Global Market Comments

December 23, 2024

Fiat Lux

Featured Trade:

(A BUY WRITE PRIMER)

(AAPL)

Global Market Comments

December 20, 2024

Fiat Lux

Featured Trade:

(THE EIGHT WORST TRADES IN HISTORY)

Global Market Comments

December 19, 2024

Fiat Lux

Featured Trade:

(A CHRISTMAS STORY),

(THE U-HAUL INDICATOR)

It is the end of the semester at the University of California, and as a single parent, the unenviable task of retrieving my daughters out of the dorms for the holidays fell to me.

When I arrived, I was stunned to find nothing less than a war zone. Both sides of every street were lined with mountains of trash, the unwanted flotsam and jetsam cast aside by departing students.

Computer desk, embarrassingly stained mattresses, broken lava lamps, and an assortment of heavily worn Ikea furniture were there for the taking. Newly arriving students were sifting through the piles, looking for that reusable gem.

Diminutive Chinese teenagers were seen pushing massive suitcases on wheels down the sidewalk on their way back to Shanghai, Beijing, and Hong Kong. The university attempted to bring order to the chaos by strategically placing dumpsters on every block, but they were rapidly filled to overflowing.

It was all worth it because of the insight it gave me into one of my favorite, least-known leading economic indicators. When I picked up the truck at U-HAUL, the lot was absolutely packed with returned vehicles, and there were more parked on both sides of the streets.

The booking agent told me there is a massive influx of people moving into California from the Midwest and the Northwest, with the result that lots all over the San Francisco Bay Area are filled to capacity.

I love this company because, in addition to providing a great service, they get the first indication of any changes to the migratory habits of Americans. The last time I saw this happen was after the dotcom bust when thousands of tech-savvy, newly unemployed pulled up stakes in the foggy city and moved to Lake Tahoe to work in “the cloud.”

Bottom line: California is enjoying a resurgence of hiring and new economic growth, most likely driven by Artificial Intelligence. This is what the stock market is screaming at us right now.

Want a Great Deal on a Used Lava Lamp?

Global Market Comments

December 18, 2024

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(WHAT EVER HAPPENED TO THE GREAT DEPRESSION DEBT?),

($TNX), (TLT), (TBT)

It's so great having John as my Personal Investment 911. Even when he was navigating the current of his excellent Summit … it took him less than 3 minutes to answer my questions & guide me on my way. I’m underway & making hay … thank you, John.

Andy

Sarasota, Florida

Global Market Comments

December 17, 2024

Fiat Lux

Featured Trade:

(I’M TAKING OFF FOR THE YEAR)

By the time you read this, I will be 200 miles off the west coast of Mexico on the Coral Princess. I’ll be occupying the spacious owner's suite and packing all three of my tuxes (and all my black socks) just to make sure I am never underdressed.

You see, I need a vacation.

I have been working nonstop for decades and desperately need a break. It seems that the older I get, the more I know the more in demand I become. Why quit taking tests when I already know all the answers?

You can tear up your Rolodex card for me, unfriend me on Facebook, designate my email address as SPAM, and block my Twitter account. It won’t do you any good.

If I don’t take some time off, I am going to start raving MAD!

Over the last 17 years, I have worked the hardest in my entire life. And the last year, I have had to work with a bullet wound in my hip courtesy of the Russian Army in Ukraine. Whenever I have free time, I go fight a war. That’s who you want calling your trades.

This year, I have brought in a total return of +75.25%, versus +27% for the S&P 500, far and away among the best of my life and almost certainly yours as well. If you got half of my performance, you beat virtually everyone else in the industry, even the best hedge funds. In other words, I underpromised and over delivered….in spades. That is my way.

If you wonder why I do this, it’s really very simple. Read my inbox, and you would burst into tears.

Every day, I learn tales of mortgages paid off, student loans dealt with, college educations financed, and early retirements launched. I am improving lives by the thousands. That’s far better than any hedge fund bonus could offer me, although I wouldn’t mind owning the Golden State Warriors.

At this late stage in my life, the most valuable thing is to be needed and listened to. If that means becoming a cult leader, that’s fine with me. After all, the last guy to try this route got crucified.

When horrific uncontrollable wildfires broke out in California, I flew volunteer spotter planes for Cal Fire, holding the stick with one hand and a pair of binoculars with the other, looking for trouble and radioing in coordinates, and directing aerial tankers. Nobody can fly wildfires like I can.

I lost access to my Lake Tahoe house when the big fire hit right in the middle of a remodel. All the contractors disappeared, chasing much higher-paying insurance work. At least we now have a 20-mile-wide fire break to the southwest of the house.

I have high hopes for next summer, starting with my seminar at sea across the Atlantic in June, then a trip on the Orient Express to Venice, another Matterhorn climb in July, client visits in Europe for August, flying Spitfires in England in September, and hiking the 170 mile Tahoe Rim Trail in October.

On top of all this, I was on speed dial at the Joint Chiefs and the US Marine Corps. A major? Really? And now I’m a major in two armies, the US and Ukraine. Seems you’re not the only one in desperate need of global macro advice.

So, I will spend the next 16 days reading the deep research, speaking with old hedge fund buddies, the few still left alive, and trying to come up with a game plan for 2025. One thing is certain: we will likely make a lot more money next year, the setup is so clear. Market volatility is about to go through the roof.

Instead of sending out urgent trade alerts, emergency news flashes, and more research than you can read, I’ll be playing Monopoly and Risk, practicing my banjo, and catching up on some classic films.

I already have one trade-on: I’ll watch Elf for the millionth time if the kids watch Gary Cooper’s 1949 Task Force, the history of Naval Aviation (semper fi).

In the meantime, I’ll be running some of my favorite research pieces from the past over the next two weeks. Hot Tips will include the same.

So, everyone, please have some great holidays, spend your monster Tesla profits well, and get well rested.

We have some serious work to do in 2025.

Merry Christmas and Happy New Year,

John Thomas

CEO and Publisher

The Diary of a Mad Hedge Fund Trader

Selling Christmas Trees for the Boy Scouts

Global Market Comments

December 16, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or CATCHING THE NEXT MARKET TOP), plus (A LIFETIME OF FLIGHT INSTRUCTION),

(JPM), (NVDA), (BAC), (C), (CCJ), (MS), (BLK), (TSLA)

We all learned as children how to win at “Merry Go Round.” All you have to do is remember to sit down when the music stops playing.

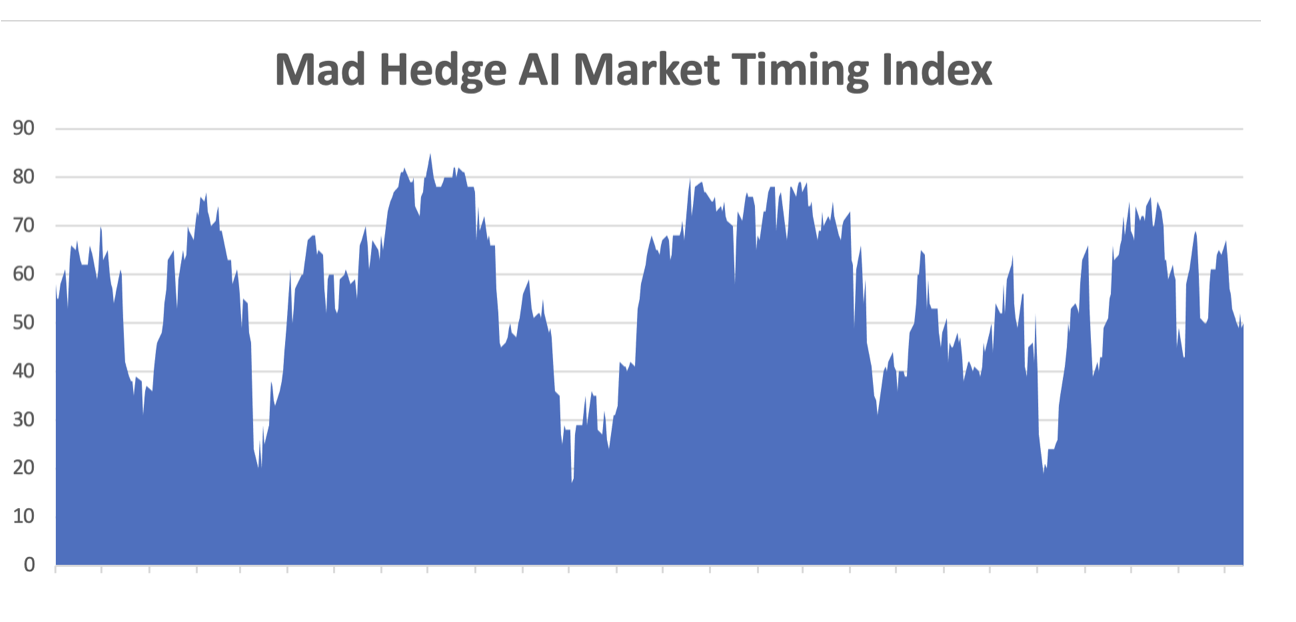

We are now entering a market with the greatest uncertainty since the pandemic. This is when expansive election promises meet harsh reality. And the new president has to attempt to deliver on his almost uncountable promises with a one-seat majority in the House of Representatives, the smallest in history.

In 2025, you are going to have to work twice as hard to make half the money with double the volatility. Markets like this are the sweet spot for Mad Hedge Fund Trader, which makes money in all market conditions. We are entering 2025 with a 30X multiple for NASDAQ, near a record high. Since 2012, the value of the Magnificent Seven has exploded from $1 trillion to $18 trillion, and you are buying, or at least staying long, on top of that move.

Amidst all the euphoria, someone failed to notice that the Republicans actually lost two seats in the House, and two more were given away in cabinet appointments. They probably don’t realize that Republicans die faster than Democrats because they are, on average, ten years older.

There are also more Democratic women who, on average, live six years longer than men. That means the slim majority will be gone in six months. Am I the only one who pays attention to demographics?

No House means no money to do anything. Many of the new administration’s proposals cost enormous amounts of money. My ancestors came from Missouri before they moved to California during the gold rush in 1849, which is known as the “Show me” state.

Show me.

So, in my early take on the New Year, look for a 10%-15% rally in stocks led by the same old sectors during the first half of 2025. Buy election winners and sell the losers. Artificial intelligence is accelerating faster than ever, and that is going on independent of Washington. Embrace the bubble. Call it the “pre-reality” rally.

After that, look for a give-back of some, if not all, of this rally. Tax cuts and spending increases will explode the National Debt well beyond the current $36 trillion. Inflation will return. Interest rates will rise. A trade war will exact a high price. Perhaps two million small businesses will go under, thanks to their loss of cheap supplies from China. Antitrust law will only be enforced against the left coast Magnificent Seven, and everyone else will get a free pass.

And now it’s my turn to deliver you a harsh reality. Every recession and stock market in my lifetime has started during a Republican administration, and I am pretty old. The causes are always the same. The expectation of tax cuts and hands-off on regulation creates over-investment and excessive leverage that always ends in tears. When that peaks, stocks crash, and a recession ensues.

Except that this time, it’s different. The incoming administration promises to sow the seeds of its most destructive policies, a trade war, and massive tax cuts during a booming economy that explodes the deficit and inflation “on day one.” That means we could see an earlier recession than a later one. That is when the music stops playing.

That is fine with me. I make more money in down markets than I do in up markets. That is because I get the hockey stick effect of falling share prices, rising volatility, and soaring options premiums to play on the downside.

As for you, I’m not so sure. I don’t have to run faster than the bear to survive, just faster than you.

It could be a great year to “Sell in May and Go Away.” I’m already booking summer cruises on Cunard (https://www.cunard.com/en-us).

A lot of readers have been asking about my take on the sudden collapse of the Bashar al Assad regime in Syria in the context of my nearly 60 years of experience in the region. I have never been to Syria; just viewed it from a distance from the Golan Heights in Israel.

The one-liner here is that it is a huge win for the US and the West and a huge loss for Russia, Iran, and the main terrorist groups.

It ejects Russia from the Middle East for the time being after making massive 50-year investments there in military support. Syria will default on all of its billions of dollars in debts to Russia. Russia built the enormous Aswan Dam on the Nile, then saw defaults here, too, when Egypt sided with the West after the Camp David Accords.

Russia built the world's third largest military in Iraq, with 5,000 tanks, which the US then completely destroyed in the first Gulf War, where I participated. Their failure in Afghanistan caused the collapse of the Soviet Union. Russia has lost its only Mediterranean port at Aleppo, and its ships there have already been withdrawn. At this point, there must be a lot of unemployed Middle East experts in Moscow.

Iran has been fighting a proxy war against Israel and the US through Hamas, Hezbollah, and Syria for 45 years, which it has just ignominiously lost. It used to supply Gaza with weapons by trucking them through Syria and loading them on ships. It now has to go all the way around Africa, and there is no one there to take them anyway.

The cost of this victory to the US has been zero: no money, no troops, no heavy equipment. Sometimes, doing nothing is the right thing. The cost to Russia and Iran has been exponential.

Of course, in the Middle East, be careful what you wish for because you might end up getting something far worse. Assad may have just been replaced with another anti-western terrorist group. That is why President Biden has directed the complete destruction of all arms stockpiles in Syria, with the assistance of Israel and Turkey. We have their exact latitude and longitude in seconds. Better there to be no weapons and have an incoming regime that is toothless in Syria than having them fall into the hands of the next terrorist group. There are no defenders in Syria at the moment.

Finally, I was amazed to see Assad’s extensive classic and race car collection, the ultimate symbol of modern dictators. Can I make a bid on the 1956 Cadillac? To where and who do I send my offer?

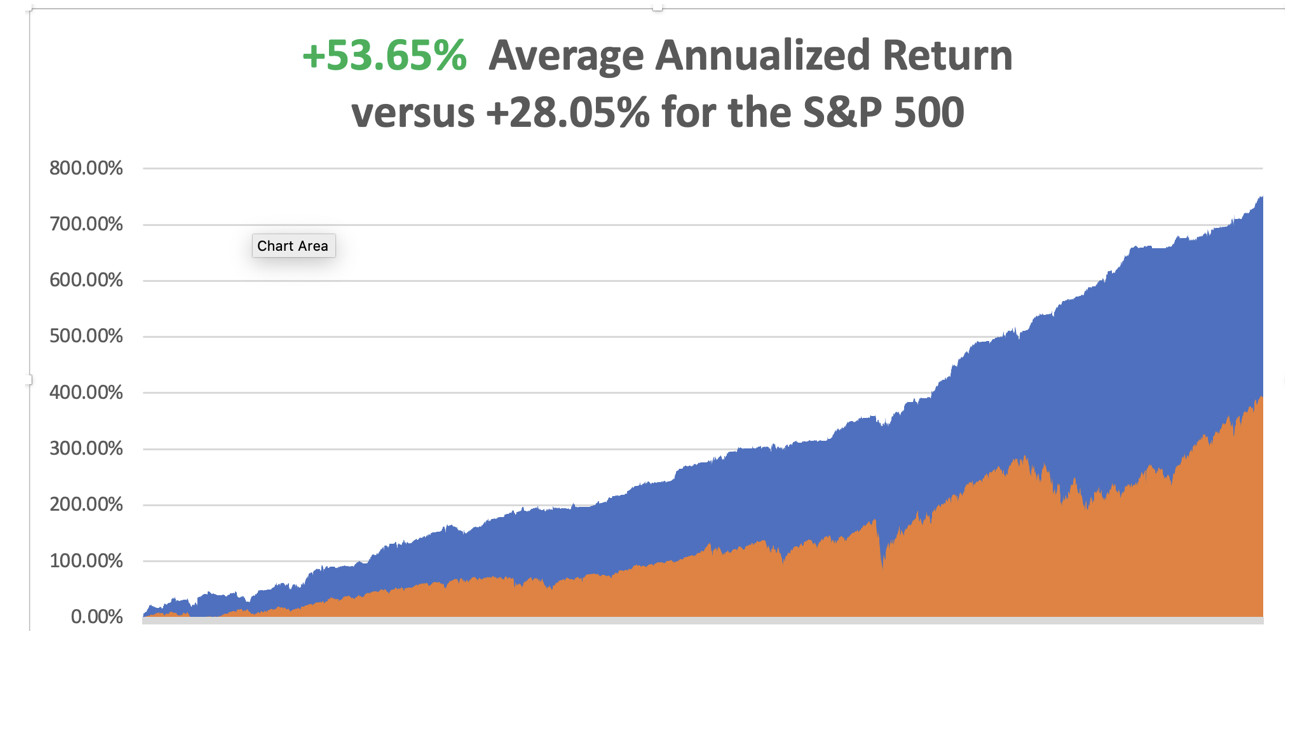

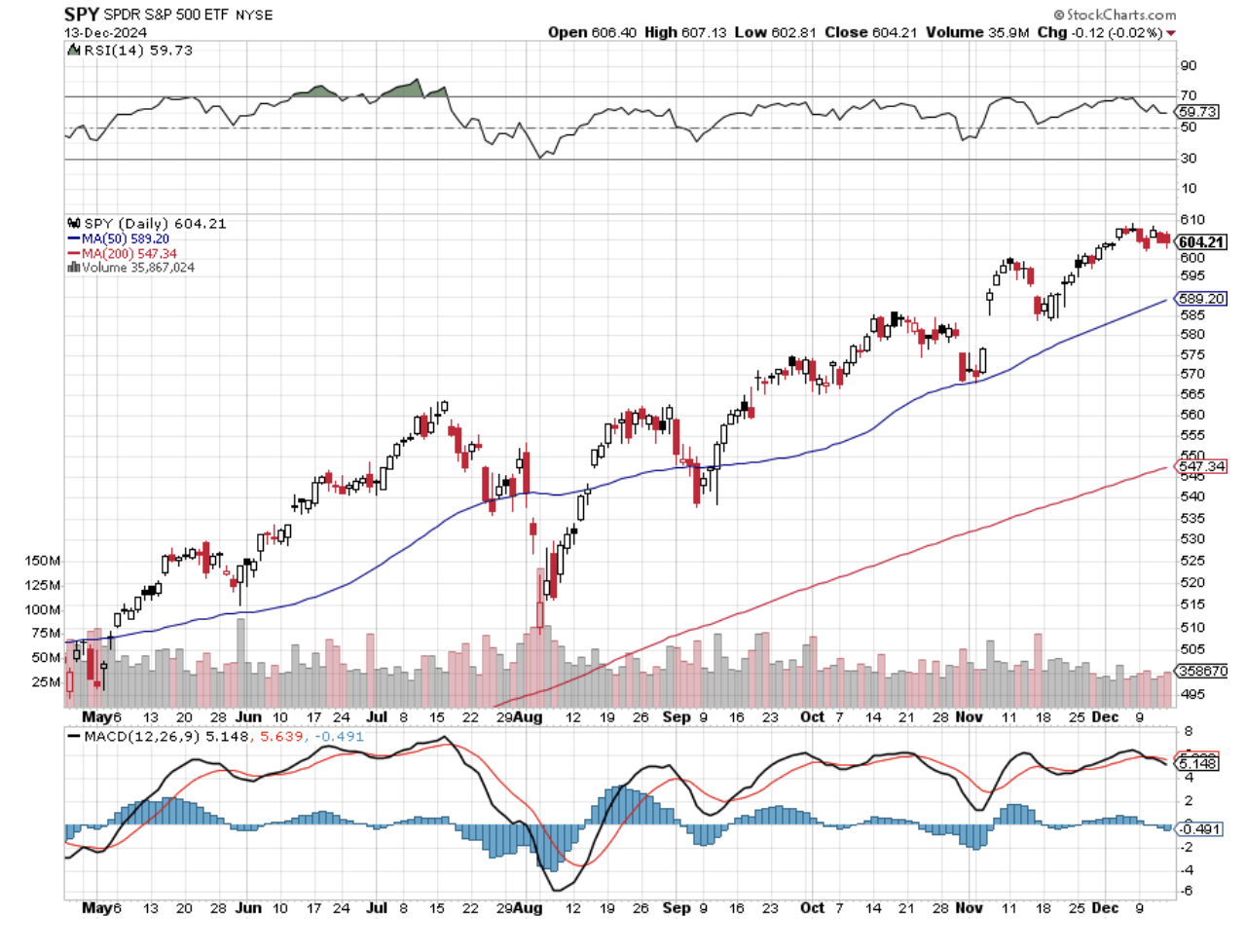

In December, we have gained +2.53%. My 2024 year-to-date performance is at an amazing +74.53%. The S&P 500 (SPY) is up +26.62% so far in 2024. My trailing one-year return reached a nosebleed +75.21%. That brings my 16-year total return to +751.16%. My average annualized return has recovered to an incredible +53.65%.

My bet that the market wouldn’t drop below pre-election levels proved wildly successful. As a result, all of my long positions will expire at max profit. They are anywhere from 7% to 70% in the money. That includes (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (BLK) and a triple long in (TSLA). My largest position was a triple weighting in Tesla, which went up the most. This is the first time I have been able to pull this off in the 16-year history of the Mad Hedge Fund Trader.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable so far in 2024, and several of those losses were really break evens. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

When we have to substantially downsize our expectations of equity returns in view of the election outcome, my new American Golden Age, or the next Roaring Twenties, is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow down. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, December 16, at 8:30 AM EST, the S&P Global Flash PMI is out.

On Tuesday, December 17 at 8:30 AM, the Retail Sales are published.

On Wednesday, December 18, at 8:30 AM, the Building Permits are printed.

On Thursday, December 19 at 8:30 AM, the US GDP Growth Rate is announced.

On Friday, December 20, Core PCE is printed. It is effectively the last trading day of the year as the BSDs take off on vacation, and the “B” team sticks around to handle the low-volume holiday trading. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, in the seventies, Air America was not too choosy about who flew their airplanes at the end of the Vietnam War. If you were willing to get behind the stick and didn’t ask too many questions, you were hired.

They didn’t bother with niceties like pilot licenses, medicals, passports, or even real names. On some of their missions, the survival rate was less than 50%, and there was no retirement plan. The only way to ignore the ratatatat of bullets stitching your aluminum airframe was to turn the volume up on your headphones.

Felix (no last name) taught me to fly straight and level so he could find out where we were on the map. We went out and got drunk on cheap Mekong Whiskey after every mission just to settle our nerves. I still remember the hangovers.

When I moved to London to set up Morgan Stanley’s international trading desk in the eighties, the English had other ideas about who was allowed to fly airplanes. Julie Fisher at the London School of Flying got me my basic British pilot’s license.

If my radio went out, I learned to land by flare gun and navigate by sextant. She also taught me to land at night on a grass field guided by a single red-lensed flashlight. For fun, we used to fly across the channel and land at Le Touquet, taxiing over the rails for the old V-1 launching pads.

A retired Battle of Britain Spitfire pilot named Captain John Schooling taught me advanced flying techniques and aerobatics in an old 1949 RAF Chipmunk. I learned barrel rolls, loops, chandelles, whip stalls, wingovers, and Immelmann turns, everything a WWII fighter pilot needed to know.

John was a famed RAF fighter ace. Once, he got shot down by a Messerschmitt 109, parachuted to safety, took a taxi back to his field, jumped into his friend’s Spit, and shot down another German. Every lesson ended with a pint of beer at the pub at the end of the runway. John paid me the ultimate compliment, calling me “a natural stick and rudder man,” no pun intended.

John believed in tirelessly practicing engine off-landings. His favorite trick was to reach down and shut off the fuel, telling me that a Messerschmitt had just shot out my engine and to land the plane. When we got within 200 feet of a good landing, he turned the fuel back on, and the engine coughed back to life. We practiced this more than 200 times.

When I moved back to the US in the early nineties, it was time to go full instrument in order to get my commercial and military certifications. Emmy Michaelson nursed me through that ordeal. After 50 hours of flying blindfolded in a cockpit, you get very close with someone.

Then came flight test day. Emmy gave me the grim news that I had been assigned to “One Engine Larry,” the most notorious FAA examiner in Northern California. Like many military flight instructors, Larry believed that no one should be allowed to fly unless they were perfect.

We headed out to the Marin County coast in an old twin-engine Beechcraft Duchess, me under my hood. Suddenly, Larry shut the fuel off, told me my engines failed, and that I had to land the plane. I found a cow pasture aligned with the wind and made a perfect approach.

Then he asked, “How did you do that?” I told him. He said, “Do it again,” and I did. Then he ordered me back to base. He signed me off on my multi-engine and instrument ratings as soon as we landed without bothering with the rest of the test. Emmy was thrilled.

I now have to keep my many licenses valid by completing three takeoffs and landings every three months. I usually take my kids and make a day of it, letting them take turns flying the plane straight and level.

On my fourth landing, I warn my girls that I’m shutting the engine off at 2,000 feet. They cry, “No, Dad, don’t.” I do it anyway, coasting in bang on the numbers every time.

A lifetime of flight instruction teaches you not only how to fly but how to live as well. It makes you who you are. Thus, my insistence on absolute accuracy, precision, risk management, and probability analysis. I live my life by endless checklists, both short and long-term. I am the ultimate planner, and I have a never-ending obsession with the weather one week out.

It passes down to your kids as well.

Julie became one of the first female British Airways pilots, got married, and had kids. John passed on to his greater reward many years ago. There are no surviving Battle of Britain pilots left. The last one passed away this year. Emmy was an early female hire as a United pilot. She married another United pilot and was eventually promoted to full captain. I know because I ran into them in an elevator at San Francisco airport ten years ago, four captain’s bars adorning her uniform.

Flying is in my blood now, and I’ll keep flying for life. I can now fly anything anywhere and am the backup pilot on several WWII aircraft for air shows, including the B-17, B-24, and B-25 bombers, the P-51 Mustang fighter, and, of course, Supermarine Spitfires.

Captain John Schooling would be proud.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Captain John Schooling and His RAF 1949 Chipmunk

A Mitchell B-25 Bomber

A 1932 De Havilland Tiger Moth

Flying a P-51 Mustang

The Next Generation

A Supermarine Spitfire Mark IX