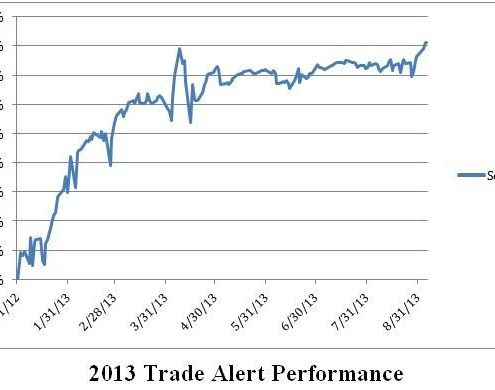

The Trade Alert service of the Mad Hedge Fund Trader has posted a year-to-date gain of 40.53%, a new all time high. Performance since inception 33 months ago soared to 95.58%. This pegs the average annualized return at 34.75%.

Some 71% of all Trade Alerts since the beginning have been profitable. Carving out the closed 2013 trades alone, 41 out of 50 have made money, a success rate of 82%. It is a track record that most big hedge funds would kill for.

The performance spike brings to a close months of sideway action when the markets provided no clear trends. This summer seemed quieter than most. But I have had a hot hand since returning from my European Strategy Tour. Anticipating seasonal strength in the US dollar, I piled on short positions in the Japanese yen and the Euro. A long position in gold proved profitable. My short in the oil market has been volatile, and now sits close to my breakeven point.

The coming autumn promises to deliver a harvest of new trading opportunities. On the menu are the taper, a new Fed governor, a debt ceiling crisis, a possible war with Syria, and the death of the bull market in bonds. The Trade Alerts should be coming hot and heavy.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars, and Jim Parker?s Mad Day Trader service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $191.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

When anyone starts lecturing you that the US has the highest tax rate in the industrialized world, just turn around, walk away, and pretend you never heard them. This person is either ignorant about this country?s taxation system, or is deliberately trying to deceive or mislead you.

According to a report released by the Internal Revenue Service, America?s tax collection agency, the top 400 individual tax returns filed in 2009 reported an average gross income of $358 million each. The average amount of tax paid by these individuals came to under 17%, less than half the maximum Federal rate of 39.5%, which kicks in on annual income over $388,350 (click here for the 2012 tax tables). This explains why Warren Buffet pays a much lower tax rate than his secretary. It really is true that in America, only the poor people pay taxes.

Look at any international comparison of taxes to GDP, and one can always find the United States at the bottom of the table. Low American taxes are one of the main reasons why I moved my company here from England 19 years ago, fleeing their hellacious then 15% VAT tax. Take a look at the Fortune 500, where one third of the largest companies pay no tax at all, and many that dominate the top of the list, like the oil majors, pay only token amounts. In 2010, General Electric (GE), one of the most profitable companies in the world, paid a 3% tax rate. However, if any politician wants to pander to voters during election time on a tax cutting platform he will only bluster on about ?tax rates?, not actual taxes paid.

What the US has that other countries lack is the 100,000 pages of the Internal Revenue Code. It is a 100 year accumulation of deductions, accelerated depreciation rates, tax credits, and other tax breaks that are the end product of intensive lobbying efforts and bribes by special interest groups, corporations, unions, and even religious groups. Take a look at the oil industry again. The oil depletion allowance permits drillers to deduct a substantial portion of the cost of a new well in the first year, while spreading the income over the extended life of the well. ?(Click here for its fascinating history, Oil Depletion Allowance.) When I first got into the oil and gas business a decade ago, after reading the relevant sections of the tax code, I couldn?t understand why everyone wasn?t drilling for Texas tea.

I have a very simple solution to the country?s budget deficit problem. Hit the reset button. Eliminate the Internal Revenue Code. Just set it on fire. Keep the existing progressive, hockey stick tax rates on income, but eliminate all deductions. And I mean everything; deductions for dependents, home mortgage interest, medical expenses, charitable contributions, the works. There are no sacred cows. My revised Form 1040 would have only three lines on it:

Income?????? ______________

Tax Rate??? ______________

Tax Due???? ______________

The budget deficit would disappear overnight. Government spending would shrink dramatically, because you could ditch most of the 100,000 who work for the IRS. Some 1.3 million auditors and CPA?s would have to hit the road in search of new work too. The amount of money that is wasted on tax collection in this country is truly staggering. This is not some pie in the sky concept. This is how taxation already works in most countries, and they seem to get along just fine.

In fact, the whole scheme might even pay for itself.

I Think This One Should Be Income, Here

I Think This One Should Be Income, Here

Global Market Comments

September 5, 2013

Fiat Lux

Featured Trade:

(OCTOBER 18 SAN FRANCISCO STRATEGY LUNCHEON)

(TAKING PROFITS ON MY EURO SHORT),

?(FXE), (EURO),

(POPULATION BOMB ECHOES),

(POT), (MOS), (AGU), (WEAT), (CORN), (SOYB), (RJA)

CurrencyShares Euro Trust (FXE)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

Agrium Inc. (AGU)

Teucrium Wheat (WEAT)

Teucrium Corn (CORN)

Teucrium Soybean (SOYB)

ELEMENTS Rogers Intl Commodity Agri ETN (RJA)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $191.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

September 4, 2013

Fiat Lux

Featured Trade:

(WHY I?M KEEPING MY OIL SHORT),

(USO), (SCO),

(A COW BASED ECONOMICS LESSON),

(ON THAT TESLA RECOMMENDATION), (TSLA)

United States Oil (USO)

ProShares UltraShort DJ-UBS Crude Oil (SCO)

Tesla Motors, Inc. (TSLA)

SOCIALISM -You have 2 cows. You give one to your neighbor.

COMMUNISM -You have 2 cows. The State takes both and gives you some milk.

FASCISM -You have 2 cows. The State takes both and sells you some milk.

NAZISM -You have 2 cows. The State takes both and shoots you.

BUREAUCRATISM -You have 2 cows. The State takes both, shoots one, milks the other, and then throws the milk away.

TRADITIONAL CAPITALISM -You have two cows. You sell one and buy a bull. Your herd multiplies, and the economy grows. You sell them and retire on the income.

ROYAL BANK OF SCOTLAND (VENTURE) CAPITALISM -You have two cows. You sell three of them to your publicly listed company, using letters of credit opened by your brother-in-law at the bank, then execute a debt/equity swap with an associated general offer so that you get all four cows back, with a tax exemption for five cows. The milk rights of the six cows are transferred via an intermediary to a Cayman Island Company secretly owned by the majority shareholder who sells the rights to all seven cows back to your listed company. The annual report says the company owns eight cows, with an option on one more. You sell one cow to buy a new president of the United States, leaving you with nine cows. No balance sheet provided with the release. The public then buys your bull.

SURREALISM -You have two giraffes. The government requires you to take harmonica lessons.

AN AMERICAN CORPORATION -You have two cows. You sell one, and force the other to produce the milk of four cows. Later, you hire a consultant to analyze why the cow has dropped dead.

A FRENCH CORPORATION -You have two cows. You go on strike, organize a riot, and block the roads, because you want three cows.

A JAPANESE CORPORATION -You have two cows. You redesign them so they are one-tenth the size of an ordinary cow and produce twenty times the milk. You then create a clever cow cartoon image called a Cowkimona and market it worldwide.

AN ITALIAN CORPORATION -You have two cows, but you don?t know where they are. You decide to have lunch.

A SWISS CORPORATION -You have 5000 cows. None of them belong to you. You charge the owners for storing them.

A CHINESE CORPORATION -You have two cows. You have 300 people milking them. You claim that you have full employment, and high bovine productivity. You arrest the newsman who reported the real situation.

AN INDIAN CORPORATION -You have two cows. You worship them.

A BRITISH CORPORATION -You have two cows. Both are mad.

AN IRAQI CORPORATION -Everyone thinks you have lots of cows. You tell them that you have none. No-one believes you, so they bomb the ** out of you and invade your?country. You still have no cows, but at least you are now a Democracy.

AN AUSTRALIAN CORPORATION -You have two cows. Business seems pretty good. You close the office and go for a few beers to celebrate.

A NEW ZEALAND CORPORATION -You have two cows. The one on the left looks very attractive. The one on the right is very nervous.

Will the person who bought Tesla shares (TSLA) on my recommendation last year at $30 please email me? I was traveling in Europe over the summer and lost your email address. I would like to get a testimonial from you. The stock hit $173.70 today, and is up 580% from your cost, making it the top performing US stock this year.

With the money you?ve made you can probably buy a Tesla now. I recommend the high performance Model S-1 with the upgraded sound system and the 270-mile range. I have one, and they are to die for. It?s the only car I ever bought where the specifications keep improving every month with each automatic software update. Or you can wait until next year and by the four-wheel drive SUV Model X. I am on the waiting list for that one.

You owe me.

Long-term readers of this letter are well aware of my antipathy towards General Motors (GM). For decades, the company turned a deaf ear to customer complaints about shoddy, uncompetitive products, arcane management practices, entitled dealers, and a totally inward looking view of the world that was rapidly globalizing. It was like watching a close friend kill himself through chronic alcoholism.

During this time, Japan?s share of the US car market rose from 1% to 42%. The only surprise when the inevitable bankruptcy came was that it took so long. This was traumatic for me personally, since for the first 30 years of my life General Motors was the largest company in the world. Their elegant headquarters building in Detroit was widely viewed as the high temple of capitalism. I was raised to believe that what was good for GM was good for the country. Oops!

I opposed the bailout because it interfered with creative destruction, something America does better than anyone else, and gives us a huge competitive advantage in the international marketplace. Probably 10% of the listed companies in Japan are zombies that should have been killed off 20 years ago. Without GM a large part of the US car industry would have moved to California and gone hybrid or electric.

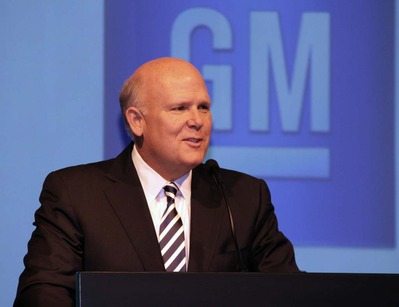

When an opportunity arose to spend a few hours with the new CEO, Dan Akerson, I gratefully accepted. After all, he wasn?t responsible for past sins, and I thought I might gain some insights into the new GM. Besides, he was a native of the Golden State and a graduate in nuclear engineering from the Naval Academy at Annapolis and the London School of Economics. How bad could he be?

When I shook hands, I remarked that his lapel pin looked like the hood ornament on my dad?s old car, a Buick Oldsmobile. He noticeably winced. So to give the guy a break, I asked him about the company?s outlook.

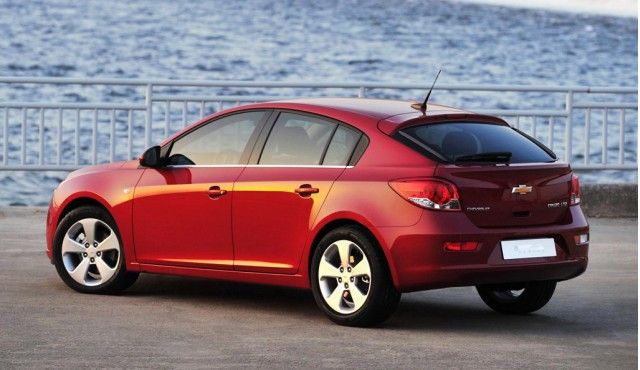

Last year was the best in the 104-year history of the company. It is now the world?s largest car company, with the biggest market share. The 40-mpg Chevy Cruze is the number one selling sub compact in the US. GM competed in no less than 117 countries, and was a leader in the fastest growing emerging market, China.

I asked how a private equity guy from the Carlyle Group was fitting in on the GM board. He responded that all of the Big Three Detroit automakers were being run by ?non-car guys? now, and they generated profits for the first time in 20 years. However, it was not without its culture clashes. When he publicly admitted that he believed in global warming, he was severely chastised by other board members. He wasn?t following the official playbook.

When I started carping about the bailout, he cut me right off at the knees. Liquidation would have been a deathblow for the Midwestern economy, killing 1 million jobs, and saddling the government with $23 billion in pension fund obligations. It also would have deprived the Treasury Department of $135 billion in annual tax revenues. It was inevitable that in the last election year the company became a political punching bag. Akerson said that he was still a Republican, but just.

GM?s Chevy Volt is so efficient, running off a 16kWh lithium ion battery charge for the first 25-50 miles, that many are still driving around with the original tank of gas they were delivered with a year ago. Extreme crash testing by the government and the bad press that followed forced a relaunch of the brand. Despite this, I often get emails from readers saying they love the car.

The summer production halt says more about GM?s more efficient inventory management than it does about the hybrid car. GM?s recent investment in California based Envia Systems should succeed in increasing battery energy densities threefold.

However the Volt is just a bridge technology to the Holy Grail, hydrogen fuel cell powered cars, which will start to go mainstream in four years. These cars burn hydrogen, emit water, and cost about $300,000 a unit to produce now. By 2017, GM hopes to make it available as a $30,000 option for the Chevy Aveo.

Another bridge technology will be natural gas powered conventional piston engines. These take advantage of the new glut of this simple molecule and its 80% price discount per BTU compared to gasoline. The company announced a dual gas tank pickup truck that can use either gasoline or compressed gas. Cheap compressors that enable home gas refueling are also on the horizon. Fleet sales will be the initial target.

Massive overcapacity in Europe will continue to be a huge headache for the global industry. There are just too many carmakers there, with Germany, England, Italy, France, and Sweden each carrying multiple manufacturers. Governments would rather bail them out to save jobs and protect entrenched unions than allow market forces to work their magic. GM lost $700 million on its European operations last year, and Akerson doesn?t see that improving now that the continent is clearly moving into recession.

I asked if GM stock was cheap, given the dismal performance since the IPO. It is still just above the $33/share launch price. Now that the government has unloaded its shareholding the way for further appreciation should be clear. Also, the old bondholders still owned substantial numbers of shares and were selling into every rally. That is hardly a ringing endorsement.

Akerson said that a cultural change had been crucial in the revival of the new GM. Last year, the Feds announced an increase in mileage standards from 25 to 55 mpg by 2025. Instead of lawyering up for a prolonged fight to dilute or eliminate the new rules, as it might have done in the past, it is working with the appropriate agencies to meet these targets.

Finally, I asked Akerson what went through his head when the top job at GM was offered him at the height of the crisis. Were they crazy, insane, delusional, or all the above? He confessed that it offered him the management challenge of a generation and that he had to rise to it.

Spoken like a true Annapolis man.