Another great American Icon is falling victim to the collapse of the country?s manufacturing industry. Shanghai Zhenhua Heavy Industries has completed construction of the last of four steel modules for the new Oakland Bay Bridge. The pieces of this giant erector set, which weigh 5,300 tons together, will shortly begin the arduous 22 day journey across the Pacific, baring weather delays.

These are the last of 43,000 tons of Chinese heavy engineering handiwork that will be used to rebuild the aging structure, which was damaged in the 1989 Loma Prieta earthquake. Caltrans authorities have been holding their breath ever since, with potholes occasionally opening up to the bay 100 feet below, cables snapping to behead unfortunate rush hour commuters, and trucks breaking through a treacherous ?S? curve to crash land below.

Zhenhua won the contract with a rock bottom $250 million bid, which is not much more than the cost of the steel itself. The company had to agree to train 1,000 welders to US union standards to get the job. An all American bid would have come in at several times this figure. When the 525 foot tall tower is completed, it will become the world?s largest single span suspension bridge.

The only catch is that if repairs are required on site, the operating manual is written in Mandarin. Will the last person to leave US based manufacturing please turn out the lights? At least many of the tourists photographing the new bridge will be visiting from the Middle Kingdom and paying for it with their vacation dollars.

Small consolation if you are an American worker waiting for his next food stamp hand out.

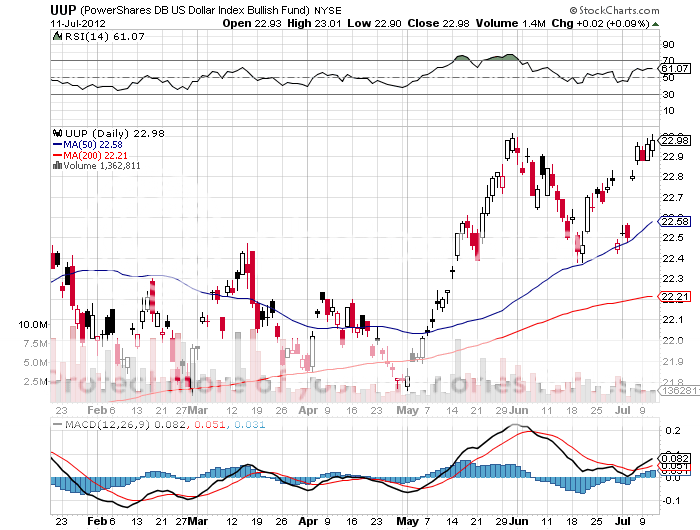

Any trader will tell you the trend is your friend, and the overwhelming direction for the US dollar for the last 220 years has been down.

Our first Treasury Secretary, Alexander Hamilton, found himself constantly embroiled in sex scandals. Take a ten dollar bill out of your wallet and you?re looking at a world class horn dog, a swordsman of the first order. When he wasn?t fighting scandalous accusations in the press and the courts, he spent much of his six years in office orchestrating a rescue of our new currency, the US dollar.

Winning the Revolutionary War bankrupted the young United States, draining it of resources and leaving it with huge debts. Hamilton settled many of these by giving creditors notes exchangeable for then worthless Indian land west of the Appalachians. As soon as the ink was dry on these promissory notes, they traded in the secondary market for as low as 25% of face value, beginning a centuries long government tradition of stiffing its lenders, a practice that continues to this day. My unfortunate ancestors took him up on his offer, the end result being that I am now writing this letter to you from California?and am part Indian.

It all ended in tears for Hamilton, who, misjudging former Vice President Aaron Burr?s intentions in a New Jersey duel, ended up with a bullet in his back that severed his spinal cord. Cheney, eat your heart out.

Since Bloomberg machines weren?t around in 1790, we have to rely on alternative valuation measures for the dollar then, like purchasing power parity, and the value of goods priced in gold. A chart of this data shows an undeniable permanent downtrend, which greatly accelerates after 1933 when FDR banned private ownership of gold and devalued the dollar.

Today, going short the currency of the world?s largest borrower, running the greatest trade and current account deficits in history, with a diminishing long term growth rate is a no brainer. But once it became every hedge fund trader?s free lunch, and positions became so lopsided against the buck, a reversal was inevitable. We seem to be solidly in one of those periodic corrections, which began six month ago, and could continue for months or years.

The euro has its own particular problems, with the cost of a generous social safety net sending EC budget deficits careening. Use this strength in the greenback to scale into core long positions in the currencies of countries that are major commodity exporters, boast rising trade and current account surpluses, and possess small consuming populations. I?m talking about the Canadian dollar (FXC), the Australian dollar (FXA), and the New Zealand dollar (BNZ), all of which will eventually hit parity with the greenback. Think of these as emerging markets where they speak English, best played through the local currencies.

For a sleeper, buy the Chinese Yuan ETF (CYB) for your back book. A major revaluation by the Middle Kingdom is just a matter of time.

I?m sure that if Alexander Hamilton were alive today, he would counsel our modern Treasury Secretary, Tim Geithner, to talk the dollar up, but to do everything he could to undermine the buck behind the scenes, thus over time depreciating our national debt down to nothing through a stealth devaluation. Given Geithner?s performance so far, I?d say he studied his history well. Hamilton must be smiling from the grave.

I recently spent an evening with Ambassador Richard Jones, the Deputy Executive Director of the International Energy Agency in Paris, who had some eye opening things to say about the energy space. The IEA was first set up as a counterweight to OPEC during the oil crisis in 1974, and has since evolved into a top drawer energy research organization.

World GDP will grow an average 3.1%/year through 2030, driving oil demand from the current 84 million barrels/day to 103 million b/d. That means we will have to find the equivalent of six Saudi Arabias to fill the gap or prices are going up, possibly a lot. His conservative target has crude at $190 in twenty years. Some 39% of that increase in demand will come from China and 15% from India.

A collapse in investment caused by the financial crisis means that supply can?t recover in time to avoid another price spike. More than 1.5 billion people today don?t have electricity at all, but would love to have it. The best the climate negotiations can hope for is for CO2 to rise until 2020, and then plateau after that, because once this greenhouse gas enters the atmosphere it is very hard to get out.

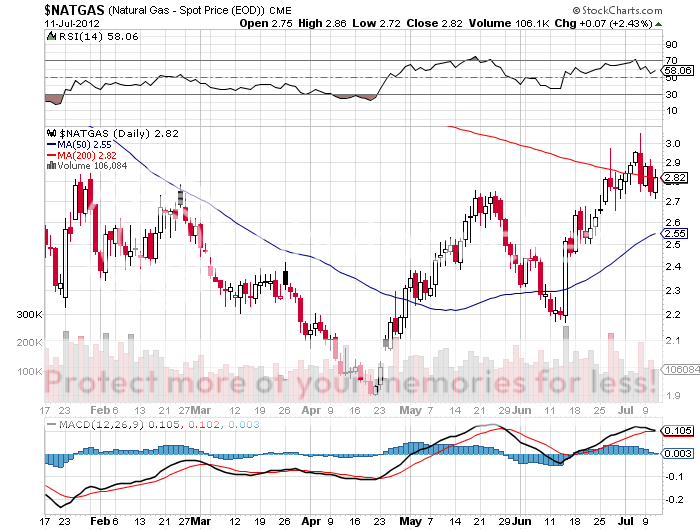

This will require a massive decarbonization effort reliant on nuclear, hydro, alternatives, and carbon capture and storage. Up to half of the needed carbon reduction can be achieved through simple efficiency measures, like ditching the incandescent light bulb, driving more hybrids, and closing dirty, old coal fired power plants. Natural gas will be a vital bridge, as it is cheap, in abundant supply, and emits only half the carbon of traditional fossil fuels. The total 20 year bill for the rebuilding of our new energy infrastructure will exceed $10 trillion.

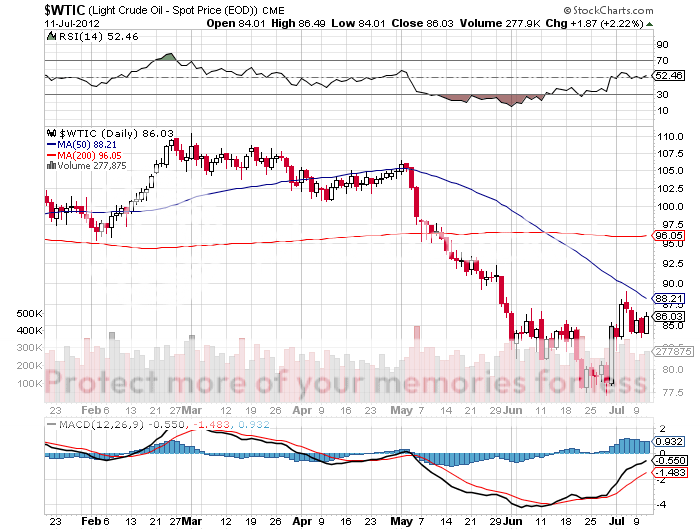

Richard, who comes from a long diplomatic career in Kuwait, Kazakhstan, and Israel, certainly didn?t pull any punches. I have been a huge fan of the IEA?s data for 35 years. Better use any weakness in oil prices to accumulate long term positions in crude through the futures, the ETF (USO), the offshore drilling companies like Transocean (RIG), and oil and gas plays like XOM, and OXY. When oil comes back, it will do so with a vengeance.

I?ll Take Another Six Please

If you have been living in a cave for the last 72 years and missed the work of management guru, Peter F. Drucker, here is your chance to catch up. I just finished reading The Essential Drucker, a weighty tome of 368 pages which summarized the high points and pearls of wisdom of the author's 38 books published since 1939.

A self-described 'social ecologist', Drucker was a journalist who moved to Germany because job prospects in his native Austria-Hungary were so poor following its defeat in WWI. He became a close friend of Austrian economist Joseph Schumpeter, who popularized the term 'creative destruction,' and attended lectures by John Maynard Keynes. He fled to the US in 1934 after his writings were burned by the Nazis.

For most of human history, armies were the predominant management model, and most corporations today show the military influence. Management only emerged as a science during the 1920's, and Drucker was one of the founding fathers. Early adopters, like Coca Cola, Du Pont, IBM, and General Electric, went on to prosper mightily.

He observed that Franklin Delano Roosevelt set up the most productive administration in history. Taking even a single step was so painful for him that he, and all those who worked around him, had to organize the government with the maximum efficiency possible. This was a key element in America's victory in WWII.

Drucker writes at length on the risks and opportunities of entrepreneurship, and argues that all companies must innovate, or die, no matter how pedestrian their product. He predicted many of the trends that came to dominate the late 20th and early 21st century, such as privatization, decentralization, globalization, and the rise of the knowledge worker. He had a huge following when I was in Japan during the seventies, and his mark can be seen in today's global presence of the major Japanese keiretsu.

While most define a company in terms of producing products and making a profit, Drucker sees its mission as 'creating a customer.' He presents a rigorous process for decision making. He lauds nonprofits as the best run organizations in the country because they have to be. Groups like the Girl Scouts, the Red Cross, and United Way maintain an effective global presence without paying their people any money. He makes the distinction between efficiency and effectiveness; doing things well, versus doing the right thing.

Anyone who manages any business of whatever size, from a Fortune 500 company to a single individual banging away on a PC at home, will benefit from reading this book. It forces you to take a look at your own operation with a fresh set of eyes. It even advises on how to manage one's own time, from dispensing with unnecessary meetings to minimizing paperwork and bureaucracy.

Drucker moved to California during the seventies, where he set up one of the early MBA programs for Claremont College. He died in 2005 at the age of 96. To obtain preferential pricing from Amazon for this insightful book, please click here.

Feel Like Investing in a State Sponsor of Terrorism? How about a country whose leaders have stolen $400 billion in the last decade and have seen 300 foreign workers kidnapped? Another country lost four wars in the last 40 years. Still interested? How about a country that suffers one of the world?s highest AIDs rates, endures regular insurrections where all of the Westerners get massacred, and racked up 5 million dead in a continuous civil war?

Then, Africa is the place for you, the world?s largest source of gold, diamonds, chocolate, and cobalt! The countries above are Nigeria, Egypt, and the Congo. Below the radar of the investment community since the colonial days, the Dark Continent has recently been attracting the attention of large hedge funds and private equity firms.

Goldman Sachs has set up Emerging Capital Partners, which has already invested $2 billion there. China sees the writing on the wall, and has launched a latter day colonization effort, taking a 20% equity stake in South Africa?s Standard Bank, the largest on the continent. There are now thought to be over one million Chinese agricultural workers in Africa.

In fact, foreign direct investment last year jumped from $53 billion to $61 billion, while cross border M & A leapt from $10.2 billion to $26.3 billion. The angle here is that all of the terrible headlines above are in the price, that prices are very low, and the perceived risk is much greater than actual risk.

Price earnings multiples are low single digits, cash flows are huge, and returns of capital within two years are not unheard of. These numbers remind me of those found in Japan during the fifties, right after it lost WWII.

The reality is that Africa?s 900 million have unlimited demand for almost everything, and there is scant supply, with many firms enjoying local monopolies. The big plays are your classic early emerging market targets, like banking, telecommunications, electric power, and other infrastructure.

For example, in the last decade, the number of telephones has soared from 350,000 to 10 million. It?s like the early days of investing in China in the seventies, when the adventurous only played when they could double their money in two years, because the risks were so high.

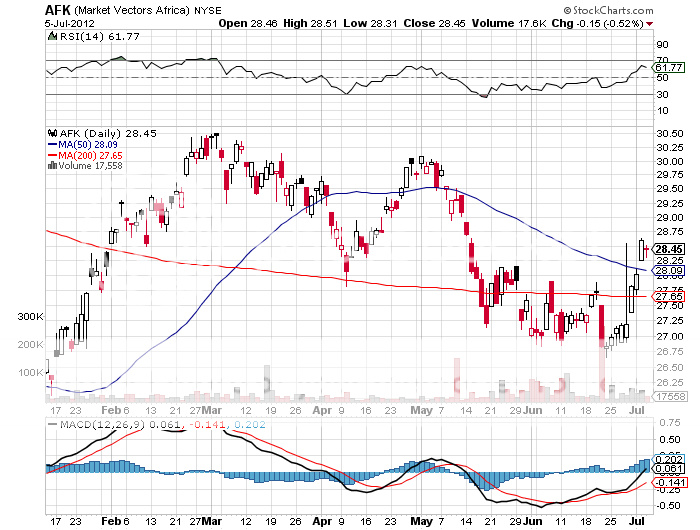

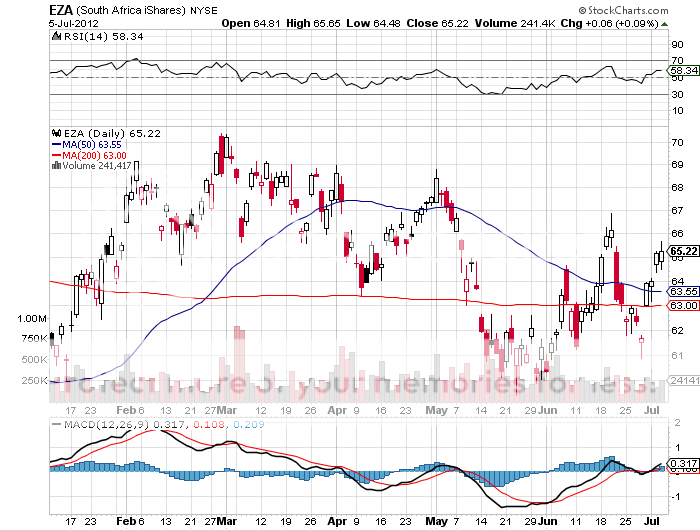

This is definitely not for day traders. If you are willing to give up a lot of short term liquidity for a high long term return, then look at the Market Vectors Africa Index ETF (AFK), which has 29% of its holdings in South Africa and 20% in Nigeria. There is also the SPDR S&P Emerging Middle East & Africa ETF (GAF). For more of a rifle shot, entertain the iShares MSCI South Africa Index Fund (EZA).

Meet Your New Partner

Where is the 2012 London Olympics turning to meet gargantuan cost overruns? None other than BP, which is going the extra mile to burnish its tarnished image.

With the British economy mired in a vicious financial crisis, many are wondering if hosting the games was such a great idea. The original plan was to convert the one square mile, Lower Lea Valley site into a new suburb, and sell the condos to speculative buyers at high prices.

Market conditions today couldn?t be more hostile. Cost overruns have pushed the budget from $4.9 billion to a back breaking $14 billion. It turns out that protecting a global audience from suicide bombers doesn?t come cheap. The East London neighborhood is so bad that ?when you take the tube out there, life expectancy declines with every stop,? said one staffer.

A profusion of undiscovered WWII bombs, a Stone Age cemetery, and a toxic waste dump have also caused delays. When I lived in England I flew over this area weekly to skirt the Eastern edge of the London air traffic control zone, and I will be charitable in calling this place an industrial wasteland.

The last time the British attempted a major project like this, the 2000 Millennium Park, multibillion dollar losses resulted. But who can forget that great film Chariots of Fire, which idolized the success of British runners in the 1924 Olympics? Maybe it?s worth it for the Brits after all? Just watch that delegation from Afghanistan carefully.

My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations (click here for the story).

Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The index counts the cost of McDonald?s (MCD) premium sandwich around the world, ranging from $7.20 in Norway to $1.78 in Argentina, and comes up with a measure of currency under and over valuation. What are its conclusions today? The Swiss franc, the Brazilian real, and the Euro are overvalued, while the Hong Kong dollar, the Chinese Yuan, and the Thai Baht are cheap.

I couldn?t agree more with many of these conclusions. It?s as if the august weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas. I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it to my ass. Better to use it as an economic forecasting tool, than a speedy lunch.

The Big Mac in Yen is Definitely Not a Buy

?When the fools are dancing, the greater fools are watching,? according to an old Japanese proverb.

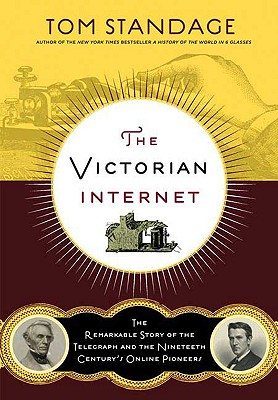

I have just finished leisurely reading Tom Standage?s book The Victorian Internet: The Remarkable Story of the Telegraph and the Nineteenth Century On-Line Pioneers.

Standage discusses the creation and development of the telegraph system and how it revolutionized communication in the nineteenth century. The book claims that Modern Internet users are in many ways the heirs of the telegraphic tradition, meaning that how people used the telegraph during the nineteenth century parallels how people use the Internet today.

Standage goes on to suggest that by studying how the telegraph developed and created certain trends in society, we can learn a lot about the challenges, opportunities, and pitfalls of the Internet today. From discussing the social impact of both systems with the development of online social interactions to the way that business and work was revolutionized, the book has it all!

You can laugh about how Victorians flirted and developed romantic connections over Morse code and you can marvel at the way getting more rapid information, particularly with the invention of the stock ticker, allowed financial markets to emerge and grow. If you Bloomberg slaves are looking for an educational and entertaining read, click here.

My friend, Ian Bremmer of the Eurasia Group, a global risk analyst who I regularly follow, will soon publish another book entitled The End of the Free Markets: Who Wins the War Between States and Corporations. I find this highly depressing, as it takes me as long to read one of Ian?s books as it takes him to write another one. To read a review of his highly insightful tome published in 2008, The Fat Tail: The Power of Political Knowledge for Strategic Investing, please click here. The world is reaching a tipping point. For the past 40 years, global multinationals with unfettered access to capital, consumer, and labor markets have driven the world economy. There is now a new competitor on the scene, the ?state capitalist,? where political considerations trump economic ones in the allocation of resources. Of course, China is the main player, joined by several other emerging nations. The middle kingdom has posted double digit annual growth for the past 30 years without freedom of speech, economic rules of the road, and independent judiciary, and credible property rights. China?s leadership is clearly worried that Western style freedoms will enable wealth to be generated outside their control and be used to orchestrate their overthrow. Private Western companies can only engage in transactions, which stand on their own economically and deliver the short-term profits, which their shareholders demand. In China, long term political goals enable them to pay through the nose to obtain stable supplies of oil, gas, minerals, and materials. That keeps the country?s massive work force employed, off the streets, and politically neutered. The bottom line is that there are now two competing forms of capitalism. The recent financial crisis has accelerated their entrance to the global stage, moving us from a G7 to a G20 dominated world. Globalization is not ending, but it is definitely entering a new chapter. For those of us who read tea leaves to ascertain long term economic trends, this will be a must read. ?