Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three-course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $209.

The formal luncheon will run from 12:00 to 2:00 PM. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a prestigious private club on Central Park South, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

June 4, 2013

Fiat Lux

Featured Trade:

(AUGUST 9 ZERMATT STRATEGY SEMINAR),

(BREAKFAST WITH PIMCO?S MOHAMED EL-ERIAN),

(TAKE A RIDE IN THE NEW SHORT JUNK ETF),

(JNK), (SJB), (CORN), (TBT)

SPDR Barclays High Yield Bond (JNK)

ProShares Short High Yield (SJB)

Teucrium Corn (CORN)

ProShares UltraShort 20+ Year Treasury (TBT)

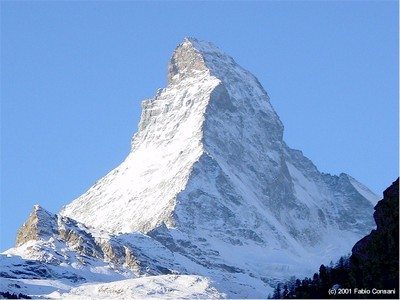

Come join me for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, August 9, 2012. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but happy.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $189, down from last year, thanks to the dramatic and welcome, as well as predicted, depreciation of the Swiss franc against the US dollar.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

June 3, 2013

Fiat Lux

Featured Trade:

(HARRY S. DENT, JR. ON HEDGE FUND RADIO),

(SPY), (IWM), (UUP), (GLD), (SLV), (USO), (XLE), (TLT)

(A RELIGIOUS EXPERIENCE)

SPDR S&P 500 (SPY)

iShares Russell 2000 Index (IWM)

PowerShares DB US Dollar Index Bullish (UUP)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

United States Oil (USO)

Energy Select Sector SPDR (XLE)

iShares Barclays 20+ Year Treas Bond (TLT)

Your stock portfolio will get decimated by a stock market crash that could take the Dow average down 60% to 6,000 or lower. There will be no place to hide, as gold, silver, oil, real estate will see declines of similar magnitude.

Given the fresh dose of uncertainty besieging the markets these days, I thought I'd touch base with my pal, co-conspiring Eagle Scout, and fellow traveler, Harry S. Dent, Jr. I was inviting a bomb thrower to tea.

I listen to Harry, not because he is an iconoclast, one of the few original thinkers out there, and sometimes, a complete wild man, although these are all admirable qualities to be found in a global strategist. I listen to him because in the past, he has been as right as rain.

So when an opportunity arose to bag him for Hedge Fund Radio, I jumped. It would give my listeners an opportunity to sort through the tealeaves, work through alternative scenarios for the future of disparate asset classes, and test competing investment theories. What I got was nothing less than a Vulcan mind meld.

Harry argues passionately that we are witnessing the end of the third great bubble in debt, hot on the heels of earlier forays into madness in technology stocks and real estate. Add public and private debt from all sources, and it totals $130 trillion, the greatest accumulation of IOU?s in history. The Federal Reserve is now manipulating all markets, and the exercise is certain to end in tears. The only way out from this will be to suffer an economic and financial crisis worse than we have seen to date.

A key part of Harry?s work revolves around generational spending patterns. Americans see spending peak when they reach the ages of 46-50, and bleed off from there. He blends this perspective in with historical data on demographics and some traditional Eliot Wave Analysis to produce one of the most refined long-term views in the marketplace.

Harry runs an independent research boutique, which has accurately predicted many of the major moves in financial markets during the past 25 years.

His unique blend of demographic research, identification of global consumer spending patterns, and long-term cycle analysis, really makes Harry one of a kind. Foreign governments, major hedge funds, financial advisors, and individuals are all just wild about Harry. They have found his advice indispensible when navigating the sticky shoals of international finance.

Growth of the national debt (TLT) continues to be a major headache. Since the Great Depression, public spending has grown steadily, from supporting small town 'Mayberry' to the equivalent of a New York City. While much of the early deficit explosion resulted from WWII and Vietnam, all of the recent growth has come from entitlements, like Medicare and Social Security. Government estimates of $46 trillion in unfunded liabilities are wildly inaccurate, with $70 trillion closer to reality.

Harry's advice to investors is to use any strength in coming months to unload stocks (SPY) (IWM). He would sell all remaining holdings in gold (GLD) and silver (SLV). He also wants to dump oil (USO) and other energy plays (XLE). And he believes we are about to enter a prolonged period of dollar strength. His favorite vehicle for the greenback is the ETF (UUP), which offers investors a long position against a basket of foreign currencies.

Harry is a native of South Carolina, who like Federal Reserve governor Ben Bernanke, went off to Harvard where he got his MBA. His career then took him to the top-notch private equity firm, Bain & Co., where he reported to recent presidential candidate, Mitt Romney.

After years of consulting with Fortune 100 companies, he found gaping holes in their understanding of the global economy. That spurred him to take off and create his own research boutique to address these grievous shortfalls in understanding.

To learn more about Harry S. Dent, Jr. please go to his website at http://www.harrydent.com/.

In addition to Harry?s many talents, he is also a prolific writer. His most recent tome is The Great Crash Ahead (click here to purchase from Amazon). You can guess the topic. He has also published The Great Boom Ahead (1993) (click here to purchase from amazon),? The Roaring 2000?s (1999) (click here to purchase from Amazon),? and The Great Depression Ahead (2008) (click here to purchase from Amazon). Note that the timing on all of these volumes is prescient.

Purchasing a download of the entire interview for $4.95 is very simple. Just go to the HEDGE FUND RADIO menu tab and click on the pull down menu for RADIO SHOW (click here for the link at http://madhedgefundradio.com/radio-show/). Click on the green BUY NOW button and complete the order form. A blue link will appear telling you to ?click here to proceed?. Then click on the small blue box with the question mark inside to download. Hit the PLAY arrow to listen. You can pause, fast forward, or rewind at any time.

A couple times a year, I feel the need to abandon civilization and contemplate the meaning of life, while accomplishing a great physical challenge. For me, this is a mandatory religious experience.

That?s why I was up at Lake Tahoe last week, completing a 100 mile hike in eight days, mostly over 8,000 feet, carrying a 60 pound pack. I fast while accomplishing this, eating only 600 calories a day of fruit and nuts. I?m down about ten pounds on the since I began.

Hint to readers: almonds have unique, hunger fighting chemical properties. Eat a handful before you go to sleep, and hunger pangs won?t wake you in the middle of the night. I lost about ten pounds, which works out to about one belt loop off the waist. I plan on doing some industrial strength eating this summer during my two-month European strategy luncheon tour, so I need to make some room.

My friends call this a death march, and worry about my health. I think of it as a cleansing and a general stocktaking, and I feel great! I always go alone. How many other 61 year olds do you know who are in condition to do this sort of thing? Sure, I might break my ankle someday, die of exposure, and have my bones scattered by wild animals. Who cares? It would be a good death. It?s worth it.

The scenery up there is so spectacular that I almost didn?t feel the pain. Almost. On more than one occasion, while gazing at the endless shades of blue the pristine waters offered, I tripped on a rock and almost fell flat on my face. Sorry, but a broken arm is not on the schedule this year. While hiking along the East Ridge, succeeding mountain ranges in northern Nevada explored every kind of purple.

I managed to summit each major peak around the body of water the Washoe Indians called ?da-ow-a-ga?, or edge of the lake, which they considered the origin of the universe. Those included Squaw Peak (8,885), Mt Tallac (9,735 feet), Monument Peak (10,067), and Mount Rose (10,776 feet). Snowfields were a bit of a challenge at the higher elevations this late in spring, but my trusty ice ax and crampons saw me through.

I was constantly reminded that I was in the ?Old West? by the many artifacts I encountered. Prominent granite boulders displayed prehistoric Indian petroglyphs. I found a few abandoned log cabins, complete with potbelly stoves and canned food from the 1950?s. Rusted out cast iron mining equipment was strewn about everywhere. Along the old Pony Express Trail one finds old horseshoes and the occasional ancient bottle turned purple by the sun.

Lake Tahoe supplied all of the water and bracing wood for the Comstock mining boom of the 1870?s. A hundred years ago, not a single tree was left standing, except for the southwest section of the lake owned by mining baron ?Lucky Baldwin? who won it in a card game and made it his private retreat. It was all covered in meticulous and colorful detail by a budding young newspaperman who went by the name of Mark Twain.

My ambitious goals often saw me hiking well into darkness. After the batteries died on my three backup headlamps, that flashlight app on the iPhone 5s proved a real lifesaver. It?s good for a full hour, and illuminates the eyes of on looking wildlife a bright yellow up to 200 yards.

I often looked behind to make sure a mountain lion was not stalking me. Don?t worry. Only 20 people have been killed by mountain lions in California over the last 100 years. More than that are killed by their pet dogs in the Golden State every year. Besides, I am good at staring down mountain lions and black bears. It is just a matter of attitude.

I still wanted to follow the market and write my daily newsletter during my ordeal. So I repaired nightly to my lakefront estate at Incline Village to soak in the hot tub and re-bandage my feet. The slow business recovery has made its way here, with some commercial properties vacant for years now occupied by a new generation of entrepreneurs. Nothing beats creative destruction as an economic accelerant. God bless America!

The old souvenir stand for the Ponderosa Ranch, of the TV series Bonanza fame, is now the Tunnel Creek Station Caf? and bike rental. Good luck to Patty and Max! The nearby Flume Trail offers some of the best mountain biking in the world. I know because I was almost run over several times (sorry, sir!).

Of course, I am not just thinking great thoughts during these hikes. An endless series of economic and market data points are constantly churning around in the back of my mind, and I occasionally reach a ?Eureka? moment. I keep a pen and notebook in my pack so I don?t forget these great revelations.

It was during a similar expedition up the face of the Matterhorn in the Swiss Alps (14,692 feet) last summer when I realized that the S&P was beginning a long run up that would take it to 1,600 by April. I?ll never forget the expression on my guide?s face when I stopped midpoint through an abseil and started feverishly writing. That little maneuver cost me a bottle of schnapps. The readers and Trade Alert followers prospered mightily.

What is this year?s ?Eureka? conclusion? The stock market could keep going up until August. After that, stocks will be unable to ignore an impending ?taper?, or the complete end of quantitative easing. The bond market told us as much last week.

I have been doing this sort of thing since I was 22, and in somewhat better shape. Then, I was one of the few foreigners attending karate school in Japan, learning the iron discipline and focus of samurai warriors, known as ?bushido?.

Every February, we underwent ?kangeiko?, or ?winter training. This involved the entire class running the five miles around Tokyo?s Imperial palace in a pack, suffering freezing temperatures, barefoot, every day for a week. When we returned to the dojo, we where hosed down with ice-cold water, our feet senseless, bloody stumps. Then we would train for three more hours.

The idea was that the extreme pain and exhaustion would deliver insights into ourselves and the world at large. It worked. At least one current reader endured the experience with me and is still alive. Remember that, David? By the way, thanks for breaking my nose.

On the way home I stopped in Sacramento for a well deserved double cheeseburger, fries, and chocolate shake at In and Out Burger. You can?t take this diet and health thing too seriously.

Well, next week, it is back to normal. I?ll be glued in front of my screens scouring the planet for the next great trading opportunity, although, I?m not sure I?ll find many. Buying market tops is against my nature. What are you supposed to do when all of your forecasts and predictions come true? I have a feeling that the answer is not to make more forecasts and predictions.

Perhaps, the right answer is to take another hike.

This is What 188 Trade Alerts Gets You

This is What 188 Trade Alerts Gets You

A Snow Plant

A Snow Plant

My Health Care Plan

My Health Care Plan

Life is Good

Life is Good

Global Market Comments

May 31, 2013

Fiat Lux

Featured Trade:

(UPDATED 2013 STRATEGY LUNCHEON SCHEDULE),

(WHY JIM CHANOS IS WRONG ON CHINA), (FXI), (CYB)

(DRINKS WITH ROBERT REICH),

(BECOME MY FACEBOOK FRIEND)

iShares FTSE China 25 Index Fund (FXI)

WisdomTree Chinese Yuan (CYB)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/ and click on ?STRATEGY LUNCHEONS?.

New York City - July 2

London, England - July 8

Amsterdam, Netherlands - July 12

Berlin, Germany - July 16

Frankfurt, Germany - July 19

Portofino, Italy - July 25

Mykonos, Greece - August 1

Zermatt, Switzerland - August 9

Hedge fund titan, Jim Chanos, is well known for his extremely bearish views on China. He says that the cracks are spreading on the fa?ade, real estate sales are falling, and that the economic engine is starting to sputter.

This will be bad news for the rest of us, as China imports 50%-80% of the world?s commodities. Commodity exporting countries will be especially hard hit, like Canada, Australia, and parts of the US. Modern China has only seen a bull market, and he doubts their ability to manage a true crisis.

There is a widespread misperception that the government will step in and provide any bailouts that will be needed. The domestic Chinese banking system has in fact already been bailed out two times. The harsh reality is that while Chinese companies are selling billions of dollars? worth of new stock issues in the US through IPO?s, a privileged elite is getting their money out of the country as rapidly as they can. Jim says that he already has short positions in the Middle Kingdom that are profitable. There is no way that even a wrinkle in a market of this size is without global implications, and on that point Jim is right.

However, I think that Jim, who confesses to having never visited China, is missing the broader long-term picture here. China has literally been building a Rome a day, the ancient kind, and the modern size every two weeks. In a year, it builds the equivalent of the entire housing stock of Spain, and in 15 years the equivalent for all of Europe.

While a lot of apartment buildings have been constructed, the country is rapidly creating the middle class to fill them. Even allowing for a pull back from its past blistering 11% per annum GDP growth rate to only 7.7%, urban disposable income per person is expected to grow by 2.5 times to $7,500 by 2020.

Over the same time frame, some 160 million are expected to move from the hinterlands to urban areas. Rising standard of livings mean that residential floor space per person will jump from 270 square feet to 369 square feet, still tiny by Western standards. That is a lot of housing demand.

China has already taken steps to head off a housing crisis, unlike the US. The People?s Bank of China has raised bank reserve requirements five times, taking them to among the most stringent levels in the world. That is almost Canadian in its conservatism. Many banks are now demanding cash deposits of 40%, well over the official requirement of 30%. The government is in effect forcing the banks to deleverage before hard times hit. Too bad they didn?t think of that here.

I think China still has several good years ahead of it, and I am going to pile into the stock ETF (FXI) and the Yuan ETF (CYB) as soon as the current bout of malaise selling exhausts itself. The Country?s real challenge arises when its demographic pyramid starts to invert in about five years, the result of a then 35 year old ?one child? policy, when too many single children have to start supporting two retiring parents.

China: Not Enough Demand?

China: Not Enough Demand?

If you would like to get a free headline service from The Diary of the Mad Hedge Fund Trader, then please join my 1,464 friends. Every day we are posting headlines along with summaries of the stories on our Facebook page. As soon as you open your own Facebook page, you will receive our latest headlines as newsfeeds. To ?friend me?, please go to my home page at http://madhedgefundradio.com/ and click on the Facebook box.