At today’s Mad Hedge Biweekly Strategy Webinar, I received an excellent question: Why is the Vertical Call Debit Spread my favorite trading vehicle?

So let me ask you this: How would you like to play blackjack now that the dealer would bust 90% of the time? What if you played roulette with the assurance that the ball would land on black 90% of the time?

I bet you would be interested….very interested.

I only trade with Vertical Call Debit Spreads in my own personal account. While your broker may be recommend outright options trades to you because that’s where the volume and the commissions are, if he is smart enough, he is almost certainly executing Vertical Call Debit Spreads for his own account.

And let me tell you why.

1) A Vertical Call Debit Spread offers the most favorable risk/reward ratio of any financial instrument among the plethora out there.

2) A Vertical Call Debit Spread allows you to precisely define your risk. You can’t lose any more money that you put up. With naked short puts, for example, which most other newsletters often recommend all day long, your potential losses are unlimited

3) Vertical Call Debit Spreads allow a vast increase in profits compared to outright stocks, potentially 10X-100X. You can get a claim on $1 million worth of stock for literally only $10,000, not bad when you know the direction. Customers of mine who are nailing 1,000%-2,000% returns in a year, and I get a few every year, are executing very deep out-of-the-money Vertical Call Debit Spread LEAPS.

4) The liquidity for Vertical Call Debit Spreads is enormous for the most popular stocks, like Nvidia (NVDA) and Tesla (TSLA), with exercise values of the options more than the underlying stocks.

5) Vertical Call Debit Spreads allow you to specifically target a share price trading range (very deep in-the-money) that has the highest probability of taking place.

6) The day-to-day volatility of Vertical Call Debit Spread is very low, usually 8% or 9%. That’s because you are long on one option and short on another. This prevents traders from selling bottoms and buying tops, always fatal mistakes. When people ask me what I do for a living, I tell them I stop people from selling market bottoms and buying market tops.

7) When you have a seasoned war horse like me with 55 years of trading experience making your stock picks, Vertical Call Debit Spreads become a total no-brainer. This is why my Trade Alert service is up 68% this year, almost triple the S&P 500 (SPY).

8) Vertical Call Debit Spreads hit their maximum profit whether markets go up, sideways, or down small. It’s only the surprise out of the blue, down moves are large, triggered by black swans, that lose us money and those we stop out of immediately.

9) A Vertical Call Debit Spread benefits enormously from time decay. That is how they hit maximum profits when the underlying stock is unchanged. It gives you a cushion against mistakes and bad stock calls. That’s why I focus on the front-month expirations where time decay is accelerated.

10) Vertical Call Debit Spreads have a built-in short volatility element. If you buy a Vertical Call Debit Spread with a Volatility Index at $24, and it then drops to $14, you make a lot of money. Over the years, I have found that it is almost impossible to lose money with Vertical Call Debit Spreads when the Volatility Index is over $30.

11) OK, I thought of one more reason. Vertical Call Debit Spreads are much cheaper than outright options. That’s because you are buying one option and then receive the proceeds from selling short another option, which cuts the price by two-thirds. That lets you triple your size compared to an outright option. Triple the size, and you triple the profits.

Given all this, I think it’s time for all of you to undergo a refresher course on how to most efficiently play the market with Vertical Call Debit Spreads.

Most investors make the mistake of investing in positions that have only a 50/50 chance of success or less. They’d do better with a coin toss.

The most experienced hedge fund traders find positions that have a 90% chance of success and then leverage up on those trades. Stop out of the losers quickly, and you have an approach that will make you well into double digits, year in and year out, whether markets go up, down, or sideways.

For those readers looking to improve their trading results and create the unfair advantage they deserve, I have posted a training video on How to Execute a Vertical Bull Call Spread.

This is a matched pair of positions in the options market that will be profitable when the underlying security goes up, sideways, or down small in price over a limited period of time.

It is the perfect position to have on board during markets that have declining or low volatility, much like we have experienced in for most of the last several years and will almost certainly see again.

I have strapped on quite a few of these babies across many asset classes, and they are a major reason why I am up so much this year.

To understand this trade, I will use the example of Apple trade, which most people own and know well.

On October 8, 2018, I sent out a Trade Alert by text messages and email that said the following:

BUY the Apple (AAPL) November 2018 $180-$190 in-the-money vertical BULL CALL debit spread at $8.80 or best

At the time, Apple shares were trading at $216.17. To accomplish this, they had to execute the following trades:

Buy 11 November 2018 (AAPL) $180 calls at….…….…$38.00

Sell short 11 November 2018 (AAPL) $190 calls at…..$29.20

Net Cost:…………………….……….....……...........…….….....$8.80

A screenshot of my own trading platform is below:

This gets traders into the position at $8.80, which costs them $9,680 ($8.80 per option X 100 shares per option X 11 contracts).

The vertical part of the description of this trade refers to the fact that both options have the same underlying security (AAPL), the same expiration date (November 16, 2018), and only different strike prices ($180 and $190, or a “spread”).

“Bull” (as opposed to “Bear”) means you receive the maximum profit in a rising market as opposed to a falling one.

“Debit” refers to the fact that you have to pay money to obtain this position rather than receive a credit.

The maximum potential profit can be calculated as follows:

+$190.00 Upper strike price

-$180.00 Lower strike price

+$10.00 Maximum Potential Profit at expiration

Another way of explaining this is that the call spread you bought for $8.80 is worth $10.00 at expiration on November 16, giving you a total return of 13.63% in 27 trading days. Not bad!

The great thing about these positions is that your risk is defined. You can’t lose any more than the $9,680 you put up.

If Apple goes bankrupt, we get a flash crash, or suffer another 9/11 type event, you will never get a margin call from your broker in the middle of the night asking for more money. This is why hedge funds like vertical bull call spreads so much.

As long as Apple traded at or above $190 on the November 16 expiration date, you will make a profit on this trade.

As it turns out, my take on Apple shares proved dead on, and the shares rose to $222.22, or a healthy $32 above my upper strike.

The total profit on the trade came to:

($10.00 expiration - $8.80 cost) = $1.20

($1.20 profit X 100 shares per contract X 11 contracts) = $1,320.

To summarize all of this, you buy low and sell high. Everyone talks about it, but very few actually do it.

Occasionally, Vertical Bull Call debit Spreads don’t work, and the wheels fall off. As hard as it may be to believe, I am not infallible.

So if I’m wrong and I tell you to buy a vertical bull call spread, and the shares fall not a little, but a LOT, you will lose money. On those rare cases when that happens (about 10% of the time), I’ll shoot out a Trade Alert to you with STOP-LOSS instructions before the damage gets out of control.

I start looking at a stop loss when the deficit hit 10% of the size of the position or 1% of the total capital in my trading account. It’s easier to dig yourself out of a small hole than a big one.

And why do I execute Vertical Call Debit Spreads rather than Vertical Call Debit Spreads like most professionals do? Because Vertical Call Debit Spreads are easier for beginners to understand.

To watch the video edition of How to Execute a Vertical Bull Call Spread, complete with more detailed instructions on how to execute the position with your own online platform, please click here.

Good luck and good trading.

Vertical Bull Call Spreads Are the Way to Go in a flat to Rising Market

Global Market Comments

November 20, 2024

Fiat Lux

Featured Trade:

(THE JOHN THOMAS BIOGRAPHY IS OUT)

(THE EIGHT WORST TRADES IN HISTORY)

After decades of pestering, pleading, and cajoling, I have finally completed the first volume of my autobiography, John Thomas – A Life Well Lived.

The online PDF contains 100 chapters, hundreds of color pictures, and my best memories over the last 60 years.

You will not be disappointed.

The book was written on Transatlantic cruises on the Queen Mary II, the Orient Express, a chalet in Zermatt, and countless airport first class lounges. The price is $52.

I have hundreds more chapters to write and boxes with tens of thousands more old and dusty pictures to scan. But if I didn’t get the first book out now, there is a risk that the project might outlive me.

I tried to get this book out years earlier. But there was always another trade alert, newsletter, or webinar to get out. New adventures had to be lived. So, at last, here it is. To buy Volume I, please click here for an immediate download.

Enjoy!

"Interest rates are the physical gravity of financial assets. The lower they are, the higher assets will levitate," said Anthony Scaramucci, the founder and managing partner of SkyBridge Capital, a leading hedge fund of funds.

Global Market Comments

November 19, 2024

Fiat Lux

Featured Trade:

(JANUARY 10 MIAMI FLORIDA STRATEGY LUNCHEON)

(THE MAD HEDGE DICTIONARY OF TRADING SLANG),

(TESTIMONIAL)

I am basically writing this email to thank you so much for coming to Australia.

Thank you again for sparing the time, for being present to hear our questions, for sharing your valued insights and knowledge and in addition to all that thank, you for your friendship.

As I said on the occasion, I was hoping for a sunny occasion for your visit to Café Sydney knowing that you would only be here for one day.

It was delightful to have the Sydney Harbour Bridge, the harbour and the Opera House bathed in pleasant autumn sun for your time with us.

As a postscript, I have an ongoing interest in the military combat in the Pacific of World War II and I have often visited on the net the stories of the combat at Guadalcanal, Tarawa, Palau, Iwo Jima, and Okinawa.

I was therefore quite electrified by your May 29 Diary of a Mad Hedge Fund Trader. You truly have an awesome family history indeed!

I rechecked the story on the battle for Henderson field and sure enough, within it is a section on Oka’s attack and the opposition he faced from a company machine gun section under Mitchel Paige

Interesting to learn of his Serbian origin - not Paige but Pejic. On your website, the first article about the next Korean War has a photo of you when you were younger from which I see a great resemblance to your uncle!

Many Thanks!

Ian

Sydney, Australia

Global Market Comments

November 18, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or OUT WITH THE NEW, IN WITH THE OLD) Plus REPORT FROM THE QUEEN MARY II),

(TLT), (TSLA), (DHI), (LEN), (KBH), (LMT), (RTX), (GD), (GLD), (SLV), (GOLD), (WPM), (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (SPY)

“Take things as they are and profit off the folly of the world.”

That is one of my favorite quotes from Anselm Rothschild, founder of the Rothschild banking dynasty, which ruled the financing of Europe for centuries. I lived next door to his great X 10 grandson in London for ten years, the late Jacob Rothschild, and boy, did I learn a few nuggets from him.

It's really just another way of saying that you have to trade the market you have, not the one you want. By the way, Anselm’s other famous quote? In 1815, the year the British defeated Napoleon at the Battle of Waterloo, he said, "I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man who controls the British money supply controls the British Empire, and I control the British money supply."

And that shall be my strategy in the coming years. The good news? There is a ton of folly out there and, therefore, tons of great new trades.

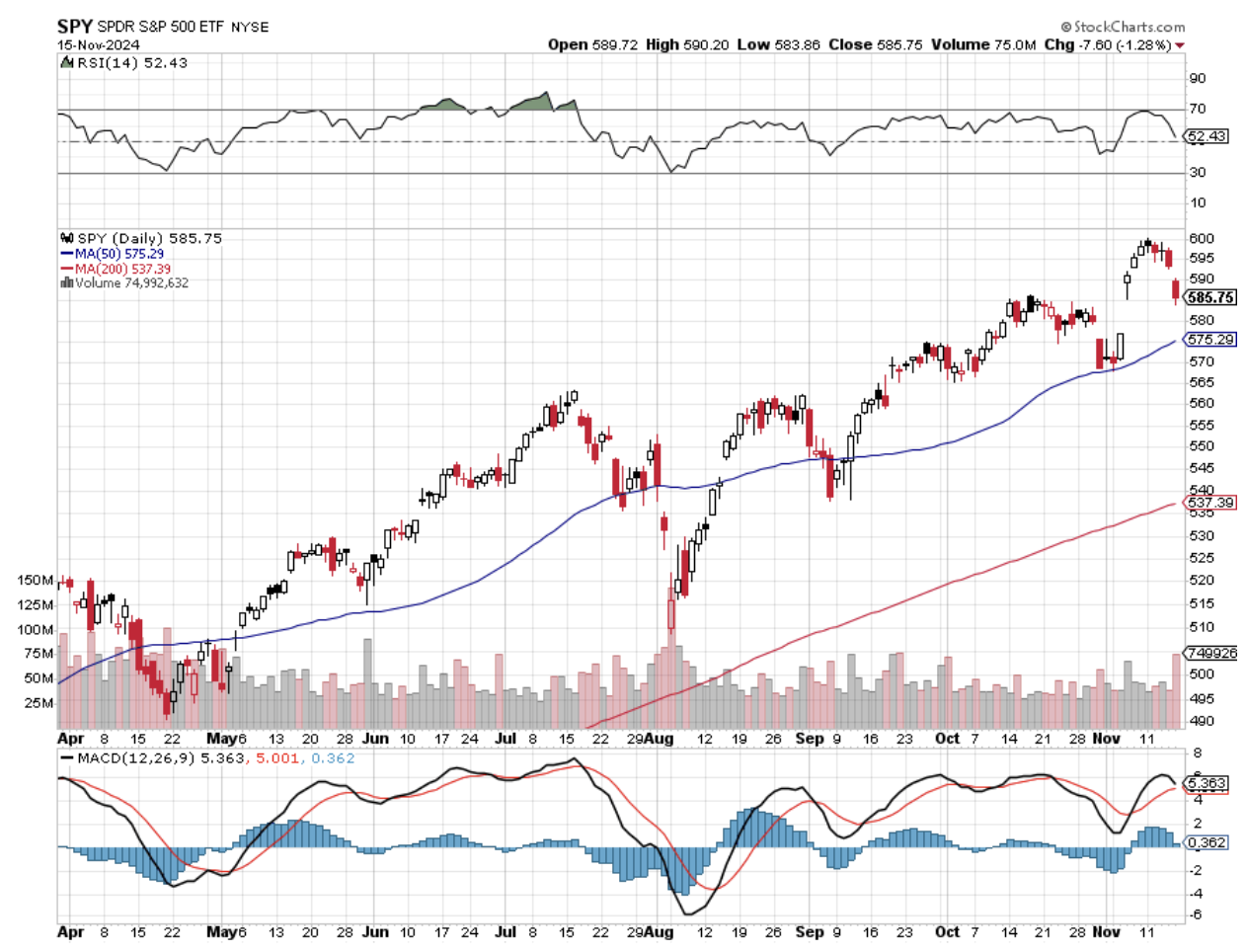

Let’s start with the market themes. Out with the new, in with the old. Falling interest rates plays are out. Rates will stay higher for longer. Artificial Intelligence will take an extended vacation. Saving the environment is history. Take a look at the woeful underperformance of NASDAQ. That will allow earnings to catch up with share prices, which are already at nosebleed levels.

Money managers will sell these areas, which in many cases have seen enormous appreciation, to finance the purchase of the new themes. These include deregulation, the end of antitrust, the Bitcoin ecosystem, and Tesla (TSLA).

It helps a lot that the outgoing themes are incredibly expensive, with price-earnings multiple of 30X-100X, while the new ones are dirt cheap, with multiples of 15X down to single digits.

Buy cheap, sell expensive….I like it!

If you think I’m just an aging old hippy from Berkeley spouting his iconoclastic, out-of-touch-with-reality views, then check with Mr. Market, who agrees with me on every point and is never wrong.

Notice the collapse of the bond market (TLT) since September. Fed funds futures have already backed out 100 basis points of easing, from 250 basis points to only 150, and we have already seen the first 75. If inflation makes a rapid comeback (prices started rising on November 6), we are likely to only see a couple more 25 basis point cuts from the Fed in this cycle, and that’s it.

The 30-year fixed rate mortgage has rocketed from 6.0% to 7.13%, sticking a dagger through the heart of the real estate market and homebuilders (DHI) (LEN), KBH).

Defense? Who needs weapons when we are withdrawing from the international community? We will just have to depend on our existing 50-year-old defense systems. And while you’re at it, end “cost plus” contracts, which have inflated defense spending since 1940.

This is what fried the shares of Lockheed Martin (LMT), builder of the Blackhawk helicopter, Raytheon (RTX), maker of Javelin antitank missiles, and General Dynamics (GD), manufacturer of the Abrams tank after the past month. What happens to these stocks when the Ukraine War ends?

I have received a lot of questions about whether it is time to go into pharmaceutical and biotech stocks. The answer is no, a thousand times no. The appointment of anti-vaxxer Robert F. Kennedy as the head of Health and Human Services puts the kibosh on that trade, who is likely to declare war on that department. That explains the wipeout of shares in that sector.

Precious metals? Forget it (GLD), (SLV), (GOLD), and (WPM). Witness their own recent hell they have entered. There is no doubt that the election ended the gold trade, which has fallen by 8.3% since November 5. That’s because investors pulled $600 million out of gold-backed ETFs just in the week ending November 8, according to the World Gold Council. It just had its worst week in three years. “Interest rates higher for longer” absolutely does not fit anywhere in the precious metals trade.

Another contributing factor has been the strength of Bitcoin, which raced to a new all-time high of $93,000 on the back of the Trump win. The industry had been a major contributor to the Trump campaign. What better way to fund Bitcoin purchases than to sell your gold, which in any case is up 40% in a year? Money has been pouring into Tesla shares for the same reason.

At some point, gold will fall to a level where Chinese saving alone supports the price. There is no way of knowing where that is, so I’ll wait for the market to tell me. Central bank buying will continue unabated, which has totaled 694 metric tonnes ($5.3 billion) so far in 2024.

I believe that gold will still hit $3,000 an ounce over the long term. But for now, the shine is clearly off those American Eagles. The last time gold took a rest, from 2011 to 2019, it was for eight years.

The bottom line is that there are plenty of new fish to fry out there and plenty of fire with which to cook them. Does anyone have any matches?

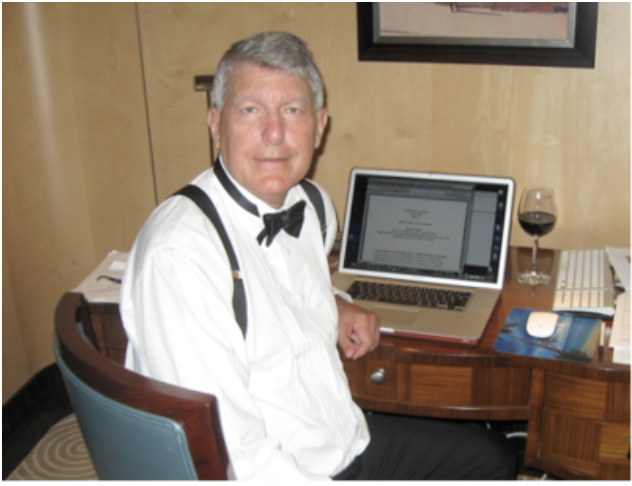

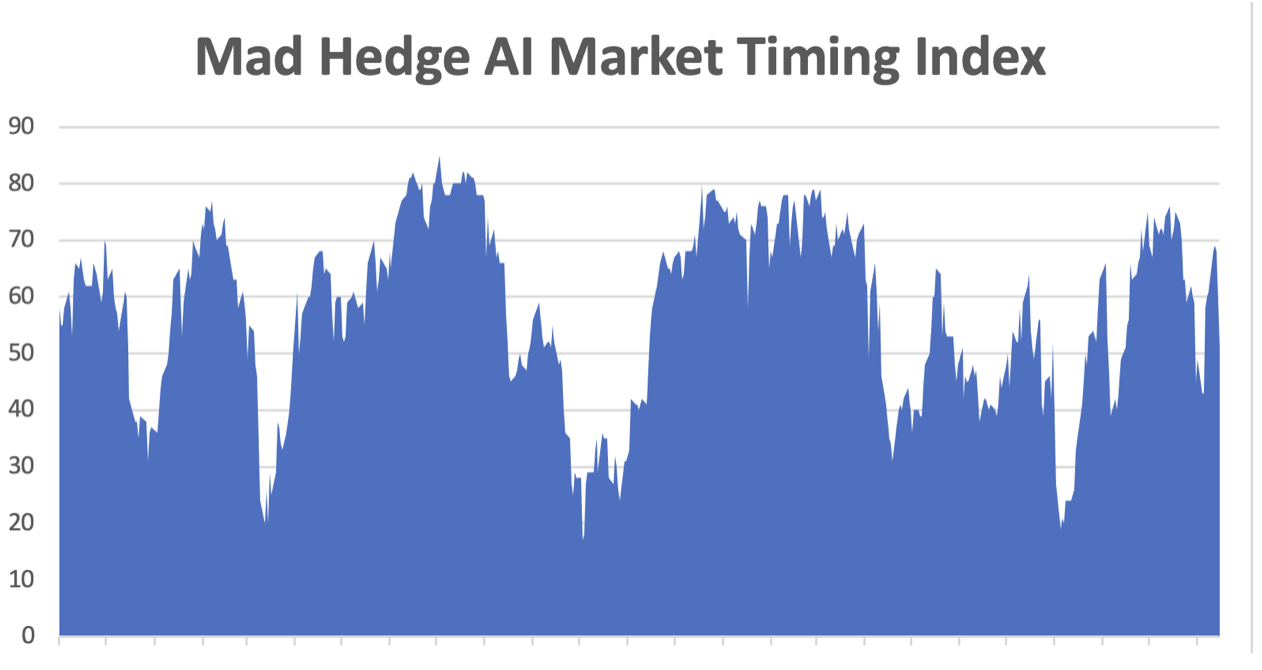

In November, we have gained a breathtaking +8.19%, amazing adding to our gains while the market dropped 2.3%. My 2024 year-to-date performance is at an amazing +61.33%. The S&P 500 (SPY) is up +25.79% so far in 2024. My trailing one-year return reached a nosebleed +62.15%. That brings my 16-year total return to +737.86%. My average annualized return has recovered to +53.02%.

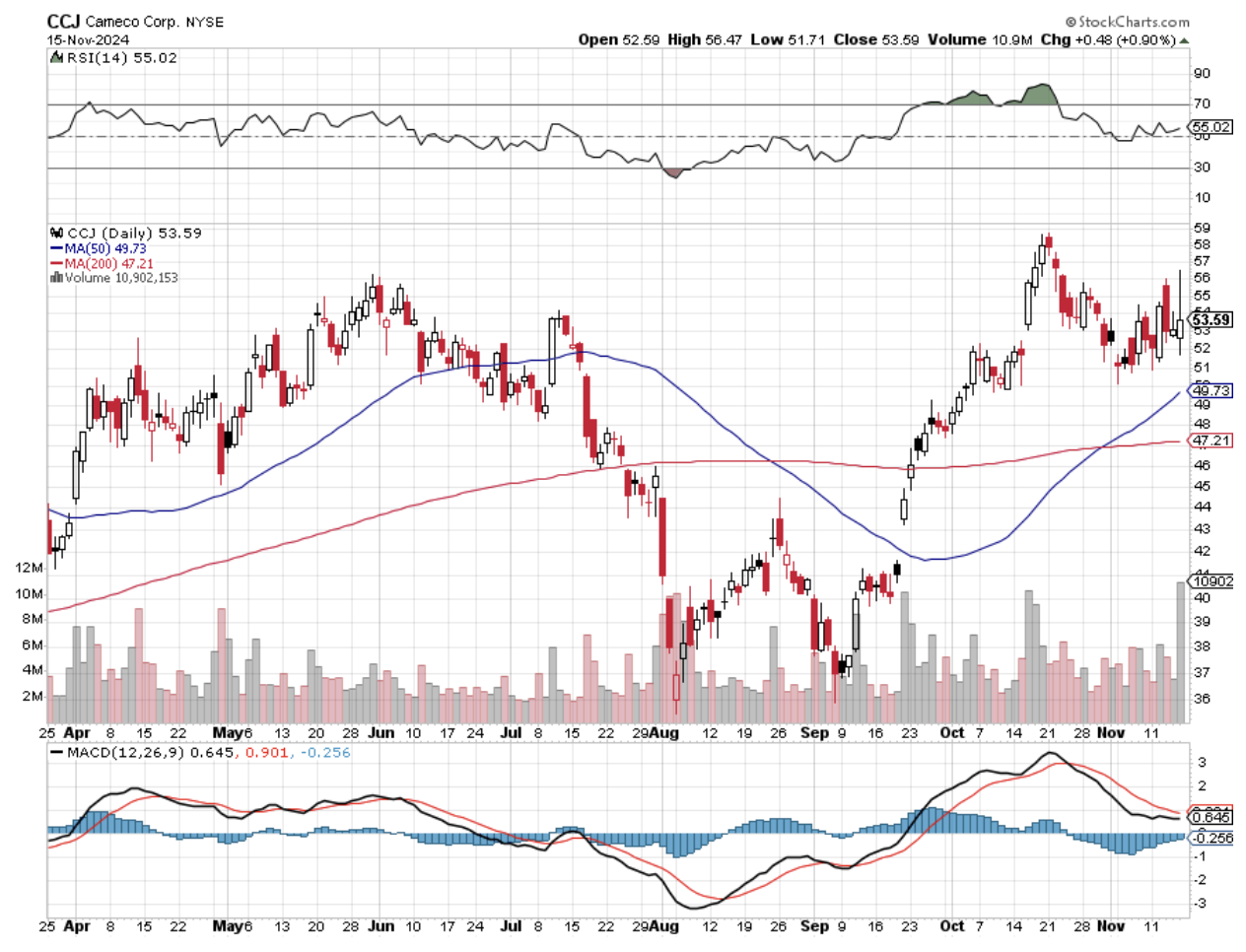

I maintained a 100% long-invested portfolio, betting that the market doesn’t drop below pre-election levels. That includes (JPM), (NVDA), (BAC), (C), (CCJ), (MS), and a triple long in (TSLA). My November position in (JPM) expired at max profit. We should make 46 basis points a day until the December 20 option expiration in 24 trading days, thanks to time decay and falling volatility.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 73 of 93 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +78.49%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, November 18 at 8:30 AM EST, the NAHB Housing Market Index is out.

On Tuesday, November 19 at 8:30 AM, the US Building Permits take place. Nvidia (NVDA) announces earnings after the close.

On Wednesday, November 20 at 8:30 AM, the MBA Mortgages Rates are announced.

On Thursday, November 21 at 8:30 AM, Existing Home sales are printed. We also get Weekly Jobless Claims.

On Friday, November 22 at 8:30 AM, the S&P Global Flash PMI is announced. At 2:00 PM the Baker Hughes Rig Count is printed.

Location: 48 degrees, 02.12 minutes North, 043 degrees, 42.08 minutes West, or 1,421 nautical miles ENE of New York.

As for me, The Queen Mary 2 is currently plowing its way through a massive fog bank a thousand miles thick, sounding the foghorn every two minutes. Visibility is less than 100 yards, and the waves are a rough 12 feet high. The captain has closed the outside decks for fear of losing a passenger overboard. The weather has disrupted our satellite link, and our Internet is down. So here I write. Leave me alone with a laptop for an hour, and I can conquer the world.

One hour out of New York, and a passenger suffered a heart attack. So the captain turned the ship around and headed back to the harbor, where the New Jersey Search and Rescue sent out a launch to pick up the unfortunate man and his distraught spouse. Every passenger leaned over the port railing to watch.

That meant we could pass under the Verrazano Bridge three times, on each occasion deftly clearing the span by a mere ten feet. Talk about inauspicious beginnings. Visions of Leonardo di Caprio going down with the ship danced across my mind.

The ship is truly gigantic. You must allow 20 minutes to get anywhere, 5 minutes to walk there, and 15 minutes to get lost. When launched two decades ago, it was the largest cruise ship ever built at 148,900 tons, nearly double the size of the now decommissioned Queen Elizabeth II. It whisks up to 3,000 passengers and 1,325 crew across the seas in the utmost luxury at a steady 21.5 knots. You could water ski behind this leviathan of a vessel if only the crew permitted it.

As a 50-year guest of Cunard and the highest paying customer on the ship, I managed to bag the Sandringham Suite, possibly the most luxurious publicly available oceangoing accommodation ever created. The 2,200 square foot, two-floor, two-bedroom, three-bathroom, Q1 class apartment on decks nine and ten included a formal dining room, kitchen, his and her closets, a small gym, and 1,000 square feet of rear-facing teak deck.

All of this was a bargain for $56,000, or about the same as renting the presidential suite at the San Francisco Ritz for a week at $10,000 a night, except at the end, you wake up in England five pounds heavier. Not that I noticed, though. By the afternoon, the two complimentary bottles of Dom Perignon Champagne were already headed for the recycling bin.

The suite came staffed with two full-time butlers, Peter and Henry, who were an endless font of fascinating information about the ship. During one unfortunate cruise, eight senior citizens passed away. The onboard morgue held only six, so the extra two were stashed in the meat locker for the duration of the voyage. There was no reported change in the flavor of the Beef Wellington.

I asked if Cunard had ever performed burials at sea in these circumstances. They said they used to. But a few years back, an elderly billionaire, “Mr. Smith,” checked into a deluxe Q1 cabin with a hot young “Mrs. Smith” and then promptly expired. The grieving widow requested he be buried mid-Atlantic with the traditional yard of sail and a cannonball. When the ship docked at Southampton, a much older, real “Mrs. Smith” appeared to claim the body and sued the company when informed of his current disposition. So, no more burials at sea.

Yes, the ship did hit a whale once, which stuck to the bulbous bow. When it landed in Portugal, Cunard was fined for commercial fishing without a license. The unlucky cetacean’s skeleton is now in a Lisbon maritime museum. Apparently, this company gets sued a lot.

Of course, the memory of the sinking of the Titanic is ever present. There is a history display down on deck 2, and you can even have your photo taken in front of a backdrop of the grand staircase of the ill-fated ship. When we passed 10,000 feet over the wreck at 48 degrees, 38.50 minutes North, 50 degrees, 00.11 minutes West one day out of New York, the Queen Mary 2 let out three long blasts of its horn in memory of the lost. Cunard took over the Titanic’s White Star Line during the Great Depression and is, therefore, the inheritor of this legacy.

When I visited the computer center, I was stunned to learn that they were offering three-hour long classes on Apple products and programs every hour, all day long. They covered iMacs, iPads, iPhones, and all of the associated software and gizmos. I promptly signed up for five classes. Watch for my next webinar. It will be a real humdinger, with all the bells and whistles.

You would think that with 280 pounds of luggage, I could remember to bring a pair of black socks. It was not to be. So I headed out to the ballroom with my black tux and navy blue socks to tango, rhumba, and foxtrot with the best of them. The problem is that just as you twirl, the ship rolls, swiping the dance floor right out from under you. With several Octogenarian couples within range and my size, the consequences could have been fatal. Still, those oldsters really knew their steps. I really hope those pictures come out, especially the one of me on the dance floor, flat on my back.

Looking at the vast expanse of the sea outside my cabin window, I am reminded of the opening scenes of the 1950’s WWII documentary Victory at Sea. An endless, dark, tempestuous ocean churns and boils relentlessly. I am now even more awed by my early ancestors, who took three months to cross from Falmouth to Boston in a 50-foot-long wooden ship called the Pied Cow in 1630. They did this without navigation to speak of rotten food and a dreaded fear of sea monsters. What courage or religious ferocity must have driven them?

Four days of hearing foghorns is starting to get tiring. Captain Wells has been ducking many of his social responsibilities, feeling more secure in the bridge close to the radar. After a few days of intermittent access, the Internet is now gone for good, the satellite connection having given up the ghost. People are blaming everything from a lightning strike on the Virginia ground station to late-night watching of porn by the crew.

Instead of surfing the net, I am devoting more time to exercise in anticipation of my upcoming Swiss mountain climbing adventures. I have developed a careful routine where I fast walk three times around deck 7 in a brisk wind, take the elevator down to deck 1, walk up the stairs to deck 13, speed past the kennels, the practice golf range, two swimming pools, and a bar.

I can accomplish all of this three times in an hour and do it with 40 pounds of books stashed in my backpack. My butler, Peter, tells me there is always a certifiable nut case on every cruise, and I have been designated by the crew as “THE ONE”.

The 2,600 passengers are quite a mixed batch. We have 1,200 British, 750 Americans, 350 Germans, 80 Canadians, 4 dogs, three cats, and an assortment of other nationalities, and exactly one Japanese couple who didn’t speak a word of English.

I took pity on them and spent an evening translating and catching up on the world at large with them. He was a retired dance instructor, which explains why he and his wife owned the dance floor on most nights. They were grateful for the conversation, for during their entire 30-day cruise from New York to Southampton, then the Baltic Sea and the Norwegian fiords, then back to New York, they had no one to speak to. Still, that was better than last year, when they completed a 105-day round-the-world cruise with no one to talk to. Before they left, they gave me an exquisite, handmade, traditional Japanese purse as a gift.

Queen Mary II Passing Under the Verrazano Bridge

Your Intrepid Reporter

Breakfast on the High Seas

Check Out My New Digs

The Hard Life at Sea

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"The government is now the biggest impediment to economic growth," said my old friend Steven Rattner of the Quadrangle Group.

Global Market Comments

November 15, 2024

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(CONTANGO IN THE VIX EXPLAINED ONE MORE TIME),

(UVXY), ($VIX), (SPY)