My friends in the gold futures puts have been telling me that the Chinese have emerged as major buyers in recent months. ?Year-to-date imports have reached 458 tonnes, more than four times the amount during the same period last year ? that amounts to $25 billion in real money. ?This is on top of the country?s massive local gold production, which is kept entirely in country, the exact details of which are unknown.

Explanations run the entire gamut of possibilities. ?There is a concerted attempt by the People?s Bank of China to diversify away from Treasury bills, notes and bonds at a 60-year market high. ?Since the end of 2011, the Middle Kingdom?s holdings of Treasuries have increased by a mere $12.4 billion to $1.164 trillion.

The Chinese have been investing in the entire range of higher-yielding securities, including European sovereign bonds with near junk bonds and emerging market debt, like the bonds issued by Singapore. ?They have also aggressively stepped up their foreign direct investment, picking up important energy assets in Canada just last month.

The Chinese could be buying gold for the simplest reason of all: it?s going up. Private gold ownership carried a death penalty there four years ago. Today there are precious metals coin shops in every city center.? The government is now encouraging individuals to keep some savings in gold. ?With a middle-class now at 400 million, that adds up to a lot of buyers.

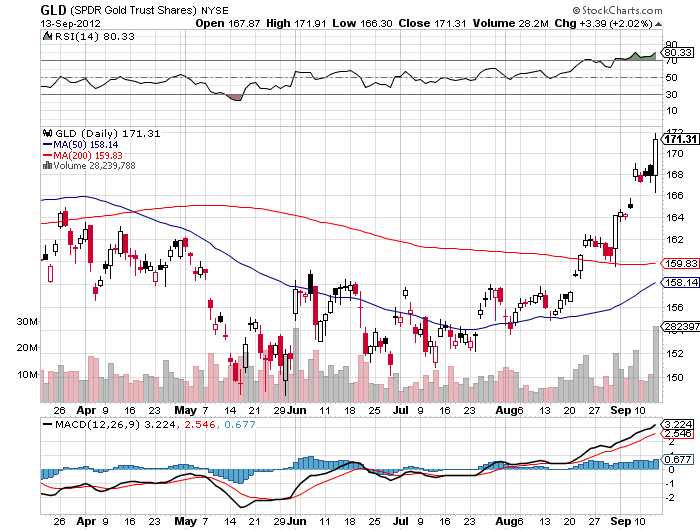

Gold remains my favorite asset class, and I?ll be looking to jump back in on the next dip.

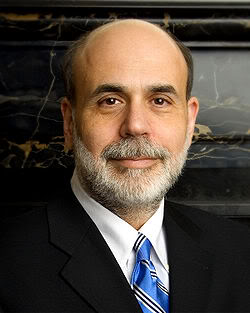

?We don?t think the economy is going to be overheating anytime soon,? said Federal Reserve Chairman, Ben Bernanke.

?First, thanks so much for your Global Trading Dispatch Trade Alert service, which is not only a wealth building tool, but offers a comprehensive trading education. ?I sometimes trade your recommendations, and sometimes use your guidance to make more aggressive options and futures plays. ?I especially liked your call on gold (GLD).? It?s working very nicely for me.?

--Darell

USA

Take those predictions, forecasts, and prognostications with so many grains of salt. ?They have a notorious track record for being completely wrong, even when made by the leading experts in their fields. In preparing for my autumn lecture series, I came across these following nuggets and thought I?d share them with you ? There are some real howlers:

1876 ?This 'telephone' has too many shortcomings to

be seriously considered as a means of communication.?

-- Western Union internal memo.

1895? ?Heavier than air flying machines are impossible.?

-- Lord Kelvin, president of the Royal Society.

1927 "Who the hell wants to hear actors talk?"

-- H.M. Warner, founder of Warner Brothers.

1943 ?I think there is a world market for maybe five computers.?

-- Thomas Watson, Chairman of IBM.

1962 ?We don't like their sound, and guitar music

is on the way out.?

-- Decca Recording Co. rejecting the Beatles, 1962.

1981 ?640 kilobytes of memory ought to be enough for anybody.?

-- Bill Gates, founder of Microsoft.

?This has been the worst year for active managers in history. We have never seen numbers of people missing benchmarks so large. As the markets have moved up, the tracking error has grown. People are missing about a third of the upside in the markets,? said Thomas Lee, a chief equity strategist at JP Morgan.

Since nothing less than the fate of the free world depends on the judgment of Ben Bernanke these days, I thought I?d touch base with David Wessel, the Wall Street Journal economics editor, who has just published In Fed We Trust: Ben Bernanke?s War on the Great Panic.

I doubted David could tell me anything more about the former Princeton professor I didn?t already know. I couldn?t have been more wrong, as David gave me some fascinating insights into the inner soul of our much-vaunted Chairman of the Federal Reserve.

Bernanke was the smartest kid in rural Dillon, South Carolina, who, through a series of improbable accidents, and intervention by a local black civil rights leader, ended up at Harvard. He built his career on studying the Great Depression, then the closest thing to paleontology economics had to offer, a field focused so distantly on the past, that it was irrelevant. Bernanke took over the Fed when Greenspan was considered a rock star, inhaling his libertarian, free-market, Ayn Rand inspired philosophy in great giant gulps.

Within a year, the economy suddenly transported itself back to the Jurassic Age, and the landscape was overrun with T-Rex?s and Brontesauri. He tried to stop the panic 150 different ways, 125 of which were terrible ideas, the remaining 25 saving us from the Great Depression II. This is why unemployment is now only 9.1%, instead of 25%.

The Fed governor is naturally a very shy and withdrawn person, and would have been quite happy limiting his political career to the Princeton, NJ school board. To rebuild confidence, he took his campaign to the masses, attending town hall meetings and pressing the flesh like a campaigning first term congressman.

The price tag for Ben?s success has been large, with the Fed balance sheet exploding from $800 million to $2.7 trillion, solely on his signature. The true cost of the financial crisis won?t be known for a decade or more. The biggest risk is that we grow complacent, having pulled back from the brink, and letting desperately needed reforms of the financial system and the rebuilding of Fannie Mae and Freddie Mac slide. This is already starting to happen.

How Bernanke unwinds this bubble will define his legacy. Too soon, and we go back into a real depression. Too late, and hyperinflation hits. That?s when we find out who Ben Bernanke really is.

A number of readers have asked me why I?m not trading now. Since I put out my calls to sell Treasury bonds in August (click here for ?The Great Treasury Bond Crash of 2010? ), and buy US stocks in September (click here for ?My Equity Scenario for the Rest of 2010? ), I have mostly been sitting on my hands. I usually try to catch three or four trend changes a year, which might generate 50-100 trades, and often come in frenzied bursts.

Since I am one of the greatest tightwads that ever walked the planet, I only like to buy positions when we are at the height of despair and despondency, and traders are raining off the Golden Gate Bridge. Similarly, I only like to sell when the markets are tripping on steroids and ecstasy, and are convinced that they can live forever.

Some 99% of the time, the markets are in the middle, and there is nothing to do but deep research, looking for the next trade. That is the purpose of this letter. Over the four decades that I have been trading, I have learned a number of tried and true rules which have saved my bacon countless times. I will share them with you.

1) Don?t over trade. This is the number one reason why individual investors lose money. Look at your trades of the past year and apply the 90/10 rule. Dump the least profitable 90% and watch your performance skyrocket. Then aim for that 10%. Over trading is a great early retirement plan for your broker, not you.

2) Always use stops. Risk control is the measure of the good hedge fund trader. If you lose all your capital on the lemons, you can?t play when the great trades set up. Consider cash as having an option value.

3) Don?t forget to sell. Date, don?t marry you positions. Remember, pigs get slaughtered. Always leave the last 10% of a move for the next guy.

4) You don?t have to be a genius to play this game. If that was required, Wall Street would have run out of players a long time ago. If you employ risk control and stops, then you can be wrong 40% of the time, and still make a living. That?s little better than a coin toss. It you are wrong only 30% of the time, you can make millions. If you are wrong a scant 20% of the time, you are heading a trading desk at Goldman Sachs. If you are wrong a scant 10% of the time, you are running a $20 billion hedge fund that the public only hears about when you pay $100 million for a pickled shark at a modern art auction. If someone says they are never wrong, as is often claimed on the Internet, run a mile, because it is impossible.

5) This is hard work. Trading attracts a lot of wide eyed, na?ve, but lazy people because it appears so easy from the outside. You buy a stock, watch it go up, and make money. How hard is that? The reality is that successful investing requires twice as much work as a normal job. The more research you put into a trade, the more comfortable you will become, and the more profitable it will be. That?s what this letter is for.

6) Don?t chase the market. If you do, it will turn back and bite you. Wait for it to come to you. If your miss the train, there will be another one along in hours, days, weeks, or months. Patience is a virtue.

7) When I put on a position, I calculate how much I am willing to lose to keep it. I then put a stop just below there. If I get triggered, I just walk away. Only enter a trade when the risk/reward is in your favor. You can start at 3:1. That means only risk a dollar to potentially make three.

8) Don?t confuse a bull market with brilliance. I am not smart, just old as dirt.

9) Tape this quote from the great economist and early hedge fund trader of the thirties, John Maynard Keynes, to you computer monitor: "Markets can remain illogical longer than you can remain solvent." Hang around long enough, and you will see this proven time and again (ten year Treasuries at 2.4%?!).

10) Don?t believe the media. I know, I used to be one of them. Look for the hard data, the numbers, and you?ll see that often the talking heads, the paid industry apologists, and politicians don?t know what they are talking about (the Gulf oil spill will create a dead zone for decades?).

11) When you are running a long/short portfolio, 80% of your time is spent managing the shorts. If you don?t want to do the work, then cash beats a short any day of the week.

12) Sometimes the conventional wisdom is right.

13) Invest like a fundamentalist, execute like a technical analyst.

14) Use technical analysis only and you will buy every rally, sell every dip, and end up broke. That said, learn what an ?outside reversal? is, and who the hell is Leonardo Fibonacci.

15) The simpler a market approach, the better it works. Everyone talks about ?buy low and sell high?, but few actually do it. All black boxes eventually blow up, if they were ever there in the first place.

16) Markets are made up of people. Understand and anticipate how they think, and you will make a lot of money.

17) Understand what information is in the market and what isn?t and you will make more money.

18) Do the hard trade, the one that everyone tells you that you are ?Mad? to do. If you add a position and then throw up afterwards, then you know you?ve done the right thing. This is why people started calling me ?Mad? 40 years ago.

19) If you are trying to get out of a hole, the first thing to do is quit digging and throw away the shovel. A blank position sheet can be invigorating.

20) Making money in the market is an unnatural act. We humans are predators and hunters evolved to track game on the horizon of an African savanna. Modern humans are maybe 5 million years old, but civilization has been around for only 10,000 years. Our brains have not had time to make the adjustment. In the market, this means that if a stock has gone up, you believe it will continue. This is why market tops and bottoms see volume spikes. To make money, you have to go against these innate instincts. Some people are born with this ability, while others can only learn it through decades of training. I am in the latter group.

Great Hunter, Lousy Trader

The gold rush is back on in California. On my way back from Lake Tahoe recently, I saw that every bend of the American river was dotted with hopeful amateur miners, looking to make a windfall fortune.

Weekend hobbyists were there panning away from the banks, while the hardcore pros stood in hip waders balancing portable pumps on truck inner tubes, pouring sand into sluice boxes. A sharp-eyed veteran can take in $2,000 worth of gold dust a day. The new 2012?ers were driven by a price of gold at $1,700 and the attendant headlines, but also by unemployment, and recent heavy rains last winter that flushed huge new quantities of the yellow metal out of the High Sierras.

They were no doubt inspired by the chance discovery of an 8.7 ounce nugget in May near Bakersfield, worth an impressive $10,000. Local folklore says that The Sierra?s have given up only 20% of their gold, and the remaining 80% is still up there awaiting discovery. Out of work construction workers are taking their heavy equipment up to the mountains and using it to reopen mines that have been abandoned since the 19th century.

The U.S. Bureau of Land Management says that mining permits in the Golden State this year have shot up from 15,606 to 23,974. Unfortunately, the big money here is being made by the sellers of supplies and services to the new miners, much as Levi Strauss and Wells Fargo did in the original 1849 gold rush. Of course, they could much more easily buy the Spider Gold Trust Shares ETF (GLD), but it wouldn?t be as much fun.

Nice to Meet You

I have just finished reading the best financial book ever, and I have read most of them. It is The Ascent of Money: A Financial History of the World by Harvard professor Niall Ferguson. It gives you a great explanation of how the broad sweep of history delivered us to the doorstep of today?s crisis.

Ferguson starts with an ancient accounting system written on clay tablets in Mesopotamia 5,000 years ago, and then takes us through the economic dominance of Greece and Rome. We learn about a medieval Italian diplomat named Fibonacci, who imported advanced mathematical concepts from the Middle East, which we still trade around today. He plots the rise of the great banking dynasties, such as the Medici?s and the Rothschild?s (Jacob was my neighbor in London).

It is also a pot boiling narrative of the great financial scandals, starting with the Mississippi bubble which wrecked France, the South Sea bubble where Sir Isaac Newton lost his shirt, to the Ponzi schemes of the 20th century. The story tells us how the financial center of the world has migrated from Babylon to Cairo, Rome, Venice, Amsterdam, London, and eventually ending up in a hedge fund dominated New York.

Ferguson is particularly astute in explaining in layman?s terms the borrowing binge and the exotic, super leveraged derivatives that lead to the current crash. The author finishes with an explanation of how American overconsumption is financed by Chinese saving, and why this can?t last. If you are looking for a single tome which ties it all together, this is it. To obtain preferential pricing in the purchase of this book, please click here.

Those who have been dying of boredom during August -- the lowest volume, tightest ranging month in many years -- may be about to get their respite. September 12 (or Wednesday next week) offers a potential cornucopia of either fantastically good or terribly bad news, and maybe both.

Let me give you a program of the upcoming events on this momentous day:

*The German Supreme Court renders its decision on the legality of the country?s bailout of troubled southern Europe. If they approve, as expected, the Euro should rally to a new multi-month high, possibly as high as $1.29, triggering a global ?RISK ON? move. If they don?t, then the beleaguered continental currency craters very quickly back to $1.20, from whence it came.

*The Federal Reserve Open Market Committee meets, which may finally give us the good news on QE3. If they deliver, markets will gap up. If they don?t, then everyone will assume that quantitative easing at the next meeting is a sure thing and the markets will go to sleep until then. Personally, I don?t think the Fed will act until the Dow drops below 10,000 and puts the fear of God into everyone. This is the day when we find out how real the ?Bernanke/Draghi Put? is.

*Apple releases the iPhone 5, which will become the greatest consumer electronics release in history, and possibly the most expensive. It turns that that all those leaks I was receiving about timing, price, and performance were correct. This should cause the stock to blast through $700, which is why it is my largest position, with a 35% weighting in my model portfolio. But we may not get much more action than that for the short term. The iPhone 5 launch is what the last $160 point move up since the end of May has been all about.

*The next biweekly Mad Hedge Fund Trader global strategy webinar takes place. Yikes! Whose idea was this? This timing is as bad as scheduling the Republican National Convention in Florida in the middle of the hurricane season. I may have to ask listeners to update me on prices while my broadcast is in progress, as I can?t tie up too much bandwidth with price feeds without crashing the program.

If you net out all the likely outcomes of the above, it is market positive. But surprises will have an outsized downside market impact. Whatever the case, life is about to become much more interesting.

How Real is the ?Bernanke/Draghi Put??