Until now, the country?s power grid has been divided into three unconnected, noncompetitive kingdoms (in the spirit of Game of Thrones), making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from periodic brown outs and sky high prices, electricity was given away virtually for free in Texas.

A group of power companies is now proposing to build the $1 billion Tres Amigas superstation in Clovis, New Mexico that would connect all three grids. The plant would use advanced superconducting technology that will send five gigawatts of power down cables cooled at 300 degrees below zero. Construction is expected to reach completion in 2014.

The facility would solve a major headache of alternative energy planners, and will no doubt accelerate development. It would allow the enormous wind farms in the Lone Star State to ship energy to the power hungry coasts. Ditto for the mega solar projects proposed in the Southwest deserts, and the big geothermal plants being built in Nevada. With the Department of Energy having already sent tidal waves of government cash towards the sector, the timing couldn?t be better.

Global Market Comments

April 3, 2013

Fiat Lux

Featured Trade:

(APRIL 19 CHICAGO STRATEGY LUNCHEON),

(PULLING THE RIPCORD ON UNITED), (UAL),

(EASTER AT INCLINE VILLAGE)

United Continental Holdings, Inc. (UAL)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $199.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

It has definitely been a tough year for ski bums, massage therapists, and black jack dealers at Incline Village, Nevada. After getting a prodigious eight feet of snow over one weekend at Christmas, there has been nary a flake since then. Hats off to the Diamond Peak ski resort for trucking down enough snow from the higher elevations to keep the bunny slope running.

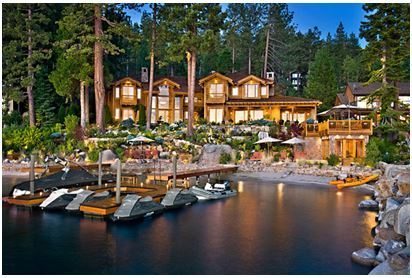

However, the real estate business is another kettle of fish. After a six-year hiatus, business is now booming in the High Sierras, as it is throughout the West. Until December, my real estate agent had only sold one house since 2007, and that to me, a nice little foreclosure deal where I picked up a beachfront estate for pennies on the dollar. Since then she has sold six residences, half to Chinese buyers for cash, and has another three in escrow. I guess when it rains, it pours.

I was surprised to learn that my neighbor, Oracle mogul, Larry Ellison, has placed on the market his nearby Glenbrook compound for $28.5 million. The property includes a six bedroom, eight bathroom 9,242 square foot main house on 2.6 acres, with 230 feet of frontage on the east shore of Lake Tahoe (click here for the listing).

I guess his existing 7.6 acre estate with 420 feet of beachfront next door is enough. Larry has been accumulating ultra high-end properties all over the world for the past two decades, more than he could ever possibly live in. Who knew these were investments, and not conspicuous consumption? This is the first time I have ever seen Larry sell anything. Is this a tell?

You can?t swing a dead cat in Incline Village without hitting a billionaire, so the public events are incredibly well funded. Junk bond king, Michael Milliken, pays for the Fourth of July fireworks, as the celebration falls on his birthday. On Sunday, the ski slopes were amply planted with plastic eggs, some containing candy, others, free lift tickets. Even the pet hospital here is better equipped than most public hospitals.

So I knew the Easter egg hunt would not disappoint. Perhaps, the eggs contained real gold coins. I have to tell you that it was a total blast wading through 500 hyped up children. Click here for the video of the event and hit the ?PLAY? arrow, if for no other reason than to admire the spectacular Lake Tahoe scenery.

This Can Be Yours for $28.5 Million

Global Market Comments

April 2, 2013

Fiat Lux

Featured Trade:

(APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON),

(THE US DOMINANCE IN HIGHER EDUCATION),

(AN EVENING WITH JAMES BAKER III),

(THE CORN CRASH CONTINUES),

(CORN), (WEAT), (SOYB), (DBA)

Teucrium Corn (CORN)

Teucrium Wheat (WEAT)

Teucrium Soybean (SOYB)

PowerShares DB Agriculture (DBA)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $189.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

I spent the weekend attending a graduation in Washington State, a stone?s throw from where the 2010 Winter Olympics were held. While sitting through the tedious reading of 550 names, and listening to the wailing bagpipes, I did several calculations on the back of the commencement program.

I came to some startling conclusions. Higher education has grown into a gigantic industry, with a massively positive impact on America?s balance of payments, generating an impact on the world far beyond the dollar amounts involved. There are 671,616 foreign students in the US (90,000 from China alone) paying an average out-of-state tuition of $25,000 each, creating a staggering $16.8 billion of payments a year.

On a pro rata basis, that amounts to a serious part of our total surplus in services in 2011 of $188 billion, not far behind financial services (click here for the Bureau of Economic Analysis site). A fortunate few, backed by endowed chairs and buildings built by wealthy and eager parents, land places at prestigious Universities like Harvard, Princeton, Yale, and the University of California at Berkeley. The overwhelming majority, however, enroll in the provinces in a thousand rural state universities and junior colleges that most of us have never heard of.

The windfall has enabled once sleepy little schools to build themselves into world class institutions of higher learning with 30,000 or more students, boasting state of the art facilities, much to the joy of local residents and state education officials. Furthermore, this dominance of education industry is steadily Americanizing the global establishment.

I can?t tell you how many times over the decades I have run into the Persian Gulf sovereign fund manager who went to Florida State, the Asian CEO who attended Cal State Hayward, or the African finance minister who fondly recalled rooting for the Kansas State Wildcats.

Those who constantly bemoan the impending fall of the Great American Empire can take heart by merely looking inland at these impressive degree factories. It also might give them an explanation of why the dollar is so strong in the face of absolute gigantic and perennial trade deficits.

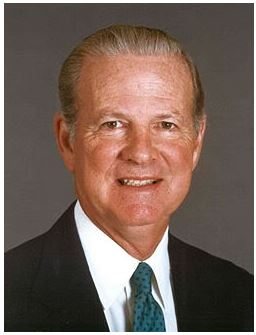

?We have 3,500 nuclear weapons left over from the cold war we don?t need, they take 20 seconds to re-aim, we?re not afraid to use them. And by the way, they?re already aimed at you.? That is the approach James Baker III thinks America should take with Iran, Ronald Reagan?s Chief of Staff and Secretary of the Treasury and George H.W. Bush?s Secretary of State.

At the same time we should be talking to the regime in Tehran, while doing everything we can to support the reformers, tighten sanctions, and enlist Europe?s help. Baker does not see a military solution in Iran, even though their potential to create instability in the region is enormous. This was one of dozens of amazing insights I gained chatting with the wily Texas lawyer during an evening in San Francisco.

Baker is happy to take on the ?America Bashers?, pointing out that the US still plays a dominant role in the UN, NATO, the IMF, and the World Bank. It accounts for 25% of global GDP, and its military is unmatched. The US spread globalization, and the spectacular growth of China and India is largely the result of open American trade policies, raising standards of living globally.

But the US can?t take its leadership role for granted. The biggest threats to American dominance are the runaway borrowing and entitlements. US debt to GDP will soar to over 100% in the near future, the highest level since WWII. This is unsustainable, is certain to bring a return of inflation, and unless dealt with, will lead to a long term American decline on the world stage.

Massive trade and capital flow imbalances also have to be addressed. The 82-year-old ex-Marine, who confesses to being the only Treasury Secretary in history who never took an economics class, believes that the advantageous rates that the government now borrows at are not set in stone.

Baker is the man who engineered an end to the cold war with a whimper, and not a bang. He thinks that ?even our power has its limits,? and that there is a risk of strategic overreach.? With the US politically evenly divided, Congress has degenerated from debating teams into execution squads, and consensus is impossible. The media are partly to blame, especially bloggers who propagate wild conspiracy theories, as confrontation sells better than accommodation.

Regarding the financial crisis, we need to end ?too big to fail? and embark on re-regulation, not strangulation. All in all, it was a fascinating few hours spent with a piece of living history who still maintains his excellent contacts in the diplomatic and intelligence communities.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

April 1, 2013

Fiat Lux

Featured Trade:

(GET READY FOR THE NEXT GOLDEN AGE)