Global Market Comments

September 24, 2013

Fiat Lux

Featured Trade:

(APPLE?S BLOWOUT NUMBERS SEND BEARS SCAMPERING),

(AAPL), (QCOM), (CHL), (SSNLF), (MSFT), (GOOG),

(EXPIRATION OF MY YEN BEAR PUT SPREAD),

(MY PERSONAL LEADING ECONOMIC INDICATOR),

(NOTICE TO MILITARY SUBSCRIBERS)

Apple Inc. (AAPL)

QUALCOMM Incorporated (QCOM)

China Mobile Limited (CHL)

Samsung Electronics Co. Ltd. (SSNLF)

Microsoft Corporation (MSFT)

Google Inc. (GOOG)

Add this one to the ?WIN? column.

I strapped on this position because I believed that the world was adding risk, expecting major bull moves, once it becomes clear that the multiple disasters now threatening the world don?t actually happen. The list includes war with Syria, the taper, the Bernanke replacement, the debt ceiling crisis, another sequester, yada, yada, yada.? A yen short is one of many ways to achieve this.

This is why US stocks refuse to sell off in any meaningful way. We are setting up for a great ?buy the rumor, sell the news? event. Remember when the first Gulf War started in 1991? Stocks drifted for six months in the run up, then soared once the bombs actually fell. We could be in for another one of those. That would take the yen and the euro to new lows for 2013.

Count on President Obama to draw out the Syria crisis for as long as possible. This gives the message of the coming military action the greatest political impact internationally. It also boosts his own political fortunes at home, leaving the Republicans drifting in the wind. Why be in a hurry to end it? They are now in the uncomfortable position of having to turn pacifist, after supporting Middle Eastern wars with a blank check for the last 11 years.

All of this worked out exactly as expected for our yen short, which is why it expired on Friday at its maximum value. The expiration print of $98.35 cleared our nearest strike of $103 by miles. This added a welcome $1,330 in profits to our $100,000 model trading portfolio for 2013.

On to the next one.

Kaching!

Kaching!

One of the joys of having small children is that you get to know the guy at the local plumbing supply shop really well. It?s amazing what will fit down a toilet these days.

He once told me that when Troll Dolls hit the market, every plumber in the country was guaranteed a job for life. When I went there yesterday I thought I?d pick up some leading economic indicators as well. After a deadly year, business is picking up a bit. Sure, it is still down from the onset of the Great Recession five years ago, but there is a definite improvement going on.

This was the Eureka moment! His comments confirm the sort of modest recovery I have been expecting. We aren?t going to zero anymore, but it is not exactly off to the races either. Throughout the nineties, a salesman at Circuit City (RIP) walked me through every generation of technology, and he was worth his weight in gold. All I had to do was buy a new TV from him every year, and they kept getting bigger and more expensive. I bought the second high definition TV sold in California, after George Lucas, who I used to run into at the local IHOP having breakfast with an aspiring young starlet. It was his casting couch.

Sometimes figuring out the direction of the economy is as simple as going down to the local butcher, baker, or candlestick maker and asking. They are on the front lines of economic activity, and they will see any changes months before those of us glued to computer screens. Make it your own unfair advantage, your own heads up in the marketplace. Just keep your eyes open and observe.

Asking George Lucas also helps.

A Troll Doll

A Troll Doll

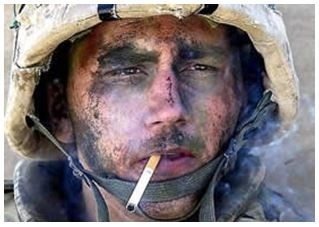

To the dozens of subscribers in Iraq, Afghanistan, and the surrounding ships at sea, thank you for your service! I think it is very wise to use your free time to read my letter and learn about financial markets in preparation for an entry into the financial services when you cash out. Nobody is going to call you a baby killer and shun you, as they did when I returned from Southeast Asia four decades ago.

I have but one request. No more subscriptions with .mil addresses, please. The Defense Department, the CIA, the NSA, Homeland Security, and the FBI do not look kindly on newsletters entering the military network, even the investment kind. If you think civilian spam filters are tough, watch out for the military kind! And no, I promise that there are no coded secret messages embedded with the stock tips. ?BUY? really does mean ?BUY.?

If I did not know the higher ups at these agencies, as well as the Joint Chiefs of Staff, I might be bouncing off the walls in a cell at Guantanamo by now. It also helps that many of the mid-level officers at these organizations have made a fortune with their meager government retirement funds following my advice. All I can say is that if the Baghdad Stock Exchange ever become liquid, I?m going to own it.

Where would you guess the greatest concentration of readers The Diary of a Mad Hedge Fund Trader is found? New York? Nope. London? Wrong. Chicago? Not even close. Try a ten-mile radius centered on Langley, Virginia, by a large margin. The funny thing is, half of the subscribing names coming in are Russian. I haven?t quite figured that one out yet.

So keep up the good work, and fight the good fight. But please, only subscribe to my letter with personal Gmail, Hotmail or Yahoo addresses, or with your spouse?s address. That way my life can become a lot more boring. Oh, and by the way, Langley, you?re behind on your bill. Please pay up, pronto, and I don?t want to hear whining about any damn budget cuts!

I Want My Mad Hedge Fund Trader!

I Want My Mad Hedge Fund Trader!

Global Market Comments

September 23, 2013

Fiat Lux

Featured Trade:

(NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON),

(TAKE A LOOK AT OCCIDENTAL PETROLEUM),

(OXY), ($WTIC), (USO),

(TESTIMONIAL)

Occidental Petroleum Corporation (OXY)

Light Crude Oil ($WTIC)

United States Oil (USO)

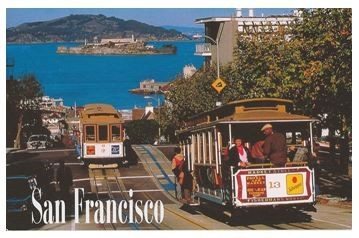

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $191.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

I have kept oil companies in my long term model portfolio for many years now. But there are a lot of belles at the ball, but you can?t dance with all of them.

While a student at UCLA in the early seventies, I took a World Politics class, which required me to pick a country, analyze its economy, and make recommendations for its economic development. I chose Algeria, a country where I had spent the summer of 1968 caravanning among the Bedouins, fighting rebels and bandits, crawling out of the desert starved, lice ridden, and half dead.

I concluded in my paper that the North African country should immediately nationalize the oil industry, and raise prices from $3/barrel to $10 (USO).? I knew that Los Angeles based Occidental Petroleum (OXY) was interested in exploring for oil there, so I sent my paper to the company for review. They called the next day and invited me to their imposing downtown headquarters, then the tallest building in Los Angeles.

I was ushered into the office of Dr. Armand Hammer, one of the great independent oil moguls of the day, a larger than life figure who owned a spectacular impressionist art collection, and who confidently displayed a priceless Faberg? egg on his desk.

He said he was impressed with my paper, and then spent two hours grilling me. Why should oil prices go up? Who did I know there? What did I see? What was the state of their infrastructure? Roads? Bridges? Rail lines? Did I see any oil derricks? Did I see any Russians?

I told him everything I knew, including the two weeks spent in an Algiers jail for taking pictures in the wrong places. His parting words were to never take my eye off the oil industry, as it is the driver of everything else. I have followed that advice ever since.

When I went back to UCLA, I told a CIA friend of mine that I had just spent the afternoon with the eminent doctor (Marsha, call me!). She told me that he had been a close advisor of Vladimir Lenin after the Russian Revolution, had been a double agent for the Soviets ever since, that the FBI had known this all along, and was currently funneling illegal campaign donations to President Richard Nixon. Shocked, I kicked myself for going into an interview so ill prepared, and had missed a golden opportunity to ask some great questions. I never made that mistake again.

Some 40 years later, while trolling the markets for great buying opportunities, I stumbled across (OXY) once more (click here for their). (OXY) has a minimal offshore presence, nothing in deep water, and huge operations in the Middle East and South America. It was the first US oil company to go back into Libya when the sanctions were lifted in 2005.

(OXY?s) substantial California production is expected to leap to 45% to 200,000 barrels a day over the next four years. Its horizontal multistage fracturing technology will enable it to dominate California shale. It has raised its dividend for the eighth year in a row, to 2.90%, more than ten year Treasury bonds Need I say more?

The clear message that has come out of the BP oil spill is that onshore energy resources are now more valuable than offshore ones. A lead in fracking is a huge plus. I think (OXY) will continue to make money, no matter what the price of oil does. That?s why it lives in my long-term model portfolio.

Oh, and I got an A+ on the paper, and the following year Algeria raised the price of oil to $12.

Can You Spot the Double Agent?

A Faberge Egg

Global Market Comments

September 20, 2013

Fiat Lux

Featured Trade:

(SEPTEMBER 25 GLOBAL STRATEGY WEBINAR),

(REPORT FROM THE MATTERHORN SUMMIT)

From where I stand, the rolling foothills of Northern Italy spread out below me to the south. On my left lie the distinctive peaks of the Dolomite Alps. On my right I can see the massive expanse of Mont Blanc, at 15,781 feet the highest mountain in Europe. I am standing at the summit of the Matterhorn. Knock another item off the bucket list.

I have been trying to climb this mountain for 45 years. During my early attempts I possessed the physical conditioning, but not the money to acquire the necessary equipment needed to get to the top. An ice axe, crampons, helmet, and ropes don?t come cheap to a 16 year old. In later years, vile weather frustrated my every attempt. Now the forecast was perfect, and the sun, the moon, and the stars aligned.

The Matterhorn has long been the premier climbing challenge on the continent. My doctor in Zermatt heads up many rescues and tells me that a dozen people a year die trying. The year 1999 was especially bad, claiming 39 lives. Still, if death isn?t on the table, it?s not worth doing.

I spent a restless night sleeping under a heavy wool blanket in a shared bunk with a dozen other climbers at the 10,695 foot Hornli Hut. Get a group of guys like this together, and there is always one who snores.

At 3:00 AM we bolted out of bed to eat a hardy breakfast of eggs, cold cuts, and lots of strong coffee before launching an assault on the mountain. We then quietly filled canteens and donned climbing harnesses and backpacks. The night sky was crystal clear, an ocean of stars shimmering upon us, with the occasional shooting star giving its blessing.

I had spent the past week acclimatizing myself to the high altitude, completing practice climbs to the top of increasingly difficult surrounding peaks. I was joined by my Swiss guide, Christian, of the Zermatt Alpine Center. In his mid forties, chocolate tanned, with thighs like tree stumps, he had already climbed the Matterhorn an impressive 77 times.

We took off at a rapid pace, passing most of the early starters. Zermatt guides are notorious for speed climbing, the theory being that the quicker they wore out their clients, the sooner they could go home. I realized there was something far more responsible going on. Christian had to gain the confidence that I had enough energy reserves left for the descent, when 90% of all fatalities occur. At 11,800 feet he said ?Good,? and we roped up.

It was about this time that I started to wonder if I should really be here. Most of the climbers we were passing were in their twenties and a few in their thirties, young enough to be my grandchildren. After all, I?m the silver haired gentleman people give their seat up to when riding the San Francisco BART. At 12,200 feet Christian ordered, ?Now we put on our crampons.?

From there on we silently pushed our way upward in the darkness, headlamps illuminating the way, methodically positioning our feet to make the leap to the next boulder above. The mountain has been climbed for 148 years, and many of the surfaces have been polished smooth by boots to the point of becoming dangerously slippery. Much of the slope is frustratingly unstable. Half the rocks you reach for are loose. Stones sent flying by climbers above are a major risk, which is why we wear helmets.

By 5:00 AM we were at 12,700 feet and the sun started to rise. I took out my camera to take a picture, but fumbling with my climbing gloves, I dropped it. It smashed into a dozen pieces and then skittered down into the great Matterhorn crevasse below.

I still had my iPhone 5s to take pictures. But its touch screen required me to take my glove off. With the temperature at 10 degrees below freezing, photos were not worth risking fingers to frostbite. So you?ll just have to read about it.

During the first half of the 19th century, the Matterhorn was the Holy Grail among climbers, and was considered impossible to conquer. Englishman, Edward Whymper, finally led a seven-man team to the top in 1865. He pioneered the same Hornli Ridge route that I was ascending today. But on the way down a rope broke and four perished. One body was never found. Today, you can see the rope in a Zermatt museum, a crude manila affair, along with the clothes from another dead climber found months later.

Some 5,000 now attempt the climb every year, and about 500 make it to the summit. Ulrich Inderbinen made the top over 370 times, and last climbed it when he was 90. I was able to shake his hand at a picture signing in Zermatt a couple of years before he died from old age at 103 (click here for his obituary).

At 13,000 feet we approached the Mosley Slab, so named for an American who fell to his death here in 1879. Beyond beckoned the Solvay Hut, a tiny, precariously sited refuge from weather that suddenly turns bad. Taking a break I found, amazingly, that I still had cell phone reception. Should I send out a Trade Alert from 13,133 feet?

That was where I encountered my first zombie, a climber who grievously underestimated the mountain and had used up every ounce of energy to get this far. His guide was coaxing, shouting, and cajoling him to climb down one rock at a time.

Looking at his dead eyes, you know it was going to be a tough and dangerous descent. I later heard that the poor fellow, Japanese, fell and broke his leg and had to be helicoptered off. There were many more zombies to come.

Above Solvay, we encountered the ?fixed ropes,? which are actually steel cables bolted to the face to help traverse the steepest and most dangerous passages. Lose your grip here, and its 3,000 feet straight down.

This is where we ran into the traffic jam, with simultaneous ascending and descending climbers competing for the same handholds. One dummy actually abseiled down on top of me, nearly knocking me off of my grip. Here, falling climbers are a major danger.

At 300 feet below the summit I passed Sophie?s Ridge, so named for a young Italian woman who was turned back in the 1880?s because high winds were blowing up her Victorian ankle length dress. Now, altitude sickness was taking its toll, with many puking climbers turning back, the disappointment showing on their faces. Luckily, I felt fine.

Not far from there was the location of the original 1865 accident. We approached the small bronze statue of Saint Bernard, the patron saint of mountain climbers. Bolted to the side of the peak, it was covered with ropes, as many teams tie on to it to rappel down.

Then we were on top. The weather was glorious. The summit was graced with a wrought iron cross that one finds atop many Alpine peaks. There was an impatient line of climbers waiting their turn to tag the summit, take some quick pictures, and then start their way down. The feeling of accomplishment was immense.

We carefully picked our way down, rappelling down the steepest faces. By now the sun was well up, the ice was melting, freeing up infinitely more loose rubble. One boulder the size of a small car crashed down 50 feet away, making a thunderous roar. ?Yikes,? I thought, ?we better get out of here.?

At 13,000 feet, we encountered a team with one climber absolutely paralyzed with fear and refusing to budge. After some discussion, I agreed to let her rope up with us and escort her down to the Hornli hut. The other guide was Christian?s friend, and that would enable him to continue upward with his other clients. Our expedition turned into a mountain rescue.

Once Christian tied her in I had second thoughts about being so charitable. If she fell, she could take me with here. Christian then convinced me he could hold both of us with a belay. We then encouraged her down the mountain one step at a time. I went through my entire repertoire of German jokes, which is rather short.

I learned that she sold toilets on behalf of a Swiss plumbing company for a living, and that until today, had never dome anything more serious than a day hike out of Lausanne. All of her equipment was brand new. Part of the problem was that she had failed to don her crampons, which we found in her backpack, untouched in its original packaging.

Back at the Hornli Hut I was dog tired. Our impromptu guest suddenly fell to the ground and burst into tears. She then bought us both a celebratory liter of beer. I was dying of thirst, as I had done the entire climb on just two quarts of water to save weight.

It had been the hardest day of my life, and after 15 minutes at the table I couldn?t move. The $1,200 investment in Christian had been well spent. He departed for Zermatt to pick up his next client. I elected to spend a second night at Hornli and complete the 3,000 foot hike down to Schwarzee the next day. From there I was taking the gondola down. Nothing left to prove here. The second time, I slept like a rock.

It is traditional for successful climbers to pick up a stone at the summit and deposit it on a giant cairn at the beginning of the trail at 7,000 feet. Some of these weigh over 50 pounds, a macho display of strength and endurance. When I made my contribution, a small pebble the size of a quarter, I made sure no one was looking.

I now have an empty place on my bucket list. What will replace it? I hear that Africa?s 19,341 foot Mount Kilamanjaro is pretty easy.

Life is good.

Climbing One Step at a Time

Only 4,000 Feet to Go

Only 4,000 Feet to Go

Half Way, and All is Good

Half Way, and All is Good

The Traffic Jam

The Traffic Jam

The Summit

The Summit

A Mountain Rescue

A Mountain Rescue

Take That Item off the Bucket List

Take That Item off the Bucket List

Global Market Comments

September 19, 2013

Fiat Lux

Featured Trade:

(BEN GIVES GREEN LIGHT TO BULL MARKETS),

(SPY), (USO), (TLT), (FXE), (FXA),

(FXY), (FXB), (YCS), (GLD), (SLV),

(HOW TO AVOID PONZI SCHEMES),

(PLAY CHINA?S YUAN FROM THE LONG SIDE),

(CYB), ($SSEC), (EEM)

SPDR S&P 500 (SPY)

United States Oil (USO)

iShares Barclays 20+ Year Treas Bond (TLT)

CurrencyShares Euro Trust (FXE)

CurrencyShares Australian Dollar Trust (FXA)

CurrencyShares Japanese Yen Trust (FXY)

CurrencyShares British Pound Sterling Tr (FXB)

ProShares UltraShort Yen (YCS)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

WisdomTree Chinese Yuan (CYB)

Shanghai Stock Exchange Composite Index ($SSEC)

iShares MSCI Emerging Markets (EEM)