Global Market Comments

May 29, 2024

Fiat Lux

Featured Trade:

(WHY THE REAL ESTATE BOOM HAS A DECADE TO RUN),

(DHI), (LEN), (PHM), (ITB)

I received a call from a real estate agent the other day asking if I wanted to sell my San Francisco home. She knew I wasn’t planning on going anywhere. But would $1 million over market tempt me?

Lately, I have been getting a lot of calls from concerned readers worried that we might be going into another 2008-2011 style real estate crash when home prices cratered by 50%-70%.

It’s not going to happen and there are a dozen reasons why. Worst case, I expect a short, shallow pause in the market, followed by a ballistic move to new all-time highs starting now. The latest S&P Case Shiller Data showing a 6.5% rise in home prices confirms my view.

Some sectors are already starting to heat up, while others, like San Diego, Miami, Tampa, and Atlanta never really cooled down.

If you have any doubt, look no further than the superheated bond market which is taking interest rates to new all-time highs. Despite a hefty 30-year fixed rate mortgage rate of 7.00%, prices are still holding up, except for San Francisco and Seattle where they have barely fallen.

You see, there is a method to my Madness.

It is all fresh fuel for a continuation in the bull market for US residential real estate, not just for this year, but for another decade, or more. More high-paying jobs means more big-spending home buyers and AI is creating those high-paying jobs at a record pace.

Although prices seem high now, I am convinced that we are only at the beginning of a long-term secular bull market in housing. If you don’t believe me check out the sky-high prices in Shanghai, Vancouver, and Sydney Australia.

Anything you purchase now is going to make you look like a genius ten years down the road.

The best is yet to come.

The big driver will be demographics, as it always is.

From 2023 onward, 65 million Gen Xers will be joined by 85 million late-blooming Millennials in a bidding war for the same houses. That will create a market of 150 million buyers, unprecedented in the history of the American real estate market.

In the meantime, 80 million baby boomers, net sellers and downsizers of homes for the past decade, will slowly die off and disappear from the scene as a negative influence. Only one-third are still working.

The first boomer, Kathleen Casey-Kirschling, born seconds after midnight on January 1, 1946, became 78 years old this year. A former schoolteacher, she took early retirement at 62.

The real fat on the fire here is that 10 million homes went missing in action this past decade, thanks to the 2008 financial crisis. They were never built.

This is the result of the bankruptcy of several homebuilding companies, and the new-found ultra-conservatism of the survivors, like DR Horton (DHI), Lennar Homes (LEN), and Pulte Group (PHM).

Did I mention that all of this makes this sector a screaming “BUY”?

Talk to any real estate agent and they will complain about the shortage of inventory (except in Chicago, the slowest growing market in the country).

Prices are so high already that flippers have been squeezed out of the market for good. Bottom feeders, like hedge funds buying at the bankruptcy auctions, are a distant memory. Some, like BlackRock (BLK) now own more than 40,000 homes and are the biggest landlords in the county.

Nobody wants to sell because it means giving up ultra-low 2.75% mortgages which they obtained during the salad days and will not see again in their lifetimes. I am one of those happy homeowners. We are prisoners of our own mortgages.

The rising rents that are turning Millennials from renters to buyers may be the first sign of real inflation beyond the increasingly dear health care and higher education that we’re already seeing.

And Millennials are having kids that demand a bigger living space! Who knew?

Have I Got a Fixer-Upper for You!

Global Market Comments

May 27, 2024

Fiat Lux

Featured Trade:

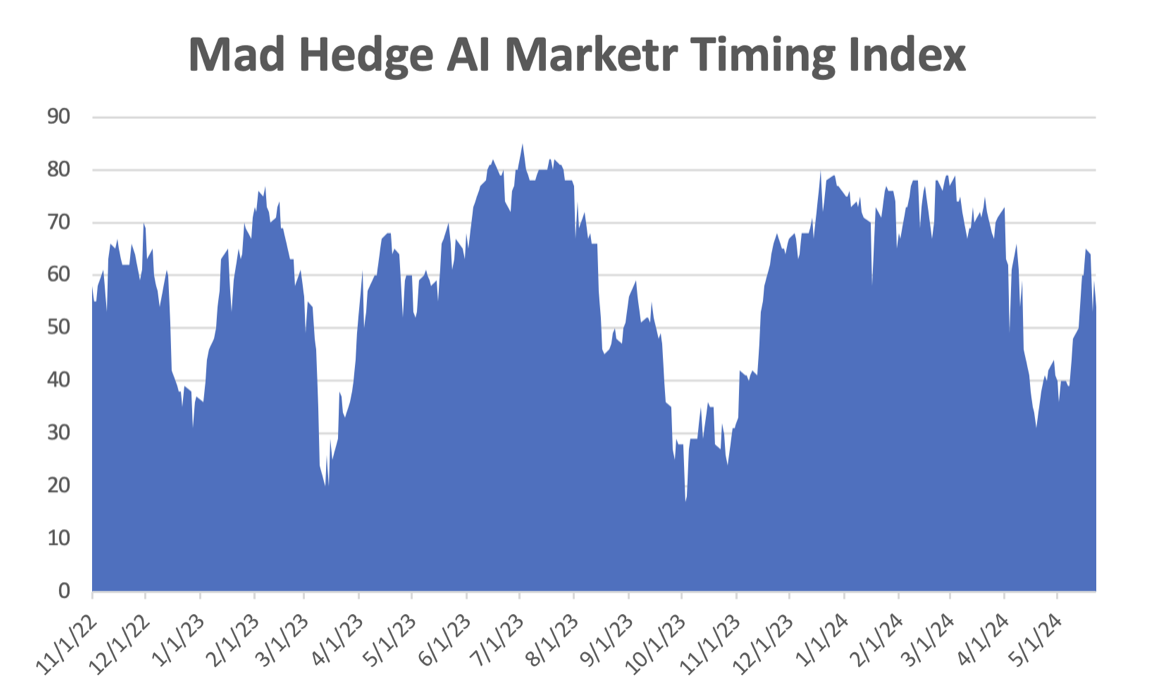

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TOP IS IN and (THE PASSING OF A GREAT MAN)

(NVDA), ($INDU), (SPY), (TLT), (GLD), (SLV), (SREIT)

In the end, it proved to be a one-stock market.

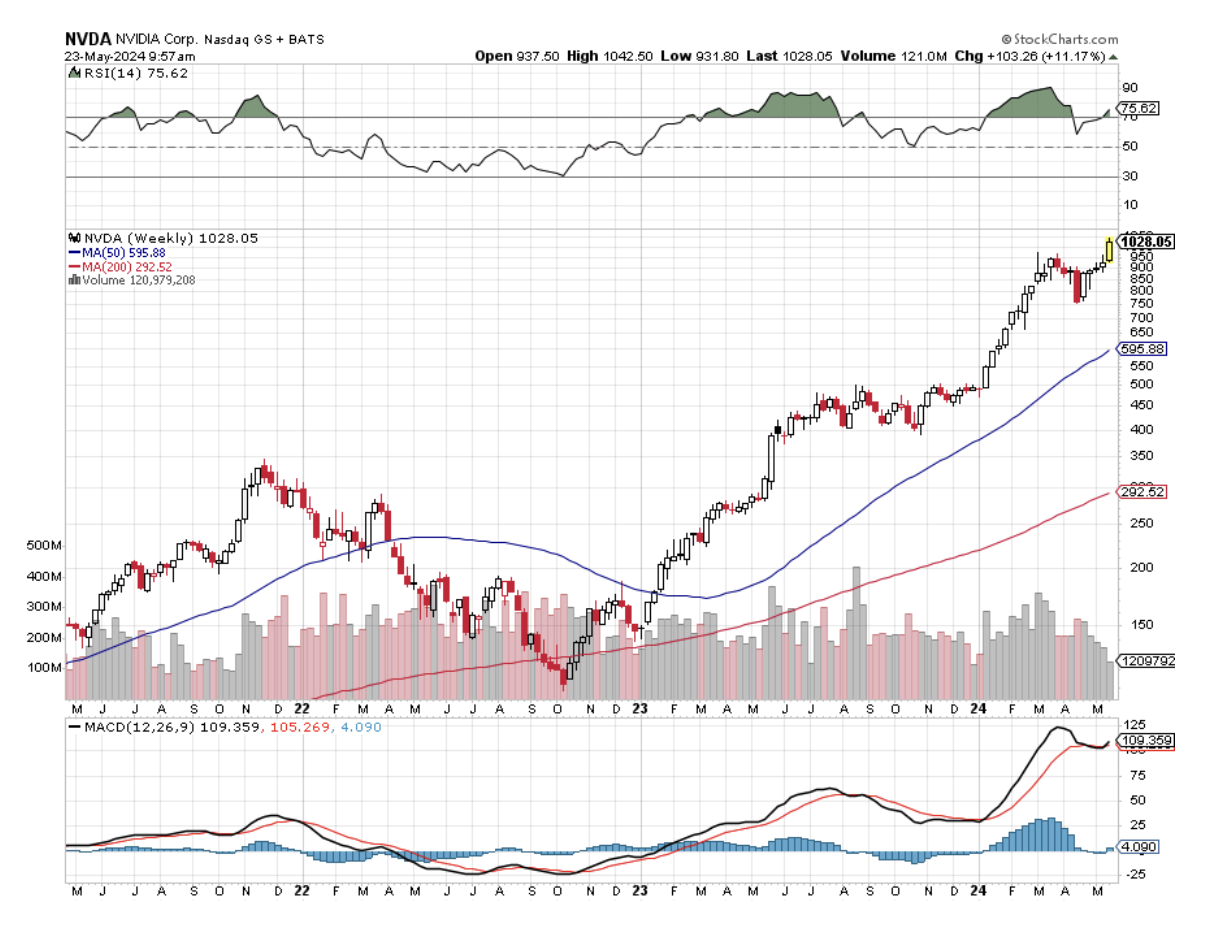

As I expected, once the NVIDIA earnings were out it proved to be not only the top for (NVDA), but also for every other stock and asset class.

It was “risk off” with a vengeance.

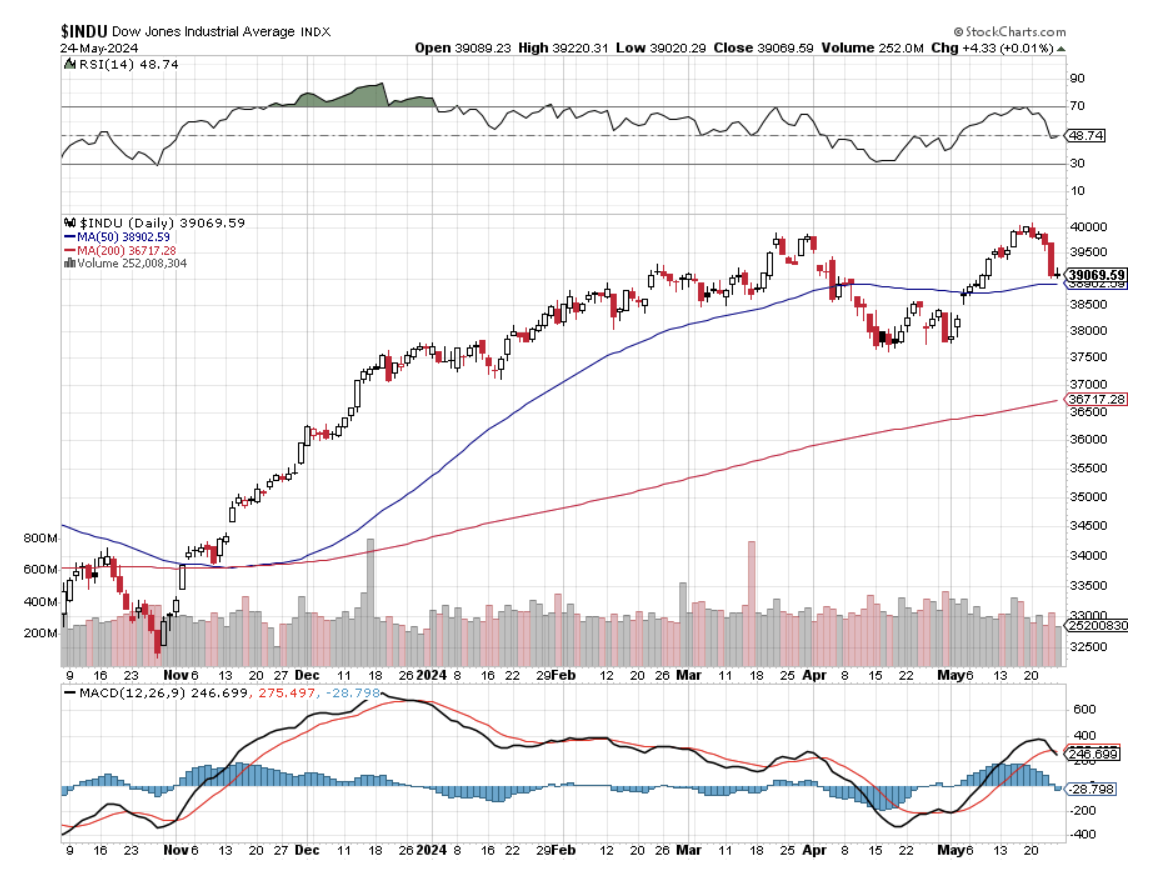

The Dow ($INDU) and S&P 500 (SPY) suffered their worst day in a year. Bonds (TLT) took it on the nose. Gold (GLD) and silver (SLV) gave up their recent 5% and 10% gains, the worst action in eight months. Even the real estate data was awful, even though it lags by a month.

It gets worse.

Look at the chart for the Dow Average below and you’ll see that a very clear double top is in place. And now we have commercial real estate REIT’s (SREIT) suspending redemptions and gating investors lest they trigger a run on the bank and force distress liquidations.

I’m not turning bearish. But all this means we have some tough rows to hoe before we reach substantial new highs again. I’m still sticking to my 2024 year-end target of $6,000 for the (SPY). But it might be a good summer to take a long Alaskan cruise, climb a high mountain like the Matterhorn, or catch the latest shows in London’s West End (Kiss Me Kate, Les Misérables, or Moulin Rouge?).

I’m doing all three.

Don’t get me wrong. All this travel does not mean that I have become lazy, indolent, or a skiver. I actually get more work done when I am on the road as I don’t have so many local distractions, like unplugging the toilet (I have two daughters), trapping rats under the house, or getting someone to weed the garden.

In the Galapagos Islands I actually achieved ten hours a day of work because, dead on the equator, you have to meter your sun exposure carefully. Notice that my trade alerts went up in volume and were all good and my original content increased. I actually had the time to write what I really wanted to write.

With Elon Musk’s global Starlink Internet service promising 200 mb/sec and actually delivering 50, the world is my oyster.

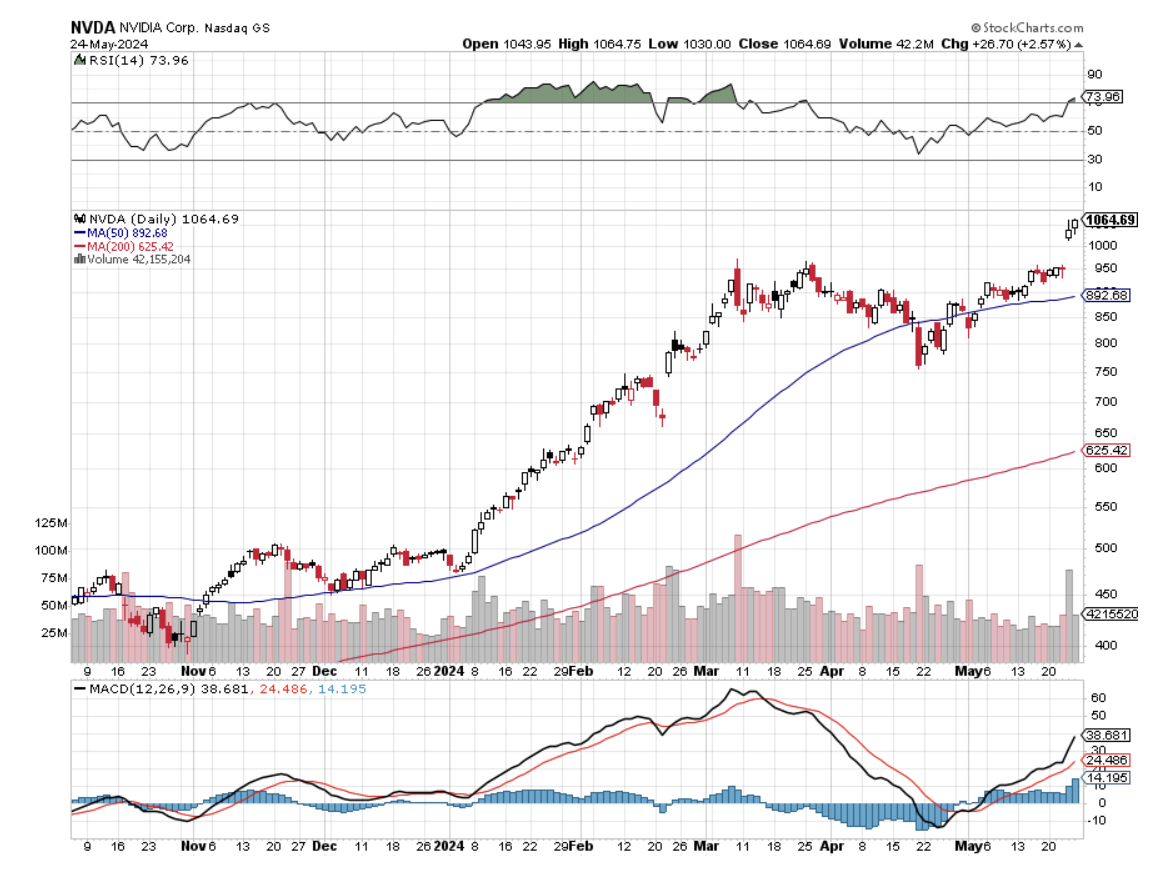

And how about those NVIDIA earnings!

They were Blockbuster for sure, and for good measure they announced a 10:1 stock split, Taking the shares over $1,000 for the first time. Talk about a one: two punch for the shorts!

Revenues came in at an astounding $26.04 billion vs. $24.65 billion expected. CEO Jenson Huang called it a new Industrial Revelation. It sounds a lot like my New American Golden Age and Pax Americana. I reiterate by yearend $1,400 target. It’s as if Microsoft (MSFT), Intel (INTC), Dell (DELL), and Netscape all combined into a single company in 1995.

If by some miracle we do get a 20% correction like we had in April, double the position I know you all already have. Oh, and Mad Hedge hit a new all-time high, up 18.01% YTD and 695% since inception.

What’s more important here is not how spectacular a bet on (NVDA) a decade ago at $15 a share a decade ago was, back when it was considered a lowly video game stock. The implications for the global economy are immense. In means the massive $200 billion in capital spending for this year is too low. It also means the future is happening faster than anyone realizes, even me.

You know those popup 15-second advertising videos that have suddenly started appearing on your phone? They eat up immense processing power and drain your battery at an epic rate (more power demands). But they can be entertaining. Think of them as a metaphor for the entire economy.

Let me assure you that I’m called “Mad” for a reason. When (NVDA) suffered its last correction, I doubled up my own personal LEAPS position. That was when the bears were arguing for a selloff in (NVDA) prompted by an air pocket in orders headed into the Blackwell superchip release.

It turns out there’s no air pocket. Customers are buying the old (NVDA) chips as fast as they can at premium prices.

Dow 120,000 here we come!

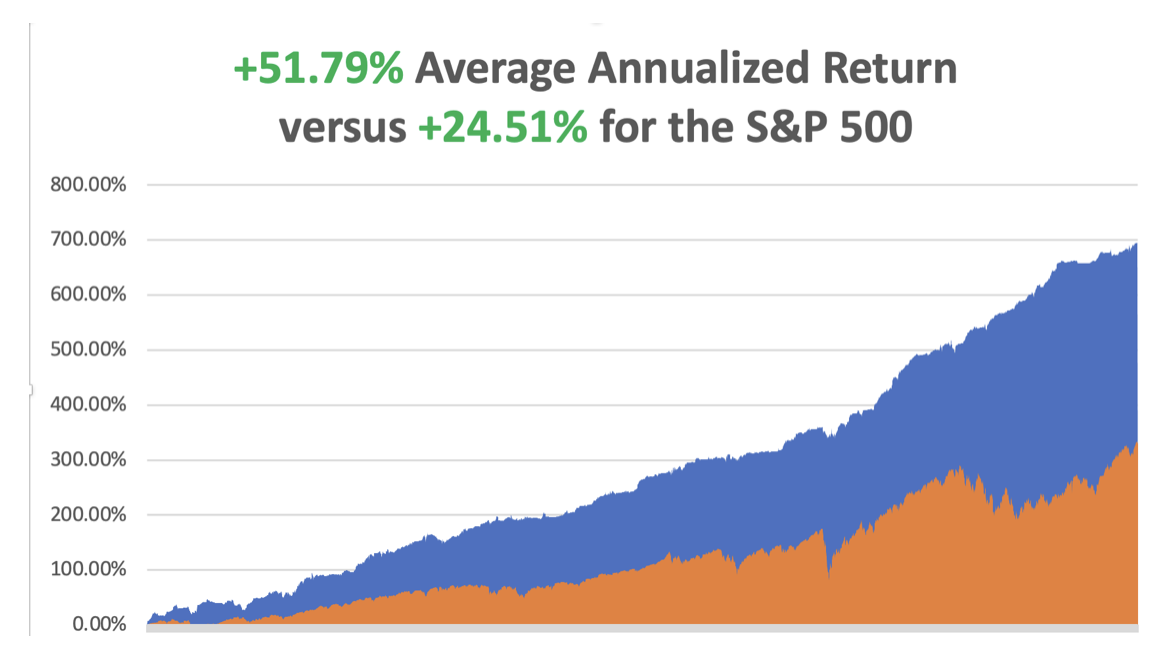

So far in May, we are up +3.38%. My 2024 year-to-date performance is at +18.01%. The S&P 500 (SPY) is up +10.90% so far in 2024. My trailing one-year return reached +33.25%.

That brings my 16-year total return to +694.62%. My average annualized return has recovered to +51.79.

As the market reaches higher and higher, I continue to pare back risk in my portfolio. I took profits on my long in (SLV) right at a multiyear high and just before a 10% plunge. That left me 90% in cash and with a single short in (AAPL) going into the worst selloff in a year.

The harder I work, the luckier I get.

Some 63 of my 70 round trips were profitable in 2023. Some 27 of 37 trades have been profitable so far in 2024.

Copper Slide Continues, down 7% in three days, as the extent of Chinese speculation becomes clear. The route has spread to gold, silver, iron ore, and platinum. Once the Chinese enter a market, the volatility always goes up. Speculators have fled a collapsing Chinese real estate market into commodities of every sort. Buy the big dip. They’ll be back.

S&P Global Flash PMI Jumps, 50.9 for services and 54.8 for manufacturing, a one-year high. Stocks and bonds took it on the nose, taking ten-year US Treasury yields up to 4.49%. Commodities were already taking a bath thanks to speculative Chinese dumping. Inflation wasn’t gone, it was just taking a nap.

Existing Home Sales Fall, down for the second month in a row at -1.9% to 4.14 million rates in April. The Median selling price rose to $407,600, a new record. The residential real estate boom is back! The nascent recovery in demand from a 13-year low in October is being hindered by limited inventory that’s keeping asking prices elevated

New Home Sales Tank in April, down 4.4%, and 7.7% in March.

The median price of a new home was $433,500, 4% higher than it was in April 2023. Builders say they cannot lower prices due to high costs for land, labor, and materials. The big production builders have been buying down mortgage rates to help boost sales, but they are able to do that because of their size.

Weekly Jobless Claims Fall, down 215,000, down 8,000, the steepest decline since September. Federal Reserve officials are looking for further weakening in demand as they try to tame inflation without triggering a surge in unemployment.

30-Year Fixed Rate Mortgage Drops Below 7.0%. The housing market taking a step back in April after a strong performance in the first quarter.

To Monetize or Not? Most of us are still using AI for free. Providers are now facing a dilemma, “Growth at or cost”, or “Take the money and run” for systems that are, with the new $40,000 Blackwell chips, still incredibly expensive to build. Microsoft’s GPT 4.0, Goggle’s AI Overview, and Gemini AI are essentially beta tests that are still free (the black George Washington’s, etc). But Amazon is looking to start charging for the AI elements of its Alexa service. Your biggest monthly bill may soon be for AI.

Thousands of Young Traders are Getting Wiped Out, following the trading advice of London-based IM Academy. The guru, Chris Terry, calls itself the “Yale of forex, the Harvard of trading,” despite his own criminal conviction for theft. Since 2014 IM Academy has grown to 500,000 members taking in $1 billion in revenues. Terry had no formal education and until the late nineties worked as a construction worker in New York. IM is now under investigation by the FTC. Be careful who you listen to, as most investment newsletters out there are fakes.

US to Drop One Million Barrels of Gasoline on the Market, ahead of the annual July 4 price spike. The fuel will come from closing down the Northeast Emergency Fuel Reserve. With the decarbonization of America, who needs it? It takes 2 gallons of oil to produce 1 gallon of gasoline. Hey, what’s the point of being a politician if you can’t engage in pre-election ploys? Another dig at the oil companies.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 27 is Memorial Day. As the senior officer, I will be leading the annual parade in Incline Village, this time wearing my Ukrainian Army major’s hat.

On Tuesday, May 28 at 1:30 PM EST, the Dallas Fed Manufacturing Index is released.

On Wednesday, May 29 at 11:00 PM EST, the Fed Beige Book is published

On Thursday, May 30 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also get the second read of the US Q1 GDP Growth Rate.

On Friday, May 31 at 8:30 AM the Core PCE Price Index is announced, an important inflation read.

At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, It was with a heavy heart that I boarded a plane for Los Angeles to attend a funeral for Bob, the former scoutmaster of Boy Scout Troop 108.

The event brought a convocation of ex-scouts from up and down the West Coast and said much about our age.

Bob, 85, called me two weeks ago to tell me his CAT scan had just revealed advanced metastatic lung cancer. I said, “Congratulations Bob, you just made your life span.”

It was our last conversation.

He spent only a week in bed and then was gone. As a samurai warrior might have said, it was a good death. Some thought it was the smoking he quit 20 years ago.

Others speculated that it was his close work with uranium during WWII. I chalked it up to a half-century of breathing the air in Los Angeles.

Bob originally hailed from Bloomfield, New Jersey. After WWII, every East Coast college was jammed with returning vets on the GI bill. So he enrolled in a small, well-regarded engineering school in New Mexico in a remote place called Alamogordo.

His first job after graduation was testing V2 rockets newly captured from the Germans at the White Sands Missile Test Range. He graduated to design ignition systems for atomic bombs. A boom in defense spending during the fifties swept him up to the Greater Los Angeles area.

Scouts I last saw at age 13 or 14 were now 60, while the surviving dads were well into their 80’s. Everyone was in great shape, those endless miles lugging heavy packs over High Sierra passes obviously yielding lifetime benefits.

Hybrid cars lined both sides of the street. A tag-along guest called out for a cigarette and a hush came over a crowd numbering over 100.

Apparently, some things stuck. It was a real cycle of life weekend. While the elders spoke about blood pressure and golf handicaps, the next generation of scouts played in the backyard or picked lemons off a ripening tree.

Bob was the guy who taught me how to ski, cast for rainbow trout in mountain lakes, transmit Morse code, and survive in the wilderness. He used to scrawl schematic diagrams for simple radios and binary computers on a piece of paper, usually built around a single tube or transistor.

I would run off to Radio Shack to buy WWII surplus parts for pennies on the pound and spend long nights attempting to decode impossibly fast Navy ship-to-ship transmissions. He was also the man who pinned an Eagle Scout badge on my uniform in front of beaming parents when I turned 15.

While in the neighborhood, I thought I would drive by the house in which I grew up, once a modest 1,800 square-foot ranch-style home to a happy family of nine. I was horrified to find that it had been torn down, and the majestic maple tree that I planted 40 years ago had been removed.

In its place was a giant, 6,000 square foot marble and granite monstrosity under construction for a wealthy family from China.

Profits from the enormous China-America trade have been pouring into my hometown from the Middle Kingdom for the last decade, and mine was one of the last houses to go.

When I was class president of the high school here, there were 3,000 white kids and one Chinese. Today those numbers are reversed. Such is the price of globalization.

I guess you really can’t go home again.

At the request of the family, I assisted in the liquidation of his investment portfolio. Bob had been an avid reader of the Diary of a Mad Hedge Fund Trader since its inception, and he had attended my Los Angeles lunches.

It seems he listened well. There was Apple (AAPL) in all its glory at a cost of $21. I laughed to myself. The master had become the student and the student had become the master.

Like I said, it was a real circle of life weekend.

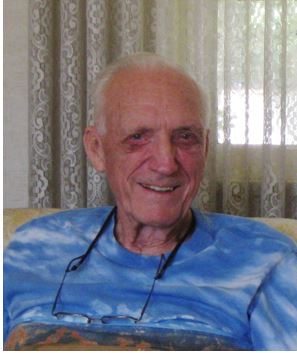

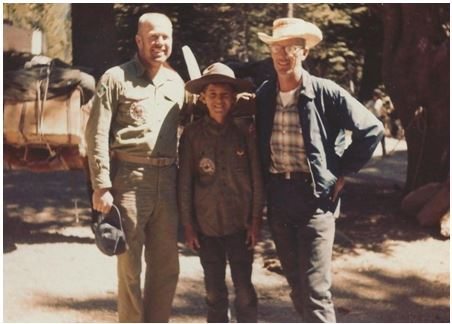

Scoutmaster Bob

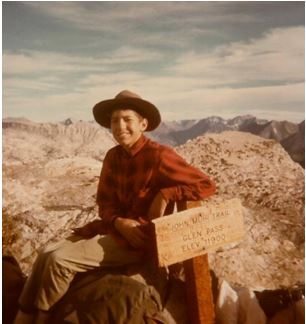

1965 Scout John Thomas

The Mad Hedge Fund Trader at Age 11 in 1963

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 24, 2024

Fiat Lux

Featured Trade:

(WELCOME TO THE PAX AMERICANA)

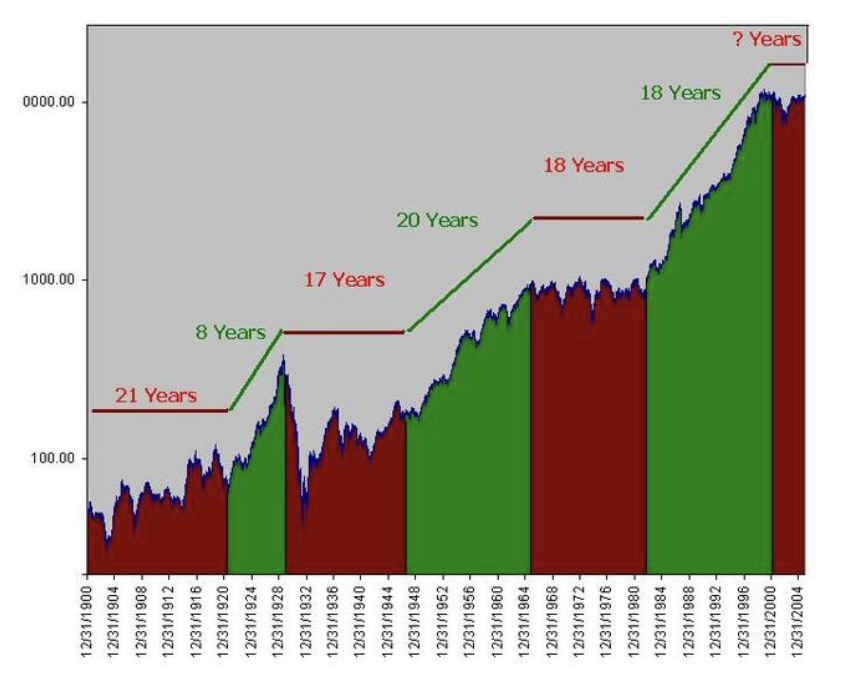

1) A huge demographic tailwind has kicked in during the 2020’s

2) The last time this happened was during the 1980’s when stocks rose twentyfold

3) Don’t believe today’s doomsayers, America is the first place to invest and will remain so for decades

4) It all sets up a Pax Americana that could continue for the rest of the century.

Remember the 1980’s, when investing was as easy as falling off a log? If you indexed your portfolio rose twentyfold.

Well, have I got some great news for you. We are about to see a repeat.

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950s and 1980’s and which I still remember fondly.

This is not some pie-in-the-sky prediction. It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The implications for your investment portfolio will be huge.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we are now enduring two “lost decades” of economic growth during the 2000’s and 2010’s is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xer’s.”

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets such as equities, and more buyers of assisted living facilities, health care, and “RISK OFF” assets such as bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to today when the reverse happens and the baby boomers are exiting the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xer’s being chased by 85 million of the “Millennial” generation trying to buy their assets.

By then we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage serious hikes.

The middle-class standard of living will reverse a then 40-year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990s.

The stock market rockets in this scenario. Share prices may rise very gradually for the rest of this decade as long as above-average 3.25% growth persists. That will take the Dow to 120,000 by the 2030’s a mere triple from present levels.

Technology and Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next 20 years should bring a fundamental restructuring of our energy infrastructure as well.

The 100-year supply of natural gas (UNG) we possess through the new “fracking” technology will finally make it to end users, replacing coal (KOL) and oil (USO). Fracking applied to oilfields is also unlocking vast new supplies.

Since 1995, the United States Geological Survey's estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC’s share of global reserves is collapsing.

This is all happening while EV’s are taking an ever-growing share of the new car market, 7.6% in 2023, or some 1,189,043 vehicles, up from 5.9% in 2022. Total US gasoline consumption is now at a ten-year low. Alternative energy technologies will also contribute in an important way in states such as California, accounting for 60% by 2030 and 100% by 2045.

I now have an all-electric garage, a Tesla Model X (TSLA) powered by solar panels and Tesla Powerwalls, allowing me to disappear from the gasoline market completely. Millions will follow. The net result of all of this is lower energy prices for everyone.

It has already flipped the U.S. from a net importer to an exporter of energy in a huge way, with positive implications for America’s balance of payments. That eliminated our once-largest import and turned it into an important export, which is very dollar-bullish for the long term. A strong greenback further reinforces the bull case for stocks as it attracts more foreign buying.

The US is now the world’s largest oil producer at 13 million barrels a day and we are now fueling much of Europe with our natural gas exports, replacing Russia.

Accelerating AI technology will bring another continuing positive. Of course, it’s great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos.

But at the enterprise level, this is enabling speedy improvements in productivity that are filtering down to every business in the U.S., lowering costs everywhere. Humans are being replaced with Chatbots at blinding speed. When was the last time you talked to an actual human in customer support?

This is why corporate earnings have been outperforming the economy as a whole by a large margin.

Profit margins are at an all-time high. Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development.

When the winners emerge, they will have a big cross-leveraged effect on the economy.

New healthcare breakthroughs will make serious diseases a thing of the past, which are also being spearheaded in the San Francisco Bay area. I tell my kids they will never be afflicted by my maladies. When they get cancer in 20 years they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday.

What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver’s seat on these innovations?

The USA.

There is a political element to the new golden age as well. Gridlock in Washington can’t last forever. Eventually, one side or another will prevail with a clear majority.

This will allow the government to push through needed long-term structural reforms, the solution of which everyone agrees on now, but for which nobody wants to be blamed.

That means raising the retirement age from 66 to 70 where it belongs and means-testing recipients. Billionaires don’t need the maximum $36,156 annual supplement. Nor do I.

A Pax Americana would ensue.

That means China will have to defend its own oil supply, instead of relying on us to do it for them. That’s why they have recently bought a second used aircraft carrier. The Middle East is now their headache.

The national debt then comes under control, and we don’t end up like Greece.

The long-awaited Treasury bond (TLT) crash never happens.

Sure, this is all very long-term, over-the-horizon stuff. My markets are discounting this now. That’s how we got to Dow 40,000, up from 600 when I first entered the US market 42 years ago.

Dow Average 1900-2024

Another American Golden Age is Here

“I wouldn’t want to see everyone get down to where Detroit is before we declare a bottom in residential housing,” said David Blitzer, former chairman of the S&P 500 Index Committee.

Global Market Comments

May 23, 2024

Fiat Lux

Featured Trade:

(BEHOLD THE POWER OF THE NVIDIA LEAPS)

(NVDA)

I know that most of you bought my recommendation on September 29, 2022, to buy the NVIDIA (NVDA) January 2025 $270-$280 out-of-the-money vertical Bull Call spread LEAPS at $0.50 or best, so I thought I’d give you an update.

Since I sent out this trade alert, (NVDA) shares have catapulted from $127 to $1,050, a gain of 8.27 times, or 827%. Today, the middle market for the LEAPS is $9.20, a gain of 18.4 times, or 1.840%. And this is a position where you never risked more money than you put up.

Those of you who bought this in size have already retired and will never work another day in their lives.

Such is the incredible power of LEAPS.

Of the 38 LEAPS I have issued over the past three years, 36 are at max profit. Only (UNG) and the last (TLT) are sucking hind tit. But they still have eight more months to run. The final bell has not been rung….yet.

There are many more LEAPS recommendations to come from the Mad Hedge Fund Trader. However, you will find I issue many more of these at market bottoms than tops. Timing is everything.

For your edification, I have included the original trade alert below.

Trade Alert - (NVDA) – BUY

BUY the NVIDIA (NVDA) January 2025 $270-$280 out-of-the-money vertical Bull Call spread LEAPS at $0.50 or best

Opening Trade

9-29-2022

expiration date: January 17, 2025

Number of Contracts = 1 contract

Keep in mind that NVIDIA is one of the most volatile stocks in the market. You don’t have to buy it today. A big selloff would be ideal. But it should be at the core of any long-term LEAPS portfolio.

If you are looking for a lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 2:1 in your favor. And the payoff is 19:1. That is the probability that NVIDIA shares will double over the next two years and four months.

Santa Clara-based NVIDIA designs and manufactures high-end, top-performing graphics cards or GPUs. There is probably one in your PC. They are essential in the artificial intelligence, automobile, PC, supercomputing, cybersecurity, and gaming industries.

They are also crucial for national defense. The Biden administration recently banned NVIDIA from exporting high-end chips and their manufacturing equipment to China, which they were using to build sophisticated weapons to use against us. This revenue loss is what has taken the shares down to their current low levels, down 65% in six months.

NVIDIA has long been one of the fastest-growing US companies, Since 2005, its annual net income has soared from $89 million to $9.7 billion. Its NVIDIA Titan V graphics processing unit used for supercomputing architecture sells for an eye-popping $2,999.

And before you ask, NVIDIA is an abbreviation for the Latin word for “envy.”

To learn more about the company, please visit its website at https://www.nvidia.com/en-us/

I am therefore buying the NVIDIA (NVDA) January 2025 $270-$280 deep out-of-the-money vertical Bull Call spread LEAPS at $0.50 or best.

Don’t pay more than $1.00 or you’ll be chasing on a risk/reward basis.

January 2025 is the longest expiration currently listed. Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the NVIDIA (NVDA) January 2025 $270-$280 out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $0.50-$1.50. Enter an order for one contract at $0.50, another for $0.60, another for $0.70, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is minuscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a 112% rise in (NVDA) shares will generate a 1,900% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 19:1 across the $270-$280 space.

(NVDA) doesn’t even have to get to a new all-time high to make the max profit. It only has to get back to $270 where it traded last March.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that NVIDIA will not fall below $280 by the January 17, 2025 option expiration in 2 years and 4 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (NVDA) $270 calls at………….………$11.00

Sell short 1 January 2025 (NVDA) $280 calls at…………$10.50

Net Cost:………………………….…….…..…………...........….....$0.50

Potential Profit: $10.00 - $0.50 = $9.50

(1 X 100 X $9.50) = $950 or 1,900% in 2 years and 4 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

"I had no idea Amazon would produce this kind of performance. I blew it," confessed Oracle of Omaha Warren Buffett.