Now it?s time for some cultural edification. I first became aware of ?Margin Call? as a pre-production project two years ago when news leaked out that the principal actors, Kevin Stacey, Demi Moore, Stanley Tucci, and Jeremy Irons, were reading the Diary of a Mad Hedge Fund Trader to learn about the industry and get in character.

The plot covers a 24-hour period on the eve of the 2008 financial crisis at a fictitious Wall Street house obviously modeled on Lehman Brothers. A strategic downsizing sacks the firm?s risk manager, Stanley Tucci, who casually mentions to a young associate as he carries his cardboard box down the elevator that the firm is on the verge of getting wiped out in the subprime securities market.

A series of emergency, all night meetings ensue. At the last minute, the CEO, John Tuld, not to be confused with Lehman?s Dick Fuld, alights, godlike, on the roof in a helicopter, obviously clueless about what has been going on in his firm, and the instruments involved. The decision is made to dump their entire position at a huge loss at the market opening, even if it means causing the failure of many of the firm?s clients and counterparties.

When the sales staff rebel, they are offered extra million dollar bonuses if the positions are gone by noon. On orgy of predatory salesmanship ensures, which I have seen myself of trading floors a thousand times. In an hour, prices for some bonds drop 40%. The firm lives on to fight another day, but only at the cost of wiping out reputations and ending careers. The CEO has a laugh and flies away.

Those in the business will uncomfortably recognize many of the hard hearted practices, half-truths, and ethical lapses endemic on Wall Street. It really is only about making money and survival of the fittest.

Despite being a total flop at the box office on a limited release, the film is generating a lot of Oscar buzz, and it is certain to garner a handful of nominations. The acting is incredible. So if you have some free time over the holidays, order the DVD on Netflix.? And hey, Kevin baby, have your people call my people and let?s do lunch when I?m in Beverly Hills in January!

?Washington got the wrong message from the debt ceiling debate. They got the message that the downgrade didn?t matter very much when it came to the US Treasury?s ability to float debt. It?s the wrong message. We are watching a major economy like Italy having trouble getting financing from international capital markets. One day it will come to the US,? said Federal Reserve Governor James Bullard.

The volatility index (VIX) is just not buying this sell off. Even with the Dow down over 300 today, the (VIX) has only managed a meager 3% gain on the day. With a move in equities of this magnitude, you would expect volatility to rise by 15% or more. If traders and investors really believed that the risk markets were really going to crash to new lows, they would be paying through the nose to buy downside protection, which would be clearly visible in a (VIX) spike. These figures prove they aren?t.

Let?s do a quickie cross asset class review here and look at what else on the table. The S&P 500 is precisely at the 50% retracement of the entire 200 point move up from October 4. It could hold this level and keep the bull move intact. While junk bonds (HYG) are down, they are nowhere near the levels suggesting that a financial collapse is imminent. Advance decline ratios are at all-time highs, not exactly an argument for a new bear market. Nor are Treasury bonds drinking the Kool-Aide. Sure they are up today, but not as much as they should be.

It all has the makings of an asymmetric trade for me. That means that the next piece of good news will deliver a larger move up than the next piece of bad news will bring a down one. So a tactical long here will bring an outsized returns. It could well be that the failure of the Super committee is fully in the price, and the mere passage of the deadline might bring a big rally. There are certainly a lot of hedge funds looking to chase yearend performance and value players happy to bottom fish to pull this off.

The bulls also have the calendar strongly in their favor. Not only is the November-December period the second strongest bimonthly period of the year, investors are massively underweight equities. As I never tire in explaining to my permabear friends, most investors can?t sell stock they don?t own. That?s why the Armageddon scenario never kicked in during September. That leaves hedge funds and high frequency trading alone to break the downside supports, something they have so far been unable to do alone.

Which girls will get invited to the next dance? The same ones taken to the last one: commodities, energy, rail, coal, and technology stocks, especially Apple, which is sitting bang on its 200 day moving average today.

Of course I could be wrong about all of this. Conditions in the markets are so uncertain here that there are no real high quality trades to be found. Almost everyone is posting negative returns this year, including some of the smartest people I know. That?s why I have pared back my own trading in order to preserve my own 42% year to date gain. But then, I am 75% in cash, so I can afford to take a relaxed view of things.

Only trade here if your wife is pestering you for a larger Christmas shopping budget. Don?t even think about opening up a new short here, because you have already missed the big, easy move. Then again, you could consider getting a new wife. It might be cheaper.

How unpopular is Congress? Freshman senator Michael Bennet of Colorado, who recently compiled the results of a popularity public opinion poll showing how far in the dumps the Congressional reputation has fallen. Only Fidel Castro is more despised than our august representatives on capital hill.

40% IRS

16% BP during the Gulf oil spill

15% Paris Hilton

11% US reverts to communism

9% Congress

5% Fidel Castro

It hasn?t always been this bad. As recently as 2001, congress boasted an approval rating of 65%. Is your representative really liked less than Paris Hilton? Really?

?Europe is really too far away to get the American family to cancel that trip to Disney World. That is the guts of it,? said Federal Reserve Governor James Bullard.

I am writing this from the back of a taxi in Hong Kong?s Central district. My meetings with assorted bankers, hedge fund managers, Taipans, and the press stretched on longer than expected, with the result that I am now stuck in rush hour traffic on the way to the airport. So I might as well use the time productively and sum up my thoughts on my recent trip to China.

When I first cajoled my way into to the Middle Kingdom in the early seventies, it was in the back of a broken down truck carrying bags of wheat, no doubt destined to a thriving black market. We drove down a heavily potholed single lane road that had not seen serious maintenance since the thirties.

The Communist border guards couldn?t have been more hostile, and sneered at my US passport. Chairman Mao was then constantly railing against American imperialists and capitalist roaders to massive crowds of people wearing green, blue, or grey uniforms chanting with little red books in hand. The Korean War, where China lost 2 million men, had ended only 20 years earlier, and bitter memories were still fresh.

I arrived to find a country in utter chaos. Bands of Red Guards were rampaging through the countryside, lynching anyone with a connection to the West, such as university professors or those with a single foreign possession, like a violin. The lucky were simply made to wear dunce caps and paraded down the street where abuse was hurled upon them. Famine was rampant, and authorities were piling up the bodies of those who had starved, burning them with kerosene. Even getting just a single egg to eat was hard work, no matter how rich you were. My paper money was worthless.

Fast forward four decades, and conditions couldn?t be more different. As I waited patiently for an attractive young immigration official to clear me, I noticed a small voting machine asking if I was satisfied with my experience. It showed 4,734 ?yes? votes for that day. I counted 1,000 people a minute crossing the border, squeezing into packed trains that were leaving every 15 minutes. The sheer scale of this human tide was breathtaking. Welcome to the new China.

On this trip, I approached the country from the end of its long distribution chain and worked my way back towards the source, starting in New Zealand, and traveling on to Australia, Singapore, and Hong Kong. The message was the same all the way down the line: China is slowing. I heard countless stories of cancelled orders, reduced volumes, and thinning shipments.

So it was no surprise to me when, one my first day in Shenzhen, a local developer slashed the prices on new condominiums by 25%. This should come as no surprise, as the Chinese government has been determined to slow the economy for the past two years with no less than eight interest rate hikes and 12 bank reserve snuggings. Local residents were surprised when I explained to them that the 5% they were getting on overnight deposits seemed incredibly generous compared to the zero we get at home.

But slowing is not crashing, contrary to the view argued assertively by some prominent hedge fund managers, like Jim Chanos, who constantly refers to ghost cities of unsold real estate easily visible via Google Earth. Well, I checked out those ghost cities. It turns out that the cities in question change every six months. That?s how long it takes the Chinese to fill one city with people and bring another one somewhere else up for sale.

The Chinese essentially have an assembly line for cities which runs 24/7. They are really building a Rome a day. That?s what you would expect in a country that is attempting to bring another 400 million into the modern economy.

What I think is true is that China is in the midst of permanently downshifting from a blistering 11%-13% annualized growth rate to a more sustainable 8%. This is a good thing, and I saw the Japanese economy go through the same teething process over four decades, first growing at 10%, then 7%, 5%, 3%, and finally bottoming out at 1%. More stability in China will lead to less volatility in the global economy. This will be welcomed with open arms by oil and copper traders whose lives have been shortened by the extreme market moves this year.

The good news for the rest of us is that a China with a GDP today of $5.5 trillion today growing at 8% generates far more GDP growth than it did a decade ago with a $1 trillion economy growing at 10-13%. In fact, a China growing at 8% generates much more new GDP ($440 billion) that a US economy growing at 2% ($290 billion). This means that China is still a great investment for the long term.

What if it starts to grow less than an 8% rate? Senior government officials refer to this as the ?red line? below which the risk of political instability rises. No government fears its own people more than China, which refers to its ?bicycle economy?; it must keep moving forward or fall over. And in China they don?t send retiring political leaders off to putter around at country clubs, they put them in front of firing squads.

Fortunately for the health of the current leadership, they have a lot of resources to head off this worst case scenario. China currently has the largest accumulation of foreign exchange reserves in human history, some $3.2 trillion. During the 2008 crash, they implemented a $500 billion emergency stimulus package, which was three times larger than ours on a per capita GDP basis, and they had a second one on the shelf which they never had to use.

The country now has enough savings to execute six such packages to head off a hard landing, or even a substantial slow down. This is not idle speculation. The budgets have already been drawn up with triggers ready to pull. They involve spreading the country?s impressive modernization inland from the coast to enfranchise more of the population.

Of course, such action would be massively inflationary and require inconveniences like making the Yuan, or Renminbi (CYB), a freely floating and exchangeable currency. Development of a serious secondary renminbi (or people?s currency) bond market would also be a big help. But these liberalizations are eventually going to happen anyway (by 2015?). There is also the additional benefit in that this would help pacify the 2.3 million strong People?s Liberation Army, which is largely recruited from the countryside and is unhappy with the unequal distribution of the country?s wealth. Sound familiar?

This will fundamentally change the investment targets in the Middle Kingdom. Huge fortunes have been made investing in Chinese Internet and export companies. Go no further than my own call to buy Baidu (BIDU) at $12 three years ago, 10% of its current value, by clicking here. In the future the focus will shift to firms capitalizing on the growth of the domestic economy.

None of this makes the Middle Kingdom immune from the ?RISK ON?/?RISK OFF? paradigm that has the world?s financial markets marching up and down in lockstep. As long as the global economic and political scene is jittery, Chinese financial assets are going to trade just as poorly as everyone else?s. But when emerging markets catch a bid that lasts more than a day, China (FXI) will be a good place to be.

Will you Take a 2 Bed, 2 Bath With a Hot Tub?

My hedge fund friends in Shenzhen asked what I needed in a translator and guide to accompany me on my local forays. I said that I required someone who could walk at least ten miles on the city streets on the 90 degree heat, and be prepared to ask the price of everything and everything.

The next morning a diminutive young woman showed up at my hotel wearing an imitation pair of Nike?s and a cheap polyester suit. She told me that she migrated to the city from a small village eight hours away by train after learning English from the radio. I quickly discovered that she free lanced for local hedge funds as a research analyst. Not only did she know where all of my target companies were, she had cousins working at all of them. Talk about a total home run.

At the top of my list was a visit to a fake Apple (AAPL) store. She looked perplexed, and then told me she would not take me to a single store, but an entire city where every business sold the full range of Apple products, from IPhones, to iPods, tablets, and iMacs. Sure enough, I found a building downtown with at least 500 such businesses. They were even offering products that Apple itself hadn?t invented yet. Want a G5s iPhone for $75? No problem.

An iPhone G5? No problem

At one dinner the country?s second largest furniture maker told me of his hugely successful strategy of offshoring manufacturing from China to Vietnam, where labor is one third the cost. This means that the automation and globalization that has decimated America?s labor force was now turning full circle and coming back to haunt Chinese workers. If he can replace 1,000 men with a single high end machine imported from Germany, he will do it in a heartbeat. He then whisked me off to a karaoke bar in his brand new, yellow, Ferrari 360.

As modern as China is, you still stumble across pockets of the 19th century. Prostitution is absolutely rampant, with the hotels posting security guards at the front door to keep them at bay. I will not delve into this topic in any detail so as not to offend my female readers. Suffice it to say that the current market price for virgins is $150, but are probably as authentic as the $75 Apple G5 iPhones.

Not All of China is Modern

On my last evening in the Middle Kingdom, a state dinner was given in my honor thanking me for 40 years of service to the People?s Republic of China. As the evening drew to a drunken close, I thanked my hosts and outlined the broad sweep of my family?s connection with China over the past century.

I once listened with rapt attention as Alice Roosevelt Longworth, President Teddy?s oldest daughter, described the wreckage in the wake of the short-lived 1900 Boxer Rebellion. Senate majority leader, Mike Mansfield, told me of the sweating Chinese coolies who carried bags of coal onto his cruiser when it docked in Shanghai in 1920.

Veteran AP correspondent, Roy Essoyan, riveted younger correspondents at the Tokyo Press Club with a blow by blow account of the Japanese invasion of Shanghai?s foreign quarter in 1937. My dear friend, Al Pinder, head of the OSS in China during WWII, described how children working in sweatshops in China during the thirties dipped tiny, but deeply scarred hands into boiling water to fish out silk cocoons.

My Uncle, Mitchell Paige, recalled his adventures as a young Marine on gunboat duty on the Yangtze in 1935. He later fought off massed waves of Chinese attackers when his First Marine Division conducted its infamous frozen retreat from Chosen Reservoir in Korea in 1950.

The First McDonalds in China

When I came on the scene, the Chinese initially treated me as a capitalist tool and CIA spy, while the FBI viewed me as a communist sympathizer, opening my mail for years. For all I know they still do. When I asked Premier Zhou Enlai about the long term impact of the French Revolution, he responded that ?it was too early to say.? When

I queried Generalissimo Chiang Kai-Shek why he continued his stubborn 50 year battle to wipe out the communists, he responded simply that ?the sky cannot have two suns.? My impudence didn?t prevent him from introducing me to his wife, the lovely Madame Chiang Kai-Shek, one of the Soong sisters famed for being the most beautiful women in China.

I mentioned that the scar on my hip still itched whenever the weather changed. That?s the one left from a slug fired from a Chinese supplied AK-47 in the jungles of Cambodia.

In 1978, I questioned Deng Xiaoping, the father of modern China, when he would allow free emigration. He responded ?Feeding our people is our biggest problem. How many do you want? 20 million? 30 million? I?ll give them to you.?

In the late 1990?s I became an unofficial advisor to the Chinese government on their financial and economic modernization efforts, meeting regularly with friends at the Ministry of Finance and the People?s Bank of China. More than once I responded with ?You want to do what?? as they outlined grandiose plans for a nationwide network of bullet trains, 200 nuclear power plants, the damming of the Yangtze at Three Gorges, and building new cities to accommodate a half billion people. Needless to say, I told any of my hedge fund friends who would listen, this represented the investment opportunity of the century.

I finished by saying that over four decades, I had known the Chinese as both friends and enemies, and definitely preferred the former. It?s better to trade than to fight. I believe they felt the same way. The younger people sitting around the table sat there with their jaws dropped.

?The asymmetric risk is more on the upside than on the downside because people are prepared for the downside,? said Lawrence Fink, CEO of Blackrock, a manager of $3.3 trillion in assets.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

You would think that this was going to be a good day. Weekly jobless claims fell to 388,000, a new six month low. New permits for home construction in October were up 10.2%. The October CPI even fell by 0.1%.

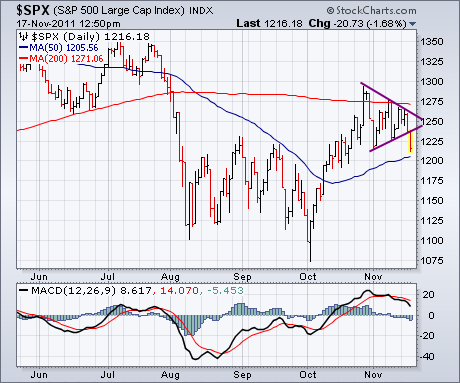

But the second that Spanish bond yields spiked, it was all over but the crying. The S&P 500 opened weak, and then proceeded to plunged 25 points, decisively breaking a triangle to the downside on the charts that has been narrowing for the past three weeks. Once again, improving fundamentals in the US were trumped by contagion fears in Europe. If you don?t bounce off the 50 day moving average on Friday, then we?ll be on the Lexington Avenue Downtown Express to 1,150 or worse.

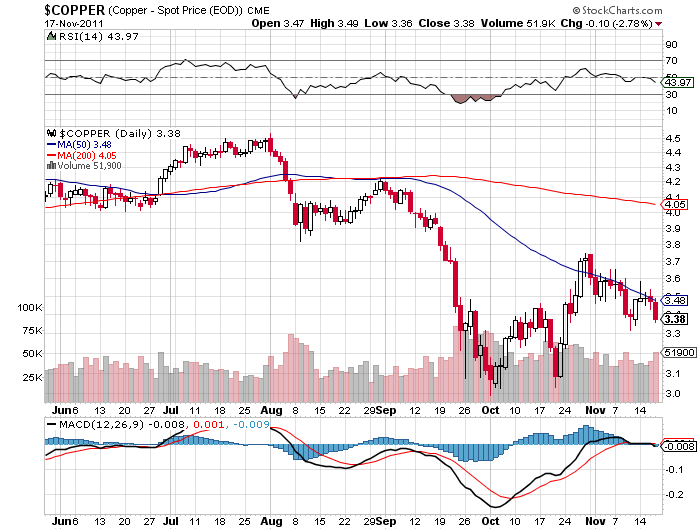

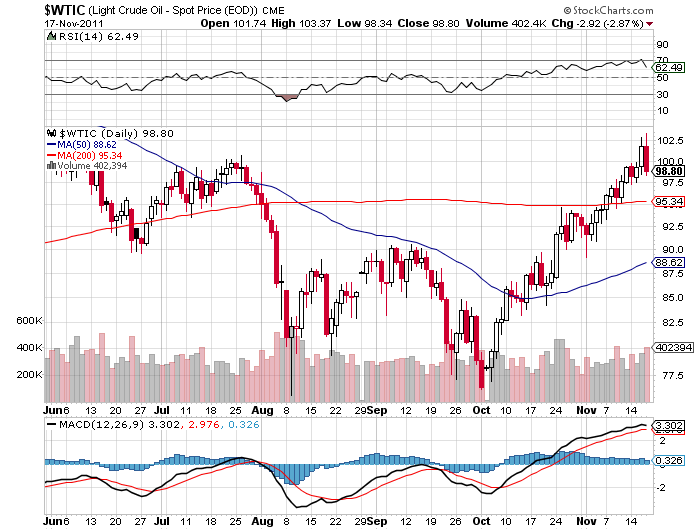

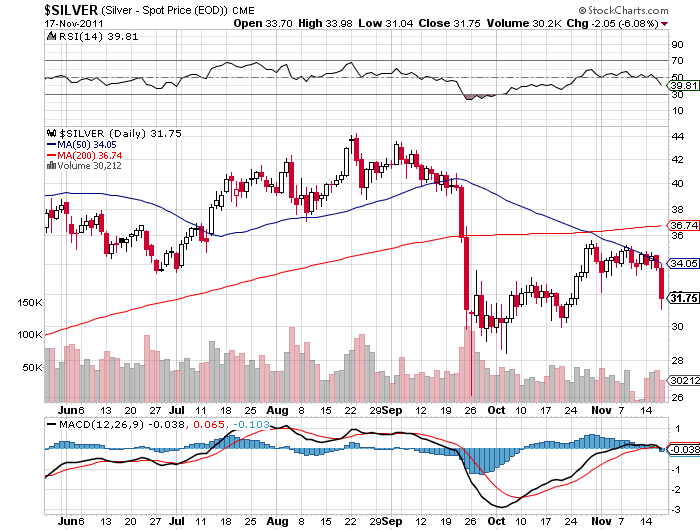

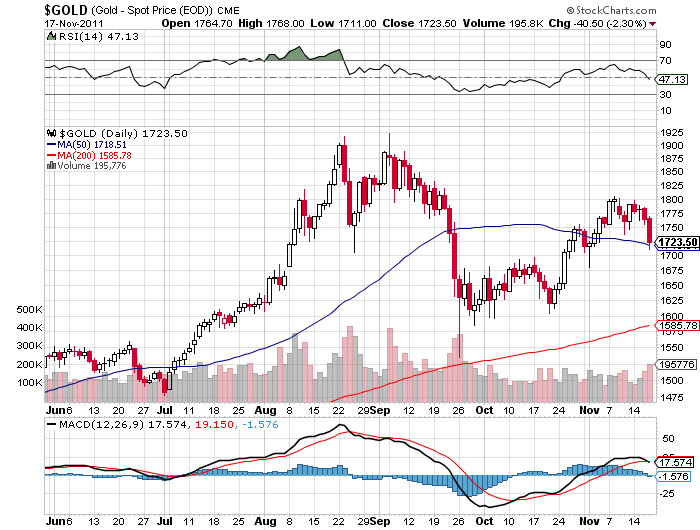

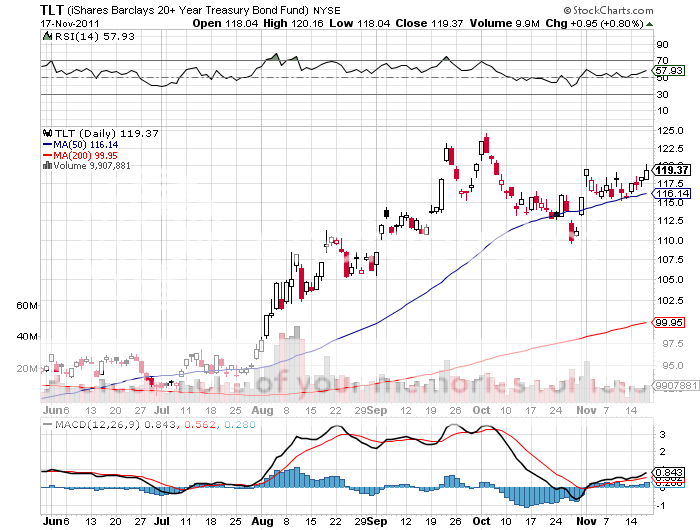

The ?RISK OFF? nature of the move across all asset classes could not have been more clear. Oil skidded by $5, gold gave up $65, silver pared $2.20, copper gave back 15 cents. Ten year Treasuries, which never believed in this ?RISK ON? rally for two seconds, received a nice little boost, but not as much as you might expect. Perhaps we are near a top in this most bubblicious of asset classes? In the meantime, the (TBT) was beaten like a red headed stepchild.

One cannot underestimate the impact of the bankruptcy of MF Global, which has deprived the market of $600 million of trading capital. It is particularly serious in the metals and energies, where MF was particularly active. Hence the gut churning moves. The peripatetic CNBC commentator and Tea Party founder, Rick Santelli, is finding out that ?let the chips fall where they may? means that all his friends on the Chicago CME floor get fired.

Strangely, the Euro, the currency that everyone loves to hate, was one of the best performing assets of the day, down less than a penny. The headline risk here is huge. Will the European Central Bank continue buying enough bonds? Forex traders tell me this is because of a number of temporary, one off factors like European bank repatriation of funds back into Euros to shore up their balance sheets and Asian and Middle Eastern central bank purchases of high yield PIIGS bonds. The second shoe has yet to fall on this beleaguered means of exchange.

While recently winging my way across the South Pacific, I spotted an unusual job offer:

WANTED: Social worker, tax free salary of $60,000 with free accommodation and transportation, no experience necessary, must be flexible and self-sufficient.

With the unemployment rate stuck at 9.1%, and running as high as 45% for recent college grads, I was amazed that they were even advertising for such a job. Usually such plum positions get farmed out to a close relative of the hiring officials involved. Intrigued, I read on.

To apply you first had to fly to Auckland, then catch a flight to Tahiti. After that you must endure another long flight to the remote Gambler Island, then charter a boat for a 36 hour voyage. Once there, you had to row ashore to a hidden cove, as there was no dock, or even a beach.

It turns out that the job of a lifetime is on remote Pitcairn Island, some 2,700 miles ENE of New Zealand, home to the modern decedents of the mutineers of the HMS Bounty. History buffs will recall that in 1790 Fletcher Christian led a rebellion against the tyrannical Captain William Bligh, casting him adrift in a lifeboat.

He then kidnapped several Tahitian women and disappeared of the face of the earth. When he stumbled across Pitcairn, which was absent from contemporary charts, he burned the ship to avoid detection. An off course British ship didn?t find the island until some 40 years later, only to find that Christian had been killed for his involvement in a love triangle decades earlier.

The job is not without its challenges. There is one doctor, and electric power is switched on only 10 hours a day. Supply ships visit only every three months. The local language is a blend of 18th century English and Tahitian called Pitkern, for which there is no dictionary. Previous workers have a history of going native. Oh, and 10% of the island?s 54 residents are registered sex offenders, due to its long history of incest.

The next time someone you know complains about being unable to find a job, just tell them they are not looking hard enough, and to brush up on their Pitkern.