All indications are that we have a total nightmare of a Christmas coming up this year. Santa Claus and his elves can’t get any parts, and the reindeer are short of hay.

There are now a record 70 large container ships from China parked off the coast of Long Beach, CA and nobody to unload them. If they could be unloaded, there are no trucks to move the cargo or drivers to drive them. It turns out that stores don’t have enough staff to sell the products either.

You see this in share prices that are traditionally strong going into the holidays which have lately taken a pasting, like UPS (UPS) and FedEx (FDX).

Perhaps the US economy is losing up to a third of its total output due to parts and labor shortages. This will take at least a year to sort out.

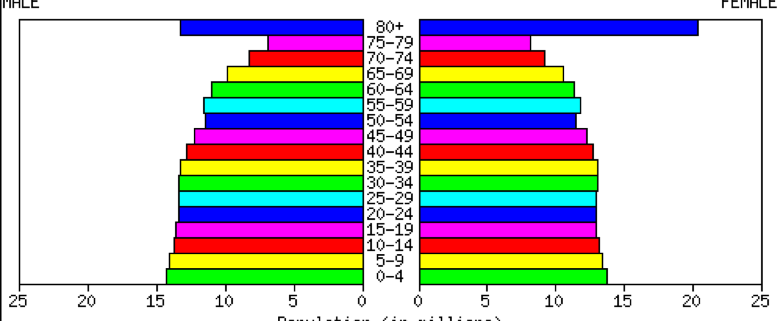

Then there is the issue of 10 million missing workers. Are they afraid of dying of Covid? Or have they decided it’s time for a career change and that working for a minimum wage of $7.25 an hour is no longer worth it? This may take a decade to sort out.

Covid could be masking fundamental changes to the American economy and society which won’t become obvious until well into the 2030s.

Those of us who analyze these things can’t wait for the outcome. The global economy has just undergone more change than at any time since WWII. But what exactly happened we may not know for years.

Better to complete your Christmas shopping early this year or you may end up with a piece of coal in your stocking (where do I find coal in California?). And don’t forget to do some shopping for your retirement portfolio as well. Valuations are the best they have been in a year and this bull market in stocks has another nine years to run.

In the meantime, after dumping all of my technology stocks, I’ll be betting my entire persona net worth buying financial ones. These should lead the markets for the next six months, or until bond yields hit 2.0%, whichever comes first. Bonds now yield 1.46%.

With interest rates rising sharply, economic growth continuing at record levels, and default rates plunging, we are just entering a new golden age of banking.

Powell sees Inflation lasting higher for longer. It was enough to kill off a nascent rally in the bond market. The Dollar Store is about to become the $2 Store. Shortages from China are the reason.

Treasury Yields hit a three-month high. You can blame the coming taper, deal on a deficit-financed infrastructure bill, and drained Fed accounts against a coming massive supply of bonds. I’m already running a massive bond short. Keep selling rallies in the (TLT), or buy (TBT).

China bans Crypto, triggering a 7% plunge in Bitcoin. Financial systems the government can’t control are forbidden in the Forbidden City. It’s all part of a flight out of a restricted Yuan into unrestricted crypto by wealthy Chinese. China used to account for 99% of all Bitcoin mining and now it is at zero. The business will flock to the US, Canada, and any other country with cheap electricity. It’s a short-term negative for crypto but a long-term positive. Buy Bitcoin and Ethereum on the dip.

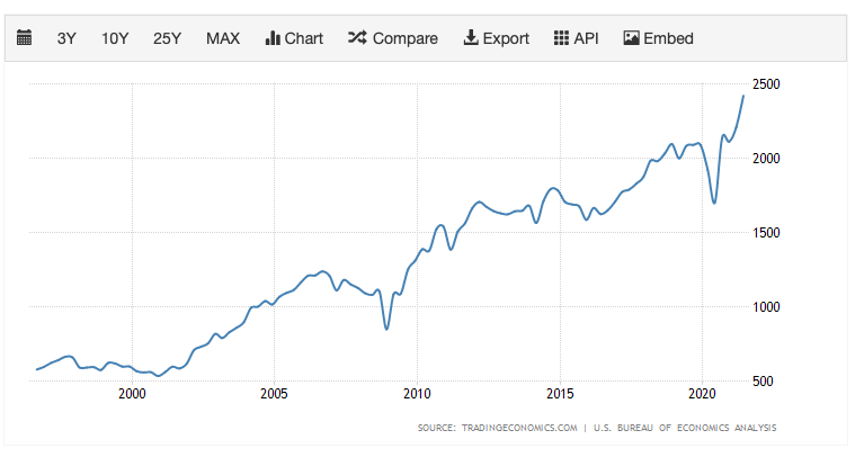

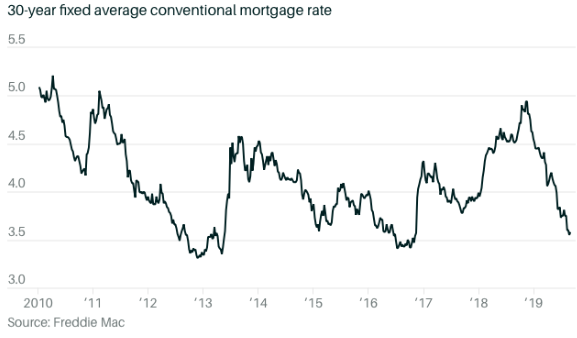

Case Shiller shatters all records, rising an astronomical 18.7% in June, a new record. Home prices are now 41% higher than the last peak in 2006. Phoenix was up an eye-popping 29.3%, San Diego by 27.1%, and Seattle by 25.0%. What are they putting in the water in these cities? My belief is that the structural shortfall of housing continues for another decade.

New Home Sales jump by 1.5% in August to a seasonally adjusted 740,000 units. The south saw the biggest gains at 6.0%. Median New Home Prices jumped an amazing 20.1% to 390,000 YOY. The exodus from the city to the burbs continues unabated. Inventory is at 6.1 months.

Pending Home Sales rocket, in August by 8.1% on a signed contract basis compared to only 1.2% expected. That’s a seven-month high. The Midwest led the charge with a 10.4% gain. Rising inventories and continued low interest rates were a big help. The bidding wars are abating.

China Energy Shortage causes Apple and Tesla cutback and they are buying 70% of America’s coal production to meet the shortfall. Several key chip packaging and testing service providers supplying Intel, Nvidia, and Qualcomm also received notices to suspend production at their facilities in Jiangsu for several days. It’s Another Black Swan from the Middle Kingdom.

The First Trust Skybridge Crypto Industry & Digital Economy ETF (CRPT) launched on September 23. It will be kicked off by my longtime friend and Mad Hedge Summit speaker Anthony Scaramucci. Get on the crypto train before it leaves the station.

Ford (F) announced massive $11.4 Billion in US EV factories in Kentucky and Tennessee in partnership with South Korea’s SK Innovations, creating 11,000 jobs. It is one of the largest US industrial investments in recent memory. It is all part of a plan to completely reposition the company and invest $30 billion in EVs by 2025. A smart move, (F) finally read the writing on the wall.

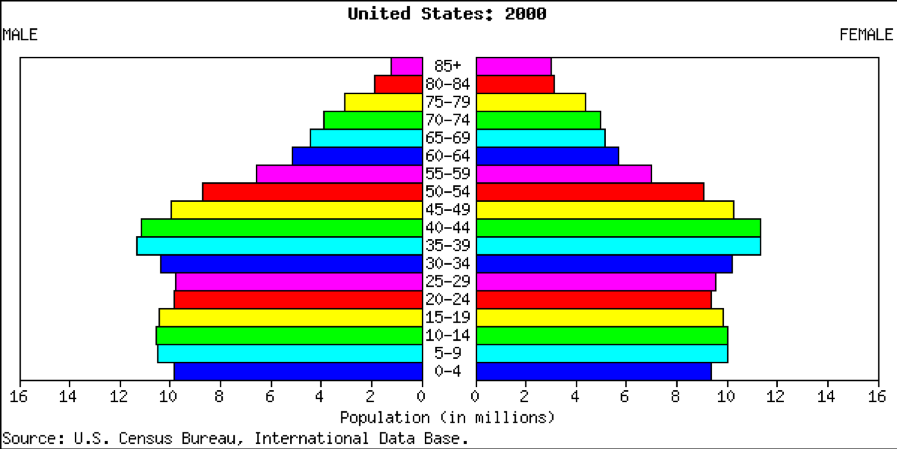

My Ten-Year View

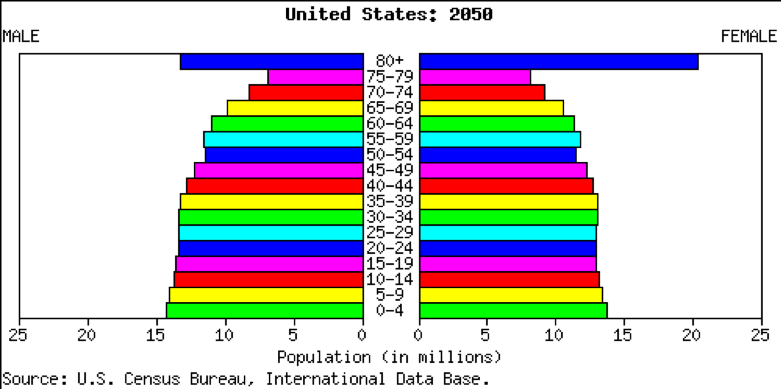

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

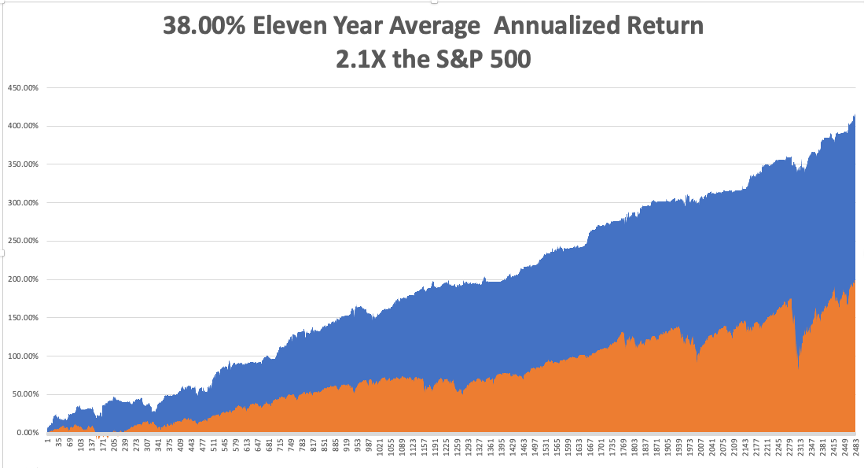

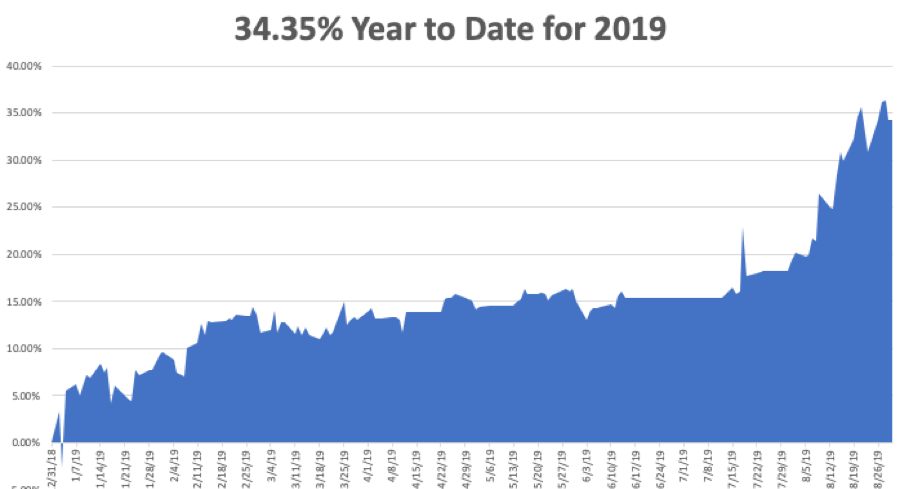

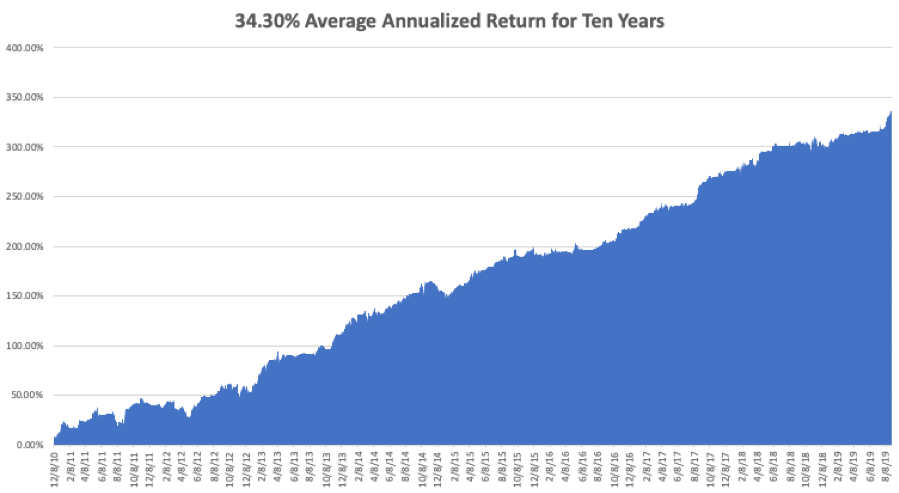

My Mad Hedge Global Trading Dispatch saw a modest +1.03% gain in September. That’s against a Dow Average that was down -5.65% for the month. My 2021 year-to-date performance soared to 80.30%. The Dow Average was up 12.18% so far in 2021.

Figuring that we are either at or close to a market bottom, and being a man of my convictions, I am 80% invested in financial stocks. Those include (MS), (GS), (JPM), (BLK), (BRKB), and (C). In for a penny, in for a pound. I am also 10% invested in the (SPY) and 10% long bonds (TLT).

I quick trip by the Volatility Index (VIX) to $29 and a rapid 45 basis point leap in ten-year US Treasury bond yields gave us the entry point for all of these positions.

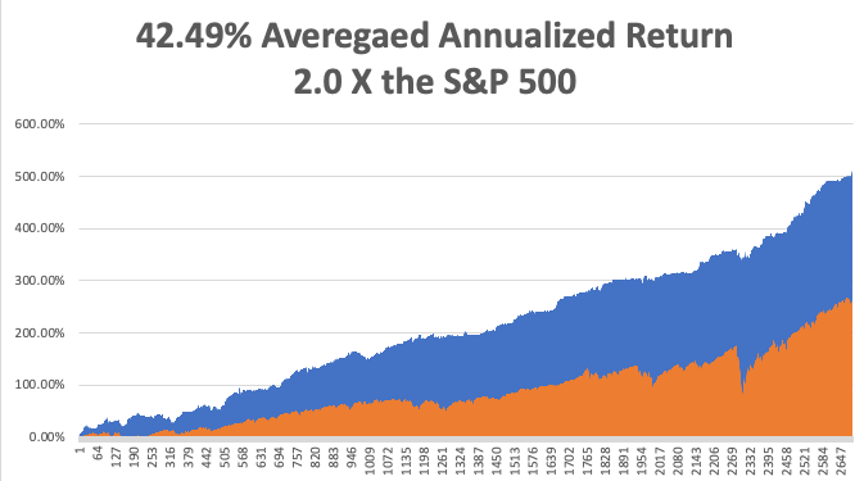

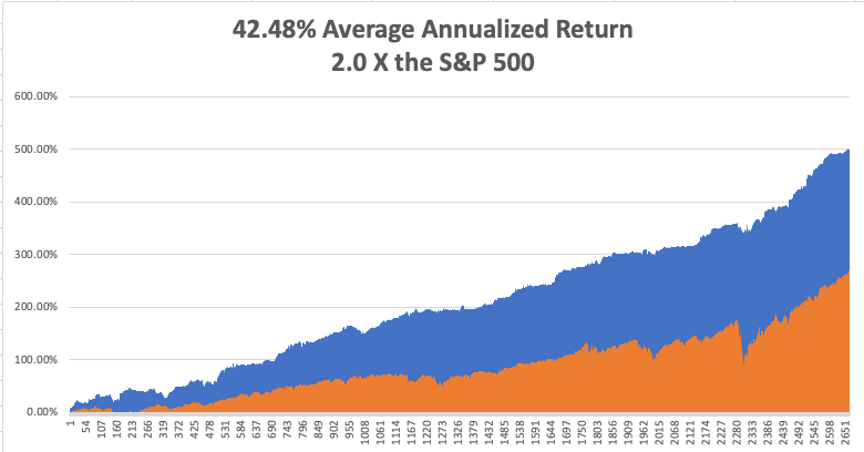

That brings my 12-year total return to 502.85%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.49%, easily the highest in the industry.

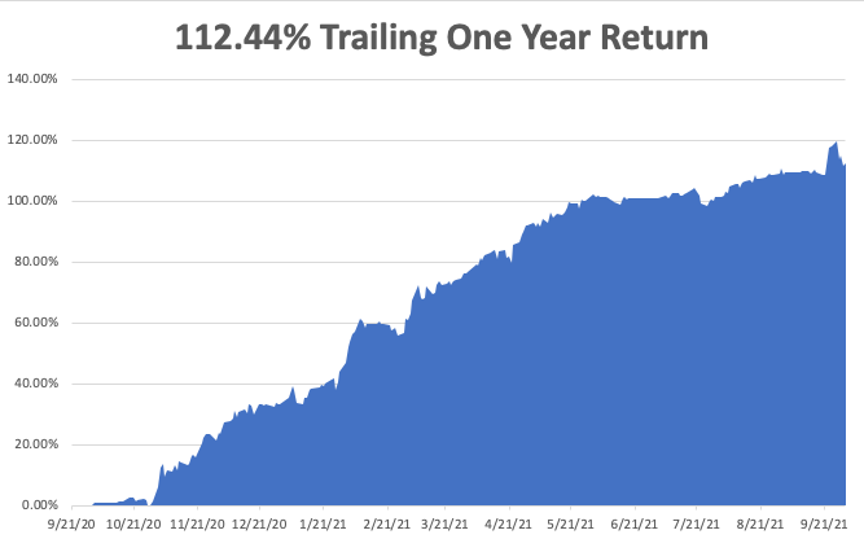

My trailing one-year return popped back to positively eye-popping 112.44%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 44 million and rising quickly and deaths topping 701,000, which you can find here.

The coming week will be slow on the data front.

On Monday, October 4 at 10:00 AM, US Factory Orders for August are out.

On Tuesday, October 5 at 8:30 AM, the US Balance of Trade for August is announced.

On Wednesday, October 6 at 8:15 AM, we get the Challenger Private Jobs Report for September.

On Thursday, October 7 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, October 8 at 8:30 AM, we learn the September Nonfarm Payroll Report. At 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, in my many travels around the world, I never hesitate to visit places of historical interest. The London grave of Carl Marx, the Paris grave of Jim Morrison, the bridge of the cruiser of the USS San Francisco, which took a direct hit from an 18-inch Japanese shell, you name it.

After attending one of my global strategy luncheons in Charleston, South Carolina, where the Civil War began with the Confederates firing on Fort Sumter in 1861, I looked for something to do. Fort Sumter was a full day trip and there wasn’t much to see anyway.

So I pulled out my trusty iPhone to get some ideas. It only took me a second to decide. I attended Sunday church services at the Mother Emanuel African Methodist Episcopal Church, where 15 people were gunned down by a deranged white nationalist in 2014.

The church was built in 1891 by freed slaves and their children. The congregation dates back earlier to 1791. It has every bit a handmade touch with fine Victorian stained-glass windows.

The ushers stopped me at the door for 20 minutes where they suspiciously eyed me. Then they invited me in and sat me down next to the only other white person there, a Jewish woman from New York.

It was a working-class congregation and polyester suites and print dresses were the order of the day. Everyone was polite, if not respectful, and I sang the hymns with the air of a book in the pew in front of me.

The gospel singing was incredible, if not angelic. When I left, an usher thanked me for supporting their cause. Very moving. I praised them for their strength and tossed a $100 bill into the basket.

Charleston is a big wedding destination now, with young couples pouring in from all over the South to tie the knot. Saturday night on Market Street saw at least a dozen bachelor and hen parties going bar to bar and getting wasted, the women falling off their platform shoes.

The United States still has a lot of healing to go to recover from the recent years of turmoil. I thought this was one small step.

Mother Emanuel African Methodist Episcopal Church

Punting in Cambridge