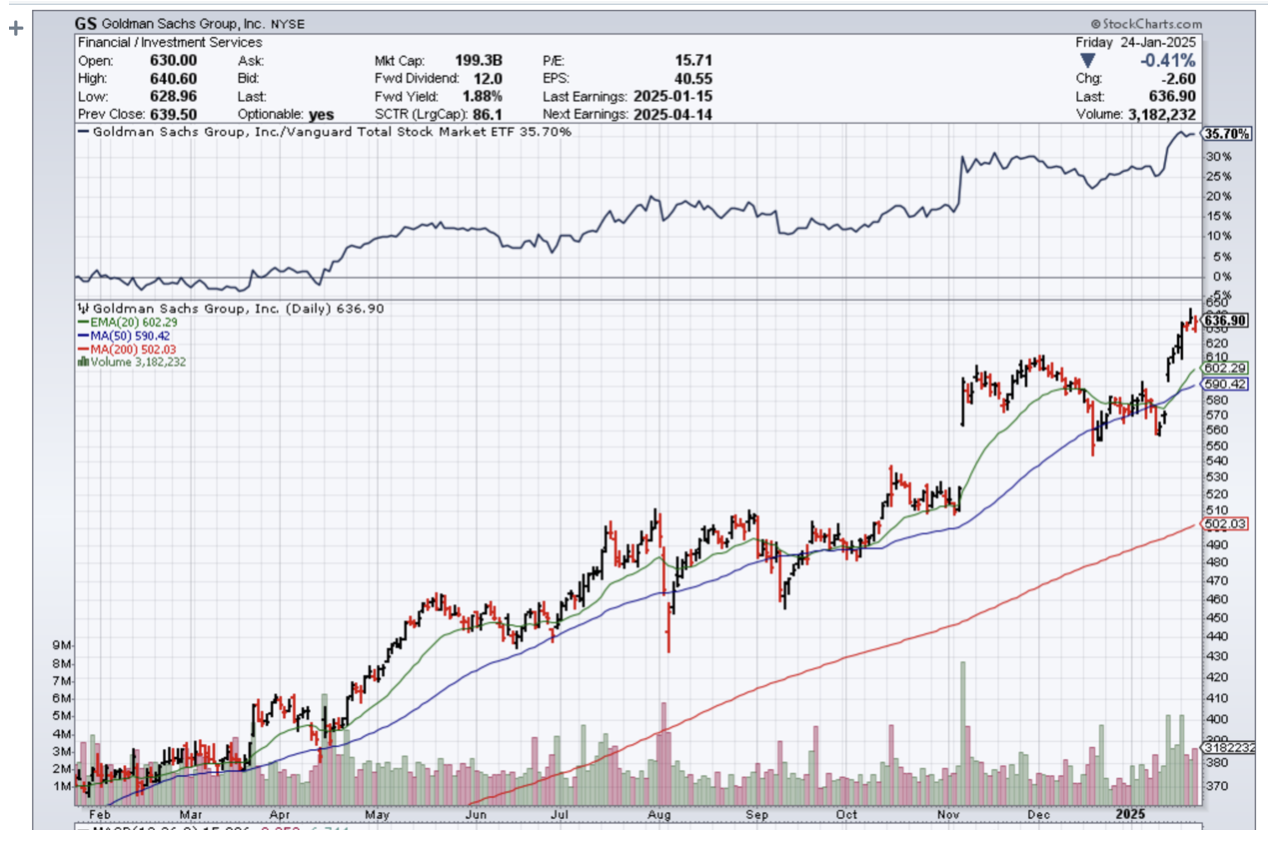

Partly I have acquired a newfound shyness because I don’t want to spoil a near-perfect record for the last five months of 2025. During this period, I executed 47 trades and lost on only 4 of them for a win rate of 91.49%. This is the highest success rate in the nearly 17-year history of the Mad Hedge Fund Trader. What’s more, we took in a staggering 57.9% during this time when the stock market was earning almost nothing.

But the market is certainly indecisive, can’t decide where to go, and is awaiting its marching orders. This is not a time to bet the ranch as we did in Q4 with financials, but only to stick a nervous toe in the water until the market tells you what to do. For now, better to bet just a single cow.

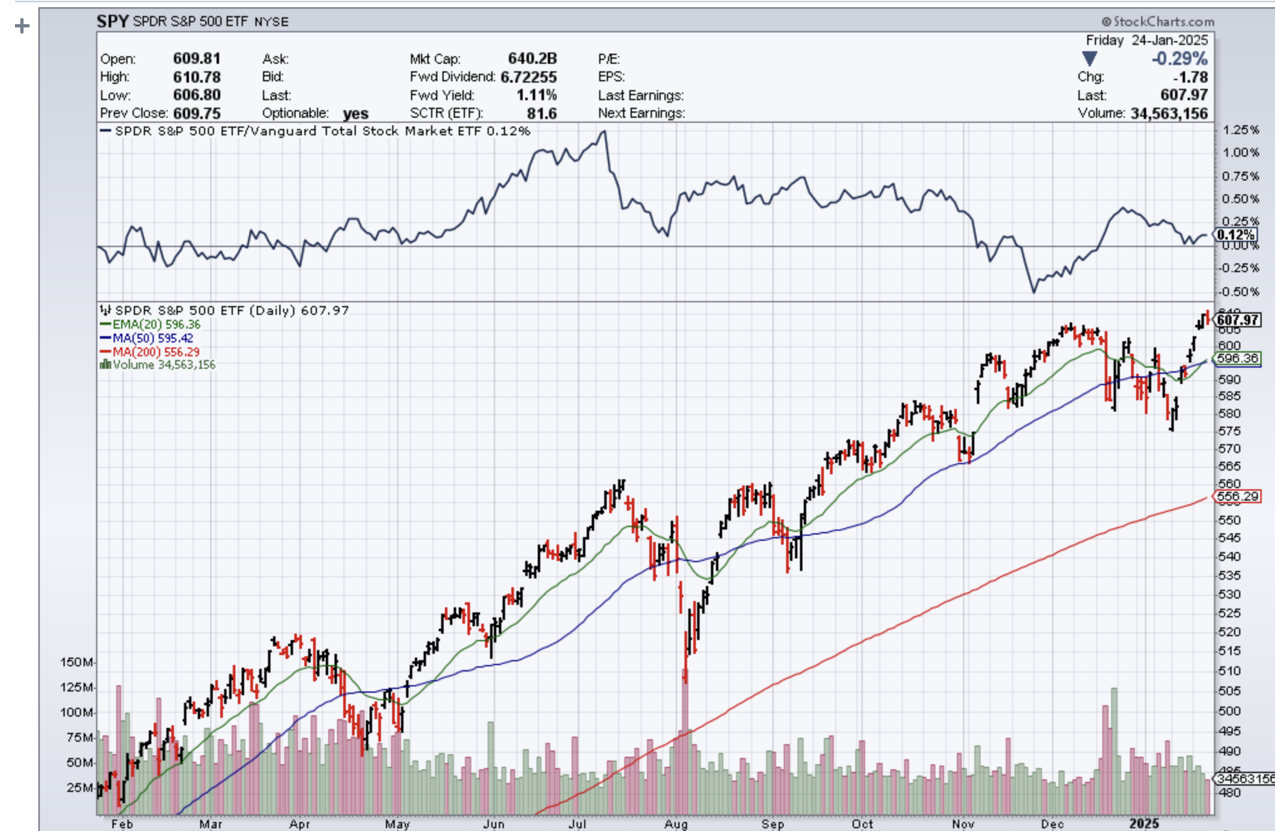

By far the most interesting chart last week is that for the S&P 500 (SPY). Two weeks ago, we saw a lower low at $575 followed by a higher high up to $610 the following week. This is known as an “outside trade” in the trade and always presages an increase in volatility. And volatility we shall get.

All of the traditional market valuation indicators followed by Wall Street are now at their 98% to 100% levels of extreme. This is a clear warning signal of hard times ahead. Apple is giving us the best “tell” having its worst start to the year since 2008, down $40, or 15.38%, some $600 billion in market cap.

It could be a long wait.

The new administration is attempting to pass a Grand policy bill that will approve all of its policy initiatives in a single bill. That might take until May at the earliest and November at the latest, if it passes at all. That is a very long time for the market to wait for a result.

I explained last week that the bull case is that the new administration does nothing. We got a step in that direction last week when Trump said he would “study” tariffs rather than implement them. If Trump ends up not implementing tariffs, or only token ones, it would be good news for the growth of the US economy.

Let me summarize how the China-US trade works in a single sentence. China makes a widget for $1.00 which it then sells to an American buyer for $2.00, reaping a 100% profit. The American buyer then sells its Chinese widget for $20. Some 5% of the profit stream stays in China and 95% with the American seller. Stop this trade and that $18 US profit is lost, wiping out two million US small businesses. I argue that 95% of something is better than 100% of nothing.

By the way, the same argument applies to TikTok, which probably supports another two million single individual revenue streams.

Netflix Earnings Rocketed on the back of 19 million new subscribers. The streaming giant reported better-than-expected fourth-quarter results and raised its 2025 revenue forecast. For the fourth quarter, earnings of $4.27 per share topped Street estimates of $4.18. Revenue of $10.25 billion also topped the Bloomberg consensus estimate of $10.11 billion. Netflix added 18.91 million subscribers in the quarter versus an expected 9.18 million. Mad Hedge already took profits on a long going into the announcement.

The streaming wars are well and truly over.

Apple is in Free Fall, after multiple downgrades, taking the stock down $40, or 15% in a month. Apple has lost some market share in China and has had limited traction with its AI offerings. Even a strong dollar is hurting. Apple sells a lot of things overseas. That’s the fundamental backdrop. The technical picture shows investors what can happen if investors continue to see a deterioration in the company’s business. Avoid (AAPL) for now.

Morgan Stanley (MS) Warns Customers to Cut Stock Exposure. With the S&P 500 index touching a new all-time high Wednesday, U.S. stocks remaining pricey and valuations appearing stretched, investors should make sure to keep a diversified portfolio. The S&P 500 index’s valuation is too high, expectations for earnings growth are too ambitious, and that it’s unclear what President Donald Trump’s policies will mean for Wall Street.

Credit Card Delinquencies Soar, as have minimum monthly payments. The share of active credit card holders just making minimum payments rose to 10.75% in the third quarter of 2024, the highest ever in data going back to 2012. The share of cardholders more than 30 days past due rose to 3.52%, an increase from 3.21%, for a gain of more than 10%. Even with the rising delinquency rate, it is still well below the 6.8% peak during the 2008-09 financial crisis and not yet indicative of serious strains.

Home Insurance Costs are Soaring, for homeowners in the most-affected regions, California and Florida. For consumers living in the 20% of zip codes with the highest expected annual losses, premiums averaged $2,321, or 82% more than those living in the 20% of lowest-risk zip codes from 2018-22. This is going to get worse before it gets better.

Ban Lifted on New Natural Gas Export Facilities in 4 Years, reversing a Biden-era climate initiative. Cheniere Energy (LNG), an old Mad Hedge favorite has risen 75% since the summer and sold off on the news. The big winner here? China, which can now buy more low-priced natural gas.

Housing Starts were up 3.0% in December, with single-family homes up only 3%, while multifamily saw a 59% rise. It should be the shift away from home sales crushed by 7.2% mortgage rates. You can write off real estate in 2025.

EV and Hybrid Sales Reach a Record 20% of US Vehicle Sales in 2024 and now account for 10% of the total US fleet. And you wonder why oil prices are so low. That includes 1.9 million hybrid vehicles, including plug-in models, and 1.3 million all-electric models. Tesla continued to dominate sales of pure EVs but Cox Automotive estimated its annual sales fell and its market share dropped to about 49%.

SpaceX Starship Blows Up on test launch number seven. The Federal Aviation Administration issued a warning to pilots of a “dangerous area for falling debris of rocket Starship,” according to a pilots’ notice. Looks like that Mars trip will be delayed.

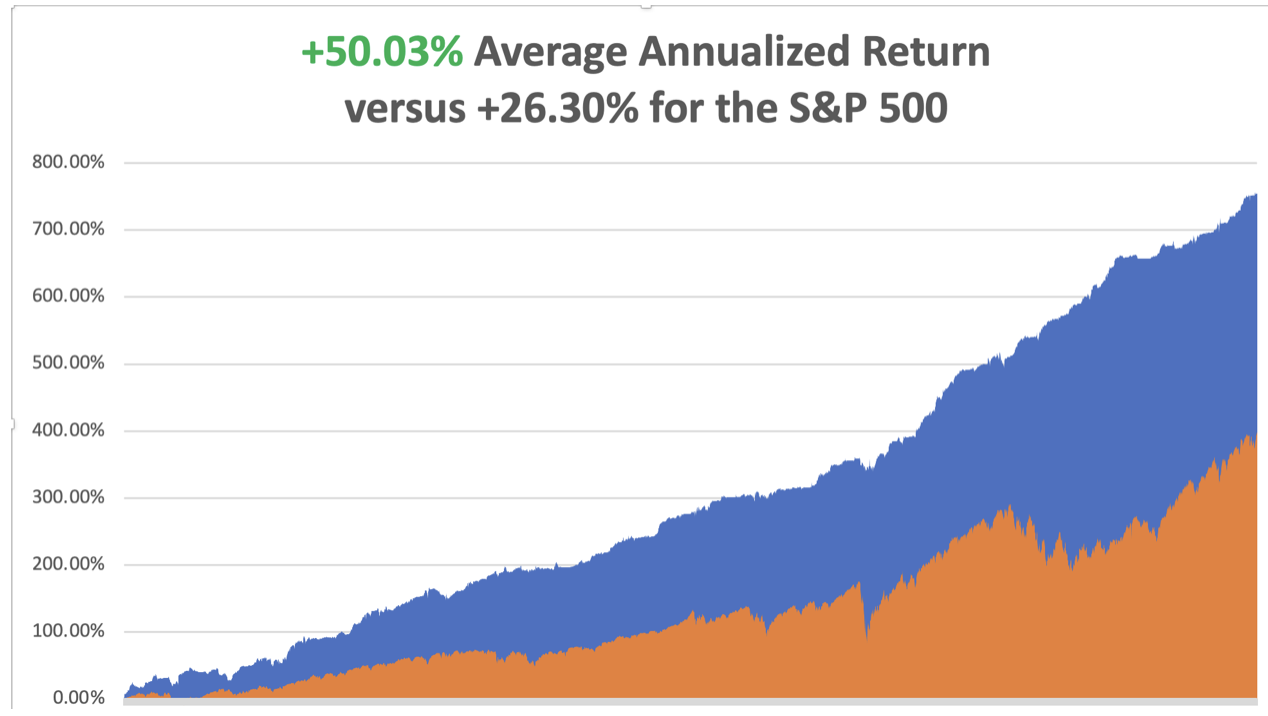

We managed to grind out a +2.29% return so far in January. That takes us to a year-to-date profit of +2.29% so far in 2025. My trailing one-year return stands at +88.88% as a bad trade a year ago fell off the one-year record. That takes my average annualized return to +50.03% and my performance since inception to +754.13%.

I used a 19% spike in Tesla shares to add a new short position there. The combination of my long and short hedging each other is known as a “short strangle.” It is a combined bet that Tesla will not fall below $310 or rise above $540 by the February options expiration in 19 trading days. Sounds pretty good to me.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, January 27, at 8:30 AM EST, Leading Economic Indicators are out.

On Tuesday, January 28 a 8:30 AM, the Durable Goods are released.

On Wednesday, January 29 at 8:30 AM, the Federal Reserve Interest Rate Decision is announced. A press conference follows at 2:30.

On Thursday, January 30 at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get an update on GDP growth.

On Friday, January 31 at 8:30 AM, Core PCE is printed. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, occasionally I tell my close friends that I hitchhiked across the Sahara Desert alone when I was 16 and met with looks that are amazed, befuddled, and disbelieving, but I actually did it in the summer of 1968.

I had spent two months hitchhiking from a hospital in Sweden all the way to my ancestral roots in Monreale, Sicily, the home of my Italian grandfather. My next goal was to visit my Uncle Charles, who was stationed at the Torreon Air Force base outside of Madrid, Spain.

I looked at my Michelin map of the Mediterranean and quickly realized that it would be much quicker to cut across North Africa than hitching all the way back up the length of Italy, cutting across the Cote d’Azur, where no one ever picked up hitchhikers, then all the way down to Madrid, where the people were too poor to own cars.

So one fine morning, I found myself taking a deck passage on a ferry from Palermo to Tunis. From here on, my memory is hazy and I remember only a few flashbacks.

Ever the historian, even at age 16, I made straight for the Carthaginian ruins where the Romans allegedly salted the earth to prevent any recovery of a country they had just wasted. Some 2,000 years later, it worked as there was nothing left but an endless sea of scattered rocks.

At night, I laid out my sleeping bag to catch some shut-eye. But at 2:00 AM, someone tried to bash my head in with a rock. I scared them off but haven’t had a decent night of sleep since.

The next day, I made for the spectacular Roman ruins at Leptus Magna on the Libyan coast. But Muamar Khadafi pulled off a coup d’état earlier and closed the border to all Americans. My visa obtained in Rome from King Idris was useless.

I used the opportunity to hitchhike over Kasserine Pass into Algeria, where my uncle served under General Patton in WWII. US forces suffered an ignominious defeat until General Patton took over the army in 1943. Some 25 years later, the scenery was still littered with blown-up tanks, destroyed trucks, and crashed Messerschmitts.

Approaching the coastal road, I started jumping trains headed west. While officially the Algerian Civil War ended in 1962, in fact, it was still going on in 1968. We passed derailed trains and smashed bridges. The cattle were starving. There was no food anywhere.

At night, Arab families invited me to stay over in their mud brick homes as I always traveled with a big American Flag on my pack. Their hospitality was endless, and they shared what little food they had.

As the train pulled into Algiers, a conductor caught me without a ticket. So, the railway police arrested me and on arrival, they took me to the central Algiers prison, not a very nice place. After the police left, the head of the prison took me to a back door, opened it, smiled, and said “Si vou plais”. That was all the French I ever needed to know. I quickly disappeared into the Algiers souk.

As we approached the Moroccan border, I saw trains of camels 1,000 animals long, rhythmically swaying back and forth with their cargoes of spices from central Africa. These don’t exist anymore, replaced by modern trucks.

Out in the middle of nowhere, bullets started flying through the passenger cars splintering wood. I poked my Kodak Instamatic out the window in between volleys of shots and snapped a few pictures.

The train juddered to a halt and robbers boarded. They shook down the passengers, seizing whatever silver jewelry and bolts of cloth they could find.

When they came to me, they just laughed and moved on. As a ragged backpacker, I had nothing of interest for them.

The train ended up in Marrakesh on the edge of the Sahara and the final destination of the camel trains. It was like visiting the Arabian Nights. The main Jemaa el-Fna square was amazing, with masses of crafts for sale, magicians, snake charmers, and men breathing fire.

Next stop was Tangiers, the site of the oldest foreign American Embassy, which is now open to tourists. For 50 cents a night, you could sleep on a rooftop under the stars and pass the pipe with fellow travelers which contained something called hashish.

One more ferry ride and I was at the British naval base at the Rock of Gibraltar and then on a train for Madrid. I made it to the Torreon base main gate where a very surprised master sergeant picked up my half-starved, rail-thin, filthy nephew and took me home. Later, Uncle Charles said I slept for three days straight. Since I had lice, Charles shaved my head when I was asleep. I fit right in with the other airmen.

I woke up with a fever, so Charles took me to the base clinic. They never figured out what I had. Maybe it was exhaustion, maybe it was prolonged starvation. Perhaps it was something African. Possibly, it was all one long dream.

Afterward, my uncle took me to the base commissary where I enjoyed my first cheeseburger, French fries, and chocolate shake in many months. It was the best meal of my life and the only cure I really needed.

I have pictures of all this which are sitting in a box somewhere in my basement. The Michelin map sits in a giant case of old, used maps that I have been collecting for 60 years.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

North Africa in 1968

Welcome to Florida

“To pursue the mosquito theory as a cause of yellow fever would be a complete waste of government money,” said an army doctor in 1898.

Global Market Comments

January 24, 2025

Fiat Lux

Featured Trade:

(SOME SAGE ADVICE ON ASSET ALLOCATION)

Asset allocation is the one question that I get every day, which I absolutely cannot answer.

The reason is simple: no two investors are alike.

The answer varies whether you are young or old, have $1,000 in the bank or $1 billion, are a sophisticated investor or an average Joe, are in the top or the bottom tax bracket, and so on.

This is something you should ask your financial advisor if you haven’t fired him already, which you probably should.

Having said all that, there is one old hard and fast rule, which you should probably dump.

It used to be prudent to own your age in bonds. So, if you were 70, you should have had 70% of your assets in fixed-income instruments and 30% in equities.

Given the extreme overvaluation of all bonds today, and that we are probably already in a 30-year bear market, I would completely ignore this rule and own no bonds whatsoever.

This is especially true of government bonds, which are yielding near zero interest rates in Europe and Japan, and only 2.23% in the US.

Instead, you should substitute high dividend-paying stocks for bonds. You can get 4% a year or more in yields these days, and get a great inflation hedge, to boot.

You will also own what everyone else in the world is trying to buy right now, high-yield US stocks.

You will get this higher return at the expense of higher volatility. So just turn the TV off on the down days so you won’t get panicked out at the bottom.

That is until we hit the next recession. Then all bets are off. That may be three years off, or more.

I hope this helps.

John Thomas

The Diary of a Mad Hedge Fund Trader

Under or Over 70?

“Fair value doesn’t mean you have to go down. It just means you have to be cautious,” said hedge fund legend David Tepper of Appaloosa Management.