If you really want to get a read on how ?the 1%? are faring these days, take a ski vacation to the tony hamlet of Incline Village on the pristine shores of Nevada?s Lake Tahoe.

Each morning, I trekked to Starbucks, one of the few local sources for the Wall Street Journal and the New York Times. There, trophy wives line up to buy their chai tea lattes, all tall, thin, and blonde, wearing designer sunglasses and snow boots, as if produced from a Gucci cookie cutter. The parking lot is jammed with Range Rovers and Cadillac Escalades.

Keeping up with the Jones?s here on fabled Lakeshore Drive can be quite a task, especially when they are populated by such names as Oracle?s Larry Ellison, casino mogul, Steve Wynn, and Saudi arms dealer, Adnan Kashoggi. Ellison alone is thought to have poured $200 million into his mountain retreat. Some of these compounds offer private beach lodgings for bodyguards and dog groomers. Junk bond king, Michael Milken, springs for the cost of the town?s annual Fourth of July fireworks display as it coincides with his birthday.

In the ultimate feat of hubris one upsmanship, one billionaire is converting the profits from his check cashing business to build a $150 million, 36,000 square foot residence that looks like a convention center. He has ruffled the feathers of locals by chopping down every ancient pine and cedar tree on the property to max out the square footage, violating multiple town ordinances. Who knew that cashing checks was so profitable?

In fact, lakefront Incline boasts one of the few neighborhoods in the US that has held up reasonably well during the real estate crash, with six properties changing hands at $1,000 a square foot in the last year. I guess they?re just not making beachfront property any more. Current listings include a 3 bedroom, 2 bath bungalow for $49.9 million and a 8,694 square foot palace for $43 million. If you are looking for a real bargain, check out the five bedroom French castle at www.inclinecastle.com for $22.85 million. As with the large diamond shortage I have written about previously, this is further evidence that the rich are getting richer at an accelerating rate.

The land here was originally owned by one of the Comstock silver barons of the 1860?s. You may recall it as the location of the TV series ?Bonanza? and I?m sure that every female reader will remember ?Little Joe?. A development company subdivided the land during the 1950?s with the intention of creating a Palm Springs in the mountains, spurred on by the completion of Interstate 80 as part of the infrastructure demanded by the 1960 winter Olympics at nearby Squaw Valley.

Devoid by edict of the down market fast food chains that afflict most of America, Incline boasts two municipal golf courses, where at 6,300 feet, the air is so thin that your drive travels an extra 50 yards. If you want a Big Mac, you have to travel down the road to California-- if the road isn't blocked by snow.

Incline is also a Mecca for libertarian millionaires drawn by the absence of a state income tax. Unfortunately, they also possessed the financial sophistication to buy gorgeous mountainside homes, extract cash-out refi's all the way up, invest the proceeds in the stock market, and lose it all in the subsequent crash.

The result has been a meltdown of Biblical proportions in the housing market. Of the 8,000 homes in the village, 400 are for sale at distressed prices and another 400 or more discouraged sellers hang over the market. Brokers report a brisk business in bank owned short sales, foreclosures, and sales on the Washoe County Court House steps for homes worth less than $800,000 at prices down 60%-70% from the 2006 peak.

Jumbo financing is now an extinct species, unless you're happy to pay a 200 basis point premium over conventional loans. So the middle market, where homes are priced from $1 million to $4 million, has ceased to exist. Only cold, hard cash talks here. But high net worth individuals hate tying up capital in an illiquid asset when more attractive options abound. Precious metal coins are especially popular in the Silver State.

I am sad to report that antidepressant addiction among realtors in Incline Village is at epidemic proportions, since they don?t have anything to sell to the 1%. Some of their properties have been on the market so long that snow drifts have collapsed balconies, the local wildlife have moved in, and prospective buyers are scared away by offensive odors. Break-ins by black bears have become a serious problem, leaving basketball sized poops on the living room floor.

Abandoned homes see their pipes freeze and burst, causing irreparable damage. In Las Vegas, foreclosed homes can be easily spotted from the air by their dead lawns and green swimming pools. In Incline the 'tells' are the ten foot high mountains of frozen snow dumped there by snow plows, blocking entry. I guess all real estate markets really are local.

Owners used to be able to cover half their annual carrying costs by renting out their properties during Christmas and New Year's, and for a few weeks in the summer. Unfortunately, that market has collapsed also. There are not a lot of high rollers willing to fork out $10,000 a week for a vacation rental in a recession.

If you are one of the 99%, I?d think again before buying a vacation home any time soon. The only consolation is that conditions are much worse in Las Vegas. The optimists concede that prices could stay down for another decade. The pessimists can already be found at the bottom of the lake with the Godfather's Fredo Corleone, another former resident of Incline Village.

?America?s colleges and universities churn out lots of liberal arts graduates?.By and large, the economy doesn?t need all these generals. We?re not training enough scientists and engineers. The high schools used to churn out enough people with technical skills in the fifties and sixties, but not so today. It?s cheaper just to prepare everyone to go to college and pretend that a liberal arts education is going to solve everyone?s problems,? said Professor Peter Morici at the University Of Maryland School Of Business.

I am writing this report from a first class cabin on Amtrak?s California Zephyr en route from Chicago to San Francisco. The majestic snow covered Rocky Mountains are behind me. There is now a paucity of scenery, with the endless ocean of sage brush and salt flats of Northern Nevada outside my window, so there is nothing else to do but to write. My apologies to readers in Wells, Elko, Battle Mountain, and Winnemucca. It is a route long traversed by roving banks of Indians, itinerant fur traders, the Pony Express, my immigrant forebears in wagon trains, the transcontinental railroad, the Lincoln Highway, and finally US Interstate 80.

After making the rounds with strategists, portfolio managers, and hedge fund traders, I can confirm that 2011 was the most hellacious in careers lasting 30, 40, or 50 years. With the S&P 500 up 0.4% 2011, following a roaring 0.04% decline in 2010, the average hedge fund was up a pitiful 1%, and thousands lost money.

It is said that those who ignore history are doomed to repeat it. I am sorry to tell you that we are about to endure 2011 all over again. You can count on another 12 months of high volatility, gap moves at the opening, tape bombs, a lot of buying of rumors and selling of news, promises and disappointments from governments, and American markets being held hostage to developments overseas.

If you lost money in 2011, you will probably do so again in 2012, and should consider changing your line of work. It takes a special kind of person to make money in markets like these; someone who thrives on raw data and ignores the hype and the spin, who invests based on facts and not beliefs, and who thinks all things can happen at all times.? In other words, you need somebody like me, as my 40% return last year will attest. Those who don?t think they are up to it might consider pursuing that long delayed ambition to open a trendy restaurant, the thoughtful antique store, or finally get their golf score down to 80.

If you think I spend too much time absorbing conspiracy theories from the Internet, let me give you a list of the challenges I see financial markets facing in the coming year:

*Long term structural issues will overwhelm short term positives.

*Corporate profits continue to grow, but at a much slower rate, reaching diminishing returns.

*2009 stimulus spending is a distant memory, and there will be no replays.

*Bush tax cuts expire, creating a 1% drag on GDP.

*An epochal downsizing continues by state and local governments, chopping another 2-3% off of GDP.

*A recession in Europe further reduces American growth by 1%.

*Expect an actual default out of the continent in 2012, certainly from Greece, possibly also from Portugal and Ireland.

*There will be no QE3, since QE2 never filtered down to the real economy. There is little the Fed can do to help us.

*Huge demographic headwinds bring another leg down in the residential real estate market.

*The first baby boomer hit 65 last year and it is now time to pay the piper on entitlements.

*The new hot button social issue will become ?senior homelessness,? as millions retire without a cent in the bank and are unable to find jobs.

*Falling home prices bring secondary banking crisis, but this time there will be no TARP and no bail outs

*Gridlock in Washington prevents any real government solution, and there is nothing they can do anyway.

*Candidates from both parties will attempt to convince us that their opponents are crooks, thieves, idiots, or ideologues, and largely succeed. That will leave the rest of us confused and puzzled, and less likely to invest or hire.

*Unemployment remains stuck at an 8-9% level, then ratchets up to 15%. The real, U-6 rate soars to 25%.

Now let me give you a list of possible surprise positives, which may mitigate the list of negatives above.

*American multinationals continue to squeeze more blood out of a turnip and post stellar earnings increases yet again.

*China successfully slams the breaks on the real estate market without cutting the rest of the economy off at the knees and engineers a soft landing with 7%-8% GDP growth.

*Europe somehow pulls a new treaty out of its hat that addresses its structural financial and monetary shortfalls a decade ahead of schedule.

*Through some miracle, the American consumer keeps spending at the expense of a declining savings rate. There is evidence that this has been going on since October.

The Election Will Not Be Good for Risk Assets

So, let me summarize what your 2012 will look like. The ?RISK ON? trade that started on October 4 will spill into the new year, driven by value players loading up on cheap multinationals, chased by frantically short covering hedge funds, hitting a peak sometime in Q1. The S&P 500 could reach 1,350. In Q2 and Q3 traders will have to deal with flocks of black swans, giving 4-7 months of the ?RISK OFF? trade. We should rally into Q4 as markets discount the end of the election cycle. It really makes no difference who wins. The mere disappearance of electioneering will be positive for risk takers.

I Said ?Black Swans,? Not Crows!

The Thumbnail Portfolio

Equities-A ?V? shaped year, up, down, then up again

Bonds-Treasuries grind towards new 60 year peaks, then an eventual collapse

Currencies-dollar up and Euro and Australian, Canadian and New Zealand dollars down

Commodities-Look to buy for a long term hold mid-year

Precious Metals-take a longer rest, then up again

Real estate-multifamily up, single family down, commercial sideways

1) The Economy-The Second Lost Decade Continues

I am sticking with a 2% growth forecast for 2012. I see the huge list of negatives above that add up to at least a 5% drag on the economy. There is only one positive that we can really count on. Corporate earnings will probably come in at $105 a share for the S&P 500 this year, a gain of 15% over the previous year, and a double off the 2008 lows. During the last three years we have seen the most dramatic increase in earnings in history, taking them to all-time highs, no matter how much management complains about over regulation.

Can the magic continue? I think not. Slowing economies in China and Europe will fail to deliver the stellar gains seen in 2011, which account for half the profits of many large multinationals.? A global economy that grew at 4.1% in 2010 and 2.5% in 2011 will probably eke out only a subdued 1.5% in 2012. A strong dollar will further eat into foreign revenues.

Cost cutting through layoffs is reaching an end as there is no one left to fire. Growing companies can?t delay new hires forever. That leaves technology as the sole remaining source of margin increases, which will continue its inexorable improvements. So corporate earnings will rise again in 2012, but possibly only by 5%-10%? to $105-$110 for the $S&P 500. Hint: technology will be the top performing sector in the market in 2012, with Apple (AAPL) taking the lead.

Deleveraging will remain a dominant factor affecting the economy for another 5-8 years. Much of the hyper growth we witnessed over the past 30 years, possibly half, was borrowed from the future through excessive credit, and it is now time to pay the piper. We are still at the beginning of a second lost decade. Don?t expect a robust GDP while governments, corporations, and individuals are sucking money out of the economy. This lines up nicely with my 2% target.

Forget about employment. The news will always be bad. I believe that the US has entered a period of long term structural unemployment similar to what Germany saw in the 1990?s. Yes, we may grind down to 8% before the election. But the next big move in this closely watched indicator is up, possible as high as 15%. Keep close tabs on the weekly jobless claims that come out at 8:30 AM Eastern every Thursday for a good read of the financial markets to head in a ?RISK ON? or ?RISK OFF? direction.

Equities: No Place for Old Men

2) Equities? (SPX), (QQQQ), (AAPL), (XLF), (BAC), (EEM),(EWZ), (RSX), (PIN), (FXI), (TUR), (EWY), (EWT), (IDX)

With a GDP growing at a feeble 2% in 2012, and corporate earnings topping out at $105-$110 a share, those with a traditional buy and old approach to the stock market will fare better taking this year off. While earnings are growing, multiples will shrink from 13 to 12, multiple? for the indexes unchanged. It is also possible that the economy will never meet the textbook definition of a recession, that of two back to back quarters of negative GDP numbers.? But the market will think the economy is going into recession and behave accordingly. ?Double dip? will get dusted off one again. Remember how ?Sell in May and Go Away? has worked so well for the past three years? This year you may want to sell in January.

I am looking for some new liquidity from value players and additional short covering to spill over into the New Year, possibly taking us up to 1,325-$1,350. If we get that high, take it as a gift, as the big hedge funds will be very happy to pile on the leveraged shorts at the top of a multiyear range.

A continuing stream of positive economic data will also help. Since we don?t have the ?oomph? offered by the tax compromise and QE2 a year ago, look for equities to peak much earlier than the April 29 apex we saw in 2011. The trigger for this deluge could be a sudden spike in jobless claims as the temporary Christmas hires are fired combined with economic data that cools coming off a hot Q4.

Let me tell you why the value players up here don?t get it. A 2% growth rate doesn?t justify the 10-22 price earnings multiple range that we have enjoyed during the last 30 years. At best it can support an 8-16 range, or maybe even the 6-15 range that prevailed when I first started on Wall Street 40 years ago. That makes the current 13 multiple look cheap according to old models, but expensive in the new paradigm.

When the guys in the white coats show up to drag away the value managers, they will be screaming that ?They were cheap,? all the way to the insane asylum. What these hapless souls didn?t grasp was that we are only four years into a secular, decade long downtrend in PE multiples, the bottom for which is anyone?s guess.

After that, the way should be clear for a 25% swoon down to 1,000, which will happen sometime in Q2 or Q3. That will be caused by a ton of new short selling triggered by the break of the 2011 low at 1,070, which then get stopped out on the upside. The heating up of trouble with Iran is another unpredictable variable, which is really just a pretext for attacking Syria, their only ally. How will the market decline in the face of growing earnings? That is exactly what markets did in 2011, once the fear trade was posted on the mast for all to see?

Crash, we won?t, and this is what my Armageddon friends don?t get. To break to new lows, you need sellers, and lots of them. Those were in abundance in 2008, when the bear market caught many completely by surprise, everyone was leveraged to the hilt, and risk controls provided all the security of wet tissue paper.

This time around it?s different. Prime brokers now require a pound of flesh as collateral, especially in the wake of the MF Global Bankruptcy, and leverage as almost an extinct species. In the meantime, individuals have been decamping from stocks en masse, with equity mutual fund sales over the past three year hitting $400 billion, compared to $800 billion in bond fund purchases. That will leave hedge funds the only players at an (SPX) of 1,000, who will be loath to run big shorts at multiyear bottoms. You can?t have a crash if there is no one left to sell.

That gives us the juice to rally into Q4, just as the presidential election is coming to an end. It really makes no difference who wins, as long as one doesn?t get control all three branches of government. My money is on Obama, who has the highest approval rate in history with unemployment at 8.6%. The mere fact that the election is over will lift a cloud of uncertainty overhanging risk assets. It will be a real stretch to hope that stock markets will close unchanged in 2012, as we did in 2011. My expectation is for a single digit loss for 2012.

This Could? be the Big Trade of 2012

Equities will be no place for old men

3) Bonds?? (TBT), (JNK), (PHB), (HYG), (PCY)

The single worst call by myself and the hedge fund industry at large this year was that massive borrowing by the Federal government would cause the Treasury bond market to collapse. Not only did it fail to do so, it blasted through to new 60 year highs, sending ten year yields to 1.80%, which adjusted for inflation is a real negative yield of -1.5% a year.

Investors today will get back 80 cents worth of purchasing power at maturity for every dollar they invest. But institutions and individuals will grudgingly lock in these appalling returns because they believe that the losses in any other asset class will be much greater.

What I underestimated was the absolute perniciousness of today?s deflation. The price for everything you want to sell is continuing a relentless fall, including your home and your labor.? The cost of the things you need to buy, like food, energy, health care, and education, is rocketing. Globalization is the fat on the fire. I call this ?The New Inflation?. This goes a long way in explaining the causes behind a 30 year decline in the middle class standard of living.

The other thing I miscalculated on was how rapid contagion fears spread from Europe. When the world gets into trouble, everyone picks up their marbles and goes home. For the financial markets, that translates into massive buying of the core ?flight to safety? assets of the US dollar and Treasury bonds.

While much of the current political debate centers around excessive government borrowing, the markets are telling us the exact opposite. A 1.80%, ten year yield is proof to me that there is a Treasury bond shortage, and that the government is not borrowing too much money, but not enough. Given the choice between what a politician wants me to believe and the harsh judgment of the marketplace, I will take the latter every time.

So what will 2012 bring us? More of the same. For a start, we have seen a substantial ?RISK ON? rally for the past three months where equities tacked on a virile 20% gain. Bond yields have ticked up barely 30 basis points from the lows, not believing in the longevity of this rally for one nanosecond. That tells me that the next equity sell off could see Treasury yields punch through to new lows, possibly down to 1.60%. Given even a modest recession, bond yields could touch 1%.

Surveying the rocky landscape that lies ahead of me, I expect to get five months of ?RISK ON? conditions and a turbulent and volatile seven months of ?RISK OFF?. This augers very well for a continuation of the bull market in Treasuries at least until August.

This scenario does not presage a good year for the riskiest corner of the fixed income asset class - junk bonds, whose default rates are not coming in anywhere near where they were predicted just a few months ago. Don?t get enticed by the siren song of high yields by the junk ETF?s, like (JNK), (PHB), and the (HYG). There will be better buying opportunities down the road.

As for municipal bonds, we are seeing only the opening act of a decade of fiscal woes by local government. Still, there is a good case for sticking with munis. No matter what anyone says, taxes are going up, and when they do, this will increase muni values. The continued bull market in Treasuries will do the same.

So if you hate paying taxes, go ahead and buy this exempt paper, but only with the expectation of holding it to maturity. Liquidity could get pretty thin along the way. Be sure to consult with a local financial advisor to max out the state, county, and city tax benefits. And thank Meredith Whitney for creating the greatest buying opportunity in history for muni bonds a year ago.

Perhaps the best place to live in bond world is in emerging market debt, where you can participate via the (PCY). At least there, you have the tailwinds of strong economies, little outstanding debt, appreciating currencies, and already high interest rates. But don?t buy here. This is something you want to pick up at the nadir of a ?RISK OFF? cycle, when the dollar and Treasury markets are peaking.

The Fat Lady Will Have to Wait to Sing for the Treasury Market

4) Foreign Currencies (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

Any trader will tell you to never bet against the trend, and the overwhelming direction for the US dollar for the last 220 years has been down. The only question is how far, how fast. Going short the currency of the world?s largest borrower, running the greatest trade and current account deficits in history, with a diminishing long term growth rate is a no brainer.

But once it became every hedge fund trader?s free lunch, and positions became so lopsided against the buck, a reversal was inevitable. We seem to be solidly in one of those periodic bear market corrections, which began in March and could continue for several more months, or even years.

The big driver of the currency markets is interest rate differentials. With US interest rates safely at zero, and the rest of the world chopping theirs as fast as they can, this will provide a very strong tailwind for the greenback for much of 2012. Use rallies to sell short the Euro (FXE), (EUO), the Canadian dollar (FXC), the high beta Australian dollar (FXA), and the lagging New Zealand dollar (BNZ). Australians could see a print of 85 cents before the bloodletting is over, and should pay for their upcoming imports and foreign vacations now, while their currency is still dear.

The Euro presents a particular quandary for foreign exchange traders, with a never ending sovereign debt crisis causing its death through a thousand cuts. Just look at Greece, with a budget deficit of 13% of GDP against the 3% it promised on admission to the once exclusive club. But this is not exactly new news, and traders have already built shorts to all-time records. Still, the next crisis in confidence could easily take the Euro to $1.25, and new momentum driven shorts could take us to the $1.17?s.

As far as the Japanese yen is concerned, I am going to stay away. How the world?s worst economy has managed to maintain the planet?s strongest currency is beyond me. The problems in the Land of the Rising Sun are almost too numerous to count: the world?s highest debt to GDP ratio, a horrific demographic problem, flagging export competitiveness against neighboring China and South Korea, and the world?s lowest developed country economic growth rate. But until someone provides me with a convincing explanation, or until the yen decisively reverses, I?ll pass. Let hedge fund manager, Kyle Bass, figure this one out.

For a sleeper, use the next plunge in emerging markets to buy the Chinese Yuan ETF (CYB) for your back book, but don?t expect more than single digit returns. The Middle Kingdom will move heaven and earth to in order to keep its appreciation modest to maintain their crucial export competitiveness.

Suddenly, Everyone Loves Uncle Buck

5) Commodities (FCX), (VALE), (DIG), (RIG), (JOY), (KOL), (CCJ), (FSLR), (USO), (DUG), (DIG), (UNG), (JJG), (MOO), (DBA), (MOS), (MON), (AGU), (POT), (CCJ), (NLR), (PHO), (FIW), (CORN), (WEAT), (SOYB)

This is my favorite asset class for the next decade, as investors increasingly catch on to the secular move out of paper assets into hard ones. Don?t buy anything that can be manufactured with a printing press. Focus instead on assets that are in short supply, are enjoying an exponential growth in demand, and take five years to bring new supply online. The Malthusian argument on population growth also applies to commodities; hyperbolic demand inevitably overwhelms linear supply growth.

Of course, we?re already nine years into what is probably a 30 year secular bull market for commodities and these things are no longer as cheap as they once were. You?ll never buy copper again at 85 cents a pound, versus today?s $3.40. You are going to have to allow these things to breathe. Ultimately, this is a demographic play that cashes in on rising standards of living in the biggest and highest growth emerging markets. You can start with the traditional base commodities of copper and iron ore.

The derivative equity plays here are Freeport McMoRan (FCX) and Companhia Vale do Rio Doce (VALE). Add the energies of oil (DIG), coal (KOL), uranium (NLR), and the equities Transocean (RIG), Joy Global (JOY), and Cameco (CCJ).

As much as I love the long term case for hard commodities, I am not expecting any action in the immediate future. Commodities will remain a no go area until it is clear whether China?s economy will suffer a soft or a hard landing, or continues to remain airborne. Use this year?s big ?RISK OFF? trade to acquire serious positions. If markets rally into year end, you might catch a quick 50% gain in the more volatile securities.

Oil has in fact become the new global de facto currency, and probably $30 of the current $100 price reflects monetary demand, and another $30 representing a Middle Eastern risk premium. Strip out these factors, and oil should be trading at $40.? That will help it grind to $100 sometime in early 2012, and we could spike as high as $120. After that, the ?RISK OFF? trade could take it back down to the $75 we saw in September.

Skip natural gas (UNG), because the discovery of a new 100 year supply from ?fracking? and horizontal drilling in shale formations is going to overhang this subsector for a very long time. Major reforms are required in Washington before use of this molecule goes mainstream.

The food commodities are also a great long term Malthusian play, with corn (CORN), wheat (WEAT), and soybeans (SOYB) coming off the back of great returns in 2010. These can be played through the futures or the ETF?s (MOO) and (DBA), and the stocks Mosaic (MOS), Monsanto (MON), Potash (POT), and Agrium (AGU). The grain ETF (JJG) is another handy play. Though an unconventional commodity play, the impending shortage of water will make the energy crisis look like a cake walk. You can participate in this most liquid of asset with the ETF?s (PHO) and (FIW).

Here is Your Lead Contract for ?RISK ON?

Meet Your New Currency

5) Precious Metals??? (GLD), (DGP), (SLV), (PTM), (PALL)

Let?s face it, gold is not a hard asset anymore, it?s a paper one. Since hedge funds and high frequency traders moved into this space, the barbarous relic has been tracking one for one with the S&P 500 and other risk assets.

The chip shot here is $1,500 on the downside, once the remaining hedge fund redemptions and other hot money are cleared out. If we have a real recession this year, $1,050 might be doable. Remember, the speculative frenzy is as great as it was in 1979, which saw the beginning of a 75% plunge in the yellow metal.

But the long term bull case is still there. Obama has not suddenly become a paragon of fiscal restraint. Bernanke has not morphed into a tightwad. When I pull a dollar bill out of my wallet, it?s as limp as ever.

If you forgot to buy gold at $35, $300, or $800, another entry point is setting up for those who, so far, have missed the gravy train. The precious metals have to work off a severely overbought condition before we make substantial new highs. Remember, this is the asset class that takes the escalator up and the elevator down, and sometimes the window.

If the institutional world devotes just 5% of their assets to a weighting in gold, and an emerging market central bank bidding war for gold reserves continues, it has to fly to at least $2,300, the inflation adjusted all-time high, or more. ETF players can look at the 1X (GLD) or the 2X leveraged gold (DGP). But you should only go into these as part of a broader ?RISK ON? move.

I would also be using the next bout of weakness to pick up the high beta, more volatile precious metal,+ silver (SLV), which I think could hit $50 once more. Palladium (PALL) and platinum (PPLT), which have their own auto related long term fundamentals working on their behalf would also be something to consider on a dip.

Here?s a Nice Busted Bubble

6) Real Estate

There is no point in spending much time on this most unloved of asset classes, so I?ll keep it brief. There are only three numbers you need to know in the housing market: there are 80 million baby boomers, 65 million Generation Xer?s who follow them, and 85 million in the generation after that, the Millennials.

The boomers have been desperately trying to unload dwellings to the Gen Xer?s since prices peaked in 2007. But there are not enough of them, and three decades of falling real incomes mean that they only earn a fraction of what their parents made. If they have prospered, banks won?t lend to them.

Now consider the coming changes that will affect this market. The home mortgage deduction is unlikely to survive any attempt to balance the budget. And why should renters be subsidizing homeowners anyway? Nor is the government likely to spend billions keeping Fannie Mae and Freddie Mac alive, which now account for 95% of home mortgages.

That means the home loan market will be privatized, leading to mortgages rates 200 basis points higher than today. If this sounds extreme, look no further than the jumbo market for proof. It is already bereft of government subsidy, and loans here are now priced at premiums of this size. This also means that the fixed rate 30 year loan will disappear, as banks seek to offload duration risk to consumers. This happened long ago in the rest of the developed world.

There is a happy ending to this story. By 2025 the Millennials will start to kick in as the dominant buyers in the market. Some 85 million Millennials will be chasing the homes of only 65 Gen Xer?s, causing housing shortages and rising prices. This will happen in the context of a labor shortfall and rising standards of living. In fact, the mid 2020?s could bring a repeat of our last golden age, the 1950?s.

The best case scenario for residential real estate is that it bounces along a bottom for another decade. The worst case is that it falls another 25% from here. Only buy a home if your wife is nagging you about living in that cardboard box under the freeway overpass. But expect to put up your first born child as collateral, and bring in your entire extended family in as cosigners if you want to get a bank loan. Then pray that the price starts to go up in 15 years. Rent, don?t buy.

Rent, Don?t Buy

Well, that?s all for now. We?ve just passed the Pacific mothball fleet and we?re crossing the Benicia Bridge, where the Sacramento River pours into San Francisco Bay. The pressure drop caused by an 8,000 foot descent from Donner Pass has crushed my water bottle. The Golden Gate and the soaring spire of the Transamerica building are just around the next bend. So it is time for me to unglug my laptop and pack up.

I?ll shoot you a trade alert whenever I see a window open on any of the trades above. Good trading in 2012!

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that the barbaric relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD). They claim the move in the yellow metal we are seeing is only the beginning of a 30 fold rise in prices similar to what we saw from 1972 to 1979, when it leapt from $32 to $950.

So when the chart below popped up in my in-box showing the gold backing of the US monetary base, I felt obligated to pass it on to you to illustrate one of the intellectual arguments these people are using. To match the 1936 monetary value peak, when the monetary base was collapsing, and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by eight times, or to $9,600 an ounce.

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter. But I am not that bullish. It makes my own three year $2,300 prediction positively wimp-like by comparison. The seven year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg to unload my own krugerands in 1979, was triggered by a number of one off events that will never be repeated.

Some 40 years of demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold. South Africa, the world?s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence my more subdued forecast. But then again, I could be wrong.

You may have noticed that I have not been doing much trading in gold or the other precious metals lately. That is because they are still working off an extremely overbought condition. Given some time, and a nice little dip in prices, and I?ll be back there in a heartbeat. You?ll be the first to know when that happens.

In Despicable Me, the latest animated children?s? film from 20th Century Fox, the Bank of Evil, used to finance the nefarious deeds of villains, has listed under its name ?formerly known as Lehman Brothers.?

?Oh, how I despise the yen, let me count the ways.? I?m sure Shakespeare would have come up with a line of iambic pentameter similar to this if he were a foreign exchange trader. I firmly believe that a short position in the yen should be at the core of any hedged portfolio for the next decade, but so far every time I have dipped my toe in the water, it has gotten chewed off by a piranha.

To remind you why you hate the Japanese currency, I?ll refresh your memory with this short list:

* With the world?s weakest major economy, Japan is certain to be the last country to raise interest rates.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world?s worst demographic outlook that assures its problems will only get worse. They?re not making Japanese any more.

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt approaching 200% of GDP, or 100% when you net out inter agency crossholdings, Japan is at the top of the list.

* The Japanese long bond market, with a yield of 0.1.2%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji if they must to get the yen down and bail out the country?s beleaguered exporters.

When the big turn inevitably comes, we?re going to ?100, then ?120, then ?150. That works out to a price of $40 for the (YCS), which last traded at $16.35. But it might take a few years to get there. The Japanese government has some on my side with this trade, not that this is any great comfort. Four intervention attempts have so been able to weaken the Japanese currency only for a few nanoseconds.

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360. To me the ?83 I see on my screen today is unbelievable. That would then give you a neat 15 year double top.

It?s All Over For the Yen

There are a lot of belles at the ball, but you can?t dance with all of them.

While a student at UCLA in the early seventies, I took a World Politics course which required me to pick a country, analyze its economy, and make recommendations for its economic development. I chose Algeria, a country where I had spent the summer of 1968 caravanning among the Bedouins, crawling out of the desert half starved, lice ridden, and half dead.? I concluded that the North African country should immediately nationalize the oil industry, and raise prices from $3/barrel to $10.? I knew that Los Angeles based Occidental Petroleum (OXY) was interested in exploring for oil there, so I sent my paper to the company for review. They called the next day and invited me to their imposing downtown headquarters, then the tallest building in Los Angeles.

I was ushered into the office of Dr. Armand Hammer, one of the great independent oil moguls of the day, a larger than life figure who owned a spectacular impressionist art collection, and who confidently displayed a priceless Faberg? egg on his desk. He said he was impressed with my paper, and then spent two hours grilling me. Why should oil prices go up? Who did I know there? What did I see? What was the state of their infrastructure? Roads? Bridges? Rail lines? Did I see any oil derricks? Did I see any Russians? I told him everything I knew, including the two weeks in an Algiers jail for taking pictures in the wrong places. His parting advice was to never take my eye off the oil industry, as it is the driver of everything else. I have followed that advice ever since.

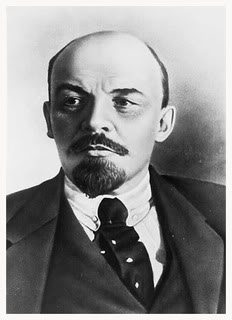

When I went back to UCLA I told a CIA friend of mine that I had just spent the afternoon with the eminent doctor (Marsha, call me!). She told me that he had been a close advisor of Vladimir Lenin after the Russian Revolution, had been a double agent for the Soviets ever since, that the FBI had known this all along, and was currently funneling illegal campaign donations to President Richard Nixon. Shocked, I kicked myself for going into an interview so ill prepared, and had missed a golden opportunity to ask some great questions. I never made that mistake again.

Some 40 years later, while trolling the markets for great buying opportunities set up by the BP oil spill, I stumbled across (OXY) once more (click here for their site at?http://www.oxy.com ). (OXY) has a minimal offshore presence, nothing in deep water, and huge operations in the Middle East and South America. It was the first US oil company to go back into Libya when the sanctions were lifted in 2005. (OXY?s) substantial California production is expected to leap to 45% to 200,000 barrels a day over the next four years. Its horizontal multistage fracturing technology will enable it to dominate California shale. The has raised its dividend for the eighth year in a row, by 15% to 1.60%. Need I say more?

The clear message that has come out of the BP oil spill is that onshore energy resources are now more valuable than offshore ones. I decided to add it to my model portfolio. Energy is one of a tiny handful of industries I am willing to put my money in these days (technology and commodities are the others), and BP has handed me a rare opportunity to get in as the tightwad that I truly am.

Oh, and I got an A+ on the paper, and the following year Algeria raised the price of oil to $12.

A Faberge Egg

I always thought that a great strategy for a new hedge fund would be to only buy positions from existing hedge funds that were blowing up. That fund would buy securities subject to margin calls and distressed liquidations, which are by definition at six standard deviation extremes. It would not trade very often, but few it executed on would be humdingers.

If I were running such a fund today, I would be getting reading to short natural gas.

There has been a lot of talk about using CH4 to bridge our way to a carbon free economy because it produces half the CO2 that coal does. But virtually nothing has been done to put the infrastructure in place needed to consume the newly found 100 year supply in the US. To burn significantly more of this simple molecule, you need vastly more pipelines, power plant conversions, and above all, storage, than we have now. So far there has been a lot of talk (thanks, Boone), but little action.

Until then, the big production companies, like Chesapeake Energy (CHK) and Devon Energy (DVN) are going to race to out produce each other, praying they can use volume to offset price cuts, creating a huge weight on prices.

When natural gas was trading at $6 at the beginning of the year, I warned readers to stay away. Gas then launched into an agonizing, three month plunge, where it lost one third of its value. The ETF (UNG) did even worse, spiraling down 38%, as the widening contango decimated investors.

Since October, battered CH4 has rallied 28% off its $3.50 low. Talking heads on TV have explained this is because of the the record breaking cold weather we are seeing this winter, the imminent passage of a gas subsidies in congress, or because of crude supply shortages caused by the deep water drilling ban.

Don?t believe a single word of this. The supply overhang and storage shortage for this diminutive molecule is still as bad as it ever was. If we can claw our way back to the last high of $5, I think natural gas would be a screaming short again. The way to play this will be to short the United States Natural Gas Fund (UNG), which because of the straightjacket that limits its investment to near month futures contracts, is one of the worst performing funds in ETF land with the greatest tracking error to the underlying.

Natural Gas Prices Are Headed For Another Fall

I received some questions last week on my recent solar pieces as to whether I minded paying more money for ?green? power. My answer is ?hell no,? and I?ll tell you why. My annual electric bill comes to $1,500 a year. Since the California power authorities have set a goal of 33% alternative energy sources by 2020, PG&E (PGE) has the most aggressive green energy program in the country. More expensive solar, wind, geothermal, and biodiesel power sources mean that my electric bill may rise by $150-$300 a year.

Now let?s combine my electricity and gasoline bills. Driving 15,000 miles a year, my current gasoline engine powered car uses 750 gallons a year, which at $3/gallon for gas costs me $2,250/year. So my annual power/gasoline bill is $3,750. My new all electric Nissan Leaf (NSANY) will cost me $180/year to cover the same distance. Even if my power bill goes up 20%, as it eventually will, thanks to the Leaf, my power/gasoline bill plunges to $1,980, down 47%.

There is an additional sweetener which I?m not even counting. I also spend $1,000/year on maintenance on my old car, including tune ups and oil changes. The Nissan Leaf will cost me next to nothing, as there are no oil changes or tune ups, and my engine drops from using 400 overcooked parts to just five. We?re basically talking tires and brake pads only.

There is a further enormous pay off down the road. We are currently spending $100 billion a year in cash up front fighting our wars in the Middle East, or $273 million a day! Add to that another $200 billion in back end costs, including wear and tear on capital equipment, and lifetime medical care for 3 million veterans, some of whom are severely torn up.

We import 9.1 million barrels of oil each day, or 3.3 billion barrels a year, worth $270 billion at $82/barrel. Some 2 million b/d, or 730 million barrels/year worth $60 billion comes from the Middle East. That means we are paying a de facto tax which amounts to $136/barrel, taking the true price for Saudi crude up to a staggering $219/barrel!

We are literally spending $100 billion extra to buy $60 billion worth of oil, and that?s not counting the lives lost. Even worse, all of the new growth in Middle Eastern oil exports is to China, so we are now spending this money to assure their supplies more than ours. Only a government could come up with such an idiotic plan.

There is another factor to count in. Anyone in the oil industry will tell you that, of the current $90 price for crude, $30 is a risk premium driven by fears of instability in the Middle East. The Strategic Petroleum Reserve, every available tanker, and thousands of rail cars are all chocked full with unwanted oil. This is why prices remain high.

The International Energy Agency says the world is now using 87 million b/d, or 32 billion barrels a year worth $2.6 trillion. This means that the risk premium is costing global consumers $950 billion/year. If we abandon that oil source, the risk premium should fall substantially, or disappear completely. What instability there is becomes China?s headache, not ours.

If enough of the country converts to alternatives and adopts major conservation measures, then we can quit importing oil from that violent part of the world.? No more sending our president to bow and shake hands with King Abdullah. Oil prices would fall, our military budget would drop, the federal budget deficit would shrink, and our taxes would likely get cut.

One Leaf shrinks demand for 750 gallons of gasoline, or 1,500 gallons of oil per year. That means that we need 20.4 million Leafs on the road to eliminate the need for the 2 million barrels/day we are importing from the Middle East. The Department of Energy has provided a $1.6 billion loan to build a Nissan plant in Smyrna, Tennessee that will pump out 150,000 Leafs a year by end 2012. Add that to the million Volts, Tesla S-1?s, is Mitsubishi iMiEV?s hitting the market in the next few years. Also taking a bite out of our oil consumption are the 1 million hybrids now on the road to be joined by a second million in the next two years. That goal is not so far off.

Yes, these are simplistic, back of the envelop calculations that don?t take into account other national security considerations, or our presence on the global stage. But these numbers show that even a modest conversion to alternatives can have an outsized impact on the bigger picture.

By the way, please don?t tell ExxonMobile (XOM) or BP (BP) I told you this. They get 80% of their earnings from importing oil to the US. I don?t want to get a knock on the door in the middle of the night.

Is This Worth It?

This is the last chance to? join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Tuesday, December 27, 2011. A three course lunch will be followed by a PowerPoint presentation and an extended question-and-answer period.

I?ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $229.

Yes, I know the timing is not the best. But family business brings me to the Windy City this week. As I am hopelessly addicted to the financial markets, I am counting on you to give me my weekly fix. So this luncheon is aimed at those unloved souls left behind by family or significant others who are off vacationing in the Bahamas, skiing at St. Moritz, or are visiting relatives in Wisconsin.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that I will email to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

[button size="large" color="red"]Sold Out[/button]