Global Market Comments for February 13, 2009

Featured Trades: (ABX), FCX), (GOLD)

1) We learned yesterday that not only does the Obama administration watch the stock market carefully, it also has a technical analyst on board. We were exactly at a crucial support point on the charts when the Treasury leaked the home mortgage subsidy plan, triggering a ferocious 300 point short covering rally in the Dow. A couple of points lower, and a deluge of stop loss sales would have been triggered, taking the market down 500. The message from the Feds is that if you want to play on the short side here, do so at your own peril. Suddenly, running a hedge fund has become harder, as if we didn't have enough on our plate already.

2) If you have been regularly reading my letter you should by now have sacks of gold American Eagles stacked up against the walls, your portfolio is brimming with gold mining stocks like Barrick (ABX), Freeport McMoran (FCX), and Rangold Resources (GOLD), and your safety deposit box is groaning from the weight of the gold bars it is holding. The barbaric relic is now up 20% since I recommended it in December, and you are no doubt wondering how to spend your new found fortune. Gold has since become the trade of the first quarter, with the open interest on call options on the Street Tracks Gold Shares ETF (GLD) exploding from 445,000 to 1.1 million in just the past few weeks. Options implied volatilities are suggesting that gold could hit $1,115/ounce by June. Oops, you forgot to buy the yellow metal? Use $50 pullbacks to get long. Investors will continue to pour into the sector, since it is one of the few things the government can't create more of with a printing press.

3) New Hampshire's Republican Senator Judd Greg withdrew his nomination for Commerce Secretary, the second such to go down in flames. The bribes he must have gotten not to switch sides had to be enormous. Why is the administration having difficulty filling this position at the height of the worst financial crisis in 70 years? Who wouldn't want to take the job of social director on the Titanic?

4) Noted economist David Hale sees Obama's stimulus package and bank bailout paving the way for a US led a global economic recovery from this summer. The plans will act as an insurance policy against a worsening of conditions, and may be worth 3% of GDP growth. The spending is necessarily back ended because of the time delay needed by large projects. It is spread out over the following years:

2009-$170 billion

2010-$356 billion

2011-$174 billion

2012-$48 billion

2013-$25 billion

2014-$24 billion

2015-$11 billion

Q1 GDP could fall by as much as 6% as a huge inventory liquidation ensues. The new TALF will make available $1 trillion to private investors cheaply to buy CDO's backed by credit card, student loans, and home mortgages. It is significant enough to have a major impact on prices, although the market has not digested this yet. The program will preclude any further major bank failures and lead to a rally in bank shares, although many small banks will still go under. The collapse of the global auto industry, with sales falling from 50 million annually to 39.5 million in a year, has been especially damaging for export economies. Japan will see -11% GDP this year, the worst since WWII, followed by -6% for Germany, and -4% for the UK. What to buy now? Gold, which could see new highs this year. What a surprise! Net, net, it is a pretty upbeat, but realistic analysis.

QUOTE OF THE DAY

'The rate of profit is always highest in the countries that are going fastest to ruin,' said Adam Smith in The Wealth of Nations on the dangers of 'overtrading.'

Global Market Comments for February 12, 2009

Featured Trades: (DEO)

1) Those who believe that the wine and spirits business is recession proof should take a look at UK based Diageo (DEO). Its shares just hit a new low for the year of $50, down 42%. Although the giant purveyor of alcoholic beverages posted profits up 18% in the recent half, CEO Paul Walsh says that a consumer in retreat is forcing him to scale back expectations for this year.?? The UK firm is hoping to limit the damage by restructuring to cut costs. There is no doubt they have buyer's remorse for the many wine labels it acquired at premium prices in recent years, including Rosenblum, Blossom Hill, Sterling, Acacia, and Chalone. The economic collapse has been so rapid and so severe, that old, trusted models for predicting consumer behavior are now useless. Shoppers are trading down to less expensive labels, and it is harder to realize higher prices on everything. People are going out to drink less, but taking beverages home for consumption more. Shoppers are more inclined to buy well known brands, and less prone to risk limited disposable income on experimenting with unproven new brands. Of course the world's largest owner of alcohol brands would say this, talking his own book.

2) In excessively focusing on our own problems here in the US, it is easy to miss an economic collapse of Biblical proportions that is going on in Japan. Q4 GDP is coming out next week, and the median forecast is -12%, with more dire numbers of -15% out there. This is four times the rate of decline we saw in the US. The global economic shut down is heavily concentrated in the auto industry, of which Japan is the largest exporter. My old friend IMF managing director Eisuke Sakakibara, known as 'Mr. Yen', does not see a recovery for two more years. The country has no ability to convert from an export led to a domestic demand economy in the short term. Bubbles are long in building, and long in deflating. As Vice Minister of Finance in Japan during the lost decade of the nineties, he should know.

3) Why don't we accept the wisdom of crowds and accept the market's judgment that the big banks are worthless? Let them all go bankrupt. With Bank of America (BAC) and?? Citigroup (C) down 95% from their peaks, shareholders have already been wiped out. All we are arguing about here is whether they should be allowed to come back in the next economic recovery. The Geithner bailout plan missed a golden opportunity to shock us all to our senses. Whatever happened to creative destruction? Let the weak banks go, and they will be replaced by stronger, better managed ones without any government involvement at all. Let the natural Darwinian survival of the fittest run its course. I watched with chagrin while Japanese banks pretended they were solvent for 15 years. Everyone in the country suffered as a result, and a whole generation's worth of economic growth was lost.

4) Notice how the campaign against hedge fund short sellers has quietly slithered back into the hole from which it came. It turns out that many of these banks were worthless after all. Hedge funds have in fact been one of the few sectors of the financial system that has not taken government bailout money. For this they got hit with the ill conceived short sale ban, which cost many players big money.

QUOTE OF THE DAY

'Perfect can't be the enemy of the necessary,' said President Obama about the just passed stimulus bill.

Global Market Comments for February 11, 2009

Featured Trades: (IWM), (LSE-AJG), (BAC)

1) After the passage of an $800 billion in stimulus, and another bank bailout package, I don't see any market boosting events on the horizon. Hence the Dow's 400 point swan dive yesterday. The market is not going to wait until the end of the year for all of this stuff to work. Until then, we only have Obama moaning about the Republican caused train wreck of an economy he inherited, and Congress highlighting how incompetent and crooked our financial leaders are. This isn't exactly going to inspire investors to rush out and buy stocks. Look for new lows.

2) I always hate listening to Barney Frank's House Financial Services Committee hearings. Bank of America (BAC) CEO Ken Lewis took an eight hour train ride from North Carolina to attend. Talk about the blind leading the one eyed. I can't believe how much Morgan Stanley's CEO John Mack has aged. I'd rather listen to someone scratch their fingernails across a chalk board. And our fate is in their hands! Sheesh. No wonder gold hit a new high for the year of $948. The people are voting with American Eagles.

3) More than 48 million Americans own shares in the top five banks.

4) Some 90% of all mortgage lending is now coming from the government. The balance is being made by large banks to borrowers with FICO scores of 800 or better, or by small regional banks you never heard of that never got into the securitization business.

5) According to one recent poll, 44% of the workforce is worried about losing their jobs. These people aren't going to be trading up to new houses anytime soon.

6) These are indeed dark days for Silicon Valley's venture capital industry. With the exit door slammed shut for years to come, new money is staying away, avoiding the high risk multiyear lock up. Angel investors have gone back to heaven. The deterioration of the economy has been so rapid that the rationale for many start ups is no longer there. Many web 2.0, next generation models for social networking sites, video sharing sites, wikis, blogs, and folksonomies never made it to profitability, and will be swept away. Expect a lot of once hard to get office space to become available for cheap on Sand Hill Road soon.

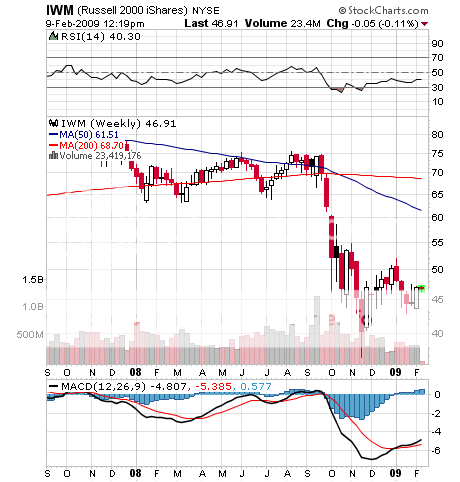

7) This is a great time to buy small cap stocks in any equity market, including Japan. This sector was one of the worst hit in the recent melt down, but historically it outperforms by a large margin in the first 12 months after the end of a recession. Once their survival is no longer in doubt, these often debt dependent stocks rocket on any improvement in the economic trend. This is the only time I ever hire outside managers, because I haven't the patience, the manpower, or the expertise to scour over the balance sheets and earnings statements of hundreds of obscure little niche companies. I have always been a big cap player because I have always dealt with investors who had to get $100 million to work in the market in a hurry, an impossibility in the small cap arena. In the U.S., buy the iShares Russell 2000 Index ETF (IWM). For the Japan play, buy the closed end Atlantis Japan Growth Fund (LSE-AJG) traded in London, managed by my old friend Ed Merner, at $8.05, a bargain basement 27% discount to its NAV of $11.04, if you are lucky enough to find shares to buy.

Atlantis Japan Growth Fund

QUOTE OF THE DAY

'Necessity never made a good bargain,' said Benjamin Franklin.

Global Market Comments for February 10, 2009

Featured Trades: (IWM), (C), (BAC), (INTC)

1) Treasury Secretary Tim Geithner announced his bailout plan and the market gave him a big raspberry. Long on platitudes and short on specifics. The Dow plummeted 381, Bank of America (BAC), dropped 18%, and Citigroup (C) pared 16%. The 'End of the World' trade is back on again. A number of technical models had gotten traders long, and you could see the stop losses being triggered all the way down. Ouch! The market is betting these banks will run out of money before the economy has a chance to recover. One analyst said that up to 1,000 banks could go under over the next 3-5 years. Listening to the House financial committee hearings, it is clear that Geithner has become the whipping boy for Hank Paulson's sins. In the meantime, Obama wheedled a Senate majority for his stimulus package by getting the Republican Senator from Maine, Susan Collins, to switch sides. I predict that a rash of new bridges, freeways, and roadside rests is about to break out in the Pine Tree State.

2) Nassim Taleb, author of The Black Swan, made a great point today. He argued that the financial crisis was caused by a complete failure of risk control. Investors focused only on large short term gains, and ignored possible, but highly improbable events that can have a huge, even cataclysmic impact on your performance. Who does the opposite of this? The Pentagon, which spends all of its time preparing for infinitesimally possible events, like nuclear war. Taleb applauds the US military's risk control as a model for all professional investors.

3) I loved the piece in the New York Times yesterday informing us that at the last market top in 2007, 95% of broker analysts had 'buy' recommendations on their stocks. Today it is still 60%. A worse lagging indicator there never was. These people are nothing more than shills for their investment banking departments. The surest way to the poor house is to listen to your broker. Remember, 'When EF Hutton speaks, others listen?' RIP.

4) If you wondered where the gold rally went, take a look at this chart of the yellow metal priced in Euros at a multi year high of ???720. Safe haven buying of bars and coins is accelerating, with demand for $50 American Eagles up four times from a year ago. Flows into gold ETF's in January soared by 105 tonnes to a record 1,370 tonnes ($1.23 billion). Much of the buying has been by high net worth individuals who are stashing large bars in bank vaults.

5) Here is a nice early spring mustard seed. Intel (INTC) announced they plan to invest $7 billion in new factories in Arizona, New Mexico, and Oregon, hiring 7,000 workers. The company in the past has said that high costs, over regulation, and unreliable power supplies will prevent it from ever again building a major manufacturing facility in California. The plants will build low energy chips using the next generation 32 nanometer technology. At least this round is not going to China. Only the big cap tech companies have the cash to pull this off.

Global Market Comments for February 9, 2009

Featured Trades: (IWM), ($COPPER), (DRYS)

1) This week it is all about Washington. CNBC has turned into CSPAN. Democrats coming off an eight year starvation diet are loading the stimulus plan with more pork than a bacon factory, and sending Obama the bill. There is also a personal element of payback going on here by the former minority party for eight years of administration abuse. The Republicans are retaliating by painting Nancy Pelosi as Karl Marx 2.0. It all makes for great theater. Apolitical traders are thankful for any rally to sell into.

2) More than $1 billion of the stimulus package will be spent in the San Francisco Bay Area, creating 27,000 jobs. The shovel ready projects include the reconstruction of Doyle Drive, the San Jose BART extension, a parking structure for the Oakland Airport, a terminal extension at the San Francisco International Airport, and a fourth tunnel through the mountains on Highway 24 from Oakland to Walnut Creek.

3) The American Securitization Forum is meeting in Las Vegas Today. How appropriate. I bet they got great deals on their rooms. I didn't know this, but there has never been a standardized definition for 'full documentation.' The hotter the market became the more dilutive the definition became, until a 'full doc' loan had minimal requirements. A classic example of 'definition creep.' There also has never been a requirement to notify a first mortgage holder about the extension of a second mortgage. What an eye opener! Until these questions are resolved there will be $2 trillion in lending capacity missing in the US.

4) One of the rock stars at Davos was Professor Nouriel Roubini, the firebrand uber bear who forecasted the current recession three years ago. He believes that if the government does everything perfectly we will have a 'U' shaped recession three times longer than usual, followed by only 1% growth in 2010. If they blow it, we will have a lost decade. The consumer is on the ropes. Credit losses will top out at $3.7 trillion. The 'bad bank' plan won't work because so many are insolvent zombie banks which will have to be nationalized Sweden style. The US economy that recovers will be substantially different, with less leverage, fewer MBA's, and more engineers. Medium term, Dr. Doom sees globalization driving a healthy economic growth rate. Only 5% of the world are Americans, and the other 95% want to live like US.

5) Early reflationary plays were flashing the green light today. Copper was limit up in Shanghai to a two month high at $1.61/pound. Also, take a look at the Greek shipping firm Dry Shipping Inc. (DRYS), which I recommended in November at $3. It soared 460% to $17, fell back to $5, and is now up to $6.30 on news that they successfully rolled over $800 million in debt. It is another great time to make a second visit to the trough for (DRYS), in case you missed it the first time. This shows you that successful refinancings are going to have a huge positive impact on stock prices as we bump along the bottom here, and will be a major market play for the rest of the year.

Global Market Comments for February 6, 2009

Featured Trades: (BAC), (TM), (TBT)

1) The dreaded January nonfarm payroll came in at minus 598,000, the third monthly figure over a half million, taking the unemployment rate up to 7.6%. It was the worst monthly reading since 1974. We'll probably see 9% by June. Notice how the numbers always come in worse than expected, with big revisions upward in the back months. Three million jobs were lost in 2008, and 3.6 million since the recession began in Q4, 2007, taking the national total up to 11.2 million. Only the health care and education sectors gained jobs. Because the lion's share of job losses are in male dominated industries, like auto manufacturing and construction, and hiring is taking place in female staffed industries, women will soon account for more than 50% of the U.S. work force.

2) Yesterday, Bank of America (BAC) stock hit a low of $3.60. The preferred is now paying 25%, a yield you normally see only in the lowest grade of junk bonds, those in default. Unbelievable! One leading bank analyst is still keeping his earnings forecast for BAC at $5/share, giving you a multiple of 0.7 X. We learned that during its last year of trading, the bank's new Merrill Lynch subsidiary increased its long position in collateralized debt obligation s from $4 billion to $60 billion. More unbelievable! Where was the risk control? What is the market telling us that we don't know? If this company isn't going bankrupt, it is certainly doing a great imitation.

3) There is a new proposal making the rounds for solving the financial crisis known as 'desecuritization.' There are $1.4 trillion in CDO's outstanding backed by Alt-A and subprime loans in the form of 3,700 individual securitizations. Over 68% of the loans backing these bonds are current.?? Mark to market rules are forcing the banks to carry this paper on their balance sheets at 50% discount. This is where the $700 billion figure for the first TARP comes from. The problem is that mark to market is a meaningless accounting fiction when there is no market. If you break up these securities and place the underlying loans back on the banks' balance sheets, the good mortgages can be valued at 100% of face, and those behind in their payments can be discounted to maybe 70% because they are still secured by the value of the underlying homes. This would boost the value of the entire asset class assets from 50 cents to 90 cents on the dollar. Restored balance sheets would enable banks to resume lending. It sounds like a workable plan, and therefore is unlikely to ever see the light of day.

4) Japanese analysts were stunned when Toyota Motors (TM) announced that it expects to lose $3.8 billion in the current fiscal year, its first loss since 1950. The company is getting decimated by the strong yen, which raises the cost of production in Japan, while shrinking foreign earnings when brought back to Japan. Moody's cut its rating of TM debt from AAA to AA+. The forecast was three times worse than one made only two months ago. The company expects sales to fall from 9.3 million cars in 2008 to only 7.2 million this year. Every assembly line in Japan has been shut down except one. Management does not expect sales to recover until year end, and that, I'm sure, is just a hopeful guess. This is a once in a lifetime opportunity to buy one of the world's greatest companies on the cheap, down 60% from its 2008 high.

5) My top pick of the year, the Lehman Power Shares Ultrashort 20 Year Plus short ETF (TBT), which gives you a 200% short play on long government bonds. It has been absolutely roaring, hitting a high of $49.5, up 37% from my recommended buy a month ago. With a $900 billion stimulus package, and a $2 trillion 'bad bank,' piled on top of a $700 billion TARP, it is clear to everyone that the government is about to flood the debt markets with paper. The US money supply M2 is now growing at a breakneck 20% rate and is accelerating. This trade has further to run.

OBITUARY OF THE DAY

Herbert Hamrol, the last survivor of the 1906 San Francisco earthquake, died yesterday, aged 106. Hamrol was three when his mother hustled him out of a collapsing building during the great earthquake, which killed 3,000. Hamrol, who worked at stocking supermarket shelves until he retired last month, said the secret to a long life was 'wild women and good liquor.'

QUOTE OF THE DAY

Global Market Comments for February 5, 2009

Featured Trades: ($GOLD), ($SILVER), (BRK/A), (GS), (GE), ($SSEC), ($BDI)

1) UBS was matched by Goldman Sachs in raising its 2009 target for gold ($GOLD) up to $1,000, triggering a $30 rally to $920.While jewelry demand from India and the Middle East remains weak, this is being more than offset by the ongoing financial crisis boosting safe haven buying in the US of coins, bars, and ETF's. Deleveraging of long gold positions by hedge funds is now almost done. Buyers of gold are now spilling into other precious metals like silver ($SILVER), which is up 47% to $12.50/ounce from its October lows, and can offer can offer investors double the upside volatility.

2) One of Warren Buffet's key indicators for timing stock buys is the ratio of?? total equity assets to GNP. In 2007 stocks peaked at 190% of GNP, and have since fallen to 70%, a level only seen during the thirties and the early eighties. While the Sage of Omaha's Berkshire Hathaway (BRK/A) has been hammered by 50% in the last four months, with too early purchases of Goldman Sachs (GS) and General Electric (GE), this indicator could be worth tracking.

3) In case you missed the business section of the San Francisco Chronicle today, there is a fabulous graphic illustrating the hard times for the city's commercial real estate market. The epicenter of the melt down is Tishman Speyer's 556,000 sq. ft. 555 Mission Street, which opened in late 2008 during the worst possible market conditions, and remains 70% empty. What is really impressive is how bad the implosion of the legal profession is hitting landlords. The dissolution of Heller Ehrman has emptied 350,000 sq. ft. 333 Bush Street, while 388,000 sq. ft. 101 Second Street has been vacated by the dissolution of Thelen LLP. Conditions will worsen as more new buildings started during better times come on the market.

4) The free online telephone and video conferencing service Skype has launched its version 4.0. The upgrade is faster, has better quality video streaming, and allows you to attach files, like photos, to your calls. It still only offers 1:1 communication though, not the group calls available at more expensive video conferencing competitors.

5) Hedge Fund Traders scouring the world for leading indicators hinting that it is safe to get back into the water currently have a laser like focus on Shanghai, which fell an amazing 72% from its October 2007 top. China's once red hot largest domestic stock market, which is closed to direct investment by foreigners, peaked nine months before China's own economic slide began in earnest after the Olympics. This has given the unregulated emerging market oracle like status among global market timers. This week, the Shanghai Composite ($SSEC) broke out of a six month trading range to the upside, possible entering a new uptrend. The move, along with the record 15% explosion upward yesterday by the Baltic Dry Shipping Index ($BDI), and turning noises being made by the dollar, is prompting some managers to quietly lift their global equity exposures.

QUOTE OF THE DAY

'If you're gonna owe money, owe more than you can pay, then people can't afford to foreclose,' said Clint Murchison, a famous Texas oil wildcatter during the thirties.

Global Market Comments for February 4, 2009

Featured Trades: (FCX), (CAT), ($BDI), ($BVSP), (EWC), (EWZ), (EWA)

1) There is a rare anomaly in the markets now, where mining stocks are trading at huge discounts to the metals they mine. Usually they trade at substantial premiums. This is the result of the credit crisis, as well as a global multiple compression that is punishing good and bad equities alike. Take a look at one of my favorite stocks, Freeport McMoran (FCX), one of the world's largest copper and gold producers, which just announced a record Q4 loss of $14 billion. The stock cratered from $122 to $15 after June, while copper dove from $4.10 to $1.25, and gold dropped from $1,050 to $700. CEO Richard Adkerson says that he is cutting costs by chopping capital spending from a record $2.8 billion in 2008, to $1.3 billion in 2009 and $1 billion in 2010. He is delaying projects in high cost countries like the U.S. That is why Caterpillar (CAT) stock has been getting killed. This and other measures are cutting FCX's break even cost for copper from $1.16/pound to 71 cents. Gold is now being sold for $900/ounce versus an industry break even cost of $500/ounce. While the Phelps Dodge takeover in March, 2007 now looks rich, you couldn't do that deal today because of a lack of financing. So many new projects are now being frozen, that when demand recovers, the next price spike could be worse than the last one. If you aren?t buying FCX and CAT right here I am going to lay down on the nearest train tracks until a train runs over me. If you can?t buy stocks at these insanely low prices, then you should be in the business.

2) Here is another early, nascent sign of global economic recovery. The Baltic Dry Index ($BDI) of international shipping rates was one of the markets worst hit by the seizing up of international trade, vaporizing 95% from 12,000 to only 600. It has since clawed its way back up to 1,200 from the November bottom. It lead the commodity collapse in June by a good month. Could it now be signaling a recovery? At least things are not getting worse, and we may see a period of bottom bouncing before a sustainable up trend develops.

3) The online research firm Zillow.com says that the US real estate market has lost $6.1 trillion since the top, including $3.3 trillion last year alone. One in six American homeowners is now underwater on their mortgages, the equivalent of 11 million homes. These unhappy home owners are not trading up, down or sideways anytime soon. Only prices in Fayetteville, NC, Yakima, WA, and Utica-Rome, NY went up. I won't bore you with how much Las Vegas, Phoenix, Miami, and San Francisco have gone down. Expect more frightening tidal waves of foreclosures, which will cap residential real estate for years to come.

4) Take a look at the recent performance of Brazil's Bovespa stock index, which fell 47% since June. It has jumped a healthy 48% since the November low and gives credence to my theory that when global stock markets recover, emerging markets will rise twice as fast as developed ones. The best recovery the Dow could mount was 30%, and that is looking wobbly. There is really only one global stock market now moving in the same direction. Only volatility varies country to country, and when conditions improve you want to own the most volatile one. Look at the ETF for Brazil (EWZ). Also on your shopping list should be the ETF's of other young natural resource exporting countries like Canada (EWC), Australia (EWA). You might go long term currency and bond markets too.

QUOTE OF THE DAY

'You are never are as good as they say you are at the top, nor as bad as they say you are at the bottom,' said Gerry Levin, the former fired CEO of Time Warner, who is now operating a day spa in Santa Monica, California.

Global Market Comments for February 3, 2009

Featured Trades: (SQM), (CGW), (TIP)

Special 'Invade Bolivia' Issue

1) Politicians, industrialists, and environmentalists who see battery powered vehicles as the wave of the future are overlooking the fact that 50% of the world supply of lithium comes from impoverished, landlocked Bolivia. This is a country that until now was best known for killing off famous foreigners (Che Guevara, Butch Cassidy and the Sundance Kid), and being the source of a new form a venereal disease. Lithium ion batteries are four times more efficient than the current generation of nickel cadmium batteries, and are essential for electric cars to finally become economically viable. But now that the country finally has something the world wants, nationalism is rearing its ugly head. Local politicians see their country as the Saudi Arabia of the highly corrosive, toxic, reactive metal, and are already discussing ways to restrict access. The only other supplies are to be found in Chile, Argentina, Australia, China, and Nevada.?? Should the US invade to insure supplies? Iraq worked didn't it? The best way for opportunistic investors to play this is to buy Sociedad Quimica Y Minera (SQM), Chile's largest producer of lithium.

2) Noted Chicago economist David Hale does not see a pretty picture for 2009, and believes the recovery in 2010 will be weak at best. It may take until 2011 before we return to a normal growth rate because of the systemic financial carnage that makes this downturn unique. His just released report on the global economy was a tour de force of negative metaphors (cliff diving, David?). Deleveraging will continue for 2-3 more years, with mortgage financing plunging from $3.9 trillion in 2003 to $1.9 trillion last year. US home prices will drop 40% peak to trough, so they still have more to fall. The Q4 24.6% collapse in consumer spending is unprecedented. American real estate loan losses could reach $2 trillion. The export dependent economies of Germany and Japan have been especially hard hit by this recession. Chinese exports are also falling, but the country has $2 trillion in reserves to absorb the shock. The Fed's desperately expansionary monetary policy could trigger a bull market in gold. The US financial system has lost $5 trillion in market capitalization in 18 months. A safe haven bid will keep the dollar strong for the time being. The Obama stimulus plan will save millions of jobs and add 3.7% of GDP growth by Q4 2010, but will come at enormous cost and have only a delayed effect. All sobering food for thought.

3) Water may be the ultimate consumer staple, and investment in fresh water infrastructure is going to be a good long term investment theme. Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles.?? Some 18% of the world population lacks access to potable water, and demand is expected to rise by 40% in the next 20 years. The UN says that $11 billion a year is needed for water infrastructure investment, and $15 billion of the US stimulus package will be similarly spent. An easy way to participate is to buy the Claymore S&P Global Water Index ETF (CGW), or buy the individual stocks Geberit AG (GEBN) and Veolia Environment (VIE).

4) If you believe that imminent and massive Treasury issuance is going to pop the Treasury bond bubble, and that Obama's reflationary policies are long term inflationary, you have to be looking at Treasury Inflation Protected Securities. TIPS offer investors a US government guaranteed protection against future price hikes by raising the principal in line with the inflation rate. A 3% coupon TIPS facing a 10% inflation rate automatically boosts the face value of your bond from an issue price of 100 to 110, giving you a total return of 13%. You can buy these directly from the US Treasury, or buy the iShares Lehman TIPS Bond Fund (TIP). The best time to buy flood insurance is at the end of a long drought.

QUOTE OF THE DAY

'The mission of a conservative is to stand in the onward path of history and shout 'Stop,' said the late conservative commentator William F. Buckley.

Global Market Comments

February 2, 2009

Featured Trades: (BX)

One month into the year, let's review where we are among major asset classes:

'? Stocks are down globally and falling. The Dow is down 10% year to date.

'? The long Treasury bond bubble has popped. Corporate bonds of all grades are on a tear.

'? There is a bull market in gold that is spreading into other precious metals.???? Soft commodities like wheat and soybeans are bouncing along a bottom, but showing signs of recovery.

'? The dollar has a strong fight to safety bid. Carry trade unwinds are pushing the yen up. All other currencies are weak.

'? Real estate is going from bad to worse, with the crisis spreading from residential into commercial real estate. Rents are falling everywhere.

The markets are still in risk reduction mode. This Friday's nonfarm payroll could take unemployment up from 7.2% to 7.5%. Bankruptcies are spiraling upward. Corporate managements are in defensive mode. The consumer is hanging on to every nickel he has.

1) Swap spreads shows that interbank transactions are almost back to pre Lehman bust levels, and that credit markets are reviving. The question remains of how long this will take to filter down to increased bank lending to customers and the real economy.

2) Barron's ran an interesting article over the weekend arguing that private equity will be the next big shoe to fall in the financial crisis. The weekly paper opines that all of the investments made by KKR, Blackstone Group, Carlyle, and Europe's 3i over the last three years are now worthless. To add insult to injury, one PE firm, Blackstone Group (BX), stuffed investors with its own stock at the absolute top of the market 18 months ago, and it is now down 90%. Leveraged buyouts account for a large part of their portfolios, and these tend to be loaded with junk debt which can't be rolled over. The list of bad bets starts with Chrysler and goes on to include Clear Channel Communication, Hilton, Harrahs, and many others. Deferred accounting practices have enabled managers to keep these losses under wraps, but a newly invigorated SEC may shed daylight soon. The offshore listed PE funds are trading at an average 72% discount to published net asset values, suggesting that not a few investors are looking askance at asset valuations. Even vaunted Harvard University, a big player in the sector, has tried to quietly unload some PE funds, to no avail. The end result of all of this will be that bond investors are soon going to become equity investors in a lot of money losing, and possible worthless companies. Headlines may not be far off, and big layoffs are a sure thing.

4) I spent a shivering Saturday morning lined up for Recreational Equipment Inc.'s (REI) monthly members' only used equipment sale. This time, outdoor enthusiasts were joined by the newly jobless and homeless, who were hoping to pick up deeply discounted equipment so they could live out of their cars. They were not disappointed. I picked up a pair of Asolo heavy mountaineering boots, list price $280, with tax, for $5! I guess the size 13's have not been flying out the door. It does not bode well for our economy when retailers are selling boots for the value of their laces.

QUOTE OF THE DAY

'This is the time when fortunes are made', said Sir Richard Branson, CEO of the Virgin Group, at the Davos Economic Forum. During the eighties, Sir Richard lived on a canal boat around the corner from me in the Little Venice section of London. We flew together to Moscow once on his Virgin Air, and he graciously allowed me to take the flight controls of the Boeing 767. Again, it's been a full life.