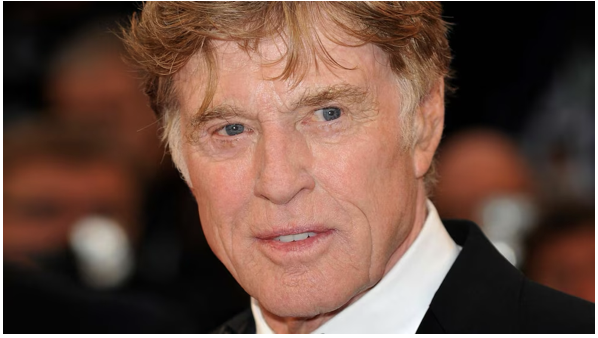

“Success is a double-edged sword. You want to shadow box with it and not dance with it,” said my late neighbor, Robert Redford.

Global Market Comments

September 22, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WHY THE CRASH WILL START ON NOVEMBER 5)

(GS), (JPM), (AAPL), (TLT), (MSFT)

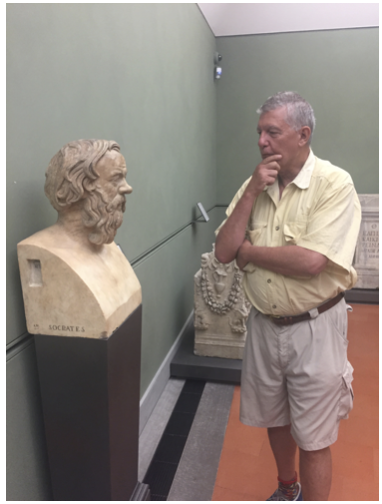

“A life not self-examined is not worth living,” said the Greek philosopher Socrates.

Global Market Comments

September 19, 2025

Fiat Lux

Featured Trade:

(SEPTEMBER 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(GS), (HOOD), (DAX), (SPY), (TLT),

(GLD), (MSTR), (PFE), (FCX), (BITO)

“I’m long and I hate it. The closer we get to the top of the mountain, the closer we get to the other side, which can be terrible,” said old friend, hedge fund legend David Tepper.

Global Market Comments

September 17, 2025

Fiat Lux

Featured Trade:

(TAKE A LEAP INTO LEAPS)

“You can reduce discretionary spending down to zero and it won’t have much impact on our fiscal problems because it’s such a small proportion of the total,” said Ben Bernanke, former chairman of the Federal Reserve.

Global Market Comments

September 16, 2025

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE FRIDAY, SEPTEMBER 19, OPTIONS EXPIRATION)

(GS), (JPM)

Global Market Comments

September 15, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WATCHING THE DANCING FOOLS)

"Every attempt to make war easy and safe will result in humiliation and disaster," said the Civil War General, William T. Sherman.