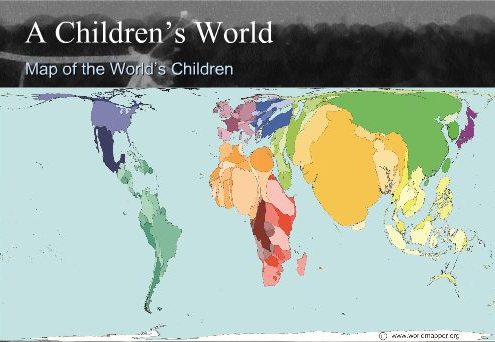

You can never underestimate the importance of demographics in shaping long term investment trends, so I thought I?d pass on these two highly instructive maps.

The first shows a map of the world drawn in terms of the population of children, while the second illustrates the globe in terms of its 100 year olds. Notice that China and India dominate the children?s map. Kids turn into consumers in 20 years, stay healthy for a long time, and power economic growth. The US, Japan, and Europe shrink to a fraction of their actual size on the children?s map, so economic growth is in a long term secular downtrend there.

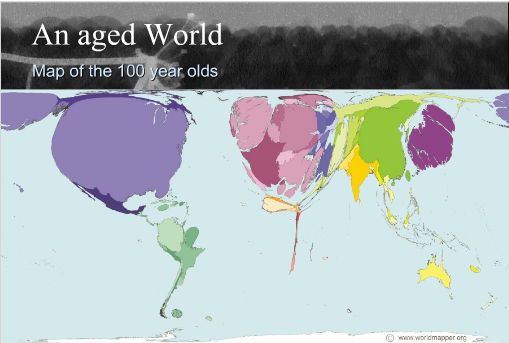

There is more bad news for the developed world on the centenarian?s map, which show these countries ballooning in size to grotesque, unnatural proportions. This means higher social security and medical costs, plunging productivity, and falling GDP growth.

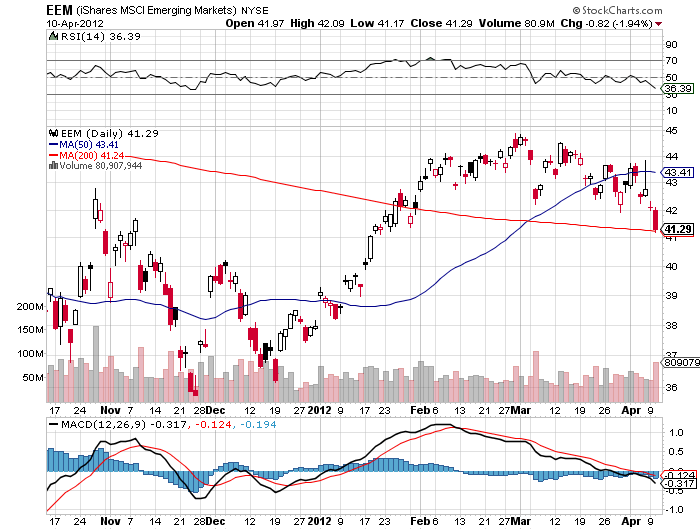

The bottom line is that you want to own equities and local currencies of emerging market countries, and avoid developed countries like the plague. This is why we saw tenfold returns from SOME emerging markets (EEM) over the past ten, and why there is an irresistible force pushing their currencies upward (CYB). Use any major melt downs this year to increase your exposure to emerging markets, as I will.

Would You Rather Own Them?

Or Them?

Fear of law suits prevents most analysts from publishing lists of short selling targets. But the GMI Ratings, Inc., a forensic accounting firm, regularly posts lists of public companies they believe may go bankrupt (see http://www.auditintegrity.com ).

Many of their picks reflect the accelerating shift from the old economy to the new economy. With offices in New York and Los Angeles, they look at leverage, market position, debt, and their own proprietary indicators. Another red flag are the legal shenanigans that companies resort to when coming out of a recession, like writing off large amounts of good will.

In the media space, CBS (CBS), Sirius XM Radio (SIRI), and Hertz Global (HTZ) are at risk. In the consumer field, Rite Aid (RAD), Macy?s (M), and Las Vegas Sands (LVS) made the list. Advanced Micro Devices (AMD) is the largest tech company to warrant scrutiny.

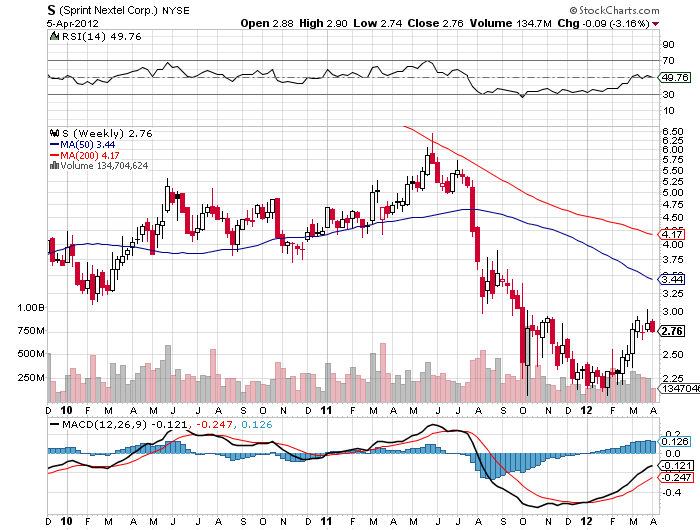

Airlines are always a favorite of bankruptcy mavens. The company correctly pegged American Airlines (AMR) as seriously at risk two years ago. Continental (CAL) dodged the executioner by merging with United Airlines. Sprint Nextel (S) tops the list of telecom companies. Better take that portfolio out and give it a good scrubbing.

Looks Like I Hooked a Whopper

Regular readers of this letter know that I rely on long term demographic trends to predict the direction of global financial markets. Let me approach this topic from a different angle, measuring the number of retirees a population must support versus the anticipated burden in 20 years, and its implications.

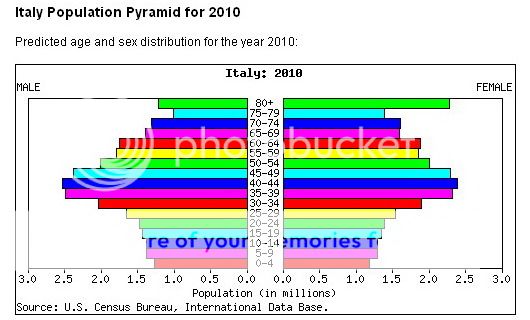

I start with the basket cases. Japan?s problems on this front are well known, with a retiree population of 30% today growing to 56% by 2030. That means every worker will be saddled with the costs of maintaining a senior citizen. Italy is worse, with the retiree load soaring from 30% to 60%. The rest of developed Europe is posting similar numbers. This is why you rarely hear me issuing ?BUY? recommendations on European companies, especially in the retail sector.

The US is stuck in the middle. Some 21% of our 310 million souls are retired today, and that is growing to 48% in 20 years. If you think our social security funding problems are bad now, just wait. On our current trajectory, bankruptcy is assured. Our saving grace is the large number of young immigrants who are continuously entering the country, legal and otherwise.

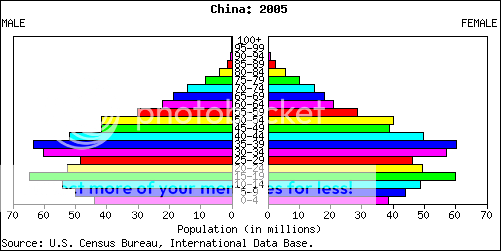

China is in a unique situation because of its ?one child? policy, which has reduced population growth by 400 million over the last 30 years. This guarantees that the country will undergoing a slow ?Japanization? that raises its ratio of retirees from 14% today to 42% by 2020. You can count on the Chinese economic miracle to hit a wall in about five years as a vast share of resources have to be redirected to supporting long lived senior citizens, who live on a healthier diet than your or I.

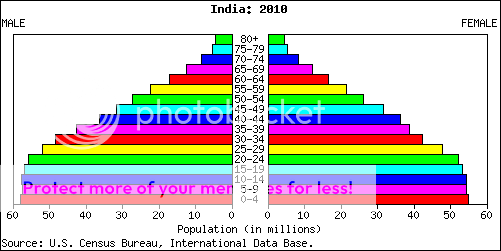

Other emerging markets are in a far healthier position. Only 8% of India?s 1.2 billion are retirees today, and that will only reach 20% in 20 years. Vietnam, Brazil, Mexico, Indonesia, and Malaysia are looking at the same numbers. One of the reasons that these countries don?t have to suffer the crushing expense of western style social safety nets is that they don?t need them. This is the basis for my constant table pounding that this is where you need to be overweighting your equity exposure.

I?ll be going into this subject in more depth next week, when I explain why demographics is so important. Until then your homework assignment is to read the excellent book, Boom, Bust, and Echo by David K. Foot, which you can buy by click here.

The bottom line message here is to be nice to your cleaning lady. She may be supporting you someday.

The ?Japanization? of China

They?re Not Making Italians Anymore

This is Where You Want to Put Your Money

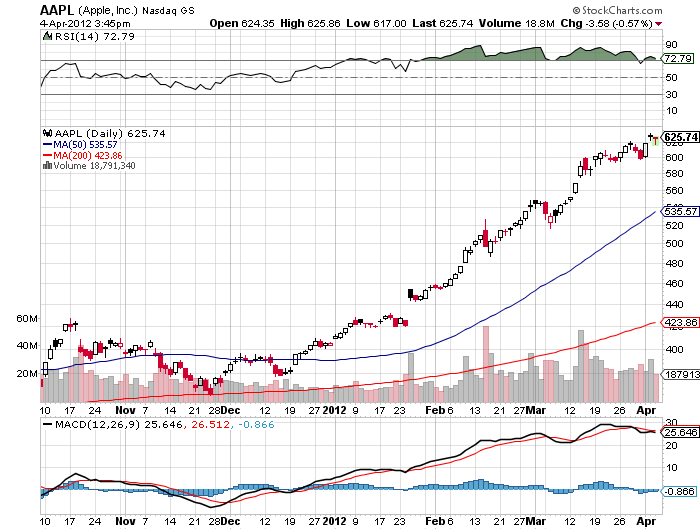

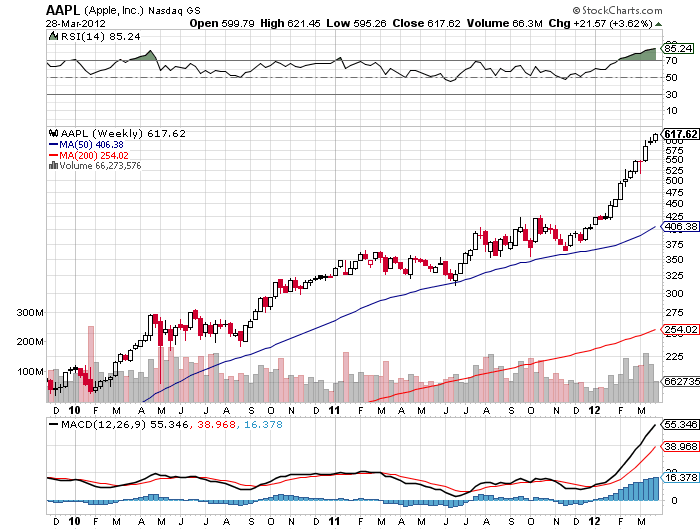

I was more than amused when technology analyst superstar, Piper Jaffray?s Gene Munster, put out his own forecast that Apple (AAPL) would reach $1,001. Munster made the call after conducting a survey that showed that 40% of students plan on buying an iPhone in the next 6 months, while 19% of non-tablet owners plan on purchasing a tablet in the next 6 months.The shares responded by immediately running up to a new all-time high of $632.

For my own prediction of this target, you have to reach back 18 months, when it first breached $300 (click here for the piece). With the establishment now jumping on the bandwagon, is this an indicator of a short term trading top in the sought after stock? Those deep out of the money short dated Apple puts are starting to look more interesting by the day.

Is Apple Losing Its Flavor?

The handful of Chinese army officers I huddled with in the underground bunker all stared intently at their watches. Three, two, one, and then KABOOM! At exactly 12:00 noon, the blast of distant artillery sent a five inch shell screaming over our heads and exploded into the hill above us. The ground shook under our feet, causing dust to drift down from the concrete ceiling above us. It was 1976, and The People's Republic of China just let lose its daily symbolic protest against its errant rebellious province, known locally as the Republic of China, and to you and me, as Taiwan.

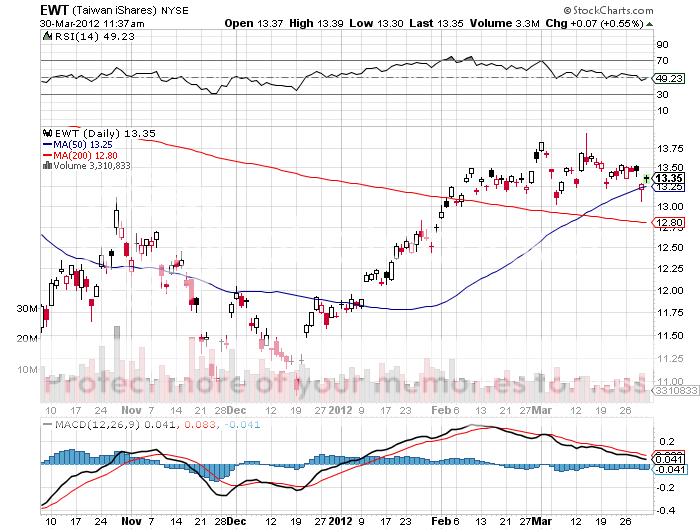

Fast forward 36 years later and the Middle Kingdom is sending salvos of money raining down on that prosperous island. Two years ago, China Mobile (CHL), the world's largest cell phone company, bought 12% of Far Eastone Telecommunications (4904.Taiwan). Although a small deal, it represented the first ever direct investment from China into Taiwan. The move triggered a takeover binge by big Chinese companies of their offshore cousins.

It was only a few years ago Taiwanese businessmen suffered long prison terms for just visiting, let alone investing in China, which they have done in a major, but surreptitious way, for 30 years. Readers of this letter are well aware of the long term attraction of both of these countries, which see GDP growth rates at a multiple of our own.

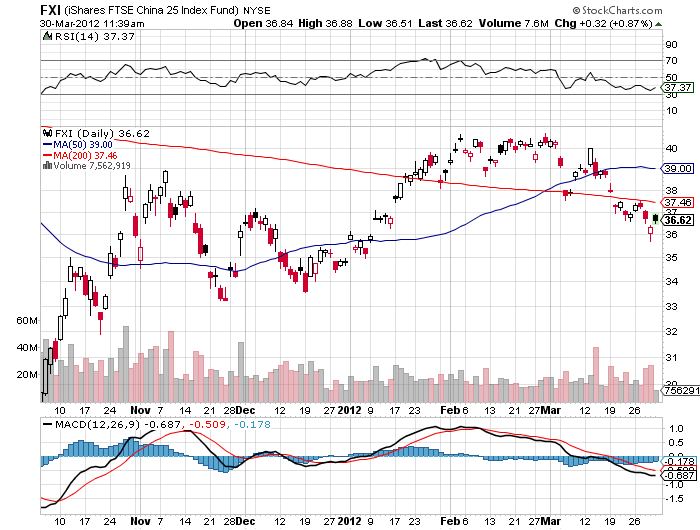

Closer ties between China and Taiwan auger well for the stock markets of the two high growth countries. The iShares MSCI Taiwan fund ETF (EWT) jumped by 17% in Q1, 2012. The iShares FTSE China 25 Index (FXI) has done less well, up 5%, as the country grapples with a temporarily slowing economy. At some stage, a country that is growing at four times our own rate, but at the same earnings multiple, will be a buy. But it appears not yet.

In the meantime, I guess that Beijing figured out that if you can't beat them, buy them. The proxy takeover bid is mightier than the sword.

A few years ago, I went to a charity fund raiser at San Francisco's priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war for one of the Bay Area's premier hotties, who shall remain nameless. She?s happily married to a tech titan now, and gentlemen don?t tell. Suffice it to say, she has a sports stadium named after her.

The bids soared to $10,000, $11,000, $12,000. After all, it was for a good cause. But when it hit $12,400, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer's remorse came to me and offered his date back to me for $12,000.? I said ?no thanks.? $11,000, $10,000, $9,000?? I passed.

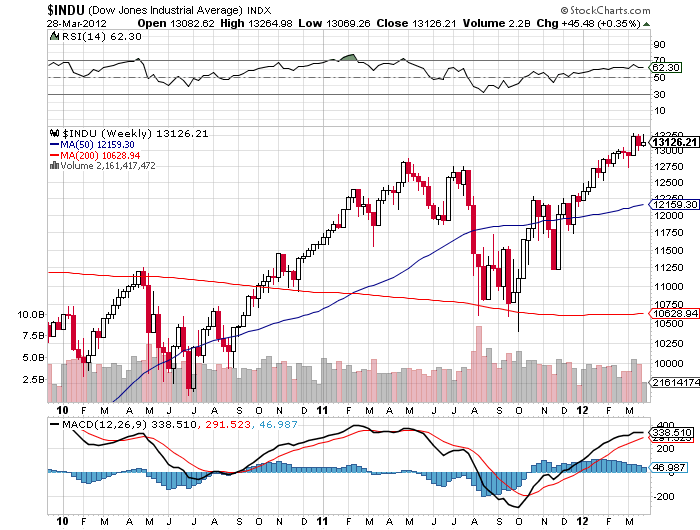

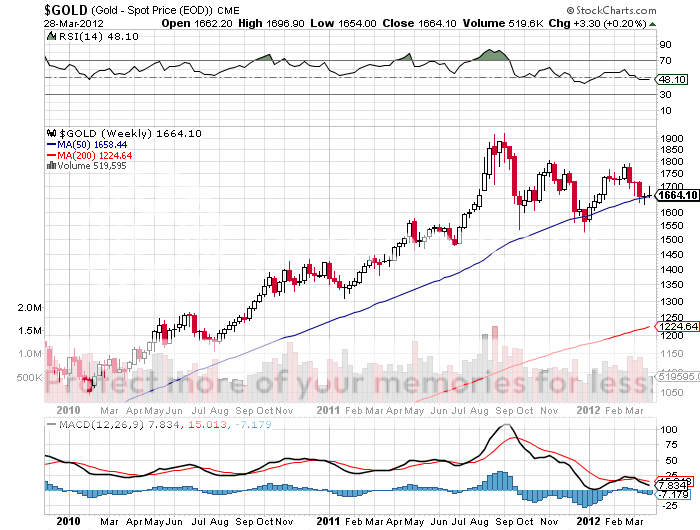

The current altitude of the stock market reminds me of that evening. If you rode gold (GLD) from $800 to $1,900, oil, from $35 to $110, and Apple (AAPL) from $200 to $610, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I have a feeling that those who loaded up on stocks in March may develop the same sort of buyer?s remorse that I witnessed at Shreve?s.

I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me, ?There is a time to fish, and a time to hang your nets out to dry.?

At least then I'll have plenty of dry powder for when the window of opportunity reopens for business. So while I'm mending my nets, I'll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

See Any Similarity?

Time to Mend the Nets

I am getting tired of the endless procession of perma bulls who keep insisting that, at a 14 times multiple, the S&P 500 is cheap. The last time I heard this was in 2000, when NASDAQ multiples went from 100 to 50, on their way to 10. Before that, it was in Japan in 1990, when multiples went from, guess what, 100 to 50 on their way to 10. Some 20 years later, Japanese multiples are still at a lowly 15.

When I first entered the stock business in the seventies, typical equity earnings multiples were in the seven to eight neighborhood. If you performed exhaustive stock screens, which then involved paging through endless reams of 10-k's, newsletters, and tip sheets printed in impossibly small type, you could occasionally find something at a two multiple, the kind Graham and Dodd wrote about. Anything over ten was considered outrageously overpriced, fit only to be sold on to retail investors. This is when the prime rate was at 6%.

The weakness we saw this week is consistent with my long term view that we are permanently downshifting from a 3.9% to a 2%-2.5% growth rate, and the lower multiples this deserves. I'm convinced that if the circuit breakers had not been installed, we would have been visited by another flash crash last week. If you look at a 30 year range of market multiples, it ranges from 10-22. Given our flaccid growth prospects going forward, I think the new range will be 10-16. It doesn?t make today's 14 multiple look like such a bargain.

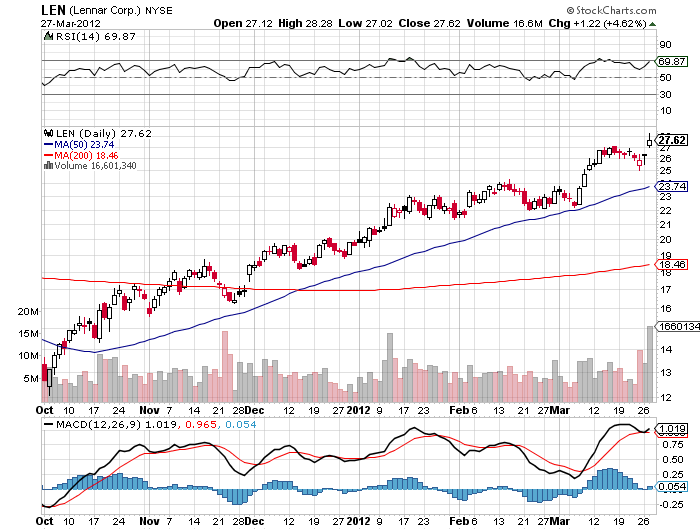

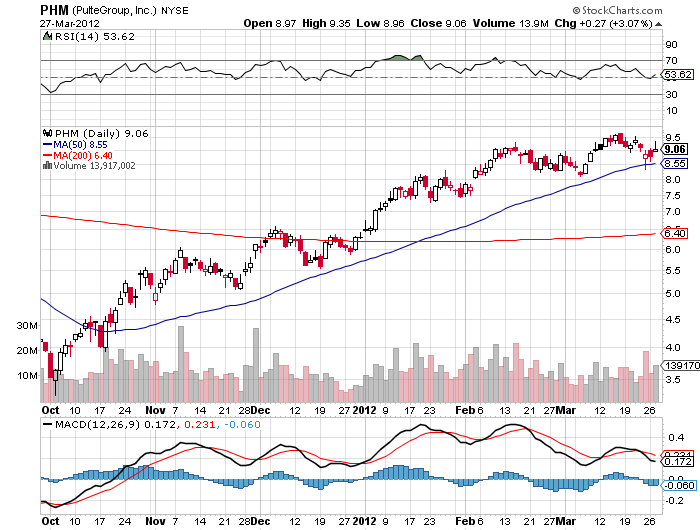

Still missing in action from this economic recovery has been the residential real estate market. Everyone who is in the business of selling me a new home assures me that we have hit bottom and things are getting better, including the home builders, real estate agents, and countless local chambers of commerce. Look no further than home builder Lennar (LEN), which had more than doubled since the October low, and Pulte Homes (PHM), which has tripled.

Much of the improvement in bank shares, which saw Bank of America (BAC) double in three months, was based on the improving fortunes of homeowners. Is there something wrong with this picture? Should I be relying on these ?belief based? sources of information?

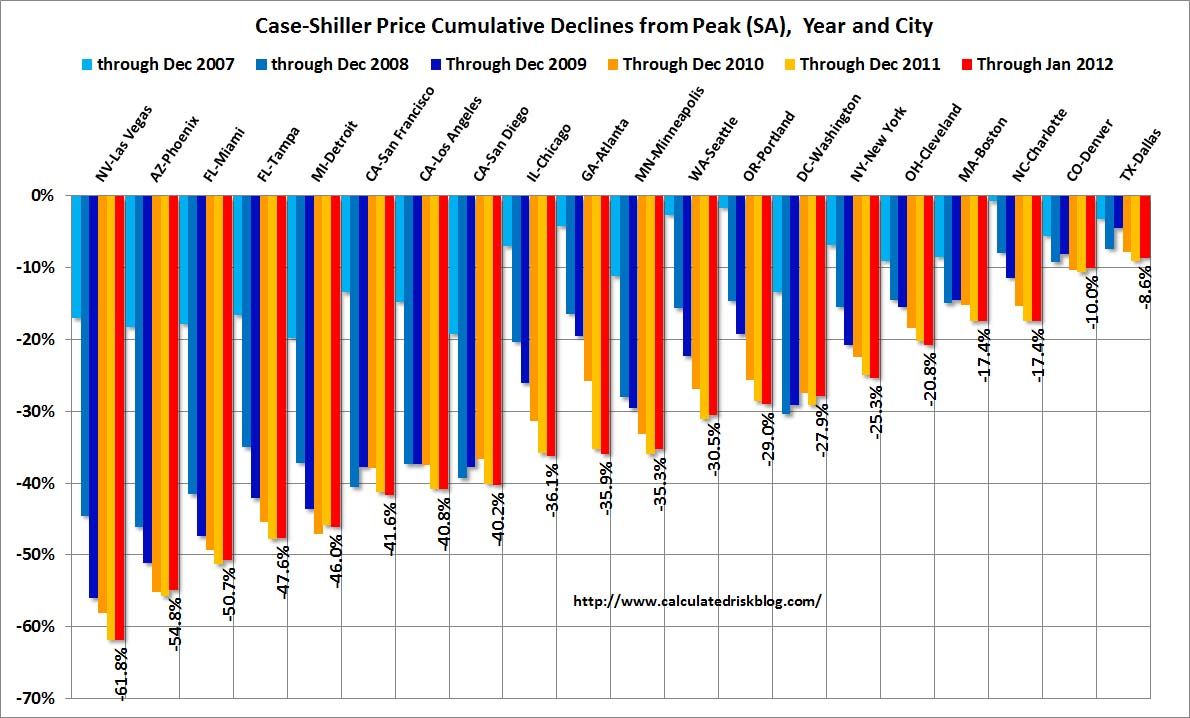

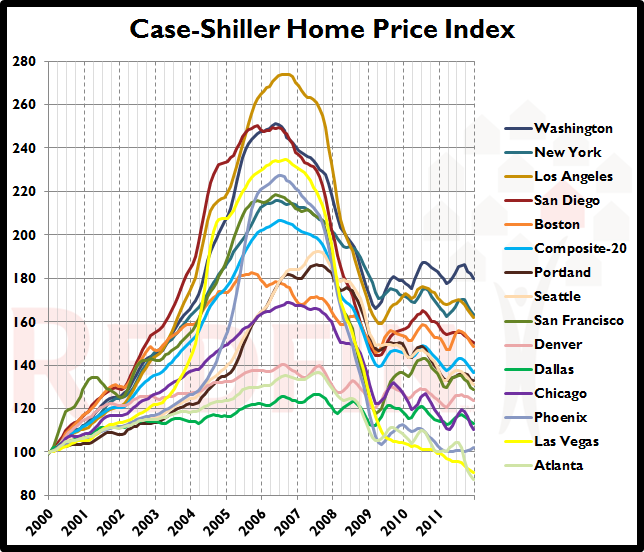

The hard data say otherwise. This morning, the January S&P 500 Case Shiller Real Estate Index put in a new seven year low, dropping 0.8% from the previous month. San Francisco showed the biggest loss (-2.5%), followed by Atlanta (-2.1%), Portland (-2.1%), Cleveland (-2.0%), and Chicago (-1.9%). Some 47% of transactions nationally are from short sales and foreclosures. This figure exceeds 60% in some troubled markets in the West. There is a foreclosure tidal wave of Biblical proportions now sweeping the South.

The cancellation rate for new purchases is still a stunningly high 30%. First time buyers have virtually ceased to exist, a key component of this market, as few young couples can qualify for bank loans under the new credit regime. They were once 40% of the market.

Who is buying all of these houses? Hedge funds, which are setting up partnerships to buy distressed homes at discounts of 25% or more, remodeling and modernizing them, and flipping them out as fast as they can. This presages a new institutionalization of the market that was once the refuge of the individual homeowners. I have heard of aggregations of as many as 1,000 units, which are individually bought at bankruptcy auctions on the courthouse steps, and moved as quickly as possible on an assembly line to the market.

While this may bring a welcome increase in turnover in a once moribund market, it will also cap any future price appreciation. These guys are not long term investors by any means. They are in for the quick buck, and will happily walk away with a net profit of only 5%. The money is made on the turnover. These resellers are successfully front running retail owners desperately trying to unload holdings from the vast shadow inventory where negative equity is more often the rule than the exception.

They say all real estate is local, and that has never been more true than now. Where you do find real end buyers is at the absolute top end, with prices listed at over $2 million. The players here often pay with cash to avoid the higher interest rates that usually come with jumbo loans. I am seeing this across the entire expanse of the economy, from American Express (AXP) to Coach (COH) to Tiffany (TIF).

I even see this at my local ski resort of Incline Village in Nevada, where homes over $10 million are moving nicely, but there is a constipated glut of hundreds of dwellings priced under $800,000. Right now, business is great for anyone selling to rich people. This is why we are seeing bidding wars in the San Francisco Bay area for any homes within commuting distance of Google (GOOG), Facebook, and Apple (AAPL) headquarters, while market for homes in the rest of the region is dead in the water.

I write all of this with the usual provisos. Case Shiller lags the real market by 3-5 months. There is no doubt that this year?s unusually warm winter has pulled forward a lot of real estate investment. Even still, the monthly data is taking a turn for the worse. March signed contracts are down -0.5%, while February housing starts were down -1.1%.

Why do I care about any of this, since I have been renting for the past seven years? It is hard to see the broader economy growing faster than 2% a year without serious real estate participation, which in the past has accounted for up to half of our total growth. It is the missing 2% that used to take us to 4% growth. That harsh reality affects all markets everywhere, whether you are renting or not.

The Fire Isn?t Out Yet

Since I am in the long term forecasting business, it was with some fascination that I caught the Associated Press report that minority children born this year may exceed Caucasian children for the first time. Whites lost their majority in San Francisco many years ago, and will do so in California as a whole in the near future.

The report said that the US will have a ?minority? majority by 2050. Whites now account for 2/3 of the population. While minorities now dominate only 10% of counties, they account for 40% of new births.

Demographers say the trend will be reinforced by a large number of Hispanic women entering their prime child bearing years, who historically have more children than other races. More white women are delaying childbearing, reducing fertility.

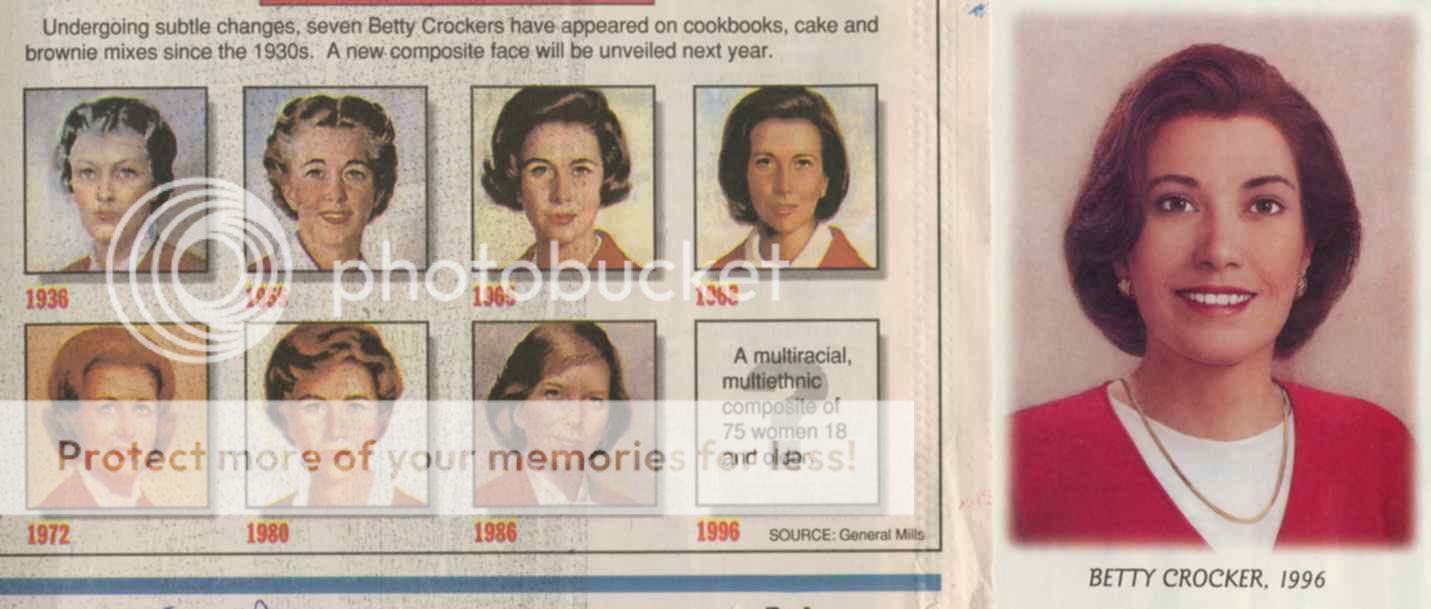

As demographics is destiny, this is bound to have huge political and economic ramifications for the country going forward. It is also going to influence the marketing priorities of corporations. 16 years ago, Betty Crocker anticipated this trend by using shorter, darker skinned models on the boxes of its cake mix boxes.

Companies that target specific ethnic groups are going to gain a competitive advantage. Furthermore, the rate of interracial mixing is accelerating at a tremendous rate. In California, 50% of all Chinese woman and 60% of Japanese women marry whites. This is amazing given that this was illegal until the Civil Rights Act was passed as recently as 1962.The young millennial generation are virtually color blind. Talk to them and you?ll see what I mean.

Genetically recessive blonde haired, blue-eyed people, who sprang out of a mutation in the Caucuses 7,000 years ago, may completely disappear in 200 years. Pure Caucasians themselves may eventually go too, as they only account for 15% of the world?s population, and that number is falling.

If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill.

?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.?

The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds.

Thank freemason Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s historical adventure movie ?National Treasure.? The balanced scales in the seal are certainly wishful thinking and a bit quaint if they refer to the Federal budget. Study the buck closely, because there are soon going to be a lot more of them around.

What Did You Really Mean, Ben?