Global Market Comments

August 19, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or LESSONS LEARNED) plus (GLIDING INTO LITHUANIA),

(SPY), (GLD), (DHI), (TSLA), (JPM), (AAPL), (DHI), (LRCX)

After the worst week of the year, we get the best. If you are confused by all of this, so am I.

On the one hand, the downside was firmly rejected by the $8 trillion sitting under the market that has been trying unsuccessfully to get into the market all year. The upside was rejected as well and who knows why? Did it run too far, too fast? Did valuations get overblown? Or was it simply time to take a summer vacation?

Who knows? All three were true.

I don’t really care. I am up 2.67% in August and am 100% in cash. I’m waiting for the market to tell me what to do next. If we get another crash, I’ll buy. I’m selling the next melt-up as well. The only thing I’m really confident in is my 6,000 target for the S&P 500 by year-end which appears right on schedule.

London certainly has become the most internationally diverse city in the world. Last week my tablemates in pubs included two women from Japan who nearly fell out of their chairs when they heard me speak Japanese. A business consultant from Milan was visiting London for the first time. The head of international marketing for Industrial Light & Magic from Mill Valley, CA, filled me in on the latest developments in the digital arts.

Two Arabic-speaking ladies from Oxford University were working for a charity getting food into Gaza. One bartender was headed for Sandhurst, England’s West Point. The other was from China, and I had to explain to him what Bushmills was (it’s an Irish whiskey). Oh, and my barber was from Syria and my cleaning lady was from Barbados.

All seven of my languages were given a thorough workout. There are 56 countries in the British Commonwealth, and it seems like all of them are here at once.

This summer’s crash down, then up offered many lessons and I want to make sure you catch them all. Let every loss be a learning experience, lest you be doomed to repeat it. Of the 20 great single-day losses in the S&P 500 (SPX) since 1923, I have traded through nine. The other 11 took place in the aftermath of the 1929 crash where the market eventually dropped by 90%. But I had many friends who traded all of those. Click here for details.

For a start, it helps a lot if you see a crash coming. This market had been begging for a crash during May and June and I positioned accordingly. I went into the meltdown with nine short positions in July-August, which covered most of my losses. And I only ran positions into very short August 16 option expiration, thus greatly limiting damage incurred by the losers.

I limited losses by stopping out of out-of-the-money losers quickly in (CAT), (BRK/B), and (AMZN), right at the August 5 opening in most cases. I then became super aggressive when the Volatility Index ($VIX) hit $65, a 2-year high. I also went hyper-conservative by adding four technology positions very deep 20% in-the-money in (NVDA), (META), (TSLA), and (MSFT), which instantly became money makers.

I used the first 1,000-point rally to add a short position for a very long, thus neutralizing the portfolio at the middle of the recent range and taking in a lot of extra income.

I did ALL of this while traveling in England, Switzerland, Lithuania, Poland, Austria, and Slovakia, from assorted airport business lounges, hotels, and Airbnb’s. The travel actually helped because the New York market doesn’t open until 3:30 PM each day, giving me plenty of time to plan the day’s strategy.

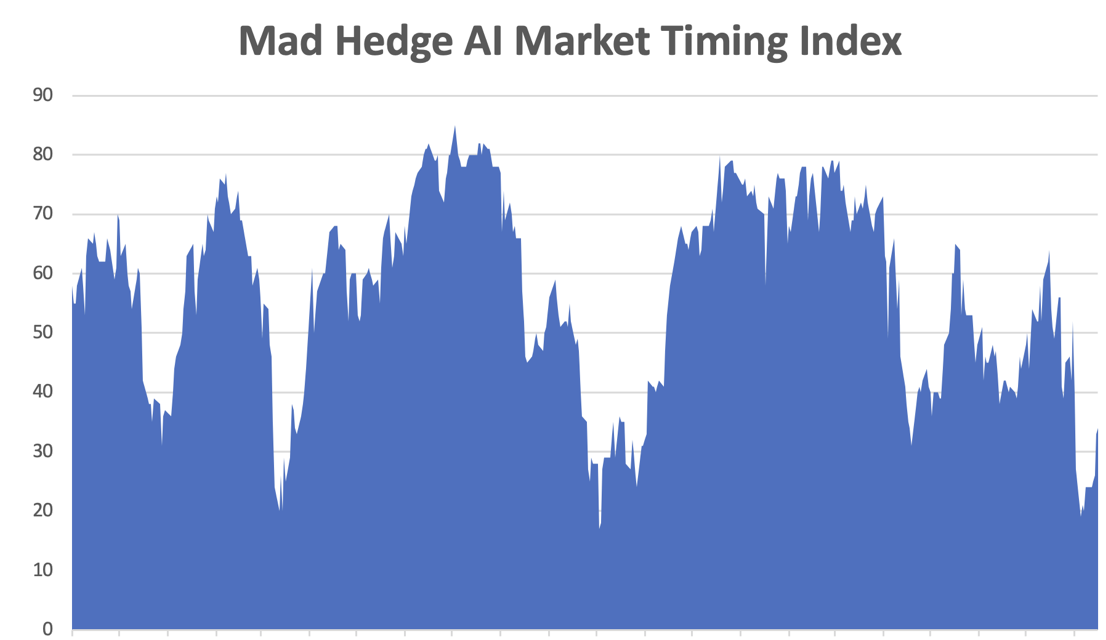

Now all we have to do is figure out what the Volatility Crash ($VIX) from $65 to $14 in 9 days means, the fastest in history by a huge margin. It usually takes 170 days to make this kind of move. Could it mean that our lives are about to become boring beyond tears once again?

I doubt it.

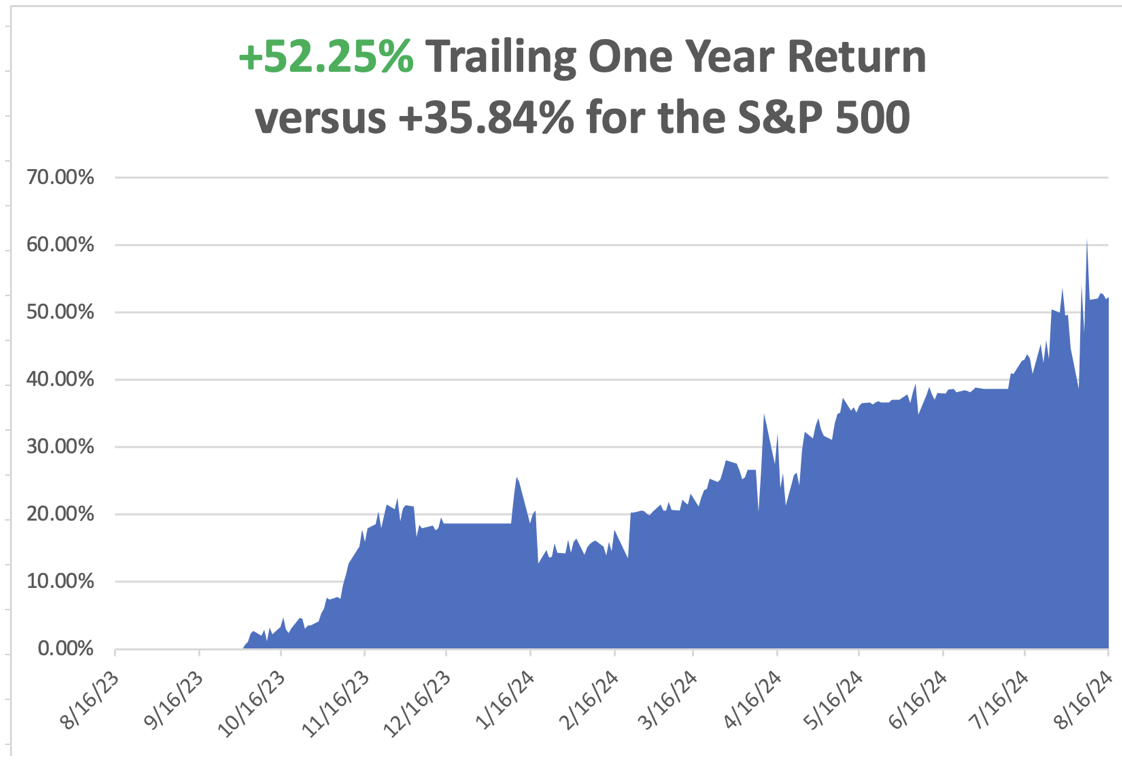

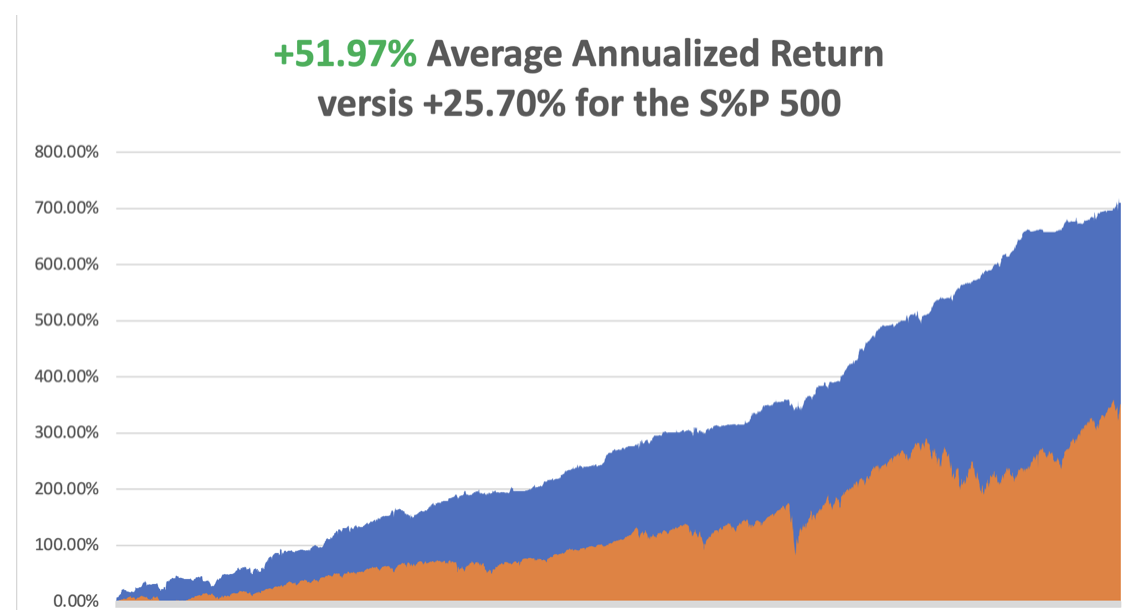

In July we ended up a stratospheric +10.92%. So far in August, we are up by +2.67%. My 2024 year-to-date performance is at +33.61%. The S&P 500 (SPY) is up +16.14% so far in 2024. My trailing one-year return reached +52.25.

That brings my 16-year total return to +710.24. My average annualized return has recovered to +51.97%.

I spent the entire week taking profits. I cashed in on my longs in (GLD) and (DHI) and covered shorts in (TSLA), (JPM), (AAPL), and (DHI). I am now 100% in cash and boy does it feel good.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 49 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of 74.24%.

Try beating that anywhere.

The “Soft Landing” is Back, or so says Goldman Sachs after the meteoric rise in share prices of the last ten days. The extreme concerns about the U.S. economy that have re-emerged over the past month appear overblown and investors shouldn’t get too defensive. The recent spike of market volatility had more to do with positioning than a real scare about economic growth and that investors should “keep the faith” that the U.S. avoids a recession, while also avoiding a revival in inflation.

Now it’s Volatility That’s Crashing, down a record 49 points from $65 to $16 in 9 trading days, suggesting that investors may be returning to strategies that bank on low stock volatility despite a near-meltdown in equities early this month. The ($VIX) long-term median level is $17.6. Similar reversions in the so-called fear gauge have, on average, taken 170 sessions to play out.

Consumer Price Index is a Snore, at 0.2% MOM and 2.9% YOY, below the long-term average. Ebbing inflation aligns with anecdotes from businesses that consumers are pushing back against high prices, through bargain hunting, cutting back on purchases, and trading down to lower-priced substitutes. Stock was a snore as well.

Consumer Sentiment Drops, to an eight-month low according to the University of Michigan. It was revised higher to 66.4 in July 2024 from a preliminary reading of 66.

The Yen Carry Trade is Back, with hedge funds piling back into positions they baled on only two weeks ago. It’s just a matter of math, now that the Bank of Japan has given up on raising interest rates anytime soon. What this means is more leverage, risk, and volatility for global financial markets. I love it!

New Home Construction Dives, in July to the lowest level since the aftermath of the pandemic as builders respond to weak demand that’s keeping inventory levels high. Total housing starts decreased 6.8% to a 1.2 million annualized rate last month, dragged down the biggest decline in single-family units since April 2020

Global EV Sales Jump 21% YOY, in July thanks to a large rise in China. In the European Union MG Motor, owned by China's SAIC Motor Corp, expects to be hit hardest by provisional imposed on EVs imported from China. Europe is not going to give away its core industry, especially Germany’s. EVs - whether fully electric (BEV) or plug-in hybrids (PHEV) - sold worldwide were at 1.35 million in July, of which 0.88 million were in China, where they were up 31% year-on-year.

Refi’s Rocket 35% in a Week, the result of falling inflation and a monster rally in the bond market. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) fell slightly to 6.54% from 6.55%. The refinance share of mortgage activity increased to 48.6% of total applications from 41.7% in the previous week

US Producer Price Index Fades, coming in at a weak 0.1%, and giving the interest rate cut crown a high five. Stocks took off like a scalded chimp. Treasury yields fell on Tuesday as wholesale inflation measures came in softer than expected. The yield on the ten-year US Treasury was lower by about 4 basis points at 3.867%.

Foreign Investors Pull Record Amount from China, $15 billion in Q2. Chinese firms invest a record $71 billion overseas at the same time. It’s why the Chinese yuan has been so weak. The glory days are never coming back. Avoid (FXI).

Weekly Jobless Claims totaled 227,000, a decrease of 7,000 from the previous week and lower than the estimate for 235,000.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, August 19 the Meeting of Central Bankers at Jackson Hole begins. Traders will peruse the tea leaves looking for clues about future interest rates policy. All the major countries of the world have already started cutting rates except the US.

On Tuesday, August 20 nothing of note is released.

On Wednesday, August 21 at 8:30 PM EST, the Minutes from the last FOMC meeting are released.

On Thursday, August 22 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, August 16 at 8:30 AM, Federal Reserve Chairman Jay Powell speaks. Also, New Home Sales are disclosed. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, when a Concierge member invited me to spend a week in Lithuania, I jumped at the chance. I had never been to this miniscule country of 3 million, formerly a part of the Soviet Union. The last time I spent any appreciable amount of time in Eastern Europe was in 1968, at the height of the Cold War.

My friend grew up in the old USSR. He remembers as a child having to go to school in the snow wearing worn-out shoes repaired with duct tape because there weren’t any in the stores.

I remember the old Soviet Union and it was grim beyond belief. Standards of living were sacrificed for military spending in the extreme. I remember I swapped my Levi’s for a worn-out pair plus $50 because they were unobtainable.

My friend cashed in on the collapse of the Soviet Union and the mass privatizations that followed. As a trader in Gazprom shares, he made millions. Now he lives a life of leisure, taking occasional potshots at the market with my assistance. He has been with me since 2011.

Knowing I was an avid pilot he treated me to a day at the local glider club. Introduced as a Top Gun instructor who had flown everything from RAF Spitfires to F-18s, and whose grandfather had worked for Orville Wright, the club pilots were somewhat in awe. I was asked to sign logbooks, which is a great honor among pilots.

I donned my parachute with ease, and everyone relaxed. A tow plane took us up to 2,500 feet, we pulled the release from the cable and suddenly were floating over the endless green forests of Eastern Europe.

I took the stick and performed some light aerobatics, careful not to scare the daylights out of my co-pilot. The thing that really impresses you about gliders is the complete silence. No earplugs inside your headphones here, just the whooshing of the wind. We headed for the nearest clouds in search of uplifting thermals.

I was informed that birds knew more about thermals than any of us, and sure enough, we found a flock and followed them right in. We immediately picked up a few hundred feet, our electronic altimeter whining all the way.

Flying with the birds on a perfect day, how cool is that?

We could have stayed up for hours but I had a lunch appointment. So we yanked on the speed brakes and plummeted down towards the field. At 50 feet, wind shear hit us from the side and we fell like a ton of bricks, bouncing hard. My left elbow smashed against the side of the cockpit inflicting a big gash.

The glider club rushed the aircraft expecting the worst, but I gave them a thumbs up. Any landing you walk away from is a good landing. I later learned that the previous day another pilot broke both legs executing the same maneuver.

When the Soviet Union broke up in 1991, we thought it would take 100 years to integrate the former republics with the West. Although Lithuania is still one of the cheapest countries in Europe, the improvement in the standard of living has been enormous. Old Towns in Europe are usually prime real estate with the most expensive accommodation. Here it’s so cheap that you see a lot of young families with kids in strollers on the sidewalks and in the parks.

They have adopted our vices too, with elaborate tattoos commonplace and teenagers vaping on every street corner.

In the capital city of Vilnius, I developed a work schedule that was tolerable. I spent my mornings walking the Old Town, visiting palaces, castles, baroque churches, museums, and art galleries. Then when the New York Stock Exchange opened up at 4:30 PM I was at my computer banging out my trade alerts as fast as I could write them. The market closed at 11:00 PM. Thank goodness the bars were still open.

Of course, the language is a challenge. Usually, I can understand half of what is going on in Europe. But Lithuanian is a direct descendant of Sanskrit so I couldn’t understand a single word. Everyone under 40 speaks English so I was thankfully able to do my grocery shopping with some assistance.

Every year, I like to return to all my favorite countries, plus add one or two new ones. Where will next year’s new countries be? I’m already scheduled to visit Nicaragua, Columbia, Panama, Costa Rica, and Curacao before yearend. Estonia, Argentina, Latvia, Brazil, Tahiti, who knows?

Ask me in 2025.

To watch a short video of my Lithuanian glider flight, please click here.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"The level of fact available from news services is way less than it once was," said Roger McNamee, co-founder of venture capital fund Elevation Partners.

Global Market Comments

August 16, 2024

Fiat Lux

Featured Trade:

( AUGUST 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (CMG), (SBUX), (TLT), (CCI),

(FCX), (SLRN), (DAL), (TSLA), (LRCX)

Below please find subscribers’ Q&A for the August 15 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from London, England

Q: Do you think we’ll still have another significant test of the lows for the year, or was that it last week? Stocks are rebounding huge this week.

A: They never really went down very much. The average drawdown IN THE S&P 500 (SPY) in any given year is 15%. We only got a 10% drawdown this month because there is still $8 trillion dollars in cash sitting under the market, which never got into stocks. All of this year it's been waiting for a pullback, so I was kind of surprised we even got 10%. I was forecasting maybe 6%. So could we get a new low? You never discount the possibility, but we really have to have another shocking data point to get down to a 15% correction. That is exactly what triggered this sell-off with the Nonfarm Payroll we got in early July. So give me another rotten Nonfarm Payroll report, and we could be back at last week's lows. Which is why I'm 100% cash. I want to have tons of dry powder, if and when that happens.

Q: We've seen a big increase in refi’s for homes in the last week. Is this going to be positive for the economy?

A: Absolutely yes, and that's why we're not going to have a recession. You get housing back into the economy which has been dead meat for almost 3 years now, and suddenly one quarter to one-third of the economy recovers. So that's what takes us into probably 3% economic growth for another year in 2025.

Q: What do you think of the Chipotle CEO (CMG) moving to take over Starbucks (SBUX)?

A: I think it's a very positive move. Starbucks was dead in the water. Their stores are old and dirty and products need refreshing. So if anyone needs a fresh view it's Starbucks, and the guy from Chipotle has a spectacular track record. Chipotle is probably one of the more successful fast-food companies out there. I usually don't ever play fast food—the margins are too low, but I certainly like to watch the fireworks when they happen.

Q: Should I be shorting airline stocks here like Delta Airlines (DAL), now that a recession risk is on the table?

A: Absolutely not. If anything, airlines are a buy here. They've had a major sell-off over the last 3 months for many different reasons, not the least of which was the software crash that they had a month ago. This is not shorting territory. That was 3 months ago for the airlines. Just because it's gone down a lot doesn't mean you now sell, it's the opposite. You should be buying airlines. I usually avoid airlines because they never have any idea if they're going to make money or not, so it's a very high-risk industry, and the margins are shrinking. Let me tell you, the airlines in Europe are absolutely packed. The fares are rock bottom and the service is terrible. Anybody who thinks the consolidation of the airline industry brought you great service has got to be out of their mind.

Q: Do you have any rules on when you stop loss?

A: The answer is very simple. If I do call spreads, whenever we break the nearest strike price, I'm out of there. That’s where the leverage works exponentially against you. Usually, you get a 1 or 2% loss when that happens, and you want to roll it into another trade as fast as you can and make the money back. Sometimes you have to do three trades to make up one loss because when you issue stop losses, everybody else is trying to get out of there at the same time. It's not a happy situation to be in, so we try to keep them to a minimum—but that is the rule of thumb. Keep your discipline. Hoping that it can recover your costs is the worst possible investment strategy out there. Hoping is not a winning strategy.

Q: Why don't you wait for the bottom?

A: Because nobody knows where the bottoms are. All you can do is scale. When you think things are oversold, when you think things are cheap, then you start buying things one at a time unless you get these giant meltdown days like we got on August 5th. So that's what I probably will be doing, is scaling in on the weak days on stocks that have the best fundamentals. That’s the only way to manage a portfolio.

Q: Is it a good time to buy REITs for income?

A: Absolutely. REITs are looking at major drops in interest rates coming. That will greatly reduce their overheads as they refi, and of course, the recovering economy is good for filling buildings. So I've been a very strong advocate of REITs the entire year, and they really have only started to pay off big time in the last month, and Crown Castle Inc (CCI) is my favorite REIT out there.

Q: I own Freeport McMoRan (FCX). Do you think China’s problems will make FCX a sell?

A: Not a sell, but a wait. China (FXI) is delaying any recovery in a bull market. If we get another move in (FCX) down to the thirties I would double up, because eventually American demand offsets Chinese weakness, and we’ll be back in a bull market on the metals. It's American demand that is delivering the long-term bull case for copper, not the return of Chinese construction demand, which led to the last bull market. So we really are changing horses as the main driver of the demand for copper. It still takes 200 pounds of copper to make an EV whose sales are growing globally.

Q: Is it time to buy (TLT) now?

A: No, the time to buy (TLT) was at the beginning of the year, seven months ago, three months ago, a month ago. Now we've just had a really big $12 point rally, and really almost $18 points off the bottom. I would wait for at least a 5-point drop-in (TLT) before we dive back into that. If you noticed, I haven't been doing any (TLT) trades lately because the move has been so extended. And in fact, if they only cut a quarter of a point in September, then you could get a selloff in (TLT), and that'll be your entry point there. You have to ditch your buy high, sell low mentality, which most people have.

Q: What bond should I buy for a 6 to 10-year investment?

A: I’d buy junk bonds. Junk bonds have always been misnamed, or I would buy some of the high-yield plays like the BB loans (SLRN). With junk bonds, the actual default rate even in a recession, only gets to about 2%. So it certainly is worth having. I still think they're yielding 6 or 7% now, so that's where I would put my money. Or you can buy REITs which also have similarly high yields, like the (CCI), which is around 5% now. Risks in both these sectors are about to decline dramatically.

Q: Will there be an inflation spike next year?

A: No. Technology is accelerating so fast it's wiping out the prices of everything that's highly deflationary, and that pretty much has been the trend over the last 40 years. So don't expect that to change. The post-COVID inflationary spike was a one-time-only event, which then ended two years ago. We've gone from a 9% down to a 2.8% inflation rate; unless we get another COVID-induced inflation spike, there's no reason for inflation to return. Deflation is going to be the next game.

Q: What do you think of the UK economy now that you're in London?

A: Awful! Brexit was the worst thing that happened to England—that's why it was financed by the Russians. Brexit will have the effect of dropping both the economic growth rate and standards of living by half over the next 20 years. Expect England to beg their way back into Europe sometime in the future, although I may not live long enough to see it. There are no English people in London anymore. It's all foreigners. No one can afford it.

Q: Should I leap on Tesla (TSLA) where the current price is?

A: No. We’re waiting for the nuclear winter in EVs to end—no sign of it yet. And unfortunately, Elon Musk is scaring away buyers, especially in blue states, by palling around with Donald Trump, a well-known climate change denier. What's in that relationship? I have no idea. One of the first things Trump did was to dump subsidies for electric cars last time he was president. It's hard to tell who’s gone crazier, Trump or Musk.

Q: I have an empty portfolio, when should we expect your options trade to start coming in again?

A: As soon as I see a great sell-off or a great individual situation like we got a couple days ago with the Mad Hedge Technology Letter in Lam Research (LRCX). That's what we look for all day, every day of the year. There's no point in trading for the sake of trading, that only makes your broker rich, not you. There's no law that says you have to have a trade every day, and actually having cash isn't so bad these days. They're still paying 5% for 90-day T Bills. If you don’t know what T Bills are, look up 90-day T bills on my website.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

August 15, 2024

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(ELECTIONS IN DAYS GONE PAST)

Hi John,

I made it to Cortina on my European vacation paid for entirely by my successful trades this year from the Mad Hedge Fund Trader.

Today, we hiked to Lago di Sorapis and I am now enjoying a Dolomiti on the veranda. I will depart tomorrow to continue through the Alps to avoid the heatwave in southern Italy.

Tonight, I will be searching for a few Bond girls….but haven’t seen any yet.

Best regards,

David

You may have noticed that the 2024 presidential election has reached a fever pitch, so it is time to fill you in on the deep background of this all-American practice.

I come from a background that is drowning in history. I am the end product of pilgrim stock who landed in Massachusetts in 1630. I am descended from two of the witches executed at the Salem Witch Trials, a connection to which friends attribute my marketing predicting prowess. We have traced ourselves back to 17 ancestors who fought in the Revolutionary War.

The original John Thomas served on George Washington’s staff at Valley Forge and was responsible for building log cabins for the troops. We sued the government to overturn a portion of Andrew Jackson’s 1830 Indian Removals Act and won. We still know the names of all the slaves we owned because the wills were registered with the county courthouse. We fought on both sides of the Civil War.

So I feel well qualified to comment on elections past. In the late 18th century, only “men of property” were allowed to vote. You had to own 25 acres of land with a house, or 50 acres unimproved. Only about 5% of the population qualified. The great irony of the Tea Party movement, which wants to return the country back to our old ways, is that virtually none of them would have been permitted to vote back then.

The US was largely a rural agricultural country in those days. Voters often had to ride on horseback for days to vote at the county seat, frequently through frigid November snows. Some congressional seats were decided by the casting of a mere 10 or 20 votes.

Candidates greeted the hungry and exhausted travelers with feasts of venison on a spit and a concoction of dark rum, honey, and cloves, haranguing them with speeches while they ate.

Often, the candidates who put on the best spread and got the most voters drunk won the election. These frequently degenerated into drunken brawls, and more than one county courthouse was burned down. This led to laws mandating election “dry” days, which are still in force in many parts of the country today.

Look at the long lines snaking out of polling stations today, and citizens enduring eight-hour waits, I am reminded of how much the country has changed in 242 years.

But it is also clear how much it has remained the same.

Elections were Much Simpler in the Old Days

“I used to tell lies. But I’ve given it up, because the field has become overrun with amateurs,” said the great American 19th century humorist, Mark Twain.

Global Market Comments

August 14, 2024

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)