?My heart sank when I heard the corn number. I literally felt sick to my stomach. I just knew that most of the market was looking for a big rally in corn and had positioned themselves that way,? said Scott Shellady, a trader at ICAP US Derivatives.

Chicago?s Union Station is one of those places that is permanently jammed. Commuters rushing to catch trains run into bottlenecks at every turn. Today, they were fleeing a freezing rain outside that left the city?s skies a leaden overcast. The entire station smelled of wet wool. Only the Great Hall, which was setting up for a celebrated New Year?s party, offered decent running room.

I was there to catch the California Zephyr to Emeryville, California, which is just a quick hop over the Bay Bridge from San Francisco. The waiting room was packed with GI?s in uniform on home leave, Mennonites traveling to distant Iowa farms, and romantic couples embarking on discreet getaways. There was also a mix of excited tourists from Europe and Australia on USA Rail passes which offered unlimited travel for 45 days at a bargain $869.

Amtrak is certainly no Orient Express. Substitute polished, rare hardwoods for all American grey plastic. Instead of gourmet black tie dinners, I wore sweats to eat cheeseburgers and fries. Replacing the vintage 1920?s Pullman sleeping cars I slept in the cramped double decker US kind where you must negotiate the movement of every limb. Still, the service from my train attendant, JR, was excellent, who kept the coffee urn constantly fresh and full. I enjoyed every minute of the 52 hour adventure.

Traveling via a 19th century mode gives one a rare opportunity to slow down in this peripatetic world. As with the transatlantic liners, you set your watch back one hour each night as the porter makes up your bed. Away from the highways the complete absence of billboards, signs, and fast food joints makes the view all the more pleasant.

A Visit to the Old West

On the first morning, the sun rose from the billiard table flat landscape of Eastern Colorado. Dusty, ramshackle ranch structures backed onto the tracks with scattered cattle dotting the horizon.

These trains are a great social experiment, because the shortage of space dictates that you share your table with strangers at every meal. You never know if your next dining companion will come from a first class cabin, a shrunken ?sleeperette,? or the tedious ordeal of coach, where passengers must sit up all night, tortured by snorers. The nuggets of information you glean from these exchanges are worth far more than the mediocre food.

For me, the great upgrade in these trains is the 110 volt outlets that allow me unlimited use of my laptop. There is no Internet access, or even cell phone coverage for most of the route. You can connect briefly with the outside world for a few minutes as you stop at each station. That allowed me a productivity burst that saw a weeks? worth of work get done in two days. For 2,000 miles I alternated between reading and writing, briefly pausing to top up the coffee and take in the magnificent view.

Taking the train, you are afforded a voyeur?s look into America?s back yard. The observer notes cars on blocks, junk yards, pigeon coops, bee hives, aged recreational vehicles, dilapidated trailers, and farm animals of every description. Since prime real estate does not usually abut onto railroad tracks, you get a peek into the lives of many of the 60 million who now receive food stamps. You also go through rail yards that are laid out like a giant Lionel model train set.

The Rocky Mountains rose out of the plains like a dark rolling thunderstorm, with the steep grades starting just outside of Denver. At one bend we passed a line of hopper cars filled with dirt and welded to the tracks. Here, a severe gust barreling out of the mountains once blew a train over some years ago. Then we began a passage through the Old West. Double engines labored past a Disneyland like landscape, complete with abandoned log cabins, dramatic rock formations, and assorted wildlife around every steep bend in the track.

Crossing the Continental Divide

Crossing in a furious blizzard, an avalanche alert was triggered, slowing us to ten miles an hour. After that, the engineer red balled it to make up lost time. At the Continental Divide I jumped out and ran the length of the train twice in freezing temperatures to get the blood flowing and the crooks out of my back. From there, we followed west the frozen headwaters of the Colorado River. The evening saw us pulling out of Salt Lake City, the residents walking briskly to their alcohol free New Year?s Eve celebrations.

Following the Frozen Headwaters of the Colorado River

Although freight trains are given priority, the dispatchers cut us some slack. The only product I saw shipped was coal carried by endless lines of Burlington Northern cars on its way to China so they can make steel, which they ship back to us. Who says America has nothing left to sell?

I entered 2012 just east of Promontory Point, Utah where the Central Pacific and Union Pacific Railroads met to drive the golden spike in 1869. I crossed the Nevada border an hour later, a half-finished bottle of Champagne still in hand. Maybe its by age, but I skipped the raucous party in the lounge car.

I awoke on New Year?s Day to the vast expanse of the Great Western Desert where there was nothing to see but tumble weeds, sand dunes, and salt flats. On my return from another sprint along the tracks in Reno, JR said ?Happy New Year? and presented me with a hot cup of Joe and a Reno Gazette.

Nevada Didn?t Have a Lot to Offer

My family has been crossing the High Sierras for 160 years, and it is impossible to tire of the experience. The summit tunnel blasted out of granite with black powder by Chinese laborers during the 1860?s was bypassed for a more modern route 35 years ago. The mountains were strangely devoid of snow for this time of year. If the Donner Party only had it so lucky, who reportedly resorted to cannibalism when trapped just short of the pass. A passenger train was snowed in here for three days as recently as 1947.

Crossing the Benicia Bridge

An hour later we came across the view of the Central Valley that caused pioneer emigrants to fall to their knees in tears and prayer, believing they had reached the promised land. From there it was an easy run past the old gold mining towns, across the Sacramento marshes, and over the Benicia Bridge, to San Francisco Bay, and home at last.

A 200 Ton Monster Arrives at San Francisco Bay

?Our medical technology has completely outstripped our ability to pay for it,? said Boris Schlossberg, a foreign currency strategist at BK Forex Advisors.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

When climbing peaks in the Alps, the High Sierras, or the Himalayas, you know you?re getting close to the top when the air becomes thin, it is difficult to breathe, and your nose suddenly starts to bleed. I remember trying to smoke a cigarette at 20,000 feet on Mount Everest. If you didn?t keep puffing it went out immediately because of the lack of oxygen.

I am starting to suffer from a similar woozy feeling from the US stock markets. I have long since quit smoking, but the higher the indexes go, the more light headed I feel.

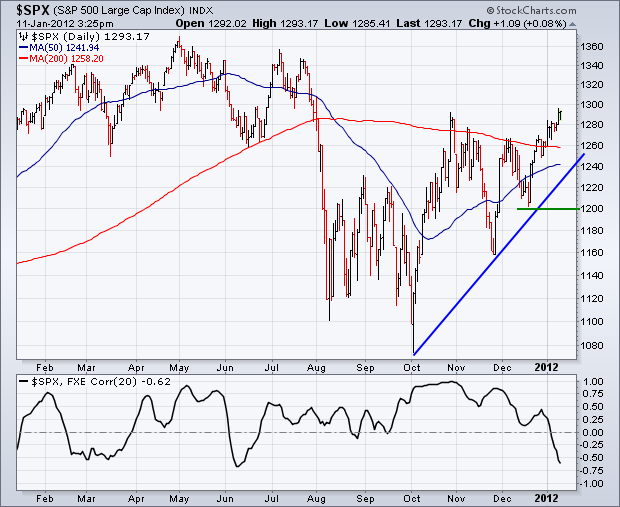

Take a look at the chart below produced last Friday by my friends at StockCharts.com. It shows the NYSE advance-decline ratio smoothed by a five day moving average. We have since blasted through to a new high for the year. The last time we were this high in July, the S&P 500 commenced a 23% swan dive down to 1068.

If you failed to protect yourself from this gut churning plunge, there is a good chance your clients fired you at the end of last year and you are now trolling through Craigslist looking for new employment opportunities. If you did follow the advice of this letter at the time, you sold short the S&P 500, the Russell 2000, gold, the Euro, and the Swiss franc. That enabled you to make a bundle, and your clients are now showering new money upon you.

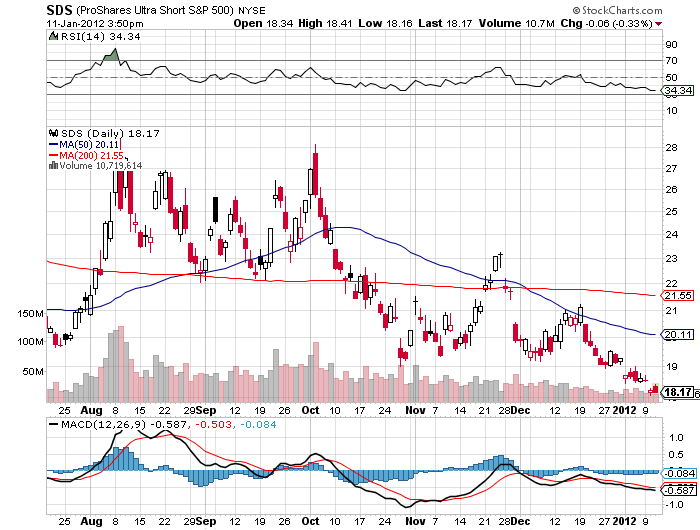

I was hoping a sweet spot would set up that would allow me to pick up some meaty short positions, like the leveraged short (SDS) and put options, once a squeeze took us up to 1,350 in the S&P 500. Looking at the slow, low volume grind we are getting, I may not get my wish. Instead, we may get a choppy, rolling type top at a lower level that frustrates the hell out of everyone. We could top out as low as 1,312 instead. Every hedge fund trader I know is just sitting on his hands waiting for a decent entry point to present itself.

Aggressive traders may start scaling in short positions from here in small pieces. Until then, discretion is the better part of valor. Only buy here if your clients have a long term view, a very long term view.

Mount Everest 1976

Is It Time to Sell Yet?

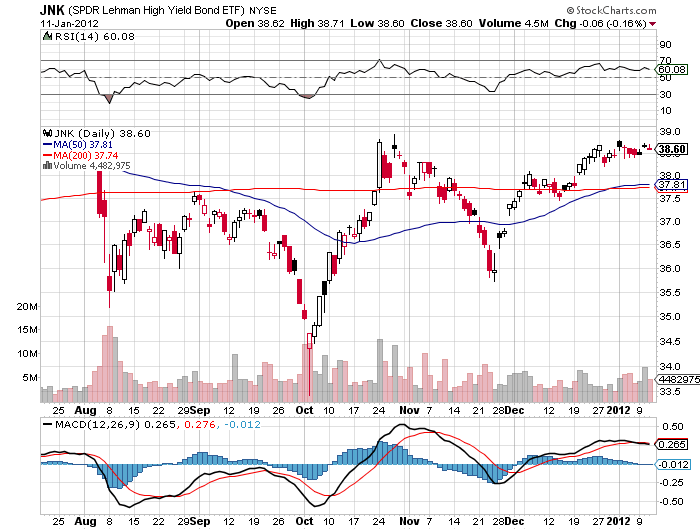

Have I seen this movie before? Three years ago, analysts were predicting default rates as high as 17% for Junk bonds in the wake of the financial meltdown, taking yields on individual issues up to 25%. Liquidity in the market vaporized, and huge volumes of unsold paper overhung the market. To me, this was an engraved invitation to come in and buy the junk bond ETF (JNK) at $18. Since then, the despised ETF has risen to $39, and with the hefty interest income, the total return has been over 160%. What was the actual realized default rate? It came in at less than 0.50%.

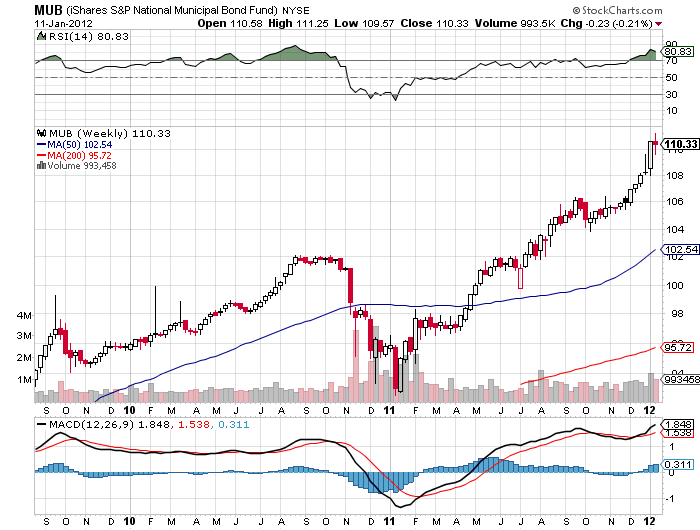

Fast forward to a year ago (has it been that long?). Bank research analyst Meredith Whitney predicted that the dire straits of state and local finances will trigger a collapse of the municipal bond market that will resemble the ?Sack of Rome.? She believed that total defaults could reach $100 billion. This cataclysmic forecast caused the main muni bond ETF (MUB) to plunge from $102 to $93. Oops! That turned out to be one of the worst calls in the history of the financial markets. But the fees she earned landed her on Fortune?s list of the wealthiest women in America.

I didn?t buy it for a second. States are looking at debt to GDP ratios of 4%, compared to 100% for the federal government. They are miles away from the 130% of GDP that triggered distressed refinancings by Italy, Greece, Portugal, and Ireland.

The default risk of muni paper is being vastly exaggerated. I have looked into several California issues and found them at the absolute top of the seniority scale in the state's obligations. Teachers will starve, police and firemen will go on strike, and there will be rioting in the streets before a single interest payment is missed to bond holders.

How many municipal defaults have we actually seen in the last 20 years? There have only been a few that I know of. The nearby City of Vallejo, where policemen earn $140,000 a year, is one of the worst run organizations on the planet. Orange County got its knickers in a twist betting their entire treasury on a complex derivatives strategy that they clearly didn't understand, sold by, guess who, Goldman Sachs (GS). The Harrisburg, PA saga continues. To find municipal defaults in any real numbers you have to go back 80 years to the Great Depression. My guess is that we will see a rise in muni bond defaults. But it will be from two to only a dozen, not the hundreds that Whitney is forecasting

Let me preface my call here by saying that I know didly squat about the muni bond market. It has long been a boring, quiet backwater of the debt markets. At Morgan Stanley, this is where you sent the new recruits with the 'C' average from a second tier schools who you had to hire because his dad was a major client. I have spent most of my life working with top hedge funds, offshore institutions, and foreign governments for whom the tax advantages of owning munis have no value.

However, I do know how to use a calculator. Decent quality muni bonds now carry 6% yields. If you buy bonds from your local issuer, you can duck the city, state, and federal tax due on equivalent grade corporate paper. That gives you a pre tax yield of 11%. While the market has gotten a little thin, prices from here are going to get huge support from these coupons.

Since the tax advantages of these arcane instruments are highly local, sometimes depending on what neighborhood you live in, I suggest talking to a financial adviser to obtain some tailor made recommendations. There is no trade for me here. I just get irritated when conflicted analysts give bad advice to my readers and laugh all the way to the bank. Thought you should know.

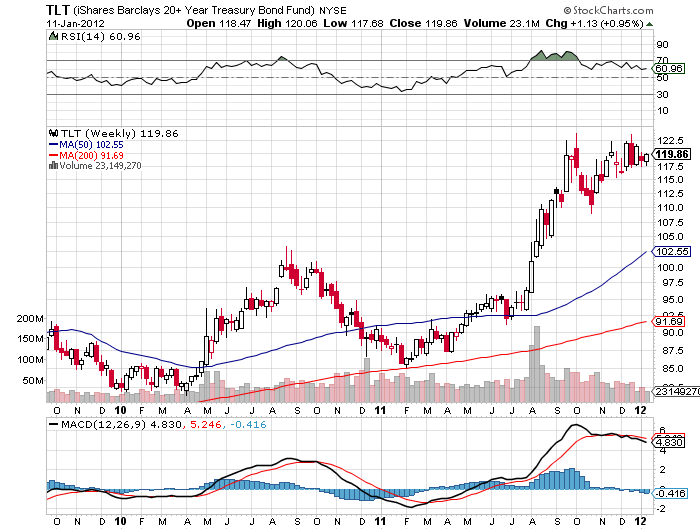

There are two additional tail winds that munis may benefit from in 2012. No matter what anyone says in this election, your taxes are going up. Balancing the budget without major revenue increases is a mathematical impossibility. That will increase the value of the tax free aspect of munis. A serious bout of ?RISK OFF? that sends the Treasury market to a new all-time high, as I expect, will cause munis to rise even further.

This is Not the Muni Bond Market

Some people will do anything for a good stock tip. Futures magazine, published a complimentary profile about me in their recent issue. The publication is associated with the highly educational and informative annual Hard Asset Conferences in New York, San Francisco, and soon to be Chicago, where I have been a regular keynote speaker and panelist. For a quickie update on my global views, please take a look at the piece by clicking here. You might also get a peek into my murky and mysterious past. They take nice pictures too.

There is no doubt that the recent jobs data has been absolutely blistering. On January 4, weekly jobless claims plunged by 15,000 to 372,000, well below the 400,000 that is required for a sustainable recovery. The next day, the ADP report delivered a gob smacking 325,000 in job gains for December. Then the big kahuna surprised to the upside, the December non-farm payroll, reporting 200,000 new jobs, taking the unemployment rate to a three year low at 8.5%.

Are happy days here again? Is it off to the races? More importantly, should we be adding risk positions here in expectation of a continued economic miracle?

I think not. You all know well that I am a history buff. But I know enough about history to understand that it can be a dangerous thing. Don?t let these numbers lull you into a false sense of security. Any slavish reliance on the past can cause you to become history, if you?re not careful.

There is no doubt that a seasonal surge in hiring caused by the holidays has created this spike. Normally, governments and agencies smooth these figures through a seasonal adjustment process. The problem arises when the structure of the economy is changing faster than can be reflected in these seasonal adjustments, as it is now.

A large part of our economy is moving online more rapidly than most people realize. According to comScore, a marketing data research firm, online sales leapt by 15% to $35.3 billion during the November-December holiday period, an all-time high.? I speak from a position of authority here as I happen to run one of the most successful financial sites on the Internet, which I kicked off four years ago with a $500 investment.

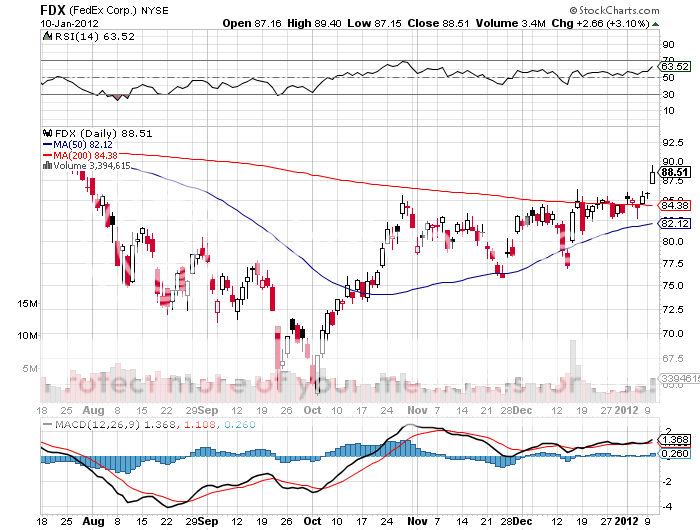

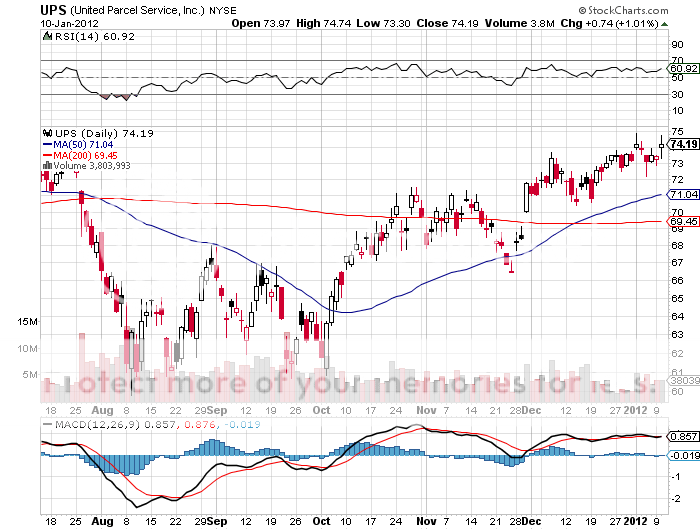

Much of this migration is being captured by Fedex and UPS, the nexus at which Internet commerce meets the real world. After all, virtual products require a real world delivery. This explains why the couriers are seeing a booming business in an otherwise flat economy. Fedex hired 10,000 temporary workers to deal with the Christmas surge in 2011, a gain of 18% over the same period last year. UPS added a stunning 55,000, a 10% increase.

Watch for the other shoe to drop. That will become apparent when that the newly hired become the newly fired, leading to a sudden and rapid deterioration of the jobs data. This could be the information the stock market and other risk assets need to put in a top for the year. The scary part is that this may happen sooner than you think.

Yup, I Just Got My Pink Slip Too

After pulling some strings at the Pentagon, I managed to gain access for readers of The Diary of a Mad Hedge Fund Trader to a briefing from General Douglas Fraser. He is a four star Air Force General who is the commander of US Southern Command (SOUTHCOM), one of nine unified Combatant Commands in the Department of Defense.

Its area of responsibility encompasses Central America, South America, and the Caribbean. SOUTHCOM is a joint command comprised of more than 1,200 military and civilian personnel representing the Army, Navy, Air Force, Marine Corps, Coast Guard, and other federal agencies.

General Fraser graduated from the Air Force Academy in 1974 and is fluent in Spanish. He has commanded Air Force combat units in Japan, Korea, and Germany. He was later a senior officer in the Space Operations Command. General Fraser joined SOUTHCOM in 2009 after serving as deputy commander of the Pacific Command for two years.

The event will be held on Tuesday, January 24, 2012 at 6:00 PM at the Marines Memorial Association, 609 Sutter Street, San Francisco, CA 94102. To register, please click here , check the box next to ?SOUTHCOM Commander?, then click on ?next? and complete the registration process.

This is a rare opportunity for civilians to meet one of America?s most senior military officers. Expect every retired general and admiral in the San Francisco Bay area to attend, along with many active duty members of the US Marine Corps. Absolutely no recordings of any kind are permitted. If you want to say hello, I?ll be standing next to the registration desk, wearing a blue cap with ?USS Potomac? in gold letters. Just ask for USMC Captain John Thomas.