When I rode Amtrak?s California Zephyr service from Chicago to San Francisco last year, I passed countless trains heading west hauling hoppers full of coal for shipment to China. This year I took the same trip. The coal trains were gone. Instead I saw 100 car long tanker trains transporting crude oil from North Dakota south to the Gulf Coast. I thought, ?There?s got to be a trade here.? It turns out I was right.

Look at the share prices of the major listed railroads, and it is clear they have been chugging right along to produce one of the best performances of 2013. These include Union Pacific (UNP), CSX Corp (CSX), Norfolk Southern (NSC), and Canadian Pacific (CP). In the meantime, coal shares, like Arch Coal (ACI) have been one of the worst performing this year.

Those of a certain age, such as myself, remember railroads as one of the great black holes of American industry. During the sixties, they were constantly on strike, always late, and delivered terrible service. A friend of mine taking a passenger train from New Mexico to Los Angeles found his car abandoned on a siding for 24 hours, where he froze and starved until discovered.

New airlines and the trucking industry were eating their lunch. They also hemorrhaged money like crazy. The industry finally hit bottom in 1970, when the then dominant Penn Central Railroad went bankrupt, freight was spun off, and the government owned Amtrak passenger service was created out of the ashes. I know all of this because my late uncle was the treasurer of Penn Central.

Fast forward nearly half a century, and what you find is not your father?s railroad. While no one was looking, they quietly became one of the best run and most efficient industries in America. Unions were tamed, costs slashed, and roads were reorganized and consolidated.

The government provided a major assist with a sweeping deregulation. It became tremendously concentrated, with just four roads dominating the country, down from hundreds a century ago, giving you a great oligopoly play. The quality of management improved dramatically.

Then the business started to catch a few lucky breaks from globalization. The China boom that started in the nineties created enormous demand for shipment inland of manufactured goods from west coast ports. A huge trade also developed moving western coal back out to the Middle Kingdom, which now accounts for 70% of all traffic. The ?fracking? boom is having the same impact on the North/South oil by rail business.

All of this has ushered in a second ?golden age? for the railroad industry. This year, the industry is expected to pour $14 billion into new capital investment. The US Department of Transportation expects gross revenues to rise by 50% to $27.5 billion by 2040. The net of all of this is that freight rates are rising right when costs are falling, sending railroad profitability through the roof.

Union Pacific is investing a breathtaking $3.6 billion to build a gigantic transnational freight terminal in Santa Teresa, NM. It is also spending $500 million building a new bridge across the Mississippi River at Canton, Iowa. Lines everywhere are getting double tracked or upgraded. Mountain tunnels are getting rebored to accommodate double-stacked sea containers.

Indeed, the lines have become so efficient, that overnight couriers, like FedEx (FDX) and UPS (UPS), are diverting a growing share of their own traffic. Their on time record is better than that of competing truckers, who face delays from traffic jams and crumbling roads, and are still hobbled by antiquated regulation.

I have some firsthand knowledge of this expansion. Every October 1, I volunteer as a docent at the Truckee, California Historical Society on the anniversary of the fateful day in 1846 when the ill-fated Donner Party was snowed in. There, I guide groups of tourists over the same pass my ancestors crossed during the 1849 gold rush. The scars on enormous ancient pines made by passing wagon wheels are still visible.

During 1866-1869, thousands of Chinese laborers blasted a tunnel through a mile of solid granite to complete the Transcontinental Railroad. I can guide my guests through that tunnel today with flashlights because (UNP) moved the line to a new tunnel a mile south to improve the grade. The ceiling is still covered with soot from the old wood and coal-fired engines.

While the rebirth of this industry has been impressive, conditions look like they will get better still. Massive international investment in Mexico (low end manufacturing) and Canada (natural resources) promise to boost rail traffic with the US.

The rapidly accelerating ?onshoring? trend, whereby American companies relocate manufacturing facilities from overseas back home, creates new rail traffic as well. It turns out that factories that produce the biggest and heaviest products are coming home first, all great cargo for railroads.

And who knew? Railroads are also a ?green? play. As Burlington Northern Railroad owner, Warren Buffett, never tires of pointing out, it requires only one gallon of diesel fuel to move a ton of freight 500 miles. That makes it four times more energy efficient than competing trucks.

In fact, many companies are now looking to railroads to reduce their overall carbon footprints. Warren doesn?t need any convincing himself. The $34 billion he invested in the Burlington Northern Railroad two years ago has probably doubled in value since then.

You have probably all figured out by now that I am a serious train nut, beyond the industry?s investment possibilities. My past letters have chronicled adventures riding the Orient Express from London to Venice, and Amtrak from New York to San Francisco. I even once considered buying my own steam railroad; the fabled ?Skunk? train in Mendocino, California, until I figured out that it was a bottomless money pit. Some 50 years of deferred maintenance is not a pretty sight.

It gets worse. Union Pacific still maintains in running condition some of the largest steam engines every built, for historical and public relations purposes. One, the ?Old 844? once steamed its way over the High Sierras to San Francisco on a nostalgia tour. The 120-ton behemoth was built during WWII to haul heavy loads of steel, ammunition, and armaments to California ports to fight the war against Japan. The 4-8-4-class engine could pull 26 passenger cars at 100 mph.

When the engine passed, I felt the blast of heat of the boiler singe my face. No wonder people love these things! To watch the video, please click here and hit the ?PLAY? arrow in the lower left hand corner. Please excuse the shaky picture. I shot this with one hand, while using my other hand to restrain my over excited kids from running on to the tracks to touch the laboring beast.

Global Market Comments

July 18, 2013

Fiat Lux

Featured Trade:

(AUGUST 9 ZERMATT, SWITZERLAND STRATEGY SEMINAR),

(MONEY DOWN THE DRAIN),

(MID ATLANTIC THOUGHTS ABOARD THE QUEEN MARY 2, PART II)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, August 9, 2012. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but happy.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $189, down from last year, thanks to the dramatic and welcome, as well as predicted depreciation of the Swiss franc against the US dollar.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the Strategy Seminar, please go to my online store.

Who was the top paid state employee in California last year? The governor? The Chief Justice of the Supreme Court? How about the leader of the Senate?

Nope. It was a prison psychiatrist who took home an eye popping $838,706, most of it in overtime. I love it! The state drives people insane by sending them to jail, then tries to cure them with triple overtime. It is a wealth destruction mechanism that only a government could come up with.

These are among the revelations uncovered when state controller, John Chang, listed the salaries of all 256,222 state workers on a government website. Only the names were missing. In fact, over 500 state workers earned more than $250,000 a year, vastly more than they could take in with private sector jobs. At least nine made more than $500,000, the top ten taking in $5.8 million.

The data was made public after a huge outcry that followed the disclosure of the salaries of town officials in the small Los Angeles municipality, Bell, which topped $700,000. Those generous paydays resulted in criminal prosecutions. Maybe prosecutors should be casting a wider net?

Thanks, Sacramento!

Global Market Comments

July 17, 2013

Fiat Lux

Featured Trade:

(AUGUST 1 MYKONOS, GREECE STRATEGY LUNCHEON),

(EXPLORING MY NEW YORK ROOTS),

(MID ATLANTIC THOUGHTS ABOARD THE QUEEN MARY 2, PART 1)

Come join John Thomas for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting on the Greek island of Mykonos in the Aegean Sea on Thursday, August 1, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $259.

The lunch will be held at major resort hotel on the south shore of the island, which can be found by steering a course of 120 degrees 99 nautical miles from the port of Piraeus. Just make sure you don't run aground on the island of Andros on the way, as the tides can be treacherous. The pirates on Mykonos have already been dealt with. Moorings can be made available for private visiting yachts offshore. I will email more details with your purchase confirmation.

Bring your broad brimmed hat, sunglasses, and plenty of SPF 50 suntan lotion. You will need them. The Greek islands are cooking hot this time of the year. The dress is casual. Those not wishing to view the clothing optional beach can have a chair with its back to the sea. Accompanying spouses and significant others will be free to bill drinks to my personal account as my guest. Together we will plot the future of western civilization.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

July 16, 2013

Fiat Lux

Featured Trade:

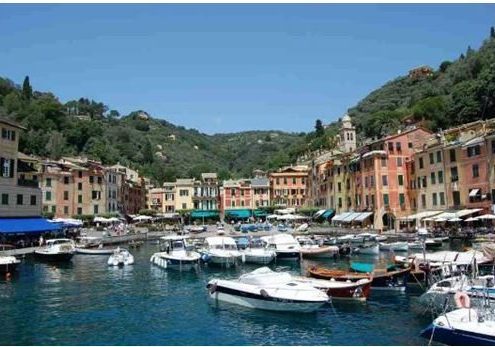

(JULY 25 PORTOFINO, ITALY STRATEGY LUNCHEON),

(KNOWING THE PRICE OF EVERYTHING AND THE VALUE OF NOTHING),

(DINNER WITH NOBEL PRIZE WINNER PAUL KRUGMAN)

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting near Portofino, Italy on the Italian Riviera, on Thursday, July 25, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $205.

The lunch will be held at major hotel on the beach in the village of Santa Margherita Ligure, the details of which will be emailed with your purchase confirmation. The town is easily accessible by train from Genoa, and the hotel is about a ten-minute walk from the train station.

Bring your broad brimmed hat, sunglasses, and suntan lotion. You will need them. The dress is casual. Accompanying spouses will be free to use the beach below and bill drinks to the luncheon. Together we will plot the future of western civilization.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

As a fanatical follower of the price of everything, I have long been an avid viewer of the television program, Antiques Roadshow, for 14 years, and the English version of the show well before that. This is where you learn what stuff like ?majolica? is. Many aspiring collectors come into the open appraisal events hoping they have inherited something of untold value from their late Aunt Gertrude.

The show has had its ups and down, and was once ensnared in a scandal where appraisers deliberately overvalued objects to boost television ratings. But some of the stories that come with these objects are amazing, and their educational value can?t be underestimated. Once, they really did discover an original seal of the United States, missing since the British burned Washington DC in 1814, which someone had bought at a Paris flee market for $20.

The knowledge that I gained over the years has allowed me to swoop in and pick up incredible bargains, everywhere from Sotheby?s auctions to local garage sales.

Some of my better deals have included buying a pair of prewar German Zeiss binoculars for $10 (I recently saw an identical pair inside U-505 at the Museum of Science and Industry in Chicago). I also managed to score three cases of 1909 and 1915 Massandra port and sherry, last own by Czar Nicholas II of Russia, for $25 a bottle. Current market price: $1,000. The taste is amazing.

So it was with some amusement that I noticed yesterday that the show recently made its greatest find in history. A man in Tulsa, Oklahoma appeared with five tea cups that he had purchased at a local antique store in the seventies for a couple of bucks. The Chinese antiquities expert was aghast, informing the surprised owner that these dated from the 17th century, were made from extremely rare rhinoceros horn, and were estimate to worth $1-$1.5 million.

It turns out that the previous record for an object was also Chinese, some? $1 million for some carved jade bowls. It has long been a rule of thumb that when a country sees of burst of strong economic growth, its antiques rise in value. I saw this happen to Japanese screens, swords, and woodblock prints in the seventies and eighties during their economic boom, and it is happening now with Islamic antiquities, thanks to the high price of oil.

In the meantime, I will continue to visit the local garage sales with a sharp eye. I wonder about that copy of the Declaration of Independence I have lining an attic drawer upstairs. Could it be the real thing?

How about $300,000 Each?

The first thing I noticed when Paul walked in was the few extra pounds and silvery tinge to his hair he acquired since I saw him last. He?s clearly spending too much time behind a computer writing those acidic columns for the New York Times. We?re all short dated options in the end, I thought.

We met at my favorite San Francisco restaurant, Gary Danko?s (click here for their site at http://www.garydanko.com/), where one can get a once in a lifetime, bucket list type meal for about $300 for two, but only if you get the cheaper wine. Ideally located near Fisherman?s Wharf, they are one of only a tiny handful of Bay area restaurants to boast a coveted Michelin star. Good luck getting a reservation if you?re not having dinner with Bill Clinton.

Paul went for the lobster salad with hearts of palm and the soft shell crab with bacon. I settled for the Dungeness crab salad with quinoa and quail stuffed with foie gras. We washed it down with an excellent 2008 Duckhorn cabernet called ?The Discussion?. I kidded him about recent articles in the press that described him as the ?Mick Jagger of economics?.

These days, Paul is not about pulling any punches. He argued that the US is really in another Great Depression that started in 2007. Only narrow segments of the economy are doing well, like the fracking driven boom in the Dakotas, which has a population smaller than Brooklyn.

In terms of chronic unemployment, human suffering, and hopelessness, this Depression is every bit as soul crushing as the one the country experienced during the 1930?s. Long term unemployment over 4 million is unprecedented in the postwar period. The jobless rate of recent college grads is even worse.

The only thing preventing Depression era breadlines and soup kitchens is the Food Stamp program that is feeding 45 million people, including many active duty military. The original Great Depression lasted ten years and included two mini recoveries like the one we just saw. The current one will last just as long if we continue the current policies.

The great misconception is that these problems are long term and structural. Adopt the right policies, and the economy would rebound ?faster than you can possibly imagine?. Vicious austerity at the state and local level is the main culprit, squeezing the life out of the economy and cancelling out any stimulus efforts by the federal government.

Austerity is not the answer. It doesn?t work when everyone is trying to reduce their debt at the same time. One man?s debt is another?s income. It?s all about the teachers. The Great Recession has prompted the firing of 1.2 million and prevented the hiring of another 800,000. Hire 2 million teachers, and the unemployment rate drops from 8.1% to 6.5%, and the consumer spending and the multiplier effects they bring with them will return the economy from a 2% to a more normal and sustainable 3% growth rate.

The answer is to spend more money, and a lot of it. If you need proof before proceeding, look no further than the 1939-41 period. Then it was massive government spending in the buildup to WWII that caused the unemployment rate to plummet from 20% to near zero.

If Paul were king of the world, he would immediately allocate $300 billion to the states to rehire teachers, and maintain the infusion annually until we are out of the crisis. The one time only injection we saw in 2009 was inadequate. He would change FHA rules to allow underwater homeowners to refinance at current rock bottom interest rates. That will keep their homes off the market and allow some recovery there, one of the largest sectors of the economy. He would keep monetary policy easy. A modest level of subsidies for alternative energy so we can quit financing sellers of oil in the Middle East who are trying to kill us is also justified.

The origins of the current malaise aren?t hard to fathom and are an exact repetition of what occurred in the 1920?s. A long period of complacency led to a relaxed attitude towards debt and risk. The flames were fanned by deregulation. Gatekeepers of the public interest were lavishly paid to look the other way. Then the Wiley E. Coyote moment came when he only plummets after looking down, that particular physics unique to cartoon characters.

Today, the waters are being deliberately muddied by a dozen billionaires funding hundreds of PAC?s and countless bogus research institutes. Their sole interest is to minimize their own tax bills, at whatever cost.

Krugman spits out ideas with machine gun rapidity and is a gold mine of insightful economic data. Eye opening observations are regularly interlaced with biting humor. I?m sure that in a past life he was a standup comedian, or in vaudeville.

I only touched on Europe with him, as my own predictions there have already come true. He said that the US and Europe are in a contest to see who has the worst managed economy, and that right now, Europe is winning. He observed that maintaining a single currency without a single government is untenable. It doesn?t help that in the German language the same word is used for debt and guilt. A work out will take years, if not decades.

Paul used to work for Fed Chairman Ben Bernanke as a Princeton economics professor before Ben was demoted to the job of saving the world. When he recently met him he handed him a well-known academic paper written in the 1990?s on the monetary policy mistakes that led to the post bubble collapse of the Japanese economy, and admonished him for repeating the mistakes. The author of the paper? Ben Bernanke.

Krugman argued that the tax system was long overdue for a major overhaul, which now has the lowest tax burden of any developed country in terms of GDP. He said the maximum rate should rise from the current 43%, including state and local taxes, to 70%, possibly for earners over $1 million.

That is still well below the 90% peak rates during the Roosevelt era. Money is concentrating at the top at an unprecedented rate and stagnating in the bond market instead of being invested to create jobs. As for health care, we may have to implement a European style VAT tax to pay for it, however regressive that may be.

I asked, with the national debt now over 100% of GDP, how much more could the US borrow without crashing the bond market, he answered ?a lot more.? Japan is able to borrow 240% of GDP at only 0.9% interest rates with far worse fundamentals than our own. There is a global savings glut and bond shortage, and investors are crying out for a safe haven.

Runaway government borrowing is a problem, but not now. Falling bridges and failing infrastructure are causing much more long-term damage to the economy than additional debt. Kids today are infinitely more concerned about getting a job tomorrow than the amount of money the government will owe in 30 years.

Paul is a naturally shy fellow who avoids the limelight whenever possible. He once had a thin skin, but after the attacks from the right that erupted after he started writing for the New York Times, ?a rhinoceros has nothing on me?.

As divine as they are at Gary Danko?s, I skipped the desert, as I know I will be packing on the pounds during my upcoming cruise across the Atlantic on the Queen Mary 2. Paul went for the warm Louisiana butter cake with apples, huckleberry sauce and vanilla bean ice cream. Well, that explains the weight gain.

Before he left, Paul handed me an autographed copy of his latest book, End This Depression Now!, the second tome he penned since the 2008. There was one condition. I had to give him an autographed copy of my next book.

I pointed out that by grinding out 10,000 words a week with my blog, trade alerts, and webinars, I was effectively knocking out a new book every two months. That was no excuse he said, with the impatience of a university professor admonishing a grad student who was late with a dissertation. With that, he was out the door like a whirlwind.

I don?t get to meet with Nobel Prize winners very often, not more than once a month, so I thought I would give you the full blast. Believe it or not, I left out some of his more incendiary opinions. After all, this is a family oriented, PG website. So take from it what you may.

To buy Paul?s book at Amazon, End This Depression Now!, please click here.