Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $199.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

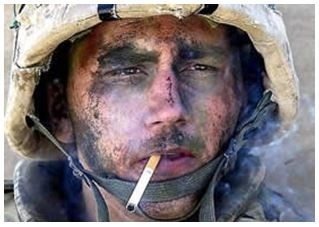

To the dozens of subscribers in Iraq, Afghanistan, and the surrounding ships at sea, thank you for your service! I think it is very wise to use your free time to read my letter and learn about financial markets in preparation for an entry into the financial services when you muster out. Nobody is going to call you a baby killer and shun you, as they did when I returned from Southeast Asia four decades ago. In fact, employers have been given fantastic tax breaks and other incentives to hire you.

I have but one request. No more subscriptions with .mil addresses, please. The Defense Department, the CIA, the NSA, Homeland Security, and the FBI do not look kindly on private newsletters entering the military network, even the investment kind. If you think civilian spam filters are tough, watch out for the military kind! And no, I promise that there are no secret messages embedded with the stock tips. ?BUY? really does mean ?BUY.? ?Sell? means ?Sell? too.

If I did not know the higher ups at these agencies, as well as the Joints Chiefs of Staff, I might be bouncing off the walls in a cell at Guantanamo by now. It also helps that many of the mid-level officers at these organizations have made a fortune with their meager government retirement funds following my advice. All I can say is that if the Baghdad Stock Exchange ever become liquid, I'm going to own it.

Where would you guess the greatest concentration of readers The Diary of a Mad Hedge Fund Trader is found? New York? Nope. London? Wrong. Chicago? Not even close. Try a ten-mile radius centered on Langley, Virginia, by a large margin. The funny thing is, half of the subscribing names coming in are Russian. I haven't quite figured that one out yet. Did we hire the entire KGB at the end of the cold war? If we did, it was a great move. Those guys were good.

So keep up the good work, and fight the good fight. But please, only subscribe to my letter with personal Gmail, Yahoo, or Hotmail addresses. That way my life can become a lot more boring. Oh, and by the way, Langley, you're behind on your bill. Please pay up, pronto, and I don't want to hear whining about any damn budget cuts!

I Want My Mad Hedge Fund Trader!

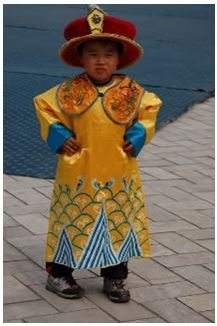

Thanks to China's ?one child only? policy adopted 30 years ago, and a cultural preference for children who grow up to become family safety nets, there are now 32 million more boys under the age of 20 than girls. Large scale interference with the natural male:female ratio has been tracked with some fascination by demographers for years, and is constantly generating unintended consequences.

Until early in the last century, starving rural mothers abandoned unwanted female newborns in the hills to be taken away by ?spirits.? Today, pregnant women resort to the modern day equivalent by getting ultrasounds and undergoing abortions when they learn they are carrying girls.

Millions of children are ?little emperors,? spoiled male-only children who have been raised to expect the world to revolve around them. The resulting shortage of women has led to an epidemic of ?bride kidnapping? in surrounding countries. Stealing of male children is widespread in Vietnam, Cambodia, Laos, and Mongolia.

The end result has been a barbell shaped demographic curve unlike that seen in any other country. The Beijing government says the program has succeeded in bringing the fertility rate from 3.0 down to 1.8, well below the 2.1 replacement rate. As a result, the Middle Kingdom's population today is only 1.2 billion instead of the 1.6 billion it would have been.

Political scientists have long speculated that an excess of young men would lead to more bellicose foreign policies by the Middle Kingdom. But so far the choice has been for commerce, to the detriment of America's trade balance.

In practice, the one child policy has only been applied to those who live in cities or have government jobs. That is about two thirds of the population. On my last trip to China I spent a weekend walking around Shenzhen city parks. The locals doted over their single children, while visitors from the countryside played games with their three, four, or five children. The contrast couldn?t have been more bizarre.

Economists now wonder if the practice will also understate China's long-term growth rate. Parents with boys tend to be bigger savers, so they can help sons with the initial big-ticket items in life, like an education, homes, and even cars. The end game for this policy has to be the Japan disease; a huge population of senior citizens with insufficient numbers of young workers to support them. The markets won't ignore this.

I tell people at my strategy luncheons that living in the San Francisco Bay area is like living in the future. There is an explosion of high tech innovation going on here, and we locals often find ourselves the guinea pigs for the latest hot products. However, sometimes the future is not such a great place to be.

I learned this the other day when I received a parking ticket in the mail. I didn?t recall finding a notice of violation tucked under my windshield wiper in the recent past, so I looked into it. To my chagrin, I learned that the city is now outfitting its buses with video cameras pointing forward and sideways. The digital recordings are then transmitted to parking control officers sitting behind computers for review.? They issue tickets, which are mailed to the registered owner of the vehicles.

San Francisco suffers from one of the worst parking nightmares in the country. The streets were never planned, they just sort of happened on their own during the frenzy of the 1849 gold rush. They were built to handle the traffic of horses and carriages, and later cable cars, not the crush of traffic we get today.

Sky-high real estate prices have driven millions into the suburbs across the bridges over which they must commute. So parking has always been in short supply and it is very expensive. When I drive into the city for a Saturday night dinner, sometimes the parking tab is more expensive than the meal.

Newly minted millionaires from tech IPO?s are now buying vintage Victorian homes, and then retrofitting garages underneath them. Every time this is done, it eliminates another parking spot on the street to make room for the driveway. So while the traffic is increasing, the number of parking spots is actually declining.

The city originally installed the cameras to catch offenders driving in bus lanes during rush hour. When they discovered that the cameras also captured the license plates of illegally parked cars they expanded the program. Last year 3,000 such tickets were issued.

The program has been so successful that the cash strapped city will greatly expand it this year. And with a great San Francisco track record to point to, the firm selling the system is planning on going nationwide. Soon it will come to a city near you. Like I said, sometimes the future is not such a great place to be.

Parking in San Francisco Can be Tight

Global Market Comments

April 17, 2013

Fiat Lux

Featured Trade:

(AMERICA?S DEMOGRAPHIC TIME BOMB),

(TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN)

Global Market Comments

April 16, 2013

Fiat Lux

Featured Trade:

(MAY 8 LAS VEGAS STRATEGY LUNCHEON),

(BIDDING FOR THE STARS), (DOW AVERAGE), (SPY),

(AN EVENING WITH TRAVEL GURU ARTHUR FROMMER),

(HAPPY BIRTHDAY IRS!)

SPDR S&P 500 ETF Trust (SPY)

Come join me for the lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

A few years ago, I went to a charity fundraiser at San Francisco?s priciest jewelry store, Shreve & Co. The well-heeled masters of the universe bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area?s premier hotties, whom shall remain nameless. Suffice to say, she has a sports stadium named after her.

The bids soared to $12,000, $13,000, $14,000. After all, it was for a good cause, Pari Livermore?s California State Parks Foundation. But when it hit $12,400, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his date back to me for $14,000.? I said ?no thanks.? $13,000, $12,000, $11,000? I passed.

The current altitude of the stock market reminds me of that evening. If you rode gold (GLD) from $800 to $1,920, oil, from $35 to $149, and the (DIG) from $20 to $60, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now?

I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: ?There is a time to fish, and a time to hang your nets out to dry.? That?s why my cash position has steadily been rising over the last few weeks.

At least then I?ll have plenty of dry powder for when the window of opportunity reopens for business. So while I?m mending my nets, I?ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

As for that date? She eventually married one of California premier technology titans, an established billionaire in his own right, and now has two cute kids. It?s all part of life?s rich mosaic. And sorry, I?m not saying who because gentlemen don?t talk.

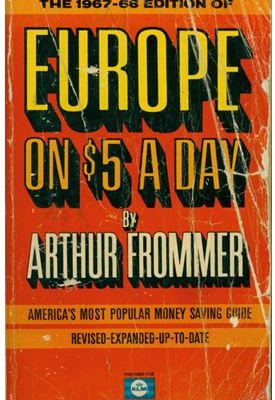

Travel guru, Arthur Frommer, says that now is the best time to travel in 20 years, thanks to a combination of a strong dollar and desperate price-cutting forced by the recession.

Three years after oil hit an historic peak at $148/barrel, when $500 fuel surcharges abounded, and the demise of the travel industry was widely predicted, costs in some countries, like Mexico and Costa Rica are 50% lower than a year ago. Talk about price elasticity with a turbocharger!

Frommer believes there are three sea change trends going on today. Business is moving away from the big three travel websites, Travelocity, Orbitz, and Priceline, who have more preferential side deals with airlines than can be counted, towards pure aggregator sites that almost always offer cheaper fares, like Kayak.com, Momondo.com, and farechase.yahoo.com.

There is a move away from traditional 48 person escorted bus tours towards small group adventures, like those offered by Gap Adventures, Intrepid Tours, and Adventure Center, that take parties of 12 or less on eye opening public transportation.

There has also been a huge surge in programs offered by universities that turn travelers into students for a week to study the liberal arts at Oxford, Cambridge, and UC Berkeley. His favorite was the Great Books programs offered by St. Johns University in Santa Fe, New Mexico. He says that the Internet has given a huge boost to international travel, but warns against user generated content, 70% of which is bogus and posted by the hotels and restaurants themselves.

The 79-year-old Frommer turned an army posting in Berlin in 1952 into a travel empire that publishes 340 books a year, or one out of every four travel books on the market. I met him on a swing through the San Francisco Bay Area (his ticket from New York was only $150), and he graciously signed my original 1968 copy of Europe on $5 a Day, which was crammed in my backpack for two years.

Which country has changed the most in his 60 years of travel writing? France, where the citizenry have become noticeably more civil since losing WWII. Bali is the only place where you can still travel for $5/day, although you can see Honduras for $10. Always looking for a deal, Arthur's next trip is to Chile, the only country hes has never visited, because the currency there has crashed.

Some taxpayers have been sending birthday cards in with their tax returns this year. That?s because the International Revenue Service, the collector of America?s tax revenues, is 100 years old this week.

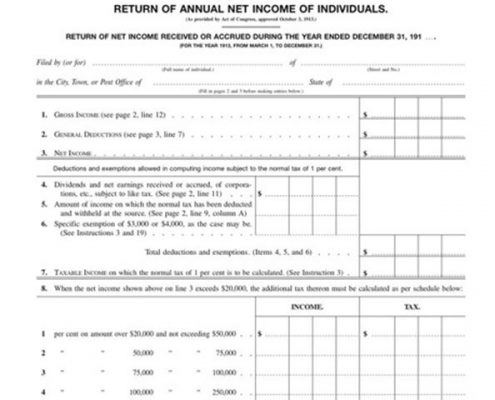

Although the wealthy have been paying income taxes since the 1861-65 Civil War, they did not apply to the rest of us until the passage of the 16th Amendment. The original form 1040, of which I have included a copy below, was one page long and imposed a starting tax rate of 1% over incomes of $3,000. The maximum tax rate was 7%. It included a deduction for shipwrecks.

When WWI broke out, that rate was taken up to 77%. Only 3% of the population had tax liabilities, compared to 54% today. Since 1913, the pages of instructions and deductions have soared from one to over 77,000. Today, some 6.6 billion man hours are spent preparing US tax returns. Talk about a growth business!

According to the Pew Research Center, 56% of Americans dislike taxes, but 71% feel they have a moral responsibility to pay what they owe. Yet, 34% say they pay more than their fair share of taxes, while 60% believe they are paying the right amount.

In 1775, the American Revolution first started as a tax revolt, with American merchants protesting the special exemptions enjoyed by British ones. That led to the Boston Tea Party whereby Americans masquerading as Indians dumped competing duty free imports overboard. Fairness of the system has been a recurring theme ever since. That is why Mitt Romney?s 13.9% tax rate was such a big deal in the 2012 presidential election.

About 1% of taxpayers are audited each year, with the wealthiest 12 times more likely to get audited than the middle class. Where are the residents least likely to be audited by the IRS? The Aleutian Islands in Alaska. And the most likely? Beverly Hills, California. Small businesses top the list, with those in the real estate and construction industries dominating.

The Justice Department brings about 1,000 criminal tax evasion cases a year. Jail times have only been required since 1987. That works out to one return out of every 150,000, so play audit roulette if you will. Their success rate in obtaining convictions is a mathematically impossible 98.5%.

What is the most common error committed on tax returns? Divorced parents both claiming the same children as dependents. The mistake is automatically caught by electronic filing with the earliest filer getting the tax savings. So don?t bother.

Now how much did I lose on that shipwreck last year?

Equalizing the Tax System

Now What Line Does This Go On?