Gold is Breaking Out All Over

Longtime readers of this letter are well aware that I have been bullish on gold since August. However, this week, the barbarous relic really got the bit between its teeth and is now poised to break out to a new five year high.

All of a sudden, the sun, moon, and stars have aligned in favor of a new leg of the bull market for gold. We could even see a bitcoin-style melt up over the next 18 months to its previous all-time high of $1,927 an ounce.

Gold is not seeing this in isolation. With the primary focus of all financial markets now exploding US deficits, inflation plays everywhere have found new vigor. These would include, other precious metals, commodities, energy, and any security that shorts the bond market.

The really great news here is that your investment life has suddenly gotten very easy. We are probably only months into a megatrend that could last for another decade.

If you look carefully at the long-term charts you will see that gold has in fact been in a new bull market for three years now. But the rate of appreciation was at a snail’s pace, with the yellow metal averaging only 14% a year since then.

For a while, bitcoin and other cryptocurrencies were stealing gold’s thunder and sucking up gold’s volatility. Inflation, the traditional driver of gold prices, was nowhere to be seen.

It is no accident that the recent strength in gold has been matched with the decimation of Bitcoin, down 80% from its high. Investors are finally seeing the light of day.

Other factors have been assisting in gold’s resurgence. Chinese dumping of US treasury bonds is freeing up lots of cash in the middle Kingdom to buy gold.

The run-up to the Chinese New Year on February 16, when Chinese traditionally settle debts with gold coin purchases, has thrown some exploding firecrackers on the move.

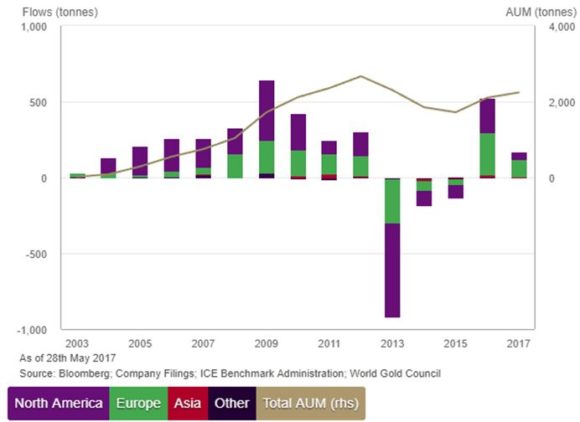

The Europeans saw the inflation boogeyman before we did. Look at the chart below showing global gold ETF purchases, which helped market the 2015 bottom. Some 75% of global flows into gold ETF’s were for Europe based funds.

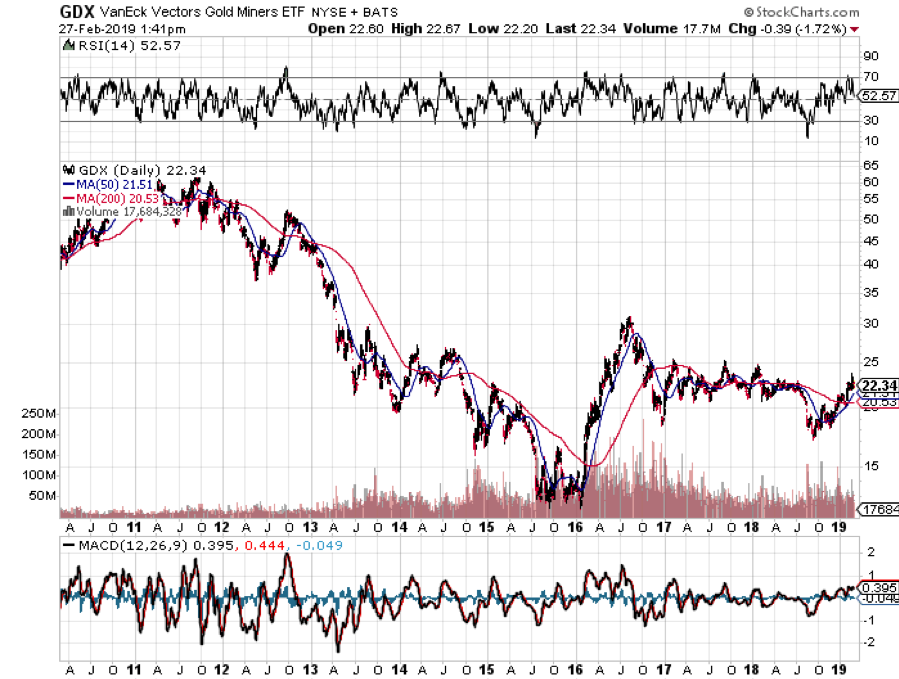

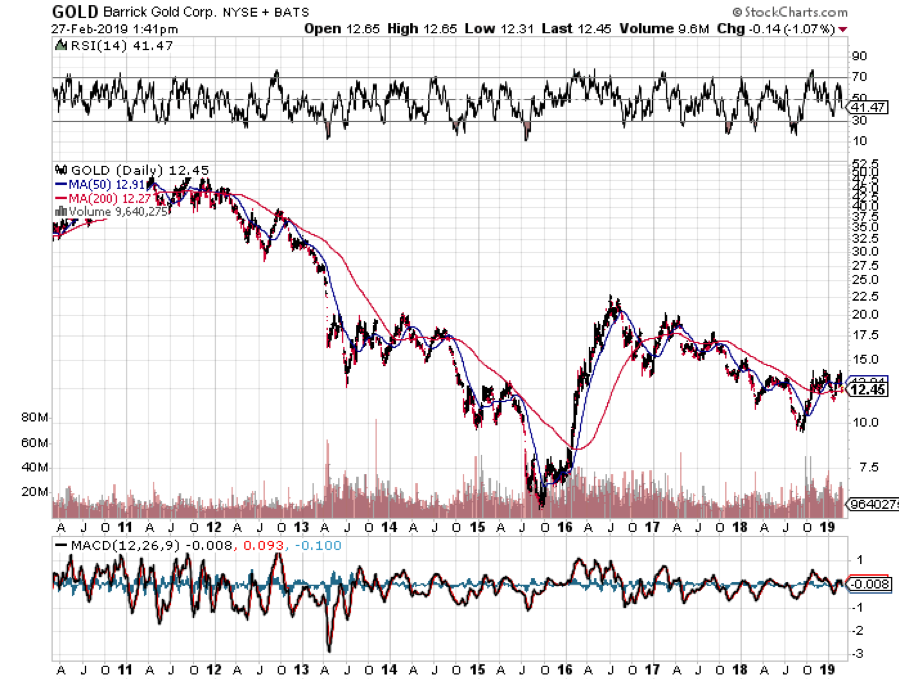

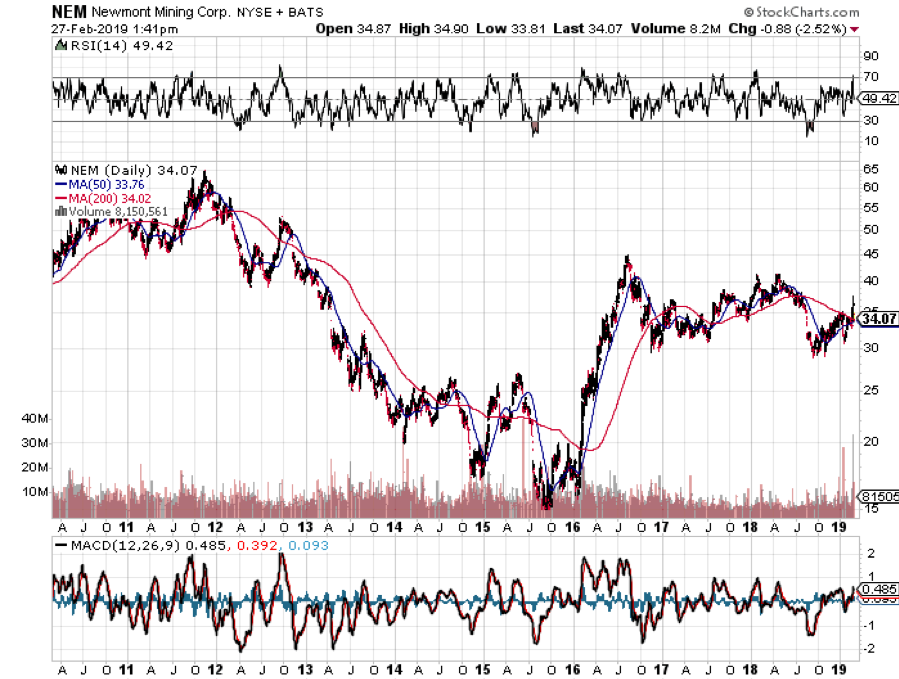

The buying has spread into the entire precious metals space. The Van Eck Vectors Gold Miners ETF (GDX) is off to the races. So is Newmont Mining (NEM), Canada’s largest miner and one of my long-time favorites. (NEM) by the way, is considering a takeover offer from Barrick Gold (GOLD).

Look to buy dips in gold whenever you get them. Remember those black swans? They are still out there in a holding pattern awaiting landing instructions.

When they finally return, you’ll be happy you have a nice position in gold to hedge your other risk positions.