Long the domain of hedge funds and large banks, the carry trade has gone mainstream. Individual investors are increasingly resorting to the techniques employed by the masters of the universe to boost trading and investment returns.

But they lack the risk control infrastructure and discipline employed by the big boys. As with other innovations of yore, the net result has been to build up more risk in the system than many realize. This always ends in tears, not just for the players, but for everyone.

The ?carry trade? is just another way of buying low and selling high and doing both at the same time. In its newest incarnation, retail investors borrow cheap overnight money from their discount brokers and invest in high dividend paying stocks. Favorite targets have included REIT?s, tobacco, and utilities. They then use broker margin facilities to double up the bet. Large individual players can obtain private credit lines that increase leverage even further.

Let me give you an example with one of the favorite target stocks, Altria (MO), the old Phillip Morris. The dividend yield today is 5.40%. Take out the 2% cost of funds provided by online broker TD Ameritrade, and that brings the net down to 3.40%. Double is up with margin and it rises to 6.80%. In a zero return world that is quite a pick up. This is no doubt why the stock has risen 20% since October, bringing the total return up to 26.80%.

There is only one problem with this picture. What happens when the stock goes down? Leveraged positions are subject to margin calls, whether the customer is willing or not. While there is abundant margin in rising markets, it has the habit of disappearing of disappearing in falling ones. Read the fine print in your margin agreement and you will find that your friendly broker has the right to call in their loans at any time without notice.

They have a long history of doing this after sharp selloffs, right when distress is the greatest. Many traders only find this out when they get an email telling them their entire position has been liquidated at market. I can tell you from hard earned experience that there is no person in the world more blind to reason that a margin clerk.

Bunch up a lot of liquidations of these carry trades and you could throw gasoline on any fires that ignite during a market correction. Who might provide the matches? The government, which is expected to substantially raise taxes on dividends after the next election. High dividend stocks that were last year?s stars could become this year?s goats. Be careful that your carry trade doesn?t carry you out.

Will High Dividend Stocks Become This Year?s Goats?

A confidential report from the Pentagon just made public says that the 2008 financial crisis was the result of targeted attacks by terrorists groups. A ramp up of oil prices that began in 2007 led to the bear raids against Bear Stearns and Lehman Brothers in 2008. The final phase may be in place now, forcing the US to engage in massive and unsustainable borrowing to cope with the Great Recession that followed. The consequent collapse of the dollar is assured.

Two firms, left anonymous in the report, were particularly aggressive in the execution of this plan, which engaged in highly leveraged purchases of credit default swaps and the shorting of stocks. It is believed they were acting as agents on behalf of unnamed enemies of the US. Was it China? Jihadists? Or Goldman Sachs (GS)?

I know that parties with advanced knowledge of the 9-11 attacks bought a massive position in American Airlines puts just days before, which they executed through Swiss banks. They never collected a windfall profit thought to exceed $200 million, as the FBI was ready to pounce. So we know that at least terrorist friends are active in the market in big size.

However, this report sounds more like a John le Carre novel than having any bearing in reality. Did terrorists force Alan Greenspan to keep interest rates artificially low? Did they intimidate millions of subprime borrowers into taking out loans they could never repay. Did terrorists drug the SEC, putting them to sleep while bankers ran wild? Did Chinese agents lobby for the repeal of Glass Steagle?

I doubt it. It all sounds like a fantasy that squeezed through the cracks on a slow news day. I think the Pentagon better stick to their day job of blowing up stuff rather than analyzing financial markets.

Was This a Trading Strategy?

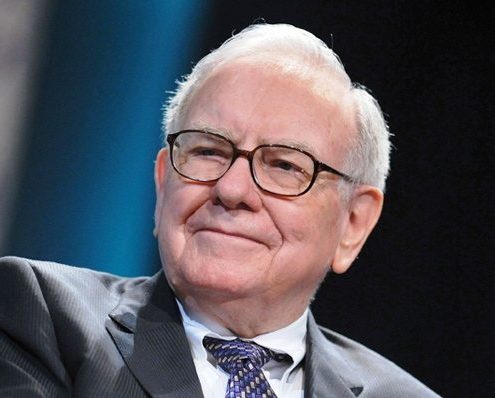

The 'Oracle of Omaha' expounded at length today on why he despises the barbarous relic. The sage doesn't really care about the yellow metal, whatever the price. He sees it primarily as a bet on fear.

If investors are more afraid in a year than they are today, then you make money. If they aren't, then you lose money. If you took all the gold in the world, it would form a cube 67 feet on a side, worth $7 trillion. For that same amount of money, you could own other assets with far greater productive power, including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*Seven Apple?s (AAPL), the largest capitalized company in the world.

*You would still have $2 trillion in walking around money left over.

Instead of producing any income or dividends, gold just sits there and shines, letting you feel like you are King Midas.

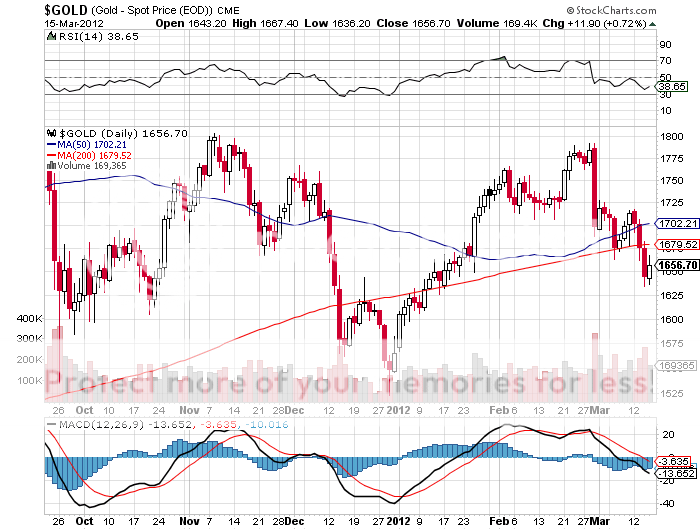

I don't know. With the stock market peaking around here, and oil trading at $105/barrel, a bet on fear looks pretty good to me right now. I'm still sticking with my long term forecast of the old inflation adjusted high of $2,300/ounce. But we may have to visit $1,500 on the way there first.

Maybe Feeling Like King Midas is Not So Bad

?What the wise man does in the beginning the fool does in the end,? said oracle of Omaha, Warren Buffett.

With global quantitative easing now getting long in the tooth, I think the party is about to end for the Treasury bond market. For the last four months, this market has been stuck in a tedious, narrow range, with ten year paper stuck between a 1.90% - 2.10% yield. Trading bonds has been as exciting as watching paint dry, with only professionals able to engineer profitable round trips. The charts below show that we have at last broken out of that range.

Private US investors and foreign central banks are not going to be able to make up the shortfall in bond buying once the Fed and the ECB exit the stage. The big problem is that the bond market these days is very much like a Ponzi scheme. Unless there is a steady inflow of new suckers, the entire plan collapses like a house of cards.

I can?t tell you how many hedge funds are itching to short Treasury bonds. Thousands jumped in too early last year only to get their fingers burned, myself included.

The ideal instrument for the individual investor to get involved in this market is with is the ProShares Ultra Short 20+ Treasury ETF (TBT). I have included a three year chart below to show you what the long grinding bottom looked like. The only surprise is that it took this long to turn up, given the strength we have seen in risk assets since October.

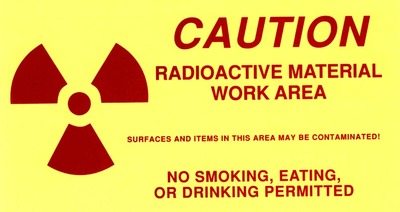

Keep in mind that the cost of admission to play this game is high. A 200% short bond position means that you are short the coupon twice. For a 30 year bond with a 3.4% yield, that adds a cost of carry of 6.8%. Add in another 1.2% for management fees, expenses, and other hidden costs, and you really need Treasury bonds to fall 8% year just to break even in the ETF. You won?t ever see the interest and fees deducted. It just feeds directly into the ETF price. On top of that, you can expect some tracking error. That?s why it is best to catch only the short term pops in this security, much like you have seen this week.

Of course, I hate buying anything that has just popped 10%. You know me, I am not a chaser. Ideally, the long awaited 5% correction in stocks will create a rally in bonds and a selloff in the (TBT) that could provide a prudent entry point.

If this really is the end of the 30 year bull market, there is a lot of room on the upside for the (TBT). Take 30 year yields back to last year?s high of 4.2%, and the (TBT) nearly doubles to $40. If the markets want to finally pay attention to our large and ballooning budget deficits, now over 100% of GDP, it could deliver a multiple of that.

Is the Fat Lady Singing for the Treasury Market?

?At these prices, bonds should have warning labels on them,? said Doug Kass of Seabreeze Partners.

Due to overwhelming demand, I have improved and expanded my 2012 schedule of strategy luncheons. The Phoenix lunch got moved to Scottsdale to access a more stylish hotel. The French said they would start mailing me frog legs if I didn?t come to France, so my European Tour now includes a Paris lunch.

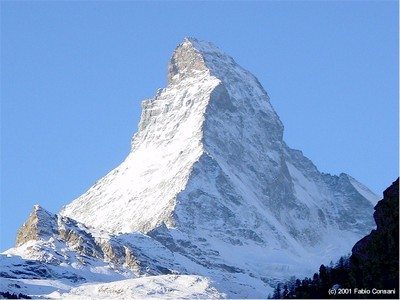

The Swiss threatened to they would cancel my invitation to the Davos conference next year, so I have added a seminar in Zermatt. But you will have to climb the Matterhorn to get there. Don?t forget your pitons, crampons, karabiners, ropes, and GPS in case you get buried in an avalanche. I don?t mind visiting the Alps again. Last year, my short in the Swiss franc was my best performing trade, so it should be considerably cheaper this time around.

April 20 San Francisco

May 3 Scottsdale

June 11 Beverly Hills

June 29 Chicago

July 5 New York

July 6-13 Queen Mary II

New York to Southampton

July 16 London

July 17 Paris

July 18 Frankfurt

July 27 Zermatt

October 26 San Francisco

November 8 Orlando

January 3, 2013 Chicago

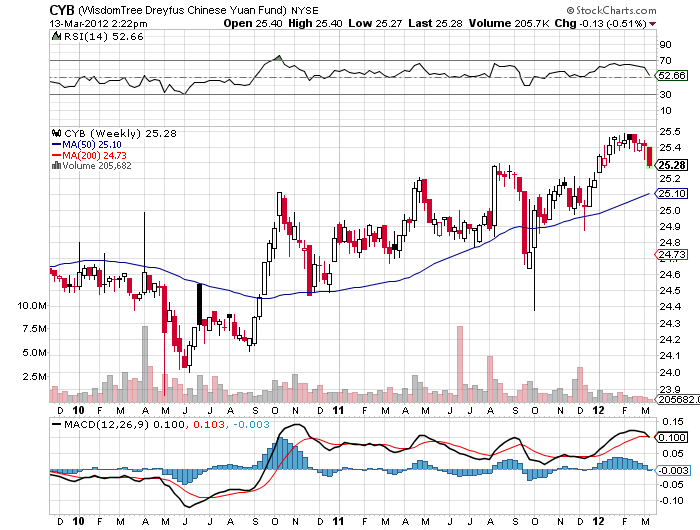

Long time readers of this letter are well aware of my advice to hold cash in the Chinese Yuan ETF (CYB) for the past four years. Those who followed my advice profited nicely.

The Yuan to you and me is known domestically in China as the ?renminbi?, or people?s currency. China has a quasi-fixed exchange rate against the US dollar that limits movement to just a couple of percent a year.

Since the People?s Bank of China removed a decade long dollar peg in 2005, it allowed a very gradual rise in this band of 2-3% a year. That is a vastly superior return compared to the zero interest Americans currently earn from money market funds, cash management accounts, or through buying Treasury notes with up to two year maturities.

This week, rumors roiled the marketplace that the government might slow, or even stop, this drip by drip appreciation. The trigger was a shocking $$31.5 billion February trade deficit, the largest monthly figure since 1998, primarily caused by the recession in Europe, its largest export market. The (CYB) reacted by plunging nearly 1% overnight.

One thing is certain. A free floating Yuan would be at least 50% higher than it is today, and possibly 100%. I can say this in confidence having watched the Japanese yen appreciate from ?360 to the dollar to ?75 while running a trade surplus of similar magnitude for the past 40 years, an increase of almost 400%.

In fact, the desire to prevent foreign hedge funds and speculators from making a killing in the market is a not a small factor in Beijing?s thinking to keep its currency artificially undervalued. The Chinese Central bank governor, Zhou Xiaochuan, says he won?t entertain a revaluation for the foreseeable future. He is no doubt thinking about the millions of Chinese workers who would lose their jobs if their exporting employers? razor thin profit margins are vaporized by a stronger currency.

The Americans say they need a stronger Yuan now. And now the matter has become a campaign issue, with candidate Mitt Romney saying he would label China a ?currency manipulator? on day one in office, not a nice thing to say to the country that is supposed to fund the bulk of his promised tax cuts. Obama has responded in kind, filing a WTO complaint on Chinese export restrictions of rare earth metals essential for our manufacture of electric cars.

I think you could see continued weakness in the Yuan as long as Europe is in the penalty box, slowing the Middle Kingdom?s economic growth. But this is merely a short term dip in a long term trend.

Buy the Yuan ETF on weakness. Just think of it as a cash management tool with an attached lottery ticket. If the Chinese continue to stonewall liberalization of their currency, you will get the token 2%-4% annual revaluation the swaps have been discounting. Given the massive $250 billion annual trade surplus the Middle Kingdom is now running with the US, the chances of a prolonged fall in the Yuan against the dollar are minimal. If they cave, then you could be in for a home run.

Is China a Good Parking Place for Cash?

?I don?t pay any attention to the GDP forecasts of economists?, said Oracle of Omaha Warren Buffet,

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950?s, and which I still remember fondly. This is not some pie in the sky prediction. It simply assumes a continuation of existing trends in demographics, technology, and economics. The implications for your investment portfolio will be huge.

What I call ?intergenerational arbitrage? will be the principal impetus. The main reason that we are now enduring two ?lost decades? is that 80 million baby boomers are retiring to be followed by only 65 million ?gen Xer?s. When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and ?RISK ON? assets like equities, and more buyers of assisted living facilities, health care, and ?RISK OFF? assets like bonds. The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward ten years when the reverse happens and the baby boomers are out of the economic, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home. That is when you have 65 million gen Xer?s being chased by 85 million of the ?millennial? generation trying to buy their assets.

By then we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage hikes. The middle class standard of living will reverse a then 40 year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990?s.

The stock market rockets in this scenario. Share prices may rise gradually for the rest of the teens as long as growth stagnates. A 5% annual gain takes the Dow to 20,000 by 2020. After that, we could see the same fourfold return we saw during the Clinton administration, taking the Dow to 80,000 by 2030. Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next 20 years should bring a fundamental restructuring of our energy infrastructure as well. The 100 year supply of natural gas (UNG) we have recently discovered through the new ?fracking? technology will finally make it to end users, replacing coal (KOL) and oil (USO). Fracking applied to oil fields is also unlocking vast new supplies. That?s why oil is now $70 a barrel in North Dakota versus $100 in Oklahoma 1,000 miles to the South.

Since 1995, the US Geological Survey estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC?s share of global reserves is collapsing. This is all happening while automobile efficiencies are rapidly improving and the use of public transportation soars.? Mileage for the average US car has jumped from 23 to 24.7 miles per gallon in the last couple of years. Total gasoline consumption is now at a five year low.

Alternative energy technologies will also contribute in an important way in states like California, accounting for 30% of total electric power generation. In two years, my own vehicles will be all electric, with a Nissan Leaf (NSANY) and a Tesla (TSLA) Model X plugged in in my garage, allowing me to disappear from the gasoline market completely. Millions will follow. The net result of all of this is lower energy prices for everyone.

It will also flip the US from a net importer to an exporter of energy, with hugely positive implications for America?s balance of payments. Eliminating our largest import and adding an important export is very dollar bullish for the long term. That sets up a multiyear short for the world?s big energy consuming currencies, especially the Japanese yen (FXY) and the Euro (FXE). A strong greenback further reinforces the bull case for stocks.

Accelerating technology will bring another continuing positive. Of course, it?s great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos. But at the enterprise level this is enabling speedy improvements in productivity that is filtering down to every business in the US.

This is why corporate earnings have been outperforming the economy as a whole by a large margin. Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development. When the winners emerge they will have a big cross leveraged effect on economy.

New health care breakthroughs will make serious disease a thing of the past, which are also being spearheaded in the San Francisco Bay area. I tell my kids they will never be afflicted by my maladies. When they get cancer in 40 years they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday. What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver?s seat on these innovations? The USA.

There is a political element to the new Golden Age as well. Gridlock in Washington can?t last forever. Eventually, one side or another will prevail with a clear majority. This will allow them to push through needed long term structural reforms, the solution of which everyone agrees on now, but nobody wants to be blamed for. That means raising the retirement age from 66 to 77 where it belongs, the age at which 50% of the population dies, and means testing recipients. Billionaires don?t need the $30,156 annual supplement.

The ending of our foreign wars and the elimination of extravagant unneeded weapons systems cuts defense spending from $800 billion a year to $400 billion, or back to the 2000, pre-9/11 level. Guess what happens when we cut defense spending? So does everyone else. I can tell you from personal experience that staying friendly with someone is far cheaper than blowing them up. A Pax Americana would ensue.

Medicare also needs to be reformed. How is it that the world?s most efficient economy has the least efficient health care system? This is going to be a decade long workout and I can?t guess how it will end. Trim back the government?s participation in the credit markets and you make the numerous miracles above more likely. The national debt comes under control, and we don?t end up like Greece. The long awaited Treasury bond (TLT) crash never happens.

Sure, this is all very long term stuff. But you can expect the financial markets to start discounting a few years hence, even though the main drivers won?t kick in for another decade. But some individual industries and companies will start to discount this rosy scenario now. Perhaps this is what the nonstop rally since October in technology, energy, and health care stocks has been trying to tell us.

Dow Average 1970-2012

Is Another American Golden Age Coming?