Global Market Comments

November 22, 2013

Fiat Lux

Featured Trade:

(TAKING PROFITS ON CITIGROUP),

(C), (XLF), (WFC), (MS), (GS), (JPM),

(WATCH OUT FOR THE JOBS TRAP),

(FDX), (UPS),

(WATCH THOSE MONETARY AGGREGATES)

Citigroup, Inc. (C)

Financial Select Sector SPDR (XLF)

Wells Fargo & Company (WFC)

Morgan Stanley (MS)

The Goldman Sachs Group, Inc. (GS)

JPMorgan Chase & Co. (JPM)

FedEx Corporation (FDX)

United Parcel Service, Inc. (UPS)

We are about to get some wild, seasonal gyrations to the jobs numbers, and I think you will be well advised to know about them in advance.

A large part of our economy is moving online more rapidly than most people and governments realize. According to ComScore, a marketing data research firm, online sales leapt by 15% to $35.3 billion during the last November-December holiday period, an all-time high.

I speak from a position of authority here as I happen to run one of the most successful financial sites on the Internet, which I kicked off four years ago with a $500 investment.

Much of this migration is being captured by FedEx and UPS, the nexus at which Internet commerce meets the real world. After all, virtual products require a real world delivery. This explains why the couriers are seeing a booming business in an otherwise flat economy. FedEx (FDX) hired 10,000 temporary workers to deal with the last Christmas surge in 2012, a gain of 18% over the same period the previous year. UPS added a stunning 55,000, a 10% increase.

Watch for the other shoe to drop. That will become apparent when that the newly hired become the newly fired, leading to a sudden and rapid deterioration of the jobs data. This could be the information the stock market and other risk assets need to put in a top for the year. The scary part is that this may happen sooner than you think.

Yup, I Just Got My Pink Slip Too

Yup, I Just Got My Pink Slip Too

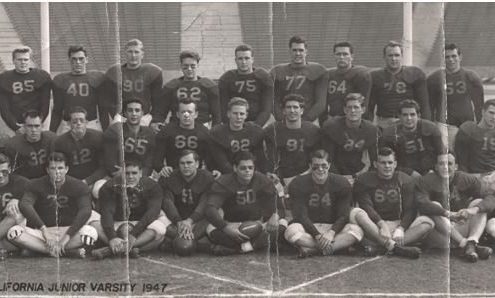

Call me a nerd, but instead of spending my Sundays watching football, I pour over data analyzing the monetary aggregates. That?s a tough thing to say for someone whose dad was a lineman on the University of Southern California?s legendary 1947 junior varsity football team.

This is so I can gain insights into the future performance of assets classes. What I am seeing these days is not just unusual, it?s bizarre. Call it a double reverse, a Hail Mary, and a Statue of Liberty all combined into one.

You can clearly see the impact of QE2 at the end of 2010 on the chart below, which caused the monetary base to explode and triggered a six month love fest for all risk assets. Hard asset prices, like energy, commodities, the grains, and precious metals did especially well, leading to fears of resurging inflation. This prompted the European Central Bank to commit a massive policy blunder by raising interest rates twice. The US dollar (UUP) was weak for much of this time.

When quantitative easing ended in June of that year, not only did the base stop growing, it started shrinking. Hard assets rolled over like the Bismarck, and gold peaked in August. No surprise that when you take away the fuel, the fire goes out. And guess what else happened? The dollar began an uptrend that continues unabated.

So what happens next? Given the continuing strength of the economic data, I think that the prospects of a taper have been greatly diminished. Not only has it been taken off the back burner, the flame has been extinguished and the pot put back into the cupboard.

Needless to say, if this trend continues it will have an inflationary impact on the global economy as a whole, and ?RISK ON? assets specifically. It?s simply a question of supply and demand. Print a lot more dollars and you create a supply shortage of other assets, forcing bidders to pay up.

Dad Was Always a Great Monetarist

Dad Was Always a Great Monetarist

Global Market Comments

November 21, 2013

Fiat Lux

Featured Trade:

(CASHING IN ON OBAMACARE),

(XLV), (GILD), (AET), (WPT),

(THE FLASH CRASH RISK IS RISING), (SPX), ($INDU),

(TESTIMONIAL)

Health Care Select Sector SPDR (XLV)

Gilead Sciences Inc. (GILD)

Aetna Inc. (AET)

World Point Terminals, LP (WPT)

S&P 500 Index (SPX)

Dow Jones Industrial Average ($INDU)

Those who lived through the cataclysmic ?flash crash? that occurred precisely at 2:45 pm EST on May 6, 2010, have been dreading a replay ever since. Their worst nightmares may soon be realized.

That is when the Dow Index (INDU) dropped a gob smacking 650 points in minutes, wiping out nearly $1 trillion in market capitalization. On that day, some ETF?s saw intraday declines of an eye popping 75% before recovering. A flurry of litigation ensued where many sought to break trades as much as 99% down from the last indication, some successfully.

The true reasons for the crash are still a matter of contentious debate. Many see a smoking gun in the hands of the high frequency traders who account for so much of the daily trading volume. But I happen to know that many of these guys pulled the plugs on their machines and went flat as soon as the big move started.

I think that it was the obvious result of too many people following similar models in markets with declining liquidity. The ease of instant execution through the Internet was another contributing factor. It also could be a symptom of no growth economies and lost decades in the stock market. The increasing short-term orientation of many money managers also played a hand.

Mathematicians who follow chaos theory and ?long tail events? known as ?black swans? argue that the flash crash was not only inevitable, it was predictable. They are also saying that the next one could be far worse.

Since then we have suffered several mini flash crashes. These include the recent $200 collapse in gold, a $5 plunge in silver, a five-cent gyration in the Euro, and a ten-cent gap in the Swiss franc. Notice that these ?flash? events only happen on the downside, and that we don?t have flash melt ups.

In many respects, traders and portfolio managers dodged a bullet on that fateful day. What if it had happened going into the close? Then assets would have been marked to market less $1 trillion, and the Asian openings that followed hours later would have been horrific. This could have triggered a series of rolling flash crashes around the world from time zone to time zone that would have caused several trillion more in losses. Those losses eventually did happen, but they were spread over several more months at a liquidation rate that could be absorbed by the markets.

Regulators claim that they have reduced the risks of a flash crash through the enforcement of daily trading limits across a broader range of financial instruments. I am not so sure. During a real panic, preventing people from unloading risk is almost an impossible feat. I know because I have lived through many of them.

In the meantime, the S&P 500 continues its inexorable rise well above the exact point at which the last flash crash started, at 1,160. We are now 55% above that last flash point. Avoid, like the plague, shorting leveraged naked puts on anything. It is the best way to wipe out your entire equity that I know of.

Like me, you are probably too old to start life over again with a job at McDonald?s, and they probably would take you anyway.

I sit here painfully typing this letter, as my fingertips have been worn down to bloody stumps. I have been pounding out the Trade Alerts since the month started, sending out 37, and the month is only half over. That works out to a 3.3636 Trade Alerts a day!

I have been so busy that I literally haven?t had time to eat, living entirely on black coffee, and losing three pounds since November 1. Maybe I should go into the weight loss business. I hear it?s more profitable than this financial stuff.

Not only have I worked myself to the bone, my staff is rapidly wearing out as well. Everyone is taking a well-earned rest this weekend, melting a few ice cubes along the way.

Still, you don?t get market melt ups like this very often in life. You have to strike while the iron is hot, make hay while the sun shines, and carpe diem. Usually I warn investors that if they ?invest in haste, they will repent at leisure.? In this market it?s the opposite. Invest at leisure, repent with haste.

Still, it?s all worth it when it?s working. Including both open and closed trades, the last 18 consecutive Trade Alerts have been profitable. I am rapidly closing in on an old record of 25 successful Trade Alerts, made earlier this year.

The Global Trading Dispatch service of the Mad Hedge Fund Trader is now up 56.4% in 2013. The November month to date record is now an enviable 11.92%.

The three-year return is an eye popping 111.43%, compared to a far more modest increase for the Dow Average during the same period of only 30%.

That brings my averaged annualized return up to 38.2%.

This has been the profit since my groundbreaking trade mentoring service was launched 35 months ago. These numbers place me at the absolute pinnacle of all hedge fund managers, where the year to date gains have been a far more pedestrian 3%. I predict the arrival of a lot more job seekers on Craig?s List in January.

I took profits on all of my extensive shorts in the Treasury bond market, taking advantage of the sudden back up in ten-year yields from 2.47% to 2.77%, the sharpest move of the year. I then reloaded on the first 9 basis point back up in yields

I then bet that the stock market would continue another tedious sideways correction going into the Thanksgiving holidays. I bought an in the money put spread on the S&P 500, and then bracketed the index through buying an in the money call spread. Both of these expired profitably on Friday.

I then took advantage of the weakness to add another long in the Industrials ETF (XLI), a rifle short at one of the best performing sectors of the market. I piled on more shorts in the Japanese yen (FXY), (YCS), believing that the Bank of Japan will have to accelerate its monetary easing program to deal with an economic slowdown. I also caught the China recovery play by going long the Australian dollar (FXA).

This is how the pros do it, and you can too, if you wish.

Carving out the 2013 trades alone, 74 out of 89 have made money, a success rate of 83%. It is a track record that most big hedge funds would kill for.

My esteemed colleague, Mad Day Trader Jim Parker, has also been coining it. He caught a spike up in the volatility index (VIX) by both lapels. He also was a major player on the short side in bonds, to the delight of his many followers.

The coming winter promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere in 2014. The Trade Alerts should be coming hot and heavy. Please join me on the gravy train.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. Upgrade to Mad Hedge Fund Trader PRO and you will also receive Jim Parker?s Mad Day Trader service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Global Market Comments

November 20, 2013

Fiat Lux

Featured Trade:

(THE MARKET TAKES A BREAK),

(SPY), (IWM), (FXY), (AAPL), (C), (TLT),

(RINGING THE REGISTER WITH THE AUSSIE),

(FXA), (EWA), (FXI),

(THE MYSTERY OF THE BRASHER DOUBLOON)

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

CurrencyShares Japanese Yen Trust (FXY)

Apple Inc. (AAPL)

Citigroup, Inc. (C)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Australian Dollar Trust (FXA)

iShares MSCI Australia (EWA)

iShares China Large-Cap (FXI)

This is our 13th consecutive closing profitable position, and 19th consecutive profitable Trade Alert when you include our remaining open positions. I have only seven more winners to go before I break my old record of 25.

Since I strapped on this trade last week, the (FXA) has popped a full 1 ? points to the upside. It?s tough to say where these options are really trading, they are so illiquid and the spreads so wide. If you didn?t do the trade at all, just consider this part of your educational effort.

However, the Currency Shares Australian Dollar Trust December, 2013 $89-$91 bull call spread was marked at their maximum possible value of $2.00 by the market makers at last night?s close. So I am going to take the hint and close the position. At this price we have harvested 75% of the potential profit, and we still have a full month to run before the December 20 expiration.

Yes, I should have been more aggressive, moving the strikes closer to the money, farther out in expiration, and bigger in size. But it?s always easy to say that about your winners.

To close the position just put in a limit order for the entire spread at $1.95 and wait for the market to come to you, even if it is for a few days. It is impressive how much they are crushing volatility in the options markets in the run up to the Thanksgiving holidays, so you should eventually get done.

Then you can plow the money back into other trades, such as buying global stocks and commodities, and shorting bonds and the yen. You can also buy back the Aussie on the next two-point dip.

I still believe that we are in bull mode for the Aussie longer term, and that we should make it above par, or $1.00, next year. The recent reforms announced by China (FXI) last week certainly remove any doubt about the northward direction.

It all provides fresh rocket fuel for the global synchronized recovery in 2014, which I have been predicting since the summer. A parallel pop in Australian stocks (EWA) confirms this view. So if you aren?t in the options and own the (FXA) outright, I?d hang in there.

The Aussie has been Hopping

The Aussie has been Hopping

Global Market Comments

November 19, 2013

Fiat Lux

Featured Trade:

(CHINESE REFORMS AND THE US STOCK MARKET),

(FXI), (CHL), (CYB),

(RUBBING SHOULDERS WITH THE ?1%? AT INCLINE VILLAGE)

iShares China Large-Cap (FXI)

China Mobile Limited (CHL)

WisdomTree Chinese Yuan (CYB)

If you really want to get a read on how ?the 1%? are faring these days, take a ski vacation to the tony hamlet of Incline Village on the pristine shores of Nevada?s Lake Tahoe.

Each morning, I trekked to Starbucks, one of the few local sources for the Wall Street Journal and the New York Times. There, trophy wives line up to buy their chai tea lattes, all tall, thin, and blonde, wearing designer sunglasses and snow boots, as if produced from a Gucci cookie cutter. The parking lot is jammed with Range Rovers and Cadillac Escalades.

Keeping up with the Jones?s here on fabled Lakeshore Drive can be quite a task, especially when they are populated by such names as Oracle?s Larry Ellison, casino mogul, Steve Wynn, and Saudi arms dealer, Adnan Kashoggi. Ellison alone is thought to have poured $200 million into his mountain retreat. Some of these compounds offer private beach lodgings for bodyguards and dog groomers. Junk bond king, Michael Milken, springs for the cost of the town?s annual Fourth of July fireworks display as it coincides with his birthday.

In the ultimate feat of hubris one upsmanship, one billionaire is converting the profits from his check cashing business to build a $150 million, 36,000 square foot residence that looks like a convention center. He has ruffled the feathers of locals by chopping down every ancient pine and cedar tree on the property to max out the square footage, violating multiple town ordinances. Who knew that cashing checks was so profitable?

In fact, lakefront Incline boasts one of the few neighborhoods in the US that has held up reasonably well during the real estate crash, with six properties changing hands at $1,000 a square foot in the last year. I guess they?re just not making beachfront property any more. Current listings include a 3 bedroom, 2 bath bungalow for $49.9 million and an 8,694 square foot palace for $43 million. If you are looking for a real bargain, check out the five bedroom French castle for $22.85 million. As with the large diamond shortage I have written about previously, this is further evidence that the rich are getting richer at an accelerating rate.

The land here was originally owned by one of the Comstock silver barons of the 1860?s. You may recall it as the location of the TV series ?Bonanza? and I?m sure that every female reader will remember ?Little Joe?. A development company subdivided the land during the 1950?s with the intention of creating a Palm Springs in the mountains, spurred on by the completion of Interstate 80 as part of the infrastructure demanded by the 1960 winter Olympics at nearby Squaw Valley.

Devoid by edict of the down market fast food chains that afflict most of America, Incline boasts two municipal golf courses, where at 6,300 feet, the air is so thin that your drive travels an extra 50 yards. If you want a Big Mac, you have to travel down the road to California-- if the road isn't blocked by snow.

Incline is also a Mecca for libertarian millionaires drawn by the absence of a state income tax. Unfortunately, they also possessed the financial sophistication to buy gorgeous mountainside homes, extract cash-out refi's all the way up, invest the proceeds in the stock market, and lose it all in the subsequent crash.

The result has been a meltdown of Biblical proportions in the housing market. Of the 8,000 homes in the village, 400 are for sale. At its worst brokers reported a brisk business in bank owned short sales, foreclosures, and sales on the Washoe County Court House steps for homes worth less than $800,000 at prices down 60%-70% from the 2006 peak.

The middle market, where homes are priced from $1 million to $4 million, is still languishing. Only cold, hard cash talks here. But high net worth individuals hate tying up capital in an illiquid asset when more attractive options abound. Precious metal coins are especially popular in the Silver State.

I am sad to report that antidepressant addiction among realtors in Incline Village is at epidemic proportions, since they don?t have anything to sell to the 1%. Some of their properties have been on the market so long that snow drifts have collapsed balconies, the local wildlife have moved in, and prospective buyers are scared away by offensive odors. Break-ins by black bears have become a serious problem, leaving basketball-sized poops on the living room floor.

Abandoned homes see their pipes freeze and burst, causing irreparable damage. In Las Vegas, foreclosed homes can be easily spotted from the air by their dead lawns and green swimming pools. In Incline the 'tells' are the ten foot high mountains of frozen snow dumped there by snow plows, blocking entry. I guess all real estate markets really are local.

Owners used to be able to cover half their annual carrying costs by renting out their properties during Christmas and New Year's, and for a few weeks in the summer. Unfortunately, that market has collapsed also. There are not a lot of high rollers willing to fork out $10,000 a week for a vacation rental during our new era of humility and restraint.

If you are one of the 99%, I?d think again before buying a vacation home any time soon. The only consolation is that conditions are much worse in Las Vegas. The optimists believe that the market there has finally turned around. The pessimists can already be found at the bottom of the lake with the Godfather's Fredo Corleone, another former resident of Incline Village.