Global Market Comments

August 7, 2013

Fiat Lux

Featured Trade:

(MUSINGS OF A DINOSAUR),

(THE INSIDE STORY ON APPLE?S STEVE WOZNIAK), (AAPL)

Apple Inc. (AAPL)

I often get accused by readers of being a dinosaur, of being insensitive to the feelings of others, and of living as a relic from a previous age. Well, you all may be right. So it is with some amusement I run a piece that I have lifted from my friend, Dennis Gartman?s The Gartman Letter, on the difference between going to school in 1957 and 2010:

Scenario 1: Jack goes quail hunting before school and then pulls into the school parking lot with his shotgun in his truck?s gun rack.

1957 ? Vice Principal comes over, looks at Jack?s shotgun, compliments him on the model, goes to his car and gets his shotgun to show Jack.

2010 ? School goes into lock down, FBI called, Jack hauled off to jail and never sees his truck or gun again. Counselors called in for traumatized students and teachers.

Scenario 2: Johnny and Mark get into a fist fight after school.

1957 ? Crowd gathers. Mark wins. Johnny and Mark shake hands and end up buddies.

2010 ? Police called and SWAT team arrives ? they arrest both Johnny and Mark. They are both charged with assault and both expelled even though Johnny started it.

Scenario 3: Jeffrey will not be still in class, he disrupts other students.

1957 ? Jeffrey sent to the Principal?s office and given a good paddling by the Principal. He then returns to class, sits still and does not disrupt class again.

2010 ? Jeffrey is given huge doses of Ritalin. He becomes a zombie. He is then tested for ADD. The family gets extra money (SSI) from the government because Jeffrey has a disability.

Scenario 4: Billy breaks a window in his neighbor?s car and his dad gives him a whipping with his belt.

1957 ? Billy is more careful next time, grows up normal, goes to college and becomes a successful businessman.

2010 ? Billy?s dad is arrested for child abuse, Billy is removed to foster care and joins a gang. The state psychologist is told by Billy?s sister that she remembers being abused herself and their dad goes to prison. Billy?s mom has an affair with the psychologist. It then all becomes a reality TV show.

Scenario 5: Mark gets a headache and takes some aspirin to school.

1957 ? Mark shares his aspirin with the Principal out on the smoking dock.

2010 ? The police are called and Mark is expelled from school for drug violations. His car is then searched for drugs and weapons. The DEA then auctions off the car and keeps the money as criminal proceeds.

Scenario 6: Johnny takes apart leftover firecrackers from the Fourth of July, puts them in a model airplane paint bottle and blows up a red ant bed.

1957 ? Ants die.

2010 ? ATF, Homeland Security and the FBI are all called. Johnny is charged with domestic terrorism. The FBI investigates his parents ? and all siblings are removed from their home and all computers are confiscated. Johnny?s dad is placed on a terror watch list and is never allowed to fly again. Johnny?s name is placed in an NSA data base for life.

Scenario 7: Johnny falls while running during recess and scrapes his knee. He is found crying by his teacher, Mary. Mary hugs him to comfort him.

1957 ? In a short time, Johnny feels better and goes on playing.

2010 ? Mary is accused of being a sexual predator and loses her job. She faces 3 years in State Prison. Johnny undergoes 5 years of therapy. It all becomes another reality TV show.

So True!

Our Leaders Hard at Work Solving Nation?s Problems

Our Leaders Hard at Work Solving Nation?s Problems

Global Market Comments

August 6, 2013

Fiat Lux

Featured Trade:

(AUGUST 9 ZERMATT, SWITZERLAND STRATEGY SEMINAR),

(WHY US STOCKS ARE DIRT CHEAP),

(SPX), (IWM), (AAPL), (MS), (GS), (TSLA), (USO)

S&P 500 Large Cap Index (SPX)

iShares Russell 2000 Index (IWM)

Apple Inc. (AAPL)

Morgan Stanley (MS)

The Goldman Sachs Group, Inc. (GS)

Tesla Motors, Inc. (TSLA)

United States Oil (USO)

Come join me for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, August 9, 2013. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but happy.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $189, down from last year, thanks to the dramatic and welcome, as well as predicted depreciation of the Swiss franc against the US dollar.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

August 5, 2013

Fiat Lux

Featured Trade:

(THE MYSTERY OF THE STRONG EURO), (FXE), (EUO),

(THE LONG VIEW OF THE US ECONOMY)

CurrencyShares Euro Trust (FXE)

ProShares UltraShort Euro (EUO)

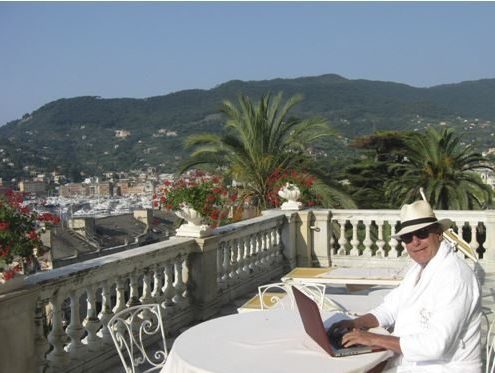

I sit here on the Carrera marble paved terrace of the Emperor?s Suite of the Imperial Hotel, in Santa Margherita Ligure on the Italian Riviera. As the sun sets into a languid Mediterranean, a distant church bell tolls, calling the evening mass. A flock of larks perform a spectacular aerobatic display overhead. A never-ending torrent of Vespa?s speed past on the road below, driven by texting cigarette smoking young women, like a swarm of angry wasps.

A plaque on the wall tells me that the peace treaty that ended WWI between Germany and Russia was negotiated in my bedroom in 1922. At night, I count no less than 22 goddesses, nymphs, and cherubs gazing down on me from the fresco above. It seems that the hotel was once a summer palace for some long forgotten European nobility. Offshore, the mega yachts of Russian oligarchs bob at anchor, drifting with the tide, our visiting nouveau nobility.

All of which leads me to ponder the question of the day: ?Why is all of this so damn expensive?

Dinner down at the market corner trattoria is costing me $100, and it rises to $200 or $300 for the nicer places. A five-minute taxi ride set me back $20. Even a lowly, genetically engineered Big Mac here costs $5.

It?s not like our continental cousins are rolling in cash these days. Now that Japan is on the mend, thanks to Abenomics, Europe has the world?s worst economy. The unemployment rate is 26% in Spain, and 40% for those under 25. Rolling layoffs are hitting the French auto industry, long the last bastion of the protected job. Italy is in its third painful year of recession. Greece is only just getting off its back after a European Central Bank enforced austerity. Chinks are even starting to appear in the armor of the German economy.

The weak economy has fueled non-stop political crises in Spain, Portugal, and Greece. Italy is not even sure it has a government. The debt crisis is never ending. Even European Central Bank president, Mario Draghi, seems to be taking a page out of Ben Bernanke?s playbook. He has recently said that interest rates will remain ?at or below current levels for an extended period.? With all of this angst, you would think that the Euro was the greatest short on the planet.

Except that it isn?t.

So we have to search for he reasons why. The great mystery among economists, politicians, bankers, and hedge fund managers here this summer is why the Euro is so strong, given these desperate fundamentals.

I am now two weeks into making the rounds with the European establishment, and to a man, they are short the beleaguered continental currency in their personal accounts. There are really only two opinions here. One is that the Euro is headed to parity against the dollar, down 24% from here. The other is that it will revisit the old 2002 low of 86 cents, down 32%.

The reality is that while the Fed?s balance sheet continues to expand at a breakneck pace, the ECB?s is shrinking. This is because European banks are repaying the subsidized loans they received at the height of the crisis to shore up their balance sheets. It is a distinctly positive development for the Euro.

Relentless austerity measures have the unanticipated side effect of increasing the continent?s current account surplus. Imports are drying up, further boosting the Euro, much to the grief of China. While the economic news here is bad, it is better than it was a year ago. This is what the year on year precipitous drop in sovereign bond yields is telling you. So there is a huge amount of bad news already in the Euro price.

Global currency positioning may also have something to do with it. This year, the big play was in selling short the yen, Australian and Canadian dollars, and emerging market currencies against the greenback. The Euro is simply benefiting from inertia, or getting ignored.

In the meantime, some big hedge funds have been throwing in the towel on the Euro and shifting capital to greener pastures elsewhere. With all of Europe seemingly competing for my beach chair, who is left to sell the Euro?

In the end, the strength of the Euro may end up becoming one of those ephemeral summer romances. There is no doubt that the American economy is improving, and further distancing itself from Europe.

This will turbocharge that great decider of foreign exchange rates?interest rate differentials. That?s when rising US rates and flat or falling European ones can send the buck in only one direction over the medium term, and that is northward.

Then my European friends should become as rich as Croesus, and the price of that Big Mac will come more into line with the one I buy at home.

The Dalliance With the Euro Will Be Strictly a Summertime Affair

The Dalliance With the Euro Will Be Strictly a Summertime Affair

A number of analysts, and even some of those in the real estate industry, are finally coming around to the depressing conclusion that there will never be a recovery in residential real estate. Long time readers of this letter know too well that I have been hugely negative on the sector since late 2005, when I unloaded all of my holdings. However, I believe that ?forever? may be on the extreme side. Personally, I believe there will be great opportunities in real estate starting in 2030.

Let?s back up for a second and review where the great bull market of 1950-2007 came from. That?s when a mere 50 million members of the ?greatest generation?, those born from 1920 to 1945, were chased by 80 million baby boomers born from 1946-1962. There was a chronic shortage of housing, with the extra 30 million never hesitating to borrow more to pay higher prices. When my parents got married in 1948, they were only able to land a dingy apartment in a crummy Los Angeles neighborhood because he was an ex-Marine. This is where our suburbs came from.

Since 2005, the tables have turned. There are now 80 million baby boomers attempting to unload dwellings on 65 million generation Xer?s who earn less than their parents, marking down prices as fast as they can. As a result, the Federal Reserve thinks that 50% of American homeowners either have negative equity, or less than 10% equity, which amounts to nearly zero after you take out sales commissions and closing costs. That comes to 70 million homes. Don?t count on selling your house to your kids, especially if they are still living rent-free in the basement.

The good news is that the next bull market in housing starts in 20 years. That?s when 85 million millennials, those born from 1988 to yesterday, start competing to buy homes from only 65 million gen Xer?s. By then, house prices will be a lot cheaper than they are today in real terms. The ongoing melt down in residential real estate will probably knock another 25% off real estate prices. Think 1982 again. Fannie Mae and Freddie Mac will be long gone, meaning that the 30-year conventional mortgage will cease to exist. All future home purchases will be financed with adjustable rate mortgages, forcing homebuyers to assume interest rate risk, as they already do in most of the developed world. With the US budget deficit problems persisting beyond the horizon, the home mortgage interest deduction is an endangered species, and its demise will chop another 10% off home values.

For you millennials just graduating from college now, this is a best-case scenario. It gives you 15 years to save up the substantial down payment banks will require by then. You can then swoop in to cherry pick the best neighborhoods at the bottom of a 25-year bear market. People will no doubt tell you that you are crazy, that renting is the only safe thing to do, and that home ownership is for suckers. That?s what people told me when I bought my first New York coop in 1982 at one-tenth its current market price. Just remember to sell by 2060, because that?s when the next intergenerational residential real estate collapse is expected to ensue. That will leave the next, yet to be named generation, holding the bag, as your grandparents are now.

Global Market Comments

August 2, 2013

Fiat Lux

Featured Trade:

(AUGUST 9 ZERMATT, SWITZERLAND STRATEGY SEMINAR),

(THE WORLD?S LARGEST SOLAR PLANT),

(DINNER WITH JOSEPH STIGLITZ)

Come join me for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, August 9, 2012. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but happy.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $189, down from last year, thanks to the dramatic and welcome, as well as predicted depreciation of the Swiss franc against the US dollar.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Unfortunately, I know Blythe, California too well. This natural blast furnace is in a God forsaken corner of the state where I hunted jackrabbits as a kid, the Indians survived on Gila monsters for protein, and it regularly reaches 130 degrees in the shade.

It is also where Peter Fonda and Dennis Hopper crossed the ?bridge of no return? over the Colorado River in the cult flick Easy Rider. Blythe has unsurprisingly become ground zero for the global thermal solar movement, which I have been chronicling with great interest in these pages (see ?The Solar Boom in California?).

The entire industry has just taken a quantum leap forward with the approval of a massive 2.8 megawatt plant to be built by Solar Trust of America, a joint venture between two European companies. The Solar Trust project qualified for $900 million in cash grants and additional loan guarantees from the Department of Energy.

The facility will deploy arrayed mirrors over 7,025 acres, or 11 square miles, aimed at a conventional steam turbine. This will generate enough electricity for 2 million homes, about 15% of the total in California. With the Tres Amigas facility in New Mexico coming online soon, this raises the possibility of the Golden State selling excess green, carbon free power to the rest of the rest of the west.

Sorry guys, no equity play here. The new plant will be built and operated by privately held European companies that have been flocking to the US with their advanced technology to cash in on our generous subsidies. But it does make other publicly listed smart grid, transmission, and storage plays out there more interesting. It is all part of a huge, new alternative energy industry that is growing far faster than most investors realize.