As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

I spent ten years of my life tramping in and out of Japan?s Ministry of Finance headquarters in Tokyo?s Kasumigaseki district. It was a dreadful reinforced steel and concrete affair with a dull grey tile siding that was so solidly built that it was one of the few structures in the city to survive WWII. But the building offered spacious prewar dimensions, and I never tired of walking its worn hardwood floors. I was there so often that some government officials thought I worked there, and they did eventually give me an office, the first ever granted to a foreign correspondent.

So to get an update on the Land of the Rising Sun, I called a senior official whose father I knew well as a Deputy Minister of Finance for International Affairs during the 1970?s. I was a regular at his apartment in Shinjuku on Saturday nights, where we spent endless hours alternately playing chess and Scrabble over a bottle of Johnny Walker Red and smoking Mild Sevens. We did everything we could to expand each other?s? Japanese and English vocabularies with the words not found in dictionaries. When the bottle was almost finished and his face was beet red, the Elvis impersonations would start.

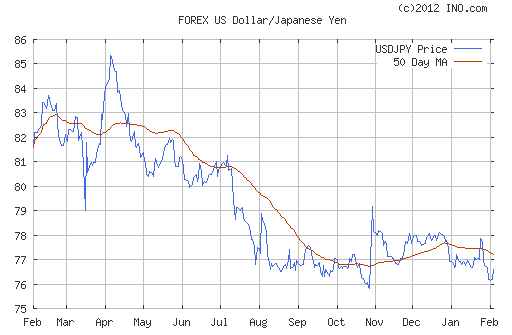

My friend told me that the ongoing strength of the yen is rapidly becoming a major political issue in Japan. The spot market is now threatening an all-time high, and on a trade weighted basis it was already at a new peak. Exporters were getting destroyed by the strong yen, which was making their goods increasingly expensive in a cost cutting competitive world.

This was forcing them to accelerate a 20 year effort by corporations to offshore production to China, which was ?hollowing out? Japan and causing economic growth to bleed away, and unemployment to rocket. The situation was getting so bad that American companies that offshored jobs to Japan years ago, like Caterpillar (CAT), were taking them back home because labor costs are so high. He expected Japan?s GDP to shrink at a 1.4% annualized rate during Q4, compared to a healthy 2.9% rate in the US.

His boss, Japanese finance minister, Juri Azumi, made comments in the Diet this week about his concern over yen strength. More specifically, he is seeking approval for a much more aggressive stance to pursue Bernanke style quantitative easing to knock the stuffing out of the yen and stimulate the economy.

The last time he did this, on October 31 last year, the Bank of Japan followed up with a massive $120 billion intervention in the foreign exchange market a few weeks later. One of the largest such interventions in history, it instantly knocked the yen down from ?75.90 to ?79.20. We may be about to see a replay. In fact, if they can just break resistance at ?80, then they might be able to knock it down to the 2011 low of ?85.30.

This time, Azumi has much more ammunition to work with. Japan reported its first trade deficit in 30 years just a few weeks ago. This may not be an anomaly. In response to the tsunami induced melt down at the Fukushima plant, Japan is permanently shutting down a large part of its nuclear power generating capacity. At its peak, nuclear accounted for 25% of the country?s electric power supply. That is forcing a huge surge in oil imports from the Middle East that has greatly tipped Japan?s balance of trade against it. Crude?s surge from $75/barrel to as high as $103 has only made matters worse.

He then told me that he too was now learning to play Scrabble and asked me for my list of words where the letter ?Q? is not followed by a ?U?. I said that I was not inclined to disclose America?s most valuable trade secrets to a foreign competitor. However, in deference to his late father, he couldn?t go wrong starting with ?Qi?, ?Qabala?, ?Qadi?, ?Qaid?, ?Qat? and ?Qanat?. I hung up the phone and immediately sold more yen against the dollar.

Economists were left speechless with Friday?s report of the January nonfarm payroll, which came in at an amazing 243,000, more than double the consensus expectations. It was the sharpest improvement in the data since April. Analysts have become inured to bad data that a mediocre report sounds like The Second Coming.

The headline unemployment rate plunged from 8.5% to 8.3%, and is now down an eye popping 0.5% in two short months. Unemployment is now at a three year low. More importantly, it was the second month in a row where the report delivered a major upside surprise.

The private sector led the charge, with new hiring accelerating from 220,000 to 257,000. Average hourly earnings increased by 0.2%. While most nonfarm payroll reports are a confusing jumble of contradictory statistics, this one was almost universally good. Is this the beginning of an important new trend? Are the good times here to stay?

I am no so quick to leap to that conclusion. Past economic recoveries have seen 400,000 jobs added monthly at this stage. The economy needs to add 150,000 jobs per month just to keep up with natural population growth. Never mind that a far larger portion of these new jobs are earning only minimum wage than in the past, far lower than the incomes that went into this recession. Union assembly jobs are out and burger flipping ones are in. The overall net drag on the economy is large.

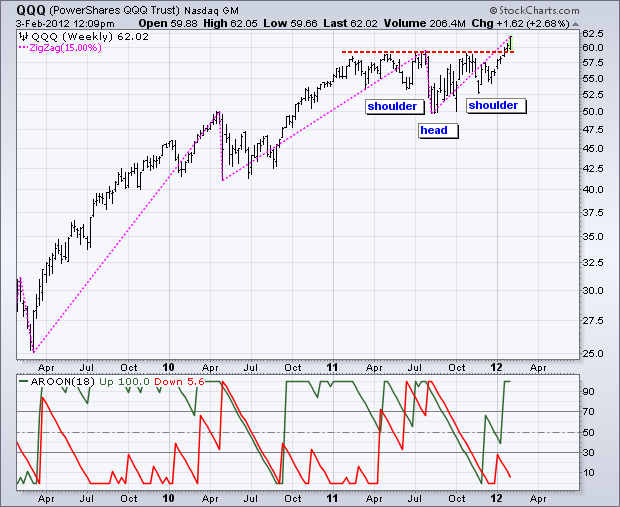

In fact, this rate of job growth is contestant with an economy that is growing at a 2.0%-2.5%, nicely matching my own prediction and that of the congressional Budget Office. On the other hand, the stock market is reacting as if the GDP was growing at a 4.0% rate, far higher than reality. When it wakes up to reality, the reaction could be harsh.

Let me tell you what I am taking great pains not to do here. I am not trying to cherry pick the data in order to support my own fundamentally cautious view. I am not looking for the clouds within the silver lining. I see perma bulls and perma bears do this all day long, usually with grievous results. Your net worth suffers as a result. The challenge here is to look at the data alone, and ignore the spin, hype, and emotion.

I see the nonfarm report as far more likely to set up a ?sell? of risk assets than a ?buy?. Look at the charts below and tell me that I am wrong. Are those double tops on the S&P 500 and the Russell 2000? Only the NASDAQ disagrees.

?Under current law there will be a massive fiscal contraction in 2013,? said Ben Bernanke, chairman of the Federal Reserve.

The Japanese yen has been flat lining since the tsunami struck in March of last year and was quickly followed by the nuclear meltdown and an economic collapse. In the meantime, the country?s long term structural problems have gotten steadily worse.

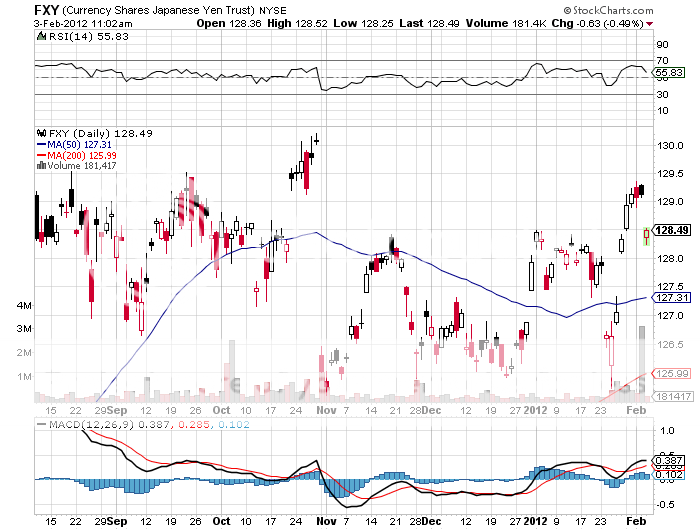

Last week, the yen was driven back to the very top of the range with a modest ?RISK OFF? trade in the global financial markets that has so far only lasted three days. It was enough to take the (FXY) from $125.80 to $129.10, a big move for such a normally quiescent currency. So I am going to buy the Currency Shares Japanese Yen Trust ETF (FXY) March 2012 $129 puts at $1.60 or best.

Because the yen has been stuck in such a narrow range for so long, the options are fantastically cheap. You can buy the March Yen puts with an implied volatility of only 8%, compared to 50% for the (UNG) puts, and a nose bleeding 80% for the (VIX) calls. Break out of this range, and these implieds, and put prices, go through the roof.

If the yen moves back to the bottom end of this range, which appears on the charts etched in stone, then you should get a triple on the puts. If the rapid deterioration of Japan?s horrific fundamentals starts to accelerate, then you could get a downside breakout on the (FXE) and far larger profits that many hedge fund managers have been calling for.

Those unable to execute trades in options can buy the Pro Shares Ultra Short Yen ETF (YCS), a double leveraged bet that the yen goes down.

I also have a tactical reason for putting on a short yen trade here. A short position in the yen is clearly a ?RISK OFF? trade, a place that people can go when they are feeling good about the world. I can use this to counterbalance my existing ?RISK ON? positions in the (SPY), the (EUO), and the (SDS). With a balanced portfolio I can simply sell whatever is up, buy more of whatever is down, and hopefully make money hand over fist. This is the approach that I used to such great effect last year.

For a much more detailed explanation of the problems besetting the Land of the Rising Sun, please click here for ?Is This the Chink in Japan?s Armor?? by clicking here.

Subscribers to my Global Trading Dispatch received this research piece as a trade alert on Monday. To subscribe to the Mad Hedge Fund Trader?s Trade Alert Service, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button at the bottom.

Finally, all that driving down dusty, bumpy, washboard dirt roads in the Barnet Shale in Texas paid off. The thing about a great trade is that when it works, new reasons to justify it that you never thought of suddenly come out of the woodwork. That is exactly what happened with my decision to sell short natural gas two days ago.

That unloved molecule, CH4, cratered this morning, the ETF (UNG) trading all the way down to $5.07. The value of my April puts soared, jumping 75% in a mere two days. Being a trader all the way down to my DNA, I took the money and run. The gain took the value of my Global Trading Dispatch model trading portfolio up to 1.41% year to date.

I got up at 4:00 AM this morning to call my friends in Texas before they headed off the fields. I wanted to get the lowdown on what caused the catastrophic decline in natural gas yesterday, the sharpest one day sell off in 18 months. What I got was a complete earful, which I will summarize below:

1) Chesapeake Energy?s (CHK) announcement that they would cut natural gas production was complete BS. If you cap a well prematurely you damage the field. You might as well blow it up. What they probably will do is cut back new drilling by 50% going forward. But that does nothing to address the glut of gas that is spewing out of the wells now.

2) The fear is that so much gas will be produced that we will completely run out of storage by summer, leading to a further collapse in prices. While new storage is being built, it will be woefully inadequate.

3) The winter never showed. This has been the warmest winter in a decade, and traditional heating demand for gas has vaporized.

4) Efforts to build an LNG export industry to ship product to China are being slowed by law suits from pesky environmentalists and zoning officials in local neighborhoods nervous about the construction of new liquifaction facilities that might blow up.

5) In the meantime, other companies are in a race to out produce each other to offset lower prices with volume, causing further price cuts.

6) President Obama can promise all he wants about natural gas corridors, but is unlikely to get anything he wants through a gridlocked congress. See a national map of the proposed corridors below.

The pros in the pits assure me that we are not anywhere close to a bottom in natural gas. If we break the ten year low at $2/MBTU, then we could see trapdoor stop loss selling that takes is all the way down from the current $2.36 to $1.75, down 25%. That would take the ETF (UNG) down to $3.75 and the April, 2012 $6 puts up to $2.20, up 340% from my cost. But hey, nobody ever got fired for taking a profit.

To subscribe to the Mad Hedge Fund Trader?s Trade Alert Service, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button at the bottom. I look forward to working with you. And thank you for supporting my research.

?The only way out for Europe is to devalue the Euro to help the peripheral countries,? said Scott Minerd, chief investment officer at Guggenheim Partners.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

All good things must come to an end, and it is time for me to bid adieu to the Wealth Insider Alliance. There is no doubt that this innovative and aggressive online marketing firm played a major role in placing the Mad Hedge Fund Trader on the map in the virtual world. They acted as the able midwives to the birth of my Macro Millionaire Trade Alert Service. One of the most successful online launches in Internet history brought thousands of new followers to my site. I give my heartfelt thanks to the hard working and imaginative WIA staff for a job well done.

Mad Hedge Fund Trader has since grown into a major international business, with subscribers in over 130 counties (including two in the Maldives). Apparently, I am still weak in Mali and North Korea, perhaps because of the absence of electricity. So I am plowing the profits back into the business to improve the service at every level.

Existing paid up subscribers will be transferred to my new database this week and sent new user ID?s and passwords necessary to access the premium content. To prevent your daily letters and trade alerts from getting caught up in spam filters, please add the addresses, alert@madhedgefundtrader.com and newsletter@madhedgefundtrader.com to your address book.

A link will be emailed to you directly that will give you live access and enable you to participate in my biweekly strategy webinars. If anyone has trouble with any of this, please email my dedicated live customer support at support@madhedgefundtrader.com .

Long term readers are well aware of my antipathy towards natural gas, which has been in your worst nightmare of a bear market for the past three years.

Well, the simple molecule finally got some good news last week. First, major producer, Chesapeake Energy (CHK) announced that it was cutting its natural gas production by 50%, taking some immediate pressure off the market. Sure, (CHK) is just one company, but others may follow suit.

Second, at the urging of my friend, Boone Pickens, Present Obama announced funding of some natural gas corridors in his State of the Union address. These are chains of natural gas stations placed every 100 miles stretching from east to west and north to south that would allow heavy trucks on transcontinental routes to refuel. This would provide the extra incentive for these 18 wheelers to convert from diesel fuel to CH4 at a nominal cost and put a major dent in our oil imports.

The news was enough to trigger a massive short covering rally in this most unloved of molecules. The spot market soared 25%, from $2.25 to $2.82 per MBTU?s, while the ETF (UNG) leapt from $5 to $6.

I am going to call the bluff of the market here and buy the United States Natural Gas Fund April, 2012 $6 puts at $0.65 or best. That way I can take advantage of the huge contango that exists between the spot and forward markets for natural gas futures contracts. To avoid actually drilling its own wells, the (UNG) buys forward contracts at huge premiums and holds them until they expire at spot. They then roll the cash forward into new contracts and repeat the process. It is one of the best wealth destruction machines I have ever seen and explains why (UNG) has, by far, outperformed natural gas on the downside. It is a great thing to be short.

To see how extreme this contango is, please visit the CME website. June futures natural gas futures are trading at a 10% premium to March, which is more than 40% annualized. All of that premium goes to money heaven for the (UNG).

If (UNG) double bottoms at $5, the put options should double in value. If a continuing glut of gas breaks us down to new lows, you could make much more. With the industry expected to run out of new storage capacity by the summer, I am betting on the latter, hence the heavy position. One other thing worth knowing here is that once drilled with the fracking process, you cannot turn off or cap a natural gas well without damaging the output. There is no ?OFF? switch.

For a much more detailed explanation on why natural gas is in dire straits, please click here. Subscribers to my Global Trading Dispatch received this research piece as a trade alert on Monday. To subscribe to the Mad Hedge Fund Trader?s Trade Alert Service, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green? ?SUBSCRIBE NOW? button at the bottom.

Where Did You Say the ?OFF? Switch is?