I am looking to hear from the readers who have enjoyed the most profitable trading experience following my Trade Alerts in 2012. I am interested in learning about the specific trades you placed, the amount of money you made, and how the service has enhanced your trading experience.

The winner will receive a free one year renewal to Global Trading Dispatch, which currently costs $3,000. I will interview the winner live at my next biweekly strategy webinar on Wednesday, October 10 at 12:00 noon EST.

Please email your entries to me at madhedgefundtrader@yahoo.com, put ?CONTEST ENTRY? in the subject line and include your name and phone number at the bottom of your message. This contest is open to paid subscribers only. This should be fun. I Look forward to hearing from you.

John Thomas

?China is the classic emerging market roach motel, except it?s a really big one. It is very difficult to earn adequate returns on capital and to get your capital back as a westerner,? said Jim Chanos of hedge fund Kynikos Associates.

Thank you so much for the newsletter you sent out ? I really enjoyed reading it. You?ve got quite a unique and engaging style as a writer, world traveler/lecturer and of course, trader. I?m glad to see your performance numbers catapulted you to the top percentile of the hedge fund ranks ? all the best on your future endeavors.

Noemi

San Jose, CA

With silver back in the headlines, I thought I'd touch base with a wizened and grizzled old veteran who still remembers the last time the biggest bubble in history popped for the white metal. That would be Mike Robertson, who runs Robertson Wealth Management, one of the largest and most successful registered investment advisors in the country.

Mike is the last surviving silver broker to the Hunt Brothers, who in 1979-80 were major players in the run up in the 'poor man's gold' from $11 to a staggering $50 an ounce in a very short time. At the peak, their aggregate position was thought to exceed 100 million ounces.

Nelson Bunker Hunt and William Herbert Hunt were the sons of the legendary HL Hunt, one of the original East Texas oil wildcatters, and heirs to one of the largest fortunes of the day. Shortly after president Richard Nixon took the U.S. off the gold standard in 1971, the two brothers became deeply concerned about financial viability of the United States government. To protect their assets, they began accumulating silver through coins, bars, the silver refiner, Asarco, and even antique tea sets ? and when they opened, silver contracts on the futures markets.

The brothers? interest in silver was well known for years, and prices gradually rose. But when inflation soared into double digits, a giant spotlight was thrown upon them, and the race was on. Mike was then a junior broker at the Houston office of Bache & Co., in which the Hunts held a minority stake, and handled a large part of their business.?The turnover in silver contracts exploded. Mike confesses to waking up some mornings, turning on the radio to hear silver limit up, and then not bothering to go to work because he knew there would be no trades.

The price of silver ran up so high that it became a political problem. Several officials at the CFTC were rumored to be getting killed on their silver shorts. Eastman Kodak (EK), whose black and white film made them one of the largest silver consumers in the country, was thought to be borrowing silver from the Treasury to stay in business.

The Carter administration took a dim view of the Hunt Brothers' activities, especially considering their funding of the ultra-conservative John Birch Society. The Feds viewed it as a conspiratorial attempt to undermine the U.S. government. It was time to pay the piper.

The CFTC raised margin rates to 100%. The Hunts were accused of market manipulation and ordered to unwind their position. They were subpoenaed by Congress to testify about their motives. After a decade of litigation, Bunker received a lifetime ban from the commodities markets, a $10 million fine, and was forced into a Chapter 11 bankruptcy.

Mike saw commissions worth $14 million in today's money go unpaid. In the end, he was only left with a Rolex watch, his broker's license, and a silver Mercedes. He still ardently believes today that the Hunts got a raw deal, and that their only crime was to be right about the long term attractiveness of silver as an inflation hedge.

Nelson made one of the great asset allocation calls of all time and was punished severely for it. There never was any intention to manipulate markets. As far as he knew, the Hunts never paid more than the $20 handle for silver, and that all of the buying that took it up to $50 was nothing more than retail froth.

Through the lens of 20/20 hindsight, Mike views the entire experience as a morality tale, a warning of what happens when you step on the toes of the wrong people.

And what does the old silver trader think of prices today? Mike saw the current collapse coming from a mile off. He thinks silver is showing all the signs of a broken market, and doesn't want to touch it until it revisits the $20's. But the white metal's inflation fighting qualities are still as true as ever, and it is only a matter of time before prices once again take another long run to the upside.

Silver is Still a Great Inflation Hedge

Sometimes market moves call for options, and I?ve used a lot of them recently. Can options be profitable? The proof is in the pudding as my strategies have paid off handsomely. However, I do get a lot of questions about option strategies and how best to place trades. In an effort to help my readers improve their profits I have scheduled an options training seminar for the first week in November ? and I?ve gone one better.

This options training session will be a half-day session run by the folks at TradeMONSTER, and will be part of a 2-day economic symposium run by the HS Dent group of Harry Dent fame. I?ve been a guest speaker at this event in the past and will be part of their lineup at a later session as well. The combined program is a two-day information and education feast. The options training will be the second half of the second day of the symposium.

TradeMONSTER is the trading platform run by my friends, the Najarian brothers, the guys on CNBC with ponytails that report from the old exchange in Chicago. Their representative will discuss options in general then get into the nitty gritty of strategies like the ones I use, although I don?t often use the official names, like bull put spread, bear call spread, verticals, and even Iron Condors. Don?t get lost in the vernacular; just know that they will help you sort this out so that you better understand how to take advantage of my research. I?ll be there at the end of the options session to answer questions and share a cocktail.

The economic symposium put on by HS Dent, which they call Demographics School, gives you the lay of the land in our economy. It will outline how the economy works and what most likely lies ahead based on how consumers spend money. Here?s a hint ? old people buy less toys and spend more on healthcare, which sounds simple but has profound implications for our country and the world. These trends unfold over a long time period and if you pay attention you can make a lot of money. Short term moves can be very profitable, but you have to keep in mind how the world is shaping up in the background. If you lose sight of the long term, you risk having it run you over.

So here?s the scoop. The 2-day event will be held on Wednesday and Thursday, November 7th and 8th, 2012, in Tampa, FL at the Renaissance Hotel. The cost of the event is typically $1,995, but through my relationship with these two organizations I am able to get my subscribers in for just $895. This includes the symposium, the options training, breakfast and lunch on both days, as well as a cocktail hour. Harry Dent will be on hand Wednesday afternoon and I understand he also sticks around to share a drink. So come to learn as well as share stories and ideas with Harry and me.

To register for the event, click on this link http://www.hsdent.com/madhedge_demospecial.pdf

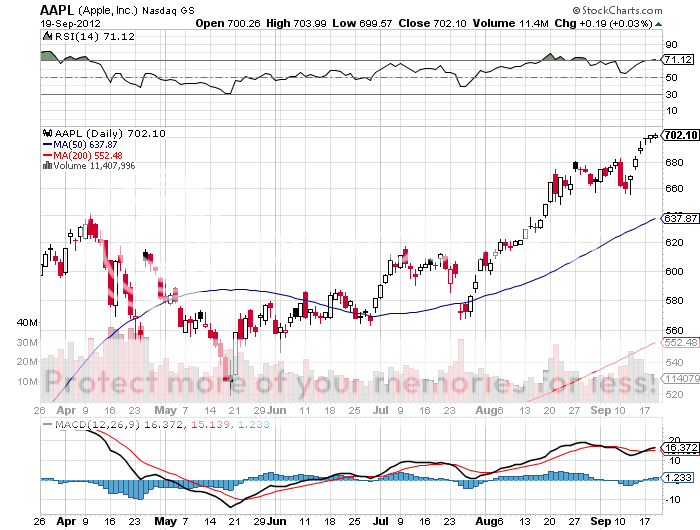

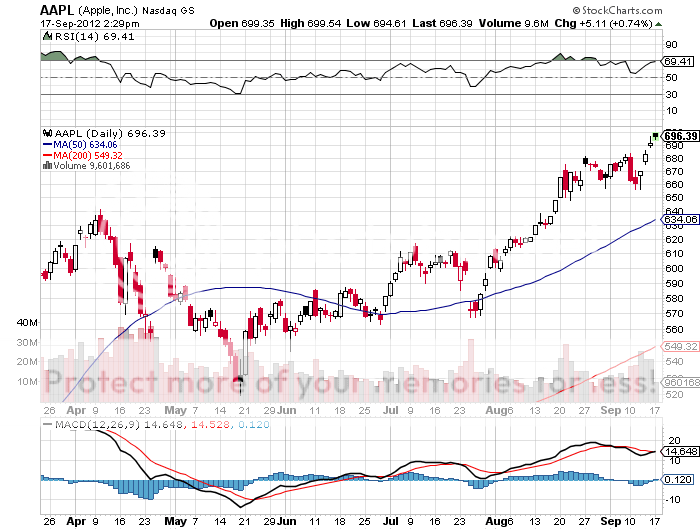

I went into my local Apple store last week to buy an iPhone 5 to replace my aging iPhone 4s. The sales girl looked at me like I was out of my mind. She gave me a website address where I could pre-order and said good luck. I found out later that the company sold a stunning 2 million units in pre-orders in 24 hours. That?s nearly a billion dollars in revenue. Wow!

I went back into the store yesterday and talked to the manager. I asked when iPhones would be physically available in the store. He said this Friday, but there will be lines around the block. I asked when I could just come in and just buy one without a long wait. He answered mid-week in the afternoon sometime at the end of October. Double wow! It is clear to me that the only limitation on the sales of this incredible product for the rest of the year is the number of units they can physically get out the door.

The stock is now up 75% year-to-date. Any money manager found missing Apple from their portfolio at year end will get fired. So a gigantic performance chase has begun, with thousands of institutions throwing in the towel and paying up at these lofty levels just to get the name on their books.

The truly bizarre thing is that the higher Apple shares go, the cheaper they get on an earnings multiple basis, because the market can?t keep up with surging profit growth. This is proof, yet again, that if you live long enough, you get to see everything.

There is one stock that is certainly not going to announce an earnings disappointment in the coming quarterly cycle, and that is Apple. The roll out of the iPhone 5 is occurring much faster than previous models. It will be offered for sale in 100 countries by yearend compared to only 53 for the iPhone 4s during the same period.

So unit sales could reach 8 million by the end of Q3 and a staggering 50 million by Q4. This will create an unprecedented surge in Apple?s reported quarterly earnings. Those waiting to buy on the next big dip could end up missing one of the most impressive multi-decade growth stories in history.

CEO Tim Cook is not finished with us with the iPhone 5 launch. My sources in the company tell me that other generational changing products will be released in the months to come which could trigger another leg up in the stock. I think it is possible for the share price to tack on another $100 by year end.

For additional research on why you should buy shares in this amazing company, please go to my website at www.madhedgefundtrader.com and do a search for ?Apple?. There you will find a zillion pieces begging you to buy the stock from $250 on up. Last week, I raised my final target for the shares to $1,600, which we could see in a couple of years. I will continue to drink from this well as long as the water is fresh and sweet.

Last week Apple?s legendary product designer, Sir Johnny Ive, bought a $17 million, 7,279 square foot mansion on San Francisco?s tony Gold Coast in Pacific Heights, an abode first built by a famous gold miner. He?s the guy who came up with the look of the iPhone, iPad, and iPhone to Steve?s Jobs? exacting standards. I want a piece of that action.

Johnny's New Kitchen

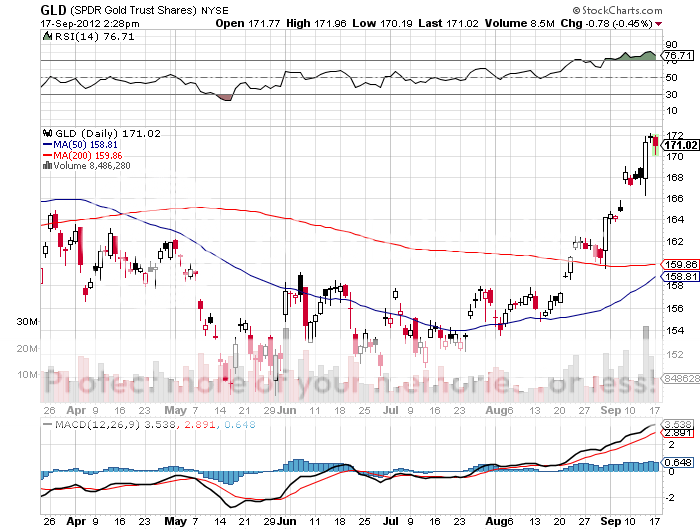

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that the barbaric relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD). They claim the move in the yellow metal we are seeing is only the beginning of a 30-fold rise in prices similar to what we saw from 1972 to 1979, when it leapt from $32 to $950. I remember those days well.

So when the chart below popped up in my in-box showing the gold backing of the U.S. monetary base, I felt obligated to pass it on to you to illustrate one of the intellectual arguments these people are using. To match the 1936 monetary value peak, when the monetary base was collapsing, and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by eight times, or to $9,600 an ounce.

I am long-term bullish on gold, other precious metals, and virtually all commodities for that matter, but I am not THAT bullish. It makes my own $2,300 prediction positively wimp-like by comparison. The seven-year spike-up in prices we saw in the seventies, which found me in a very long line in Johannesburg to unload my own krugerands in 1979, was triggered by a number of one-off events that will never be repeated.

Some 40 years of demand was unleashed when Richard Nixon took the U.S. off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20% a few years later. Newly enriched sellers of oil had a strong historical affinity with gold. South Africa, the world?s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence -- my more subdued forecast. But then again, I could be wrong.

You may have noticed that I have not been doing much trading in gold this week or the other precious metals lately. That is because they are still working off an extremely overbought condition. Given some time, and a nice little dip in prices, and I?ll be back there in a heartbeat. You?ll be the first to know when that happens.

I really like your daily take on the markets and world issues. You have earned your stripes over and over. You are a statesman of the money world. I will see you on your next visit to Seattle.

Stay safe,

Mike

Seattle, Washington

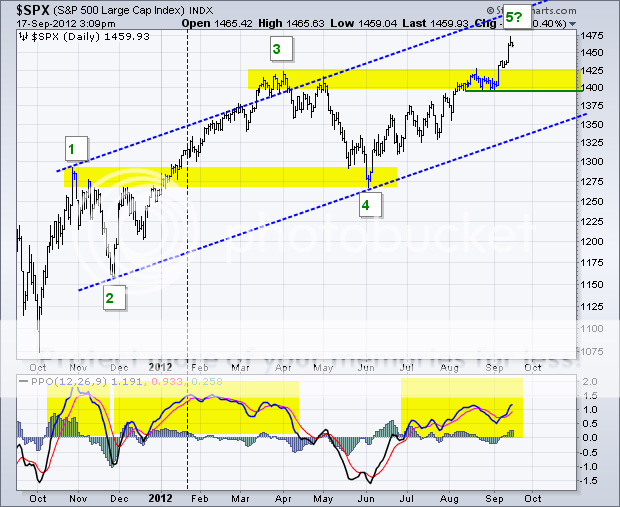

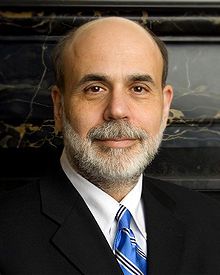

I think that Ben Bernanke?s QE3 is such a game changer, that we have to throw all existing strategies into the trash and start all over again from scratch. ?Suddenly, investors and traders have to face the prospect of adding $500 billion to $1 trillion to the Fed?s balance sheet, taking it to a record $3.7 trillion. ?All of this new money will go into risk assets.

This demands that I radically change my approach to the market. ?You can kiss the big September correction I was expecting goodbye and the ones for October, November, and December goodbye as well. ?The markets might even continue up for the rest of 2012.

In December, 1944, General George S. Patton accomplished one of the greatest feats in military history by wrenching the focus of his Third Army?s attack on Germany by 90 degrees to the North on three days? notice in the midst of a blinding snow storm with minimal supplies. ?The result was the relief of the besieged 101 Airborne Division at Bastogne and victory in the Battle of the Bulge. ?It is time for such a move in the markets.

Don?t try to apply any kind of fundamental analysis to this. ?You might overthink your way out of a job. ?This is a pure liquidity play. ?It means buying stocks solely on an anticipated multiple expansion from 14.5X today to a 15X or 15.5X multiple. ?Actual corporate earnings in the upcoming quarterly earnings cycle will be flat to down small.

I am not calling for the market to go ballistic here. ?I think a rise of 50 to 100 S&P 500 points to 1,500 or 1,550 is in the cards here. ?Why didn?t the market continue to rocket after the first day of QE3? ?I believe that there is a ?deer in the headlights? effect going on here. ?Everyone is so stunned from the magnitude of the Fed action that they have gone catatonic. ?Trading desks are awaiting a big dip to buy that isn?t happening.

I am not a person who is accustomed to buying market tops. ?I am the ultimate bargain seeker. ?I?m the guy who goes to garage sales in poor neighborhoods so I can find a full case of prime Japanese sake for $5, as I have done. ?But you don?t get a quantitative easing with these implications dumped on you very often either.

This augurs for an index that doesn?t crash, or doesn?t even have a substantial correction. ?It just continues to grind up slowly. ?There is too much cash sitting on the sidelines to allow otherwise. ?The most hated rally in stock market history is about to become even more despised. ?Best case, we add 7% by year end. ?Worst case, we continue to chop sideways and finish 2012 around these levels.

There is one stock that is certainly not going to announce an earnings disappointment, and that is Apple (AAPL). ?The roll out of the iPhone 5 is occurring faster than previous models. ?It will be offered for sale in 100 countries by yearend compared to only 53 for the iPhone 4s during the same period. ?So unit sales could reach 8 million by the end of Q3 and 49 million by Q4. ?This will create an unprecedented surge in Apple?s reported quarterly earnings. ?Those waiting to buy on the next big dip could end up missing one of the most impressive multi decade growth stories in history. ?This will impact the entire market sentiment, as it did in Q1.

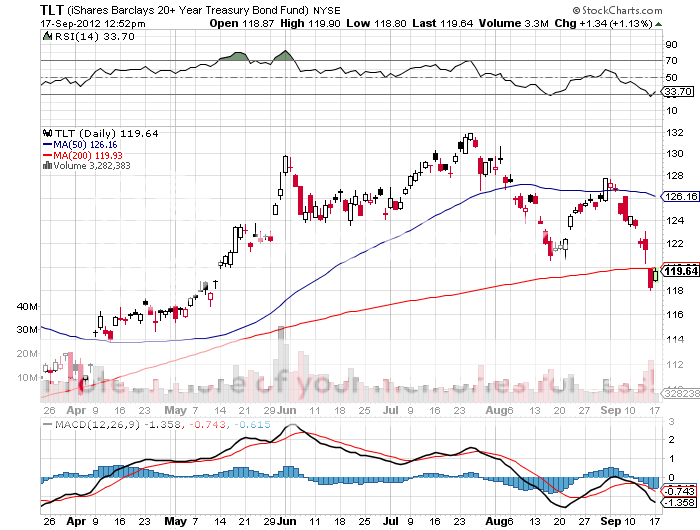

On top of this, there is a serious reallocation trade going on whereby institutions are shifting money out of Treasury bonds and into the entire risk spectrum. ?This is why the Treasury bond ETF (TLT) has been hammered yet again, taking it down to a four month low. ?So the amount of money about to pour into risk assets will be a multiple of the $1 trillion mentioned above.

I?m not expecting any contribution to the economy from housing. ?So many millions of homes still suffer from negative equity that the Fed could take the 30-year conventional fixed rate mortgage rate to zero and it still will not generate much new construction where it can most-positively affect the economy. ?But from a market point of view, we don?t need their help for the time being.

What could go wrong with this scenario? ?Israel could attack Iran. ?There is no doubt that there is a partial mobilization of armed forces going on in Israel as I write this. ?I am getting frantic emails every day now from friends there about movement of troops, cancelled vacations, reserve call ups, and senior staff put on notice. ?When generals don?t return my phone calls, something is up.

But my Mossad friends tell me they aren?t going to pull the trigger. ?Prime Minister Benjamin Netanyahu is just reacting to the collapse of the Romney campaign in the U.S. presidential election. ?He has realized in the past two weeks that he is going to have to rattle his own sword from now on instead of counting on Romney to do it for him after November. ?Even if Israel does act, the impact on financial markets is likely to be brief and largely confined to the price of oil.

The other risk is that Romney could win the election. ?When Bernanke?s current term expires in January, 2014 he would be replaced by an austerity oriented, anti-quantitative easing hardliner. ?In that case, goodbye QE3, hello Dow 6,000. ?But at this point, this is an extreme outlier. ?You don?t see the Intrade betting on an Obama win surge from 57% to 66.3% very often, as it has done in the past week (click here for their site). ?If nothing else, Bernanke?s move on QE3 has certainly deep sixed any chance Romney had of winning.

What about the ?fiscal cliff?? ?It all boils down to the election. ?The Senate is now a Democratic lock, thanks to Mr. Todd Aiken of Missouri. ?There is a 50% chance that the Democrats retake the House on the coattails of the Romney crash. ?If they do, the fiscal cliff will disappear weeks after the election to be followed by another $1 trillion reflationary package entirely focused on infrastructure.

If the Republicans hold on, you can bet on Congress to weasel out of the mid-December deadline by kicking it forward two months. ?By then, recalcitrant losing Tea Party members will be flushed out of their seats, making the party much more manageable for the leadership and paving the way towards a real final agreement. ?Either way, we don?t go over the cliff, extending the present bull run for equities until Q2, 2013.

Taking all the above into consideration, I think the way to play here is through deep in the money call spreads in risk assets with December expirations. ?The strikes should be pegged 10% to 20% out-of-the-money so you could handle a 5% market correction without sweating it. ?The December expiration will allow you to wimp out just before the November 7 election and still keep a substantial portion of your profit.

The names I will be focusing on will be gold (GLD), silver (SLV) Apple, (AAPL), Google (GOOG), Qualcomm (QCOM), and Disney (DIS). ?I will attempt to scale into this portfolio and will send you urgent trade alerts when I see entry points. ?If the market goes down small, sideways, or up, as I expect, this should enable you to add 25% to the value of your portfolio by yearend.

Call me cautious, but you don?t get to be old by being incautious. ?In flight school there is a favorite saying: ?There are old pilots and bold pilots, but there are no old, bold pilots.?

Think of this as our ?bulge? moment. ?Isn?t life interesting? ?Oh, and thanks Uncle Al for the Bastogne angle, and sorry about the two toes you lost to frostbite there. At least you got a decent Veterans Administration disability check out of it.

Our "Battle of the Bulge" Moment.

I don?t just think he hates me, he truly despises me. ?In fact, he does everything he can to put me out of business.

Take yesterday, for example, when the Federal Reserve Open Market Committee gave me and my views a complete thrashing. ?QE3 was the last thing in the world I was expecting because it was not justified by the current fundamentals. ?Most other independent analysts agreed with me, including several Fed govenors.

He could have let me off easy by announcing some minor back-door easings, like expanding his ?operation twist? to include mortgage-backed securities for the first time, or ceasing interest rate payments on deposits from private banks. ?But, no, Ben decided to make me look like a complete idiot, not by just announcing QE3, but one infinite in size that goes on forever. ?Talk about pouring salt on my wounds.

It?s not that I am not an all right guy. ?I am kind to children and small animals. ?I donate generously to many charities. ?I send my mother cards on her birthday (happy birthday mom!), even though she is 84 and not expected to last much longer. ?I even occasionally escort little old ladies across the street, although this is a holdover from my days as an Eagle Scout.

It?s just that Ben Bernanke and I don?t see eye-to-eye on a lot of important issues. He wants stocks to go up. ?As a hedge fund manager who plays from the short side more often than not when the economy is growing at a paltry 1.5% rate, I want them to go down. ?He wants bonds to go up too, as he clearly elicited with his ?twist policy? last year when he bought long term Treasury bonds and shorted overnight paper against it. ?I, on the other hand, want bonds to sell off because I know that when the bill comes due for all of this monetary easing, the crash will be momentous.

These are not the only matters we differ on. ?He wants to create jobs. ?He can wish this until the cows come home, but he?s not going to get them because of the gale-force demographic headwinds the country is now facing and the massive deleveraging by the public and private sector. ?The 6 million jobs we exported to China are never coming back.

However, all he has to do is make a mere mention of his desires, or even just mention the letter ?Q?, and asset prices go through the roof, forcing me to stop out of my shorts at losses. ?This is why I was in such a foul, acrimonious, and detestable mood during the first quarter, when stocks went up almost every day.

My problem is that Ben Bernanke isn?t the only person who dislikes me. ?President Obama doesn?t think much of me either. ?And it?s not because I refuse to buy a cold chicken dinner at his St. Francis Hotel fund raisers for $35,000, and $70,000 if I bring a date. ?He talks about jobs too. ?He frequently speaks about the need to improve our education system, even though I know he is poised to slash the budget for the Department of Education as part of some deal with the Republicans. ?Ditto for Social Security and defense.

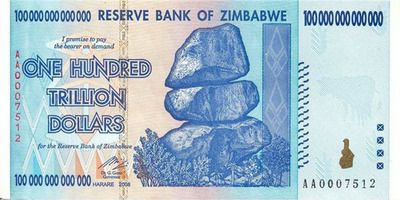

Fortunately for me, I wrote off any prospect of getting a retirement check a long time ago and have made other arrangements, like becoming a hedge fund manager. Either the payments will be too small for me to live on, or they will be made in worthless Zimbabwean dollars.

I get along with Treasury Secretary, Timothy Geithner, OK, which keeps me on his ?must see? list whenever he stops in San Francisco on his way to Beijing to ask to borrow more money. ?But we go way back. ?There are only four people in U.S. history who can discuss Japanese monetary policy of the 1920?s in depth, and do it in Japanese just for laughs (it was clearly too easy, but they had to reflate after the 1923 Great Kanto Earthquake. ?Some things never change).

Two of them, Senator Mike Mansfield of Montana and Harvard professor, John K. Fairbank, died ages ago. ?So he is kind of limited in his choices. ?Besides, there are not a lot of people out there who can give him a 40 year view on the global economy, and I am one of them.

There are plenty of others who don?t think I am so hot. ?Try making a fortune in a market crash when everyone else is losing their shirt. ?While others in the locker room at my country club are slamming doors, tearing their hair out, and breaking golf clubs in half when they see the price feed on CNBC, I am chirping happily away about selling short at the top. ?I might as well be letting out a loud fart in Sunday church service. ?This explains why I stopped getting invitations to dinners ages ago.

It?s not that my relationship with Ben Bernanke is totally hopeless. ?When the demographic picture turns from a headwind to a tailwind and individuals and corporations cease deleveraging and return to re-leveraging, we?ll probably be reading from the same page of music. ?But according to the U.S. Census Bureau, the earliest this can happen is 2022. ?By then, he probably won?t be the Fed governor anymore and I won?t care if he likes me or not.

Besides, I may be able to make a new friend or two in the meantime. ?If Mitt Romney wins the presidential election he says he?ll fire Ben Bernanke on his first day in office. ?He can?t really do that, but Ben?s term does expire a year later. ?His two most widely rumored picks to fill the post are president of the Federal Reserve Bank of Dallas, Richard Fisher, and Stanford University professor, John Taylor.

These two are not in the least bit interested in all this quantitative easing malarkey. They are much more similar in philosophy to Herbert Hoover?s Treasury Secretary, Andrew Mellon, who popularized the ?let the chips fall where they may? approach to economic policy. ?Kick the props out from under this market and all of a sudden Dow 3,000 is on the table, as argued by Global strategist and demographics maven, Harry Dent.

They might even go as far as unwinding the Fed?s hefty $2.7 trillion balance sheet. ?That would give the Chinese, who hold $1 trillion of these bonds, a heart attack. ?But who cares? It would create the mother of all trading windfalls for me. ?Hell, they might not even care if I torture small animals, beat children with a switch, and leave little old ladies in the middle of onrushing traffic. ?I think we would get along just great.

Screw Social Security, and Ben Bernanke too.

The Great Kanto Earthquake of 1923