If I were trapped on a desert island and could pick only one economic data release to float ashore in a bottle, it would doubtless be the weekly jobless claims.

Released by the Department of Labor every Thursday morning at 8:30 EST, this one number is the most accurate leading indicator of future economic activity among the hundreds out there to choose from. If you don?t believe me, take a look at the chart below provided by my friends at Goldman Sachs showing the high correlation between this data and the S&P 500.

This morning, the latest release showed a modest gain in claims of 2,000, from 348,000 to 351,000. The four week moving average fell 7,000 to 359,000. What is really important here is that the major downtrend is intact, and is well below the 400,000 thought to indicate an expanding economy. If the current trend continues, jobless claims could reach as low as 275,000 by the end of the year. Because of this, UBS has lowered its year end unemployment rate forecast from the current 8.3% to 7.8%, not far below my own.

As long as jobless claims are maintaining this trend, I am reluctant to pile on aggressive short positions, despite the fact that most technical indicators are showing the most extreme overbought conditions in several years. Instead I have been running balanced ?market neutral? positions where selective longs are balanced out with short positions.

Sure, I am leaving some money on the table with such a cautious approach. But when the fat lady sings, I?ll be the one who is laughing. When you spend money on fire insurance, you don?t call the company and complain when your house doesn?t burn down. I hate these straight lines moves up like this because it makes the idiots look like geniuses and the geniuses look like idiots, and you all know which category I place myself in.

When will the jobless figures start to turn up? The data we are seeing now are in response to a GDP that grew at a 2.9% rate in Q4, 2011. Q1, 2012 could come in as low as 1.5%. When we see managers respond to the next set of data in coming months, our recent torrid job growth could hit a wall.

Is This Around the Corner for Jobless Claims?

SOCIALISM

You have 2 cows.

You give one to your neighbor.

COMMUNISM

You have 2 cows.

The State takes both and gives you some milk.

FASCISM

You have 2 cows.

The State takes both and sells you some milk.

NAZISM

You have 2 cows.

The State takes both and shoots you.

BUREAUCRATISM

You have 2 cows.

The State takes both, shoots one, milks the other, and then throws the

milk away.

TRADITIONAL CAPITALISM

You have two cows.

You sell one and buy a bull.

Your herd multiplies, and the economy grows.

You sell them and retire on the income.

ROYAL BANK OF SCOTLAND (VENTURE) CAPITALISM

You have two cows.

You sell three of them to your publicly listed company, using letters of

credit opened by your brother-in-law at the bank, then execute a

debt/equity swap with an associated general offer so that you get all

four cows back, with a tax exemption for five cows. The milk rights of the six cows are transferred via an intermediary to a Cayman Island Company secretly owned by the majority shareholder who sells the rights to all seven cows back to your listed company. The annual report says the company owns eight cows, with an option on one more.

You sell one cow to buy a new president of the United States , leaving you with nine cows.

No balance sheet provided with the release.

The public then buys your bull.

SURREALISM

You have two giraffes.

The government requires you to take harmonica lessons.

AN AMERICAN CORPORATION

You have two cows.

You sell one, and force the other to produce the milk of four cows.

Later, you hire a consultant to analyze why the cow has dropped dead.

A FRENCH CORPORATION

You have two cows.

You go on strike, organize a riot, and block the roads, because you

want three cows.

A JAPANESE CORPORATION

You have two cows.

You redesign them so they are one-tenth the size of an ordinary cow and produce twenty times the milk.

You then create a clever cow cartoon image called a Cowkimona and market it worldwide.

AN ITALIAN CORPORATION

You have two cows, but you don't know where they are.

You decide to have lunch.

A SWISS CORPORATION

You have 5000 cows. None of them belong to you.

You charge the owners for storing them.

A CHINESE CORPORATION

You have two cows.

You have 300 people milking them.

You claim that you have full employment, and high bovine productivity.

You arrest the newsman who reported the real situation.

AN INDIAN CORPORATION

You have two cows.

You worship them.

A BRITISH CORPORATION

You have two cows.

Both are mad.

AN IRAQI CORPORATION

Everyone thinks you have lots of cows.

You tell them that you have none.

No-one believes you, so they bomb the ** out of you and invade your

country.

You still have no cows, but at least you are now a Democracy.

AN AUSTRALIAN CORPORATION

You have two cows.

Business seems pretty good.

You close the office and go for a few beers to celebrate.

A NEW ZEALAND CORPORATION

You have two cows.

The one on the left looks very attractive.

?We are witnessing the death of abundance and the birth of austerity for what may be a very, very long time,? said PIMCO managing director, Bill Gross, the world?s largest bond manager.

Troubled Bank of America (BAC) certainly earned its title as the premier Dog of the Dow last year. It managed an appalling 58% decline in 2011, the worst of any of the 30 Index stocks. It only managed to stay above the crucial $5 level by a hair?s breadth, below which many pension funds are barred from owning shares.

Since the beginning of this year, it has been the best performer, soaring 48% from $5.60 to $8.30. Will this eye-popping turnaround continue?

I think it is more likely that the enormous Lake Tahoe outside my window freezes into a gigantic mango smoothie.? Its credentials as a ?zombie? bank are as good as ever, and it will continue to play a leading role in the horror story our financial system has become.

(BAC) has become the poster boy for ?too big to manage?. The bank is still, by many measures, the largest in the US, with $2.3 trillion in assets, 288,000 employees, 5,900 branches, and 18,000 ATM?s. One out of two Americans are said to have an account at the North Carolina based institution. The $84 billion market cap company earned a penny a share last year, giving a price earnings multiple of a mind blowing 802.

The problem is that the company is so gargantuan that by the time information filters up to the top, it has become old, irrelevant, or even dangerous. It seems to want to plunge into every ?flavor of the day? strategy, which is always fatal for any organization that turns with the speed of a supertanker.

It plunged into proprietary trading in the early 2000?s, despite a woeful lack of talent to execute. Its 2007 purchase of Countrywide for $2 billion saddled it with a loan book so toxic that it still may not survive. It paid $50 billion for Merrill Lynch, when, if the positions were marked to market, it would have been worth only $1 or less.

Bank of America is a deer that can?t stay out of the headlights. Any online search about the company reveals a litany of problems, including mortgage fraud, robo signing, SEC sanctions and fines, municipal bond fraud, an ill-fated $5 debit card fee, and litigation up the wazoo. Oh, to be their outside counsel. Kaching!

The company recently announced disappointing earnings driven by falling revenues and rising costs. Their financial statement offered a panoply of special items, with prominent distressed assets sales used to cover losses. It is literally eating its seed corn to keep from starving to death. (BAC) attempted to pay a dividend in 2011, but that was nixed by the Federal Reserve due to its TARP obligations.

The size of the market that can meet their rising credit standards is shrinking dramatically, thanks to a 30 year long squeeze on the middle class. They might as well be a buggy whip manufacturer. The cost of regulation is skyrocketing. This is why I went on national TV last May and pounded the table to get viewers to sell it short at $13.50.

Despite the whopping great rally in the share price, they are trading at a big discount to book value, meaning that investors think the bank is still carrying large, unrealized loan losses on its books. Now Moody?s has threatened to downgrade the bank?s credit rating a couple of notches, which would increase its borrowing costs substantially. They are truly caught between a rock and a hard place.

I am not one of these glum guys who think that Bank of America will go bankrupt. That was a 2008 story. Don?t worry, your deposits are safe. It is far more likely to get broken up. First on the block will be Merrill Lynch, which is worth more today than in the dark days of four years ago. Think of it as (BAC)?s General Motors. Management is also making noises about withdrawing from Texas and other major markets.

There may be a time for a true national bank in the US, but that time is not now. Not when they play at being hedge funds on the side without the slightest idea of how to do so, and then blow up with your money inside, requiring taxpayer assistance. But there is a trade here for the nimble.

This is the really interesting part. Bank of America has become the favorite whipping boy of the high frequency traders. Because of them, its shares frequently accounted for 10% or more of NYSE volume last year. They have increased the volatility of these shares dramatically.? As a result, (BAC) is one of the highest beta large caps in the market.

What does this mean for the average punter working behind a PC (or Mac) at home? That a rapid 50% jump in shares is likely to be followed by a sudden 25% plunge. At this level, it has become the classic ?heads you win, tails I win 5X? situation if positioned appropriately.

The algorithms are lurking out there just waiting to pounce on this pitiful stock like a hungry leopard. Take a look at the chart below, and the setup is as clear as day. Despite an (SPX) that ground up to new highs nearly every day last week, (BAC) stock has begun rolling over like the Bismarck. Get a serious ?RISK OFF? day in global assets, and this thing could dive like a kamikaze.

No surprise then that (BAC) has become my favorite stock to sell short.

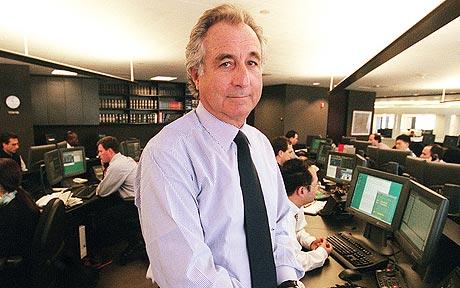

I spent a sad and depressing, but highly instructional evening with Dr. Stephen Greenspan, who had lost most of his personal fortune with Bernie Madoff. The University of Connecticut psychology professor had poured the bulk of his savings into Sandra Mansky's Tremont feeder fund; receiving convincing trade confirms and rock solid custody statements from the Bank of New York.

This is a particularly bitter pill for Dr. Greenspan to take, because he is an internationally known authority on Ponzi schemes, and just published a book entitled Annals of Gullibility-Why We Get Duped and How to Avoid It. It is a veritable history of scams, starting with Eve's subterfuge to get Adam to eat the apple, to the Trojan horse and the Pied Piper, up to more modern day cons in religion, politics, science, medicine, and yes, personal investments.

Madoff's genius was that the returns he fabricated were small, averaging only 11% a year, making them more believable. In the 1920's, the original Ponzi promised his Boston area Italian immigrant customers a 50% return every 45 days. Madoff also feigned exclusivity, often turning potential investors down, leading them to become even more desirous of joining his club. For a deeper look into Greenspan's fascinating, but expensively learned observations and analysis, go to his website at http://www.stephen-greenspan.com/ .

The other shoe has fallen in China, with the People?s Bank of China?s move to cut bank reserve requirements by 50 basis points, the second time since November. The relaxation makes the Middle Kingdom a certified, card carrying member of the international quantitative easing club.? It also confirms the country?s time tested preference for announcing major economic policy changes on American holidays. Watch that calendar!

First, a brief history lesson. China?s central bank uses the reserve rate as a means to control domestic lending without have to resort to changing interest rates. A low reserve rate means that the banks can leverage up and lend with reckless abandon, thus stimulating the economy. A high rate clips lenders? wings and slams on the brakes for the economy.

The authorities stated raising this key benchmark all the way back in 2006, when the reserve rate was only 8% and double digit GDP growth rates ignited inflation fears. The central bank raised the requirement until it reached an all-time high of 21.5% in June, 2011.

This means that banks must retain $21.50 for every $100 in leans they extend, giving them a leverage ratio of 4.6:1, making them the least leveraged banks in the world. By comparison, American banks were leveraged up to 100:1 at the top of the real estate bubble, and are thought to be running 12:1 leverage now, nearly triple China?s current rate.

The important thing to note here is not the absolute 50 basis point change in reserve requirements, but the confirmation of the new direction. The PBC only changes direction in reserve requirements a few times a decade, and when it does, it is a monumental, sea-changing occasion.

It tells us that further cuts are in the works, that Chinese banks are being encouraged to increase and not decrease lending, and that this is good for asset prices everywhere, especially copper.

China Fires the Starting Gun

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

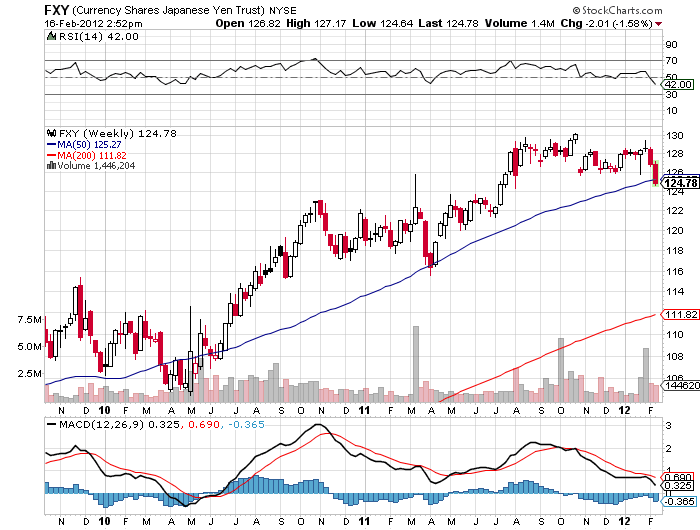

The Bank of Japan renewed its membership in the international quantitative easing club last week, announcing that it was substantially expanding its bond repurchases.

Specifically, it will increase them from ?55 trillion to ?65 trillion, a jump equivalent to $830 billion. To understand how big this is, consider that Japan?s GDP is one third the size of the US. That would be the same as the Federal Reserve announcing a repo program with $2.5 trillion here. Imagine what your asset prices would do if that happened.

For good measure, the Japanese also announced an inflation target of 1%, which is entirely wishful thinking for a country that is entering its 23rd year of deflation. It?s like a man on skid row planning on how to spend his prospective lottery winnings.

The government was prompted to action by the 2011 full year GDP figure, which came in at an appalling -0.9%, compared to a robust growth of 4.5% in 2010. The tsunami reconstruction program has fallen woefully behind schedule due to extreme mismanagement and incompetence by the authorities, despite being more than adequately funded. But after watching the Land of the Rising Sun for the last 20 years, I have come to expect incompetence. Slowdowns in Europe and China, plus the Thai floods and the Fukushima nuclear meltdown have provided additional headwinds.

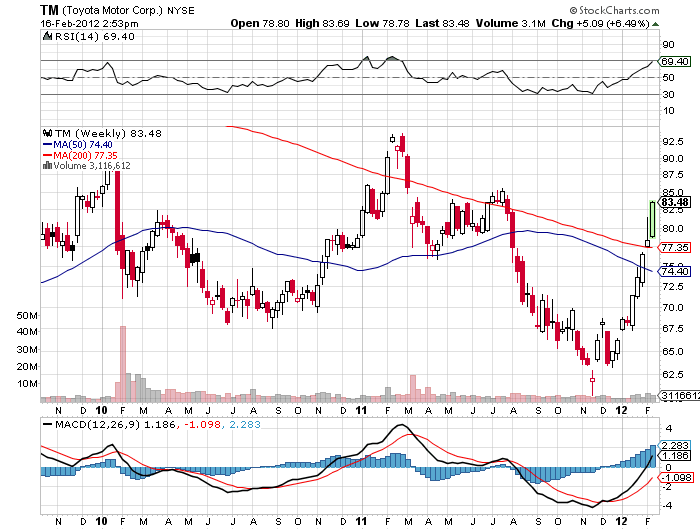

The immediate impact was to trigger a sharp selloff in the yen, delivering an immediate windfall to readers of my Trade Alert Service who were already long yen puts. Traders like myself are always looking for confirming cross market correlations.? You can find one in the movement of the Nikkei stock average, which has been the world?s most despised asset class for the last two decades.

As you can see from the chart below, it is threatening an important multi month breakout to the upside. The reasons for this are simple. A cheaper yen makes Japanese exports more competitive. It also makes the foreign earnings of Japanese multinationals more valuable when translated back into yen. Look no further than the chart of Toyota Motors (TM), which have leapt by a blistering 30% this year.

If you are still unsure about the integrity of the yen collapse, check out the chart for the long dollar basket (UUP). It is setting up for a multiyear head and shoulders breakout to the upside. Uncle Buck has recently taken a steroid shot from the continuing weakness in Europe and the new recession in Japan.

Bottom line: keep selling the yen on rallies, possibly for the next several years.

Those Steroid shots are Definitely Helping Uncle Buck

I never cease to be amazed by the intelligence provided me by the US Defense Department, which after the CIA, has the world?s most impressive and insightful economic research team. There are few places a global strategist like myself can go to get an intelligent, thoughtful forty year views, and this is one.

Of course, they are planning how to commit ever declining resources in future military conflicts. I am just looking for great trading ideas for my readers, which my assorted three star and four star friends have in abundance. I usually have to provide some extra analysis and tweak the data a bit to obtain the precise ticker symbols and entry points, but then that?s what you pay me to do.

An evening with General Douglas Fraser did not disappoint. He is an Air Force? four star who is the commander of US Southern Command (SOUTHCOM), one of nine unified Combatant Commands in the Department of Defense. Its area of responsibility encompasses Central America, South America, and the Caribbean. SOUTHCOM is a joint command comprised of more than 1,200 military and civilian personnel representing the Army, Navy, Air Force, Marine Corps, Coast Guard, and other federal agencies.

The United States is now the second largest Hispanic country in the world, and it will soon become the largest. These industrious people now account for 15% of US GDP, and that figure will grow to 35% by 2050. The Hispanic birthrate in many parts of the US is triple that of any other ethnic group. Because of this, any politicians that pursue anti-immigrant policies are doomed to failure.

Latin America?s GDP is growing at 4% a year, more than double the current US rate. American trade with the region grew by 72% last year, with imports surging an eye popping 112%. It is the source of one third of our foreign energy supplies. It has tremendous wealth in copper, iron ore, and food production that have yet to be exploited. In the last decade, 40 million have risen out of poverty. Yet 13% of the inhabitants earn less than $1 a day.

This poverty has made Latin America fertile ground for the international drug trade, which poses one of the greatest threats to America?s security today.? Profits from the cocaine trade reached $88 billion in 2011, which is more than the GDP of any single Central American country. Some $33 billion worth of this narcotic made it into the US last year. Brazil is the world?s second biggest consumer of cocaine, after the US, with the UK the largest per capita consumer. The farther you move this product from the source, the more expensive it gets. Cocaine costs $2,000 a kilo in Brazil, $40,000 in the US, $80,000 in Europe, and $150,000 in the Middle East.

Technology has made communications, organization and logistics tools once only found in the military available to anyone. This creates a level playing field for international crime organizations of all sorts. The drug business is so profitable that the cartels are now building submarines in the jungles of Columbia at a cost of $4 million each, and sending them under water to the US to make a $100 million profit per voyage.

This illicit wealth is financing the growth of other illegal activities, like money laundering, arms dealing, human trafficking, and even the transportation of exotic animals. This is corrupting the smaller and weaker governments. Key transit point Honduras bas become so violent, with the highest murder rates in the world that the US recently had to withdraw 150 Peace Corps volunteers.

As a result, Fraser has had to modify the mission of SOUTHCOM from a primarily military one to non-traditional crime fighting. His planes are intercepting smugglers at the favored Venezuela-Honduras-US air corridor, as well as craft making it up the Central American west coast.? He is providing military assistance, training, and joint operations where he can, but must balance this with the human rights record in each country.

In additional to his other responsibilities, General Fraser is also keeping close track of China?s rapidly expanding trade relations in the area. They have begun selling inexpensive, low end weapons and military equipment to some of these countries.

The investment opportunities I picked up from General Fraser were legion. It certainly made the ETF?s for Brazil (EWZ), Chile (ECH), and Columbia (GXG) no brainers for a long term portfolio. The Brazilian Real and the Chilean peso are screamers. Copper (CU) and the grains, (CORN), (SOYB), and (WEAT), are probably also good bets.

General Fraser graduated from the Air Force Academy in 1974 and is fluent in Spanish. He has commanded Air Force combat units in Japan, Korea, and Germany. He was later a senior officer in the Space Operations Command. General Fraser joined SOUTHCOM in 2009 after serving as deputy commander of the Pacific Command.

After his briefing, the readers of the Diary of a Mad Hedge Fund Trader who came at my invitation that evening were given the opportunity to ask questions of one of America?s most senior military officers on a one on one basis. In a lighthearted moment, I mentioned to the General that his career total of 2,800 flight hours exceeding my own by only 600 hours. But his rides were vastly more exciting than mine, with most of his time spent in F-16?s and F-15-s, some of the most lethal weapons ever developed.? My log contains an assortment of aircraft that include a lot of more sedentary Cessna?s, a few C-130 Hercules, a P51 Mustang, a De Havilland Tiger Moth, and a few precious hours in a Russian Mig-25 and Mig-29.

Meet my Flight Instructor