The last public event I attended before the pandemic hit was a dinner with David Pogue, the Science and Technology writer for the New York Times. It was a night well spent.

David believes that climate change is no longer an “if”, or a “maybe” but a certainty. The sooner we start adapting our lives to it, the better.

The bottom line is that a big piece of the world is about to become unhabitable by humans, possibly as much as the 20% around the equator. The loss of life could be huge.

Raise sea levels by 20 feet and you lose all the coastal cities of China, a large part of the US East Coast, and most of Florida. The US government will have to end flood insurance or go bankrupt. It is already tearing down oceanfront homes that have filed two or three federal claims. Private insurers have already gone this route.

Many species of fish, animals, and birds have been migrating north and south for decades. Indeed, tropical game fish, like mahi mahi, have been showing up along the California coast in recent years, to the delight of local fishermen.

There has been a massive migration of hummingbirds north to Oregon. Global warming could be halted in decades. But to return to pre-1970 levels would be a century-long project. Ironically, the Coronavirus started on that work right after we met, bringing the global economy to a grinding halt and dramatically shrinking the population. US lifespans shrank in 2020 for the first time in 100 years, by one full year.

We spent a lot of time at Mad Hedge Fund Trader talking about future technologies. It will be a huge net job creator over time, but the disruptions to existing industries will be enormous. Steel workers don’t morph into computer programmers easily, although I’ve seen some of the younger ones do it with enthusiasm.

When I told him I was one of the first Tesla (TSLA) buyers 13 years ago and my name still stood on the factory wall, he reached out to shake my hand and say “Thank you.” He was shocked when I told him most commercial pilots can’t safely fly a plane without a functioning autopilot.

I met David on what was certainly the worst-timed book tour in the history of the soon-to-be published How to Pre- pare for Climate Change. There he offers highly practical advice on preparing for an era of extreme weather events, possible famines and floods, and other climate-caused chaos. Click here for the Amazon link.

The 60-year-old Ohio native has an unusual eclectic background not unlike my own. He graduated from Yale with a degree in music, summa cum laude. He went on to become an itinerant Broadway producer. It was probably his desire for a steady paycheck that drove him into writing, taking a 12-year job at Macworld magazine, of which I was a steady reader.

David published the first Mac for Dummies book in 1988. He went on to write six more of the original “Dummies” books, including those for iBooks, Opera, Classical Music, and Magic. He became the personal technology correspondent for the New York Times in 2000.

David has hosted the Nova TV series for PBS and programs for the Science and Discovery channels. A five-time Emmy winner for his stories on CBS Sunday Morning, Pogue has been at the forefront of new and emerging tech trends for decades. There you can hugely benefit from his annual Christmas technology gift tips.

To learn more about David Pogue, please visit his website at https://davidpogue.com .

Global Market Comments

July 9, 2024

Fiat Lux

Featured Trade:

(ALL THAT GLITTERS IS NOW NOT COPPER)

(FCX), (COPX)

Global Market Comments

July 8, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

and NORTH TO ALASKA),

(NVDA)

“Analysts don’t know preferred stock from livestock,” said Gordon Gekko in the classic film Wall Street.

Global Market Comments

July 5, 2024

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS)

(TLT)

Global Market Comments

July 3, 2024

Fiat Lux

Featured Trade:

(MY OLD PAL, LEONARDO FIBONACCI),

(TESTIMONIAL)

Global Market Comments

July 2, 2024

Fiat Lux

Featured Trade:

(HOW MY MAD HEDGE AI MARKET TIMING ALGORITHM WORKS)

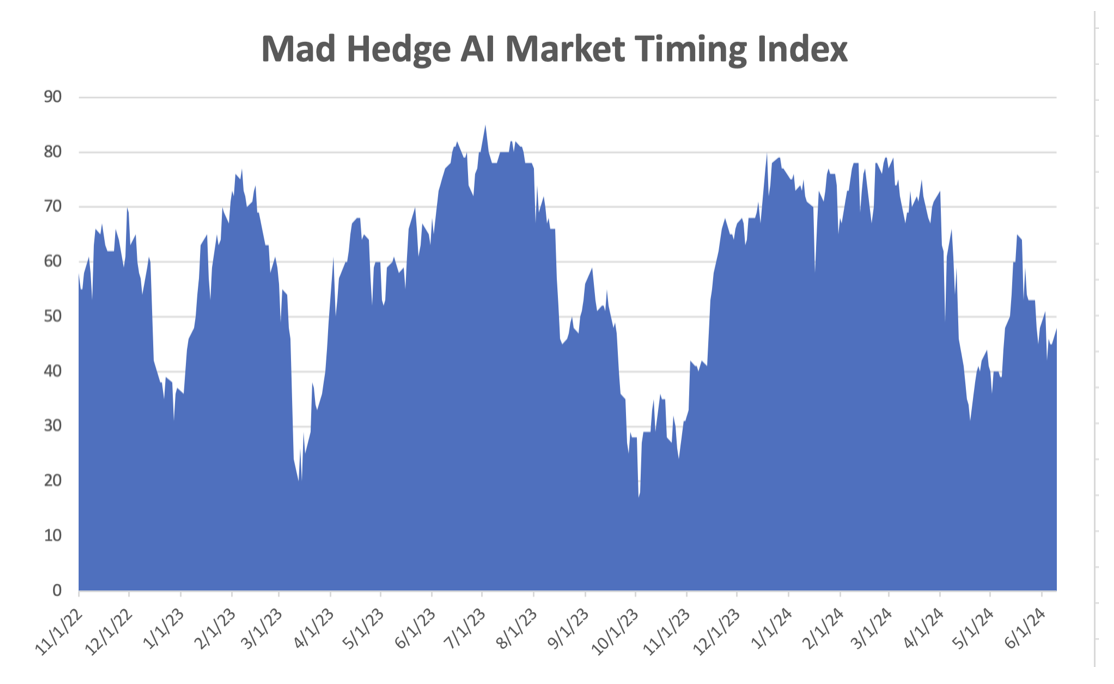

Since we have just taken in a large number of new subscribers from around the world, I will go through the basics of my Mad Hedge AI Market Timing Index one more time.

I have tried to make this as easy to use as possible, even devoid of the thought process.

When the index is reading 20 or below, you only consider “BUY” ideas. When it reads over 80, it’s time to “SELL.” Everything in between is a varying shade of grey. Most of the time, the index fluctuates between 20-80, which means there is absolutely nothing to do.

To identify a coming market reversal, it’s good to see the index chop around for at least a few weeks at an extreme reading. Look at the three-year chart of the Mad Hedge Market Timing Index.

After three years of battle testing, the algorithm has earned its stripes. I started posting it at the top of every newsletter and Trade Alert several years ago and will continue to do so in the future.

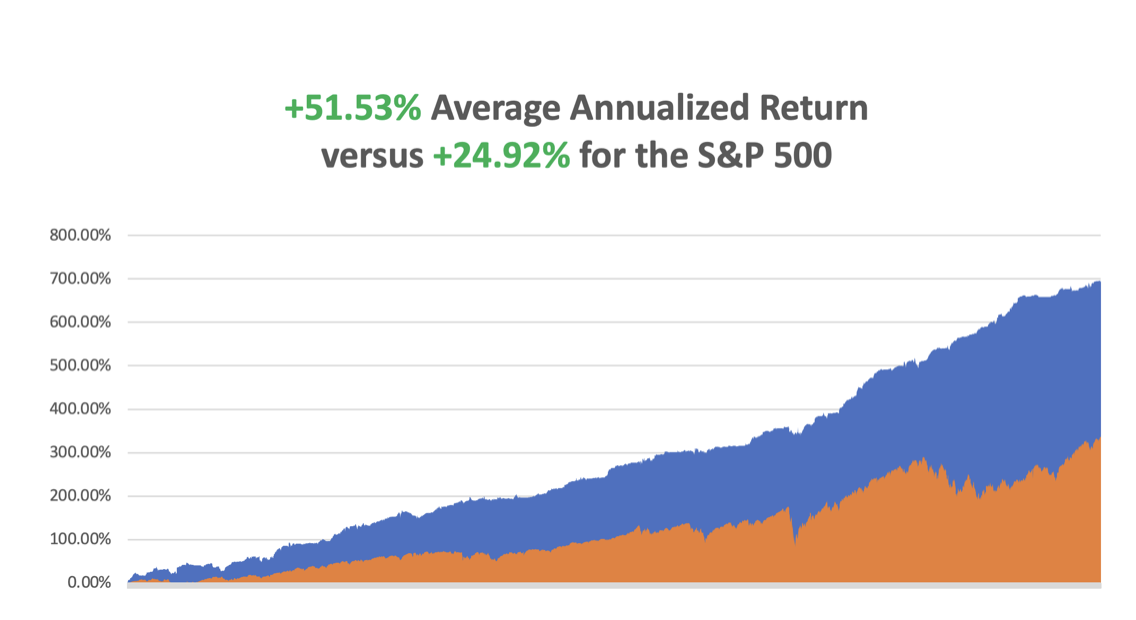

Once I implemented my proprietary Mad Hedge Market Timing Index in October 2016, the average annualized performance of my Trade Alert service soared to an eye-popping 44.54%.

As a result, new subscribers have been beating down the doors trying to get in.

Let me list the high points of having a friendly algorithm looking over your shoulder on every trade.

*Algorithms have become so dominant in the market, accounting for up to 90% of total trading volume, that you should never trade without one

*It does the work of a seasoned 100-man research department in seconds

*It runs in real-time and optimizes returns with the addition of every new data point far faster than any human can. Image a trading strategy that upgrades itself 30 times a day!

*It is artificial intelligence-driven and self-learning.

*Don’t go to a gunfight with a knife. If you are trading against algos alone, you WILL lose!

*Algorithms provide you with a defined systematic trading discipline that will enhance your profits.

And here’s the amazing thing. My Mad Hedge Market Timing Index correctly predicted the outcome of the presidential election, while I got it dead wrong.

You saw this in stocks like US Steel, which took off like a scalded chimp the week before the election.

When my and the Market Timing Index’s views sharply diverge, I go into cash rather than bet against it.

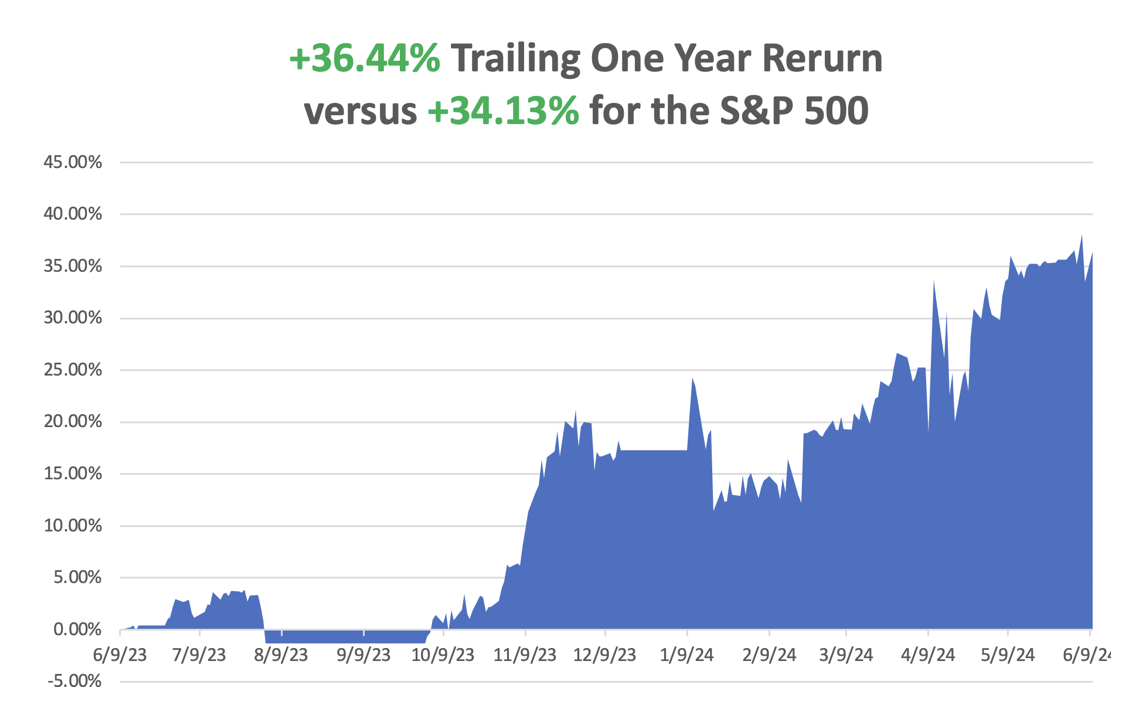

Since then, my Trade Alert performance has been on an absolute tear. In 2017, we earned an eye-popping 57.39%. In 2018, I clocked 23.67% while the Dow Average was down 8%, a beat of 31%. So far in 2024, we are up 20%.

Here are just a handful of some of the elements that the Mad Hedge Market Timing Index analyzes in real-time, 24/7.

50 and 200-day moving averages across all markets and industries

The Volatility Index (VIX)

The junk bond (JNK)/US Treasury bond spread (TLT)

Stocks hitting 52-day highs versus 52-day lows

McClellan Volume Summation Index

20-day stock bond performance spread

5-day put/call ratio

Stocks with rising versus falling volume

Relative Strength Indicator

12-month US GDP Trend

Case Shiller S&P 500 National Home Price Index

Of course, the Trade Alert service is not entirely algorithm-driven. It is just one tool to use among many others.

Yes, 50 years of experience trading the markets is still worth quite a lot.

I plan to constantly revise and upgrade the algorithm that drives the Mad Hedge Market Timing Index continuously as new data sets become available.

It Seems I’m Not the Only One Using Algorithms

Global Market Comments

July 1, 2024

Fiat Lux

SPECIAL ISSUE ABOUT THE FAR FUTURE

Featured Trade:

(PEAKING INTO THE FUTURE WITH RAY KURZWEIL),

(GOOG), (INTC), (AAPL), (TXN)

Global Market Comments

June 28, 2024

Fiat Lux

Featured Trade:

(THE NEXT COMMODITY SUPER CYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)