Global Market Comments

July 24, 2024

Fiat Lux

Featured Trade:

(WHAT AI CAN AND CAN’T DO FOR YOU)

(AAPL), (GOOGL), (AMZN), (AMZN), (TSLA), (NVDA), (MU)

Global Market Comments

July 23, 2024

Fiat Lux

Featured Trade:

(SOME SAGE ADVICE ON ASSET ALLOCATION)

Asset allocation is the one question that I get every day, which I absolutely cannot answer.

The reason is simple: no two investors are alike.

The answer varies whether you are young or old, have $1,000 in the bank or $1 billion, are a sophisticated investor or an average Joe, are in the top or the bottom tax bracket, and so on.

This is something you should ask your financial advisor if you haven’t fired him already, which you probably should.

Having said all that, there is one old hard and fast rule, which you should probably follow.

It is prudent to own your age in bonds. So, if you were 70, you should have had 70% of your assets in fixed-income instruments and 30% in equities.

That’s a lot easier to do today because 90-day T-bills yield an astonishing 5.4% while ten-year bonds bring in 3.6%.

You can also add high dividend-paying stocks for bonds. You can get 5% a year or more in yields these days, and get a great inflation hedge, to boot. Crown Castle International (CCI) is now paying a 5.5% dividend and last time I checked they are still building 5G cell phone towers, (CCI)’s specialty.

You will also own what everyone else in the world is trying to buy right now, high growth US stocks, the big FANG’s.

You will get this higher return at the expense of higher volatility. So just turn the TV off on the down days so you won’t get panicked out at the bottom.

That is until we hit the next recession. Then all bets are off.

I hope this helps.

John Thomas

The Diary of a Mad Hedge Fund Trader

It's Time for the Wakeup Call

“The bubble is in the bond market, not the stock market,” said Leon Cooperman, CEO of Omega Advisors, an original investor in my 1990s hedge fund.

Global Market Comments

July 22, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GREAT ROTATION IS ON)

I am sitting on the balcony of my chalet in Zermatt Switzerland with a river roaring past me sipping a glass of stiff cherry schnapps. Facing south, the Matterhorn towers above me.

It is 4:00 AM and pitch black.

Of course, I have nine hours of jetlag bedeviling me flying straight out from San Francisco. But when I plugged in my adapter it blew out all the power for the entire house, hence the darkness.

It is a common problem since these old chalets, some of which are 1,000 years old, were built well before the use of electricity and they have been trying to catch up with the demands of laptops, iPads, cell phones, and the Internet ever since.

It doesn’t help that all these mountains generate cheap hydroelectricity everywhere Switzerland is an all-electric country. You never see gas, coal, heating oil…. smog, asthma, or lung cancer.

On the Matterhorn north ridge, I see a stream of lights starting at the Hornli Hut stretch halfway up the mountain. It is only safe to climb the Matterhorn at night as it is the ice that holds the mountain together. You start at 1:00 AM and summit around sunrise

I’ve done it seven times.

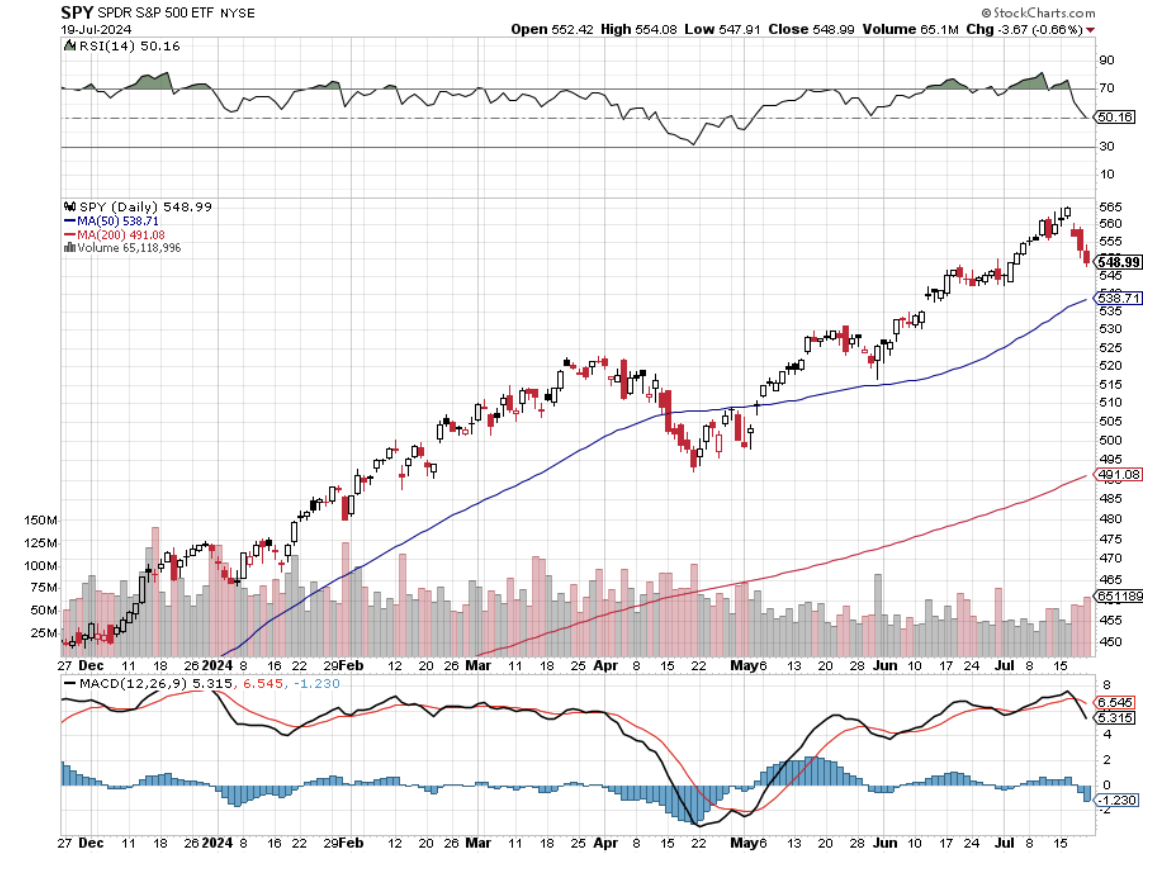

And just as with the even present risk of falling rocks, the stock market has certainly offered up some valuable lessons over the past ten days. For a start, I went into the most extreme sector rotation of all time with 100% cash.

That meant I could chase the sudden new performers instead of battle losers, as with big tech. You have to know when to stop trading, when the risk/reward in the market is poor, as it has been for months.

You’re much better off spending your money than trying to make it on these occasions, such as on a ten-day Alaska cruise. In any case, cash is refreshing, it clears the cobwebs from the mind, and opens up new avenues of thought.

I spent months warning and beseeching you that a great rotation was at hand. And now here it is. It’s looking like it will be a two-legged year, with the first half dominated by the Magnificent Seven (Tesla recently restored) and the remaining 493 interest-sensitive cyclical, industrial, and financial companies leading the second half.

And here is what most people don’t get.

Technology is accelerating so fast that no one understands. It is creating immense wealth at a staggering pace. So far, the stock market has wildly underestimated its impact. Even after this year’s prolific moves, stocks are still undervalued.

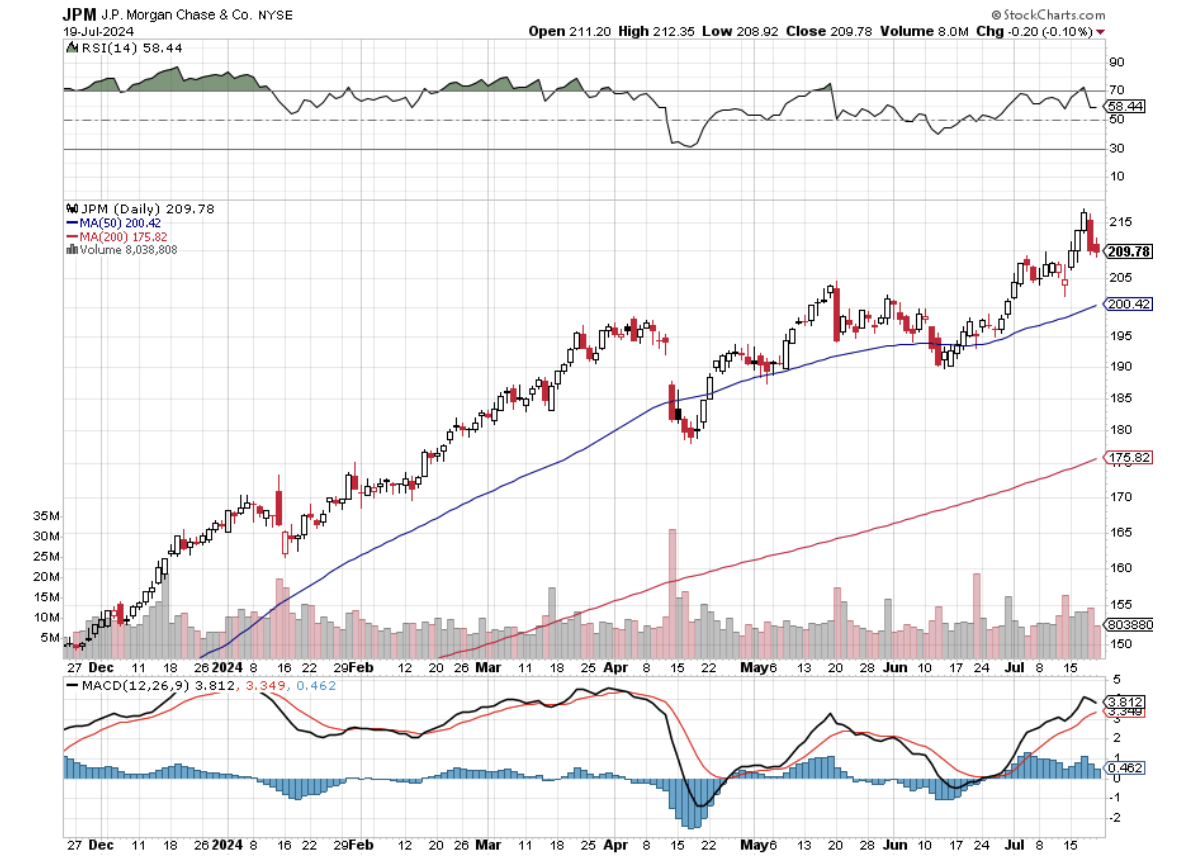

We are certainly spoiled for choice on the non-tech side of the market. Many of these have not moved for years. And when I ran the financials, price earnings multiples of a bargain basement 10X-11X were common, as opposed to the 30X-40X in tech land. I believe these sectors can run for months.

The instant reversal set up the great low-risk, high trades of the year. Suddenly, we had a bottom for 493 stocks you could trade against. With in-the-money vertical bull call debit spreads in the options market, you could make sizeable bets that they wouldn’t go to new lows. That was an easy bet to make.

So it was pedal to the metals, full speed ahead, damn the torpedoes. Off I went with reckless abandon, adding (GLD), (CCI), (BRK/B), (DE), (IBKR), and (JPM). For good measure, I put out short positions in beloved (NVDA) and (TSLA), which immediately started working.

After that, we will see a slowdown going into the presidential election in September and October. The polls are showing close to a 50/50 split and both candidates are within the margin of error. You couldn’t get more perfect uncertainly, and markets absolutely hate uncertainty.

After November 5, markets will explode to the upside into a healthy year-end rally. It’s not because any particular policy will take shape. Washington has very little ability to affect the stock market. It’s because the uncertainty is gone.

This is going to be the easiest 20% I ever made unless the world ends. Which is promptly done at midnight on Thursday night. I landed in Geneva, Switzerland just ten minutes before the global transportation system shut down because of a software flaw, including planes, railroads, busses, and hospitals. The next morning my hotel room key quit working.

Apparently, the Swiss rail system doesn’t use Microsoft or Crowdstrike so the trains ran on time and I was able to head for Zermatt High in the Alps. At least as far as Visp where the screen for departing trains listed “Anschluss” for the 14:08 to Zermatt.

What the heck does “Anschluss” mean? Apparently, it means “downfall”. I learned that torrential rains had washed out a portion of the tracks for the rest of the trip. They are now rushing to rebuild them before the ski season.

So it was on to these enormous buses for one of the most hair-raising rides in my life. The vehicles were wider than the lanes on twisting and turning mountainous roads with 500 feet straight down over the side. When another bus approached from the opposite direction, we had to stop and then crawl past.

Such are the trials of a global researcher.

Oh, and what else did I do on that Alaska cruise? I booked Cunard’s Queen Mary II from New York to Southampton on July 8, 2025 (cruise number M519 if you’re interested).

The Q1 owner’s suite is already taken and my three tuxes are already out at the cleaners.

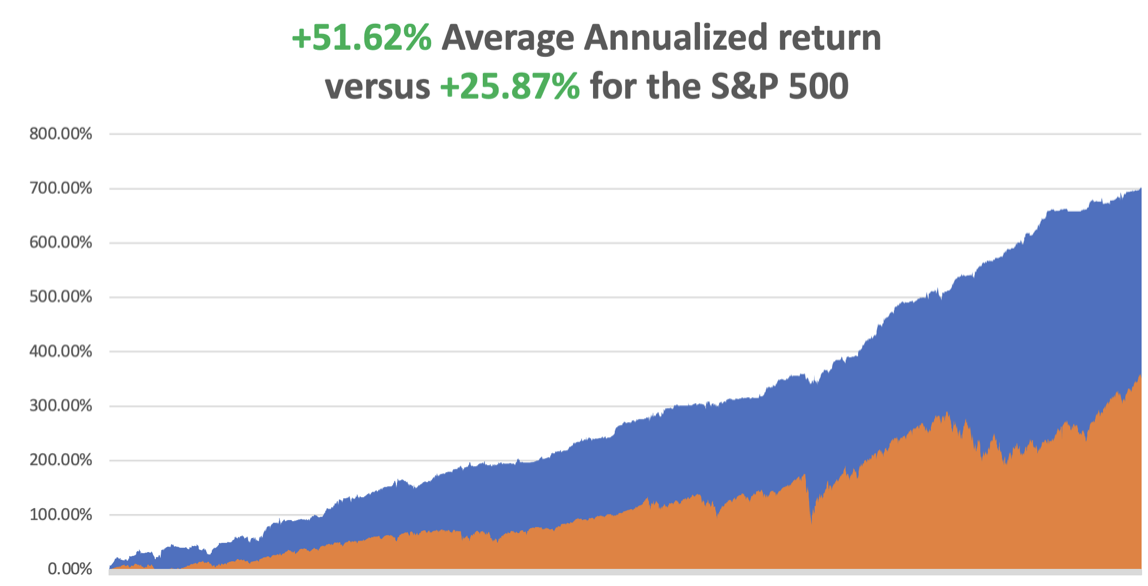

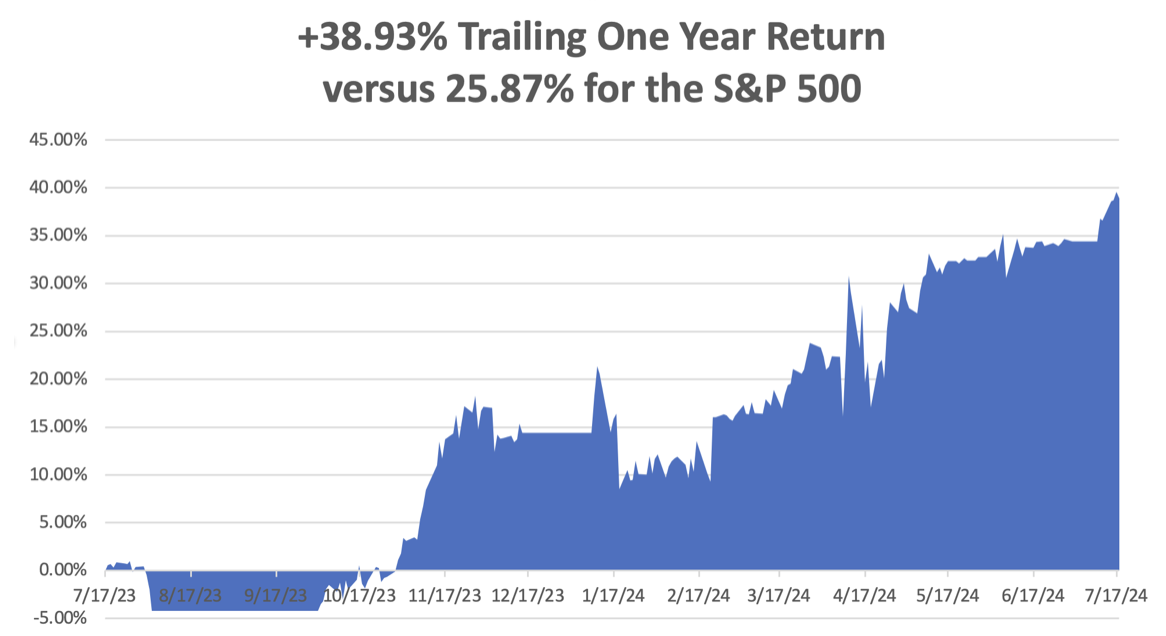

So far in July, we are up +5.17%. My 2024 year-to-date performance is at +25.19%. The S&P 500 (SPY) is up +xx% so far in 2024. My trailing one-year return reached +xx.

That brings my 16-year total return to +xx. My average annualized return has recovered to +701.82.

I used the blockbuster CPI Report last week to jump off my 100% cash position and piled on six new positions. Those included interest rate-sensitive longs in (CCI), (GLD), (DE), (BRK/B), and shorts in big tech leaders (TSLA) and (NVDA).

Some 63 of my 70 round trips were profitable in 2023. Some 37 of 46 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success ratio of 80.43%.

Try beating that anywhere.

Fed Beige Book Shows Slowing Economy, assuring a September interest rate cut. U.S. economic activity expanded at a slight to modest pace from late May through early July with firms expecting slower growth ahead as they also reported signs the jobs market continues to soften, in line with the Federal Reserve's recent pivot to more keenly assessing slowing demand for labor to ensure it doesn't wait too long before cutting interest rates. Buy all interest rate-sensitive plays, industrials, cyclicals, bonds, and precious metals.

Crowdstrike Flaw Crashes Global Transportation, canceling 4,000 flights in the US alone, costing airlines billions. The “blue screen of death”, once rare, was suddenly everywhere. The CEO said he was sorry. I missed Armageddon by minutes, landing in Geneva, Switzerland at ten to midnight. It’s a lesson on how fragile the modern economy is.

Small Cap Stocks Poised or Major Charts Breakouts, after underperforming for years. Remember, 60% of these are regional banks which would love to see lower interest rates. Buy (IWM) on dips.

US Oil Production Hits All-Time High, as are energy company profits, and is producing more oil than any country in history. The world record was set by the US in 2023, according to the federal Energy Information Administration, averaging about 12.9 million barrels per day – exceeding the Trump-era record, an average of about 12.3 million barrels per day in 2019. US production of dry natural gas was a new high in 2023, as did US crude oil exports. Overproduction has crushed prices.

US Crime plunged in 2023, according to FBI statistics, and even more in Q1 2024. The economic boom has much to do with it since anyone can get a job. Violent crime is now lower than it was in 2020, President Donald Trump’s last calendar year in office, when Covid sent police forces into hiding. A 13% decline in murders and a 6% national decline in overall violent crime compared to 2022, brings both murder and violent crime levels below where they were in 2020.

Amazon Day Send Online Sales Soaring, with sales reaching a staggering $7.2 billion, up 11.3% YOY. Major retailers including Walmart (WMT) and Target (TGT) have launched copycat deals and shopping events through July to attract customers by offering deep discounts to compete with the Amazon sales event. Never underestimate the ability of Americans to spend money. Buy (AMZN).

Single Family Home Starts Hit 8-Month Low, down 2.2%. Higher mortgage rates hurt, suggesting the housing market was likely a drag on economic growth in the second quarter. The report from the Commerce Department on Wednesday also showed permits for future construction of single-family houses dropped to a one-year low last month, indicating that any anticipated rebound in activity if the Federal Reserve cuts interest rates in September as expected, could be muted.

US Retail Sales Hit Three Month High, up 0.4% last month, following an upwardly-revised 0.1% advance in May. Total retail sales were unchanged, restrained by a 2% slide in receipts at auto dealers. The data buck a trend in recent months showing a gradual slowdown in consumption growth as Americans feel the pinch of high interest rates and a cooling labor market, suggesting the economy’s main driver is still holding up as inflation recedes and the Federal Reserve nears a start to rate cuts.

Chinese GDP Disappoints, at 4.7% in the second quarter, missing their 5.0% target. Factory output beats but retail sales lagged behind. China home prices -- both new and used -- extend drop. This is a recovery that is a very long-term coming. Avoid all China plays.

Money Pours Out of Equities. According to LSEG data, investors sold a net $3.57 billion worth of U.S. equity funds during the week, partly reversing a net $8.56 billion worth of purchases the previous week. Money piled into bonds. It’s a reversal that could continue for months.

Dollar Takes it on the Kisser, falling against all currencies, even the Japanese yen. The prospect of falling interest rates means that the greenback is toast. It’s all in response to the blockbuster negative CPI out on Thursday. Buy (FXA), (FXE), (FXB), (FXC).

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, July 22 at 9:30 AM EST, the Chicago Fed National Activity Index is out.

On Tuesday, July 23 at 9:30 AM, Existing Homes Sales are published.

On Wednesday, July 24 at 9:30 AM, New Home Sales are out.

On Thursday, July 25 at 8:30 AM, the Weekly Jobless Claims are announced. We also get Q2 GDP.

On Friday, July 26 at 8:30 AM, the Core PCE Price Index is released. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, it has been a lifetime desire of mine to fly a Supermarine Spitfire, the Royal Air Force fighter that won the 1940 Battle of Britain.

When I lived in London 40 years ago, there were only 15 flying examples in the world owned by the RAF and a handful of British billionaires who only flew them themselves. They were just too valuable to lend out.

By comparison, there were over 200 American P51 Mustangs, which you could buy from the government for scrap for $500 after the war ended.

Now in 2022, there are 75 flying Spitfires. A global network of warbird enthusiasts has rescued them from bogs, jungles, and scrapyards around the world and restored them to flying condition. It helped that the market value of these planes has shot up from $1 million to $5 million since 1982.

So when a Mad Hedge Concierge member Peter offered me his Spitfire for a day, I couldn’t wait to return to England.

There are very few people in the world who can fly prewar tailwheel configured airplanes. I have flown over a dozen different types. They are prone to ground loops, nose-overs, scraping wing tips, and crashes. The airframes are usually made of Norwegian spruce and Irish linen and the wings can fall off at any time.

No wonder the fatality rate was so high in the old days. It helped that I went armed with my old British Aerobatics license along with a phalanx of American civilian and military licenses.

It was a cool and blustery afternoon when I showed up at Biggin Hill south of London, one of the top RAF fighter stations during WWII, and told Peter “Major John Thomas reporting for duty, sir.” He laughed and set about giving me my preflight briefing. Flying 80-year-old airplanes can be deadly. 70-year-old pilots are even more dangerous.

I was cautioned to move the stick gently as the controls are famously sensitive, thanks to the plane’s unique elliptical wing tips. No rudder was needed at all.

If the engine failed, I had the choice of parachuting out or risking a hard landing. I chose the latter, as Southern England is basically one big grass landing strip. Plus, I’ve had plenty of practice with this kind of maneuver.

For good measure, I brought along a safety pilot. They’ve moved the London control zone around a bit over the years, and I wanted to make sure you keep receiving the Mad Hedge newsletter for the indefinite future. We took off, banked right, and headed for the English Channel.

While the plaque on the control panel reads “DO NOT FLY OVER 350 MPH”, I dared not go faster than 250 MPH given the age considerations of both the plane and the pilot. Another plaque reading “EMERGENCY BOOST PUMP” was wired shut. The Merlin V-12 1,250 horsepower engine purred. Later versions of the plane with the 2,000 horsepower Griffin engine flew over 450 MPH.

The Spitfire could outmaneuver any plane the German Luftwaffe threw up against it. When Hitler asked my late acquaintance Luftwaffe General Adolph Galland what he needed to win the Battle of Britain he replied, “A squadron of Spitfires.” German losses in the battle topped 2,000 planes versus 900 for the British.

But German crew losses were ten times that of the British. That meant an RAF pilot could get shot down and be in another plane in hours. That is what decided the Battle of Britain. The pilots were worth more than the planes. In the end, the British shot down two-thirds of the German Air Force, a loss from which they never recovered.

We found a clear piece of sky over the White Cliffs of Dover between two big fluffy cumulus clouds and commenced a full-on aerobatic flight test. Pilots always want to see what I can do in these old planes and this time was no different.

I executed multiple loops, barrel rolls, chandelles, lazy eights, Immelmann turns, and wingovers, careful never to exceed 1G lest, yes, the wings fall off. Spitfires can dive like crazy. We dropped from 8,000 feet to 2,000 feet in seconds.

While I was limited to one-inch moves of the stick, wartimes diaries speak of full right, full left, and steep dives to escape marauding Messerschmitt 109s and Focke Wulf 190s where pilots suffered 10G’s of force or more. The punishment those kids took was amazing.

The plane carried only two hours of fuel so after I passed my test with flying colors it was back to Biggin Hill. Spitfires lacked IFR instruments because in 1938 they hadn’t been invented yet, so we were careful to avoid clouds. I made a perfect three-point landing on runway 27, as usual, and taxied up to the hanger where Peter greeted me.

Back at the hangar, it took two men to haul me out of the plane, stinking, drenched with sweat, and elated. I felt like I had just done 15 rounds with Mike Tyson, but it was worth it.

Then it was off to the nearest pub for a well-earned pint of Guinness, as has long been the tradition of the RAF. The walls were adorned with pictures of wartime Spitfire pilots who never made it back, some looking no older than teenagers, which they were.

That’s another bucket list item off the list. The time to get them all is running out, and I keep adding new ones, so I better get a move on.

I’ll be back next summer, for sure, because the commanding general of the RAF has invited me back to fly their sole surviving WWII Avro Lancaster four-engine bomber. It’s part of the Battle of Britain Memorial Flight, the fruit of contacts made during my NATO military duties. It is a national treasure.

It seems they’re short of pilots.

To watch a two-minute video of my epic flight, please click here.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Stock Market? What Stock Market?

Global Market Comments

July 19, 2024

Fiat Lux

Featured Trade:

(THE BARBELL PLAY WITH BERKSHIRE HATHAWAY),

(BRK/B)

It’s time to give me another victory lap. Berkshire Hathaway shares are now up 16.55% to a new all-time high. Every call spread and LEAPS I issued on (BRK/B) is now either at max profit or well in the money.

I have been pounding the table all year about the merits of a barbell strategy, with equal weightings in technology and domestic recovery stocks. By owning both, you’ll always have something doing well as new cash flows bounce back and forth between the two sectors like a ping-pong ball.

After all, nobody gets sector rotation right, unless they have been practicing for 50 years, like me.

Full disclosure: I have to admit that after 50 years of following him, I love Warren Buffet. He was one of the first subscribers to my newsletter when it started up in 2008. Some of his best ideas have come from the Mad Hedge Fund Trader, like buying Bank of America for $5 in 2008.

Oh, and he hates Wall Street for constantly fleecing people. Ditto here.

In reading Warren Buffet’s annual letter (click here for the link), it occurred to me that his Berkshire Hathaway (BRKB) shares were in effect a one-stop barbell investment.

For a start, Warren owns a serious slug of Apple (AAPL), some $120 billion worth, or 2.5% of the total fund. That gives (BRKB) some technology weighting. It cost him only $20 billion. The dividends he received entirely paid for the initial cost. So he owns 4% of Apple for free.

I remember the battle over the initial “BUY” in 2015. Warren fought it, insisting he didn’t understand the smartphone business. And he even knew Steve Jobs personally. In the end, he bought Apple for its global brand value alone. His all-in cost as of today, including dividends and splits? Less than zero.

That is Warren Buffet to a tee.

The next five largest publicly listed holdings are Bank of America (BAC), Coca-Cola (KO), American Express (AXP), and Verizon Communications (VZ). These are your classic domestic recovery sectors. And with a heavy weighting in other banks (BK) (USB), Buffet is effectively short the bond market (TLT), another position I hugely favor.

Also included in the package is a liberal salting of pharmaceuticals, Merck (MRK), and AbbVie (ABBV). He has a small energy weighting with Chevron (CVX) and Occidental (OXY). He even has a position in old heavy metal America with General Motors (GM).

Berkshire is also one of the world’s largest property & casualty insurance owners. Its current “float” is $138 billion. You all know his flagship holding, GEICO. And the gecko mascot isn’t going anywhere as long as Warren lives. It was Warren’s idea.

It all seems to work for Warren. In the first quarter of 2023, he earned a staggering $35.5 billion. All told, Berkshire employ 360,000, second to only Amazon (AMZN), and is the largest taxpayer in the United States, accounting for 3% of government revenues. Berkshire is also the largest owner of capital goods & equipment in the US worth $156 billion, topping (AT&T).

Many of Warren’s early 1956 $1,000 investors are millionaires many times over….and over 100 years old, prompting him to muse if ownership of his shares extended life.

Warren’s annual letter, which he spends practically the entire year working on, is always one of the best reads in the financial markets. There isn’t a better 50,000-foot view out there. He also admits to his mistakes, such as his disastrous purchase of Precision Castparts (PCC) in 2016 for $37 billion, which later suffered from the crash in the aerospace industry. In 2020, Buffet wrote off $11 billion of that acquisition.

He can do worse. In 1993, he bought the Dexter Shoe Company for $433 million worth of Berkshire stock. The company went under, but the Berkshire stock today is worth $8.7 billion.

Buffet’s letters always refer back to some of his “greatest hits,” today legends in the business history of the United States: GEICO, Furniture Mart, Berkshire Hathaway Energy, and See’s Candies, one of the largest employers of women in the US using 150-year-old recipes. Its peanut brittle is to die for.

In 2009, Buffet snatched away from me BNSF for a song, now the most profitable railroad in the country, an amalgamation of 360 railroads over 170 years. I say “snatched away” because it was my favorite railroad trading vehicle for decades until he bought the entire company. I hear its trains run by my home every night as a grim reminder.

Another benefit to owning (BRKB) is that Buffet is far and away the largest buyer of his own shares, soaking up $25 billion worth in Q1. And he is buying the shares of other companies that are also aggressively buying their own shares, like Apple ($200 billion last year). It all sounds like the perfect money-creation machine to me.

It gets better. Berkshires “B” shares trade options, meaning you can buy LEAPS (Long Term Equity Anticipation Securities), which by now, you all know and love.

This is how poor people become rich. In fact, my target for (BRKB) was $400 for the end of 2023 and $500 for 2025, right when the two-year LEAPS expires.

One question I often get about Berkshire is what happens when Warren Buffet goes to his greater reward, which is not an impossible concept given that he is 92 years old.

I imagine the shares will have a bad day or two, and then recover. Buffet has been hiring his replacements for a decade or more, and he handed off day-to-day operations years ago (I didn’t want to move to Omaha, no mountains).

When that happens, it will be the best buying opportunity of the year. And another chance to load up on those LEAPS.

“Either you figured it out in a day or two or you were dead,” said the late Battle of Britain Spitfire pilot, John Schooling, and my aerobatics instructor in England 40 years ago.

Global Market Comments

July 18, 2024

Fiat Lux

Featured Trade:

(AUGUST 15, 2024 LONDON, ENGLAND STRATEGY LUNCHEON)

(WHY GOLD IS GOING TO A NEW HIGH),

(GLD), (GOLD), (NEM), (GDX)