“It’s really dangerous to look for rationality in the market, so much of it is psychology…. Stocks will rotate from flawless to hopeless,” said Howard Marks of Oaktree Capital Management.

Global Market Comments

August 14, 2025

Fiat Lux

Featured Trade:

(THE GOVERNMENT’S WAR ON MONEY)

(TESTIMONIAL)

“This turning 80 thing is not all it’s cracked up to be,” said Rolling Stones legend Mick Jagger.

Global Market Comments

August 11, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HOW TOOK COOK PLUCKED APPLE OUT OF THE FIRE BACK INTO THE FRYING PAN),

(SPY), (NVDA), (AAPL), (PANW), (CYBR), (META),

(MSFT), (TSLA), (FCX),(NFLX), (GLD), (DGE), (PERP)

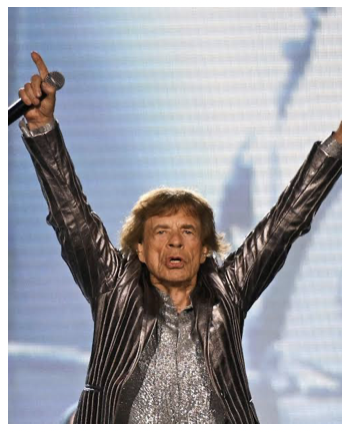

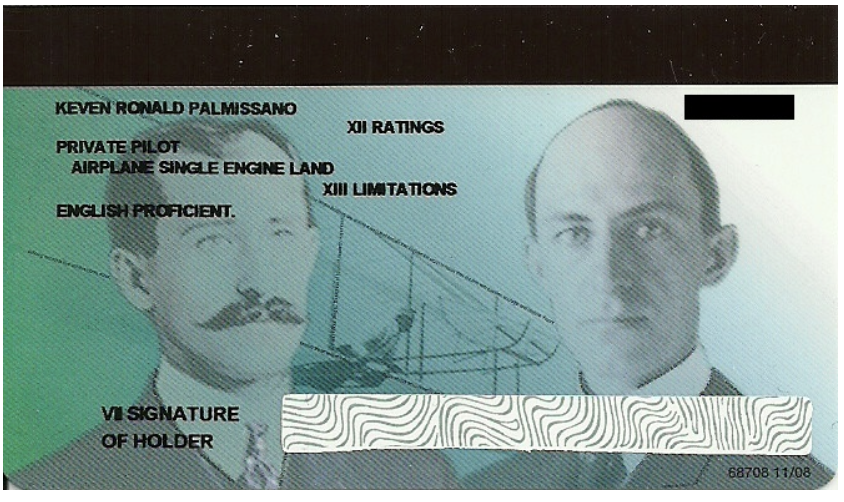

“Man will not fly for a thousand years,” said Wilber Wright in 1901, right after he crashed on a test flight. He became the first man to fly two years later. In 1909, he flew his Wright Flyer around Manhattan, watched by an amazed crowd of one million. Toda,y his image adorns every US pilot license.

Global Market Comments

August 8, 2025

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

I would like to say a big Thank You for presenting such an amazing event, the Mad Hedge Traders & Investment Summit.

I really enjoyed it and learned a lot of amazing insights that I never knew were possible.

I do not know if you guys have sent out the recorded copies or if these are still in the works so let me know.

Can you please send me a copy or let me know how the process of this is going as I would really like to hear some of these speakers again.

Absolute Appreciation and Wishing You All Prospering Success!

Best regards,

Troy

"Everything is expensive now. Worries about the future can cause safe assets to become highly priced ... I call it the 'Titanic Effect.' When the Titanic was going down, people would pay a fortune for anything that floats. We may be in a Titanic situation now," said my buddy, Nobel Prize winner Robert Shiller.

Global Market Comments

August 7, 2025

Fiat Lux

Featured Trade:

(HOW TO EXECUTE A MAD HEDGE TRADE ALERT)

I received a call from a friend the other day.

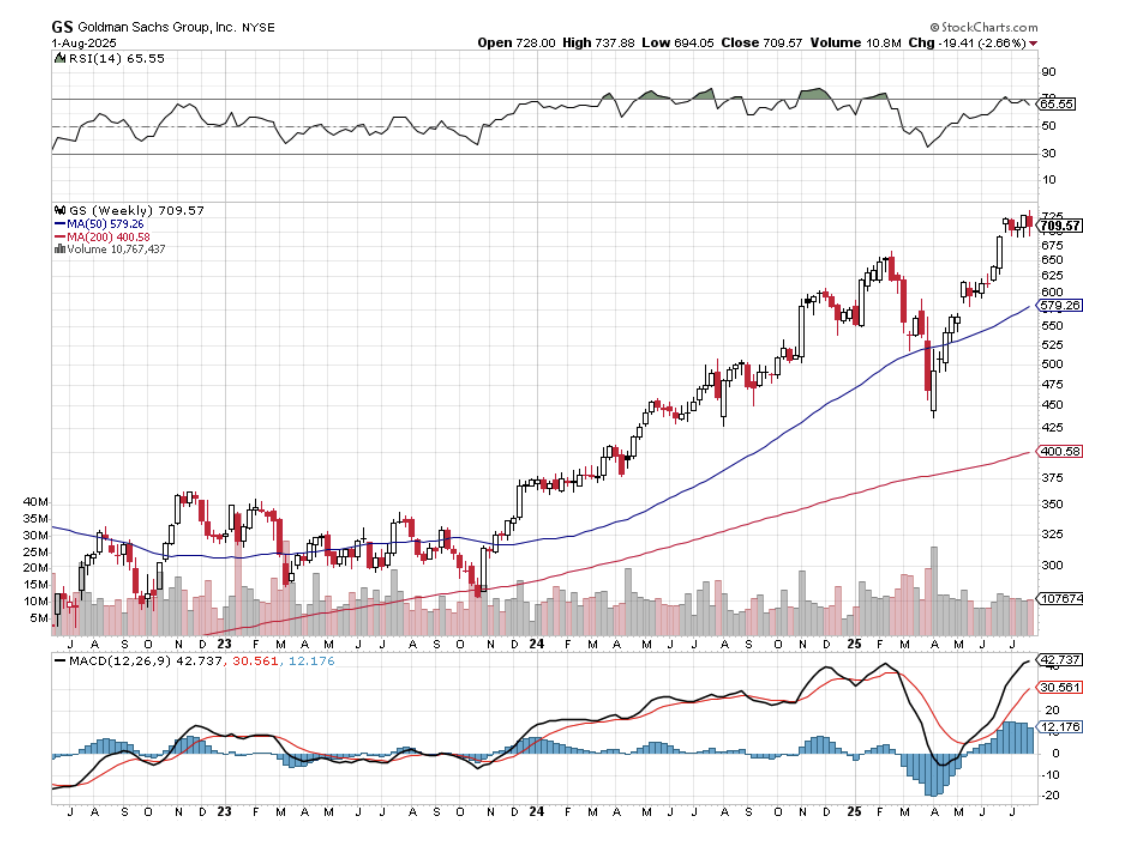

He said he bought Goldman Sachs last summer, a great move, since it has since risen by 86%. That is, until last week, when he got a margin call from Goldman Sachs. It turns out that he didn’t actually BUY (GS); he sold it short, accidentally clicking the bid instead of the offer on his online trading platform.

My friend asked if there was any recourse in this situation?

No, not a chance, not in a million years. Brokers are the most sued companies on the planet. They record absolutely everything and have massive teams of lawyers to defend themselves. Even when they mistakenly allocate someone else’s trade to your account, you only have 24 hours to contest it. After that, you own it.

Oh, if you accidentally do the wrong trade and it makes money, it will disappear from your account the second they become aware of it, even if it is months later.

What was the cost of this harsh lesson? $700,000.

So, today, I’m going to teach you how to execute one of my market-beating Trade Alerts to prevent you from suffering a similar $700,000 lesson yourself.

Pay attention, because if you have subscribed to Global Trading Dispatch or Mad Hedge Concierge, you will receive about 200 of these a year. These alerts will bunch up at market tops and bottoms. After that, we may see weeks of no action. Ideal entry points don’t happen every day of the year.

Following them is your path to understanding global financial markets.

You will also make a lot of money.

Most important is for you to add my email address to your address book. Otherwise, all my trade alerts will go into your spam filter, where they will disappear forever.

So please add alert@madhedgefundtrader.com right now to your email address book. To sign up for the Trade Alert Service so you can get alerts five seconds after they are issued, please email Filomena directly at support@madhedgefundtrader.com. Be sure to put “Text Alert Sign Up” in the subject line.

Let me show you a real-world example of how to do a round trip on a trade that I issued a few years ago.

First, start trading on paper only. All online brokers now give you the option to trade on paper with pretend money. They will even run a pretend P&L for you. That way, in a moment of excitement when you hit the bid instead of lifting the offer, you will lose $700,000 of pretend money, not the real thing.

Here's another hint. Check your positions at the end of every day. I know this can be tedious, but that way, if a surprise $16 million US Treasury bill position suddenly and erroneously ends up in your account (which happened to me last week), you can get on the phone immediately and get your friendly broker to move it into the correct account.

There are two ways to execute a trade: as a beginner or as a professional. I’ll focus on the latter.

You may notice that I send out a lot of trade alerts for options spreads, where I believe the best risk/reward for the individual trader lies. That’s because these include a hedge within a hedge within a hedge, which I will talk about another day.

These are illiquid securities that are executed by computer across 11 different online exchanges. These have wide dealing spreads. For example, yesterday I bought the Tesla (TSLA) August 2024 $150-$160 in-the-money vertical bull call debit spread at $8.60 or best. These expire worth $10 in nine trading days. The bid/offered spread was $8.30-$8.90.

This is how you enter your orders. Split your order into five parts. Then start at the middle market and place limit orders at $8.60, $8.70, $8.80, $8.90, and $9.00. You should get one or two fills at $8.80 and $8.90. If there is an intraday dip in the market, you will get all of them with an average price of $8.80. This is called scaling.

For overseas traders who are asleep when the US markets are open, such as those in Australia, this is a great approach. Just enter your limit orders before the market opens, go to sleep, and dream about how you will spend your profits. When you wake up, your files are in your in-box. I have followers in Australia who have been with me for a decade or more, and they say this approach works like a charm.

Holy smokes! What’s that?

That pinging sound from your cell phone tells you the Mad Hedge Fund Trader has just sent out a Trade Alert! The urgent text alert says:

MHFT ALERT- Buy ETF (TBT) at $57.06 or best, Opening Trade 9-8-2014, wgt: 10% =174 shares, SEE EMAIL

A minute later, I received the following email:

Sender: Mad Hedge Fund Trader

Subject: Trade Alert - (TBT) September 9, 2014

Trade Alert - (TBT)

Buy the ProShares Ultra Short 20+ Treasury ETF (TBT) at $57.06 or best

trade date 9-8-2014

Opening Trade

Portfolio weighting: 10%

Number of Shares: 174

You can buy this in a $57-$58 range and have a reasonable expectation of making money on this trade.

Logic to follow.

Here is the specific trade you need to execute this position:

Buy 174 shares of the (TBT) at……………$57.06

(174 shares X $57.56 = $10,015.44)

So that’s how it’s done.

You now own 174 shares of the (TBT). That is a bet that bond prices will fall and interest rates will rise.

So let’s see how that position worked out over the next several days.

Did you make money? Let’s see what transpired in the weeks after this trade alert was issued.

It turned out that the TBT was the perfect position to take at that time.

Bond prices fell pretty fast, and interest rates spiked up nicely, causing the (TBT) to jump by $2.91 in the following nine days. That works out to a nice little gain of 5%.

By the way, you can pull up these charts anytime you want for free by just going to www.stockcharts.com

What’s that? Here comes another text message from the Mad Hedge Fund Trader! Better check it out.

MHFT ALERT- Sell ETF (TBT) at $59.97 or best, Closing Trade 9-17-2014, wgt: 10% =174 shares, SEE EMAIL

The following email says:

Sender: Mad Hedge Fund Trader

Subject: Trade Alert - (TBT) September 17, 2014

Trade Alert - (TBT)

Sell the ProShares Ultra Short 20+ Treasury ETF (TBT) at $59.97 or best

trade date: 9-17-2014

Closing Trade

Portfolio weighting: 10%

Number of Shares: 174

Here is the specific trade you need to exit this position:

Sell 174 shares of the August 2014 (TBT) at……………$59.97

Profit: $59.97 - $57.06 = $2.91

174 shares X $2.91 = $506.34, or 0.51% for the notional $100,000 model portfolio.

So there, you’ve just made $506 in just 9 days, which works out to 0.51% per $100,000.

You did this, never risking more than 10% of your cash at any time.

Annualize that, and it works out to 206% a year.

That’s how it’s done. This is how the big boys do it. This is how I do it.

Of course, not every trade is a winner, and not all do this well so quickly. Sometimes, it requires the patience of Job to see a trade through to profitability. Last year, 90% of my trades made money. The rest I stopped out of for small losses. That’s because it’s easier to dig yourself out of a small hole than a big one.

But one thing is for sure. You win more games by hitting lots of singles. Beginners stand out by swinging for the fences and striking out almost every time.

So, watch your text message service for the next Trade Alert. Watch your email. And you can follow me on your way to successful trading and to riches.