Global Market Comments

May 16, 2025

Fiat Lux

Featured Trade:

(MAY 14 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (BLK), (SPY), (TLT), (WMT), (LLY), (UNH), (KKR), (NVDA), (ABNB), (GLD)

Global Market Comments

May 15, 2025

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE FRIDAY, MAY 16 OPTIONS EXPIRATION),

(GLD)

Global Market Comments

May 14, 2025

Fiat Lux

Featured Trade:

(A DIFFERENT VIEW OF THE US)

"Kamikaze missions are rarely successful, least of all for the pilots," said Robert Gibbs, former White House Press Secretary.

Global Market Comments

May 13, 2025

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY),

(GLD)

Global Market Comments

May 12, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR THE MISSILES TO HIT)

(GLD), (SPY), (MSTR), (NVDA), (AAPL),

(TSLA), (QQQ), (TLT), (SH), (MCD), (SVXY)

When I was in Ukraine, the air raid sirens used to go off every night exactly at 2:00 AM.

The Russian goal was to deprive the civilian population of sleep and to make their lives miserable. It was also when the country was least able to defend itself.

You knew the missiles were on the way, it was just a question of whether your number was up. You could only hope to make it to the basement before they hit. It was not safe to go back to sleep until you heard the explosions nearby.

It is not a pleasant feeling.

Here we are in the United States in 2025, and there are missiles on the way, but they are economic ones. Ford Motors (F) has already started raising prices so they can spread them out over a longer period of time. Food and produce prices from Mexico will deliver the first price shocks, as they can go bad in a day. The first hint of this might be visible with the release of the Consumer Price Index at 8:30 AM EST on Tuesday, May 13. That’s when we learn if the inflationary surge is hitting now, or if we have to wait until June. But we know for sure it’s coming.

In fact, there is an onslaught of horrific economic data headed our way. Economic growth is slowing dramatically, prices are rising, international trade is grinding to a halt, and consumer confidence is already at all-time lows. We just don’t know yet if it is going to hit us or blow up the neighbors down the street.

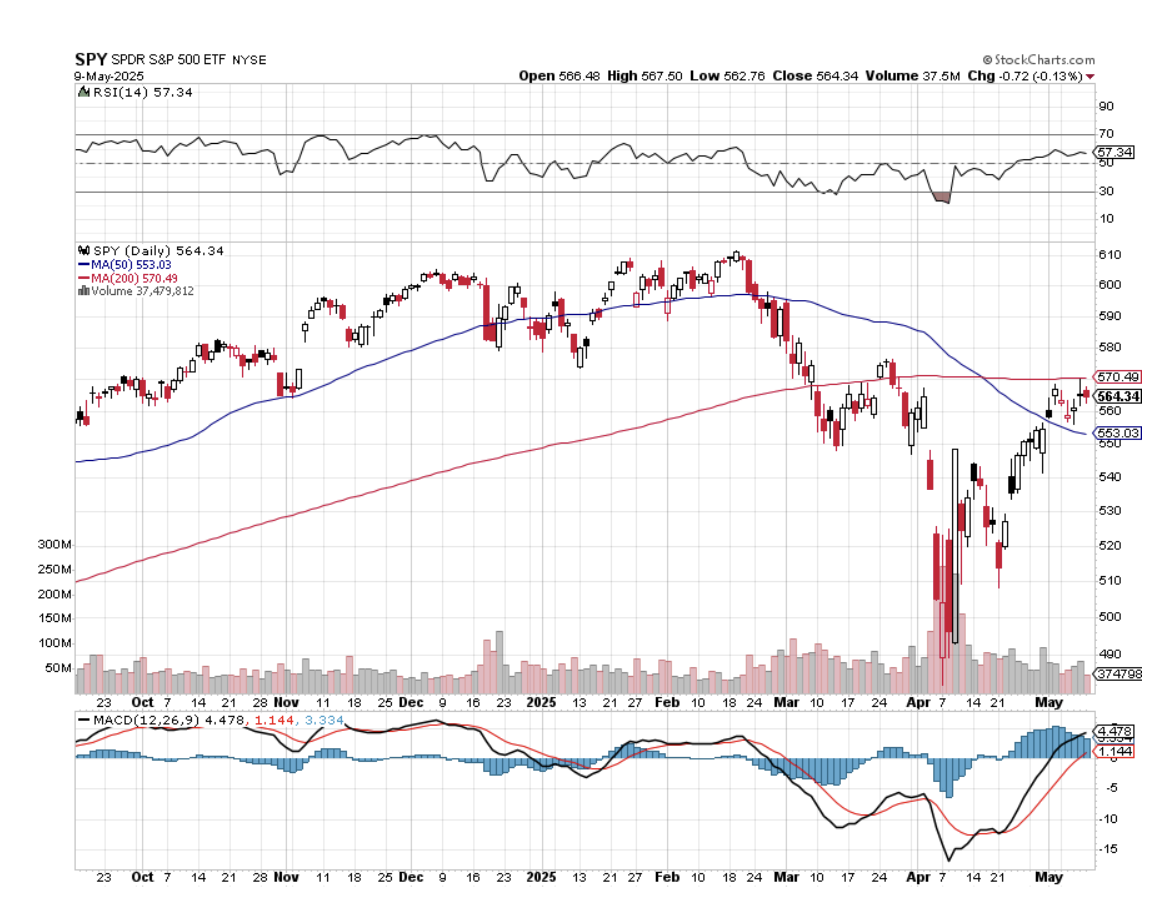

The truly alarming thing about these developments is that the data from hell is going to hit just as the stock market is completing one of its most rapid rises in history, up 19.75% in a month. Stocks are now even more expensive than they were in February, with a price earnings multiple of 22X and earnings falling.

Is anyone ready for a February market crash repeat? You may be about to get it.

I have been through many bear markets since I started trading in 1965, a move down in the indexes of 20% or more. They can last 31 months (2002) and decline as much as 56% (2009). In 1987, we had a bear market in a day!

This one is number nine for me. And while no two bear markets are alike, they all share common characteristics. I have seen them caused by oil shocks, hyperinflation, financial engineering, the Dotcom Crash, the Great Financial Crisis, and the Pandemic. This is the first one caused by a trade war.

Spoiler alert! The monster is about to jump out of a closet at you at the end of the movie.

If you’re praying that the new trade deal with the UK is going to rescue your retirement funds, don’t hold your breath. It’s not a treaty; it is simply an agreement to agree sometime in the distant future. It’s not even a letter of intent. It’s nothing but a bunch of hot air.

In 2024, the U.S. actually ran a trade surplus, not a deficit, with the UK. The surplus was $11.9 billion. The U.S. exported $79.9 billion worth of goods to the U.K. and imported $68.1 billion, resulting in a surplus.

Some $10.5 billion of US aircraft were sold to the UK in 2024, followed by $7 billion in machinery and nuclear reactors and $5.6 billion in pharmaceuticals. The deals announced last week were nothing new, just a reaffirmation of existing trade that has been going on for years.

In the meantime, the punitive 10% tariff against UK imports stands. That is nowhere near enough to move the needle for the $27.7 trillion US GDP. And this was the easy one. Why the US needs to negotiate a trade agreement with a country where it is already running a surplus is beyond me.

All of this has prompted me to run the first 100% short model portfolio in the 17-year history of the Mad Hedge Fund Trader. If the market moves sideways or up small, we will make our maximum profit by the June 20 option expiration in 28 trading days (Memorial Day is a Holiday). If the market crashes, which it can do at any time, we make the maximum profit immediately. That should take us to a 2025 year-to-date profit of over 43%.

Heads I win, tails you lose, I like it.

Current Capital at Risk

Risk On

NO POSITIONS 0.00%

Risk Off

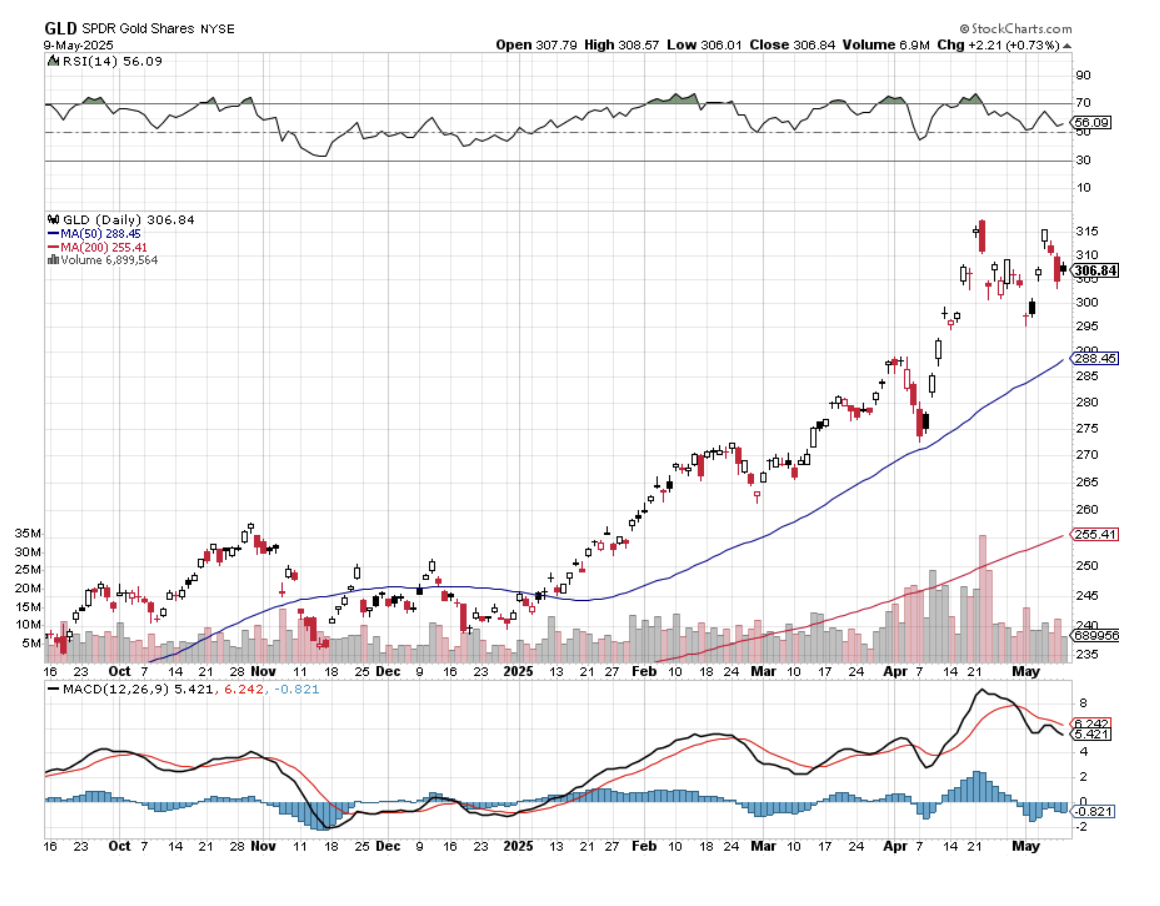

(GLD) 5/$275-$285 call spread -10.00%

(GLD) 6/$275-$285 call spread -10.00%

(SPY) 6/$610-$620 call spread -10.00%

(MSTR) 6/$500-$510 put spread -10.00%

(NVDA) 6/$140-$145 put spread -10.00%

(AAPL) 6/$220-$230 put spread -10.00%

(TSLA) 6/$370-$380 put spread -10.00%

(QQQ) 6/$540-$550 put spread -10.00%

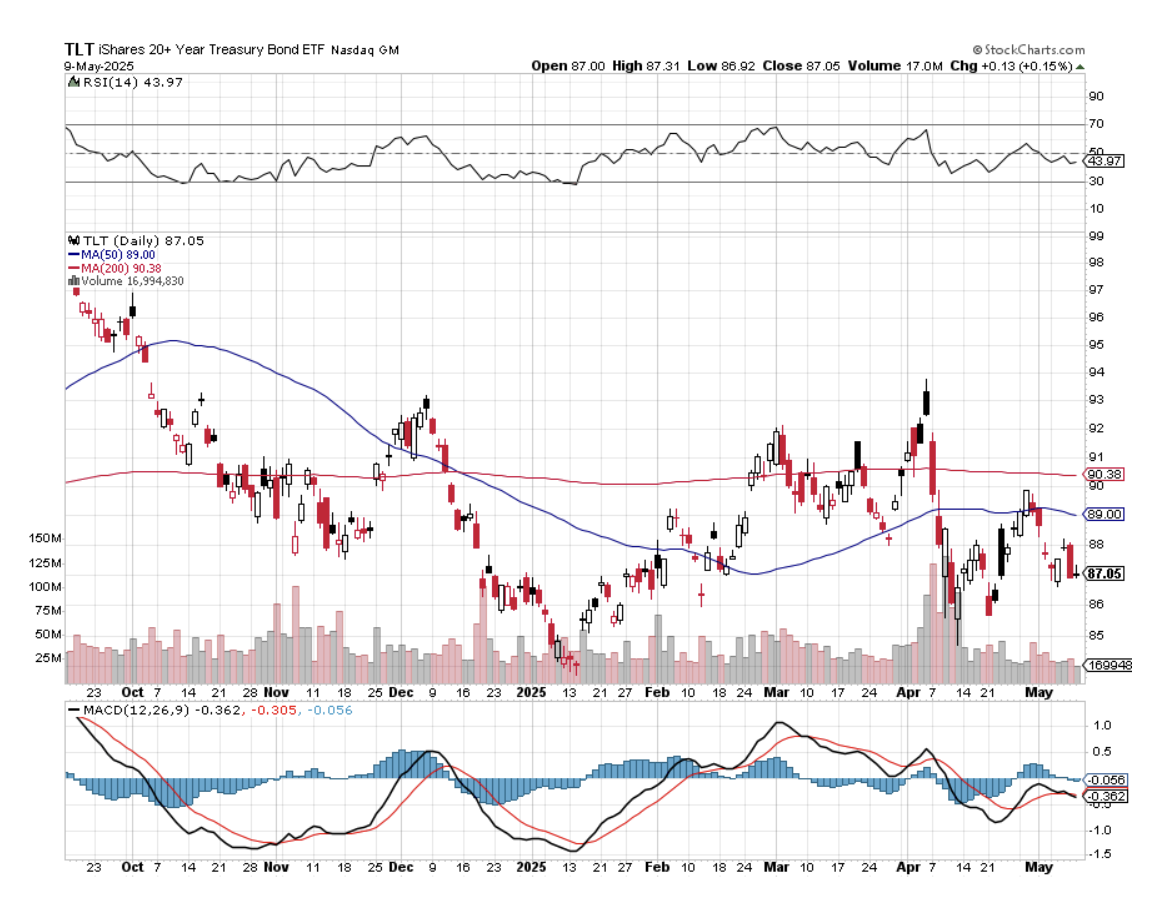

(TLT) 6/$80-$83 call spread -10.00%

(SH) 6/$39-$41 call spread -10.00%

Total Net Position -100.00%

Total Gross Position 100.00%

I love trade wars.

They shine brilliant spotlights on obscure, usually deeply hidden parts of the global economy, revealing almost impossible-to-find data points. And every single new data point enhances your understanding of the big picture.

My first real trade war was the 1973 Oil Shock. Saudi Arabia had cut off America’s oil supply because of our support for Israel in the Yom Kippur War. Huge lines formed at gas stations, and gasoline prices shot up from 25 cents a gallon to $3.00.

Ever the entrepreneur, I started a side business buying beat-up Volkswagen Beetles, the highest mileage car then available in the United States, driving them to Mexico, and getting them repainted and reupholstered in a day for $50. Then I resold them in LA for double the price.

I remember on my last run, I was in a hurry to catch a physics class, so I left a little early. The US customs office learned about the car and asked me if I had any work done while in Mexico. I answered “No.” As he walked away, I saw that his pants were covered with fresh green paint, which had not yet dried.

I drove away as fast as my green Beetle could go.

In the old days, hedge funds reaped huge trading advantages chasing down obscure data points. When satellite data became available to the public in the 1990s, my fund leased satellite time to track the progress of the US wheat crop.

Several successful trades in the commodities markets followed, until others caught on. You already know that I closely track container ship traffic not only in Los Angeles, but ports around the world. This is easy now through many cheap apps available through Apple’s App Store..

In the 2025 stock market, we have all had to become our own mini hedge fund managers. For a start, more money has been made on the short side than the long side, at least the few who participated in instruments like my many vertical bear put debit spreads in (NVDA), (SPY), (TSLA), (MSTR), and the (TLT). There were also nicely profitable plays in the (SH), the (SDS), and the many volatility plays out there, such as the (SVXY).

It's all been enough to help me achieve a welcome 32% profit this year. Those who took my advice to sit out 2025 and bought 90-day US Treasury bills yielding 4.2% are also profitable this year. Any positive return this year is a great accomplishment.

A whole new cottage industry that has gone viral on the internet, offering up more obscure data points about the economy than we could ever consume. We all know that forward-looking soft sentiment data is the worst ever recorded. Credit card balances held by low-income consumers are at all-time highs. But McDonald’s (MCD) and Taco Bell sales have been falling, while those at Domino's Pizza are rising.

What the heck is that supposed to mean?

Although this may sound arcane and deep in the weeds, the 2 year – 10 year spread recently turned positive and is now at 0.47%. That means the yield on two-year Treasury notes is higher than the yield on ten-year Treasury bonds. This has NEVER happened without a following recession. If you were looking for hard data, this is hard data.

Gold is the only asset class absent from volatility this year. That alone says a lot.

There are more than the usual number of binoculars focusing on the Port of Los Angeles these days (click here for the link). Traffic is now down a stunning 25% on the week. That means a supply chain disaster is imminent.

You learn in the Marine Corps that a 50-cent part can ground a $60 million aircraft. How much extra will you pay to get that 50-cent part to get the plane flying? $1.00, $10? $100? Certainly $1 million for a military aircraft in time of war.

This is the basis for some of the exponential inflation forecasts and supply chain disruptions on the scale last seen during the pandemic. Once started, inflation takes off like a rocket with merchants trying to outraise each other and it can take years to get under control, as we saw with the last pandemic.

By the way, I still wake up at 2:00 AM every morning expecting incoming missiles, even though I have been out of Ukraine for 18 months. It turns out that post-traumatic stress gets worse when you get older. Fortunately, my bedroom is now in the basement.

The Lucky One (it was a dud)

The Not So Lucky Ones

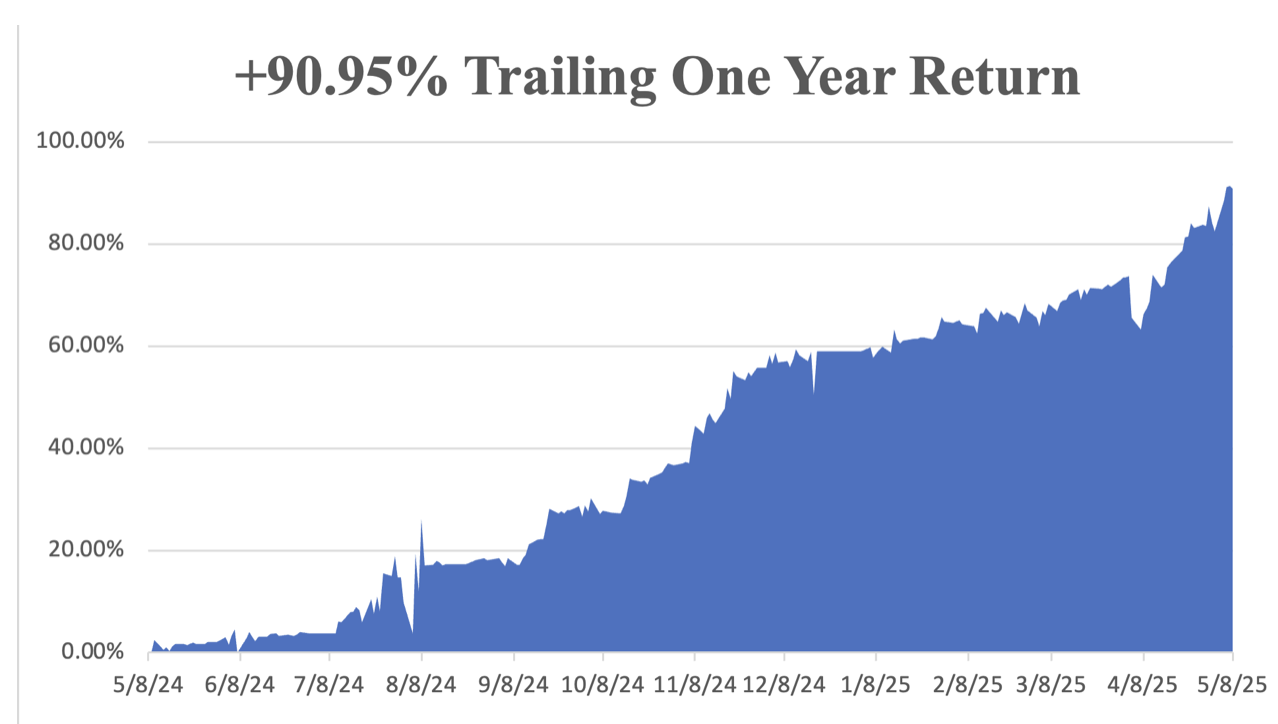

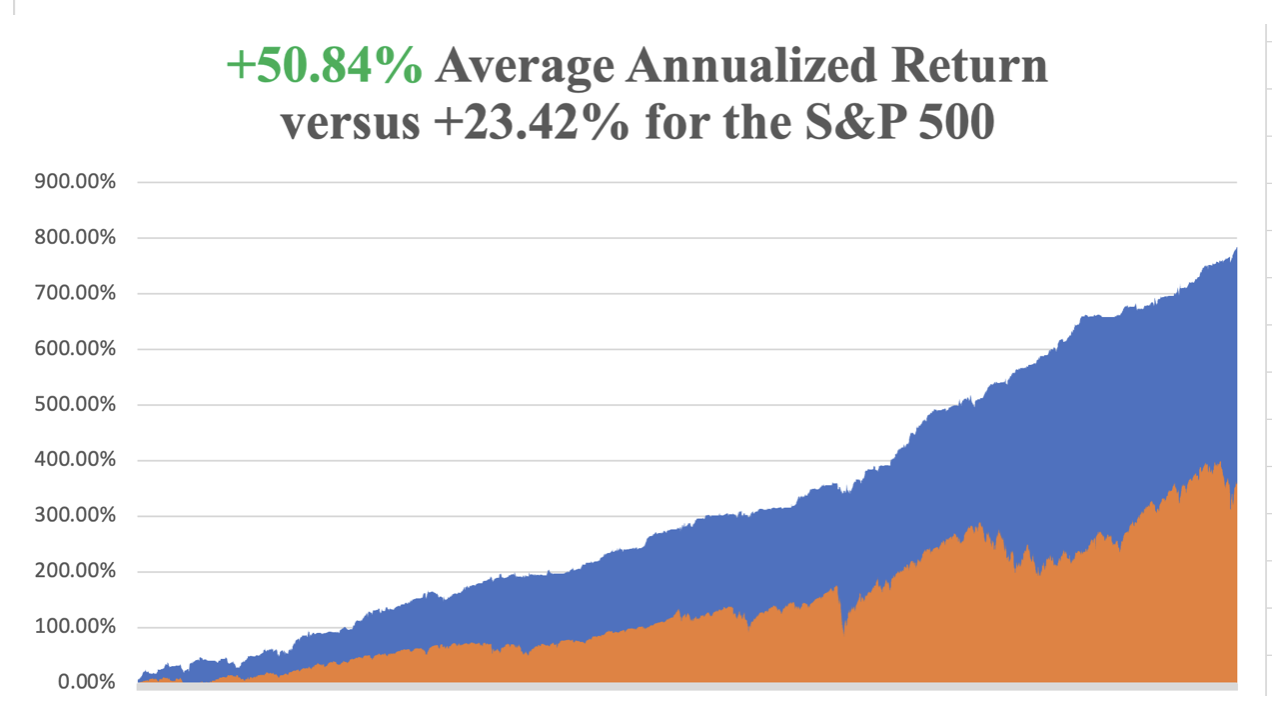

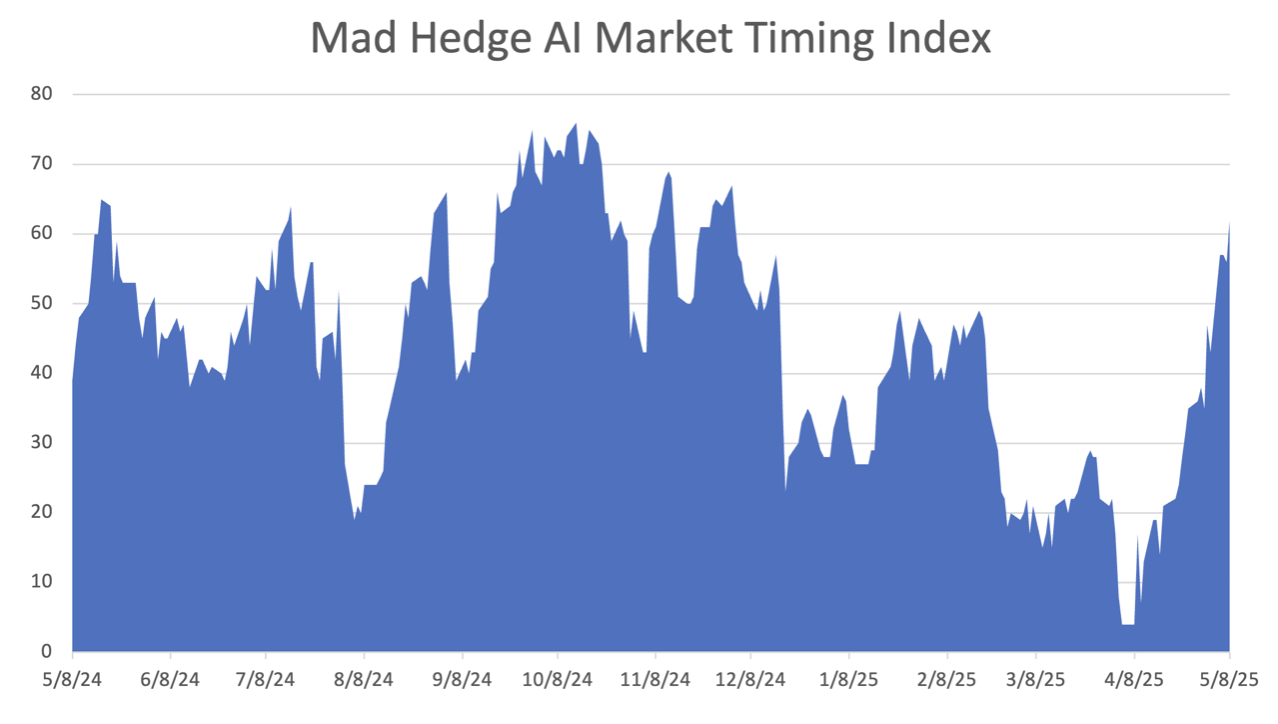

My May performance has reached +3.08%. That takes us to a year-to-date profit of +31.48% so far in 2025. My trailing one-year return stands at a record +90.95%. That takes my average annualized return to +50.84% and my performance since inception to +783.37%, a new all-time high.

It has been another wild week in the market. I took profits in longs in (MSTR) and (NVDA). I stopped out of a short in (SPY) for a small loss. I added a new long in (GLD) and (TLT), new shorts in (QQQ), (AAPL), and (TSLA). After the tremendous run we have just seen, I am moving towards a 100% short portfolio.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

The Stock Market is Headed for New Lows, even if the China tariffs drop from 145% to only 50%, says hedge fund guru and old friend Paul Tudor Jones. Trump’s rollout of the highest levies on imports in a century shocked the world last month, triggering extreme volatility on Wall Street. You have Trump, who’s locked in on tariffs. You have the Fed, which is locked in on not cutting rates. That’s not good for the stock market. We are the losers.

Fed Leaves Interest Rates Unchanged, at 4.25%-4.50%, supported by a consistently rising inflation rate. Stocks tanked and bonds rallied. In case you were wondering, the Fed ALWAYS prioritizes fighting inflation over unemployment because its mandate is to protect the value of the US dollar. It’s written into the 1913 law creating the Federal Reserve System. Don’t expect ANY rate cuts until year-end.

Apple Tanks on Falling Search Revenues. I bet you don’t get many short recommendations for Apple, but here’s a nice one. The implications for Apple were disastrous when a senior officer testified that artificial intelligence was demolishing their traditional search business. Of course, Alphabet (GOOGL) shares were trashed, down 7%. But Apple took a 5% hit as well because it earns an eye-popping $50 billion a year from its IOS operating system, referring all searches to Google. Apple shares have been trading rather feebly this month. While the S&P 500 rocketed 15%, (AAPL) managed to eak out an unimpressive 20% gain, while shares like Palantir (PLTR) doubled.

Bitcoin Recovers $100,000, for the first time since early February, bolstered by a dial down of the trade war in a sign that perhaps Trump is backing off his trade war. Overbought for now, sell Bitcoin rallies.

Nearly All US Exports are in Free Fall, reaching most ports across the U.S. and nearly all export market products as the trade impact of Trump’s tariffs worsens. Agriculture exports to China have been the hardest hit.

Oil Production has Peaked, thanks to the collapse in prices triggered by recession fears. Saudi Arabia is playing a market share game, and increasing production is another factor. Avoid all energy plays like the plague. We’re headed for $30 a barrel.

Warren Buffett Retires, handing over day-to-day management of Berkshire Hathaway (BRK/B) to Greg Abel. It’s a personal blow as Warren was one of the first subscribers to Mad Hedge Fund Trader. No one could ever match his investment performance, not even Warren himself, as stocks are so much more expensive now. Even if (BRK/B) shares dropped 99% from today, it would still be the top-performing S&P 500 stock since 1965. Listening to his annual shareholder summit, he’s still all there at age 94. I want to be Warren Buffett when I grow up.

Is Tesla the Next Boeing? By cutting production costs by 17% last year, has Musk also made the cars unsafe? That’s what happened to Boeing (BA), which prioritized raising dividends and share buybacks over quality and safety to the point where its aircraft started falling out of the sky. This year, (TSLA) shares have been matching (BA) downside one for one.

Jeff Bezos to Sell $4.7 Billion of Amazon Stock by May 2026. Time to free up some spending money. Jeff sold $13.4 billion worth of shares in 2024. Some of the money will go to finance his Blue Origin rocket hobby. Bezos still owns 9.56% of the $2 trillion company.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, May 12, at 8:30 AM EST, the WASDE Report is announced, the World Agriculture Supply and Demand Estimate.

On Tuesday, May 13, at 7:30 AM, the Consumer Price Index, a key inflation read, is released.

On Wednesday, May 14, at 9:30 AM, EIA Oil Stocks are disclosed. No move is expected in the face of a rising inflation rate. A press conference follows at 1:30.

On Thursday, May 15, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the Producer Price Index and Retail Sales.

On Friday, May 16, at 7:30 AM, we get Housing Starts and Building Permits. At 1:00 PM, the Baker Hughes Rig Count is published.

As for me, one of the many benefits of being married to a British Airways senior stewardess is that you get to visit some pretty obscure parts of the world. In the 1970s, that meant going first class for free with an open bar, and sometimes in the cockpit jump seat.

To extend out 1977 honeymoon, Kyoko agreed to an extra round trip for BA from Hong Kong to Colombo in Sri Lanka. That left me on my own for a week in the former British crown colony of Ceylon.

I rented an antiquated left-hand drive stick shift Vauxhall and drove around the island nation counterclockwise. I only drove during the day in army convoys to avoid terrorist attacks from the Tamil Tigers. The scenery included endless verdant tea fields, pristine beaches, and wild elephants and monkeys.

My eventual destination was the 1,500-year-old Sigiriya Rock Fort in the middle of the island, which stood 600 feet above the surrounding jungle. I was nearly at the top when I thought I found a shortcut. I jumped over a wall and suddenly found myself up to my armpits in fresh bat shit.

That cut my visit short, and I headed for a nearby river to wash off. But the smell stayed with me for weeks.

Before Kyoko took off for Hong Kong in her Vickers Viscount, she asked me if she should bring anything back. I heard that McDonald’s has just opened a stand there, so I asked her to bring back two Big Macs.

She dutifully showed up in the hotel restaurant the following week with the telltale paper back in hand. I gave them to the waiter and asked him to heat them up. He returned shortly with the burgers on plates surrounded by some elaborate garnish. It was a real work of art.

Suddenly, every hand in the restaurant shot up. They all wanted to order the same this, even though the nearest stand was 2,494 miles away.

We continued our round-the-world honeymoon to a beach vacation in the Seychelles, where we just missed a coup d’état, a safari in Kenya, apartheid South Africa, London, San Francisco, and finally back to Tokyo. It was the honeymoon of a lifetime.

Kyoko passed away in 2020 from breast cancer at the age of 50, well before her time.

Sigiriya Rock Fort

Kyoko

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader|

“My job is to find 10 problems for every three that exist,” said Jeffrey Gundlach of DoubleLine Capital.

Global Market Comments

May 7, 2025

Fiat Lux

Featured Trade:

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS),

(TLT)