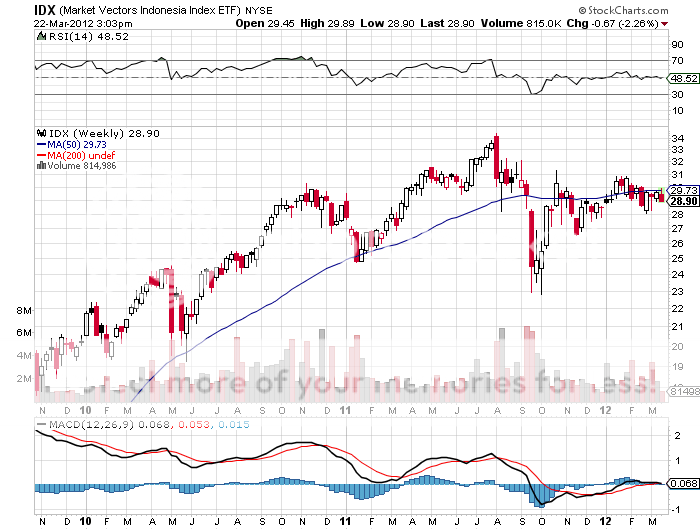

If you are looking for another emerging market to add to your list of things to buy on big dips, then take a look at Indonesia.

The world?s largest Muslim country offers a combination that I love, a population with great demographics that is also a major energy and commodities exporter. The archipelago is the biggest country in Southeast Asia and a huge exporter of oil and LPG to Japan on long term contracts. (An old friend of mine torched their Borneo fields at the beginning of WWII, and spent four years in a Japanese prison camp for his troubles.)

Other big exports include marvelous textiles, rubber, and increasingly rare tropical hardwoods. The global financial crisis only knocked their growth rate from 6.1% to 4.5%, and now it is back above 6%. No doubt, $63 billion of direct foreign investment into the country last year helped.

A series of tax reforms promise to keep the train moving, cutting the top corporate rate from 30% in 2008 to 28% in 2009, and 25% in 2010.? Wisdom Tree had the ?wisdom? to launch the country?s first ETF (IDX) close to a market bottom, a rare event indeed (what timing!), which became one of the best performers of 2009, rocketing over 300% from the lows to $60.

Islamic inspired terrorism is still a lingering concern. I keep Indonesia in the category of highly volatile, high risk, high return frontier markets that you only want to buy on a big dip. Keep it on your radar.

Expect to hear a lot about ignition in the next year. No, I don?t mean the rebuilt ignition for the beat up ?68 Cadillac El Dorado up on blocks in your front yard. I?m referring to the inauguration of the National Ignition Facility next door to me at Lawrence Livermore National Labs in Livermore, California.

Mention California to most people, and images of love beads, tie died T-shirts, and Birkenstocks come to mind. But it is also the home of the hydrogen bomb, which was originally designed amid the vineyards and cow pastures of this bucolic suburb. The thinking at the time was that if someone accidentally flipped the wrong switch, it wouldn?t blow up San Francisco, or more importantly, Berkeley.

The $5 billion project aims 192 lasers at a BB sized piece of frozen hydrogen, using fusion to convert it to helium and unlimited amounts of clean energy. The heat released by this process reaches 100 million degrees, hotter than the core of the sun, and will be used to fuel conventional steam electric power plants. There is no need for a four foot thick reinforced concrete containment structure that accounts for half the construction cost of conventional nuclear plants. The entire facility is housed in a large warehouse.

The raw material is seawater, and a byproduct is liquid hydrogen, which can be used to fuel cars, trucks, and aircraft. If this all sounds like it is out of Star Trek, you?d be right. I worked with these guys in the early seventies, back when math was used to make things, and before it was used to game financial markets, and I can tell you, there is not a smarter and more dedicated bunch of people on the planet.

If it works, we will get unlimited amounts of clean energy for low cost in about 20 years. Oil will only be used to make plastics and fertilizer, taking the price down to $10 for domestic production only. The crude left in the Middle East will become worthless. Lumps of coal will only be found in museums, or in jewelry, its original use. If it doesn?t work, it will melt the adjacent Mt. Diablo and take me with it. If you don?t get your newsletter tomorrow, you?ll know what happened. Now what is this switch for?

Until now, the country?s power grid has been divided into three unconnected chunks, making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from brown outs and sky high prices, electricity was given away virtually for free in Texas.

A group of power companies is now proposing to build the $1 billion Tres Amigas superstation in Clovis, New Mexico that would connect all three grids. The plant would use advanced superconducting technology that will send five gigawatts of power down cables cooled at 300 degrees below zero. Construction is expected to begin this year and reach completion in 2014.

The facility would solve a major headache of alternative energy planners, and will no doubt accelerate development. It would allow the enormous wind farms on the drawing board in the Midwest to ship energy to the power hungry coasts. Ditto for the mega solar projects proposed in the Southwest deserts, and the big geothermal plants being built in Nevada.

With the Department of Energy having already sent tidal waves of government cash towards the sector, the timing couldn?t be better. With gasoline prices rapidly approaching $5 a gallon, some of these projects might now actually make some sense.

?We have 3,500 nuclear weapons left over from the cold war we don?t need, they take 20 seconds to re-aim, we?re not afraid to use them. And by the way, they?re already aimed at you.? That is the approach James Baker III thinks America should take with Iran, Ronald Reagan?s Chief of Staff and Secretary of the Treasury and George H.W. Bush?s Secretary of State.

At the same time we should be talking to the regime in Tehran, while doing everything we can to support the reformers, tighten sanctions, and enlist Europe?s help. Baker does not see a military solution in Iran, even though their potential to create instability in the region is enormous. This was one of dozens of amazing insights I gained chatting with the wily Texas lawyer during an evening in San Francisco.

Baker is happy to take on the ?America Bashers?, pointing out that the US still plays a dominant role in the UN, NATO, the IMF, and the World Bank. It accounts for 25% of global GDP, and its military is unmatched. The US spread globalization, and the spectacular growth of China and India is largely the result of open American trade policies, raising standards of living globally.

But the US can?t take its leadership role for granted. The biggest threats to American dominance are the runaway borrowing and entitlements. US debt to GDP will soar to over 100% in the near future, the highest level since WWII. This is unsustainable, is certain to bring a return of inflation, and unless dealt with, will lead to a long term American decline on the world stage.

Massive trade and capital flow imbalances also have to be addressed. The 82 year old ex-Marine, who confesses to being the only Treasury Secretary in history who never took an economics class, believes that the advantageous rates that the government now borrows at are not set in stone.

Baker is the man who engineered an end to the cold war with a whimper, and not a bang. He thinks that ?even our power has its limits,? and that there is a risk of strategic overreach.? With the US politically evenly divided, Congress has degenerated from debating teams into execution squads, and consensus is impossible. The media are partly to blame, especially bloggers who propagate wild conspiracy theories, as confrontation sells better than accommodation.

Regarding the financial crisis, we need to end ?too big to fail? and embark on re-regulation, not strangulation. All in all, it was a fascinating few hours spent with a piece of living history who still maintains his excellent contacts in the diplomatic and intelligence communities.

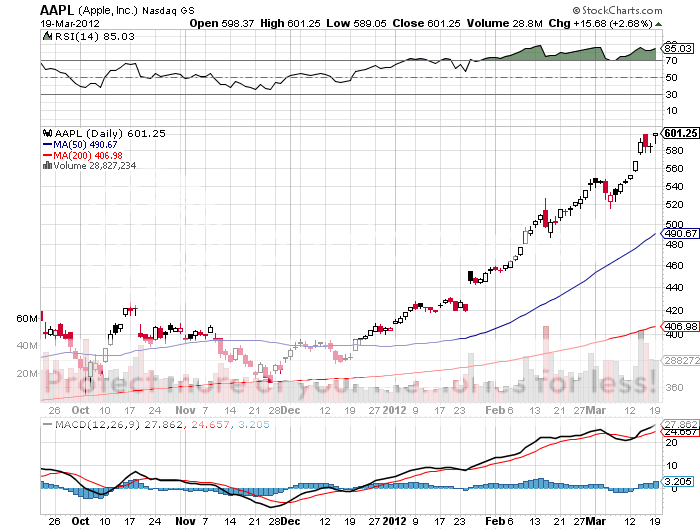

?I suspect the analysts who follow Apple are great people and are nice to their mothers. But as a group those people missed the last quarter by 40%, so I?m not listening to them. The stock is a trading sardine for a while. It?s a high beta stock which is leveraged to the market which is over extended. So I don?t see a hell of a lot of alpha until we get the next significant data point, which might be squishy,? said Dug Kass of hedge fund Seabreeze Partners.

This is the year of the one way move. That has been the harsh lesson of the marketplace since trading commenced at the New Year. We have seen this in Apple, the S&P 500, the Japanese yen, bank shares, natural gas, the volatility index, and now it looks like the Treasury bond market.

Once a move starts, it continues in a straight line. There are no pull backs, corrections, or chances for newcomers to join the party. It is all momentum, or ?momo? as the pit traders refer to it. You either have to close your eyes and buy, or read about it in the newspapers while you are fielding calls from clients complaining about underperformance.

While I am reluctant to buy highs in other asset classes, not so with short Treasury bond plays like the (TBT). The long term case is against Treasury bonds, which have been paying negative real interest rates for years now, is overwhelming. If the (TBT) pulls back 10% from here, I will happily double up.

If you want to read about Treasury bonds, warts and all, please refer to last week?s piece, ?The Structural Bear Case for Treasury Bonds? by clicking here.

There are many reasons why the markets are behaving like this. Volumes are low. Conviction is low. The big volume generators, like the high frequency traders, have departed for friendlier climes, like the foreign exchange and oil markets. Hedge fund traders are out until their models start working again. Individual investors are still back at the station waiting for the next train, having spent the last decade unloading stocks.

The markets aren?t rising because of a new surge of cash coming into the market. Rather, a lack of sellers is the cause, as almost everyone is underweight equities. It only takes a small amount of money coming in from performance chasers to cause the indexes to rise.

It is impossible to say how long the markets will last like this. They will continue until they don?t. There is no quantifying human emotion. Until then, I will keep my book relatively small. I can tell you that when the geniuses look like idiots and the idiots look like geniuses, markets can be very dangerous.

I received an email from the MF Global bankruptcy trustee this morning indicating that they would be returning another $685 million to customers. Of this amount, $600 million will go to customers who traded on US exchanges, $50 million to those who traded on foreign exchanges, and $35 million who were holders of physical metals. That would enable them to increase their payout on cash funds owned by the former US customers of MF Global to 80%.

I was suspecting that something like this would come along soon, as I recently was solicited by a couple of East coast hedge funds offering to buy out my existing claim at a discount. Now I hear that a private exchange it setting up in Connecticut which will buy and sell such claims, of which there are thought to be more than 10,000.

When MF Global filed for bankruptcy last year, it was the eighth largest in US history with debts of $40 billion. It is believed that the company lost $6.3 billion on ill-timed long positions in European sovereign debt. As is so often the case in these situations, it was the distressed liquidation of the MF portfolio that made the final bottom in that market. If MF had only been able to hold on a few more weeks, they would have made a fortune. For example, Italian ten year bond yields have fallen from over 8% to under 5% since then, creating massive capital gains.

The bankruptcy triggered a mini financial crisis just in the midst of a global selloff. It cast a pall over the agricultural markets from which they have yet to recover as thousands of farmers saw capital tied up. That left them unable to come out of existing hedges or roll into new ones. Even those who stored physical metals with MF, like gold and silver, were only given partial payouts.

Initially, the finger pointed at CEO John Corzine, once a Goldman Sachs co-chairman, US senator, and governor of New Jersey. I never believed it for a second. It now looks like a mid-level manager accidently sent $150 million to JP Morgan, which refused to return the funds before the bankruptcy was filed. A further complication is the conflict between US and UK bankruptcy law which assign different rights to creditors. The matter will no doubt be tied up in the courts for years.

I believe that that beleaguered MF customers will eventually get 100% of their funds returned. There are still substantial assets to be liquidated at far better prices than prevailed in the fall and paid out to customers. This was not a negative net worth bankruptcy, and customers are at the very top of seniority of claims. But it could be a long wait. However, their confidence on the US financial system is almost certainly gone for good.

After a 15 year hiatus, Apple (AAPL) has restored its dividend, announcing a 2% annual yield that exactly matches the average for the rest of the S&P 500. It also announced a $10 billion share buyback. The only thing missing that the cheerleaders were hoping for was a 10:1 share split.

The move now makes Apple eligible to buy for the 40% of US institutions that don?t own it yet, such as dividend funds and pension funds. Hedge funds currently only account for 4% of the Apple ownership.

Apple holds two thirds of its cash overseas in foreign holding companies to keep profits out of reach by the IRS. But it says that it will be able to fund these new commitments purely from US cash flow alone.

The tab for the new policy will only put a small dent in the company?s gargantuan cash flow. Cash on the balance sheet will soon reach $100 billion. The dividend and buy back will total $45 billion over the three years. But the cash mountain will still grow to over $200 billion by then, even after these new expenses are paid out.

Many hedge fund traders are unhappy about the current near monopoly enjoyed by the top three ETF issuers, Black Rock, State Street, and Vanguard, which control 83% of the market. At last count more than 1,100 ETF's were capitalized at more than $1 trillion. The result has been grasping management fees, exorbitant expense ratios, and poor structural designs which create massive tracking error.

The good news is that new entrants are flooding into the ETF space, and the heightened competition they are bringing will help curtail the worst of these abuses. This development will accelerate the demise of the bloated and arthritic mutual fund industry, whose end has been a long time in coming. Not only will management fees and expense ratios plunge, there will be a far broader range of offerings, as new funds are launched from a diverse range of institutions coming from differing areas of expertise. Failure to enter the newly lucrative ETF market by the remaining giants sitting on the sidelines means that their existing mutual fund businesses will be cannibalized.

Look no further than bond giant PIMCO, which is coming out with a plethora of fixed income related funds, Van Eck's expanding list of ETF's for commodities, and the even growing list of inverse and leveraged inverse ETF's presented by ProShares. The bottom line will be that lower costs and tighter spreads will leave more profits on the table for the rest of us.

The Mutual Fund Industry is Getting Cannibalized