Global Market Comments

February 5, 2013

Fiat Lux

Featured Trade:

(FEBRUARY IS THE CRUELEST MONTH), (SPX), (SPY),

(WHY GOLD IS DEAD), (GLD), (GDX),

(TESTIMONIAL), (OXY), (BYDDF)

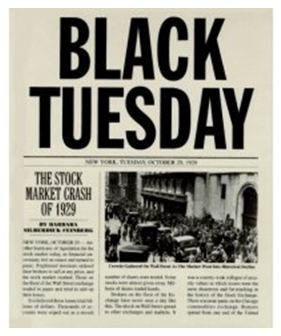

Actually, it is the second cruelest month. September is the worst, as indicated by the table below, put together by my friends at Stockcarts.com.

I think you have to get some sort of pullback between now and March 15, like of the 2%-4% range. It?s not that we are without fundamental reasons to do so. Don?t forget, we have a sequestration deadline looming on March 1, when the world as we know it is supposed to end. However, what is more likely is that Wall Street calls Washington?s bluff, since the last several Armageddon?s have failed to materialize.

Another possibility is that it grinds sideways in a narrowing range with diminishing volatility, because there are still so many investors trying to get in. If you believe, as I do, that markets will do whatever they have to do to screw the most people, then this is your scenario.

The only choices are down, or sideways. Trees don?t go to the sky, and markets don?t go up forever. I think long side plays in equities from here on will be a story of diminishing returns.

This is why I started selling short out of the money calls and call spreads on the S&P 500 (SPY), (SPX) first thing Monday morning. In either scenario these expire at their maximum point of profitability on March 15. These will help hedge, and lower the average breakeven points of my remaining long side plays in the market.

The move we have seen in stocks this year has been one of the most extended in 18 years, since back when the Dow was trading at about 3,000. These positions will partially hedge the remaining long positions that currently bulk up our portfolio. There is absolutely no way that we will repeat the January performance in February.

Yes, this is a short position. Warning: I have issued so many Trade Alerts for call spreads in the past two months, about 60, that readers forgot what bearish trades looked like. When I issued my Trade Alert on bear put spreads this morning, some readers went ahead and bought the call spread anyway.

Advice: for these alerts to work, you have to read them first.

Looks Like Another No Show

Global Market Comments

February 4, 2013

Fiat Lux

Featured Trade:

(GOLDILOCKS DELIVERS A NONFARM PAYROLL),

(SPY), (SPX), (DOW),

(FEBRUARY 6 GLOBAL STRATEGY WEBINAR),

(LOOK AT THAT YEN!), (FXY), (YCS)

Does it get any better than this? First, the hometown San Francisco Giants win the World Series in a four game sweep. Then the San Francisco 49er?s play in the Super Bowl. Finally, I win the World Series/Super Bowl of investing by capturing an absolutely pyrotechnic 21% year to date performance, boosting me once again the top ranks of the hedge fund industry. Hey, two out of three is not bad. 31-34, ouch! Life is good.

Back in the real world, traders were humming the rhythms of Lauren Hill?s Doo Wop on Friday, the top selling hit of 1998. That was the last time that a January posted such a virile stock market performance. In London they were humming Donna Summer?s This Time I Know It?s for Real, who led the charts with this tune in 1989, the previous time the FTSE 100 delivered such robust numbers.

No, this is not a compilation of Golden Oldies. Not too hot, not too cold. That was the conclusion of the equity markets on Friday when the Dow blasted over 14,000 for the first time in 5 years. With many researchers expecting a January nonfarm payroll over 200,000, you would think traders would have dumped shares on a 157,000 print. The headline unemployment rate remained etched in stone at 7.9%. Instead, stocks gapped up at the opening and never looked back, closing at the highs, up 147.

The phone lines between Wall street and San Francisco burned up with portfolio managers and investment advisors trying to figure out why. It appears that the number was strong enough to maintain a tepid 2% GDP growth rate. But is was not so expansionary as to prompt the Federal Reserve to abandon is quantitative easing policy any time soon, on which risk assets everywhere have been richly feasting.

I can see a particular psychology taking hold on Wall Street. Good data is proof that our buying of shares with reckless abandon is justified. Bad data is written off as a backward looking, one time only, statistical anomaly, as we saw with the incredibly weak Q4, 2012 GDP report of -0.1%.

In this scenario, the market either goes up, or goes up more. A new, all time high for the Dow this week looks like a done deal. We could hit my 2013 target of a Standard and Poor?s (SPX) of 1,600 by March. Like my friend, hedge fund giant, David Tepper, says ?When there?s a bubble, act bubbly.?

Our Course, I warned you all this was coming as far back as October (click here for ?My 2012-2013 Stock Market Forecast? ). I followed up with my ambitious ?Why My Shorts are Missing? in December, pressing the point home (click here ). Then, I really went out on a limb in my ?2013 Annual Asset Review? (click here), arguing that we would see an unprecedented market multiple expansion in the face of weak earnings growth. That is exactly what we got.

It is a good thing that I put my money where my mouth was. That has earned followers of my Trade Alert Service a blistering year to date performance of 21%. If the latecomers, short coverers, and lemmings keep pouring into this market, I could double that by April.

The Trend is Your Friend in Weekly Jobless Claims

Ten Years of Nonfarm Payroll

Looks Like It?s Rising to Me

Global Market Comments

February 1, 2013

Fiat Lux

Featured Trade:

(TRADE ALERT SERVICE POSTS BLAZING 16.75% JANUARY GAIN),

(LUNCH WITH SUPREME COURT JUSTICE SONIA SOTOMAYOR),

(TESTIMONIAL)

The Trade Alert Service of the Mad Hedge Fund Trader posted a

16.75% profit in January, an all time monthly high. The 26-month total return has punched through to 71.80%, compared to a miserable 10% return for the Dow average. That raises the averaged annualized return to 33.13%, elevating to the top of the hedge fund ranks.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

?I have to admit that it was with some trepidation that I joined Supreme Court Justice, Sonia Sotomayor, for lunch this week in San Francisco. I have friends in the New York federal prosecutors office who warned me that she was tough as nails and a complete bitch, first as a prosecutor herself, and later as a judge.

I confided this observation to her, and she agreed completely. Growing up as a poor Hispanic girl in the South Bronx, with a single parent family, demanded more than toughness. Her father died young from chronic alcoholism.

As a kid, she beat up a lot of others, but was thrashed often herself. It was certainly no place for weaklings, or those who stuck to establishment rules. Her family nicknamed her ?ahi?, Puerto Rican for ?hot chili pepper.?

Interviewing Supreme Court justices is tough, as I learned when I met Sandra Day O?Connor a few months ago, the first woman ever appointed. But at least we had some common ground, both growing up on ranches in the baking Southwest before air conditioning was invented. The great insight with her was that on her first day at work there was no woman?s bathroom at the Supreme Court. Sonia Sotomayor would be a different kettle of fish.

Justices are not permitted to comment on any cases in the recent past, present, or those that may appear in front of them in the future. And by recent, I mean in the past 12 years. You really have to go back to Andrew Jackson for them to feel totally comfortable.

Back then, my own family took a case to the court on the interpretation of the India Removals Act of 1830. We won. So the best that you can do is try and get the measure of the person, their character and their motivations, and distill down their essence. Then you have to extrapolate forward as to how this may influence their future decisions.

You might ask what this piece is doing in an investment newsletter. But the Supreme Court is playing a growing role in the lives of traders. The recent decision in favor of Obamacare totally upended the entire health care industry, which accounts for no less than 12% of our GDP, and will soon rise to 18% (You sold the HMO?s and bought the drug companies).

The Citizens United decision permitting unlimited anonymous corporate political donations was a boon for the media and the Washington DC commercial property market, as tens of thousands of new lobbyists were hired. Bush v Gore, which decided the 2000 presidential election, turned out to be the greatest windfall in history for the oil and defense industries. Investors ignore the Supreme Court at their peril.

Justice Sotomayor frankly admitted to me that she was an early beneficiary of affirmative action. But she ran like thoroughbred, once the bit was between her teeth. She was one of the first women admitted to Princeton, which proved to be a totally alien environment. There she heard a Southern accent for the first time. The looking glass metaphors in Lewis Carol?s Alice in Wonderland were unknown to her.

When invited to join Phi Beta Kappa for her academic excellence, she thought it was a scam. They asked for money for a lousy symbolic key, so she threw it in the trash. Sonia rarely slept, graduated Summa cum Laude in 1976, and moved on to Yale Law School.

Racial slurs, sexism, and discrimination, feature large in her life. When she worked as a corporate litigator, a senior partner complained that he didn?t know why the firm was hiring all these minorities, only to dismiss them for incompetence a few years later. I hope this guy isn?t planning on pleading any cases in front of the Supreme Court in the near future. In fact, Sotomayor will have to rule on a reverse discrimination case brought by a white college student some time this year.

Sotomayor is one of those rare individuals who walks a fine line between both political parties. She was appointed a federal judge by George H.W. Bush. She was moved up to the Appeals Court by Bill Clinton. Obama named her as his second Supreme Court appointment, and only the third woman in history.

I think the majority of observers missed the most important outcome of the 2012 presidential election. If a conservative justice dies or retires before 2016, and another liberal replaces Justice Ruth Bader Ginsburg, the impact on history will be huge. Then, the court swings from a 5-4 conservative vote, where it has been for the past 40 years, to 5-4 liberal for the next 40 years.

Sotomayor is a crucial part of this plan, and is so far following the script. In her first case, during which she confesses she was ?terrified?, she dissented on the above-mentioned Citizens United case. She has voted with left leaning Justices Ginsburg and Stephen Breyer 90?percent of the time, one of the highest agreement rates on the Court. She was in the 5?3 majority in Arizona v. United States that struck down several aspects of the state?s anti-illegal immigration law. She was also in the 5-4 majority that ruled in favor of Obamacare.

The US Supreme Court is a world stage, as its decisions are closely followed by many other countries. It is a non-stop conversation in which she walked at mid point. Sonia says most people would find her job boring, as it is very contemplative. The court only hears 60-80 cases a year, and allocates just an hour to hear arguments for each case. The rest of her time is spent reading, writing, editing, and arguing with other justices.

The reality that there is no higher court than her own places an additional burden on her decisions. It is all humbling, as every case produces someone who, in the end, believes an injustice has been done. You can?t play God. Sotomayor is the only member of the court who has worked as a judge.

Sonia revealed to me that her inspiration to go into law came from the Nancy Drew children?s mystery novels and the Perry Mason TV series. Chronic type 2 diabetes prevented her from working in the field. For her, being a lawyer enabled her to work as a detective while in the confines of an office.

On January 21, Sotomayor administered the oath of office to Vice President, Joseph Biden. Not bad for someone who claims her main accomplishment in life was throwing the opening pitch at a New York Yankees game in her hometown Bronx.

As our lunch broke up, she invited me to Washington to tour the Supreme Court and meet the other justices. I said I might just take her up on that.

Global Market Comments

January 31, 2013

Fiat Lux

Featured Trade:

(WHERE?S THE CRASH?)

(TAKING FORD OUT FOR A SPIN), (F),

(CHENIERE ENERGY GETS THE GREEN LIGHT), (LNG), (UNG),

(THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY)

That was the questions traders were scratching their heads and asking this morning in the wake of this morning?s shocking Q4, 2012 GDP figure.

While most analysis were expecting the government to report a more robust 1%-2% number we got negative -0.1%, the worst since 2009. With growth flipping from a positive 3.1% figure in Q3 many thought that a Dow down 500 points was in the cards. Instead we pared back a modest 44 points. What gives?

Ahhh, the devil is in the details. The main culprit was in defense spending, down a mind numbing 22.2%, the worst since the wind down of the Vietnam War in 1972. I remember it like it was yesterday. In fact, government spending was weak across the board as a quasi shut down in advance of the fiscal cliff brought spending to a grinding halt.

In the end, the fiscal cliff never happened. But the downshift shows you how severe such a slowdown would be, if we ever go over the cliff sometime in the future.

There were other one off factors. Hurricane Sandy put a dent into the economies of the US east coast, especially in the transportation sector. The effects of last summer?s drought, which triggered a serious shrinkage in a broad swath of the agricultural sector, were also felt.

What traders instead decided to focus on were the impressive strength of the private sector. Business investment rocketed 8.4%, while consumer spending jumped by 2.2%. It all confirms my theory that the passage of the presidential election broke the dam for private economy, and got people off their behinds once all the negativity and uncertainty was gone. Businesses suddenly began investing and hiring, while consumers stepped up consuming.

What this data tells us is that there will be a sizable postponement of growth from Q4 into Q1, 2013. The Pentagon will ramp up spending once again in the knowledge their budget is secure, at least for the time being. In the meantime, the private sector continues on fire. Q1 could well turn out to be a monster quarter. This is what the unremitting rise in share prices is shouting at us.

In the end, traders don?t really care what the GDP is. In fact, most can?t even spell it. The focus of the street is on the future, not the past. And the data promises to improve.

This morning we saw private sector job growth of 182,000 from the ADP. If Thursday morning delivers another five year low in jobless claims, the market will be primed for a hot January nonfarm payroll on Friday. It?s become ?a glass is half full, glass three quarters full? kind of market. Is either goes up, or up more.

Not Happening Here, Baby

I have been trying to buy this stock for a month. Not because I like their pedestrian cars (except the new, muscular, retro Mustang), but because it is one of the great turnaround stories in business history.

Today?s earnings announcement gives us that window. It delivered over $3 billion in profits during Q4, 2012. But the market decided to focus instead on the expectation of a loss from European operations of $2 billion in 2013, compared to only $27 million in 2011 and $1.7 billion in 2012. That was enough to drop (F) by 15% from its mid-January high.

Europe has definitely been a nightmare for the entire auto industry. When your economy crashes, your bank goes under, and you lose your job, the last thing you do is run out and buy a new car. Tough union rules prevent carmakers from downsizing to a level appropriate with current demand. Everyone is bleeding on their European operations, not just Ford.

Another problem is the collapsing yen, which is making Japanese vehicles much more cost competitive. Get the beleaguered Japanese currency above ?100 to the dollar and keep it there, and that could erode market share for the American makers.

Dig deeper, and you?ll find there?s more to the story. Half of the European losses come from one time only charges. That is far and away offset by a North American market that is absolutely on fire. Indeed, the total size of the US market could soar from 15 million units last year, to 16 million units this year, up from the 9.5 million nadir we saw in 2009. Ford is successfully cutting costs. The rocketing price of palladium (PALL), a key component of the catalytic converters that go into new cars, is telling you as much.

There is no doubt that Ford CEO, Alan Mulally, is a genius. Ford is also a high yield play, with a dividend of 2.90% off of today?s close, which is set to rise. Yet the shares are trading at a 38% discount to the S&P 500. That sounds like a bargain to me for the only US auto manufacturer to avoid a government bailout.

Think I?ll Take Ford Out for a Spin