With Treasury Secretary, Tim Geithner, in Beijing last week kowtowing to the largest foreign owner of our national debt, the prospect of the dollar?s demise as a reserve currency has once again reared its ugly head.

Will people pleeease stop incessantly nattering about the possibility of China dropping the dollar as a reserve currency? What else are they going to use? Monopoly money? Taiwanese dollars? Collectable postage stamps?

At $3.6 trillion and rising fast, the Middle Kingdom?s reserves are so enormous that no other currency in the world could accommodate the switch, and no other security offers the necessary depth and liquidity but US Treasuries. China only needs to breathe on any other market for it to skyrocket, we have seen in the relatively Lilliputian commodity markets in recent years.

And really, how likely is it that China embarks on radical new monetary policies that suddenly halves the earnings of its exporters, as well as its 30 year hoard of accumulated savings? The demise of the dollar has been predicted more often than the ditching of Microsoft?s Windows as the global PC operating system, and is just as likely. Hate the greenback as much as you like, but there just isn?t any other alternative.

I have been hearing these arguments ever since the US went off the gold standard in 1971. First there was a perennial Arab threat to price crude in a basket of currencies. Gee, they never seem to complain when the buck is going up. Then there was the speculated emergence of the ?Yen Block?, in the eighties, back when Japan was dominating international trade and the yen was bumping up against ?75 to the dollar. Remember the book ?Japan as Number One? What a laugh.

Next we got all that European whining after the launch of the euro, when the weak dollar was every trader?s free lunch. Let?s face it, Europeans hate using someone else?s currency as their primary reserve instrument. Before the dollar, sterling was the de facto international currency, and was equally despised. So rather than waste time discussing this issue anymore, let?s talk about something more important, like who is going to win the World Series this year. I?m wearing my Yankees hat.

Our New Reserve Currency?

After my entertaining repast with the head of our nation?s intelligence service, I had to ask myself this question.

During the sixties, new dwarf varieties, irrigation, fertilizer, and heavy duty pesticides tripled crop yields, unleashing a green revolution. But guess what? The world population has doubled from 3.5 to 7 billion since then, eating up surpluses, and is expected to rise to 9 billion by 2050.

Now we are running out of water in key areas like the American West and Northern India, droughts are hitting Australia, Africa, and China, soil is exhausted, and global warming is shriveling yields. Water supplies are so polluted with toxic pesticide residues that rural cancer rates are soaring.

Food reserves are now at 20 year lows. Rising emerging market standards of living are consuming more and better food, with Chinese pork demand rising 45% from 1993 to 2005. The problem is that meat is an incredibly inefficient calorie transmission mechanism, creating demand for five times more grain than just eating the grain alone.

To produce one pound of beef, you need 16 pounds of grain and over 2,000 gallons of water! I won?t even mention the strain the politically inspired ethanol and biofuel programs have placed on the food supply. Burning food so you can drive your GM Suburban to Wal-Mart on the weekends while millions are starving never made much sense to me.

It is possible that genetic engineering, sustainable farming, and smart irrigation could lead to a second green revolution, but the burden is on scientists to deliver.

The amount of arable land per person has fallen precipitously since 1960, from 1.1 acres to 0.6 acres, and that could halve again by 2050. Water is about to become even more scarce than land. Productivity gains from new seed types are hitting a wall.

China, especially, is in a pickle because it has 20% of the world?s population, but only 7% of the arable land. It has committed $5 billion to develop agricultural land in Africa. There are now thought to be over one million Chinese agricultural workers on the Dark Continent. Similarly, South Korea has leased half the arable land in Madagascar to insure their own food supplies.

An impending global famine has not escaped the notice of major hedge funds. George Soros has snatched up 650,000 acres of land in Argentina and Brazil on the cheap, an area half the size of Rhode Island, Others are getting into the game, quietly building portfolios of farms in the Midwest and the South.

This year promises to deliver one of the greatest US crop yields in history, brought on by the warmest winter in 100 years. The US Dept. of Agricultural January crop report then predicted huge surpluses, slamming prices once again, and delivering limit down moves in the futures markets. But the weather may not cooperate, as it did last year.

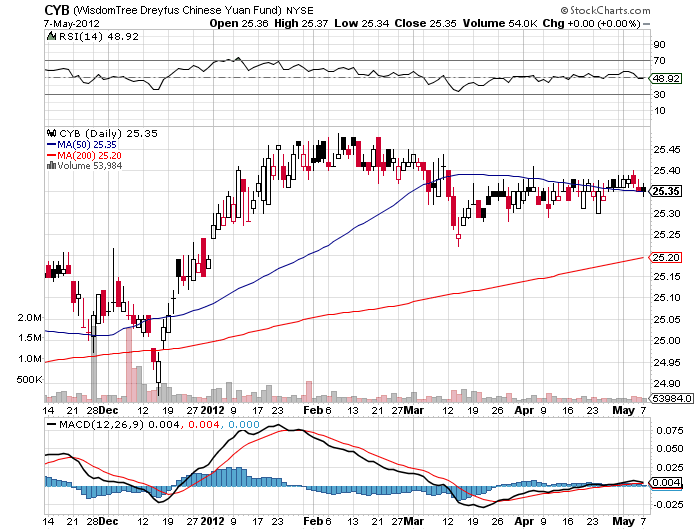

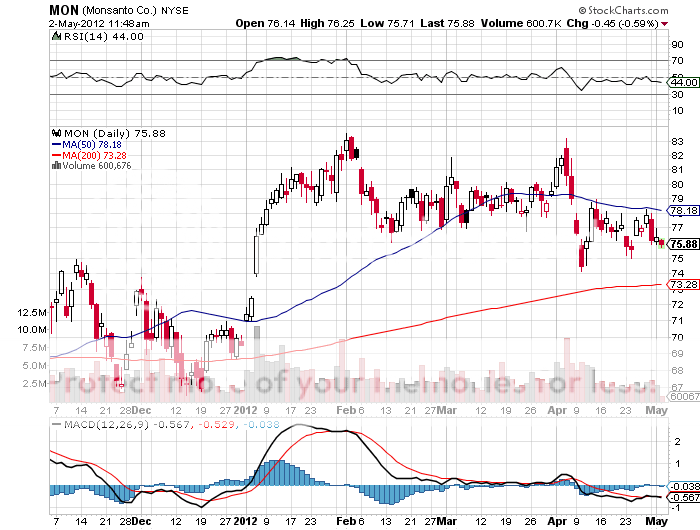

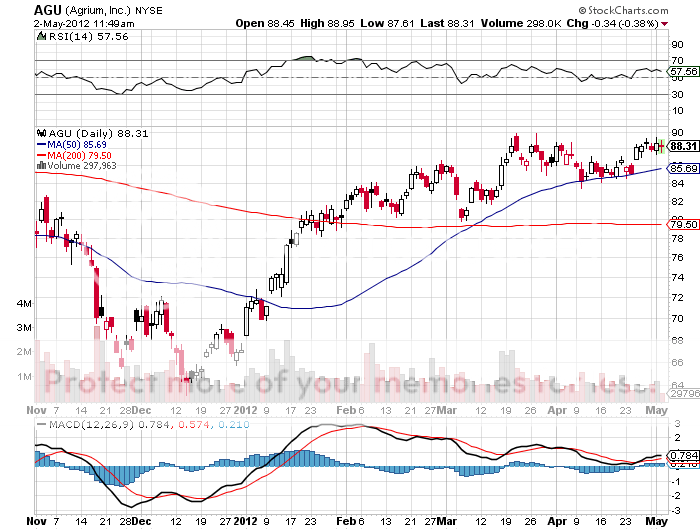

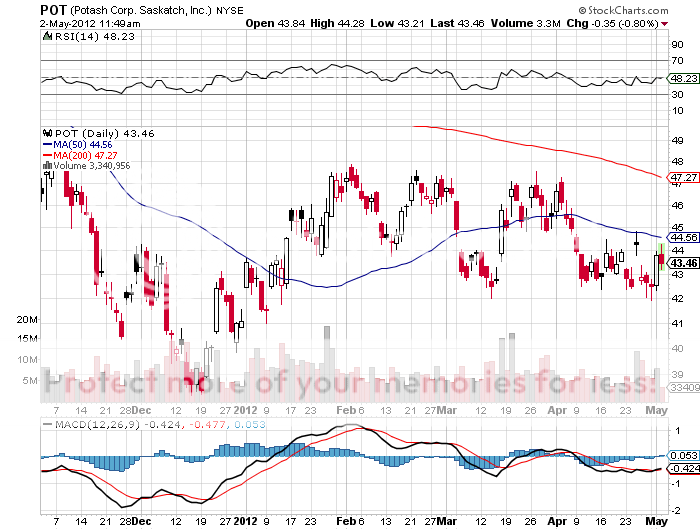

The net net of all of this is that food prices are going up, a lot. Use this year?s expected weakness in prices to build core long positions in corn, wheat, and soybeans, as well as in the second derivative plays like Potash (POT), Agrium (AGU) and Monsanto (MON). You might also look at the PowerShares Multi Sector Agricultural ETF (DBA) and the Market Vectors Agribusiness ETF (MOO).

A ?BUY? SIGNAL?

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund. When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops up. With a link chain to older stories.

You can do the same. Just type anything into the search box with the little magnifying glass in the upper right hand corner of my homepage and a cornucopia of data, charts, and opinion will appear. Even the price of camels in India (to find out why they?re going up, click here) As of today, the database goes back to February 2008, and comprises some 2 million words, or triple the length of Tolstoy?s epic novel, War and Peace.

Watching the traffic over time, I can tell you how the database is being used, and the implications are fascinating:

1) Small hedge funds want to see what the large hedge funds are doing.

2) Large hedge funds look to see what they have missed, which is usually nothing.

3) Midwestern advisors to find out what is happening in New York and Chicago.

4) American investors to find out if there are any opportunities overseas (there are lots).

5) Foreign investors wish to find out what the hell is happening in the US (about 1,000 inquiries a day come in through Google?s translation software in a multitude of languages).

6) Specialist traders in stocks, bonds, currencies, commodities, and precious metals are looking for cross market insights which will give them a trading advantage with their own book.

7) High net worth individuals managing their own portfolios so they don?t get screwed on management fees.

8) Low net worth individuals, students, and the military looking to expand their knowledge of financial markets (lots of free online time in the Navy).

9) People at the Treasury and the Fed trying to find out what the private sector is doing.

10) Staff at the SEC and the CFTC to see if there is anything new they should be regulating.

11) More staff at the Congress and the Senate looking for new hot button issues to distort and obfuscate.

12) Yet, even more staff in Obama?s office gauging his popularity and the reception of his policies.

13) As far as I know, no justices at the Supreme Court read my letter. They?re all closet indexers.

14) Potential investors/subscribers attempting to ascertain if I have the slightest idea of what I am talking about.

15) Me trying to remember trades which I recommended, but have forgotten.

16) Me looking for trades that worked so I can say ?I told you so.?

It?s there, it?s free, so please use it.

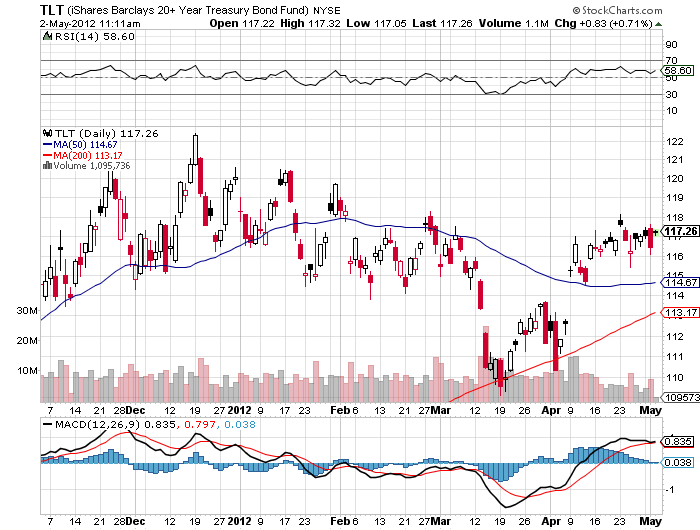

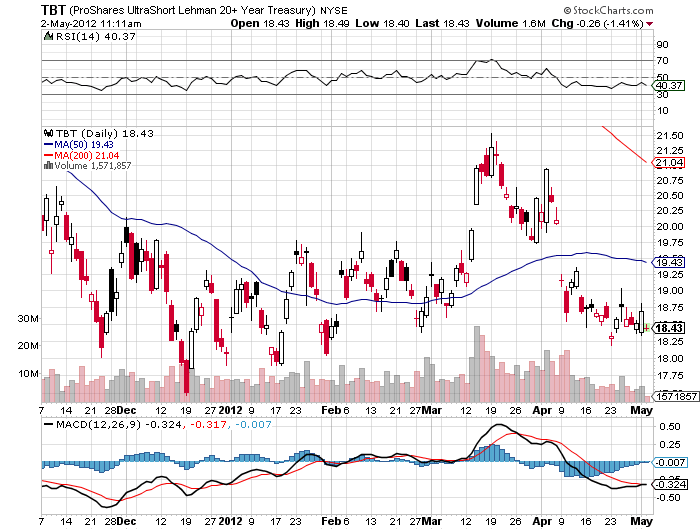

In order to enjoy your coming weekend, I thought you'd like a technical update of your positions, so feast your eyes on the two charts below. They say that a picture is worth a thousand words, so here is 2,000 words worth. If you have been negative on bonds as I have, these charts should enable you to sleep much better.

Virtually every fixed income product is peaking now. Let me draw a simple picture for you laymen out there. That means you should sell every major bond market rally for the next ten years. Whether the final bottom in yields for the ten year Treasury bond is the 1.80% that we have already seen, or 1.60% coming this summer is anyone?s guess. The technical set up is now so dire, that bonds are going to have a really tough time rallying from here. The momentum players will soon smell blood in the water, and they'll be jumping in with both feet at every opportunity. The lost decade for bonds has begun!

Of course, you knew this was coming. It doesn?t help that the budget proposals for both political parties going forward will engineer a dramatic increase in the deficit. The bond market is not laughing. Of course putting in the final top in a 30 year move could be a multiyear process. But it is time to dump that old investment guidline where you own your age in bonds. From here on, the bond/equity ratio should be o% in bonds and 100% in equities, whatever your age.

Is the Lost Decade for Bonds Beginning?

Hey! You there, staring at this monitor. This is your PC talking to you. No, not you over there standing in the background. I?m talking to the guy sitting in front of me poking at my keys. Ouch! That one hurt!

So you thought no one was watching, did you? Let me straighten you out. About a month ago you clicked on a certain website, and I installed myself as a cookie on your computer, which is an innocuous little text file that you can?t see. Since then, I have been tracking your every move, recording websites you clicked on, the pages you visited, and the stuff you ordered. I then used this handy little algorithm to build a profile of exactly who you are. I now know you better than your own mother. In fact, I know you better than you know yourself.

For example, I am aware that you make more than $250,000 a year, live in a posh zip code in San Francisco, belong to a fancy country club, and drive a Mercedes. You donate to Republican political causes, send your kids to a prestigious private school, and bill it all to an American Express Platinum Card. Did I leave anything out?

Because I know every detail of your life, down to your inside leg measurement, I am able to harness the power of this machine to more precisely service your every need. That includes directing advertising to you, which you have a high probability of clicking on. The more you click on my ads, the higher prices I can realize for those ads. The ad campaigns you now see are unique to your own personal computer because they are tied to your IP address. My program, called ?behavioral targeting? is the next ?big thing? in online advertising. It?s all part of the brave new world.

I see you have been shopping for a new car. Check out the new Hyundai at http://www.hyundaiusa.com/ , which offers the same quality as your existing ride, at half the price. Your clicks this morning suggest you?re taking your ?significant other? out to dinner tonight. Might I suggest Gary Danko?s on Bay Street at http://www.garydanko.com/site/bio.html ? The rack of lamb is to die for there. Your visits to http://www.travelocity.com/ and http://www.expedia.com/ tell me you?re planning a vacation. I bet you didn?t know you can find incredible deals in Las Vegas at http://www.visitlasvegas.com/vegas/index.jsp . Thinking about buying a condo there? They?ll even pay for the trip if you promise to check one out while you?re there.

Since we?re chatting here mano a mano, I noticed that that last pair of jeans you ordered from http://us.levi.com/home/index.jsp had a 42-inch waist, up from the 40?s in your last order. Better lay off those cheeseburgers. Pretty soon, they?ll be calling you ?tubby? or ?fatso?. Better visit http://www.weightwatchers.com/Index.aspx soon, or the legs on that chair might buckle out from under you.

Worried about privacy? Privacy, shmivacy. There hasn?t been privacy in this country since the first social security number was handed out in 1936. And don?t expect any relief from Congress. I doubt half those dummies even know how to turn on their own PC?s.

Don?t even think about trying to delete me. I?m a ?flash cookie?, an insidious little piece of code that reinstalls every time you try that. Think of me as a toenail fungus. Once you catch me, I?m almost impossible to get rid of.

I hope you don?t mind, but I?ve been passing your personal details around to some of my buddies at other websites. That?s why when you clicked on http://www.nfl.com/ you got deluged with product offers from your local team, the San Francisco 49ers. I?ve got friends at Google, Facebook, MySpace, and pretty much everywhere. Can I help it if I?m a popular guy? I bet the view from those 50 yard seats is great, isn?t it?

I noticed that your spending habits don?t exactly match with the income you reported on your last tax return. Do you think the IRS would like to know about that? I bet you didn?t know the agency offers a 10% reward for turning in tax cheats.

How did you like those triple X DVD?s you bought last week? Whoa! Hot, hot, hot! I hope your employer never finds out about those. It might not go down too well at your next performance review.

I thought it was lovely that you bought your spouse a two carat, yellow, vvs1, round cut diamond ring for $26,000 from http://www.bluenile.com/ for your 30th wedding anniversary. But who is Lolita, the Argentine firecracker, in Miami Beach? Does the old wifey know you sent her a $2,000 pair of diamond stud earrings? What?s it worth to you for me to keep mum on this? Maybe you should take a quick peak at http://www.divorcelawfirms.com/ and see what you?re in for?

Naw, I?m just pulling your leg. This is all just between friends, right? Think of it as a doctor/patient relationship. I?ll tell you what. See that leaderboard ad at the top of the page? Just click on that and we?ll call it even. Oooh that felt good! Click it again. Oh, baby! Not too many times. You?ll trigger my anti click fraud program.

Now you see that wide skyscraper add over on the right? Click on that too. Oh baby! Click it again! And there?s a little button ad at the bottom of the page. No, not that one. A little lower. What was that little cutie?s name in Miami again? Aaaaah.

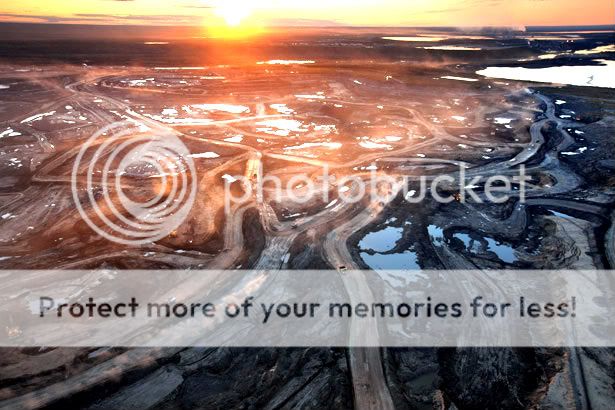

Anyone who has any illusions about the Canadian tar sands business should take a look at the picture below. I?m not a fanatic, sandal wearing, organic bean sprout eating environmentalist, but just looking at it tells you that this is an eco-disaster of Biblical proportions.

A $50 billion investment by several firms over the last decade is now producing 750,000 barrels/day, and another $100 billion in capital is headed north. You have to cut down a whole forest, remove two tons of peat, then another two tons of sand, and burn 100 barrels of oil equivalent to heat rivers of water to steam, just to produce a single miserable barrel of oil.

This gives you the world?s highest production cost, thought to be $80-$100/barrel. There are now 50 square miles of sludge ponds in Northern Alberta leaching a witch?s brew of poisons into the water supply, which has caused the local cancer rate to explode tenfold. We?re not just talking about a few sick geese here.

Canada is the largest foreign supplier of oil to the US, accounting for 19% of our total, and half of that is coming from tar sands. The whole industry was built as a hedge against some Third World War, Armageddon type total cut off of all foreign crude supplies that would drive prices to $500/barrel, making all of this hugely profitable someday.

Maybe the owners think they can get away with this because it is in the middle of nowhere. An army of lawyers hitting these projects with a tidal wave of litigation think otherwise. This is the reason why environmentalist opposition to the Keystone pipeline was so acerbic. They view the tar sands as the world?s single largest source of greenhouse gasses. With North Dakota?s production expected to exceed total Canadian tar sands production by next year, and with challenges now arising from the seemingly endless new supply of cheap natural gas, the whole project may become redundant

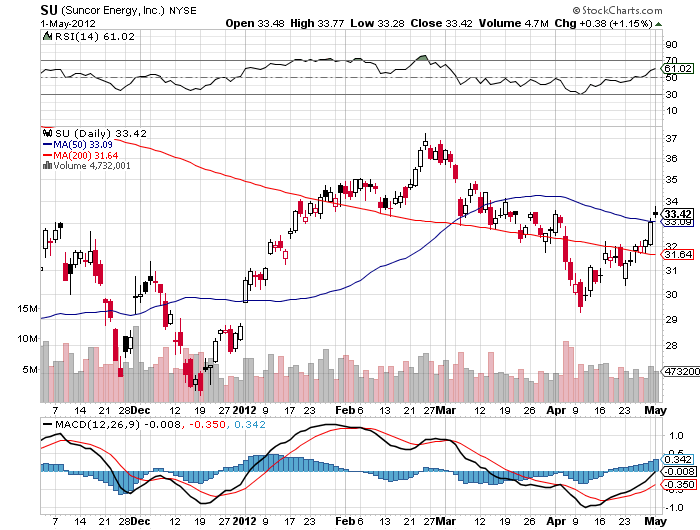

After looking at this picture and analyzing the numbers, you have to ask if it is really worth it, just so you can drive your Hummer to Wal-Mart. It all makes the future performance of major producer, Suncor Energy (SU), very suspect.

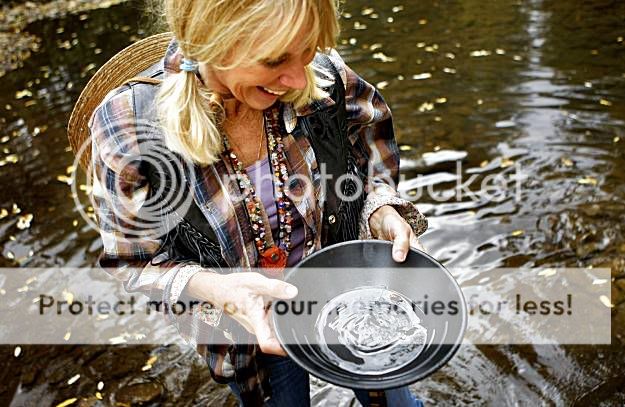

On my way back from Lake Tahoe last weekend I saw that every bend of the American river was dotted with hopeful miners, looking to make a windfall fortune. Weekend hobbyists were there panning away from the banks, while the hardcore pros stood in hip waders balancing portable pumps on truck inner tubes, pouring sand into sluice boxes. Welcome to the new California gold rush.

A sharp eyed veteran can take in $2,000 worth of gold dust a day. The new 2012'ers were driven by high prices of gold at $1,650 and the attendant headlines, but also by unemployment, and recent heavy rains that flushed out new quantities of the yellow metal out from the Sierras. They were no doubt inspired by the chance discovery of an 8.7 ounce nugget in May near Bakersfield, worth an impressive $14,300.

Local folklore says that The Sierra's have given up only 20% of their gold, and the remaining 80% is still up there awaiting discovery. Out of work construction workers are taking their heavy equipment up to the mountains and using it to reopen mines that have been abandoned since the 19th century.

The US Bureau of Land Management says that mining permits in the Golden State this year have shot up from 15,606 to 23,974. Unfortunately, the big money here is being made by the sellers of supplies and services to the new miners, much as Levi Strauss and Wells Fargo did in the original 1849 gold rush.

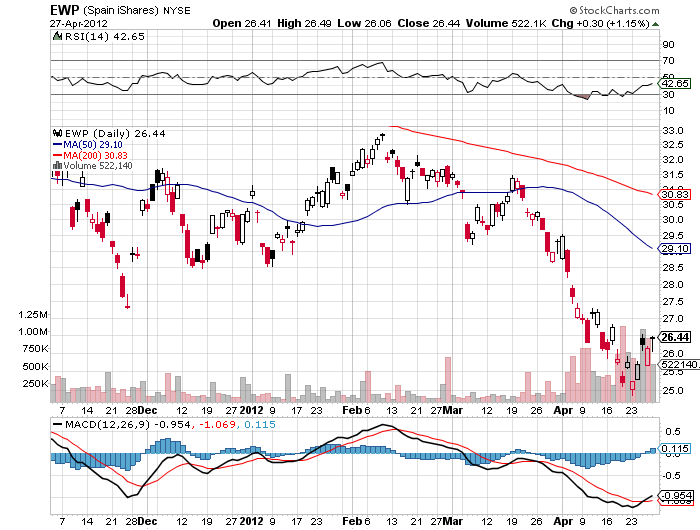

There is no doubt that the crisis in Spain is getting worse, threatening to drag down the rest of Europe, and ultimately the US, with it. Over the weekend, Standard and Poor?s downgraded the debt of 11 Spanish banks, after downgrading the country?s sovereign debt weeks earlier. Further downgrades are a given so expect them in your regular Monday morning headlines. Expect more deposit flight from banks and spiking of sovereign bond interest rates.

The country is now officially in recession, as are seven other countries, including Great Britain. Spain?s unemployment rate is now at 24%, the peak seen in the US during the great depression, and is 50% for those under 25. It all adds up to more deposit flight from banks and spiking of Spanish sovereign bond interest rates.

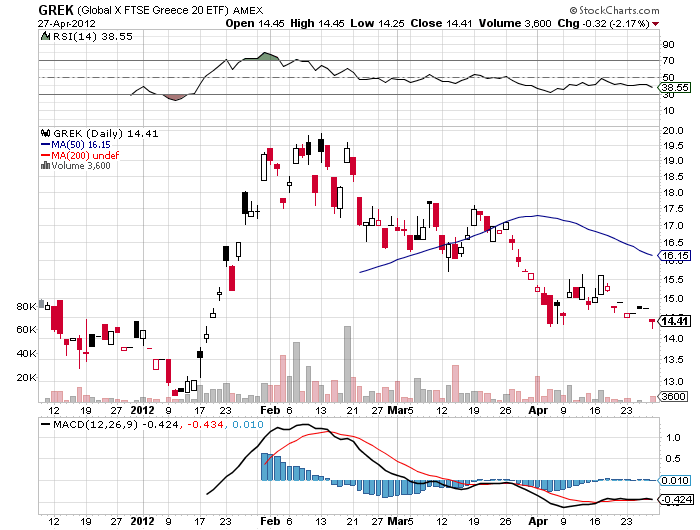

It was easy to dismiss the long, tortuous descent into the Greek bond default as irrelevant and just a favorite topic of a few journalists, as it only accounted for 1.3% of European?s $16.7 trillion GDP. That makes Greece as about as important to the continent?s total fiscal health as the bankrupt cities of Vallejo, CA, Harrisburg, PA, Central Falls, RI, and Birmingham, GA, combined, are to the US.

Spain is another kettle of fish, with the fourth largest economy accounting for 6% GDP. Spain is an even larger portion of the European financial system, with bank assets at $3.7 trillion.

Don?t expect an improvement in the Spanish economy any time soon. It just passed one of the most austere budgets in European history, attempting to roll back decades of over spending and under taxing in one shot. While austerity is great for balancing the budget for the short term, it also triggers recessions which create longer term structural problems, as it has already done in Great Britain and Greece.

The only possible growth strategy for Europe is for the private sector to ramp up spending while the governments are cutting back. In Europe, that means getting rich countries like Germany to spend more to create end demand for poor countries. However, in reality, companies run the opposite direction, hunkering down during times of economic uncertainty.

There is also an additional internal conflict afflicting Europe in that the debt heavy counties of south need inflation to devalue their debt, but deflation to restore their international competitiveness and growth. It all means that the Spanish downturn will be longer and weaker than previously thought.

In December there was a big splash when the ?500 billion LTRO was announced to take distressed sovereign debt off the hands of the banks at extremely generous prices. That has since fizzled. Now hedge funds are betting that the other shoe will fall. A second LTRO is a given, but how long will it take them to realize this and how far will bond prices plummet until we get there?

Don?t count on any US bailouts to ease Spanish pain, especially during an election year. Treasury Secretary, Tim Geithner, personally told me last week that Europe was a rich continent and had adequate resources to solve its own problems. Translation: no cash for the beleaguered continent.

It all makes my short position in the Euro through the (FXE) look pretty interesting. Some of the weaknesses mentioned above are already well known and priced into the currency markets, but not all of them. And the Europeans have a seemingly endless talent for discovering new structural problems as time goes on. Those unintended consequences can be a bitch.

With eight governments having fallen since the crisis began, and a ninth in France certain to go this weekend, who will be next is anyone?s guess. We have all become Spanish bond traders, whether we want to or not. Watch those screens.

Austerity?s Unintended Consequences

Dilbert cartoonist Scott Adams argues that you should invest in companies you hate, because only the most unprincipled and rapacious firms make the greatest profits.

Moral bankruptcy is a great leading indicator of success, and the best ones can get you to balance your wallet on the end of your nose and bark like a seal, as you buy products that you utterly despise. Companies with the work ethic of a serial killer, like British Petroleum (BP) come to mind, but you can also add other firms to the list, like Goldman Sachs (GS), Citicorp (C), Pfizer (PFE), and Altria (MO).

Adams initially started investing in companies he loved, like Enron, WorldCom, and Webvan, and absolutely lost his shirt. His advice to (BP) is not to waste money on artificial, sincere, maudlin ad campaigns apologizing, but get us to hate them more. Bring on more dead bird pictures!

Who is Adams about to hate next? Apple (AAPL), because he irrationally craves their products, resents their emotional control over his entire family, can?t get iTunes to work, and is appalled by those aloof black turtlenecks that Steve Jobs wore. For my own recent piece about this incredible company, please click here for ?Apple?s Next Stop: $1,000? a

Hand Me a &*%@* Buy Ticket!

When anyone starts lecturing you that the US has the highest tax rate in the industrialized world, just turn around, walk away, and pretend you never heard of them. This person is either ignorant about this country's taxation system, or is deliberately trying to deceive or mislead you.

According to a report released by the Internal Revenue Service, America's tax collection agency, the top 400 individual tax returns filed in 2009 reported an average gross income of $358 million each. The average amount of tax paid by these individuals came to under 17%, less than half the maximum Federal rate of 35%, which kicks in on annual income over $372,950 (click here for the 2009 tax tables). This explains why Warren Buffet pays a much lower tax rate than his secretary. It really is true that in America, only the poor people pay taxes.

Look at any international comparison of taxes to GDP, and one can always find the United States at the bottom of the table. Low American taxes is one of the main reasons why I moved my company here from England 18 years ago. Take a look at the Fortune 500, where one third of the largest companies pay no tax at all, and many that dominate the top of the list, like the oil majors, pay only token amounts. However, if any politician wants to pander to voters during election time on a tax cutting platform he will only bluster on about ?tax rates?, not actual taxes paid.

What the US has that other countries lack is the 100,000 pages of the Internal Revenue Code. It is a 99 year accumulation of deductions, accelerated depreciation rates, tax credits, and other tax breaks that are the end product of intensive lobbying efforts and bribes by special interest groups, corporations, unions, and even religious groups.

Take a look at the oil industry again. The oil depletion allowance permits drillers to deduct a substantial portion of the cost of a new well in the first year (click here for its fascinating history). When I first got into the oil and gas business a decade ago, after reading the relevant sections of the tax code, I couldn't understand why everyone wasn't drilling for Texas tea. The total value of this one tax break to the industry is estimated at $55 billion a year. This explains why we have had three presidents from Texas in the last 50 years. Some of this money ends up in campaign donations.

I have a very simple solution to the country's budget deficit problem. Hit the reset button. Eliminate the Internal Revenue Code. Just set it on fire or send it to the recycling bin. Keep the existing progressive, hockey stick tax rates on income, but eliminate all deductions. And I mean everything; deductions for dependents, home mortgage interest, medical expenses, the works. The oil depletion allowance other corporate loopholes are worth at least $150 billion a year in lost federal revenues. There are no sacred cows. My revised Form 1040 would be a postcard that would have only five lines on it:

Name

Social Security number

Income

Tax Rate

Tax Due

The budget deficit would disappear overnight. Government spending would shrink dramatically, because you could ditch most of the 100,000 who work for the IRS. Some 1.3 million auditors, CPA's, tax attorneys, and bookkeepers would have to hit the road in search of new work too. The amount of money that is wasted on tax collection in this country is truly staggering. This is not some pie in the sky concept. This is how taxation already works in most countries, and they seem to get along just fine.

In fact, the whole scheme might even pay for itself.

I Don't See Any Jobs For Former IRS Agents, Do You?