There is a new real estate bubble forming in the US, but it is not inflating where you think. Apartment rents have been rapidly rising, and are about to go ballistic. In fact the appreciation has been so strong that the cost of ownership is now less than renting in many parts of the country, provided you can get one of those hard to get, ultra low interest rate bank loans.

By 2050 the population of California will soar from 38 million to 50 million, and that of the US from 300 million to 400 million, according to data released by the US Census Bureau and the CIA fact Book (check out the population pyramid below).

That means enormous demand for the low end of the housing market, apartments in multi-family dwellings. Many of our new citizens will be cash short immigrants from Asia and Latin America. They will be joined by generational demand for limited rental housing by 65 million Gen Xer's and 85 million Millennials enduring a lower standard of living than their parents and grandparents. These people aren't going to be living in cardboard boxes under freeway overpasses, and the new square footage created will be inadequate to meet demand, thanks to the recent six-year vacation for new construction.

The trend towards apartments also fits neatly with the downsizing needs of 80 million retiring Baby Boomers. As they age, boomers are moving from an average home size of 2,500 sq. ft. down to 1,000 sq. ft. condos and eventually 100 sq. ft. rooms in assisted living facilities. The cumulative shrinkage in demand for housing amounts to about 4 billion sq. ft. a year, the equivalent of a city the size of San Francisco.

In the aftermath of the economic collapse, rents are now rising and vacancy rates are shrinking. Fannie Mae and Freddie Mac financing is still abundantly available at the lowest interest rates on record. Institutions and high net worth individuals combing the landscape for high yield, low volatility cash flows and limited risk are pouring money in.

The Next Real Estate Bubble?

Legendary Fortune Magazine editor, Winslow Jones, created the first hedge fund out of a shabby office on Broadway in New York City in 1948, and generated monster returns over the next 20 years. He got the idea of a 20% performance bonus, now an industry standard, from ancient Phoenician sea captains who kept a fifth of the profits from successful voyages. Jones must have had an historical bent.

Then came the second generation titans, George Soros, Julian Robertson, and Michael Steinhardt, who made their debut in the sixties. I count myself among the third generation along with Paul Tudor Jones and Louis Bacon, who launched funds in the late eighties, when there were still fewer than 200 funds and $25 million was still considered a lot of money. The really big money showed up in the nineties when the pension funds found them.

After that, we suffered through the many ordeals that followed, including the collapse of Long Term Capital in 1995, the Amaranth blow up in natural gas in 2006, the Lehman Brothers bankruptcy in 2008, and John Paulson?s 50% draw down in 2011. Today there are over 8,000 hedge funds, thought to manage some $2.2 trillion which dominate all financial markets.

Hedge Funds Do Have Their Advantages

Pack your portfolios with agricultural plays like Potash (POT), Mosaic (MOS), and Agrium (AGU) if Dr. Paul Ehrlich is just partially right about the impending collapse of the world's food supply. You might even throw in long positions in wheat (WEAT), corn (CORN), soybeans (SOYB), and rice.

The never dull, and often controversial Stanford biology professor told me he expects that global warming is leading to significant changes in world weather patterns that will cause droughts in some of the largest food producing areas, causing massive famines. Food prices will skyrocket, and billions could die.

At greatest risk are the big rice producing areas in South Asia, which depend on glacial run off from the Himalayas. If the glaciers melt, this crucial supply of fresh water will disappear. California faces a similar problem if the Sierra snowpack fails to show up in sufficient quantities, as it did last year.

Rising sea levels displacing 500 million people in low-lying coastal areas is another big problem. One of the 80-year-old professor's early books The Population Bomb was required reading for me in college in the 1960?s, and I used to drive up from Los Angeles to Palo Alto just to hear his lectures (followed by the obligatory side trip to the Haight-Ashbury).

Other big risks to the economy are the threat of a third world nuclear war caused by population pressures, and global insect plagues facilitated by a widespread growth of intercontinental transportation and globalization. And I won't get into the threat of a giant solar flare frying our electrical grid.

?Super consumption? in the US needs to be reined in where the population is growing the fastest. If the world adopts an American standard of living, we need four more Earths to supply the needed natural resources. We must raise the price of all forms of carbon, preferably through taxes, but cap and trade will work too. Population control is the answer to all of these problems, which is best achieved by giving women educations, jobs, and rights, and has already worked well in Europe and Japan.

All sobering food for thought. I think I?ll skip that Big Mac for lunch.

Global Market Comments

February 21, 2013

Fiat Lux

Featured Trade:

(IS THE PARTY OVER?),

(SPY), (INDU), (IWM), (FXY), (YCS), (TLT), (GLD), (SLV), (FXE),

(RUMBLINGS IN TOKYO), (FXY), (YCS),

(TESTIMONIAL)

SPDR S&P 500 (SPY)

Dow Jones Industrial Average (INDU)

iShares Russell 2000 Index (IWM)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

iShares Barclays 20+ Year Treas Bond (TLT)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

CurrencyShares Euro Trust (FXE)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

I spent ten years of my life tramping in and out of Japan?s Ministry of Finance headquarters in Tokyo?s Kasumigaseki district. It was a dreadful reinforced steel and concrete affair with a dull grey tile siding that was so solidly built that it was one of the few structures in the city to survive WWII. But the building offered spacious prewar dimensions, with lovely high ceilings, and I never tired of walking its worn hardwood floors. I was there so often that some government officials thought I worked there, and they did eventually give me an office, the first ever granted to a foreign correspondent.

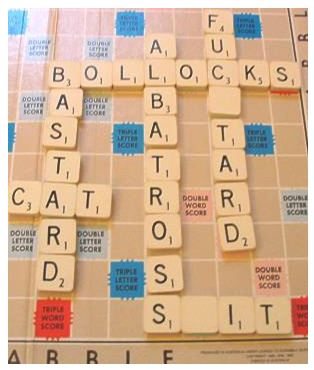

So to get an update on the Land of the Rising Sun I called a senior official whose father I knew well as a Deputy Minister of Finance for International Affairs during the 1970?s. I was a regular at his apartment in Shinjuku on Saturday nights, where we spent endless hours alternately playing chess and Scrabble over a bottle of Johnny Walker Red and smoking acrid Mild Sevens. We did everything we could to expand each other?s? Japanese and English vocabularies with the words not found in dictionaries. When the bottle was almost finished and his face was beet red, the Elvis impersonations would start.

My friend told me that the ongoing strength of the yen is rapidly becoming a major political issue in Japan. The spot market is threatened an all-time high only three months ago, and on a trade-weighted basis it was already at a new peak. Exporters were getting destroyed by the strong yen, which was making their goods increasingly expensive in a cost cutting competitive world.

This was forcing them to accelerate a 20-year effort by corporations to offshore production to China, which was ?hollowing out? Japan, and causing economic growth to bleed away, and unemployment to rocket. The situation was getting so bad that American companies that offshored jobs to Japan years ago, like Caterpillar (CAT), were taking them back home because labor costs are so high. His fears were confirmed by a Japanese GDP that shrank in Q4, 2012.

His masters have made repeated comments in the Diet, the Japanese Parliament, made comments in the Diet this week about his concern over yen strength. More specifically, the road is now clear is seeking approval for a much more aggressive stance to pursue Bernanke style quantitative easing to knock the stuffing out of the yen and stimulate the economy.

This time, the ministry has much more ammunition to work with. Japan has been running its first trade deficit in 30 years. This may not be an anomaly. In response to the tsunami induced melt down at the Fukushima plant, Japan is permanently shutting down a large part of its nuclear power generating capacity. At its peak, nuclear accounted for 25% of the country?s electric power supply. That is forcing a huge surge in oil imports from the Middle East that has greatly tipped Japan?s balance of trade against it. Crude?s recent surge from $84/barrel to as high as $98 has only made matters worse.

He then told me that, he too, was now learning to play Scrabble and asked me for my list of words where the letter ?Q? is not followed by a ?U?. I said that I was not inclined to disclose America?s most valuable trade secrets to a foreign competitor. However, in deference to his late father, he couldn?t go wrong starting with ?Qi?, ?Qabala?, ?Qadi?, ?Qaid?, ?Qat? and ?Qanat?. I hung up the phone and immediately sold more yen against the dollar.

Global Market Comments

February 20, 2013

Fiat Lux

Special Tesla Issue

Featured Trade:

(MY TAKE ON THE TESLA TIFF), (TSLA)

Tesla Motors, Inc. (TSLA)

By now, you are all probably well aware of the firestorm that has erupted between Tesla?s (TSLA) Elon Musk and the New York Times.

It started when the groundbreaking California car maker loaned out a high performance Model S for testing of its East Coast supercharger network to the Times? auto correspondent, John Broder, for a drive from Washington DC to Boston. Broder posted a story that spoke of range anxiety, confused instructions from Tesla, and ended with a picture of a drained S-1 being loaded on to a flatbed truck for return to the company.

Tesla has been down this road before. Two years ago, it lent its Roadster model to Top Gear magazine for a similar test in England. In the lawsuit that followed it was discovered that the correspondents faked a flat battery on camera by pushing a car down the road that actually had sufficient charge. It turns out that headlines shouting disaster sell more car magazines than success.

Once burned, twice forewarned. Every succeeding car loaned by Tesla to a journalist came equipped with a hidden digital data recorder, much like an aircraft ?black box?. In the Times story it showed that Bradford took unreported detours, didn?t fully charge his battery, and frequently enjoyed power draining jackrabbit starts. Musk counter attacked with a blistering blog post that outlined the driver?s, and not the car?s shortfalls (http://www.teslamotors.com/blog/most-peculiar-test-drive).

Since I am a pilot, former scientist, an occasional writer for the New York Times, and have a Tesla S-1 performance parked in my garage, I feel uniquely qualified to render an opinion here. The New York Times has it all wrong, and could well have another Jason Blaire scandal on its hands.

When the rest of the media smelled a rat, they duplicated the experiment with great success. For them, it was a rare opportunity to heap mud on the reputation of the competing New York Times. CNBC took the extra step of broadcasting its drive to Boston by reporter Phil LeBeau on live TV.

I have to admit that after sitting on a waiting list for a year, it was with some excitement that I drove to the factory in Fremont, CA to pick up my S-1. The tour was like a trip to the future, with an army of highly animated German made robots precisely assembling the vehicles.

Much of the facility was built from the wreckage of the 2008 auto industry crash. It bought the old GM Corolla factory for a bargain $50 million in stock provided by Toyota. A giant sheet metal press was salvaged from Detroit for scrap metal value of about five cents on the dollar. Today, it employs 2,500, down from the 50,000 GM once needed.

Every car on the assembly line is spoken for. As soon as they are tested they are delivered to beaming new owners in the adjacent show room at the rate of three an hour. There is no inventory. There is virtually no media advertising. It is a business model that any other carmaker would kill for.

The Tesla S-1 is unlike any car that I have ever driven. It is a real beast of a machine, taking five passengers up to a hair raising 130 mph. You can feel the G-forces. The operating manual should include a warning in big bold red letters not to kill yourself on the first day. It is basically a street legal Formula One racecar.

When you approach, flush chrome handles pop out from the doors. There is no key or ignition. Sitting in the driver?s seat activates the power, and the digital instruments panel flashes on. It also instantly synchs with your iPhone 5, displaying your entire iTunes library and address book on an impressive 18-inch screen. Talk about ?wow?!

It is linked to the Internet 24/7. So you can instantly call up the top Yelp rated Japanese restaurant in your area and have Google Maps direct you there, all while driving. The car also upgrades itself. So one morning you sit down and the screen displays 20 new applications that have been updated.

Driving for the first time is a surreal experience. The high performance model gives you instant acceleration to 60 mph in four seconds. There is no delay while one waits for gasoline to course through to the fuel injectors, as one suffers with conventional engines. And you get the same acceleration from 60 to 90 as you do from 0 to 60. Zipping in and out of traffic, it drives more like a video game than a car. This is a pink slip racer?s dream.

You can see that Tesla has completely rethought the automotive experience from the ground up with the intention of maximizing the ?cool? factor. The ordering process is entirely online. There is no more haggling with dealers. Manufacturing has been completely reimagined to cut costs. The vehicle has less than half the number of parts of traditional cars. The motor, alone, shrinks from over 500 parts to a few dozen. All of the components are made at this single plant. There is no waiting for transmissions from Japan, as there is no transmission. There is no heat to manage. It strangely and silently runs at room temperature, so there is no need for a radiator or engine cooling. The aluminum body greatly eliminates weight.

Amazingly, the car has more storage space than my Toyota Highlander SUV. Pop the hood, and you get another trunk, which Tesla dubs a ?frunk?. This titillates friends to no end.

Then there is the notorious range issue. Musk, himself, prepared the speed versus range graph below. Any pilot will instantly recognize this, as we have to memorize one of these for each aircraft type rating. To get the advertised 300 miles you have to use every range extending technique, like slow acceleration, keeping the speed at 55 mph on the flat, and not using heat or air conditioning. If you drive like you are in the Indianapolis 500, as I do, with jump to warp speed starts up to 80 mph, that range drops by half. As it should.

Actually, the car can go 455 miles if you only drive 20 miles per hour. Tesla has offered a prize for the first driver who can document this. What happens in rush hour traffic? The range extends, as it did for me driving back from Lake Tahoe in that awful Presidents Day jam.

What about cost, you may ask? You know me. I bought the most expensive high performance model, with an 85 kWh battery, a 300-mile range, and every option maxed out, including the $3,750 tech package, a $1,500 panoramic sunroof, and the $950 sound studio. That set me back $109,770, with state taxes and fees.

If you are not a highly successful hedge fund Master of the Universe, like John Thomas, then there is a cheaper way to do this. You can buy the stripped down 40 kWh, 160-mile range version for $59,900, which less the $7,500 federal tax credit, comes to $52,400.

Now you need to learn a new form of automotive math. At the special night charging rate of 4.7 cents per kilowatt offered by my local utility, 160 miles costs $1.88. This is the equivalent of buying gas for 30 cents a gallon, the prevailing price when I first learned to drive. Charging at public stations is free. So 20,000 miles a year would run $235.

There are no tune-ups or maintenance, since there is no engine. You only change tires every 60,000 miles since the car is so light, and brake pads every 100,000 since the regenerative power system does most of the slowing.

This compares to $3,200 for 800 gallons of gas, and $1,000 in tune ups for my Highlander hybrid, giving me a net savings of? $3,965 a year. Prorate this out over the guaranteed eight-year life of the 1,000-pound lithium ion battery, and you get $31,720. This brings your true cost, net of fuel and operating costs, down to $20,680. This is not bad for an ultra luxury, head turning, babe magnet of a racecar. You just effectively pay for all the fuel and maintenance for the life of the car up front.

Some 95% of all drivers travel less than 160 miles a day, so that makes a pretty big target market. Also, Tesla is building a nationwide network of fast charging stations for long distance trips that can get you fully juiced up in 45 minutes. This will include corridors that can get you from LA to New York, or Chicago to Houston, and so on. They are located in shopping malls, so the idea is to catch a quick lunch or dinner while getting refueled.

It is really easy to see how the whole Times incident happened. A young underpaid, right-brained journalism major dude is suddenly handed a $110,000 studmobile with a revolutionary new technology, not bothering to read the manual first. I see a Fast and Furious replay punctuated by a nooner in Manhattan and a car that only makes it three quarters of the way there. What did you say the difference between volts and amps was? Then it?s his little red notebook against Elon?s computer log. No contest.

I have to mention another issue here. The entire car establishment absolutely hates this car. This includes the Detroit automakers, their politicians, the automotive press, and the oil industry with fellow travelers. Of course, the foaming right considers it a giant government subsidized liberal conspiracy. Such is always the case when change comes in quantum leaps.

When gasoline powered cars were first introduced in England, Parliament passed a law stating they must at all times be preceded by a man on foot waving a red flag. The repeal of that law in 1905 is still celebrated by an annual race, the Brighton Run. Only cars built before that year are allowed to participate, and I have run it many times (fewer than half finish the 100 miles course).

Check out the jobs section on Craig?s List for New York. I see the Times is looking for a new automotive correspondent.

Global Market Comments

February 19, 2013

Fiat Lux

Featured Trade:

(WHAT?S A POOR BOND MANAGER TO DO?)

(TLT), (TBT), (NLY), (CVRR), (CWB),

(THE POPULATION BOOM)

(WHO EXPENSIVE OIL HURTS THE MOST),

(USO)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

Annaly Capital Management, Inc. (NLY)

CVR Refining, LP (CVRR)

SPDR Barclays Capital Convertible Bond ETF (CWB)

United States Oil (USO)

In their century long coverage of exotic places, cultures, and practices, National Geographic Magazine inadvertently sheds light on broad global trends that deeply affect the rest of us. Plus, the pictures are great. A recent issue celebrated the approach of the world's population to 7 billion, and the implications therein.

Long time readers of this letter know that demographic issues will be one of the most important drivers of all asset prices for the rest of our lives. The magazine expects that population will reach 9 billion by 2045, the earliest date that I have seen so far. Can the planet take the strain? Early religious leaders often cast Armageddon and Revelations in terms of an exploding population exhausting all resources, leaving the living to envy the dead. They may not be far wrong.

A number of developments have postponed the final day of reckoning, including the development of antibiotics, the green revolution, DDT, and birth control pills. Since 1952, life expectancy in India has expanded from 38 years to 64. In China, it has ratcheted up from 41 years to 73. These miracles of modern science explain how our population has soared from 3 billion in a mere 40 years.

The education of the masses may be our only salvation. Leave a married woman at home, and she has eight kids, as our great grandparents did, half of which died. Educate her, and she goes out and gets a job to raise her family's standard of living, limiting her child bearing to one or two. This is known as the ?demographic transition.?

While it occurred over four generations in the developed world, it is happening today in a single generation in much of Asia and Latin America. As a result, fertility around the world is crashing. The US is hovering at just below the replacement rate of 2.1 children per family, thanks to immigration. But China has plummeted to 1.5, Europe is at 1.4, and South Korea has plunged as low as 1.15.

Population pressures are expected to lead to increasing civil strife and resource wars. Some attribute the genocide in Rwanda in 1999, which killed 800,000, as the bloody result of overpopulation.

Every time the price of oil spikes, we learn vast amounts of information about the global reach of this indispensable commodity. It's like taking a non-core elective in geology at college. So I was fascinated when I found the chart of relative sector winners and losers below.

No surprise that energy does best from sky high crude prices. It is followed by telecommunications and health care. You would also expect consumer discretionary stocks to take it on the nose, as high energy prices almost always lead to a cyclical downturn in the economy. Who is the worst performer of all? Europe, which makes the recent weakness even more understandable.

Europe Will be the Biggest Loser from High Oil Prices