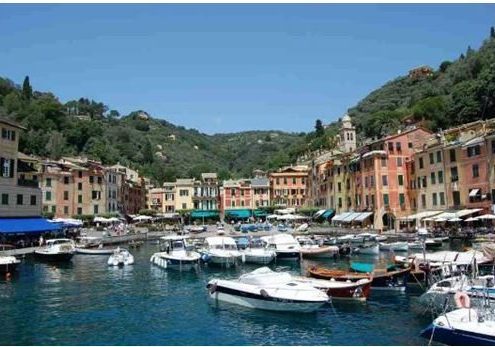

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting near Portofino, Italy on the Italian Riviera, on Thursday, July 25, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $205.

The lunch will be held at a major hotel on the beach in the village of Santa Margherita Ligure, the details of which will be emailed with your purchase confirmation. The town is easily accessible by train from Genoa, and the hotel is about a ten-minute walk from the train station.

Bring your broad brimmed hat, sunglasses, and suntan lotion. You will need them. The dress is casual. Accompanying spouses and significant others will be free to use the beach below and bill drinks to my tab as my guest. Together we will plot the future of western civilization.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

May 21, 2013

Fiat Lux

Featured Trade:

(JULY 2 NEW YORK STRATEGY LUNCHEON),

(THE END OF THE COMMODITY SUPER CYCLE)

(GLD), (SLV), (CU), (BHP), (USO), (PALL), (PPLT),

(CORN), (WEAT), (SOYB), (DBA), (FXA)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

First Trust ISE Global Copper Index (CU)

BHP Billiton Limited (BHP)

United States Oil (USO)

ETFS Physical Palladium Shares (PALL)

ETFS Physical Platinum Shares (PPLT)

Teucrium Corn (CORN)

Teucrium Wheat (WEAT)

Teucrium Soybean (SOYB)

PowerShares DB Agriculture (DBA)

CurrencyShares Australian Dollar Trust (FXA)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three-course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $209.

The formal luncheon will run from 12:00 to 2:00 PM. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a prestigious private club on Central Park South, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

May 20, 2013

Fiat Lux

Featured Trade:

(INTRODUCING THE MAD DAY TRADER),

(A SPECIAL NOTE TO TRADE ALERT FOLLOWERS)

(REVISITING THE FIRST SILVER BUBBLE), (SLV)

iShares Silver Trust (SLV)

I am pleased to announce the introduction of my first major upgrade, The Mad Day Trader. While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader will exploit money-making opportunities over a ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Mad Day Trader uses a dozen proprietary short-term technical and momentum indicators to generate buy and sell signals. These will be sent to you by text message and email for immediate execution. During normal trading conditions, you should receive three to five alerts a day.

As with our existing service, you will receive ticker symbols, entry and exit points, targets, stop losses, and regular real time updates. At the end of each day, a separate short-term model portfolio will be sent to you and posted on the website.

The new service will generate long and short selling signals for a range of widely traded exchange traded funds (ETF?s). These include stock indexes (SPY), bonds (TLT), (TBT), foreign exchange (FXY), (FXE), (FXA), commodities (CU), (CORN), energy (USO), (UNG), and precious metals (GLD), (SLV). There is also a special focus on the leading hot stocks of the day. This will be followed up with a series of educational webinars that will be an important resource for the serious trader.

The Mad Day Trader service will be provided out of Chicago by my old friend and industry veteran, Jim Parker. Jim is a 40-year veteran of the financial markets and has long made a living as an independent trader in the pits at the Chicago Mercantile Exchange. He has worked his way up from a junior floor runner, to advisor to some of the world?s largest hedge funds. We are lucky to have him on our team and gain access to his experience, knowledge, and expertise.

I have been following his alerts for the past five years, and his market timing has become an important part of the ?unfair advantage? that I provide readers. The time has finally come to offer Mad Day Trader as a stand-alone product.

A trading service with this degree of success and sophistication normally costs $20,000 a year. As a client of The Mad Hedge Fund Trader, you will be able to purchase Mad Day Trader alone for $2,000 a year or $699 a quarter. Or you can buy it as a package together with Global Trading Dispatch, which we call Global Trading Dispatch Pro, for $4,000 a year, a 20% discount to the full retail price. Give yourself the unfair advantage you always wanted and buy the combined package.

As part of the initial launch, I will send out Mad Day Trader free to all current paid subscribers of Global Trading Dispatch for the next 30 days. That will give you the opportunity to decide if the new service can enhance your trading performance. When the free service expires, we will send you a link to purchase a full subscription. There will be no automatic billing of current subscribers.

Part of the deal is that I want to hear from you on how we can evolve Mad Day Trader to make it more user friendly and coherent to better meet your needs. Sometimes, a couple of old warhorses like us forget how much our specialized language is incomprehensible to the outside world. Just send us an email with suggestions to support@madhedgefundtrader.com.

As of today, we will be sending out two types of Trader Alerts, medium term ones from the Mad Hedge Fund Trader, and short term ones from the new Mad Day Trader service. Please be careful not to confuse the two.

We have done what we can to distinguish the two, using different logos, colors, fonts, and subject. However, in the heat of battle I understand that it is all too easy to speed-read your data sources and jump to conclusions. As a back up, each service will post its model trading portfolio on the website after the close of each day.

These two services will evolve to better meet your needs, and we appreciate your input whenever possible.

With smoke still rising from the ruins of the recent silver crash, I thought I?d touch base with a wizened and grizzled old veteran who still remembers the last time a bubble popped for the white metal. That would be Mike Robertson, who runs Robertson Wealth Management, one of the largest and most successful registered investment advisors in the country.

Mike is the last surviving silver broker to the Hunt Brothers, who in 1979-80 were major players in the run up in the ?poor man?s gold? from $11 to a staggering $50 an ounce in a very short time. At the peak, their aggregate position was thought to exceed 100 million ounces.

Nelson Bunker Hunt and William Herbert Hunt were the sons of the legendary HL Hunt, one of the original East Texas wildcatters, and heirs to one of the largest Texas fortunes of the day. Shortly after president Richard Nixon took the US off the gold standard in 1971, the two brothers became deeply concerned about financial viability of the United States government. To protect their assets they began accumulating silver through coins, bars, the silver refiner, Asarco, and even tea sets, and when it opened, silver contracts on the futures markets.

The brother?s interest in silver was well known for years, and prices gradually rose. But when inflation soared into double digits, a giant spotlight was thrown upon them, and the race was on. Mike was then a junior broker at the Houston office of Bache & Co., in which the Hunts held a minority stake, and handled a large part of their business. The turnover in silver contracts exploded. Mike confesses to waking up some mornings, turning on the radio to hear silver limit up, and then not bothering to go to work because he knew there would be no trades.

The price of silver ran up so high that it became a political problem. Several officials at the CFTC were rumored to be getting killed on their silver shorts. Eastman Kodak (EK), whose black and white film made them one of the largest silver consumers in the country, was thought to be borrowing silver from the Treasury to stay in business.

The Carter administration took a dim view of the Hunt Brothers? activities, especially considering their funding of the ultra-conservative John Birch Society. The Feds viewed it as an attempt to undermine the US government. The proverbial sushi hit the fan.

The CFTC raised margin rates to 100%. The Hunts were accused of market manipulation and ordered to unwind their position. They were subpoenaed by Congress to testify about their motives. After a decade of litigation, Bunker received a lifetime ban from the commodities markets, a $10 million fine, and was forced into a Chapter 11 bankruptcy.

Mike saw commissions worth $14 million in today?s money go unpaid. In the end he was only left with a Rolex watch, his broker?s license, and a silver Mercedes. He still ardently believes today that the Hunts got a raw deal, and that their only crime was to be right about the long term attractiveness of silver as an inflation hedge. Nelson made one of the great asset allocation calls of all time and was punished severely for it. There never was any intention to manipulate markets. As far as he knew, the Hunts never paid more than the $20 handle for silver, and that all of the buying that took it up to $50 was nothing more than retail froth.

Through the lens of 20/20 hindsight, Mike views the entire experience as a morality tale, a warning of what happens when you step on the toes of the wrong people.

And what does the old silver trader think of prices today? Mike saw the current collapse coming from a mile off. He thinks silver is showing all the signs of a broken market, and doesn?t want to touch it until it hits the $20?s. But the white metal?s inflation fighting qualities are still as true as ever, and it is only a matter of time before prices once again take another run to the upside.

Silver is Still a Great Inflation Hedge

Silver is Still a Great Inflation Hedge

Global Market Comments

May 17, 2013

Fiat Lux

Featured Trade:

(HANGING OUT WITH CONGRESSMAN BARNEY FRANK),

(THE MOST FUNCTIONAL WORD IN THE ENGLISH LANGUAGE),

(AN EVENING WITH NOBEL PRIZE WINNER MICHAEL SPENCE)

(EEM),(EWZ), (EWY), (EWT), (EWS),

(EWH),(TF), (IDX), (EWM), (FXI), (EWJ)

iShares MSCI Emerging Markets Index (EEM)

iShares MSCI Brazil Capped Index (EWZ)

iShares MSCI South Korea Capped Index (EWY)

iShares MSCI Taiwan Index (EWT)

iShares MSCI Singapore Index (EWS)

iShares MSCI Hong Kong Index (EWH)

Thai Capital Fund Inc. (TF)

Market Vectors Indonesia Index ETF (IDX)

iShares MSCI Malaysia Index (EWM)

iShares FTSE China 25 Index Fund (FXI)

iShares MSCI Japan Index (EWJ)

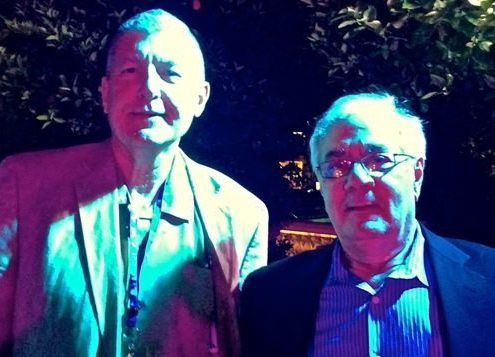

One of the highlights of last week?s SkyBridge Alternatives Conference was the blowout party on Wednesday night (click here for the blow by blow description).

Seeking refuge from a band that was blasting my ears out, and fleeing the nubile young bodies that kept bumping up against me and spilling my margaritas, I sought out a safe haven. There, cloistered in the quietest, darkest refuge from the event, far beyond the most distant swimming pool and palm tree, I found former congressman, Barney Frank, sitting in a lounge chair.

If this name piques your memory, it is because Barney was a co-sponsor of the 2011 Dodd-Frank bill, the most sweeping regulation of the financial industry since the Securities Act of 1933. As chairman of the House Financial Services Committee, he became a familiar figure during the endless hearings for the controversial legislation.

To say that Barney is a man with strong opinions is probably the understatement of the century. If you make a statement he believes is factually incorrect, he will shout you down until he has the last word. I watched him do exactly that when he sat on a discussion panel with republican strategist, Carl Rove. The two went at it like cats and dogs for ten minutes, the rest of the participants sitting there in awe, with their mouths hanging open.

Barney is upset that the US is still spending massively to defend Europe 20 years after the collapse of the Soviet Union, their only real enemy. They can easily afford to pick up the tab themselves. The US has vastly overextended itself with military commitments. We can no longer afford to be the world?s policeman.

Sunni and Shia Muslims have been hating each other for a thousand years. We are not going to change that in a few years of spending a few trillion dollars and thousands of lives. You can?t use the US military for social engineering. Attempting to do so just pisses everyone off and only creates more American enemies.

Banks are now bigger than they were before the financial crisis, largely because the government required them to post more capital. But ?too big to fail? has been solved. The new Resolution Authority has the power to wipe out shareholders in the wake of future poor business decisions. That did not exist in 2008. No more bonuses will be paid for large losses.

Corporate tax reform is a big priority, but is far more difficult than people realize. The people you take money away from get much angrier than the beneficiaries of change are made happy. That is a problem in the current big money election environment.

Son of a New Jersey truck stop operator, Barney went on to obtain a degree from the Harvard Law School. He entered politics in 1972 when he joined the Massachusetts House of Representatives. Frank was elected to congress in 1980, representing the western Boston suburbs. He went on to win reelection 12 consecutive times.

Frank first went to Washington about the same time as I joined the White House Press Corps as a correspondent for The Economist magazine. I didn?t know him personally, but shared with him his frustration in trying to explain economic issues to then president Ronald Reagan. When I asked the president from home state of California why his tax cuts gave himself the largest percentage reduction, he answered that ?It?s because I pay the most taxes.? Go figure.

What I found most fascinating about Barney was his recollections of the Boston political scene during the 1960?s. In the past year, I have read biographies on John Kennedy, Robert Kennedy, Ted Kennedy, and the most interesting, their father, Joe Kennedy. If you ever want to gain insight into one of history?s best natural traders, finest businessmen, and the first chairman of the SEC, read The Founding Father by Richard Whalen. Barney knew all of these men, and listening to his first hand stories about them was a real education.

All of this great information came at the price of sitting downwind from his cigar smoke for two hours. As a journalist, I long ago learned that if you want to get the real dope, you sometimes have to pay the price.

Passed on by a friend with my apologies:

Well, it's shit... That's right, shit!

Shit may just be the most functional word in the English language.

You can smoke shit, buy shit, sell shit, lose shit, find shit, forget shit, and tell others to eat shit.

Some people know their shit, while others can't tell the difference between shit and Shinola.

There are lucky shits, dumb shits, and crazy shits.

There is bullshit, horse shit, and chicken shit.

You can throw shit, sling shit, catch shit, shoot the shit, or duck when the shit hits the fan.

You can give a shit or serve shit on a shingle.

You can find yourself in deep shit or be happier than a pig in shit.

Some days are colder than shit, some days are hotter than shit, and some days are just plain shitty.

Some music sounds like shit, things can look like shit, and there are times when you feel like shit.

You can have too much shit, not enough shit, the right shit, the wrong shit or a lot of weird shit.

You can carry shit, have a mountain of shit, or find yourself up shit creek without a paddle.

Sometimes your breath smells like shit.

Sometimes everything you touch turns to shit and other times you fall in a bucket of shit and come out smelling like a rose.

When you stop to consider all the facts, it's the basic building block of the English language.

And remember, once you know your shit, you don't need to know anything else!!

You could pass this along, if you give a shit; or not do so if you don't give a shit!

Well, shit, it's time for me to go.

Just wanted you to know that I do give a shit and hope you had a nice day without a bunch of shit.

But, if you happened to catch a load of shit from some shit-head........... Well, Shit Happens!!!

HOPE YOUR SHITTY DAYS ARE FEW AND FAR BETWEEN