“We’ve seen the S&P 500 drop 50% twice in the last 15 years. That is the new normal”, said Richard Kang of Emerging Global Advisors.

Global Market Comments

October 1, 2025

Fiat Lux

Featured Trade:

(THERE ARE NO GURUS)

Global Market Comments

September 30, 2025

Fiat Lux

Featured Trade:

(I HAVE A NEW OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(TESTIMONIAL)

Global Market Comments

September 29, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GOVERNMENT SHUTDOWN IS HERE)

(SPY), ($INDU), (IWM), (V), (MA), (AXP), (UNG),

(CCJ) (XOM), (OXY) (DUK) (TAN), (FSLR)

“Whatever worry you have, if it’s inflation, if it's recession, if it's depression, if it’s the National Debt, gold is the answer,” said my friend John Paulson.

Global Market Comments

September 26, 2025

Fiat Lux

Featured Trade:

(TRADE ALERT - (FCX) - BUY)

Global Market Comments

September 25, 2025

Fiat Lux

Featured Trade:

(THIS IS NOT YOUR FATHER’S NUCLEAR POWER PLANT)

(SMR), (MSFT), (GOOGL), (AMZN)

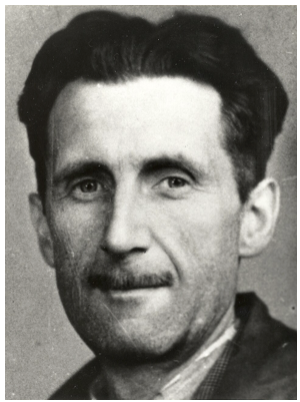

“At a time of universal deceit, truth telling is revolutionary” said English author George Orwell.

Global Market Comments

September 24, 2025

Fiat Lux

Featured Trade:

(THE NEW OFFSHORE CENTER: AMERICA),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS),

Global Market Comments

September 23, 2025

Fiat Lux

Featured Trade:

(HOW TO AVOID THE PONZI SCHEME TRAP)

(TESTIMONIAL)