I am writing this report on the Eurostar Express train 300 feet under the English Channel, which is speeding its way from London to Paris at 200 miles per hour.

Waking up in my suite on the Queen Mary 2 at the port of Southampton the other day, the first thing I noticed was that dreadful postwar English architecture. The Germans tried to bomb this place flat to block the shipment of American supplies during WWII, and in the rush to rebuild, style and taste were left by the wayside.

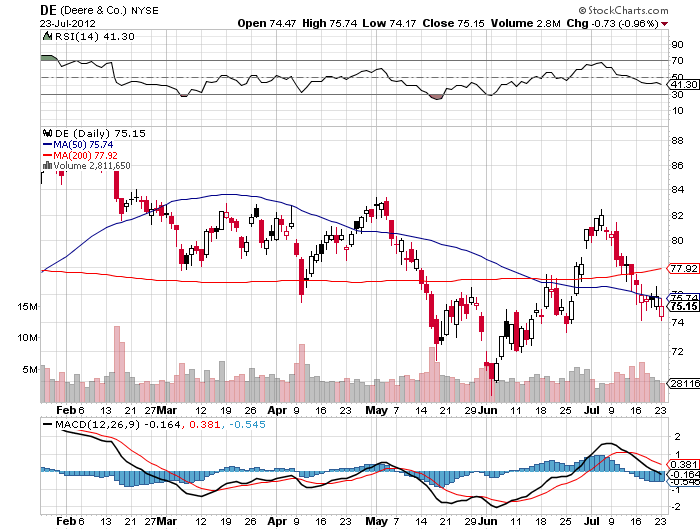

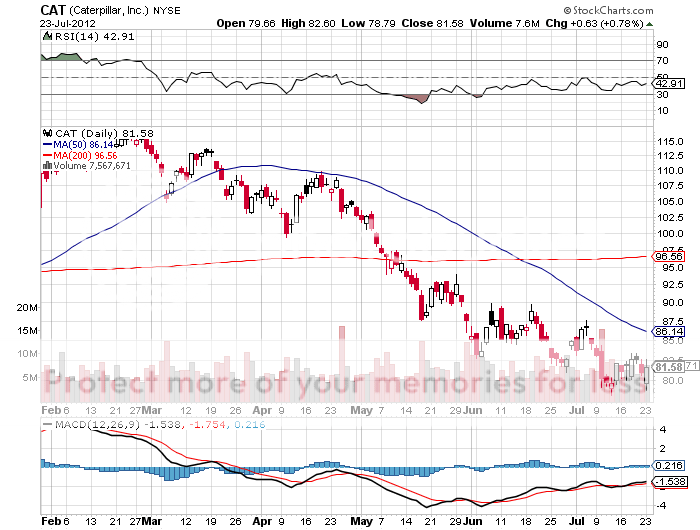

Walking out on my private deck I was greeted with an entirely different view. The pier next to us was parked bumper to bumper with US exports of Caterpillar (CAT) heavy bulldozers and John Deer (DE) tractors, the products of two of my favorite companies. God bless America! Who says we?re in decline?

God Bless America

I saw something else too, Austin Minis, thousands and thousands of them in every conceivable color and design. They crowded the docks, packed every parking structure and lot, and railcars brought in hundreds more by the hour. Roll-on-roll-off ships were loading 3,000 each for shipment to the US.

Who owns Austin Motors these days? Who else but the Germans? In a mere 60 years they have flipped from blocking imports to expediting exports from this southern English transportation hub. History may not repeat itself, but it certainly does rhyme.

To say that much of London is dreading the coming Olympic Games is a vast understatement. Much of the central part of the city has been closed to the public, with parks dedicated to events, and roads closed off to games participants only. Accommodation is so short that an entrepreneurial few have rented out their back yards for visitors to pitch tents.

There are rampant fears that Internet speeds will slow to the point of unusability, putting major multinationals out of business.? The cell phone network is supposed to crash from the backbreaking traffic load. The forecast is for rain on the opening ceremonies. Oh, and a giant asteroid will destroy the earth, at least according to an overwhelmingly downbeat media.

The security is overwhelming. Marine helicopters circle the city with crack snipers on board, the RAF is using fighters to fly combat air patrols, and the army has mounted ground to air missiles of rooftops. I hope they don?t shoot down their own planes. I asked some government officials if I could get an early peak at the Olympic Park and was given a rare flat out ?no?.

Some 4,000 tons of sand sit in front of Buckingham Palace awaiting construction of the courts for the women?s beach volleyball competition. England is suffering the wettest summer in history, and if it doesn?t warm up, the contestants, horror upon horrors, may have to wear clothes! As a result, the black market price for these tickets has fallen below $2,000 each.

More on my report from London tomorrow.

John Thomas

The Mad hedge Fund Trader

It seems that it has become fashionable to bash America these days. As I run around the country giving my strategy luncheons, I hear a lament that has become all too familiar.

America has peaked as a civilization, the story goes, and will follow the British, French, Roman, and even the Egyptian empires into the dustbin of history.? Our standard of living is falling, our technological prowess is fading, and our military strength is weakening. It will be just another generation before the Chinese take over the world and we will all be forced to learn Mandarin in high school, or somebody worse will take their place.

Such bouts of doubt, angst, and self-loathing occur every generation in America. I received a big dose after the US withdrew from Vietnam in 1972. My dad felt the same after Pearl Harbor was attacked in 1941. So did my grandfather when the Lusitania was sunk in 1917. The outbreak of the Civil War in 1861 was considered the country?s darkest day. And then there was the British burning of Washington in 1812. I remember it like it was yesterday.

I say horse feathers, bull-puckey, and balderdash to all this talk. When speaking to foreign governments, military leaders, and central bankers during my global travels I keep hearing a recurring theme. The United States is still the great shining example up on the hill. We are dominant in technology and increasing at an accelerating rate. All I hear about are our country?s strengths.

Our economy can evolve faster than anywhere else on the planet. This is because no one can beat us at creative destruction. Some 22 years into Japan?s stock market crash they are still maintaining companies on life support at enormous expense. We cleansed our system in about six months. And try downsizing outdated unions in Germany. We have cut the union share of labor from 35% to 15% in 30 years. Where else can someone with no money but good ideas become a billionaire in a couple of years?

Since I am a numbers guy, let me throw a few out there just to make my case. With a $15 trillion GDP, ours is triple contenders number two and three at $5 trillion, China and Japan. We are nearly four times Germany?s size at $4 trillion. Our per capita GDP is a staggering twelve times China?s. That means it takes 12 Chinese workers to produce an hour of output compared to our one. This is why America?s per capital income stands at $47,200, compared to only $4,260 in the Middle Kingdom, and many Chinese have to work a 70 hour week to take this home.? They are supposed to be overtaking us? Even the Chinese laugh when I tell them this.

Some 18 of the world?s 50 largest companies are still US based, like Exxon (XOM), Wal-Mart (WMT), Apple (AAPL), and Boeing (BA). But this understates the true picture. Ours occupy far and away the highest end of the value added chain. Many of the rest scrape by copying or pirating our products. You never get ahead that way. Look no further than Apple, which pays workers a minimal $15/day to build US designed products for sale at home with enormous profit margins.

It?s hard to find a strategic industry that we don?t dominate. US companies invented ?fracking? which has untapped vast new energy supplies, making the Middle East irrelevant. Saudi princes come here for their health care, not England or Japan. ?Globalization? has in fact become the polite word for ?Americanization?.

I was standing at Piccadilly Circus in London the other day when a bus stopped and unloaded 50 gorgeous high school girls. I couldn?t for the life of me figure out their nationality. They could have come from anywhere. The teacher had a big butt, so I though maybe American. Then a kid lit up a cigarette and no one cared. Aha! French. They turned out to be the winners of a national English language essay-writing contest and the prize was a trip to the Olympics.

Let me just toss a few more tidbits out there:

*The biggest selling luxury car in China is a GM (GM) Buick

* iPhones, Ford Mustangs, and Katy Perry songs are pouring into a newly freed Libya.

*Cubans and Iranians are erecting illegal satellite dishes so they can watch Law and Order

*Travel around Eastern Europe and all you see are blue jeans

*Over 70% of the drinkers of Coca-Cola are outside the US

*McDonald?s (MCD) has 10,000 hamburger stands abroad

*Microsoft?s (MSFT) Windows operating system runs 90% of the world?s computers

*London has 19,000 people a month joining Match.com

*100,000 readers a day pirate The Diary of a Mad Hedge Fund Trader, and even record a Mandarin version on YouTube

While the US has run big trade deficits for 50 years, we have a perennial surplus in services that goes unnoticed. We remain the force to reckon with in banking and finance, thanks to the reserve currency status of our dollar. Transfer dollars from the UK to Japan and it has to go through New York. This isn?t changing in my lifetime. The world?s wealthy and well connected have long sent their kids to American universities. Six out of ten of the world?s best schools are here, matched only by Oxford, Cambridge, Tokyo University, and Beijing University.

You may be concerned about our rising level of national debt. Aren?t we under saving and over spending? The credit markets beg to differ with you. With 30-year Treasury bond rates at 2.55%, the world is literally throwing money at us as fast as they can. With the long-term inflation rate probably at 3%, this means that our government can borrow money for free!

Foreign individuals and institutions regularly take down more than half of our monthly government debt issues. With Europe in trouble, this trend is accelerating. The government?s error is not that it?s borrowing too much money, but not enough. Prices tell us that there is a severe shortage of US bonds. We could probably double the national debt from here without much impact on interest rates. Apparently, the free marketers don?t look at markets very often.

You have heard me talk a lot about demographics over the years. The US still has a modestly positive slope to its demographic pyramid, which is the best in the developed world. This means that we can expect an ever larger number of young consumers to drive economic growth, largely driven by immigration. This will lead to a new Golden Age for America in the 2020?s, which I believe will be a repeat of the 1950?s. Japan, Russia, and Europe suffer from a diabolical demographic outlook. China doesn?t look so hot either, thanks to its ?One Child? policy. They?re just not making young people anymore.

Since I am also an old and grizzled Marine combat veteran and stay well connected with the military establishment, let me tell you a few harsh realities. Our military technology is the most advanced in human history, unbeatable, deeply feared, and is improving at breakneck speed. The American soldier is the best trained and most lethal ever deployed into the field. Did you know that no Air Force fighter pilot has been shot down in 20 years, despite being almost continuously at war during this entire time? The next generation of US fighters won?t even have pilots, with drones carrying much of the heavy lifting in today?s combat.

The US now provides for the active defense for about half of the landmass of the world; double that protected by the British Empire at its 1914 peak. Two decades after the end of the Cold War, the United States has no enemies of any real consequence. According to the CIA chief, General David Petraeus, Al Qaida has been worn down to a mere 200 active members. The futility of their efforts, confining explosives to shoes and underwear, show how badly things have gone for them.

We have been doing this with ever declining amounts of money. The military share of US GDP has plunged from 50% in 1943 to 6% at the end of the Cold War in 1992 to 4.7% today. It is about to fall off a cliff. Our defense budget is about to drop by half, back to pre 9/11 levels, either through budget cuts or sequestration. The Joint Chiefs are already prepared for this. Cyber warfare and drones are much cheaper than carrier groups and advanced fighters. If we spend less on weapons, the rest of the world will too. In a year, expect to start hearing about this a lot on your dinnertime news.

What about China, you may ask? They have had the blueprints of our most advanced defensive systems for many years now. But having a picture of a weapon is a long way from building one. They lack the technical expertise and the machinery even to copy what we already have. In any case, everyone knows China is indefensible. Torpedo one foreign grain ship, and the country will be starving in six months. China will never pose a threat as long as they can?t live without us and we have all of their money.

Yes, I know that it is an election year. It is up to the party that is out of power to portray conditions here as badly as possible so they can get elected to fix them. The party in power has to convince us how much things have improved so we can stay the course. The misinformation and apples versus oranges comparisons that get doled out as a result can make life complicated, frustrating, and difficult for traders and investors.

The next time I hear we have the world?s highest tax rate I am going to scream! I moved a company here from Europe 20 years ago because the actual taxes paid are low to non-existent. Just ask General Electric (GE), which pays a 3% tax rate. But hey, if this was easy, it would pay minimum wage, not ten figures, so I?ll take things as they are.

And the next time someone tells you that the US is history, consider that person a great short. It is they who are headed for the dustbin.

Things Aren?t That Bad

Can You Spot the American?

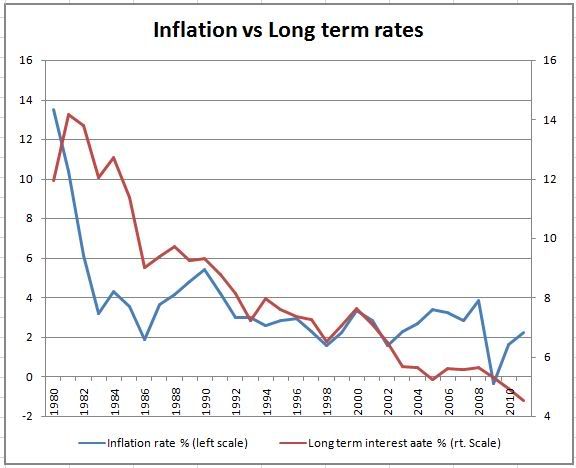

Back in the seventies and eighties, when inflation was soaring well into double digits, the markets were regularly punished by a band of gun slinging traders known as the ?bond vigilantes.? Hard asset prices were running amuck, and there was a laser like focus on the growth of the money supply.

We have just witnessed the largest expansion of the monetary base in history. The Federal Reserve?s balance sheet has ballooned from $800 million to an incredible $2.8 trillion in a mere three years. So where are the bond vigilantes?

The answer is that they were all rounded up and lynched by Paul Volker decades ago. As much as commodity prices rise, the Consumer Price Index remains dead in the water at a 2% annual rate, a shadow of the 14% we saw 30 years ago. And no, it is not a government conspiracy, no fudged numbers, that are keeping the reported inflation rate so low.

The problem is, quite simply, your salary. For every $2 dollars? worth of commodity price inflation we are seeing, there are $3 worth of wages declines. Talk to any businessman, and he will tell you that wages account for at least 50% of his total costs, while commodity cost inputs are only 10%-15%.

Commodity prices can be roaring, but as long has globalization drives down wages at home, as it has for the last 30 years, their overall impact will be modest, at best. So add it all together, and you get an inflation rate that is stagnant at low single digits. You are obviously not working hard enough.

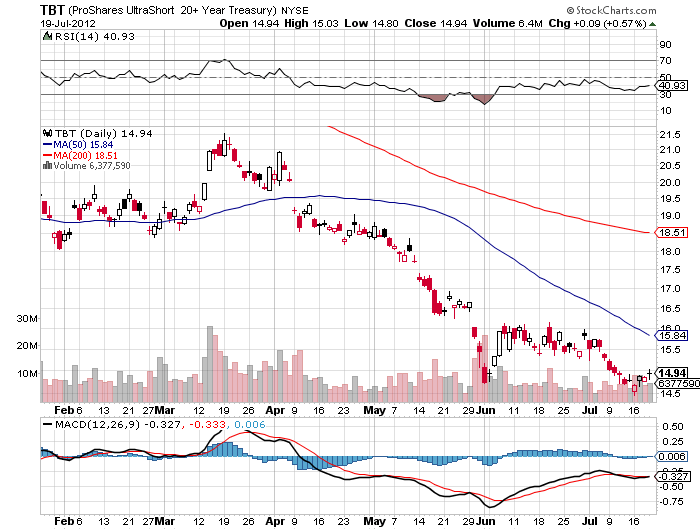

I am interested in all this because I have a dog in this fight. I happen to be short out of the money call spreads on the Treasury bond ETF (TLT). I also have more than a passing interest in the (TBT), a leveraged ETF that bets that the Treasury bond interest rates will rise and prices will fall. I used to think that a resurgence of inflation would take it from the current $14.50 to $200. I don?t believe that anymore. I instead think we will see a rise only to $43, which equates to a ten year Treasury bond yield of 4.10%, up from today?s 1.45%.

That is still a potential gain of nearly 300%, which is better than a poke in the eye with a sharp stick in this zero return world. And that middling profit will not be delivered by a reincarnation of the inflation beast, but by the sheer volume of issuance of bonds demanded by our enormous budget deficits.

The Bond Vigilantes: Gone But Not Forgotten

50 degrees, 26.68 minutes North, 022 degrees, 29.98 minutes East, or 1,000 nautical miles South of Iceland, heading 089 degrees.

Four days of hearing foghorns is starting to get tiring. Captain Wells has been ducking many of his social responsibilities, feeling more secure in the bridge close to the radar. After a few days of intermittent access, the internet is now gone for good, the satellite connection having given up the ghost. People are blaming everything from a lightening strike on the Virginia ground station to late night watching of porn by the crew.

Instead of surfing the net, I am devoting more time to exercise in anticipation of my upcoming Swiss mountain climbing adventures. I have developed a careful routine where I fast walk three times around deck 7 in a brisk wind, take the elevator down to deck 1, walk up their stairs to deck 13, speed past the kennels, the practice golf range, two swimming pools and a bar. I can accomplish all of this three times in an hour, and do it with 40 pounds of books stashed in my backpack. My butler, Peter, tells me there is always a certifiable nut case on every cruise, and I have been designated by the crew as ?THE ONE?.

The 2,600 passengers are quite a mixed batch. We have 1,200 British, 750 Americans, 350 Germans, 80 Canadians, 4 dogs, three cats, and an assortment of other nationalities, and exactly one Japanese couple who didn?t speak a word of English.

I took pity on them and spent an evening translating and catching up on the world at large with them. He was a retired dance instructor, which explains why he and his wife owned the dance floor on most nights. They were grateful for the conversation, for during their entire 30 day cruise from New York to Southampton, then the Baltic Sea and the Norwegian fjords, then back to New York, they had no one to speak to. Still, that was better than last year, when they completed a 105-day round the world cruise with no one to talk to. Before they left, that gave me an exquisite, hand made, traditional Japanese purse as a gift.

The Hard Life at Sea

?Take 200 round trips to Australia, and you really start to rack up the miles,? said Tom Stoker, and automotive sales analyst who just surpassed 10 million frequent flier points on United Airlines. It makes my own 1 million miles seem puny by comparison.

First there was your grade point average, then your SAT score, followed by GMAT and LSAT scores, and finally your FICO. Now there is a new metric with which you will be judged, your ?Influencer? score.

A new breed of marketing research firms are using data from social media sites, like Facebook, Linkedin, and Twitter, to rank members according to their ability to spur their friends to action. Companies like Klout, Peer Index, and Twitter Grader are using complex algorithms to mine their data and rank members. This is far more than just a simple listing of ?friends.?

Scores range from 1-100, with a major league socializer achieving a 40 ranking, and someone like Bono or Martha Steward coming in at a godlike 100. These scores will be made public and could have a major impact on you career prospects, your credit rating, and even your sex life. I can hear this conversation coming already: ?Thanks for the invitation to the opera, honey, but I have a better offer from an 80 to go to the Giants game.?

Do you like your new BMW, American Express card, or Rolex watch and are talking about it with your friends? Advertisers are willing to pay big bucks to get to know you. Last year, Virgin America airline offered free tickets to Los Angeles and San Francisco to highly ranked influencers, while Audi made available special discounts for a new car. Las Vegas casinos are giving away weekends with complimentary show tickets and generous room service tabs.

I have to tell you that I am looking forward to the new system. I just passed 1,200 likes on Facebook and have a massive Twitter following. My website gets 30,000 hits a day and is read in 125 countries, so I should score pretty highly.? I understand that Maria Shriver has recently become available. Hey, Maria! Want to check out my 90? I?ll even fire my cleaning lady!

Will a 90 Tickle Your Fancy?

During my college days, one of my math professors used to repeat a truism: ?Statistics are like a bikini; what they reveal are fascinating, but what they conceal is essential.? That has increasingly becoming the case with US economic data, which are leading investors astray with their faulty guidance.

It turns out that most government data releases contain a seasonal adjustment factor that includes a five-year look back. The problem arises when the 2008 figures from the global financial meltdown are averaged in, which includes a panoply of once in a century spikes. Think job losses at 700,000 a month and a shrinking GDP at an annualized -9% rate.

Those data points are skewing today?s releases in unfortunate ways. They are making the economy appear stronger from September to February, and weaker than it should be from March to August. What this does is reinforce an existing historical trend that weakens stocks every spring, only to rally them back in the fall, which has been in force for over 100 years.

My theory is that this dates back to the agricultural foundations of our nation. Farmers were always at maximum distress during the late summer when their borrowing to pay for seed, fertilizer, and labor was at a maximum, just before the harvest. This is why stock market crashes always happen in September and October.

In recent years, bailouts from the Federal Reserve have reinforced the two red herrings above. Being human, they react to four or five months of unrelenting market stress crying ?Uncle? just when the kids are headed back to school. In August 2010 Bernanke sprung QE2 on the market, and in September 2011 he launched his ?twist? policy, or ?QE light?. In both cases these actions led to 6-8 month global rallies in all risk assets.

What all of this does is explain why ?sell in May and go away? has worked so well for the past four years. Using the five-year timetable, it looks like we will see a repeat of this seasonality in 2013. After that, when everyone comes to believe that the trend is a certainty, it will fail. May bears will get run over by a stampede of bulls in 2014 as the statistical aberrations fade away. It will be then that the shortcomings of a bikini become most apparent.

Conceals More Than It Reveals

Location: 48 degrees, 02.12 minutes North, 043 degrees, 42.08 minutes East, or 1,421 nautical miles ENE of New York.

The Queen Mary 2 is currently plowing its way through a massive fog bank a thousand miles thick, sounding the foghorn every two minutes. Visibility is less than 100 yards, and the waves are a rough 12 feet high. The captain has closed the outside decks for fear of losing a passenger overboard. The weather has disrupted our satellite link, and our Internet is down. So here I write.

One hour out of New York, and a passenger suffered a heart attack. So the captain turned the ship around and headed back to the harbor, where the New Jersey search and rescue sent out a launch to pick up the unfortunate man and his spouse. That meant we could pass under the Verrazano Bridge three times, on each occasion deftly clearing the span by a mere ten feet. Talk about inauspicious beginnings.

The ship is truly gigantic. You must allow 20 minutes to get anywhere, 5 minutes to walk there and 15 minutes to get lost. When launched a decade ago, it was the largest cruise ship every built at 148,900 tons, nearly double the size of the now decommissioned Queen Elizabeth II. It whisks up to 3,000 passengers and 1,325 crew across the seas in the utmost luxury at a steady 21.5 knots. You could water ski behind this leviathan of a vessel, if only the crew permitted it.

As a 40 year guest of Cunard and the highest paying customer on the ship, I managed to bag the Sandringham Suite, possible the most luxurious publicly available oceangoing accommodation ever created. The 2,200 square foot, two floor, two bedroom, three bathroom, Q1 class apartment on decks nine and ten includes a formal dining room, kitchen, his and her closets, a small gym, and 1,000 square feet of rear facing teak deck.

All of this was a bargain for $56,000, or about the same as renting the presidential suite at the San Francisco Ritz for a week at $10,000 a night, except at the end you wake up in England five pounds heavier. Not that I noticed, though. By the afternoon, the two complimentary bottles of Dom Perignon Champagne were already headed for the recycling bin.

The suite came staffed with two full time butlers, Peter and Henry, who were an endless font of fascinating information about the ship. During one unfortunate cruise, eight senior citizens passed away. The morgue held only six, so the extra two were stashed in the meat locker for the duration of the voyage.

I asked if the Cunard they ever performed burials at sea in these circumstances. They said they used to. But a few years back an elderly billionaire ?Mr. Smith? checked into a deluxe Q1 cabin with a hot young ?Mrs. Smith?, and then promptly expired. The grieving widow requested he be buried mid-Atlantic with the traditional yard of sail and a cannonball. When the ship docked at Southampton, the much older real ?Mrs. Smith? appeared to claim the body, and sued the company when informed of his current disposition. So, no more burials at sea.

Yes, the ship did hit a whale once, which stuck to the bulbous bow. When it landed in Portugal, Cunard was fined for commercial fishing without a license. The unlucky cetacean?s skeleton is now in a Lisbon maritime museum. Apparently this company gets sued a lot.

Of course, the memory of the sinking of the Titanic is ever present. There is a history display down on deck 2 and you can even have your photo taken in front of a backdrop of the grand staircase of the ill fated ship. When we passed 10,000 feet over the wreck at 48 degrees, 38.50 minutes North, 50 degrees, 00.11 minutes West one day out of New York, the Queen Mary 2 let out three long blasts of its horn in memory of the lost. Cunard took over the Titanic?s White Star Line during the Great Depression and is therefore the inheritor of this legacy.

Peter is now at the door with my dinner, so I will continue on another post.

A number of analysts, and even some of those in the real estate industry, are finally coming around to the depressing conclusion that there will never be a recovery in residential real estate. Long time readers of this letter know too well that I have been hugely negative on the sector since late 2005, when I unloaded all of my holdings (click here for ?The Hard Truth About Residential Real Estate?). However, I believe that ?forever? may be on the extreme side. Personally, I believe there will be great opportunities in real estate starting in 2030.

Let?s back up for a second and review where the great bull market of 1950-2007 came from. That?s when a mere 50 million members of the ?greatest generation?, those born from 1920 to 1945, were chased by 80 million baby boomers born from 1946-1962. There was a chronic shortage of housing, with the extra 30 million never hesitating to borrow more to pay higher prices. When my parents got married in 1948, they were only able to land a dingy apartment in a crummy Los Angeles neighborhood because he was an ex-Marine. This is where our suburbs came from.

Since 2005, the tables have turned. There are now 80 million baby boomers attempting to unload dwellings on 65 million generation Xer?s who earn less than their parents, marking down prices as fast as they can. As a result, the Federal Reserve thinks that 50% of American homeowners either have negative equity, or less than 10% equity, which amounts to nearly zero after you take out sales commissions and closing costs. That comes to 70 million homes. Don?t count on selling your house to your kids, especially if they are still living rent free in the basement.

The good news is that the next bull market in housing starts in 20 years. That?s when 85 million millennials, those born from 1988 to yesterday, start competing to buy homes from only 65 million gen Xer?s. By then, house prices will be a lot cheaper than they are today in real terms. The ongoing melt down in residential real estate will probably knock another 25% off real estate prices. Think 1982 again. Fannie Mae and Freddie Mac will be long gone, meaning that the 30 year conventional mortgage will cease to exist. All future home purchases will be financed with adjustable rate mortgages, forcing homebuyers to assume interest rate risk, as they already do in most of the developed world. With the US budget deficit problems persisting beyond the horizon, the home mortgage interest deduction is an endangered species, and its demise will chop another 10% off home values.

For you millennials just graduating from college now, this is a best case scenario. It gives you 15 years to save up the substantial down payment banks will require by then. You can then swoop in to cherry pick the best neighborhoods at the bottom of a 25 year bear market. People will no doubt tell you that you are crazy, that renting is the only safe thing to do, and that home ownership is for suckers. That?s what people told me when I bought my first New York coop in 1982 at one tenth its current market price. Just remember to sell by 2060, because that?s when the next intergenerational residential real estate collapse is expected to ensue. That will leave the next, yet to be named generation, holding the bag, as your grandparents are now.

Another great American Icon is falling victim to the collapse of the country?s manufacturing industry. Shanghai Zhenhua Heavy Industries has completed construction of the last of four steel modules for the new Oakland Bay Bridge. The pieces of this giant erector set, which weigh 5,300 tons together, will shortly begin the arduous 22 day journey across the Pacific, baring weather delays.

These are the last of 43,000 tons of Chinese heavy engineering handiwork that will be used to rebuild the aging structure, which was damaged in the 1989 Loma Prieta earthquake. Caltrans authorities have been holding their breath ever since, with potholes occasionally opening up to the bay 100 feet below, cables snapping to behead unfortunate rush hour commuters, and trucks breaking through a treacherous ?S? curve to crash land below.

Zhenhua won the contract with a rock bottom $250 million bid, which is not much more than the cost of the steel itself. The company had to agree to train 1,000 welders to US union standards to get the job. An all American bid would have come in at several times this figure. When the 525 foot tall tower is completed, it will become the world?s largest single span suspension bridge.

The only catch is that if repairs are required on site, the operating manual is written in Mandarin. Will the last person to leave US based manufacturing please turn out the lights? At least many of the tourists photographing the new bridge will be visiting from the Middle Kingdom and paying for it with their vacation dollars.

Small consolation if you are an American worker waiting for his next food stamp hand out.