As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Read more

The Euro hit my yearend target today after a two cent plunge sent it down to the $1.29 handle. You can thank German Chancellor, Angela Merkel, who in the strongest possible terms, said there was no way she would consent to an increase in the size of the European bailout package.

It didn?t help that in the Federal Reserve comments today they basically ran up the white flag and admitted that there is nothing left for them to do but keep interest rates at ?exceptionally low levels? for the foreseeable future. They see moderate growth last pegged at 3%, which means they are about 1% higher than reality.? We are left to wait until January 25 for the all-powerful government agency to take longer term measures to help the economy, such are targeting unemployment rates.

I have been happily trading in an out of the Euro from the short side since April, catching almost all of the move down from $1.50, except for the last three cents. There was clearly a lot of new shorts initiated today as the euro broke multi month support levels. To say this is a crowded trade would be a vast understatement, as these new positions are being added to existing ones that are at all-time highs. A recent survey revealed that 67% of all hedge funds are currently running short positions in the Euro.

This is a crummy place to get involved, as the beleaguered European currency is now severely oversold on a short term basis. I want to wait for a four cent rally against Uncle Buck to jump back in the game again. I would be surprised if we plumbed new lows from here, but then this has been a surprising year. Wait until Q1, 2012 before we see a $1.25 print.

It would be easy to sit back and be complacent, believing that this is not our problem. But it is. A recession that Europe?s new austerity is certain to bring, will likely chip 0.5% to 1.0% off of US GDP growth in 2012. Since we are likely growing at a modest 2% rate now, we don?t have a lot to give away. Looking at an American economy that is facing death by a thousand cuts, this is one giant slash.

Auf Wiedersehen Euro!

Today was a real head scratcher for long time market observers, including myself. Cross market correlations that have served me so well this year are breaking down, and their predictive power has suddenly gone blind. I blame this on the liquidity drought that has plagued the market since the beginning of the month that has confined markets to frustratingly narrow ranges.

There are many reasons for the sudden opacity. The usual seasonal flight to the sidelines seems more pronounced than in years past, as many managers attempt to put a dreadful year behind them. There is still $500 million in trading capital missing from traders who used MF Global as a prime broker. This is especially felt in the energy and metals markets where MF had such a large presence.

High frequency traders have also decamped for more fertile climes in the oil and foreign exchange markets. And we all know that the big hedge funds are getting redemptions, cutting them off at the knees until January.

I?ll give you a few examples. Falling stock markets almost always produce a rising volatility index. But today it fell as low as 23%, a five month low, and closed at only 25.4% even with the Dow off 66 points. The correlation between stocks and gold has been almost perfect since the summer. But the barbarous relic has been in free fall since yesterday with the S&P 500 essentially unchanged. Ditto with the Euro, which managed a two cent plunge today.

The larger question for traders is whether this is a onetime only breakdown in cross market linkages that will end in January, or is it the beginning of a more permanent continental drift. We will find out next month when the ?A? Team managers return to the market and volume recovers.

Let me toss an alternative theory out there. It appears that the year to date returns for all asset classes are rapidly converging on zero. That?s why assets like gold and silver with the great 12 month returns are having the biggest falls this week. The S&P 500 is now down 2.2% on the year, and the Euro is up a miniscule 1.1%. Gold is still hanging on to a 17% gain, while silver is up only 12%, both rapidly headed towards single digits

Is this the inevitable result of a ?no return? world? Sounds like I better stay out of the market in this performance sapping environment, lest my own profits go up in a puff of smoke.

The ?A? Team Traders Are Gone Until January

?We should thank Meredith Whitney for creating a buying opportunity in municipal bonds,? said Aaron Gurwitz, CIO and chief strategist at Barclays? Wealth Management.

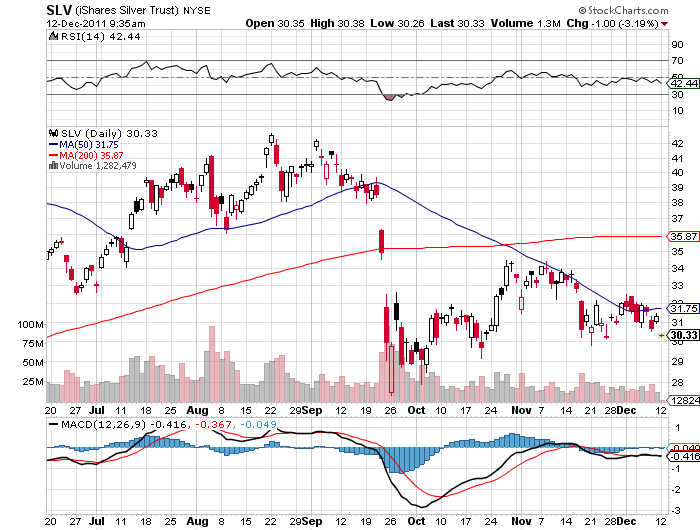

I have to tell you that I am not feeling the love from my silver position. I hung on faithfully for a month while the (SLV) churned around the 50 day moving average, building a base for a possible upside breakout. It was not to be. With another ?RISK OFF? day on our plate this morning it is clearly time to pull the ripcord on this unloved metal.

Let me tell you what I missed. Silver is still one of the few profitable positions owned by hedge funds, as it is up around 10% year to date. As we plow into the yearend book closing, hedgies have been booking profits in the white metal to offset their abundant losses in other holdings, such as in financials and their short positions in Treasury bonds.

This was offset by panic buying of precious metals in Europe until last week. Progress on a solution of the sovereign debt crisis has cooled demand from this source, taking the knees out from under the entire precious metals space.

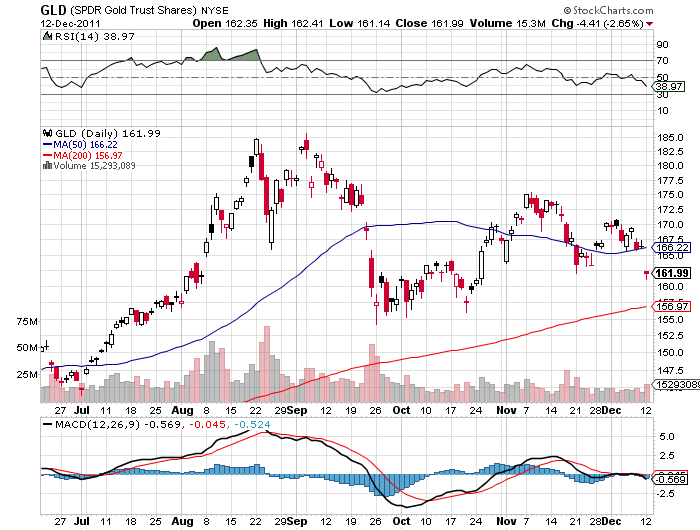

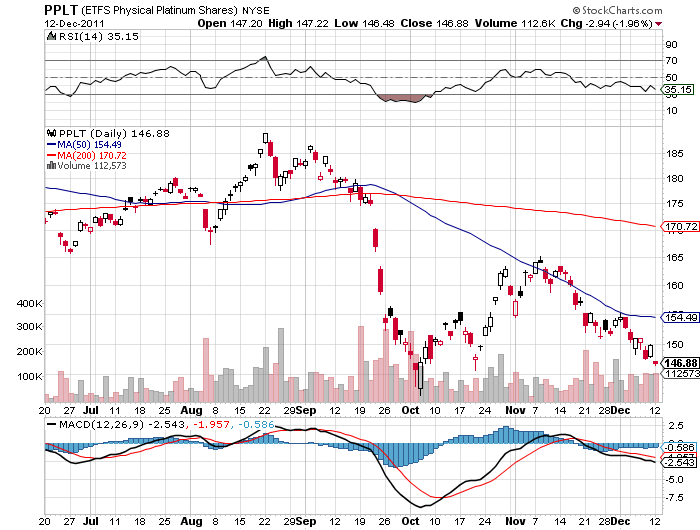

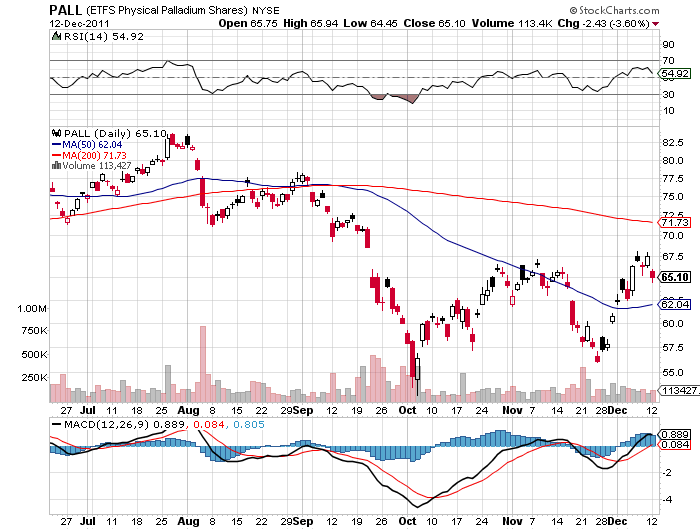

Gold (GLD) has already broken its two month support with its $50 plunge today. I won?t wait for silver (SLV) to do the same. The damage is also evident with the other precious metals, including platinum (PPLT) and palladium (PALL).

On top of this, we only have one month of life left in the January options, and from here on, accelerated time decay kicks in. I?m sure silver will see $37, $42, and even $50 or higher someday, just not in the next five weeks.

Whenever I take a loss like this I tell people that this is proof that the track record is real. The fake ones never lose money. It just illustrates the value of using an options strategy during these volatile, unpredictable, and tumultuous times. I never risked more than 5% of my capital. I never lost sleep over the position. I took a 4.27% hit, even though silver fell 12%. I never doubled up on the downside, which the silver permabulls begged me to. Being able to walk away from a position if it turns bad is a great luxury, but it still costs money.

I live to fight another day.

Pulling the Ripcord on Silver

With the onset of the 2012 elections in a few weeks, the class warfare against the millionaires is about to start in earnest. In California, the issue has already been decided, and the millionaires have definitely lost.

On the November ballot will be no less than five measures to raise taxes on high income earners, primarily to fund the state?s increasingly impoverished education system. Deficits have forced public schools to lay off teachers and replace them with inexperienced temps without benefits, shrink the school year, cancel electives, increase class sizes, and end sports and music programs. Many teaches are now paying for class supplies out of their own pockets

Why should you care, comfortably resident in one of the other 49 states? Because the Golden State often initiates social and economic measures which are then adopted by the rest of the country and the world. Take a careful look at your catalytic converters, seat belts in cars, ceilings on car emissions, caps on real estate taxes, smoking bans in bars and airplanes, recycling program, and environmental controls.? They all carry a ?Made in California? stamp on them.

The revenue raising efforts are aimed at heading off a state budget shortfall that is expected to top $13 billion in 2012. The current top California income tax rate is already a hefty 9.3%.

To give you a preview of what is headed your way, below is a listed of the proposed levies:

*Governor Jerry Brown is proposing a 1% surtax on those making more than $250,000, and a 2% tax over $500,000. Everyone else gets hit with a half cent rise in state sales taxes.

*Billionaire investor Nicolas Berggruen has teamed up with Google?s Eric Schmidt and retired real estate magnate, Eli Broad, to back a 1% surtax on income of over $1 million, to be partially offset by a reduction in corporate income taxes from 8.84% to 7%. There will be a new sales tax on services of 5% which are currently tax free. These would raise $10 billion a year.

* Berkshire Hathaway trust fund kid Molly Munger is trying to push through a $27,266 wealth tax on couples earning more than $1.5 million that would raise $10 billion.

*San Francisco hedge fund manager Tom Steyer would tax corporations nationally on their California based income, potentially raising $1 billion.

*The California Federation of Teachers wants to raise taxes on incomes over $1 million by 3%, raising $6 billion.

Tax opponents and libertarians are hoping that by having such a profusion of measures on the ballot, they will split the vote with then end result that none pass. And while many of the state?s ideas are later adopted elsewhere, sometimes they don?t work out so well. California?s 1920?s eugenics policies and racial laws were later used by Adolph Hitler as the legal foundation for Germany?s holocaust.

Be careful what you wish for, and expect a rising tide of tax refugees looking for new homes in your state.

Trade Alerts are a premium subscription service, you must login to read the details. As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Read more

No, the important economic event of the week was not the snail like progress towards solution of the European debt debacle. It was the weekly jobless claims announced on Thursday that plunged 23,000 to 381,000, a six month low. That puts it well below the 400,000 level where the economy is generally thought to be expanding.

Yes, you can argue that there are all kinds of temporary, one off hires in these numbers, as retailers step on the gas going into the Christmas season with temp hiring. But there seems to be a lot more than that going on here.

More confirming data came out the next day showing that December consumer sentiment leapt to a surprising 67.7, from 64.1. I think that one big factor in consumers? more positive feelings derive from the fact that the stock market that is no longer crashing, and double dip fears for the economy are now but distant and fading summer memories.

And you can?t view the reports in isolation. They are only the latest in a long stream of modestly improving economic reports which occasionally blow out to the upside.

The news may be enough the enable the S&P 500 (SPX) to tack on another 25 to 50 points by year end. All Europe has to do is to shut up for a few weeks and the US markets will rise. Given that this is the last real working week of the year, that is a distinct possibility.

I am going to use this strength to unload my remaining ?RISK ON? positions in silver (SLV) and the (TBT) so I can go into the New Year fresh, with a flat book. Keep in mind, also, that this is a lousy place to buy. As my friend and former mentor, Barton Biggs, always used to tell me, always leave the last 10% of a move to the next guy.

Having the flu during the holidays is the pits. This weekend, I blew my nose at the Cirque du Soliel so loudly that is perilously distracted some of the high wire acrobats. I coughed and hacked my way through the San Francisco Ballet?s Nutcracker Suite. Even the eggnog is utterly tasteless, no matter how much Myers Rum I pour in it. I am writing this piece with a fever and chills through a haze induced by Robitussin, Dayquil, and Tylenol PM.

Nevertheless, I did manage to get a dozen calls through to an assortment of European bankers, hedge fund managers, central bank officials, and finance ministry staffers this weekend to get a read on the true meaning of the Friday ministers summit agreement.

Don?t kid yourself. The deal that they cobbled together with spit, duct tape, and bailing wire was no panacea. It was just enough to keep the Euro (FXE) from collapsing, but lacked the oomph to send it off to the races. And there was some serious kicking of the can forward, with a March deadline set for the most important elements.

However, it had the juice to send US stocks soaring and European sovereign bond interest rates plunging. After a marathon, ten hour negotiating session that ended at 5:00 am local time, a deal was hammered out that includes:

*Automatic sanctions for violators of the 3% of GDP debt ceiling.

* Brussels (read Berlin) has the power to veto national budgets.

*?200 billion was chipped into the IMF to help troubled countries like Greece.

*Added with other bailout measures, the value of the safety net rises to ?700 billion, or nearly $1 trillion.

While a good start, this is by no means a grand solution. No mention was made of the $100 billion needed to recapitalize European banks, or where it is going to come from. Deleveraging will be decade long process in Europe and be a drag on asset prices worldwide.

Sovereign rating downgrades are a certainty and will trigger a bad day for the markets when they are announced. However, the bond markets won?t crash as yields are already at levels that attract serious buyers. Witness the George Soros move to buy MF Global?s distressed $2 billion portfolio of European paper and the continued purchases by a dollar diversifying Chinese government.

Mario Draghi?s European Central Bank has, in fact, done more on its own to rescue the economy that the political leaders. It cut Euro interest rates by an additional 25 basis points, the second in sext weeks. It eased collateral requirements, extended reserve ratio cuts, and permitted longer term repo agreements

Despite all of this, there was not much of a recovery in the Euro, which ticked as high as $134.20. Maybe it is heavy, or just plain tired. In any case, if we somehow get a rally as high as $1.36, take it as a gift, and sell it short one more time. Parity is still on the long term horizon.

?I don?t know where the next 1,000 points is coming from, but I know where the next 10,000 points is coming from,? said Sir John Templeton, when he was playing chess with me at his home at Lyford Cay in the Bahamas many years ago.