Global Market Comments

September 13, 2013

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS ANOTHER NEW ALL TIME HIGH),

(FXY), (YCS), (FCX), (AAPL), (FXA),

(LOADING UP ON AUSTRALIA),

(FXA), (EWA), ($SSEC), ($BDI),

(UPDATE ON FREEPORT MCMORAN) (FCX)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

Freeport-McMoRan Copper & Gold Inc. (FCX)

Apple Inc. (AAPL)

CurrencyShares Australian Dollar Trust (FXA)

iShares MSCI Australia Index (EWA)

Shanghai Stock Exchange Composite Index ($SSEC)

Baltic Dry Index ($BDI)

Those who bought my Trade Alert on the Freeport McMoRan (FCX) October $28-$30 bull call spread at $1.68 or best two days ago will be thrilled to see the charts below. They were prepared by my friends at Stockcharts.com, who offer a very reasonable subscription technical analysis product (click here for their site http://stockcharts.com ).

After testing $26 three times over the past two years, the stock has forged a major long term bottom that appears unassailable. This almost perfectly matches the chart for the Chinese stock market, which is demonstrating almost identical strength. Conclusion: higher prices for copper and the rest of the commodity space.

Just thought you?d like to know.

Global Market Comments

September 12, 2013

Fiat Lux

Featured Trade:

(BUY APPLE ON THE DIP), (AAPL), (CHL)

(PICKING UP FREEPORT MCMORAN),

(FCX), (CU), (ECH), ($SSEC)

Apple Inc. (AAPL)

China Mobile Limited (CHL)

Freeport-McMoRan Copper & Gold Inc. (FCX)

First Trust ISE Global Copper Index (CU)

iShares MSCI Chile Capped (ECH)

Shanghai Stock Exchange Composite Index $SSEC

Global Market Comments

September 11, 2013

Fiat Lux

Featured Trade:

(MY 2013 STOCK MARKET OUTLOOK),

(SPY), (IWM), (AAPL), (TLT)

SPDR S&P 500 (SPY)

iShares Russell 2000 Index (IWM)

Apple Inc. (AAPL)

iShares Barclays 20+ Year Treas Bond (TLT)

Global Market Comments

September 10, 2013

Fiat Lux

Featured Trade:

(NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON),

(BAILING ON MY OIL SHORT), (USO),

(QUANTITATIVE EASING EXPLAINED TO A 12 YEAR OLD),

(TESTIMONIAL)

United States Oil (USO)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $191.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

September 9, 2013

Fiat Lux

Featured Trade:

(JOIN THE INVEST LIKE A MONSTER SAN FRANCISCO TRADING CONFERENCE)

(SEPTEMBER 11 GLOBAL STRATEGY WEBINAR),

(THE EMERGING ?BUY? ON EMERGING MARKETS),

(EWW), (EZA), (IDX), (THD), (EWM), (EPHE), (GXG), (ECH)

iShares MSCI Mexico Capped (EWW)

iShares MSCI South Africa Index (EZA)

Market Vectors Indonesia Index ETF (IDX)

iShares MSCI Thailand Capped Invstbl Mkt (THD)

iShares MSCI Malaysia (EWM)

iShares MSCI Philippines Invstb Mkt Idx (EPHE)

Global X FTSE Colombia 20 ETF (GXG)

iShares MSCI Chile Capped (ECH)

I am pleased to announce that I will be participating in the Invest Like a Monster Trading Conference in San Francisco during October 25-26. The two-day event brings together experts from across the financial landscape who will improve your understanding of markets by a quantum leap and measurably boost your own personal trading performance.

Tickets are available for a bargain $399. If you buy the premium $499 package you will be invited to the Friday 6:00 pm VIP cocktail reception, where you will meet luminaries from the trading world, such as Trademonster?s Jon and Pete Najarian, Guy Adami, Jeff Mackey, and of course, myself, John Thomas, the Mad Hedge Fund Trader. All in all, it is great value for the money, and I?ll personally throw in a ride on the City by the Bay?s storied cable cars for free.

Jon Najarian is the founder of OptionMonster, which offers clients a series of custom crafted computer algorithms that give a crucial edge when trading the market. Called Heat Seeker ?, it monitors no less than 180,000 trades a second to give an early warning of large trades that are about to hit the stock, options, and futures markets.

To give you an idea of how much data this is, think of downloading the entire contents of the Library of Congress, about 20 terabytes of data, every 30 minutes. His firm maintains a 10 gigabyte per second conduit that transfers data at 6,000 times the speed of a T-1 line, the fastest such pipe in the civilian world. Jon?s team then distills this ocean of data on his website into the top movers of the day. ?As with the NFL,? says Jon, ?you can?t defend against speed.?

The system catches big hedge funds, pension funds, and mutual funds shifting large positions, giving subscribers a peek at the bullish or bearish tilt of the market. It also offers accurate predictions of imminent moves in single stock and index volatility.

Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength that enabled him to work as a pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ.? He formed Mercury Trading in 1989 and then sold it to the mega hedge fund, Citadel, in 2004.

Jon developed his patented algorithms for Heat Seeker? with his brother Pete, another NFL player (Tampa Bay Buccaneers and the Minnesota Vikings), who like Jon, is a regular face in the financial media.

In order to register for the conference, please click here. There you will find the conference agenda, bios of the speakers, and a picture of my own ugly mug. I look forward to seeing you there.

Cling! Cling!

Jon Najarian

Jon Najarian

Global Market Comments

September 6, 2013

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH)

(SAN FRANCISCO STRATEGY LUNCHEON POSTPONED TO NOVEMBER 1),

(THE TAX RATE FALLACY),

(THE COOLEST TOMBSTONE CONTEST)

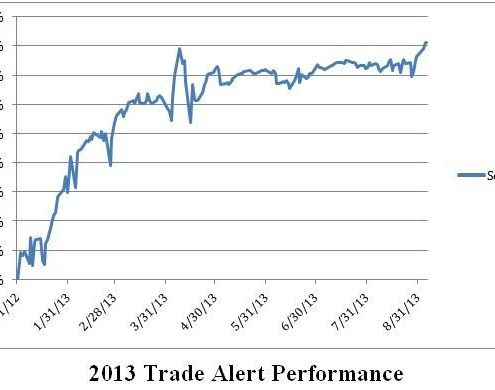

The Trade Alert service of the Mad Hedge Fund Trader has posted a year-to-date gain of 40.53%, a new all time high. Performance since inception 33 months ago soared to 95.58%. This pegs the average annualized return at 34.75%.

Some 71% of all Trade Alerts since the beginning have been profitable. Carving out the closed 2013 trades alone, 41 out of 50 have made money, a success rate of 82%. It is a track record that most big hedge funds would kill for.

The performance spike brings to a close months of sideway action when the markets provided no clear trends. This summer seemed quieter than most. But I have had a hot hand since returning from my European Strategy Tour. Anticipating seasonal strength in the US dollar, I piled on short positions in the Japanese yen and the Euro. A long position in gold proved profitable. My short in the oil market has been volatile, and now sits close to my breakeven point.

The coming autumn promises to deliver a harvest of new trading opportunities. On the menu are the taper, a new Fed governor, a debt ceiling crisis, a possible war with Syria, and the death of the bull market in bonds. The Trade Alerts should be coming hot and heavy.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars, and Jim Parker?s Mad Day Trader service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.