Global Market Comments

December 31, 2024

Fiat Lux

Featured Trade:

(SO WHAT IS YOUR “INFLUENCER” SCORE)

(REPORT FROM THE ORIENT EXPRESS)

First, there was your grade point average, then your SAT score, followed by GMAT and LSAT scores, and finally your FICO.

Now there is a new metric with which you will be judged, your “Influencer” score.

A new breed of marketing research firms are using data from social media sites, like Facebook, Linkedin, and Twitter, to rank members according to their ability to spur their friends to action.

Companies like Klout, Peer Index, and Twitter Grader are using complex algorithms to mine their data and rank members. This is far more than just a simple listing of “friends.”

Scores range from 1-100, with a major league socializer achieving a 40 ranking, and someone like Bono or Martha Steward coming in at a godlike 100.

These scores will be made public and could have a major impact on your career prospects, your credit rating, and even your sex life. I can hear this conversation coming already: “Thanks for the invitation to the opera, honey, but I have a better offer from an 80 score to go to the Giants game.”

Do you like your new BMW, American Express card, or Rolex watch and are you talking about it with your friends? Advertisers are willing to pay big bucks to get to know you.

Last year, Virgin America airline offered free tickets to Los Angeles and San Francisco to highly ranked influencers, while Audi made available special discounts for a new car. Las Vegas casinos are giving away weekends with complimentary show tickets and generous room service tabs.

I have to tell you that I am looking forward to the new system. I just passed 1,700 likes on Facebook and have a massive Twitter following.

My website gets 30,000 hits a day and is read in 125 countries, so I should score pretty highly.

I understand that Maria Shriver has recently become available. Hey, Maria! Want to check out my 90? I’ll even fire my cleaning lady!

Will a 90 Score Tickle Your Fancy?

I was awoken from a dead sleep in the middle of the night in my suite on the Orient Express by a juddering halt and the smell of burning breaks in the air.

We were somewhere high in the Swiss Alps, and every single passenger on the first-class train had to be thinking that a murder had just been discovered.

It turned out that it had, just not what you think. In the darkness, we had hit a 400-pound wild boar astride the tracks. We spent four hours on a remote siding waiting for Swiss National Rail to deliver us a new engine.

I elicited chuckles when I ordered boar for lunch the next day. The matre’d assured me it wasn’t ready yet, as the meat had to soak in vinegar for 48 hours before cooking. That’s the kind of thing you only hear in Europe.

I boarded the train that morning at London’s Victoria Station in anticipation of the trip of a lifetime. Venice Simplon Orient Express didn’t disappoint, although I would not be surprised if the IRS questioned the $8,500 cost for the 34-hour trip as a business expense on my tax return this year.

The legendary train has featured in a dozen films (James Bond and Agatha Christie) two dozen television shows, and played a major part in countless novels. You can even buy a video game.

The modern Orient Express is, in fact, three different trains.

From Victoria Station in London to Folkestone on the coast, I traveled on a vintage British train from the 1920’s that was definitely showing its age.

Then I boarded a bus, which drove on to a flatbed rail car that whisked us through the tunnel under the English Channel. There, we claustrophobes closed our eyes and held our breath for 20 minutes, which, at the nadir, my altimeter watch showed us at 1,500 feet below sea level.

The real luxury started when I boarded a 1924 Pullman first-class sleeping car in Calais, France, lovingly restored to the day it was built.

I set my watch ahead one hour and back 100 years. Suddenly, the trees resembled those in impressionist paintings, the land was dotted with Norman fortresses, and gasoline was $8 a gallon.

The original Orient Express, from Paris to Istanbul, made its inaugural journey in 1882 and quickly became famous for its unheard-of luxury and speed. Modern bullet trains and cut-rate airlines put it out of business 90 years later.

The current incarnation started in 1977 when James Sherwood, who had built up a fortune through Sea-Land Containers, bought three dilapidated Pullman rail cars at an auction in Monte Carlo. Like all of us with insanely expensive hobbies, he sought a way for outsiders to fund his passion.

Hence, the Venice-Simplon Orient Express started luring big spenders and the romantically inclined in 1982 (click here).

I became one of the original passengers in England when my broker chartered it for a day of client entertainment, an ancient steam engine laboring all the way.

Over the next 30 years, Sherwood built Orient Express into one of the world’s preeminent luxury brands, on par with Cartier, Tiffany, and Channel.

He developed a massive global network of cross-marketing deals that tied in package tours, hotels, cruises, and other vintage trains.

Today, the parent company, Belmond, carries a market cap of $1.3 billion (click here for that site).

Ironically, the company today still only owns one of its dozens of rail cars. The rest have been sold to Middle Eastern investors with long-term leaseback contracts.

The dinner onboard is the highlight of the trip, a fabulous six-course, three-hour affair. There, you meet the other passengers, all dressed to the nines.

Most were wealthy elderly couples knocking off a bucket list item, along with a few young hedge fund managers, bitcoin investors, and a passel of mistresses.

I was one of the few Americans. I ate with a casino operator in Ireland and the owner of a manufacturing company in the UK. All I can say is thank goodness for the elastic waist on my tux trousers.

Having spent a lifetime analyzing corporate managements, I was fascinated by the operation of the train. While the onboard staff is limited to 79, they are supported by a management, marketing, and engineering team of no less than 4,500.

You don’t just show up with a 17-car train in Europe’s incredibly congested rail network. You must first file a route plan and get a clearance slot, much like any airline.

Engines and crews must be changed at every border. Mechanics are onboard with an ample stockpile of 1920’s rail car parts. Oblivious passengers are frequently left stranded behind at stations along the way and must be retrieved by taxis, which catch the train down the line.

To make up for the time we lost due to the unlucky boar, the rail authorities routed us through the 12-mile long transalpine tunnel under Splügen Pass, then along the sublime shores of Lake Como, where the train rarely travels.

We roared past George Clooney’s house, who, I am told, is a frequent passenger on the train. Amazed Italians were waving and taking pictures of us with their cell phones at every stop. Suddenly, the buildings were all shaded in pastels, the churches changed from Protestant to Catholic, and the trees resembled those in Renaissance religious paintings.

We raced over the causeway to Venice’s Marco Polo station that evening, dumping our considerable luggage into a private speedboat that whisked us away down a Grand Canal crowded with gondolas en route to the fabled Cipriani Hotel.

To be continued.

“To get rich is glorious!” said Deng Xiaoping, the Chinese general who launched the country’s modern economy in the seventies.

Global Market Comments

December 30, 2024

Fiat Lux

Featured Trade:

(MY OLD PAL, LEONARDO FIBONACCI),

(TESTIMONIAL)

I remember the 12th century like it was yesterday.

In those days, the leading intellectuals used to get together and drink wine by the gallon, which then was really little more than rotten grape juice. The problem was that we all used to pass out before anybody came up with a great idea.

Then, someone started importing coffee from the Middle East, and thinkers stayed awake long enough to produce great thoughts.

Enter the Renaissance.

One of the guys I used to hang out with then was named Leonardo Fibonacci. Good old Leo was a man after my own heart, a world-class nerd and geek with a penchant for mathematics.

His dad was a diplomat from the Court at Pisa to the Algiers sultanate who had a nice little import/export business on the side. It is safe to say that there was probably as little action in Algiers then as there is today. I know because I’ve been there.

Instead of camping out in his dad’s basement and staying depressed like a lot of young men these days, Leo killed time trolling the local bazaars for interesting used books he could buy on the cheap.

Remember, this was before texting. That was not hard to do since most people couldn’t read. He took the trouble to learn Arabic and translated them back into Latin. Ancient math books were his specialty.

It didn’t take Leo long to figure out that the Arabs had developed a numbering system vastly superior to the Roman numerals then in use in Europe. Most importantly, they mastered the concept of zero and the placement of digits in addition and subtraction. The Arabs themselves, in fact, lifted these concepts from archaic Indian mathematicians as far back as the 6th century.

If you don’t believe me about the significance of this discovery, try multiplying CCVII by XXXIV. (The answer is VIIXXXVIII, or 7,038). Try designing a house, a bridge, or a computer software program with such a cumbersome numbering system.

Leo didn’t just stop there. He also discovered a series of numbers, which seemed to have magical predictive powers. The formula is extremely simple. Start with zero, add the next number, and you have the next number in the series.

Continue the progression, and you get 0,1,1,2,3,5,8,13,21,34,55…. and so on. It’s no surprise that the sequence became known as the “Fibonacci Sequence.”

The great thing about this series is that if you divide any number in it by the next one, you get a product that has become known as the “Golden Ratio.” This number is 1:1.618, or 0.618 to one.

Fibonacci’s original application for this number was to predict the growth rate of a population of breeding rabbits.

Then some other mathematicians started poking around with it. It turns out the Great Pyramid in Egypt was built to the specification of a Fibonacci ratio. So is the rate of change of the curvature in a seashell or a human ear. So is the ratio of the length of your arms to your legs.

Upon closer inspection, the Fibonacci turned out to be absolutely everywhere, from the structure of the tiniest cell to the swirl of the largest galaxies in the universe.

Fibonacci introduced his findings in a book entitled “Liber Abaci,” or “Free Abacus,” in English, which he published in 1202. In it, he proposed the 0-9 numbering system, place values, lattice multiplication, fractions, bookkeeping, commercial weights and measures, and the calculation of interest. It included everything we would recognize as modern mathematics.

The book launched the scientific revolution in Europe, which led us to where we are today. It was a major bestseller. In fact, you can still buy it on Amazon, making it the longest continuously published book in history.

Enter the stock market. By the end of the 19th century, some observers noticed that share prices tended to move in predictable patterns on charts. In particular, they always seemed to advance and pull back around the numbers forecast by my friend, Fibonacci, seven hundred years earlier.

These people came to be known as “technical analysts,” as opposed to fundamental analysts, who look at the underlying business behind each company.

By the 1930’s, Fibonacci numbers had worked their way into mainstream technical analytical theories, such as Elliot Wave. Today, most market tracking software and data systems, like Bloomberg, will automatically throw up Fibonacci support and resistance numbers on every stock chart.

Why am I talking about this? Because I am frequently asked how I pick the precise strike prices for options in my own Trade Alert Service. I use a combination of moving averages, moving average convergence-divergence (MACD) indicators, Bollinger bands, Fibonacci numbers, and a chant taught to me by an old Yaqui Indian shaman.

And I do all of this only after going over the underlying fundamentals of the stock or index with a fine-toothed comb. I can’t be any clearer than that.

Enter the high-frequency traders. Knowing that the bulk of us rely on Fibonacci numbers for our short-term trading calls, they have developed algorithms that seek to exploit that preference.

They enter a large number of stop loss orders to sell just below a “Fibo” support level, then put up fake but extremely large offers just above it, which are usually canceled. Only 1% of these orders ever get executed.

When conventional traders see these huge offers to sell, they panic, dump their stocks, and trigger the stop losses. The HFT’s then jump in and cover their own shorts for a quick profit, sometimes only for a fraction of a penny.

The net effect of these shenanigans is to make Fibo numbers less effective. Fibo support is just not as rock solid as it used to be, nor is resistance. This is why the performance of several leading technical analysts has seriously deteriorated in recent years.

Although their importance is now somewhat diluted, I still enjoy Fibonacci numbers, as I see them in nature all around me. They occasionally have other uses, such as in cryptography.

When I watched The Da Vinci Code sequel, “Angels & Demons,” and listened to the clues, I recognized the handiwork of my old friend Leo. The rest of the audience sat there clueless, except for the group in the next row wearing “UC BERKELEY” hoodies.

For the fellow geeks and nerds among you, here are the precise Fibonacci numbers indicating support and resistance, which you will find on a stock chart.

Fibonacci Ratios

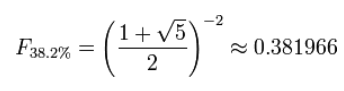

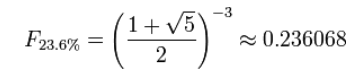

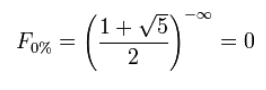

Fibonacci ratios are mathematical relationships, expressed as ratios, derived from the Fibonacci sequence. The key Fibonacci ratios are 0%, 23.6%, 38.2%, and 100%.

The key Fibonacci ratio of 0.618 is derived by dividing any number in the sequence by the number that immediately follows it. For example: 8/13 is approximately 0.6154, and 55/89 is approximately 0.6180.

The 0.382 ratio is found by dividing any number in the sequence by the number that is found two places to the right. For example: 34/89 is approximately 0.3820.

The 0.236 ratio is found by dividing any number in the sequence by the number that is three places to the right. For example: 55/233 is approximately 0.2361.

The 0 ratio is :

Leonardo Fibonacci (Maybe)

Thank John for his ceaseless banter. I enjoy this service so much. Great stories!!!!

I hope our paths cross soon.

Thank you.

Bill

North Carolina

Global Market Comments

December 27, 2024

Fiat Lux

Featured Trade:

(HOW MY MAD HEDGE AI MARKET TIMING ALGORITHM WORKS)

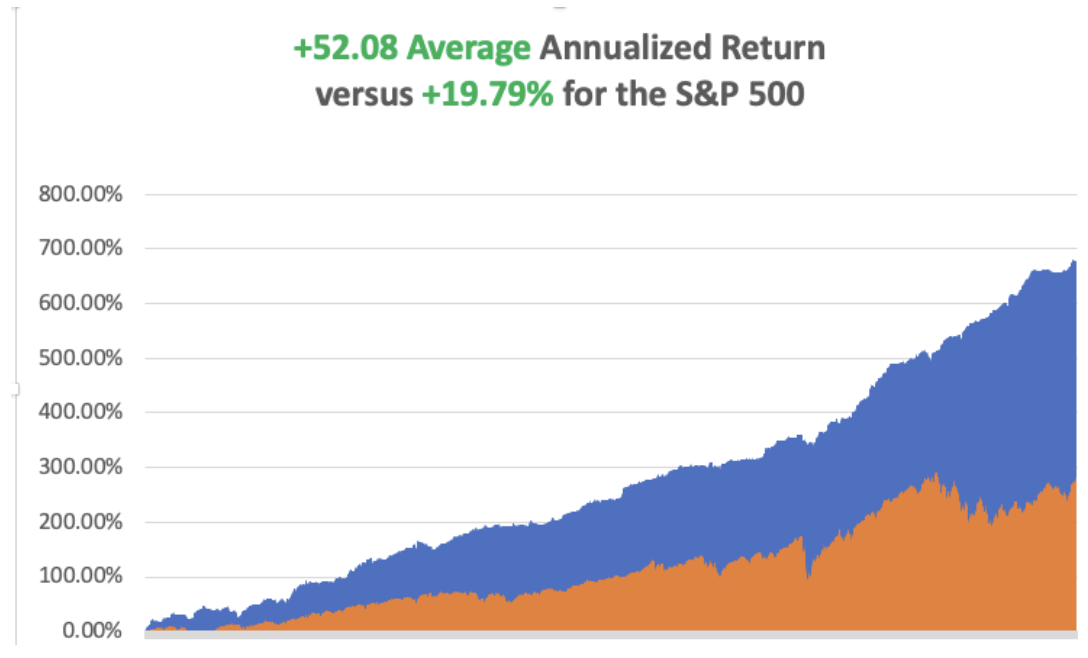

Since we have just taken in a large number of new subscribers from around the world, I will go through the basics of my Mad Hedge AI Market Timing Index one more time.

I have tried to make this as easy to use as possible, even devoid of the thought process.

When the index is reading 20 or below, you only consider “BUY” ideas. When it reads over 80, it’s time to “SELL.” Everything in between is a varying shade of grey. Most of the time, the index fluctuates between 20-80, which means that there is absolutely nothing to do.

To identify a coming market reversal, it’s good to see the index chop around for at least a few weeks at an extreme reading. Look at the three-year chart of the Mad Hedge Market Timing Index.

After three years of battle testing, the algorithm has earned its stripes. I started posting it at the top of every newsletter and Trade Alert two years ago and will continue to do so in the future.

Once I implemented my proprietary Mad Hedge Market Timing Index in October 2016, the average annualized performance of my Trade Alert service has soared to an eye-popping 44.54%.

As a result, new subscribers have been beating down the doors, trying to get in.

Let me list the high points of having a friendly algorithm looking over your shoulder on every trade.

*Algorithms have become so dominant in the market, accounting for up to 90% of total trading volume, that you should never trade without one

*It does the work of a seasoned 100-man research department in seconds

*It runs in real-time and optimizes returns with the addition of every new data point far faster than any human can. Image a trading strategy that upgrades itself 30 times a day!

*It is artificial intelligence-driven and self-learning.

*Don’t go to a gunfight with a knife. If you are trading against algos alone,

you WILL lose!

*Algorithms provide you with a defined systematic trading discipline that will enhance your profits.

And here’s the amazing thing. My Mad Hedge Market Timing Index correctly predicted the outcome of the presidential election, while I got it dead wrong.

You saw this in stocks like US Steel, which took off like a scalded chimp the week before the election.

When my and the Market Timing Index’s views sharply diverge, I go into cash rather than bet against it.

Since then, my Trade Alert performance has been on an absolute tear. In 2017, we earned an eye-popping 57.39%. In 2018, I clocked 23.67% while the Dow Average was down 8%, a beat of 31%. So far in 2024, we are up 28%.

Here are just a handful of some of the elements that the Mad Hedge Market Timing Index analyzes real-time, 24/7.

50 and 200-day moving averages across all markets and industries

The Volatility Index (VIX)

The junk bond (JNK)/US Treasury bond spread (TLT)

Stocks hitting 52-day highs versus 52-day lows

McClellan Volume Summation Index

20-day stock bond performance spread

5-day put/call ratio

Stocks with rising versus falling volume

Relative Strength Indicator

12-month US GDP Trend

Case Shiller S&P 500 National Home Price Index

Of course, the Trade Alert service is not entirely algorithm-driven. It is just one tool to use among many others.

Yes, 50 years of experience trading the markets is still worth quite a lot.

I plan to constantly revise and upgrade the algorithm that drives the Mad Hedge Market Timing Index continuously as new data sets become available.

It Seems I’m Not the Only One Using Algorithms

“The rule book on how things are done and how they will play out you can just throw away right now,” said Scott Minerd of Guggenheim Partners.