Global Market Comments

January 22, 2013

Fiat Lux

Featured Trades:

(THE DEBT CEILING CRISIS IS CANCELLED),

(SPY), (IWM), (FCX), (AIG), (FXY), (YCS),(AAPL), (VIX)

(JANUARY 23 GLOBAL STRATEGY WEBINAR)

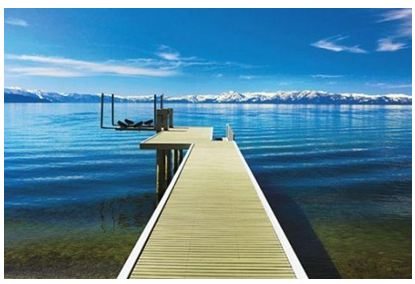

I am sitting here in front of a crackling hot fire at my lakeshore estate in Nevada?s Incline Village. It is a brilliantly clear day, with mallard ducks skimming the surface of Lake Tahoe, and the Canadian geese flying in formation overhead. Snow covered Mount Tallac, some 30 miles to the South, looks so close I feel I can almost grab it and take out a bite.

I am on my way to Washington DC for the inauguration, and had the jet touch down in nearby Truckee for a day of reading and rest. My staff greeted me like I was some kind of conquering hero. One of the perks of working for me is that they get a free subscription to my newsletter, and they all invest their 401k?s, IRA,?s pensions, and profit sharing plans accordingly. When they?re doing well, I feel it. My performance shows in those little chocolate truffles that get placed on my pillow at night.

In fact, it has been the hottest start to a year for me in a long time. The model- trading portfolio is up 8% so far in 2013, which is more than half of what I made during all of last year. With the way my positions are currently structured, I stand to make an additional 50 basis points a day until the next options expiration on February 15. All the market has to do until then is to trade up, sideways, or down small,and I get to keep it all. Right now, that is looking like a pretty good bet.

I completely nailed everything. On day one, I went aggressively long the S&P 500 (SPY) and the Russell 2000 (IWM). I averaged up with more equity positions, a financial, American Insurance Group (AIG), and copper producer Freeport McMoRan (FCX) as a China play. Sensing that it was pedal to the metal for a falling yen (FXY), (YCS), I put a major chink of the portfolio into a short position there. In effect, I am long US equities in Japanese yen.

On top of that, I have a massively short volatility position embedded in all of this, not a bad thing to have when the Volatility Index (VIX) is plumbing new six year lows at the 12% handle. Since then, the data has been released showing that the biggest cash flows into equity mutual in a decade came hot on the heels of my Trade Alerts. Things only went awry with Apple (AAPL), which continued to weaken beyond all belief, as if to prove that I was only human.

It looks like my numbers are going to get a further boost this week from no less a fan than the Republican Party. Former vice presidential candidate, Paul Ryan, from Wisconsin, has indicated that the coming debt ceiling crisis, due on March 31, will be postponed for three months.

Having covered Washington politics for 40 years, I can tell you that he is speaking in code. For ?postponed?, read ?cancelled?. I think they figured out it was a lame idea anyway. Certainly, the markets came to the conclusion two months ago that all of these media constructed ?crises? were a bunch of baloney. That is why I have been pounding the table with readers to pile on the long positions, and ?go commando? on their short positions. Risk markets can only go ballistic in response to this ?aha? moment.

All of this encourages me to stick with the strategy outlined in my 2013 Annual Asset Class Review (click here). Look for a hot first quarter, to be followed by two scary ones, and then a strong finish. This means that all good things will be coming to an end in the not too distant future. In fact, we have probably already started some sort of topping process in the markets that will take a couple of months to unfold. Then look out below.

I just got a call from the airport that the flight plan has been filed, clearance obtained, and the jet is fueled up. Got to go.

Life is good.

Nice Long!

Nice Short!

Party Pooper!

Life is Good!

Global Market Comments

January 18, 2013

Fiat Lux

Featured Trades:

(ATTENDING MY LAST ELECTRIC NISSAN LEAF RALLY)

(SPOILED FOR CHOICE)

It was a typical fall day in San Francisco, the fog wafting in and out through the Golden Gate Bridge. I took the opportunity to attend a company sponsored rally of Nissan Leaf drivers on the Marina Green.

These were the fanatics, the diehards, the truly devoted. These were people who were willing to bet big bucks on an untested, unproven new technology. These were the faithful who put up $5,000 years in advance on the chance that Nissan might actually be able to produce the car someday. In the Bay, there are at least a couple million of us. That?s why so much new, groundbreaking technology originates here.

I am considered of the eminence gris of this community, as I have been covering Nissan as a company for 40 years, and am friends with the current peripatetic Brazilian CEO, Carlos Ghosn. ?I was involved in the early design process of the Leaf, took delivery of one of the first American models, and have run up the most miles.

I strolled among the revelers, speaking to other owners and comparing notes. For the right-brained English teacher types who don?t know the difference between an amp, a volt, or a kilowatt, I answered some basic engineering questions. To admire their creativity, check out the pictures of their personalized license plate numbers, which I posted below.

One guy was there selling an aftermarket Leaf range extender he designed himself, which he claimed boosted the single charge travel distance from 80 miles to 150. The price was $4,000. You always see this sort of thing at Bay area events, people promoting something they built in their dorm room that is revolutionary. Other electric car drivers showed up, including those behind the wheels of BMW?s, Tesla?s, iMiev?s, and Fisker?s. Nissan provided all comers with a 440-volt fast charge for free.

Not only did I buy a car with a zero running cost. I also joined a social community. Someone has developed an iPhone app which lists all the people in your immediate area who will let you hook up to their home for a free charge. As a result, I have never seen one of these dead on the side of the road. But I have passed them doing 45 on the freeway, which means they are just about to run out of juice, and are employing desperate range extending tactics.

Leaf drivers are admired for their idealism, environmental consciousness, and grit by local residents. I never go anywhere without getting a thumbs up. When I first drove mine home, I told my neighbor with the solar roof panels, ?I?ve out greened you.? He grimaced. The state also treats us as royalty. Electric car owners are entitled to a coveted silver bumper sticker that allows them to drive in high occupancy vehicle lanes with a single driver 24/7. Only drivers of 100% battery electric and hydrogen fuel cell, and compressed natural gas powered cars are entitled to such a privilege. Prius drivers, eat your heart out.

Boy, am I spoiled for choice on what to do this weekend. On the one hand, I have been invited to join the president on the reviewing stand for Monday?s inauguration in Washington DC. On the other, the Maverick?s World Surf competition near California?s Half Moon Bay is on the same day, which has not been held for three years.

I have to admit that it is temping to don my wetsuit, throw my Firewire Dominator board into the back of my Highlander, and catch some 40-foot waves with the best in the world. It is rare to get these monster waves on the California coast, which are more often found at Waimea Bay on Oahu?s North Shore. But the mid Pacific buoy says they are headed our way.

I can?t tell you what impossible mission I accomplished to get invitations like these. If I did, I would have to kill you.

In the end, it?s my readership that will decide the issue. I think I can gain more market insight hanging for a day with the cabinet, the Supreme Court, and the leaders of Congress and the Federal Reserve, than a bunch of surfer dudes. It is especially critical that I gauge their thinking, since there are so many momentous political events hanging over the financial markets these days.

I also don?t want to risk offending the president, as I might lose my special access and get cut off his Christmas card list. So I?ll let you know what I decide. In the meantime, on Monday, look for me about ten rows behind the Chief Justice during the swearing in ceremony. And you can catch the Mavericks on ESPN.

Will It Be This?

Or This?

? ? ? ? ? ? ? ? ? ? ? ? ??  ??????? ? ? ? ? ? ?? ?????????????

??????? ? ? ? ? ? ?? ?????????????

Global Market Comments

January 17, 2013

Fiat Lux

Featured Trades:

(APRIL 19 CHICAGO STRATEGY LUNCHEON)

(MLP?S ARE ON FIRE),

(CVRR), (SXCP), (AMJ), (EEP), (KMP), (TLP)

(ALL I WANT TO DO IS RETIRE)

I have always believed that if you don?t have a sense of humor, then you better get the hell out of this business. Below is a link to a YouTube video entitled ?All I Want to do is Retire? which covers the decline of the brokerage industry over the last 20 years. The video is currently going viral and sent to me by a subscriber. Watch this during your next coffee break. The run time is five minutes. Sometimes the truth can be hard to swallow. Click here

Global Market Comments

January 16, 2013

Fiat Lux

Featured Trades:

(VIX), (VXX), (AAPL), (SPY), (IWM), (BA), (TLT), (USO), (FXY), (YCS), (FXE), (YCS), (EUO), (GLD), (SLV)

I?ll give myself a ?B? on this one. Sure, with the Trade Alert Service generating a 14.87% net profit for the year, I was able to bring in double the Dow average, and triple what most hedge funds delivered, including some of the biggest ones.

But for once, I did not achieve true greatness. I feel that, given the amount of work I did, I should have done much better. I issued 230 Trade Alerts in rapid-fire succession with a ?to die for? success rate of 70%.

I managed to capture these gains with half the market volatility of 2011. While the Volatility Index (VIX) reached the lofty height of 49% in 2011, in 2012 we managed to eke out a peak of only 27%, and that was only for a few nanoseconds. In fact, volatility was down for almost the entire year, save for a brief spike in May, and some yearend short covering.

In 2011, I had a much higher range in the market to work with, the high for the Dow coming in at 12,850 and the low at 10,400, for a total range of 2,450 points. In 2012, the range was only 1,630 points, making it a much more difficult market to work with. This meant shifting from outright call and put option positions to spreads, in order to keep the dosh reliably rolling in.

Nevertheless, I made some serious money in 2012. The best trade of the year was a call spread in the S&P 500, which nicely caught the yearend rally in equities, producing a 4.75% profit for the notional $100,000 portfolio. The worst was a short position in Boeing (BA), which cost me a gut wrenching 8.70%.

In terms of asset classes, foreign exchange trading was far and away my biggest earner, adding 11.85% in positive performance. This was because I shorted volatility in the Japanese yen (FXY), (YCS) for the first three quarters of the year when it flat lined, and then went aggressively short when the big break to the downside came. Thank you Mr. Shinzo Abe, Japan?s new prime minister, who championed the beleaguered country?s assertive weak yen policy during the December elections! Shorts in the Euro (FXE), (EUO) also chipped in.

Gold (GLD) was my second income producer, taking in 6.40%. I timed the summer rally in the barbarous relic perfectly, and shook it by the lapels until its gold teeth came chattering out. I would have made more, but the yellow metal then died on the announcement of Ben Bernanke?s QE3, much to everyone?s surprise.

My five years spent drilling for oil and gas in West Texas came in handy once again, netting 4.75% in gains. This was entirely made on the short side. Friends calling me from the Lone Star State with tales of endless oil gluts gushing forth from North Dakota encouraged me to be more bold in selling the (USO) than I might have otherwise.

I was also a fairly nimble bond trader in 2012 (TLT), (TBT), harvesting another 1.62% in profits. I correctly called the top in prices/bottom in yields in August, but failed to capitalize with bigger short positions. This could be a big trade in 2013.

Ah, now for the hard part. Not every trade was a winner in 2012, although many of the losers were hedges for long side plays that ultimately made money. Trading in the index ETF options for the S&P 500 (SPY) and the Russell 200 (IWM) lost -1.30%. An early long position in the volatility Index (VXX) eroded -3.42% from the performance. Fortunately, I bailed from that strategy quickly.

Options positions in individual equities bled me by another -9.54%. Almost the entire loss came from one stock, Apple (AAPL), which is still perplexing the street. I managed the first $150 decline in the stock admirably. After that, it was a bloodbath. Never have I seen a share price divorce itself so dramatically from the underlying fundamentals. Either something terrible is about to happen to Steve Jobs? creation, or the stock market has got it all wrong.

This was one tricky year to trade. I started off all right, clocking gains in January and February. I correctly anticipated another ?Sell in May, and go away? year. But I underestimated the extent that volatility would fall. Melting option premiums absolutely took me to the cleaners in March and April.

When I realized the problem, I switched from outright options to spreads, which included a short volatility element to every single position. That launched a white-hot run of 25 consecutive profitable trades from April to September.

Then Ben Bernanke caught me by surprise, launching QE3 sooner than expected, just before the presidential election. That forced me to stop out of positions that turned good only days later. I correctly called the outcome of the election in all 50 states. But the big Obama win caught many portfolio managers by surprise, who responded by dumping positions to realize capital gains and beat expected tax increases. That took the (SPX) down 10%, leaving the market unchanged on the year by mid November. This cost me more money.

I redeemed myself by accurately calling the yearend rally and going aggressively long. In the end, the ?Fiscal Cliff? that was supposed to crash the market was little more than a media invention. Stocks closed on their highs.

It was one of the tougher years in my career, so I was quite happy to deliver double-digit profits for my readers. It was also a learning experience. After slogging through 45 years in this business, I still occasionally commit the same blunders as a first year trainee. Don?t we all.

Hopefully, you learned something too from my outpouring of 400,000 words in the 250 daily letters that I penned during the year analyzing every investment theme under the sun. You should have also gained some insight from the 22 biweekly webinars I produced. You also had a chance to expand your horizons at by 26 strategy luncheons and speaking engagements held around the world.

2013 will be better, as our blistering gains so far testify.

Good Luck and Good Trading

John Thomas

The Mad Hedge Fund Trader

Global Market Comments

January 15, 2013

Fiat Lux

Featured Trades:

(ON EXECUTING TRADE ALERTS),

(THE FINAL WORD ON THE ELECTRIC NISSAN LEAF)

(NSANY), (TSLA)