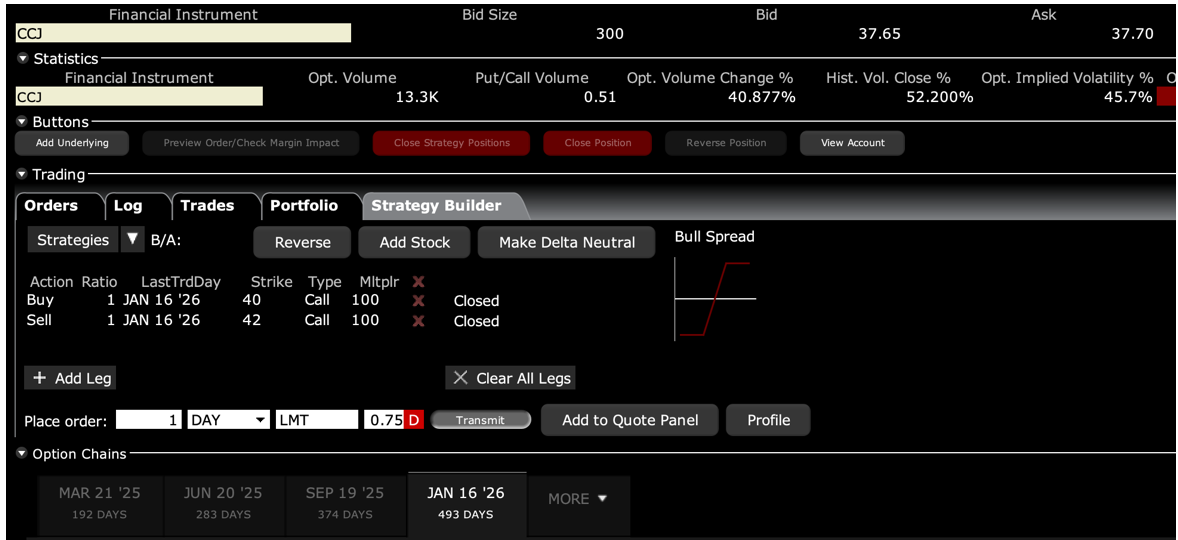

BUY the Cameco (CCJ) January 2026 $40-$42 out-of-the-money vertical Bull Call spread LEAPS at $0.75 or best

Opening Trade

9-17-2024

expiration date: January 16, 2026

Number of Contracts = 1 contract

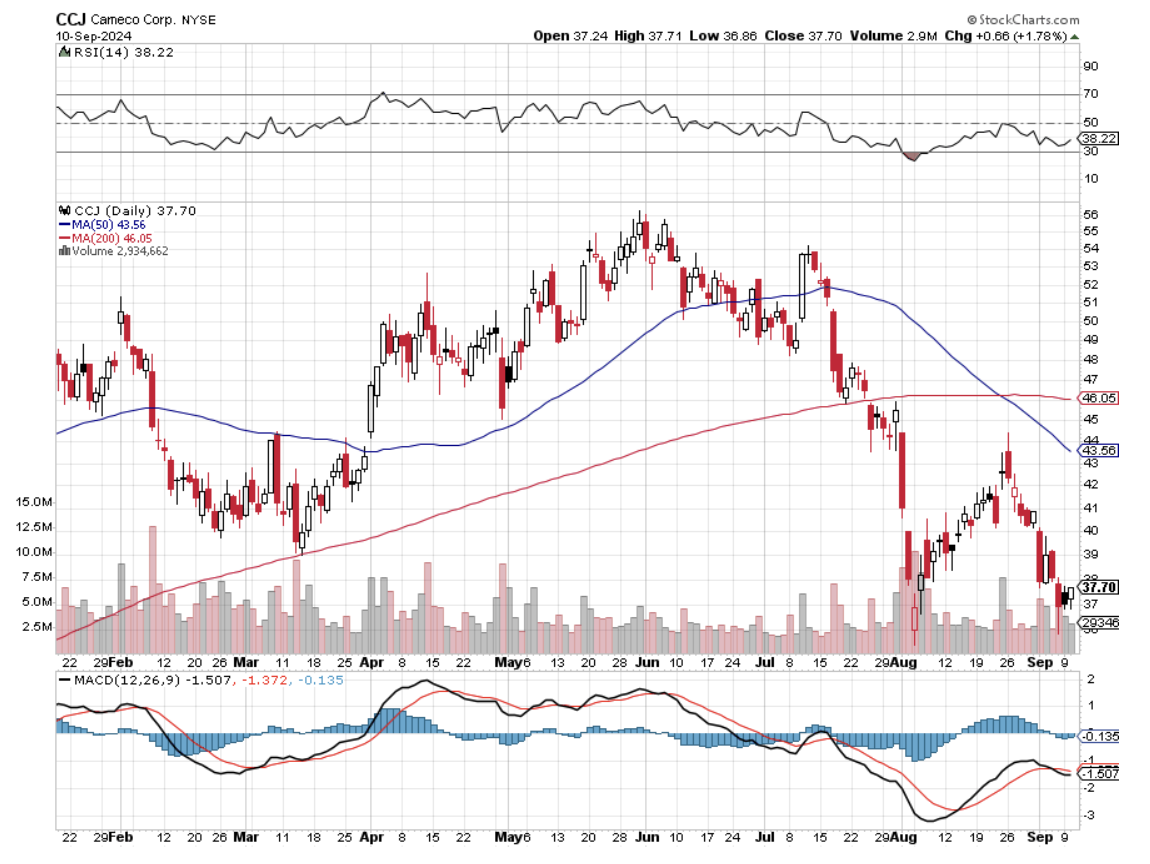

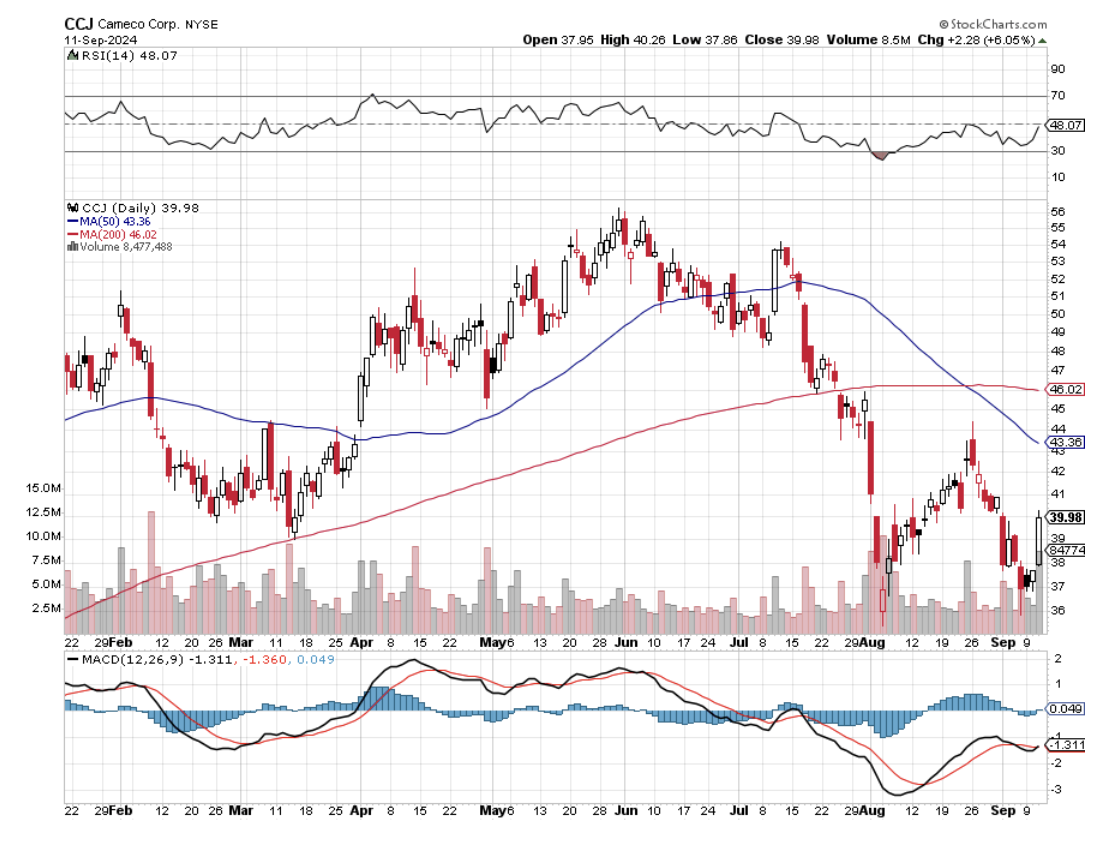

We have just seen a healthy 37% correction in the shares of Canadian uranium miner Cameco (CCJ), and I am starting to salivate. Finally, I can put my time at the Atomic Energy Commission in the 1970s to work.

If you don’t do options, buy the stock. My target for (CCJ) in 2026 is $80, up 120%.

How would you like to buy a stock that is a call option on:

* A recovery of the US economy

*A recovery of the Chinese economy

*The expansion of the electrical grid

*The conversion to clean energy

*The next generation of new energy technology.

Then that would be Cameco.

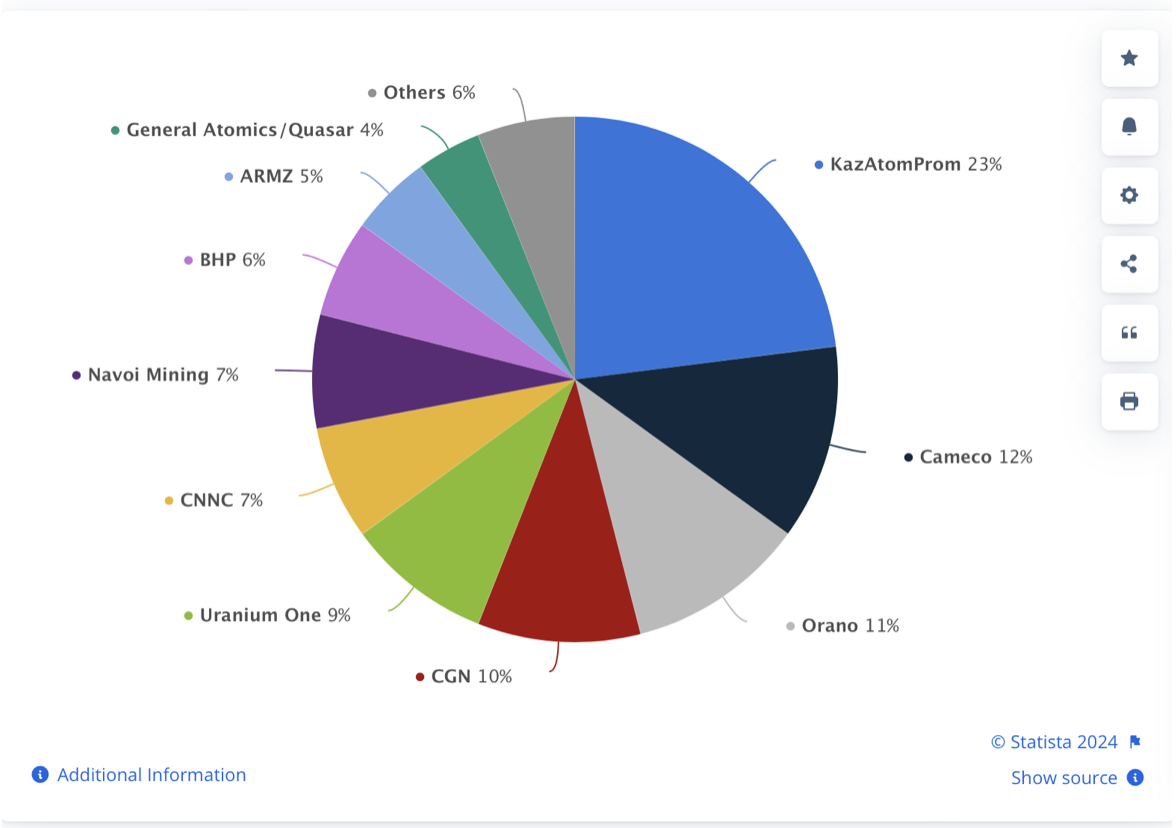

Cameco Corporation (formerly Canadian Mining and Energy Corporation) is the world's largest publicly traded uranium company, based in Saskatoon, Saskatchewan, Canada. It is the world's second-largest uranium producer, accounting for 11.61% of world production.

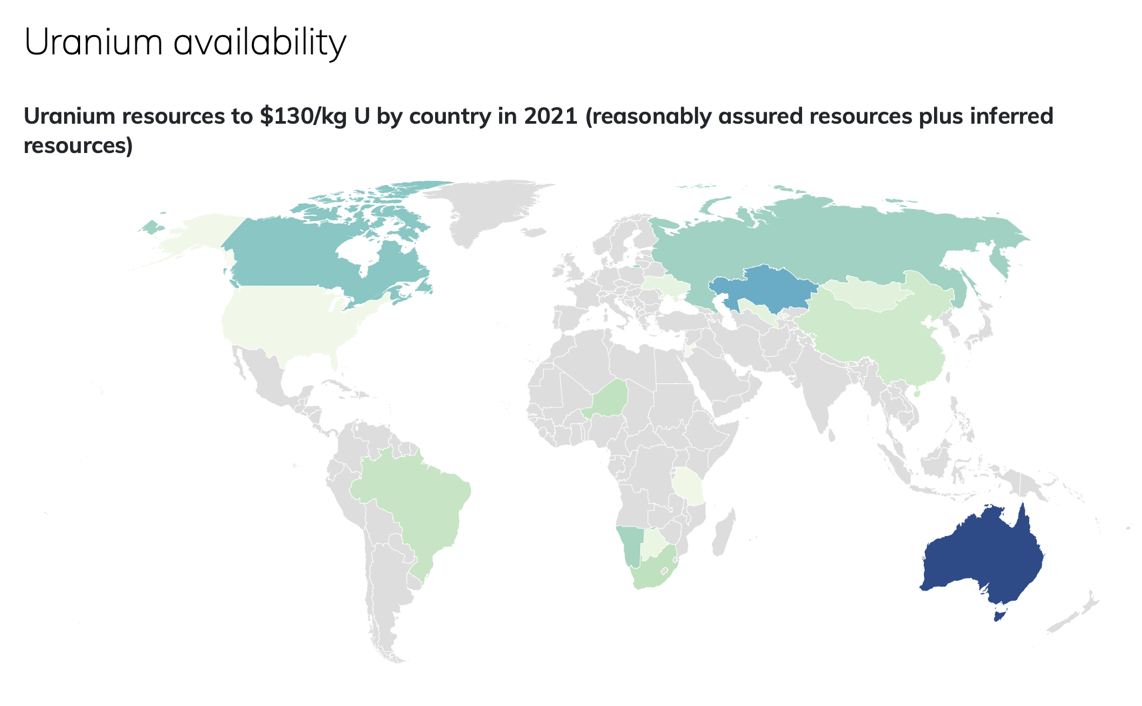

My hedge fund buddies are piling into this stock because the nuclear renaissance is just getting started. The electrification of our energy sources is creating immense demand for new electric power sources. China alone plans to build 115 new nuclear power plants, putting new upward pressure on fuel supplies. Also, the world’s largest producer, KazAtomProm in Kazakhstan, just announced an 11% cutback in production because of processing shortages (click here).

Nuclear power is also viewed as a backup for new alternative sources for the days when the sun doesn’t shine and the wind doesn’t blow. Western countries also need to replace Russian supplies of uranium in compliance with sanctions. Even California has moved to extend the life of its sole remaining nuclear power plant at Diablo Canyon by five years (San Onofre and Rio Seco were closed years ago).

Cameco is one of the largest global providers of uranium fuel. Utilities around the world rely on its products to generate safe, reliable, emissions-free nuclear power. The company is meeting the ever-increasing demand for clean, baseload electricity while delivering energy solutions to support the world's net-zero goals. It doesn’t need wind now, the sun to generate nuclear power.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 5 cents with a second order.

This is a bet that Cameco (CCJ) will not fall below $42 by the January 16, 2026, option expiration in 16 months.

Keep in mind that Cameco is one of the most volatile stocks in the market, with an implied volatility in the options of 44%. That means that after a big drop, you should see a bigger rise. You don’t have to buy it today. A greater selloff would be ideal. But it should be at the core of any long-term LEAPS portfolio, and it is selling at bargain prices.

To learn more about the company, please visit their website at https://www.cameco.com/about

I am therefore buying the Cameco (CCJ) January 2026 $40-$42 out-of-the-money vertical Bull Call spread LEAPS at $0.75 or best

Don’t pay more than $1.00, or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Cameco (CCJ) January 2026 $40-$42 out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $0.50-$1.50. Enter an order for one contract at $0.50, another for $0.60, another for $0.70 and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then, enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is minuscule, less than 10%, since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month, just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below, and you will see that an 11.40% rise in (CCJ) shares will generate a 167% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 14.65:1.

(CCJ) doesn’t even have to get to a new all-time high to make the max profit. It only has to get back to $42, where it traded months ago.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Here are the specific trades you need to execute this position:

Buy 1 January 2026 (CCJ) $270 calls at………….………$7.75

Sell short 1 January 2026 (CCJ) $280 calls at…………$7.70

Net Cost:………………………….………..………….…...........$0.75

Potential Profit: $2.00 - $0.75 = $1.25

(1 X 100 X $1.25) = $125 or 167% in 16 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here at

https://www.madhedgefundtrader.com/ltt-vbcs/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Global Market Comments

September 16, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or 25 OR 50?)

plus THE GREAT NATURAL GAS SCAM)

25 or 50?

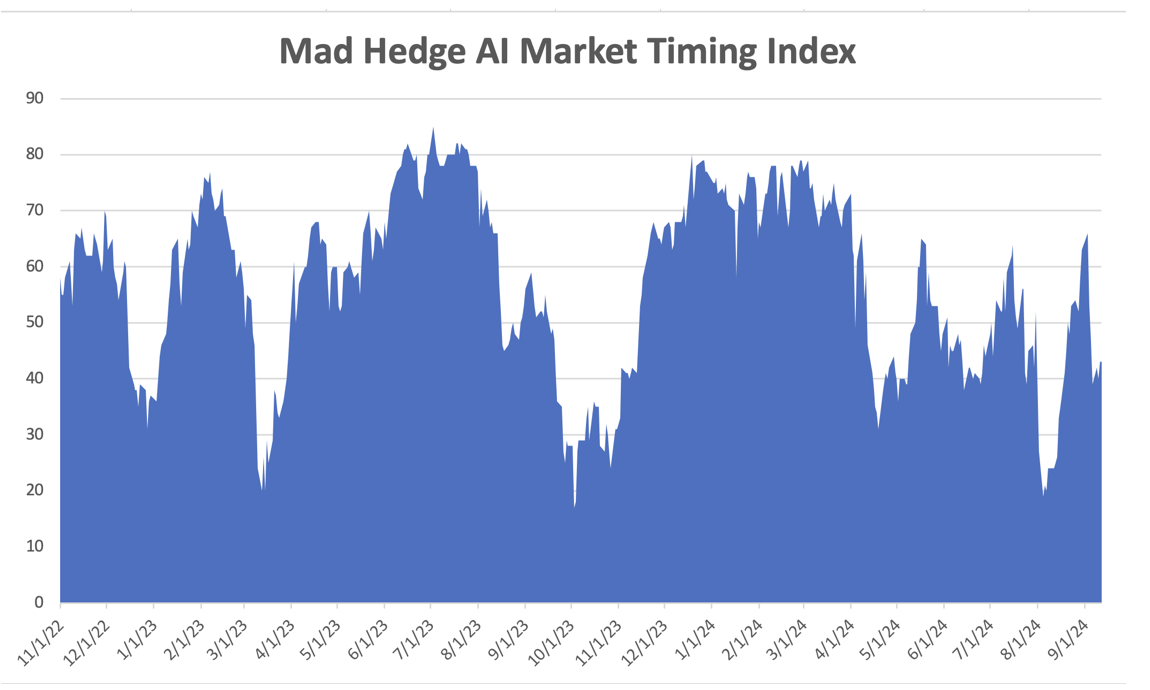

It's Fed Week, and futures markets are already indicating that overnight funds will drop from 5.25% to 3.0% by June. That amounts to two 50 basis point cuts and five 25 basis point cuts over the next seven Fed meetings.

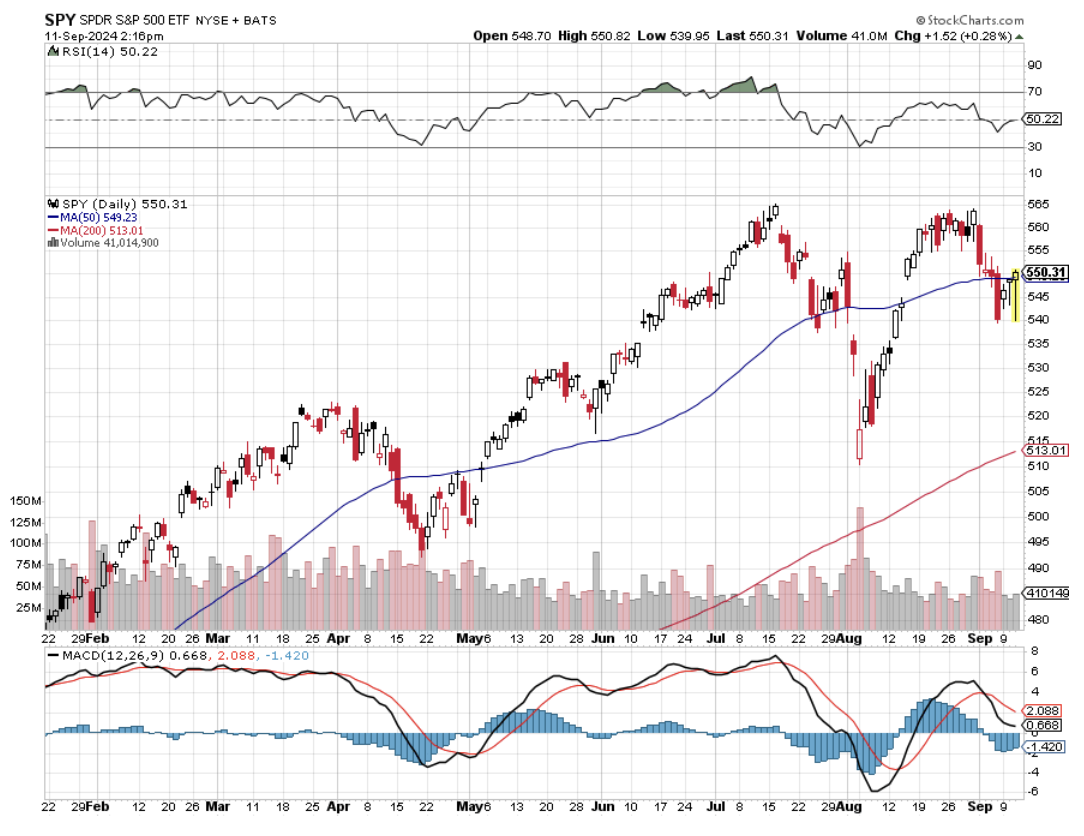

If you think that’s overdone, when reality kicks in, you could get a good selloff in stocks and bonds you can buy into. I think the warm CPI and PPI last week were dagger in the heart for the 50-basis point cut.

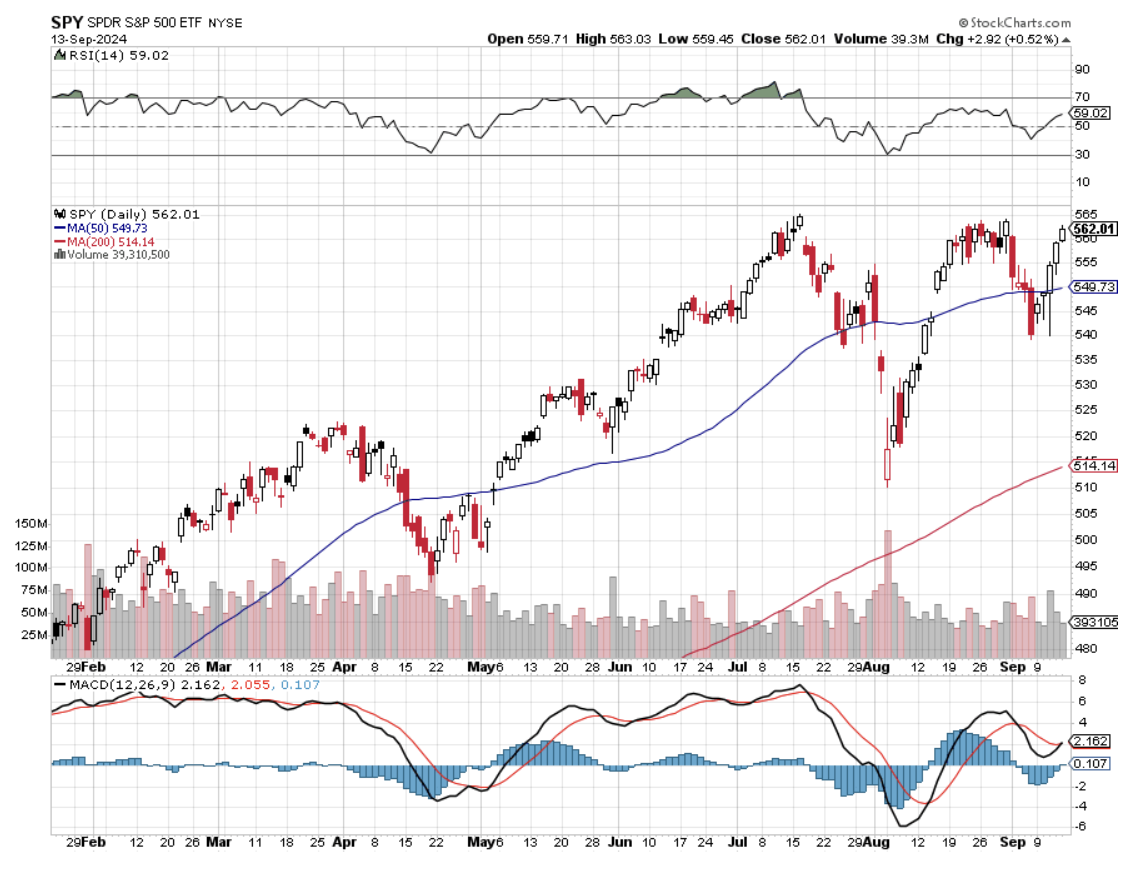

There is a good likelihood that the bottom for the stock market is in for the year, given the heroic move we saw on Wednesday. What is happening is that the market is backing out of the uncertainty of the presidential election, the font of so much uncertainty this year, in the wake of the Tuesday night debate. The weekend opinion polls confirmed that.

This was not exactly a bargain basement bottom. The S&P 500 (SPY) is now trading at 21.1X and the Magnificent Seven at 28X. But when there is $8 trillion in cash sitting the sideways and trillions more coming in the form of new AI profits, stocks tend to get expensive and stay expensive.

Expect stocks to rally into the Wednesday Fed announcement, and then you might get a “Sell on the news.” That is the dip you want to buy into. Remember, this rate cut is the first of many to come.

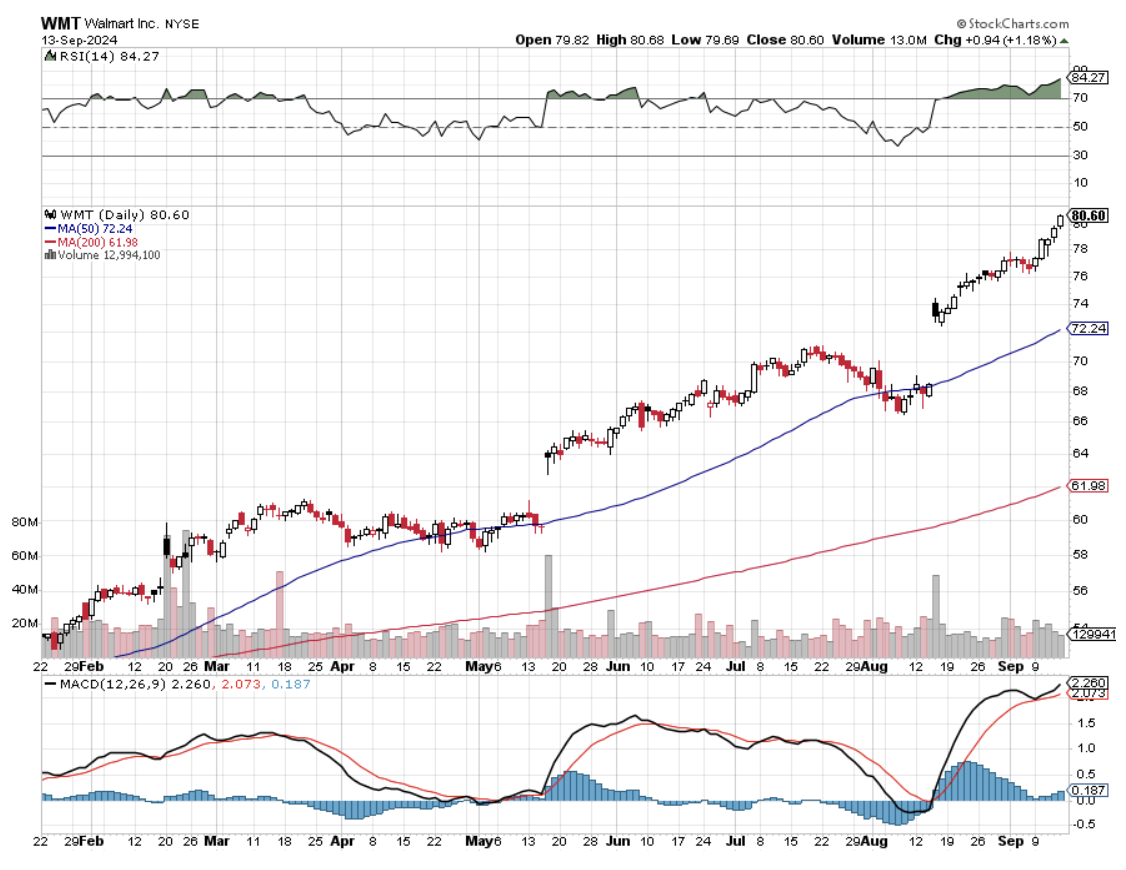

If you are wondering how this AI thing is going to work in our real world, take a look at two stocks. Walmart (WMT) was a sedentary retail stock with 3% profit margins that I never used to both with. This year, it is up 50%. That’s because they applied AI to their enormous inventory system and online sales efforts to squeeze much more profit out of the company.

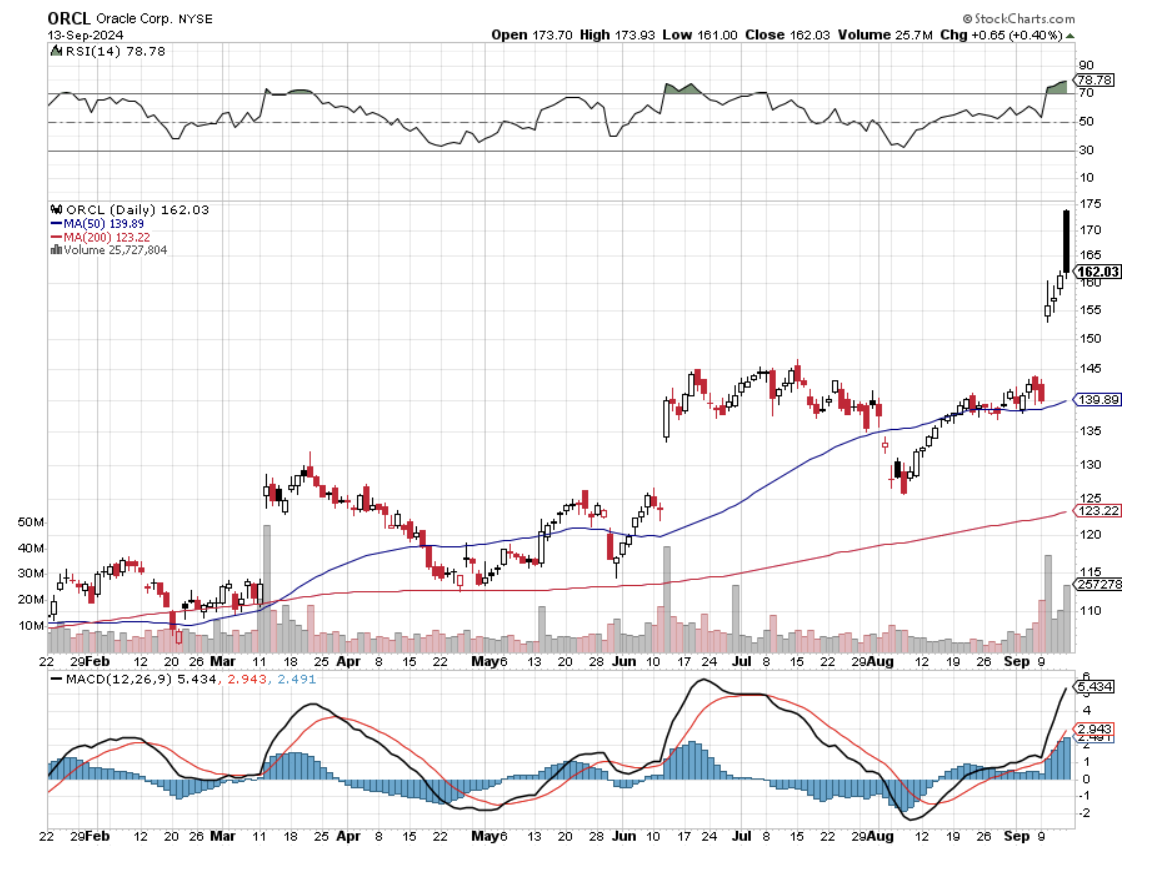

Similarly, legacy tech company Oracle (ORCL) has employed AI in upgrading its vast database network, with similar results. (ORCL) has rocketed by 32% since August. The rest of the economy is going to go this way, just as Microsoft Word, Excel, and PowerPoint did in the mid 1990’s.

If you want to know how much higher share prices, earnings growth, and GDP growth are justified, this is it.

It was a great week for Mad Hedge traders, being all cash on the down days and long gold and silver on the up ones, bringing in a 4% week.

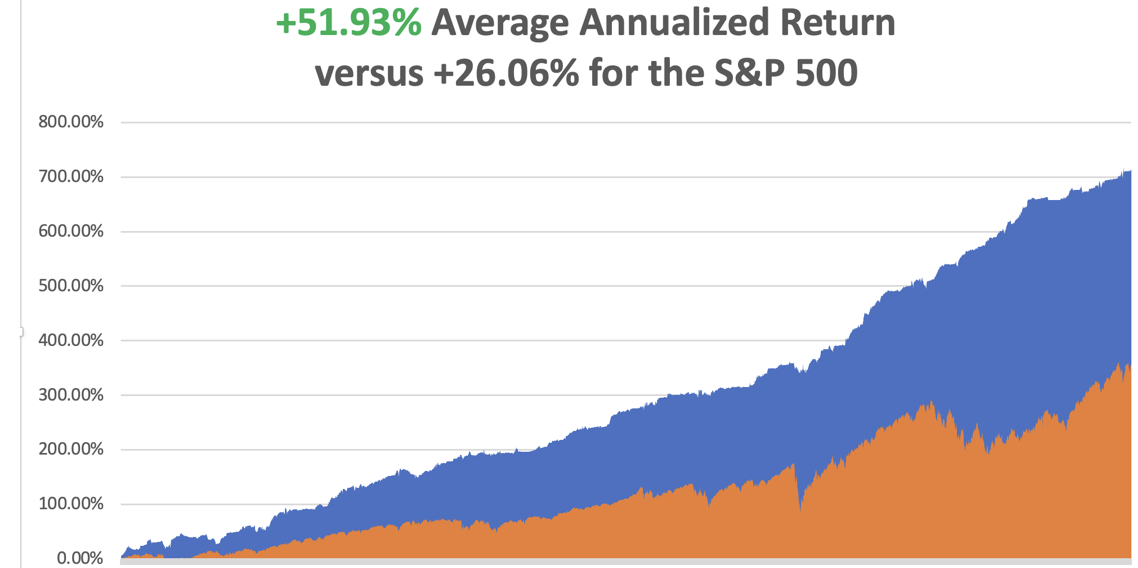

So far in September, we are up by +2.75%. My 2024 year-to-date performance is at +37.44%. The S&P 500 (SPY) is up +16.7% so far in 2024. My trailing one-year return reached +56.08. That brings my 16-year total return to +714.04. My average annualized return has recovered to +51.93%.

I piled on a double position in gold metals last week in the (GLD) and added a silver long with (WPM). I am now 30% long and 70% cash.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 47 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +72.24%.

Try beating that anywhere.

Market Scores Biggest Turnaround in Two Years, now that the presidential debate is history, scoring an amazing 900-point intraday swing. Harris trades in alternative energy soared, while Trump's trades in crypto got killed. The market is now discounting a Harris win. Now, let’s wait for next week’s Fed action.

Core CPI Comes in Warm at 0.3% when 0.1% was expected. It was actually a good report as it took the YOY inflation rate from 2.9% down to 2.5%. But anything less than expected at these prices and the market tanks. Will interest rates now get cut only 25 basis points next week?

Another Government Shutdown is in the Works, with the House unable to pass a spending bill with a four-seat majority. The deadline is September 30. It could tank the market one more time before the election.

US Household Wealth Hits New All-Time High, or the value of American home equity at $163.8 trillion, up $1.75 trillion on the quarter. The US is the richest country in the world by far. Meanwhile, home values remained lofty amid limited inventory in the resale market. There is a shortage of 10 million homes in the US.

Gold Hits New High at $2,610 an ounce as hedge funds pour in. Seasonals for the barbarous relic are now the most positive of the year. Look for $3,000 an ounce by next year. Notice how (GLD) gaps are higher every morning, signifying that the bulk of buying is coming from Asia. Buy (GLD) on dips.

Interest Payments on National Debt Top $1 Trillion per year. The jump in debt service costs came as the U.S. budget deficit surged in August, edging closer to $2 trillion for the full year. I bet the Treasury really wants to see the Fed cut interest rates next week.

ECB Cuts Interest Rates to a 3.5% to 3.75% range. It’s now part of a global trend, with the Fed cutting next week. Buy all interest-sensitive plays like gold (GLD) and homebuilders (DHI).

Apple Launches a New Range of Products, including the iPhone 16 and new iPad. The AI is strictly entry-level and beta. The new iPhone 16 failed to excite investors, with long-expected AI features still in test mode, even as an industry-first tri-fold phone from Huawei raised the stakes in a battle to dominate the global smartphone market. Buy (AAPL) on dips.

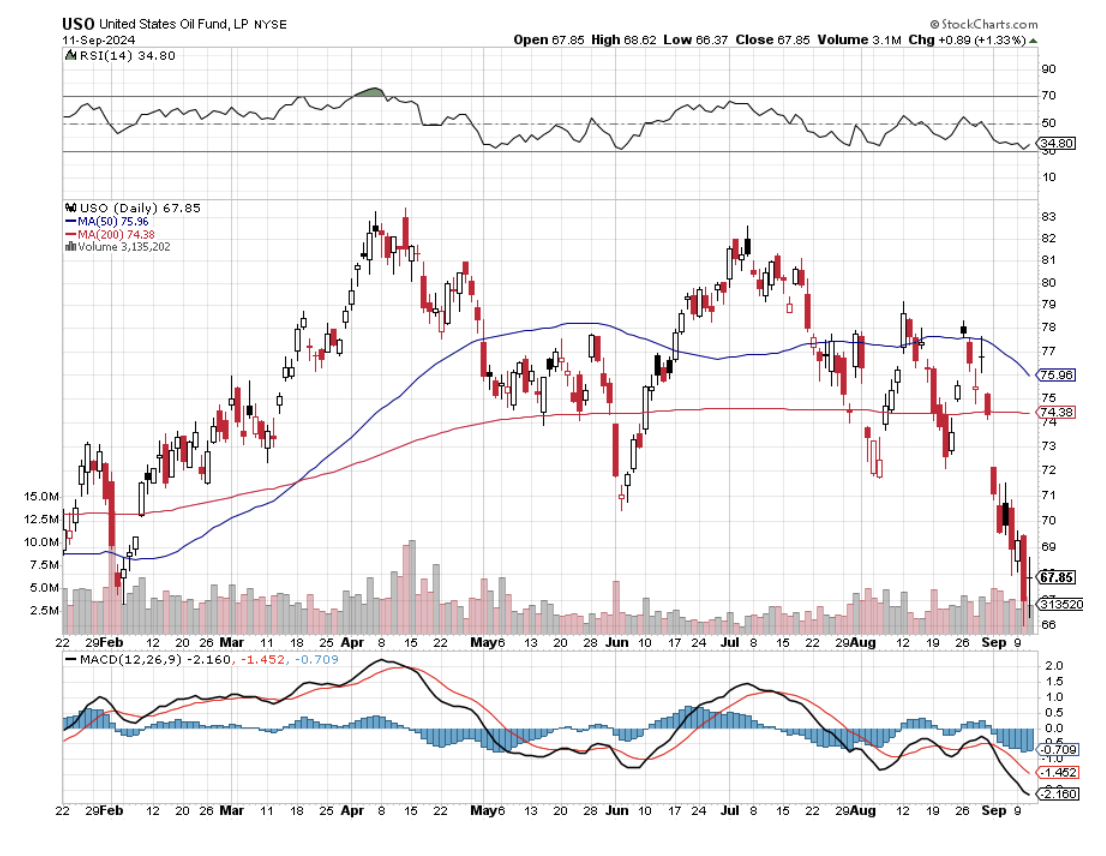

US Refinery Demand for Crude Oil Collapses, to its lowest level since January 2019 last month, a sign of weakened refinery demand as margins have softened. Feedstocks like high-sulfur fuel oil and other heavy residues can be refined into higher-value products such as gasoline and diesel using secondary units. But loadings of those products to the Gulf Coast, America's largest refining hub, fell by a third in August from the prior month to 260,000 barrels per day (bpd). Avoid all energy plays.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy is decarbonizing, and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000, here we come!

On Monday, September 16 at 8:30 AM EST, the NY Empire State Manufacturing Index is out

On Tuesday, September 17 at 6:00 AM, the US Retail Sales are released.

On Wednesday, September 18, at 7:30 PM, Building Permits are printed. At 11:00 AM, the Fed interest rate decision is announced, followed by a press conference at 11:30 AM.

On Thursday, September 19, at 8:30 AM, the Weekly Jobless Claims are announced. We also get Existing Home Sales.

On Friday, September 20, at 2:00 PM, the 2:00 PM the Baker Hughes Rig Count is printed.

As for me, the whole Archegos blow-up reminds me that there are always a lot of con men out there willing to take your money. As PT Barnum once said, “There is a sucker born every minute.”

I’ll tell you about the closest call I have ever had with one of these guys.

In the early 2000s, I was heavily involved in developing a new, untried, untested, and even dubious natural gas extraction method called “fracking.” Only a tiny handful of wildcatters were even trying it.

Fracking involved sending dynamite down old, depleted wells, fracturing the rock 3,000 feet down, and then capturing the newly freed-up natural gas. If successful, it meant that every depleted well in the country could be reopened to produce the same or more gas than it ever had before. America’s gas reserves would have doubled overnight.

A Swiss bankers friend introduced me to “Arnold” of Amarillo, Texas, who claimed fracking success and was looking for new investors to expand his operations. I flew out to the Lone Star state to inspect his wells, which were flaring copious amount of natural gas.

Told him I would invest when the prospectus was available. But just to be sure, I hired a private detective, a retired FBI man, to check him out. After all, Texas is notorious for fleecing wanabee energy investors, especially those from California.

After six weeks, I heard nothing, so late on a Friday afternoon, I ordered $3 million sent to Arnold’s Amarillo bank from my offshore fund in Bermuda. Then I went out for a hike. Later that day, I checked my voicemail, and there was an urgent message from my FBI friend:

“Don’t send the money!”

It turns out that Arnold had been convicted of check fraud back in the sixties and had been involved in a long series of scams ever since. But I had already sent the money!

I knew my fund administrator belonged to a certain golf club in Bermuda. So, I got up at 3:00 AM, called the club Starting Desk, and managed to get him on the line. He said I had missed the 3:00 PM Fed wire deadline on Friday and the money would go out first thing Monday morning. I told him to be at the bank at 9:00 AM when the doors opened and stop the wire at all costs.

He succeeded, and that cost be a bottle of Dom Perignon Champaign, which, fortunately, in Bermuda, is tax-free.

It turned out that Arnold’s operating well was actually a second-hand drilling rig he rented with a propane tank buried underneath that was flaring the gas. He refilled the tank every night to keep sucking in victims. My Swiss banker friend went bust because he put all his clients into the same project.

I ended up making a fortune in fracking anyway with much more reliable partners. No one had heard of it, so I bought old wells for pennies on the dollar and returned them to full production. Then gas prices soared from $2/MM BTU to $17. America’s gas reserves didn’t double, they went up ten times.

I sold my fracking business in 2007 for a huge profit to start the Diary of a Mad Hedge Fund Trader.

It is all a reminder that if it is too good to be true, it usually isn’t.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Happiness is having a large, loving, caring, close-knit family in another city,” said the comedian, George Burns, who lived to over 100.

Global Market Comments

September 13, 2024

Fiat Lux

Featured Trade:

(The Mad SEPTEMBER traders & Investors Summit is ON!)

(SEPTEMBER 13 BIWEEKLY STRATEGY WEBINAR Q&A),

(USO), (UUP), (FXA), (FXE), (FXC), (FXB), (DJT), ($INDU), (JPM), (BRK), (TSLA), (NVDA), (IBM), (CCJ), (BRK/B)

The Fed has stopped raising interest rates, inflation is falling, and tech stocks are on fire!

What should you do about it?

Attend the Mad Hedge Traders & Investors Summit from September 17-19. Learn from 20 of the best professionals in the market with decades of experience and the track records to prove it.

Every strategy and asset class will be covered, including stocks, bonds, foreign exchange, precious metals, commodities, energy, and real estate.

Get the tools to build an outstanding performance for your own portfolio.

Best of all, by signing up you will automatically have a chance to win up to $100,000 in prizes.

Usually, access to an exclusive conference like this costs thousands of dollars. You can attend for free!

Listening to this webinar will change your life! To register, please click here.

Below please find subscribers’ Q&A for the September 11 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe Nevada.

Q: Will the Fed cut by 50 basis points at their next meeting?

A: The probability of that happening actually dropped by about half with the warm CPI report this morning with core CPI at 0.3%. That may have pushed the Fed from a 50% basis point rate cut back down to only 25%. I think if we only get 25%, the market will sell off. So that’s Wednesday next week. Mark that on your calendars—the market may well be on hold until then.

Q: Is $50/barrel oil (USO) coming by the end of this year?

A: No, but I think $60 is in the works. And that may be the bottom of this cycle because after that we expect an economic recovery, greater demand for oil, and rising prices in 2025. Until then, overproduction both in the US and in the Middle East is knocking prices down.

Q: Will the US dollar (UUP) continue its terrible performance through the end of the year?

A: Yes, and in fact, it may be for the next 10 years that the US dollar is weak—certainly 5—so any rally or dips you get in the currencies (FXA), (FXE), (FXC), and (FXB) I’d be buying with both hands.

Q: Where are you hiding at the moment?

A: 90-day T-bills, which are yielding 4.97%. You can buy and sell them any time you want, and the interest is only payable when you sell them.

Q: Is September 18th the selloff?

A: It depends on how much we do before then. Obviously, we’re making good progress today with the Dow ($INDU) down 700 points, so we shall see. However, the market is flip-flopping every other day, making it untradable—you can’t get any position and hold on to it long enough to make money, so it’s better just to stay out. There’s no law that says you have to be in the market every day of the year, and this is a day not to be in the market for sure.

Q: How will the presidential debate reaction affect the market?

A: There’s only one stock you have to follow for that and that’s the (DJT) SPAC, and that’s Trump’s own personal ETF, and it is down 13% today to a new all-time low. I believe that’s well below its IPO price, so anyone who’s touched that stock is losing money unless they got out at the top. That is a good signal.

Q: JP Morgan (JPM) stock had a steep pullback to $200/share—is it a buy here?

A: No, but we’re getting close. If we can get (JPM) close to its 200-day moving average at $188 on high volatility, that would be a fantastic buy, because (JPM) will benefit enormously from falling interest rates, and it is the world's quality banking play.

Q: Is it too soon on Berkshire Hathaway (BRK) and Tesla (TSLA)?

A: Yes on both. It’s too soon for anything right now. I wouldn’t touch anything before the interest rate cut unless you have a really special situation, and there are some out there.

Q: Do you think Nvidia (NVDA) could test $90 again?

A: It could very easily; it got within $10 of that last week. So, it just depends on how bad the news is and how scared people get in September.

Q: Is the end of carry trade affecting the market?

A: No, we had a big deleveraging there. Although people are going back in again now, it’s not enough to hurt the market.

Q: I heard Putin is threatening over raw materials. What do we get from Russia, and what stocks or ETFs would be impacted?

A: We get nothing from Russia anymore. We used to get a lot of commodities and oil from them, and that has ceased. Russia has essentially exited the global economy because of the sanctions and the war in Ukraine, so they can’t really hurt anyone at this point.

Q: What about Russia doing an end-run around with direct trade? BRICS block is going to make the dollar even more worthless in the future.

A: I don’t buy that at all. I’ve been covering sanctions for 50 years; they always work, but they always take a long time. You could always do black market trade through the back door, but the volumes are way down, and the profits are much less because people only buy sanctioned goods at big discounts. The oil that China is buying from Russia is something like a 30% discount to the market. They execute a high cost of doing business, and nobody wants to be in sanctions if they can possibly do avoid. That said, when the war ends, the sanctions may end. That could be some time next year when Russia completely runs out of tanks and airplanes.

Q: Should I buy Nvidia (NVDA) call options now?

A: It's not just a matter of Nvidia. It's what the general market is doing, and tech is doing. And tech is not doing that well—even on the up days. So I would hold off a bit on Nvidia.

Q: Why is Warren Buffet (BRK/B) unloading so much of his equity portfolio?

A: He thinks the market is expensive, and he has thought it has been expensive for years and he's been unloading stocks for years. He has something like $250 billion in cash now so he can buy whole companies in the next recession. Whether he'll live long enough to see that recession is another question, but his replacement staff is already at work and running the fund, so Berkshire will continue running on autopilot even after he’s gone.

Q: Is IBM an AI play?

A: (IBM) wants to think that it’s an AI play. They haven’t disclosed enough to the public to make the stock a real AI investment, so I would say it probably is, but we don’t know enough at this point, and there are probably too many other candidates to buy in the meantime.

Q: How do I invest in green energy stocks, and do you have any names for me?

A: Well here’s one right here and that’s the Canadian uranium producer Cameco (CCJ). There is a nuclear renaissance going on. China just announced an increase in their plants under construction from 100 to 115. You have the new modular technology ready to take off in the US, and it uses uranium alloys, or uranium aggregates, so it’s impossible for a plant to go supercritical. You also have other countries reactivating nuclear plants that have been closed, and California even delayed its Diablo Canyon shutdown by 5 years. So Nuclear is back in play, and we have an absolute bottom in the stock here and it just dropped 37%, in case you needed any more temptation. So this would be a very attractive alternative energy play for the long term right here.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

1942 Grumman Wildcat on Guadalcanal

“Half of the global economy is in recession. Euroland is, Russia certainly is, and all of South America is. Add them all up, and North America is the only decent 2.5% growth area in the world. Rates are going down, not only because of the absence of global growth, but because inflation is very, very low,” said Bill Gross, CEO of bond giant PIMCO.

Global Market Comments

September 12, 2024

Fiat Lux

Featured Trade:

(The Mad SEPTEMBER traders & Investors Summit is ON!)

(THE 13 NEW TRADING RULES FOR 2025)

I’m sitting here at my Lake Tahoe lakefront mansion watching the Dow Average open down 700 points from its Friday intraday high.

It is one of those perfect picture postcard days, with a blue sky and cobalt lake. The fields outside are covered with snow crystals sparkling in the sunshine.

In these heart-stopping trading conditions, it is more important for me to teach you how to avoid doing the wrong thing than pursuing the right thing.

I am therefore going to introduce my 13 Rules for Trading in 2025. Tape them to the top of your computer monitor, commit them to memory, and maintain iron discipline.

They will save your wealth, if not your health. Here they are:

1) Dump all hubris, pretensions, and stubbornness. It will only cost you money.

2) The market is always right, even if all the prices appear wrong.

3) Only buy the pukeouts and sell the euphoria. Do anything in the middle, and you will get whipsawed.

4) Outright calls and puts are offering a far better risk/reward right now than vertical bull call and bear put spreads, which have a built-in short volatility element. It is also better to buy stocks and ETFs outright with a tight stop loss. This won’t last forever.

5) If you do trade spreads, you can no longer run them into expiration. If you have a nice profit, take it, don’t hang on to the last 30 basis points, even if it means paying more commission. The world could end three times, and then recover three times before the monthly expiration date rolls around.

6) Tighten up your stop loss limits. Not losing money is the key to winning in this market. There is nothing worse than having to dig yourself out of a hole. Don’t run hemorrhaging losses.

7) Buy every foreign crisis and sell every recovery. It really makes no difference to assets here in the US.

8) Several asset classes are becoming untradeable for long periods oil, and gas). Stay away and stick to the asset classes that are working (stocks and gold).

9) Keep positions small enough to sleep well at night. The doubled volatility will make up for your reduced risk. This is not the time to get greedy and bet the ranch.

10) Turn off the TV and just look at your screens and data. Public entertainers have no idea what the market is going to do, especially if their last job was sports reporting. Their job is to get you to watch the ads for General Motors and Interactive Brokers.

11) As the bull market in stocks enters its fifth year, too many traders, analysts, and strategists have become complacent. You are going to have to work for your crust of bread this year. This is an earnings, technology, and cash flow-driven bull, not a QE-driven momentum one.

12) It is clear that more money was allocated to high-frequency traders this year. That is driving the new, breakneck volatility, increasing stopouts. A sneeze now generates a 500-point intraday move.

13) It is no accident these tempestuous conditions are occurring in an election year. Some $10 billion will be spent on media convincing you how terrible this is. But over the long term, the stock market goes up 80% of the time.

Oh, and you better change your password from 12345 to DKFGGIDKFOKBJGELXPEVJBKDLKFBBJFCJCKVLBKGTY69!, and hope that the 69 doesn’t give you away. AI hackers are getting close.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Martin B26 Marauder