Global Market Comments

July 29, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GREAT ROTATION LIVES), or (FLYING THE 1929 TRAVELAIRE D4D),

(NVDA), (TSLA), (JPM), (CCI), (CAT),

(DHI), (SLV), (GLD), (BRK/B), (DE)

I am writing this from the famed Hornli Hut on the north ridge of the Matterhorn at 10,700 feet. I’m not here to climb the iconic mountain one more time. Seven summits are enough for me. What left do I have to prove? It is a brilliant, clear day and I can see Zermatt splayed out before me a mile below.

No, I am here to inhale the youth, energy, excitement, and enthusiasm of this year’s batch of climbers, and to see them off at 1:00 AM after a hardy breakfast of muesli and strong coffee. My advice for beginners is liberally handed out for free.

Each country in Europe has its own personality. Observing the great variety of Europeans setting off I am reminded of an old joke. What is the difference between Heaven and hell?

In Heaven, you have a French chef, an Italian designer, a British policeman, a German engineer, and a Swedish girlfriend, and it is all organized by the Swiss.

In hell you have an English chef, a Polish designer, a German policeman, a Spanish engineer, no girlfriend, and it is all organized by the Italians.

When I recite this joke to my new comrades, I get a lot of laughs and knowing nods. Then they give me better versions of Heaven and hell

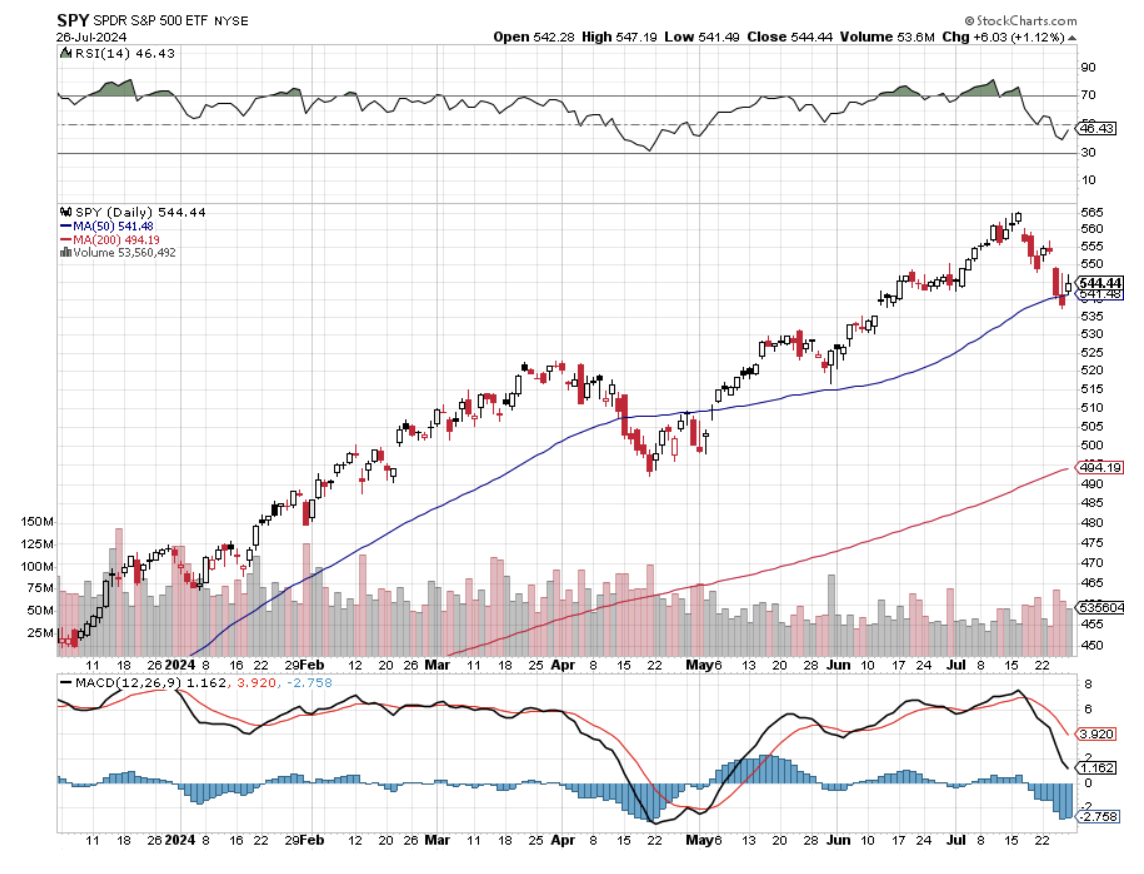

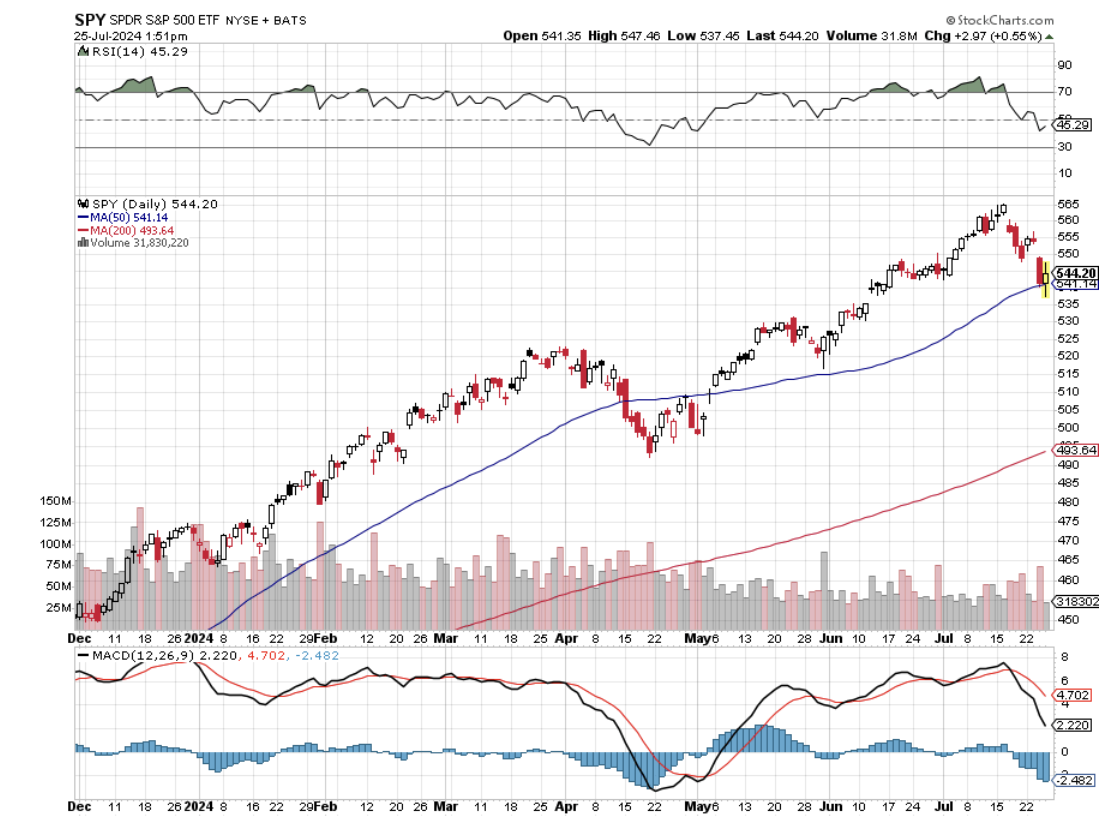

The stock market as well might have been organized by the Italians last week with the doubling of volatility and extreme moves up and down. Some 500 Dow points suddenly became a round lot, up and down. Tesla down $40? NVIDIA off 25%? Instantly, last month’s heroes became this month’s goats. It was a long time coming.

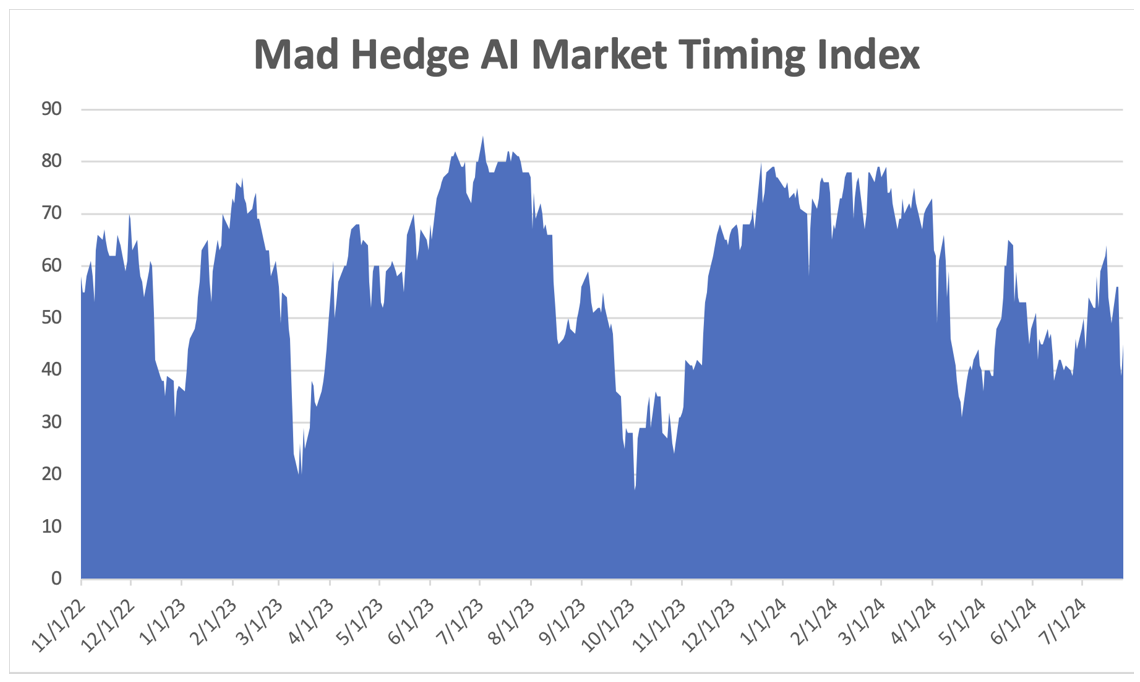

The Great Rotation, ignited by the July 11 Consumer Price Index shrinkage lives on. We are only two weeks into a reallocation of capital that could go on for months. Tech has nine months of torrid outperformance to take a break from. Interest sensitives have years of underperformance to catch up on.

Using a fund manager’s parlance, markets are simply moving from Tech to interest sensitives, growth to value, expensive to cheap, and from overbought to ignored.

A great “tell” of future share price performance is how they deliver in down markets. Last week, the Magnificent Seven (TSLA), (NVDA), got pummeled on the bad days. Interest sensitives like my (CCI), (IBKR), industrials (DE), (CAT), (BRK/B), precious metals (GLD), (SLV), and Housing (DHI) barely moved or rose.

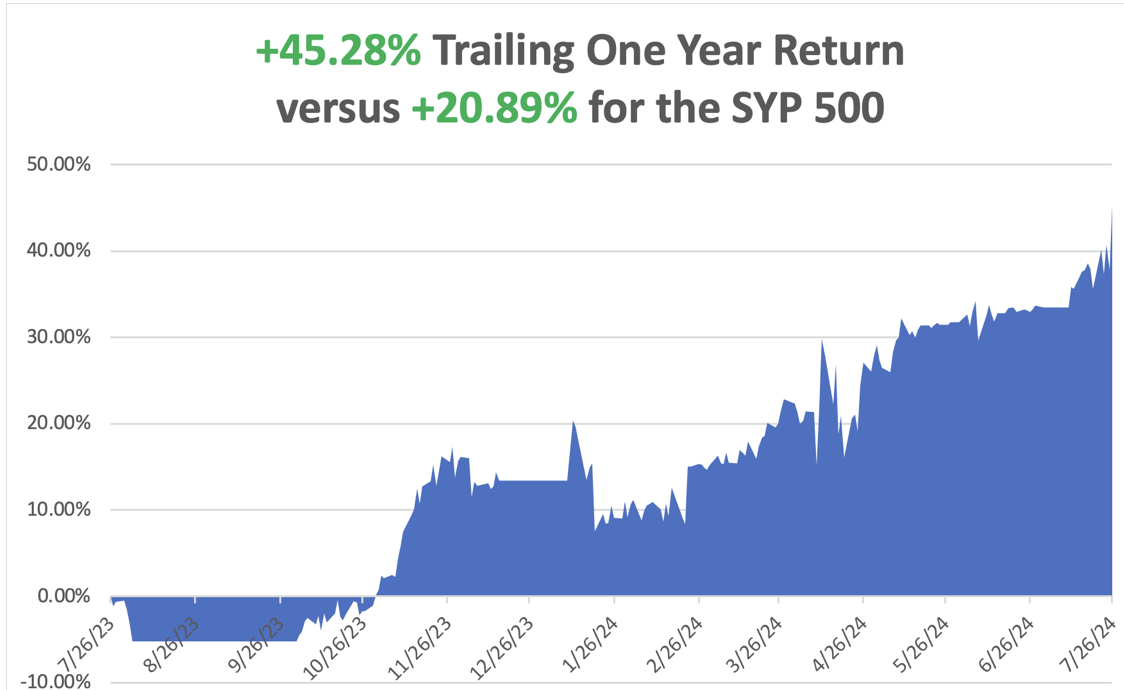

Sector timing is everything in the stock market and those who followed me into these positions were richly rewarded. My performance hit a new all-time high every day last week.

Only the industrial metals have not been reading from the same sheet of music. Copper, (FCX), (COPX), Iron Ore (BHP), Platinum (PPLT), Silver (SLV), uranium (CCJ), and Palladium (PALL) have all suffered poor months.

You can blame China, which has yet to restart its sagging economy. I blame that on 40 years of the Middle Kingdom’s one-child policy, which is only now yielding its bitter fruit. That means 40 years of missing Chinese consumers, which started hitting the economy five years ago.

And who knows how many people they lost during the pandemic (the Chinese vaccine, Sinovac, was found to be only 30% effective). This is not a short-term fix. You can’t suddenly change the number of people born 40 years ago.

I warned Beijing 50 years ago that the one-child policy would end in disaster. You can’t beat the math. The leadership back then only saw the alternative, a Chinese population today of 1.8 billion instead of the 1.4 billion we have. But they ignored my advice.

It is the story of my life.

Eventually, US and European growth will make up for the lost Chinese demand, but that may take a while. Avoid all Chinese plays like a bad dish of egg foo young. They’re never going back to the 13% growth of the 2000’s.

So far in July, we are up a stratospheric +11.82%. My 2024 year-to-date performance is at +31.84%. The S&P 500 (SPY) is up +14.05% so far in 2024. My trailing one-year return reached +xx.

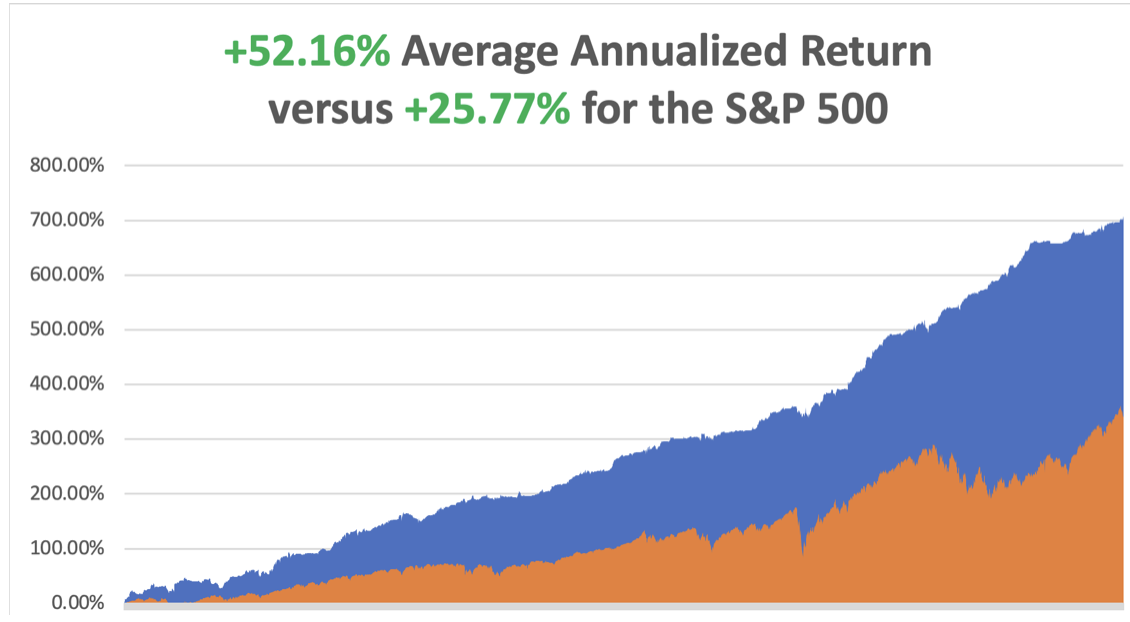

That brings my 16-year total return to +xx. My average annualized return has recovered to +708.47.

I used the market collapse to take a profit in my shorts in (NVDA) and (TSLA). Then on the first rally in these names, I slapped new shorts right back on. I used monster rallies to take profits in (JPM) and (CCI). I added new longs in interest sensitives like (CAT), (DHI), and (SLV). This is in addition to existing longs in (GLD), (BRK/B), and (DE), which I will likely run into the August 16 option expiration.

That will take my year-to-date performance up to an eye-popping 43.77% by mid-August.

Some 63 of my 70 round trips were profitable in 2023. Some 45 of 53 trades have been profitable so far in 2024, and several of those losses were break-even. That is a success rate of 84.91%.

Try beating that anywhere.

One of the great joys of hiking around Zermatt is that you meet happy people from all over the world. The other morning, I was walking up to Mount Gornergrat when I ran into two elementary school teachers from Nagoya, Japan. After recovering from the shock that I spoke Japanese I told them a story about when I first arrived in Japan in 1974.

Toyota Motors (TM) hired me to teach English to a group of future American branch sales managers. A Toyota Century limo picked me up at the Nagoya train station and drove me up to a training facility in the mountains. As we approached the building, I witnessed 20 or so men in dark suits, white shirts, and thin ties lined up. One by one they took a baseball bat and savagely beat a dummy that lay prostrate on the grass before them.

I asked the driver what the heck they were doing. He answered that they were beating the competition. A decade later, Japan had seized 44% of the US car market, with Toyota taking the largest share.

I like to think that a superior product did that and not my language instruction abilities.

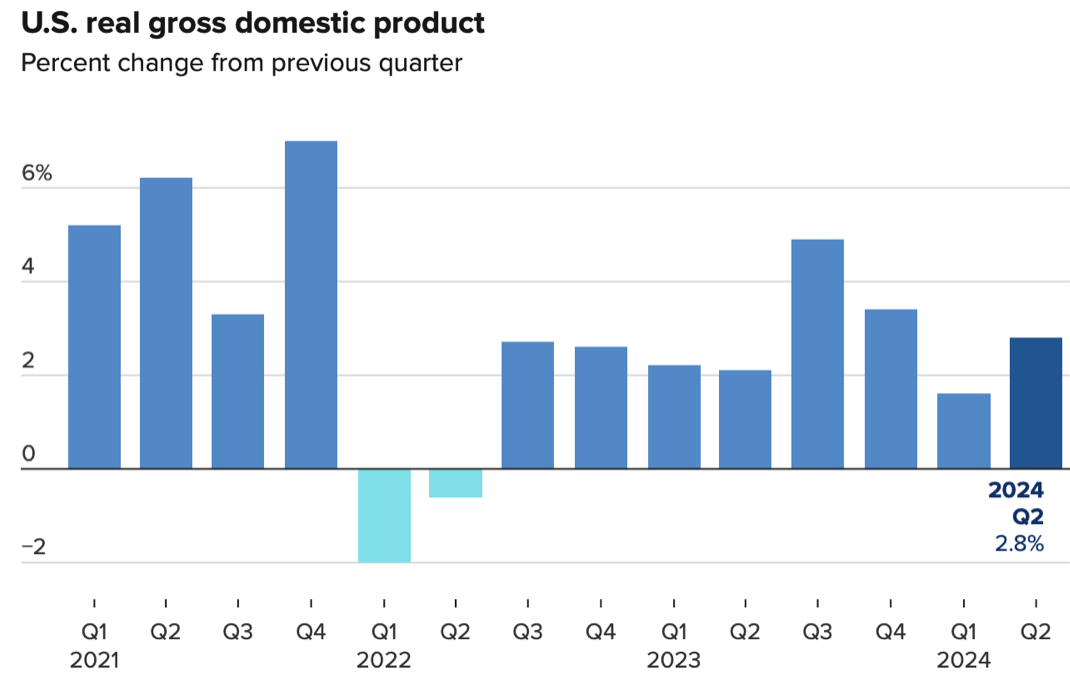

US Q2 GDP Pops, up 2.8% versus 2.1% expected. The US still has the strongest major economy in the world. Consumer spending helped propel the growth number higher, as did contributions from private inventory investment and nonresidential fixed investment. Goldilocks Lives!

Personal Consumption Expenditure Drops, a key inflation indication for the Fed, up only 0.1%in June and 2.5% YOY. Core inflation, which excludes food and energy, showed a monthly increase of 0.2% and 2.6% on the year, both also in line with expectations. Personal income rose just 0.2%, below the 0.4% estimate. Spending increased 0.3%, meeting the forecast, while the personal savings rate decreased to 3.4%.

Leveraged NVIDIA Bets Cause Market Turmoil. Great when (NVDA) is rocketing, not so much when it is crashing, with (NVDA) plunging 25.7% in a month. (NVDA) is now the largest holding in 500 traded ETF’s. I already made a nice chunk of money on an (NVDA) and will go back for another bight on the smallest rally.

The US Treasury Knocks Out a Blockbuster Auction, shifting $180 Billion worth of 7 ear paper, taking yields down 5 basis points. Foreign demand was huge. Bonds are trading like interest rates are going to be cut. Stock rallied an impressive 800 points the next day.

Durable Goods Get Slammed, down 6.6% versus an expected +0.6% in June. More juice for the interest rate cut camp.

Tesla Bombs, with big earnings and sales disappointments, taking the stock down 15%. Thank goodness we were short going into this. The EV maker put off its Mexico factory until after the November election. Adjusted earnings fell to 52 cents per share in the three months ended in June, missing estimates for the fourth consecutive quarter. Tesla will now unveil robotaxis on Oct. 10, and the cars shown will only be prototypes. Cover your Tesla Shorts near max profit.

Home Sales Dive, in June, off 5.4%. Inventory jumped 23.4% from a year ago to 1.32 million units at the end of June, coming off record lows but still just a 4.1-month supply. The median price of an existing home sold in June was $426,900, an increase of 4.1% year over year.

Oil Glut to continue into 2025, thanks to massive tax subsidies creating overproduction. Morgan Stanley said it expects OPEC and non-OPEC supply to grow by about 2.5 million barrels per day next year, well ahead of demand growth. Refinery runs are set to reach a peak in August this year, and unlikely to return to that level until July 2025, it said. Avoid all energy plays until they bottom.

Homebuilders Catch on Fire, with the prospect of falling interest rates. The US has a structural shortage of 10 million homes with 5 million Millennial buyers. Homebuilders have been underbuilding since the 2008 Great Financial Crisis, seeking to emphasize profits and share buybacks over to development land purchases. Buy (DHI), (LEN), (PMH), (KBH) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, July 29 at 9:30 AM EST, the Dallas Fed Manufacturing Index is out.

On Tuesday, July 30 at 9:30 AM, the JOLTS Job Openings Report is published. The Federal Reserve Open Market Committee (FOMC) meeting begins

On Wednesday, July 31 at 2:00 PM, Jay Powell announced the Fed’s interest rate decision.

On Thursday, August 1 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, August 2 at 8:30 AM, the July Nonfarm Payroll Report is released. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I am reminded as to why you never want to fly with Major John Thomas

When you make millions of dollars for your clients, you get a lot of pretty interesting invitations. $5,000 cases of wine, lunches on superyachts, free tickets to the Olympics, and dates with movie stars (Hi, Cybil!).

So it was in that spirit that I made my way down to the beachside community of Oxnard, California just north of famed Malibu to meet long-term Mad Hedge follower, Richard Zeiler.

Richard is a man after my own heart, plowing his investment profits into vintage aircraft, specifically a 1929 Travel Air D-4-D.

At the height of the Roaring Twenties (which by the way we are now repeating), flappers danced the night away doing the Charleston and the bathtub gin flowed like water. Anything was possible, and the stock market soared.

In 1925, Clyde Cessna, Lloyd Strearman, and Walter Beech got together and founded the Travel Air Manufacturing Company in Wichita, Kansas. Their first order was to build ten biplanes to carry the US mail for $125,000.

The plane proved hugely successful, and Travel Air eventually manufactured 1,800 planes, making it the first large-scale general aviation plane built in the US. Then, in 1929, the stock market crashed, the Great Depression ensued, aircraft orders collapsed, and Travel Air disappeared in the waves of mergers and bankruptcies that followed.

A decade later, WWII broke out and Wichita produced the tens of thousands of the small planes used to train the pilots who won the war. They flew B-17 and B-25 bombers and P51 Mustangs, all of which I’ve flown myself. The name Travel Air was consigned to the history books.

Enter my friend Richard Zeiler. Richard started flying support missions during the Vietnam War and retired 20 years later as an Army Lieutenant Colonel. A successful investor, he was able to pursue his first love, restoring vintage aircraft.

Starting with a broken down 1929 Travel Air D4D wreck, he spent years begging, borrowing, and trading parts he found on the Internet and at air shows. Eventually, he bought 20 Travel Air airframes just to make one whole airplane, including the one used in the 1930 Academy Award-winning WWI movie “Hells Angels.”

By 2018, he returned it to pristine flying condition. The modernized plane has a 300 hp engine, carries 62 gallons of fuel, and can fly 550 miles in five hours, which is far longer than my own bladder range.

Richard then spent years attending air shows, producing movies, and even scattering the ashes of loved ones over the Pacific Ocean. He also made the 50-hour round trip to the annual air show in Oshkosh, Wisconsin. I have volunteered to copilot on a future trip.

Richard now claims over 5,000 hours flying tailwheel aircraft, probably more than anyone else in the world. Believe it or not, I am also one of the few living tailwheel-qualified pilots in the country left. Yes, antiques are flying antiques!

As for me, my flying career also goes back to the Vietnam era as well. As a war correspondent in Laos and Cambodia, I used to hold Swiss-made Pilatus Porter airplanes straight and level while my Air America pilot friend was looking for drop zones on the map, dodging bullets all the way.

I later obtained a proper British commercial pilot license over the bucolic English countryside, trained by a retired Battle of Britain Spitfire pilot. His favorite trick was to turn off the fuel and tell me that a German Messerschmidt had just shot out my engine and that I had to land immediately. He only turned the gas back on at 200 feet when my approach looked good. We did this more than 200 times.

By the time I moved back to the States and converted to a US commercial license, the FAA examiner was amazed at how well I could do emergency landings. Later, I added additional licenses for instrument flying, night flying, and aerobatics.

Thanks to the largesse of Morgan Stanley during the 1980’s, I had my own private twin-engine Cessna 421 in Europe for ten years at their expense where I clocked another 2,000 hours of flying time. That job had me landing on private golf courses so I could sell stocks to the Arab Prince owners. By 1990, I knew every landing strip in Europe and the Persian Gulf like the back of my hand.

So, when the first Gulf War broke out the following year, the US Marine Corps came calling at my London home. They asked if I wanted to serve my country and I answered, “Hell, yes!” So, they drafted me as a combat pilot to fly support missions in Saudi Arabia.

I only got shot down once and escaped with a crushed L5 disk. It turns out that I crash better than anyone else I know. That’s important because they don’t let you practice crashing in flight school. It’s too expensive.

My last few flying years have been more sedentary, flying as a volunteer spotter pilot in a Cessna-172 for Cal Fire during the state’s runaway wildfires. As long as you stay upwind there’s no smoke. The problem is that these days, there is almost nowhere in California that isn’t smokey. By the way, there are 2,000 other pilots on the volunteer list.

Eventually, I flew over 50 prewar and vintage aircraft, everything from a 1932 De Havilland Tiger Moth to a Russian MiG 29 fighter.

It was a clear, balmy day when I was escorted to the Travel Air’s hanger at Oxnard Airport. I carefully prechecked the aircraft and rotated the prop to circulate oil through the engine before firing it up. That reduced the wear and tear on the moving parts.

As they teach you in flight school, it is better to be on the ground wishing you could fly than being in the air wishing you were on the ground!

I donned my leather flying helmet, plugged in my headphones, received a clearance from the tower, and was good to go. I put on max power and was airborne in less than 100 yards. How do you tell if a pilot is happy? He has engine oil all over his teeth. After all, these are open-cockpit planes.

I made for the Malibu coast and thought it would be fun to buzz the local surfers at wave top level. I got a lot of cheers in return from my fellow thrill seekers.

After a half hour of low flying over elegant sailboats and looking for whales, I flew over the cornfields and flower farms of remote Ventura County and returned to Oxnard. I haven’t flown in a biplane in a while and that second wing really put up some drag. So, I had to give a burst of power on short finals to make the numbers. A taxi back to the hangar and my work there was done.

There are old pilots and there are bold pilots, but there are no old, bold pilots. I can attest to that.

Richard’s goal is to establish a new Southern California aviation museum at Oxnard airport. He created a non-profit 501 (3)(c), the Travel Air Aircraft Company, Inc. to achieve that goal, which has a very responsible and well-known board of directors. He has already assembled three other 1929 and 1930 Travel Air biplanes as part of the display.

The museum’s goal is to provide education, job training, restoration, maintenance, sightseeing rides, film production, and special events. All donations are tax-deductible. To make a donation please email the president of the museum, my friend Richard Conrad at

rconrad6110@gmail.com

Who knows, you might even get a ride in a nearly 100-year-old aircraft as part of a donation.

To watch the video of my joyride please click here.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Where I Go My Kids Go

“There are old pilots and there are bold pilots, but there are no old, bold pilots,” according to the US Marine Corps flight school.

Global Market Comments

July 26, 2024

Fiat Lux

Featured Trade:

(AUGUST 15 LONDON ENGLAND STRATEGY LUNCHEON)

(JULY 24 BIWEEKLY STRATEGY WEBINAR Q&A),

(UUP), (FXE), (FXC), (FXA), (FXB), (USO),

(FCX), (CCJ), (FXI), (CAT), (DE), (NVDA)

Below please find subscribers’ Q&A for the July 24 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Zermatt, Switzerland.

Q: Does the entry of Kamala Harris into the presidential election have any effect on the stock market?

A: No. I know someone who did research on markets and elections going all the way back to 1792 and the long-term effect has been absolutely zero over the 232-year period. Actually, what happens is you have the two candidates very close to each other in the polls, so uncertainty is at a maximum. Markets hate uncertainty, so they’ll wait until the uncertainty goes away, which will probably be about two weeks before the election. You can expect a really hot 4th quarter in the market though, so get all your cash freed up so you can pour all your money into the market for the last quarter of the year.

Q: How do falling interest rates affect the US dollar (UUP) and the currencies?

A: Currencies (FXE), (FXC), (FXA), (FXB) are always driven by interest rates. Those with high interest rates like the US dollar, are strong; those with low interest rates like Japan, are weak. Japan has had zero rates for over 20 years now. When that reverses, those currencies reverse, ending up with a weak US dollar and a strong euro, pound, etc. These changes in direction for the currency markets only happen every few years, so that will be a reliable trade.

Q: Why is oil (USO) so cheap when the rest of the economy is so strong?

A: There are many reasons. One is that the amount of barrels of oils needed to produce a unit of GDP has been falling for 30 years. That's a function of engines becoming more efficient at using gasoline. Plus more people are switching out of gasoline into electric, and more people flying instead of driving. The “work at home” movement hasn’t helped oil demand either. It’s also the most subsidized industry in the US, and you always get overproduction leading to price crashes, which we now seem to be witnessing.

Q: I have Freeport McMoRan (FCX) as a long-term hold; why has it recently been so weak?

A: Well, the number one reason is China (FXI). China is the biggest consumer of copper in the world and their economy is dead in the water. You know, 4.5% or 4.7% is a long way from the 13% we used to get during the 2000s and when copper was absolutely on fire. Eventually, I expect industrial demand in the US to make up for the shortage of demand from China, but that isn’t happening right now. It isn’t just copper—all the industrial metals have been weak the last couple of months and that is the reason.

Q: Cameco Corporation (CCJ) has been down lately, even with seemingly good news out of Kazakhstan. Is this a good buy here at the 200-day?

A: I would say it is. It’s being dragged down by the rest of the industrial metals and the energy plays. If you watch carefully, the uranium stocks trade very closely with oil, and we have an oil glut, so it tends to drag down all the other energy forms with it, including uranium and natural gas. I love uranium demand long term; it's growing far faster than oil demand and that’s why I own (CCJ).

Q: Do you think falling interest rates will bail out the real estate market?

A: Absolutely, yes. 30-year fixed-rate mortgages hanging around the mid-sixes, you get a couple of rate cuts and we could be back into the fives and even the fours in no time. So yes, big impact on real estate, all the subsidiary plays, on home builders, on the entire economy.

Q: If the market reverses today or tomorrow, what are some of the best call options to put money into?

A: Caterpillar (CAT), Deer & Co. (DE), and you might even go $50 into the money on Nvidia (NVDA). Home builders I would love to get into as well. All of these things have had great runs, but these are just the 1st leg of moves that could go on for years. So yes, this is where the barbell portfolio works: half big tech, half domestic recovery plays.

Q: Are you stopping at Edelweiss for a frosty beer on your hike?

A: Absolutely, I go to Edelweiss every year and don’t mind climbing the 1,200 feet to get there. You certainly have an appetite when you get to the top. It has a fantastic view of the town and you can stay there overnight there as well.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"The Clinton and Bush administrations had it right with regards to our relations with China. We need to draw red lines when necessary and build bridges when possible." said my friend, columnist Tom Friedman, of the New York Times.

Global Market Comments

July 25, 2024

Fiat Lux

Featured Trade:

(AUGUST 5 VILNIUS LITHUANIA STRATEGY LUNCHEON)

(A NOTE ON OPTIONS ASSIGNED OR CALLED AWAY)

(TLT), (TSLA)

Come join me for lunch for the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Vilnius, Lithuania at 12:00 PM on Monday, August 5, 2024. A three-course lunch is included.

I’ll be giving you my up-to-date view on stocks, bonds, currencies commodities, precious metals, and real estate.

And to keep you in suspense, I’ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $197.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch location will be emailed to you prior to the event.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

With the heightened volatility this week, I am seeing an increasing number of options positions assigned or called away.

I know all of this may sound confusing at first. But once you get the hang of it, this is the greatest way to make money since sliced bread.

I still have five positions left in my model trading portfolio that are deep in-the-money, and about to expire in 11 trading days. These are:

(GLD) 8/$210-$215 calls spread 10.00%

(BRK/B) 8/$405-$415 call spread 10.00%

(DE) 8/$330-$340 call spread 10.00%

(IBKR) 8/$110-$115 call spread 10.00%

(SLV) 8/$23-$25 call spread 10.00%

That opens up a set of risks unique to these positions.

I call it the “Screw up risk.”

As long as the markets maintain current levels, this position will expire at its maximum profit value.

With the August 16 options expirations upon us, there is a heightened probability that your short position in the options may get called away.

Although the return for those calling away your options is very small, this is how to handle these events.

If exercised, brokers are required by law to email you immediately and I know all of this may sound confusing at first. But once you get the hang of it, this is the greatest way to make money since sliced bread.

If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short-option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away.

I’ll use the example of the Berkshire Hathaway (BRK/B) August 2024 $405-$415 in-the-money vertical Bull Call spread since so many of you have these.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point 11 days before the August 16 expiration date.

In other words, what you bought for $8.70 on July 12 is now worth $10.00, giving you a near-instant profit of $1,300 or 14.94% in only 11 trading days.

All have to do is call your broker and instruct them to “exercise your long position in your (BRK/B) August 16 $405 calls to close out your short position in the (BRK/B) August $410 calls.”

You must do this in person. Brokers are not allowed to exercise options automatically, on their own, without your expressed permission.

You also must do this the same day that you receive the exercise notice.

This is a perfectly hedged position. The name, the ticker symbol, the number of shares, and the number of contracts are all identical, so you have no exposure at all.

Call options are a right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Short positions usually only get called away for dividend-paying stocks or interest-paying ETFs like the (BRK/B). There are strategies out here that try to capture dividends the day before they are payable. Exercising an option is one way to do that.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to sell a long (BRK/B) position after the close, and exercising his long (BRK/B) call, which you are short, is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

There is a further annoying complication that leads to a lot of confusion. Lately brokers have resorted to sending you warnings that exercises MIGHT happen to help mitigate their own legal liability.

They do this even when such an exercise has zero probability of happening, such as with a short call option in a LEAPS that has a year or more left until expiration. Just ignore these, or call your broker and ask them to explain.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Calling All Options!

Global Market Comments

July 24, 2024

Fiat Lux

Featured Trade:

(WHAT AI CAN AND CAN’T DO FOR YOU)

(AAPL), (GOOGL), (AMZN), (AMZN), (TSLA), (NVDA), (MU)